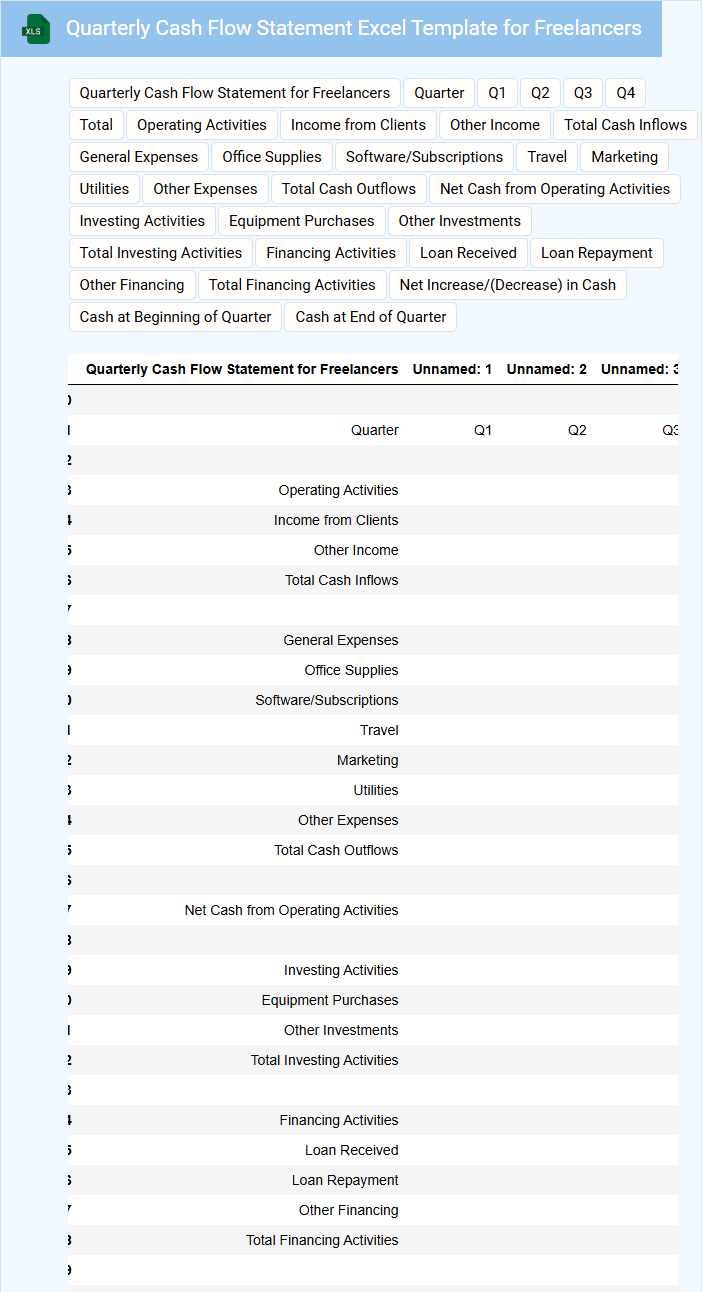

The Quarterly Cash Flow Statement Excel Template for Freelancers helps track and manage income and expenses efficiently over each quarter, providing clear visibility into financial health. Its customizable format enables freelancers to forecast cash inflows and outflows, ensuring better budgeting and financial planning. Using this template supports timely decision-making and enhances the ability to maintain positive cash flow.

Quarterly Cash Flow Statement Excel Template for Freelancers

A Quarterly Cash Flow Statement Excel template for freelancers usually contains detailed records of cash inflows and outflows over a three-month period. It helps track income from various freelance projects and monitor expenses such as software subscriptions or office supplies. This document is essential for managing finances efficiently and ensuring steady cash flow throughout the quarter.

Important elements to include are clear categories for different income streams, recurring and one-time expenses, and a summary section that highlights net cash flow. Incorporating formulas for automatic calculations enhances accuracy and saves time. Additionally, providing space for notes can help freelancers document important financial insights or upcoming expenditures.

