The Quarterly Budget Excel Template for Nonprofits is a crucial tool designed to help nonprofit organizations effectively manage their finances by tracking income and expenses on a quarterly basis. This template enables accurate financial forecasting, ensures transparency, and supports compliance with funding requirements. Organizations can easily customize it to align with their specific budget categories and reporting needs.

Quarterly Budget Tracker with Income and Expenses

What information is typically contained in a Quarterly Budget Tracker with Income and Expenses? This document usually includes detailed records of all income sources and categorized expenses for each month within the quarter. It helps in monitoring financial performance, identifying spending patterns, and ensuring that budgets are adhered to effectively.

What is an important aspect to focus on when using a Quarterly Budget Tracker with Income and Expenses? Accuracy in recording all transactions is essential to provide a clear financial overview. Additionally, regularly reviewing and comparing actual expenses against planned budgets ensures better financial control and informed decision-making.

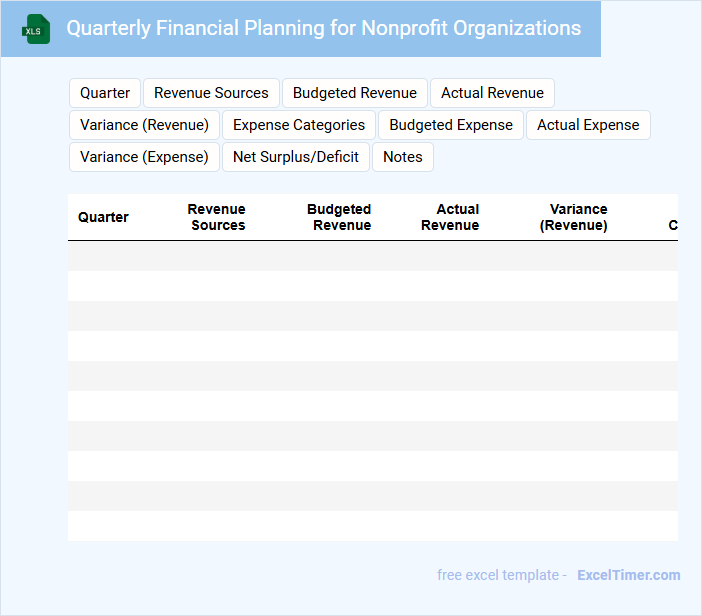

Quarterly Financial Planning for Nonprofit Organizations

The Quarterly Financial Planning document for nonprofit organizations typically includes detailed budgets, income projections, and expense tracking for the upcoming quarter. It serves as a strategic guide to ensure financial sustainability and resource allocation aligned with the nonprofit's mission. Key recommendations include regularly updating forecasts, monitoring cash flow closely, and incorporating contingency plans to address potential funding fluctuations.

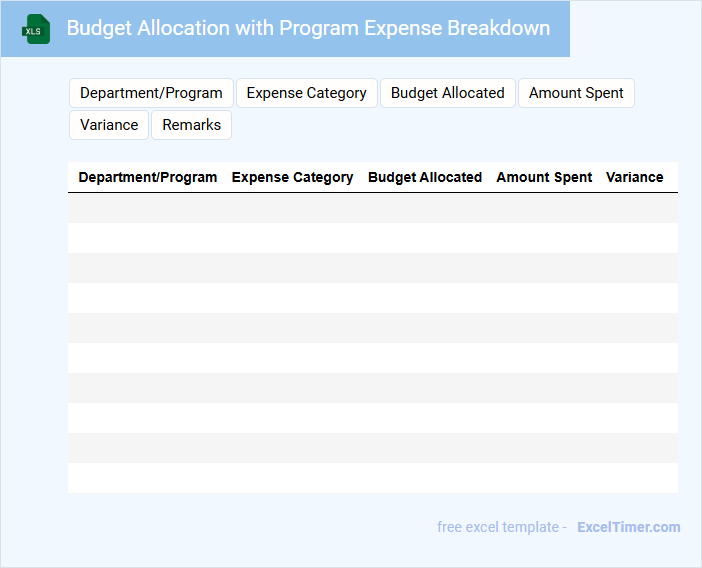

Budget Allocation with Program Expense Breakdown

Budget Allocation with Program Expense Breakdown documents typically detail the distribution of financial resources across various programs and their associated costs.

