The Quarterly Financial Forecast Excel Template for Startups is a crucial tool designed to help new businesses project revenues, expenses, and cash flow over a three-month period. It enables startups to make informed decisions by providing a clear overview of financial health and identifying potential funding needs. Accuracy in inputting data and regular updates are essential for maximizing the template's forecasting reliability and strategic value.

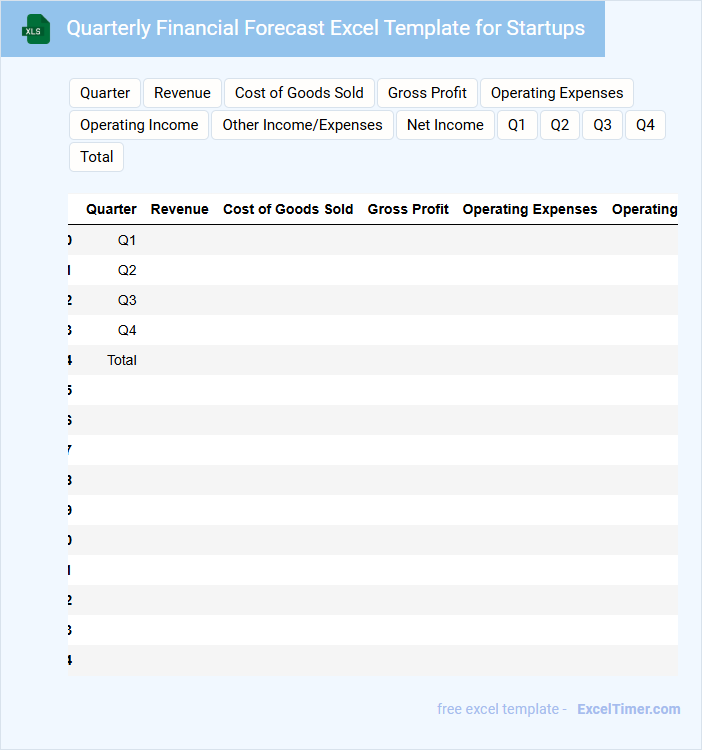

Quarterly Financial Forecast Excel Template for Startups

A Quarterly Financial Forecast Excel Template is commonly used by startups to project their revenue, expenses, and cash flow for upcoming quarters. This document helps in budgeting and tracking financial performance against goals.

It typically contains detailed sections for income statements, balance sheets, and cash flow forecasts. Including key assumptions and growth drivers is important to ensure realistic and actionable projections.

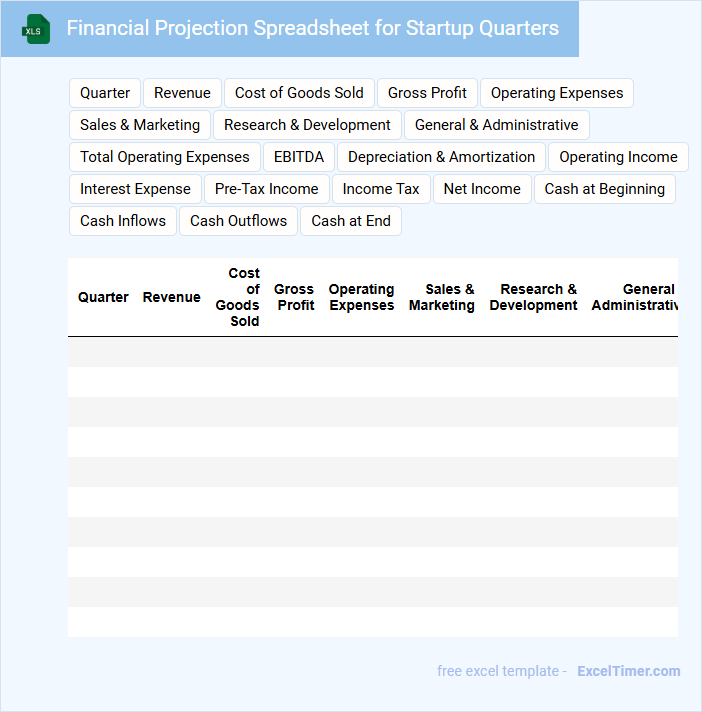

Financial Projection Spreadsheet for Startup Quarters

A Financial Projection Spreadsheet for Startup Quarters typically contains detailed forecasts of revenue, expenses, and cash flow to help startups plan their financial future effectively.