Cash Flow Tracking Workbook for Freelance Professionals

This Cash Flow Tracking Workbook is designed to help freelance professionals monitor their income and expenses efficiently. It typically includes sections for tracking invoices, payments received, and upcoming bills to maintain a clear financial overview.

Freelancers use this document to manage irregular income and plan for taxes and savings. An important suggestion is to update the workbook regularly to ensure accurate cash flow management and avoid financial surprises.

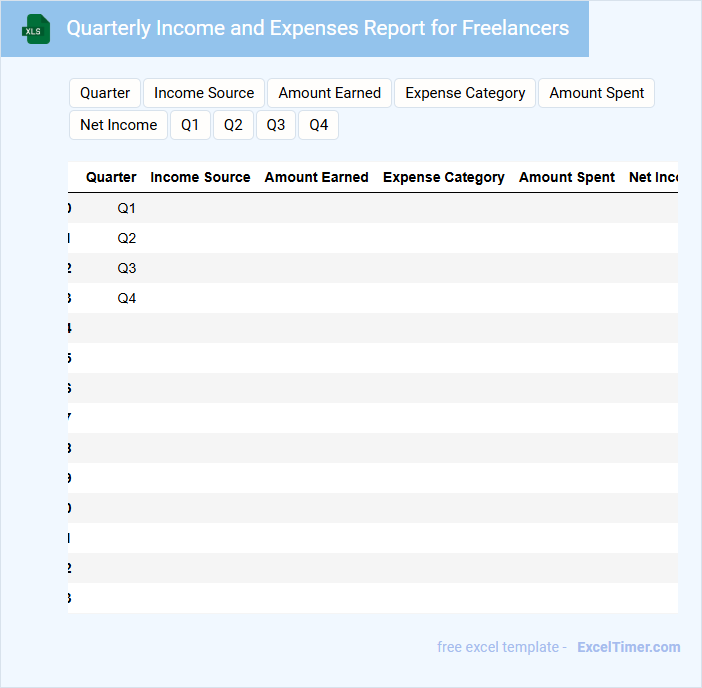

Quarterly Income and Expenses Report for Freelancers

A Quarterly Income and Expenses Report for Freelancers typically contains detailed financial records summarizing earnings and expenditures over a three-month period.

- Income Details: itemized sources of freelance revenue including client payments and project fees.

- Expense Tracking: categorized costs such as software subscriptions, equipment, and office supplies.

- Summary Analysis: net profit calculation and cash flow insights to inform budgeting and tax preparation.