- Clear categorization: Ensure all expenses are grouped by program for easy reference and accountability.

- Accurate totals: Verify that all allocated amounts and breakdown figures sum correctly to avoid discrepancies.

- Regular updates: Keep the document current to reflect budget changes and program adjustments promptly.

Quarterly Grant Spending Report for Nonprofits

A Quarterly Grant Spending Report for Nonprofits details the allocation and expenditure of awarded funds over a three-month period to ensure transparency and accountability. It highlights how the grant supports the organization's mission and tracks compliance with donor requirements.

- Include a summary of funds received and their specific uses during the quarter.

- Provide clear documentation of expenses with receipts or invoices attached.

- Highlight any challenges faced and adjustments made to the spending plan.

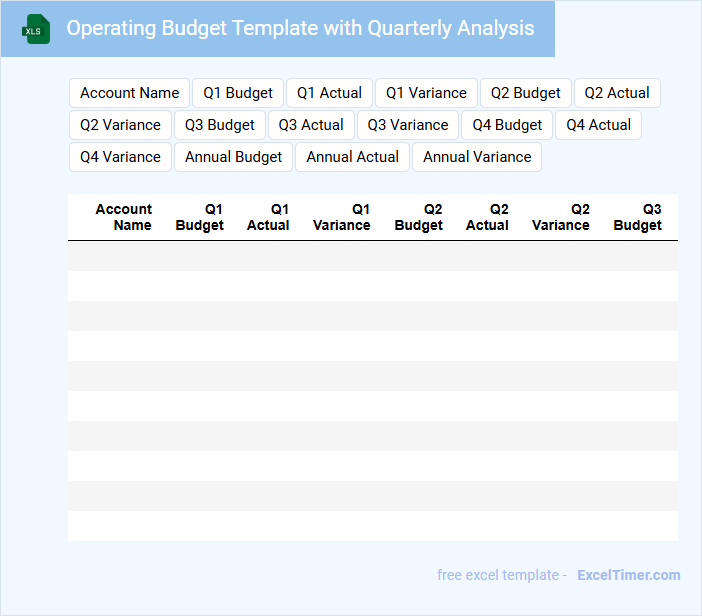

Operating Budget Template with Quarterly Analysis

An Operating Budget Template with Quarterly Analysis typically contains detailed projections of income and expenses over a fiscal year, broken down into four quarters. It helps organizations plan and control financial resources efficiently. This document serves as a crucial tool for monitoring financial performance and making informed business decisions. The template usually includes sections for revenue streams, fixed and variable costs, and profit margins analyzed quarterly to identify trends and variances. Regular quarterly analysis promotes timely adjustments to budgeting strategies. Ensuring accuracy and consistency in data entry is essential for reliable forecasting.