- Revenue Forecast: Predicts future income based on market analysis and sales strategies.

- Expense Breakdown: Lists fixed and variable costs critical for budgeting and cost control.

- Cash Flow Estimates: Tracks inflows and outflows to ensure liquidity throughout each quarter.

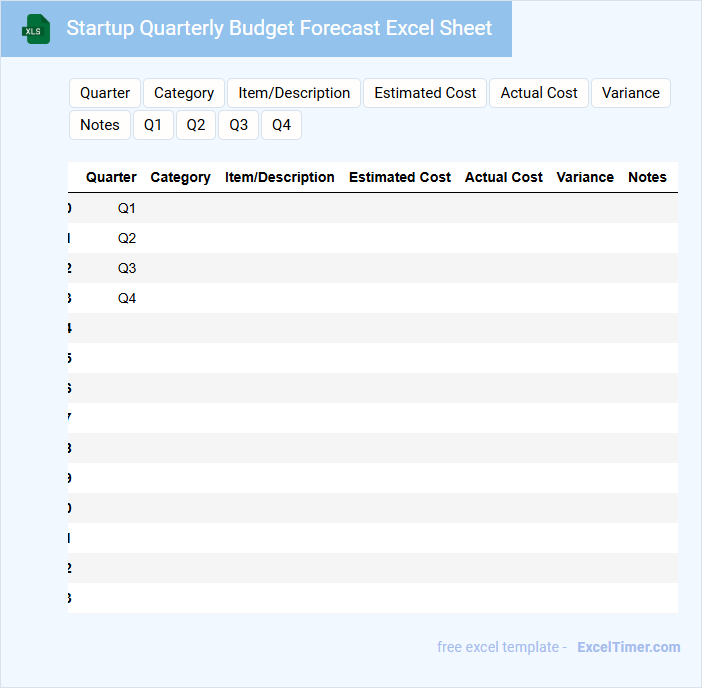

Startup Quarterly Budget Forecast Excel Sheet

A Startup Quarterly Budget Forecast Excel Sheet typically contains detailed projections of income, expenses, and cash flow to help businesses plan their finances effectively.

- Revenue Estimates: Accurately forecast sales and income streams to predict overall revenue.

- Expense Tracking: Include fixed and variable costs to monitor spending habits and control budgets.

- Cash Flow Analysis: Ensure liquidity by projecting cash inflows and outflows for each quarter.

Quarterly Revenue Forecast Excel Template for Startups

The Quarterly Revenue Forecast Excel Template is a crucial document that helps startups project their income over upcoming quarters. It typically contains detailed sales data, revenue streams, and growth assumptions, all organized in a clear and structured layout. This enables startups to make informed financial decisions and adjust strategies proactively.