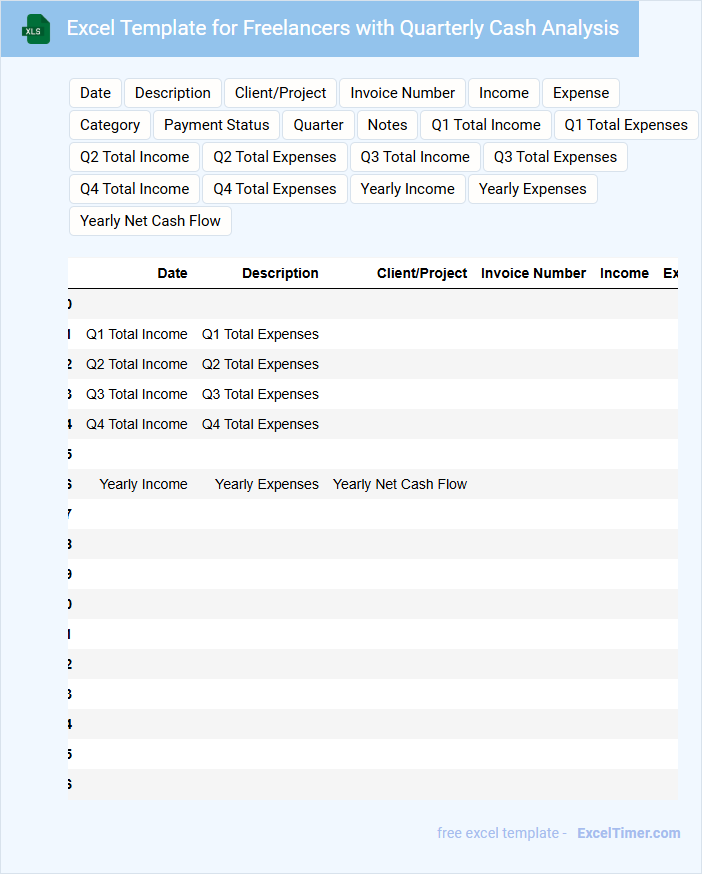

Excel Template for Freelancers with Quarterly Cash Analysis

This document typically contains organized financial data for freelancers, enabling efficient tracking and analysis of quarterly cash flow.

- Income entries: Detailed records of freelance payments received each quarter.

- Expense tracking: Categorized freelancer business expenses to monitor cash outflow.

- Quarterly summaries: Consolidated cash analysis highlighting profits and losses over three-month periods.

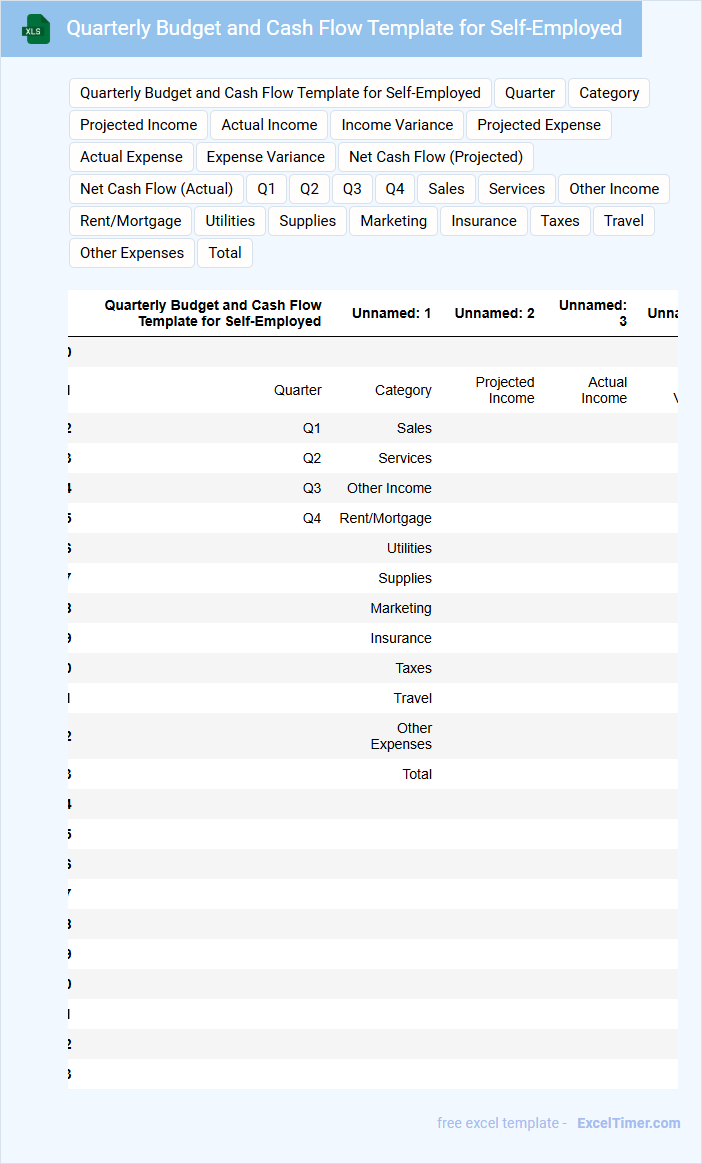

Quarterly Budget and Cash Flow Template for Self-Employed

What information is typically included in a Quarterly Budget and Cash Flow Template for Self-Employed individuals? This document usually contains detailed income forecasts, expense tracking, and cash flow projections for a three-month period. It helps self-employed professionals manage their finances by organizing expected earnings and expenditures to ensure liquidity and financial stability.