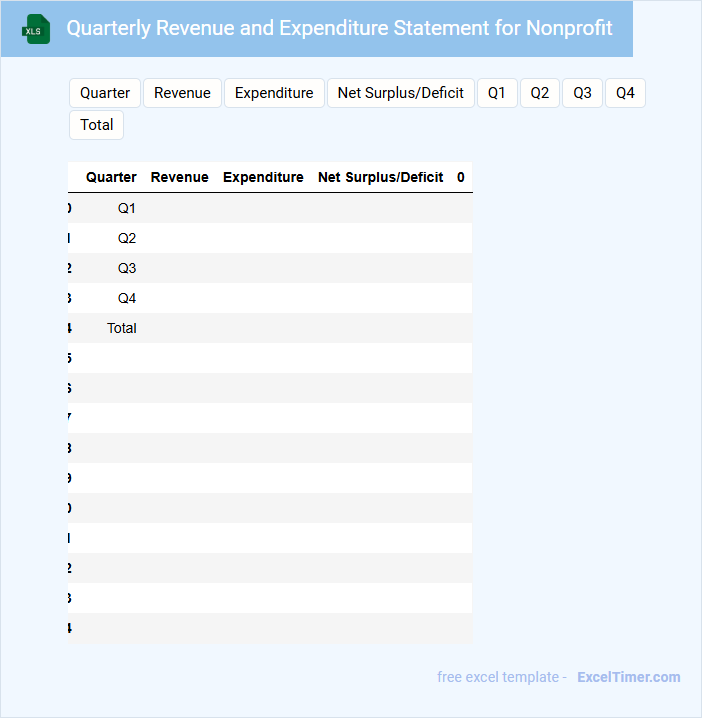

Quarterly Revenue and Expenditure Statement for Nonprofit

The Quarterly Revenue and Expenditure Statement is a financial report that outlines a nonprofit's income and spending over a three-month period. It provides transparency and accountability to stakeholders by detailing sources of revenue and categorized expenses.

Typically, this document includes revenues from donations, grants, and fundraising activities, along with operational and program costs. A key suggestion is to ensure accuracy and clarity in categorizing transactions to effectively track financial health and support strategic decision-making.

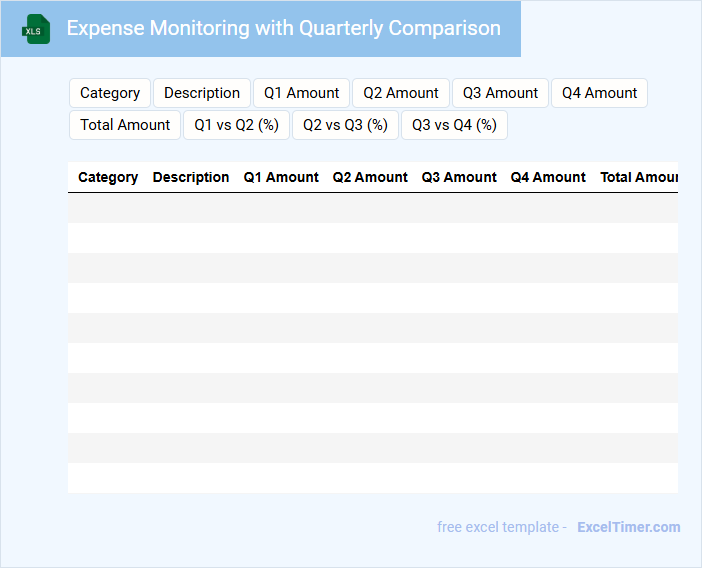

Expense Monitoring with Quarterly Comparison

Expense Monitoring with Quarterly Comparison documents typically contain summarized financial data to track spending over multiple quarters for better budget management.

- Identify Key Expense Categories: Highlight major areas where funds are spent to detect trends or anomalies.

- Compare Quarterly Variations: Analyze fluctuations in expenses between quarters to adjust financial planning.

- Set Budgetary Goals: Use the data to establish future spending limits and improve cost efficiency.