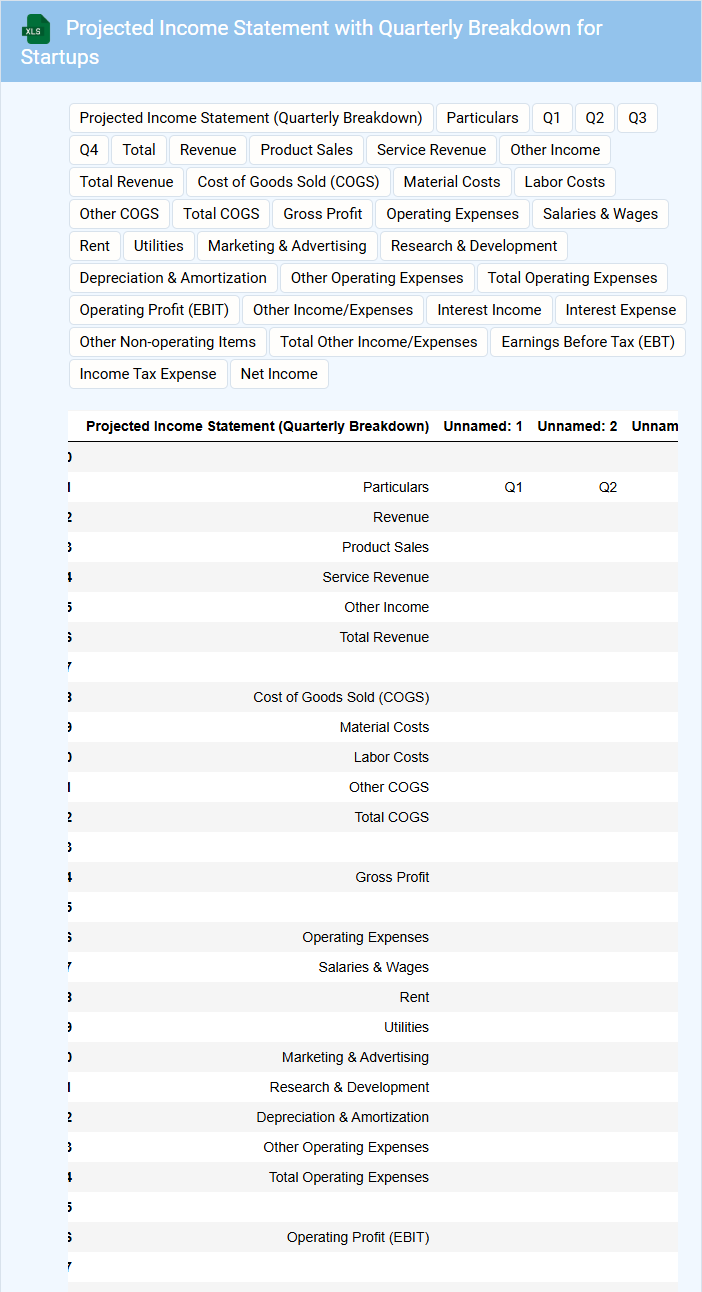

Projected Income Statement with Quarterly Breakdown for Startups

The Projected Income Statement with quarterly breakdown for startups outlines expected revenues, expenses, and profits over each quarter, providing a detailed financial forecast. This document is crucial for understanding the financial trajectory and assessing the viability of the business in its early stages.

Key components include revenue streams, cost of goods sold, operating expenses, and net income projections, all broken down quarterly for precision. Ensuring realistic assumptions and regularly updating the statement based on actual performance is important for effective financial management.