What important features should be included in this template? Key elements include categorizing income sources, itemizing fixed and variable expenses, and forecasting cash inflows and outflows. Additionally, incorporating sections for tax set-asides and emergency funds can enhance financial planning accuracy for self-employed individuals.

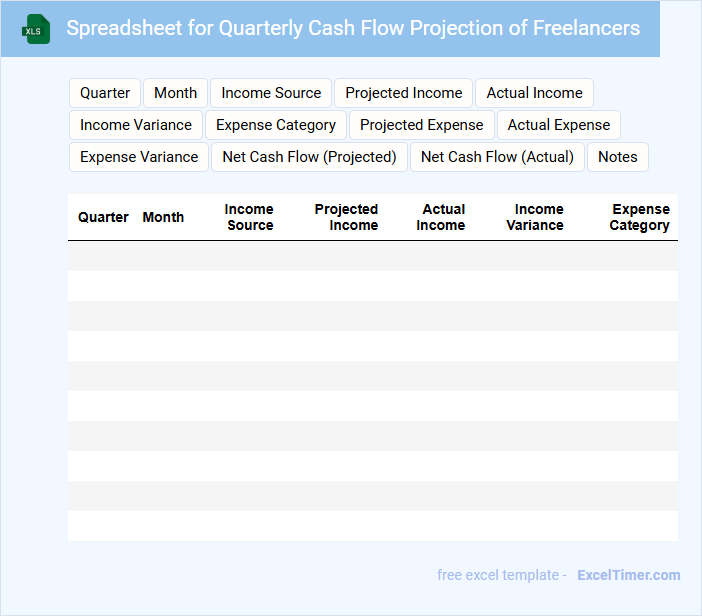

Spreadsheet for Quarterly Cash Flow Projection of Freelancers

A Spreadsheet for Quarterly Cash Flow Projection is an essential document used by freelancers to estimate their incoming and outgoing cash over a three-month period. It typically contains detailed income sources, expected expenses, and net cash flow calculations. This organized financial overview helps freelancers plan budgets, manage liquidity, and anticipate potential shortfalls.

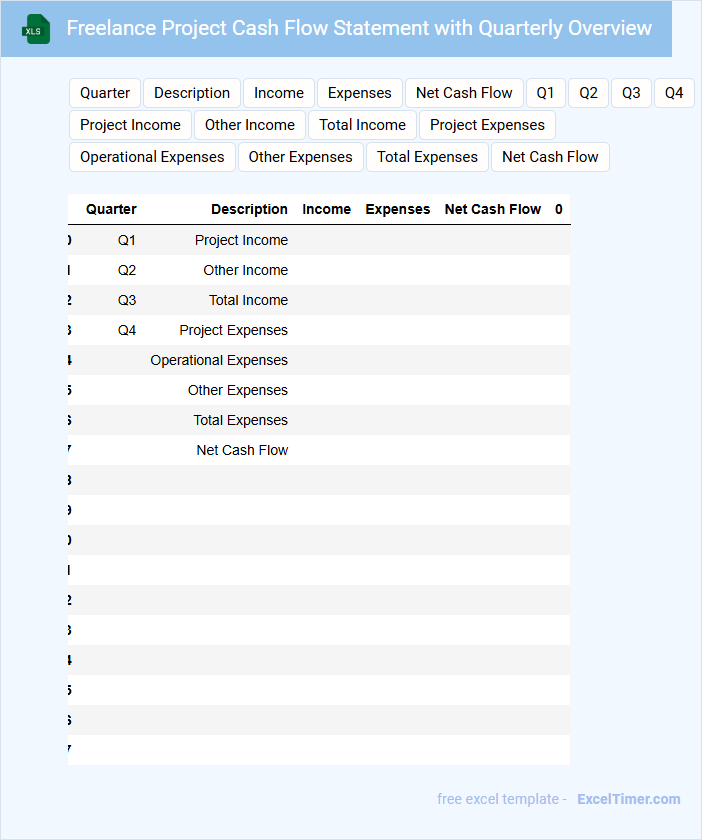

Freelance Project Cash Flow Statement with Quarterly Overview

A Freelance Project Cash Flow Statement with a Quarterly Overview typically contains detailed records of all cash inflows and outflows associated with freelance projects within each quarter. It highlights income from client payments, expenses such as software subscriptions, and any taxes or fees paid. This document provides freelancers with an organized view of their financial health over time, enabling better budgeting and financial planning.