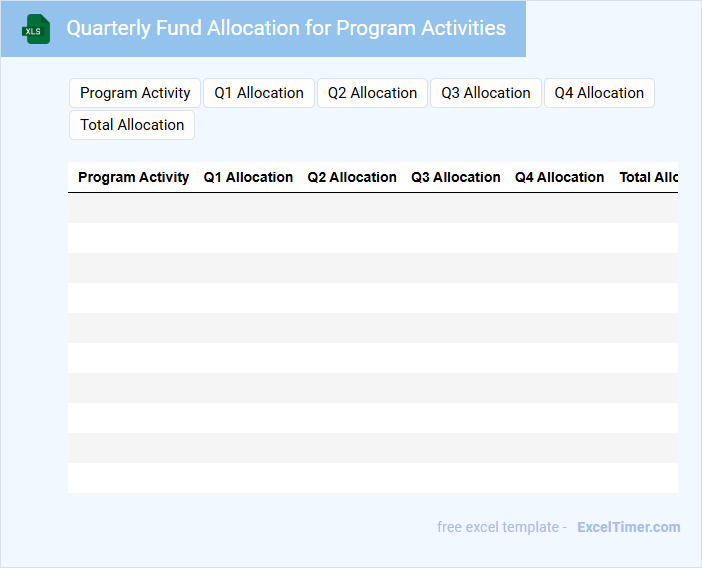

Quarterly Fund Allocation for Program Activities

Quarterly Fund Allocation for Program Activities documents the planned distribution of financial resources to various program initiatives within a three-month period.

- Budget Overview: Clearly outlines the total funds available and their intended allocation across different activities.

- Activity Prioritization: Highlights key program activities prioritized for funding based on strategic goals.

- Monitoring & Reporting: Includes guidelines for tracking expenditures and evaluating financial performance throughout the quarter.

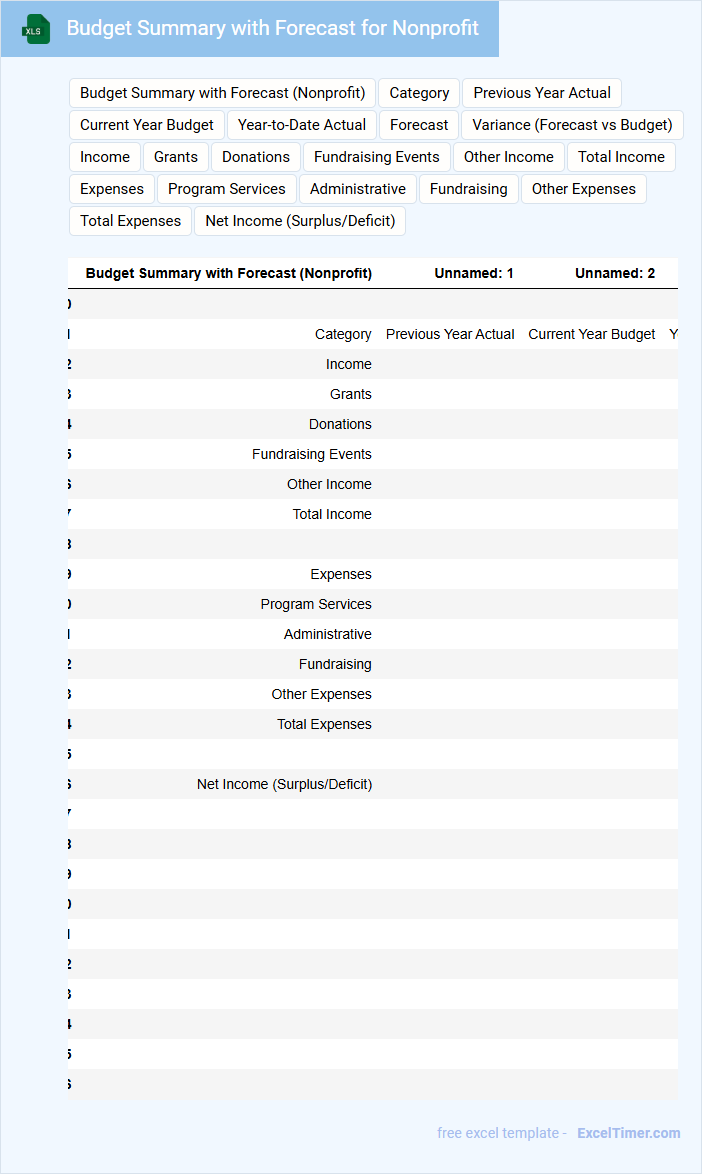

Budget Summary with Forecast for Nonprofit

A Budget Summary with Forecast for a nonprofit organization typically contains an overview of projected revenues and expenses aligned with the organization's mission and goals. It helps stakeholders understand financial sustainability by comparing current year budget allocations against anticipated future income and costs. Including key assumptions and variances in the forecast ensures transparency and informed decision-making for resource allocation.