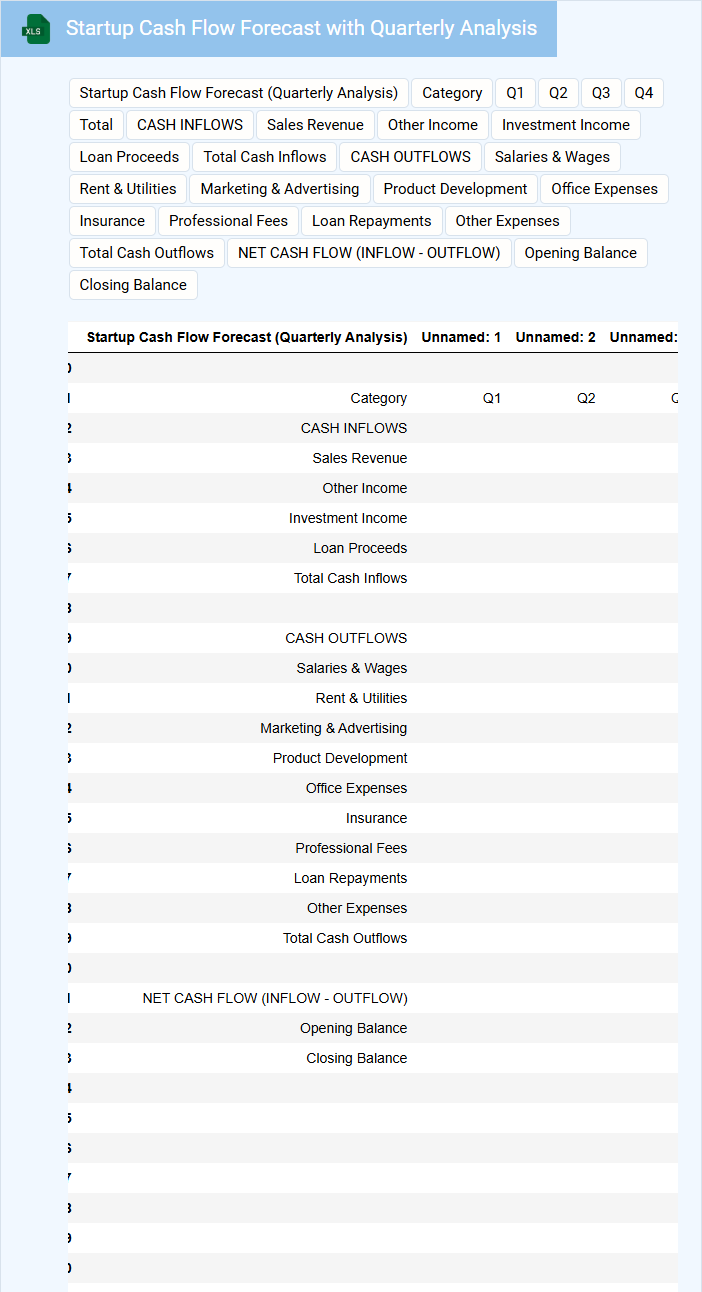

Startup Cash Flow Forecast with Quarterly Analysis

A Startup Cash Flow Forecast is a financial document that projects the inflow and outflow of cash over a specific period, typically broken down quarterly. It helps startups anticipate their liquidity needs and plan for expenses and revenues accordingly. Including quarterly analysis enables businesses to track performance trends and make informed decisions to maintain financial stability.

Quarterly Expense Tracker for Startup Financial Planning

A Quarterly Expense Tracker for Startup Financial Planning typically contains detailed records of all business expenditures within a three-month period to help monitor cash flow and budget adherence.

- Expense Categories: Clearly defined sections for different types of expenses such as marketing, operations, and salaries.

- Monthly Breakdown: A breakdown of expenses by month to identify spending trends and irregularities.

- Cash Flow Analysis: Summary and comparison of total expenses against revenue to evaluate financial health and guide future budgeting.

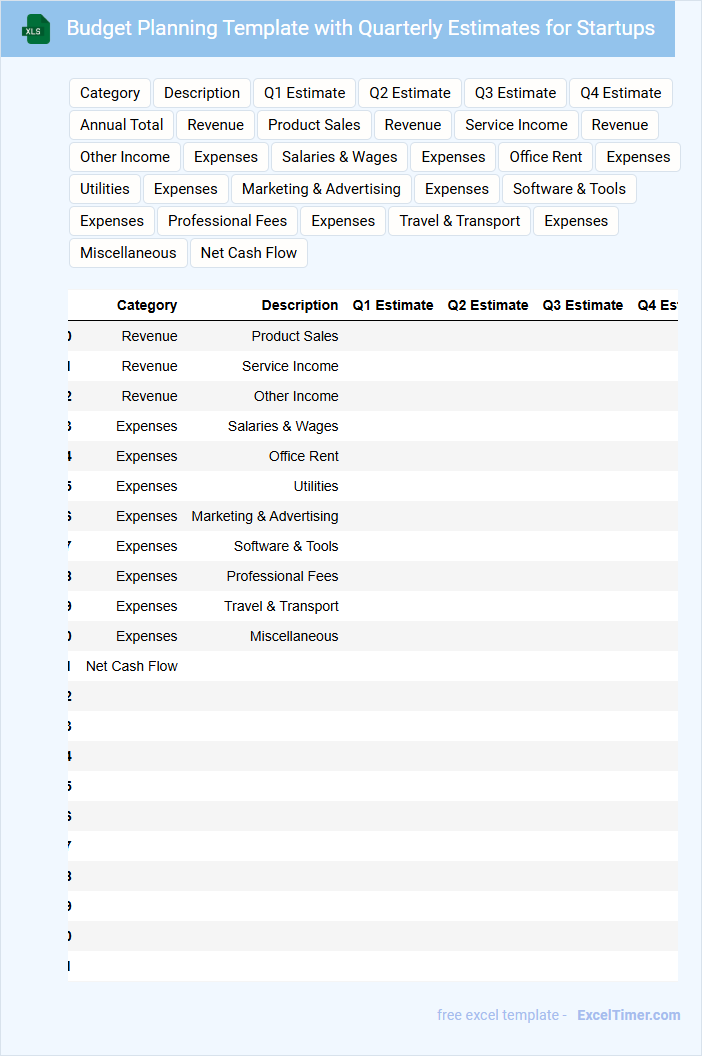

Budget Planning Template with Quarterly Estimates for Startups

A Budget Planning Template with Quarterly Estimates for Startups is a vital document that outlines expected income and expenses over specific fiscal periods. It helps entrepreneurs allocate resources efficiently and monitor financial health throughout the year. Incorporating detailed quarterly projections ensures better adaptability to market changes and supports strategic decision-making.