Important elements to include are clear categorization of income and expenses, timely recording of transactions, and projections for future cash flow. Ensuring accuracy and updating the statement regularly can help identify trends and potential shortfalls before they impact the business. Additionally, including notes on any irregular or one-time payments can improve clarity and financial decision-making.

Excel Tracker for Freelancers with Quarterly Cash Flows

An Excel Tracker for Freelancers is typically designed to organize and monitor income and expenses on a regular basis. It often includes features such as project tracking, invoicing, and detailed cash flow analysis. Managing quarterly cash flows helps freelancers anticipate financial trends and plan for taxes effectively.

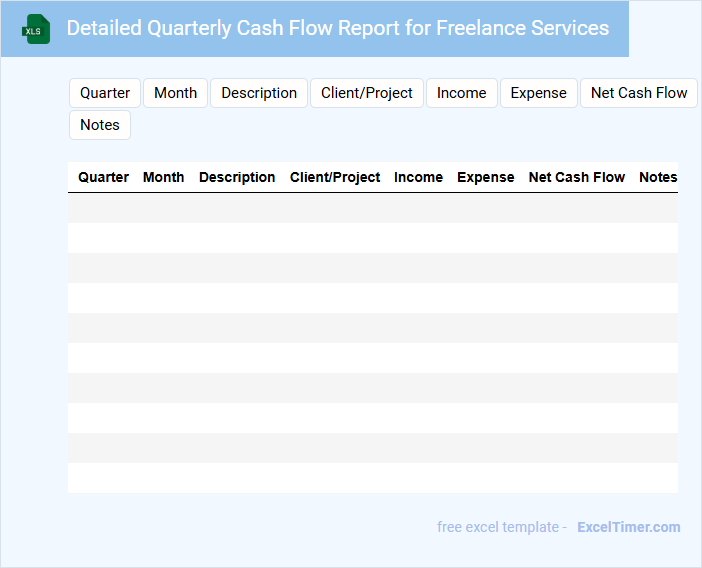

Detailed Quarterly Cash Flow Report for Freelance Services

What information is typically included in a Detailed Quarterly Cash Flow Report for Freelance Services? This document usually contains a comprehensive record of all cash inflows and outflows related to freelance work over a three-month period. It helps freelancers track their income from various clients and expenses such as software subscriptions, equipment, and taxes to maintain financial clarity and plan effectively.

What important aspects should freelancers consider when preparing this report? Freelancers should ensure accurate categorization of income and expenditures, reconcile any discrepancies with bank statements, and highlight trends or irregularities to forecast future cash flow needs. Including detailed notes on delayed payments or anticipated expenses can also greatly enhance financial decision-making and stability.