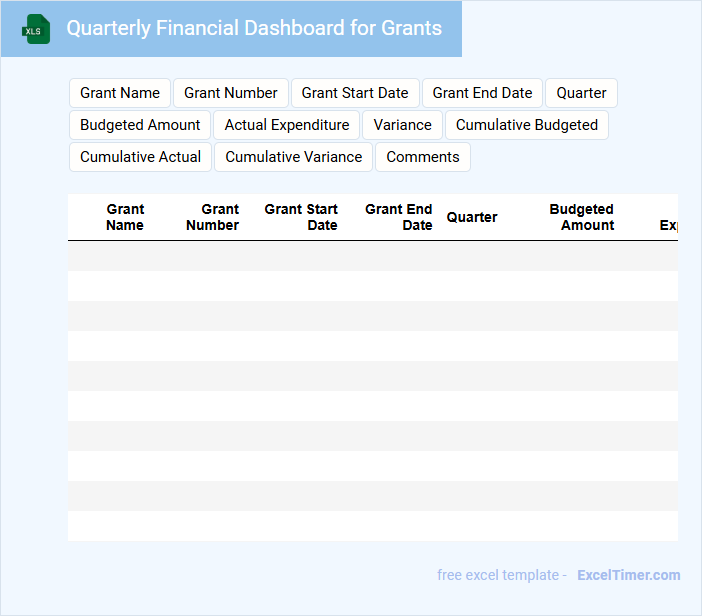

Quarterly Financial Dashboard for Grants

A Quarterly Financial Dashboard for Grants typically contains summarized financial data related to grant funding, including expenditures, budget utilization, and financial forecasts. It serves as a reporting tool for stakeholders to monitor grant performance and ensure compliance with funding requirements.

- Include a clear breakdown of grant income versus expenditures for the quarter.

- Highlight any variances or discrepancies from the approved budget.

- Provide visual aids such as charts or graphs for quick financial insights.