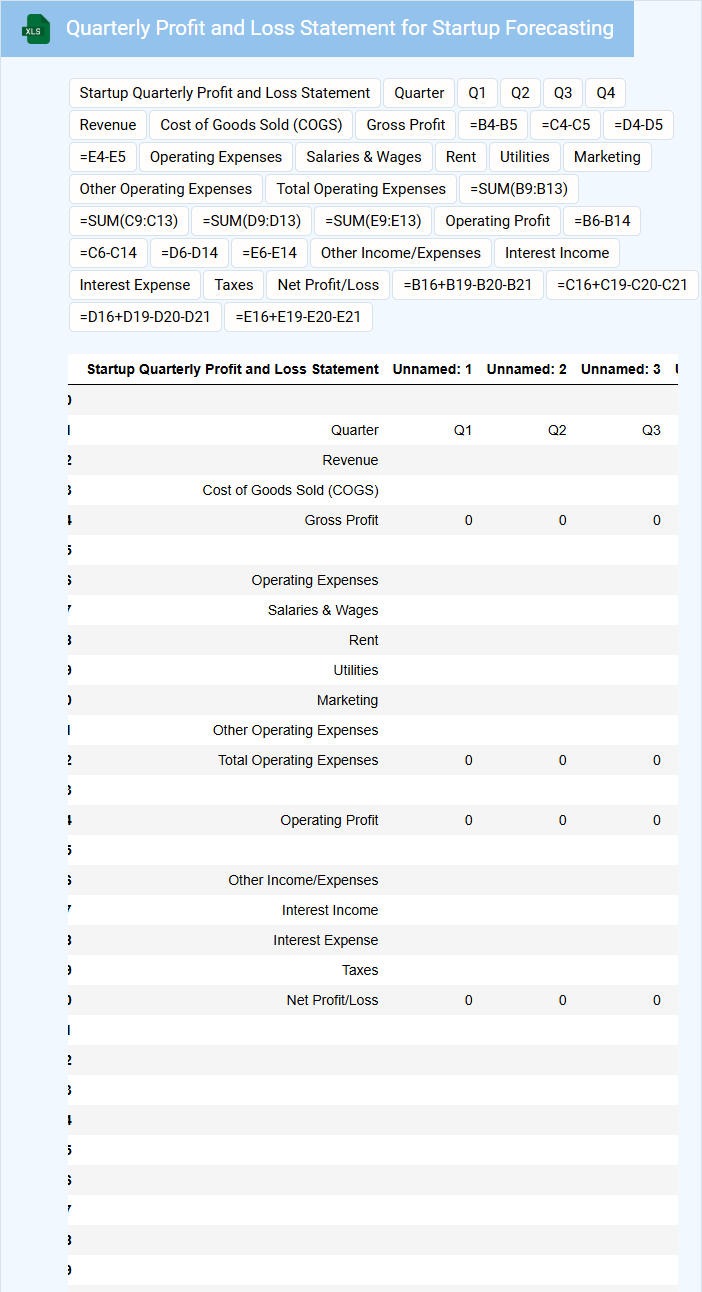

Quarterly Profit and Loss Statement for Startup Forecasting

A Quarterly Profit and Loss Statement for Startup Forecasting is a financial document that summarizes revenues, costs, and expenses over a three-month period to project profitability. It helps startups plan financial strategies and manage cash flow effectively.

- Include detailed revenue streams and cost breakdowns for accuracy.

- Focus on forecasting key expenses and potential financial risks.

- Regularly update projections based on actual performance and market changes.