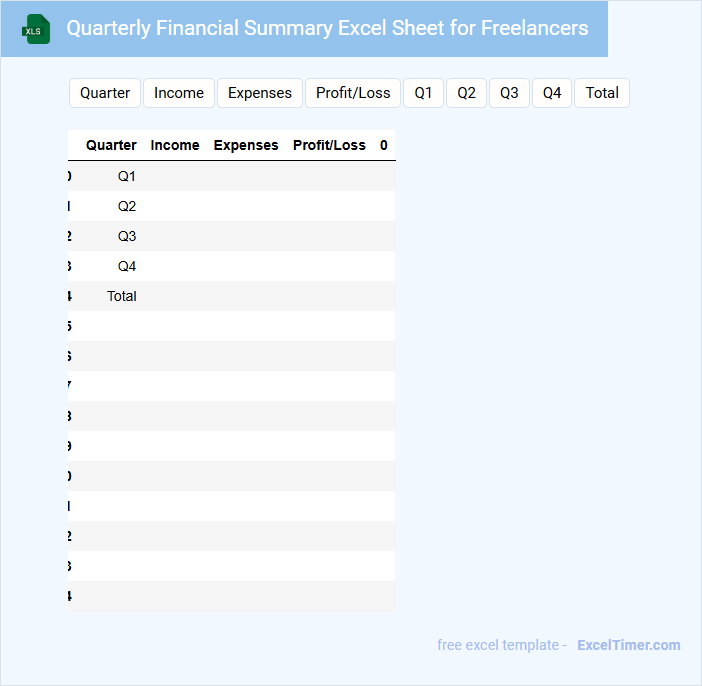

Quarterly Financial Summary Excel Sheet for Freelancers

What information is typically contained in a Quarterly Financial Summary Excel Sheet for Freelancers? This document usually includes income, expenses, tax calculations, and profit/loss data for a specific quarter. It helps freelancers track their financial performance, prepare for tax season, and make informed business decisions.

What important elements should be included in such a summary? Clear categorization of income streams and expenses, accurate formulas for automatic calculations, and sections for notes or tax deductions are essential. Including a visual representation like charts can also improve understanding and analysis.

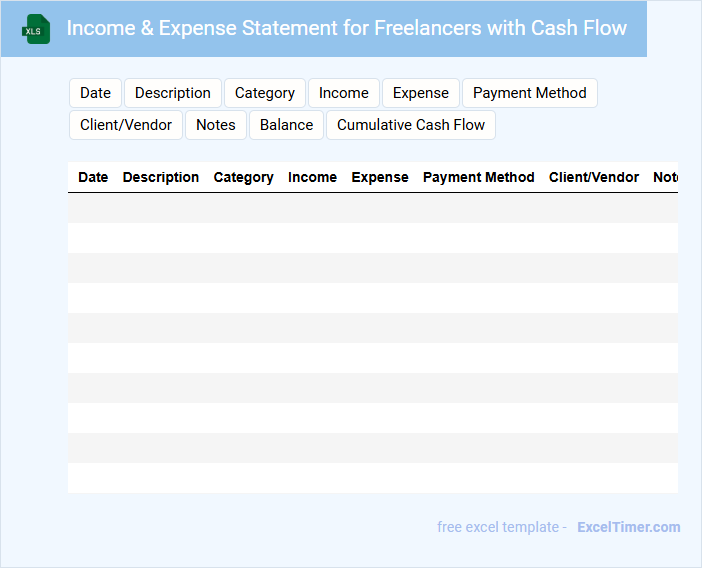

Income & Expense Statement for Freelancers with Cash Flow

An Income & Expense Statement for freelancers is a crucial financial document that tracks all earnings and expenditures over a specific period. It provides a clear overview of cash inflows and outflows, helping freelancers manage their finances more effectively. Including detailed information on income sources, expenses, and net cash flow is essential for accurate financial planning and tax reporting.