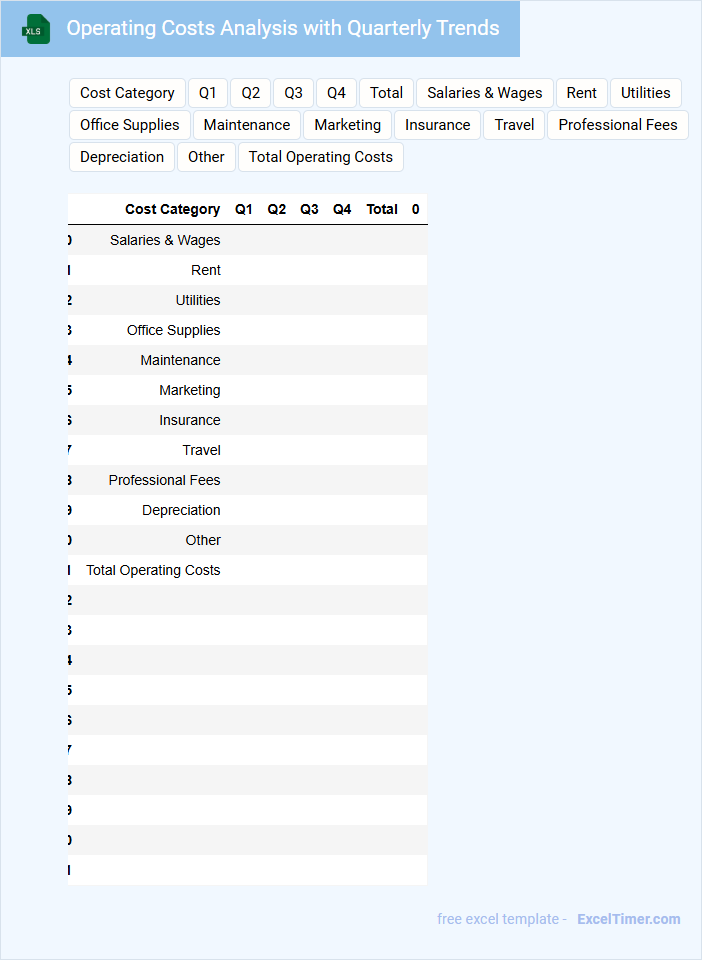

Operating Costs Analysis with Quarterly Trends

Operating Costs Analysis with Quarterly Trends is a document that outlines the expenses incurred by a business over specific periods, highlighting patterns or changes each quarter. It is crucial for identifying cost-saving opportunities and making informed financial decisions.

- Include a clear breakdown of fixed and variable costs to understand their impact on overall expenses.

- Highlight significant fluctuations between quarters to pinpoint causes and address anomalies.

- Incorporate visual aids like charts or graphs to effectively convey trend data and facilitate comparison.

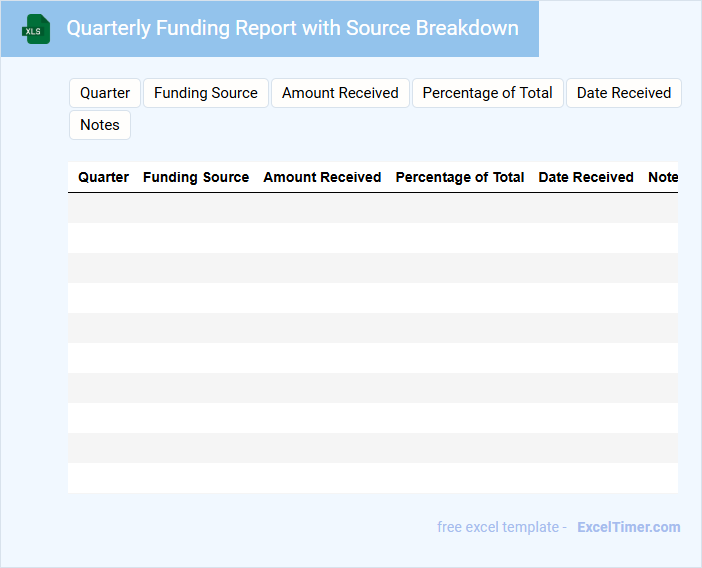

Quarterly Funding Report with Source Breakdown

The Quarterly Funding Report typically contains detailed information about the financial resources obtained during a three-month period. It breaks down the sources of funding, such as government grants, private donations, and corporate sponsorships, providing transparency and accountability. This document helps stakeholders understand the distribution and utilization of funds.

To optimize this report, it is important to include clear, categorized tables for each funding source, accurate figures, and comparison with previous quarters. Highlighting significant changes or trends in funding sources adds valuable insight. Incorporating visual aids like charts can enhance readability and comprehension.