Startup Financial Model with Quarterly Forecast Excel

A Startup Financial Model with quarterly forecasts typically includes detailed projections of revenue, expenses, cash flow, and profitability to help entrepreneurs plan their business finances effectively. It provides a structured framework to estimate financial performance over time, allowing for informed decision-making and investor presentations. Including assumptions behind growth rates and cost drivers is essential for transparency. Such a document usually contains income statements, balance sheets, and cash flow statements broken down quarterly to capture seasonal trends and operational cycles. Accurate forecasting helps startups anticipate funding needs and manage cash efficiently. Regularly updating the model with real data ensures relevance and strategic alignment.

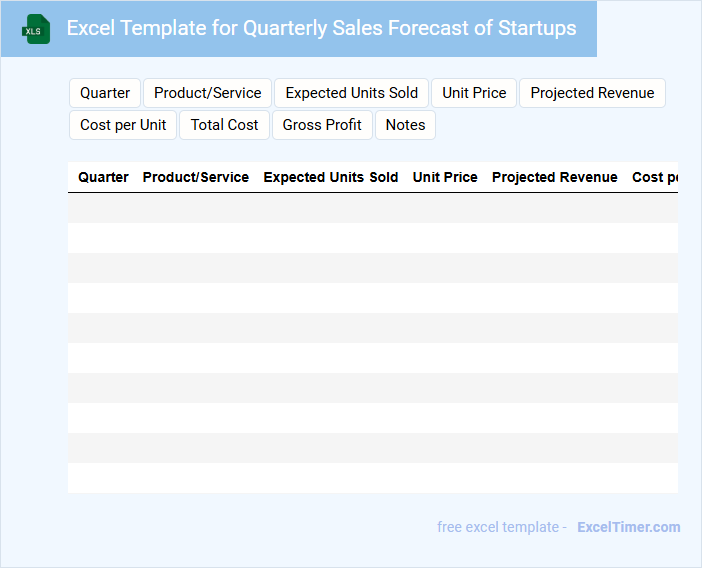

Excel Template for Quarterly Sales Forecast of Startups

An Excel Template for Quarterly Sales Forecast of Startups typically contains structured sheets for inputting historical sales data, projecting future revenue, and analyzing market trends. It often includes customizable formulas to calculate growth rates, profit margins, and cash flow projections.

This document is essential for startups to track financial performance, set realistic targets, and secure investor confidence. A key suggestion is to ensure the template incorporates clear visualization tools like charts and dashboards for quick insights.

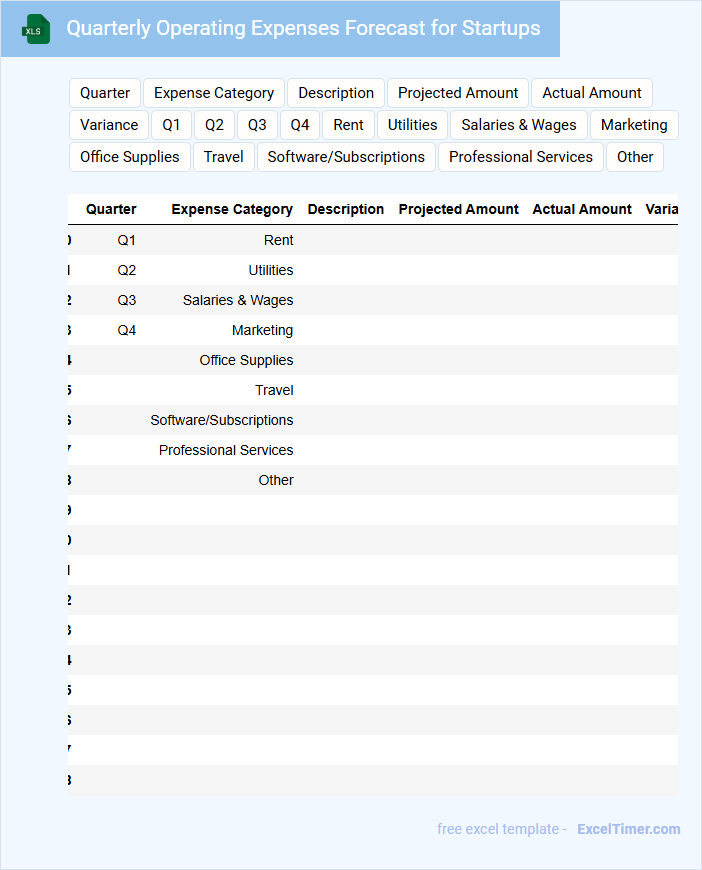

Quarterly Operating Expenses Forecast for Startups

A Quarterly Operating Expenses Forecast for startups typically contains detailed projections of all anticipated costs over the next three months, including fixed and variable expenses. It helps in budgeting and cash flow management by outlining essential expenditures such as salaries, rent, and marketing. Accurate forecasting enables startups to identify potential financial challenges early and adjust operations accordingly.