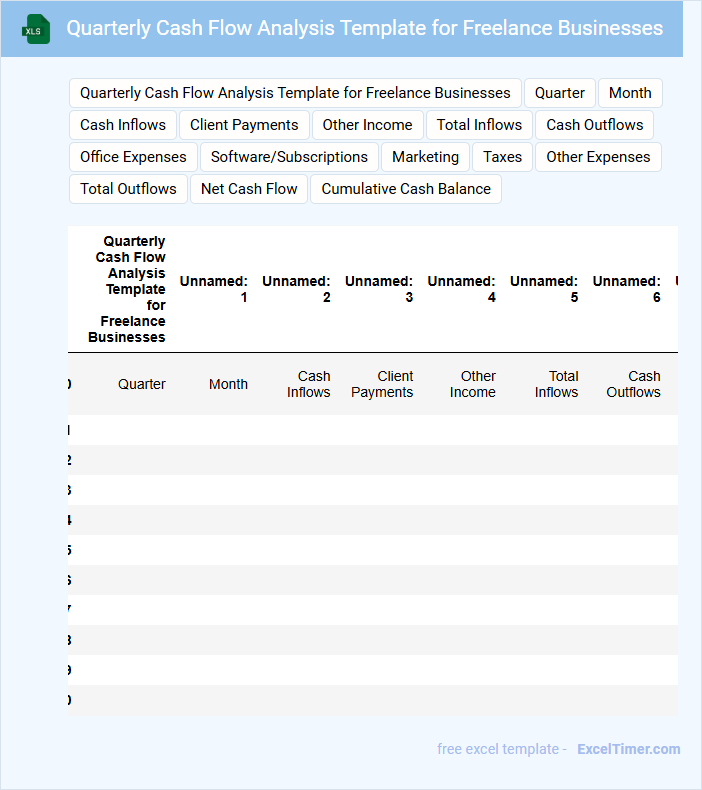

Quarterly Cash Flow Analysis Template for Freelance Businesses

A Quarterly Cash Flow Analysis Template for Freelance Businesses helps track income and expenses over three months, providing clear financial insights. It aids freelancers in managing their cash flow effectively to ensure sustainability and growth.

- Include all sources of income and categorize expenses accurately.

- Regularly update the template to monitor cash inflows and outflows.

- Use summary charts to visualize trends and make informed decisions.

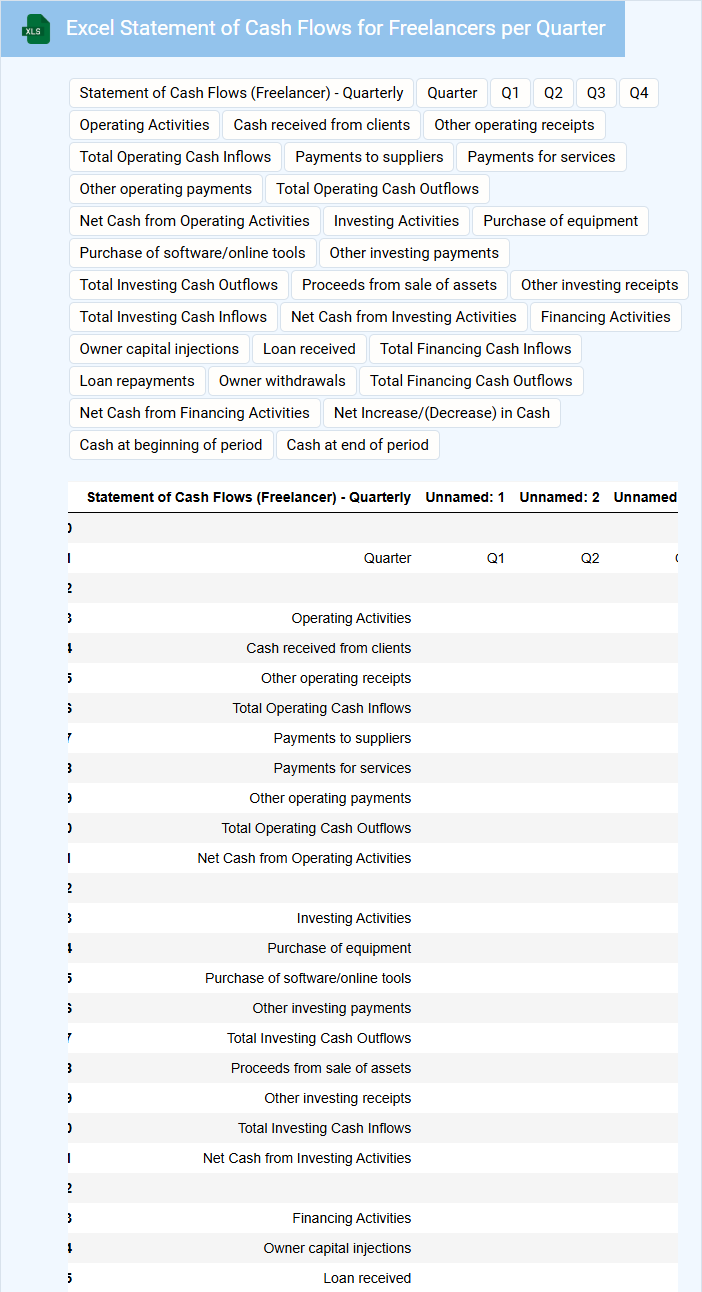

Excel Statement of Cash Flows for Freelancers per Quarter

An Excel Statement of Cash Flows for freelancers per quarter typically contains detailed records of cash inflows and outflows from operating, investing, and financing activities. This document helps freelancers track their liquidity and understand how cash is generated and spent over three months. Regularly updating this statement ensures accurate financial management and aids in strategic planning.