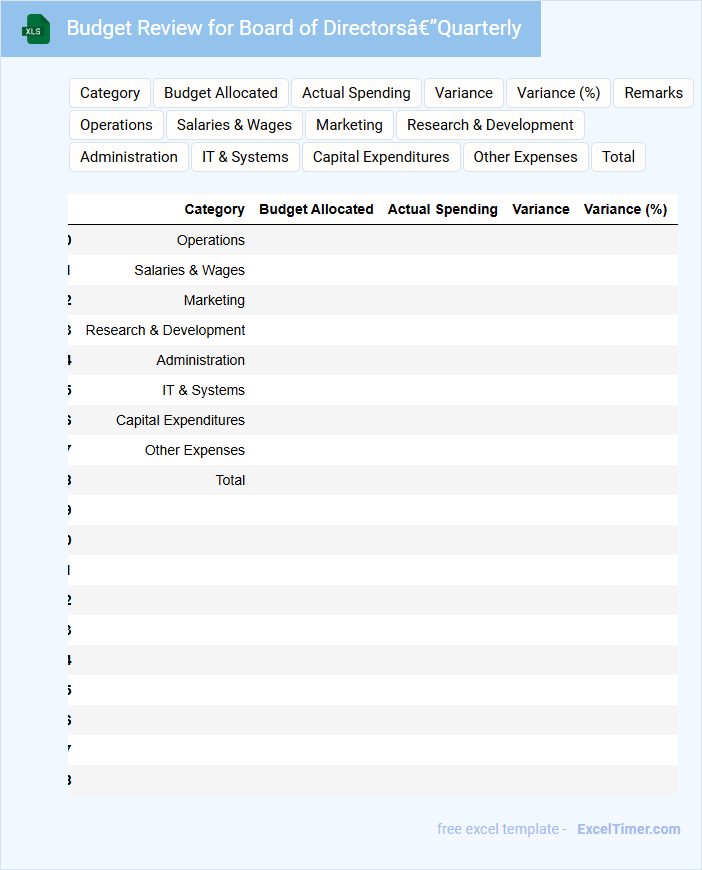

Budget Review for Board of Directors—Quarterly

The Budget Review document typically contains a detailed analysis of the organization's financial performance against the planned budget for the quarter. It includes key metrics, variances, and explanations for any deviations observed during the period.

For the Board of Directors, this report provides critical insights to facilitate informed decision-making and strategic planning. Ensuring clarity and accuracy in presenting financial data is essential for effective governance and oversight.

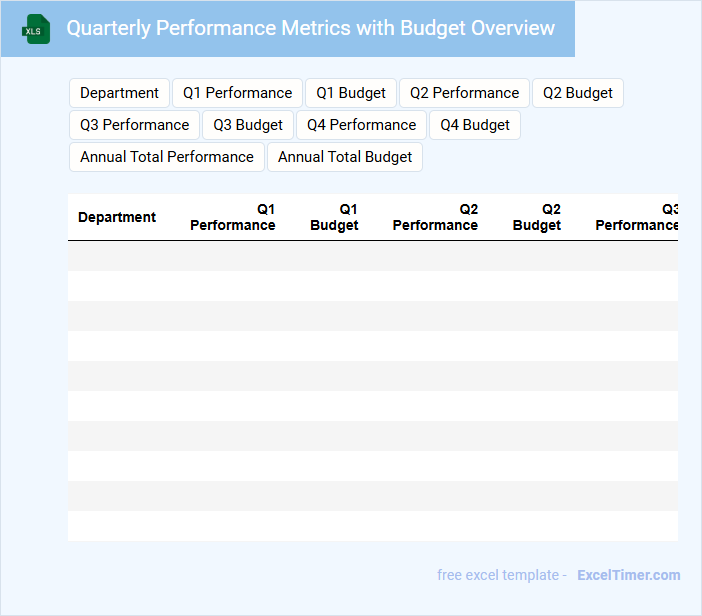

Quarterly Performance Metrics with Budget Overview

A Quarterly Performance Metrics report typically contains data on key performance indicators tracked over the quarter, providing insights into operational efficiency and goal achievement. It also includes a Budget Overview, detailing the expenditure against the allocated budget to highlight financial health. Ensuring accurate data collection and clear visualization of trends is essential for effective decision-making based on this document.