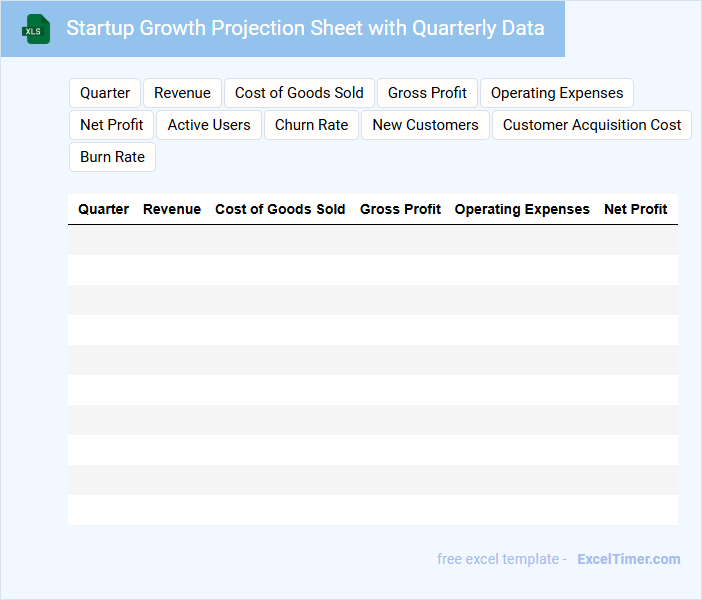

Startup Growth Projection Sheet with Quarterly Data

A Startup Growth Projection Sheet typically contains detailed quarterly data outlining anticipated revenue, expenses, and key performance indicators. It serves as a financial roadmap to guide strategic decisions and measure progress over time. For accuracy, ensure regular updates and realistic assumptions based on current market trends.

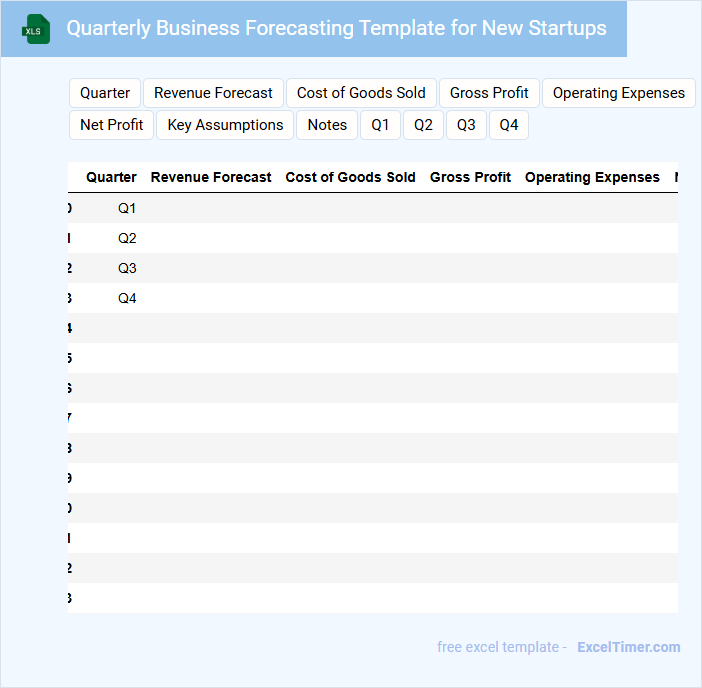

Quarterly Business Forecasting Template for New Startups

A Quarterly Business Forecasting Template for New Startups is a structured document designed to project a startup's financial performance and business metrics over a three-month period. It facilitates strategic planning by highlighting expected revenue, expenses, and growth trends.