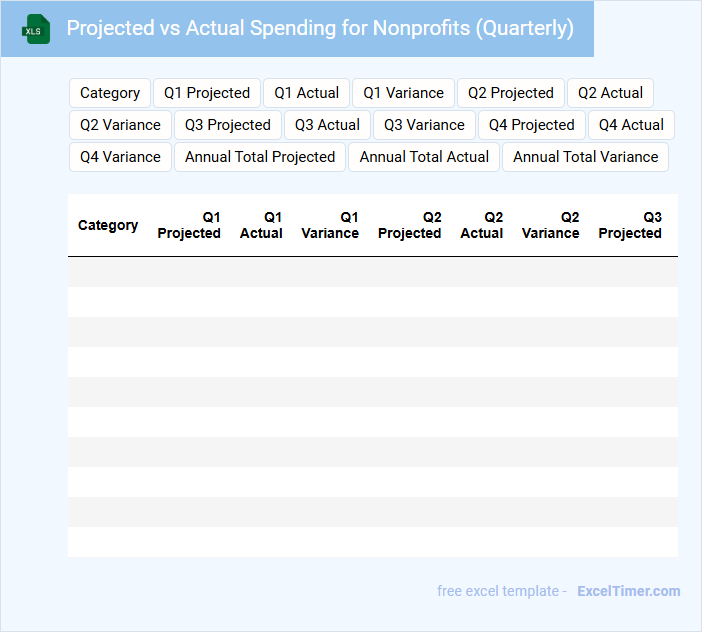

Projected vs Actual Spending for Nonprofits (Quarterly)

What information does a Projected vs Actual Spending report typically contain for nonprofits on a quarterly basis? This document usually includes estimated budget allocations compared against the real expenses incurred during the quarter. It helps organizations track financial performance, identify variances, and make informed adjustments in spending strategies.

Why is it important for nonprofits to regularly review projected versus actual spending? Consistent evaluation ensures fiscal responsibility, supports transparency with stakeholders, and enables timely detection of budget overruns or underspending. Emphasizing clear categorization of expenses and updating projections based on recent trends enhances financial planning accuracy.

What are the primary revenue sources recorded in the nonprofit's quarterly budget Excel document?

Your nonprofit's quarterly budget Excel document primarily records revenue sources such as individual donations, grants from foundations, corporate sponsorships, and fundraising event proceeds. These categories are essential for tracking funding inflows each quarter. Monitoring these sources helps ensure accurate financial planning and sustainability.

How are program expenses categorized and tracked across each quarter in the spreadsheet?

Program expenses are categorized by specific activities such as outreach, staffing, and supplies, with separate columns assigned for each quarter's budget and actual costs. Each entry includes detailed descriptions and budget codes to facilitate accurate tracking and comparison. Quarterly totals are automatically calculated to monitor spending patterns and ensure alignment with the overall nonprofit budget.

What columns or formulas are used to compare actual versus budgeted amounts in the Excel document?

The Excel document for Quarterly Budget for Nonprofits typically includes columns labeled "Budgeted Amount," "Actual Amount," and "Variance." Formulas such as =Actual Amount - Budgeted Amount calculate the variance to identify overspending or underspending. Percentage variance formulas like =(Actual Amount - Budgeted Amount) / Budgeted Amount * 100 provide insights into budget performance efficiency.

How does the Excel budget reflect restricted versus unrestricted funds for the quarter?

The Excel budget categorizes funds by clearly separating restricted and unrestricted amounts in distinct columns or tabs, providing a detailed quarterly breakdown for transparency. Restricted funds are allocated to specific projects or purposes as outlined by donors, whereas unrestricted funds cover general operational expenses. This structure allows nonprofits to track compliance with donor restrictions while managing overall financial health effectively.

Which Excel features (such as charts or pivot tables) are used to visualize financial trends in the quarterly budget?

Excel features like PivotTables summarize quarterly income and expenses, enabling efficient trend analysis for nonprofit budgets. Charts such as line graphs and bar charts visually represent financial fluctuations across quarters. Conditional formatting highlights key budget variances to aid in quick decision-making.