- Include realistic sales forecasts based on market research and early customer feedback.

- Highlight key performance indicators (KPIs) such as cash flow, customer acquisition cost, and churn rate.

- Regularly update projections to reflect changing market conditions and business milestones.

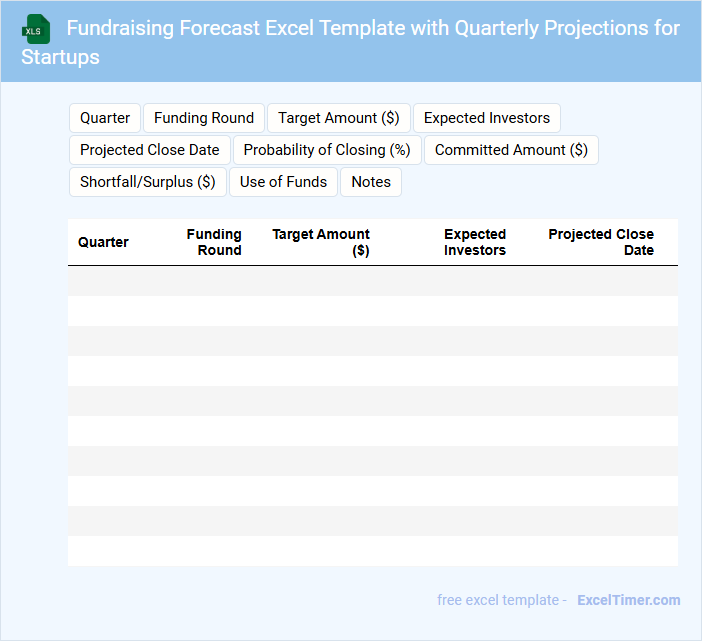

Fundraising Forecast Excel Template with Quarterly Projections for Startups

A Fundraising Forecast Excel Template is a crucial tool for startups to project their funding needs over time, typically broken down by quarters. It contains key financial data, including projected expenses, revenue, and capital requirements.

This document helps founders visualize capital flow and prepare strategic funding rounds to support growth. Important elements to include are clear assumptions, detailed quarterly financial metrics, and contingency plans.

What key revenue streams should be included in a quarterly financial forecast for startups?

Your quarterly financial forecast for startups should include key revenue streams such as product sales, subscription services, and licensing fees. Incorporate forecasted income from partnerships, advertising, and one-time project revenues to capture diverse income sources. Tracking these streams enables accurate financial planning and growth evaluation.

Which expense categories are most critical to track for accurate quarterly forecasting?

Tracking payroll expenses, research and development costs, and operational overhead is critical for accurate quarterly financial forecasting in startups. Monitoring these categories helps identify cash flow trends, allocate resources effectively, and predict funding requirements. Accurate data on marketing spend and customer acquisition costs also enhances forecast precision and strategic planning.

How should cash flow projections be structured in an Excel document for a startup's quarterly forecast?

Structure cash flow projections in your Excel document by creating separate sections for operating, investing, and financing activities, each with detailed line items for expected inflows and outflows. Use clear labels for each quarter across columns and ensure formulas automatically calculate net cash flow and cumulative cash balance to provide real-time visibility. Accurate cash flow projections enable startups to anticipate liquidity needs and make informed strategic decisions.

What assumptions must be clearly stated when preparing a quarterly financial forecast in Excel?

Key assumptions for a quarterly financial forecast in Excel include projected revenue growth rates, cost structures including fixed and variable expenses, and anticipated capital expenditures. Assumptions about market conditions, customer acquisition rates, and cash flow timing also critically impact forecast accuracy. Clearly stating these variables ensures transparency and aids in scenario analysis for strategic decision-making.

How can scenario analysis be incorporated into an Excel-based quarterly financial forecast for startups?

Scenario analysis can be incorporated into your Excel-based quarterly financial forecast for startups by creating multiple financial models that reflect different possible business conditions such as best-case, worst-case, and base-case scenarios. Use Excel features like data tables, drop-down lists, and conditional formatting to dynamically adjust key variables such as revenue growth rates, expense projections, and funding rounds. This allows you to visually compare outcomes, assess risks, and make informed strategic decisions aligned with your startup's financial goals.