Quarterly Freelance Finance Tracker with Cash Flow Statement

A Quarterly Freelance Finance Tracker typically contains detailed records of income, expenses, and invoices specific to freelance work over a three-month period. It helps in monitoring financial health and ensures timely payments and budget adherence.

This document often includes a Cash Flow Statement, summarizing the inflow and outflow of cash to provide a clear view of liquidity. Maintaining accurate entries is crucial for forecasting and tax preparation.

For optimal use, regularly update the tracker and reconcile it with bank statements to avoid discrepancies and support sound financial decisions.

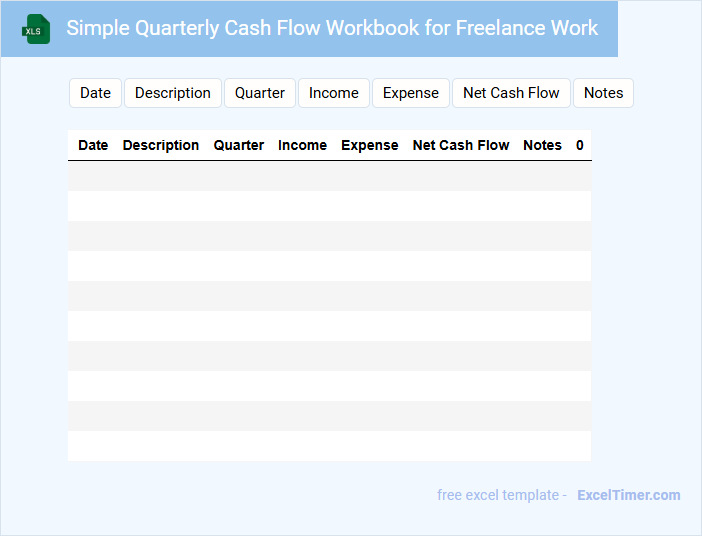

Simple Quarterly Cash Flow Workbook for Freelance Work

A Simple Quarterly Cash Flow Workbook for freelance work typically contains detailed records of income and expenses tracked over a three-month period. It helps freelancers understand their financial health by highlighting cash inflows and outflows, ensuring timely payments and budgeting. Key sections often include income sources, fixed and variable expenses, and net cash flow summaries.

What key income and expense categories should be included in a freelancer's quarterly cash flow statement?

Your quarterly cash flow statement for freelancers should include key income categories such as client payments, project advances, and royalty earnings. Essential expense categories consist of software subscriptions, equipment costs, marketing expenses, and taxes. Tracking these entities ensures accurate financial management and cash flow visibility.

How does tracking quarterly cash inflows and outflows help freelancers manage seasonal income fluctuations?

Tracking quarterly cash inflows and outflows enables freelancers to identify patterns in seasonal income fluctuations and plan expenses accordingly. This financial insight supports maintaining sufficient cash reserves during low-income periods and optimizing investment during high-income quarters. A detailed Quarterly Cash Flow Statement empowers freelancers to achieve greater financial stability and informed decision-making.

Which Excel formulas can automate the calculation of net cash flow for each quarter?

To automate net cash flow calculation for each quarter in your Excel document, use the SUM function to add all cash inflows and outflows within the period. Apply the formula =SUM(inflows_range) - SUM(outflows_range) to compute net cash flow efficiently. Utilizing these formulas ensures accurate, timely financial analysis in your Quarterly Cash Flow Statement for Freelancers.

How should freelancers separate personal and business transactions in their quarterly cash flow statement?

Freelancers should maintain separate bank accounts to clearly differentiate personal and business transactions in their quarterly cash flow statement. You must categorize income and expenses accurately to reflect true business cash flow. Using dedicated accounting software helps ensure precise tracking and reporting.

Why is forecasting future quarters based on past cash flow statements essential for freelancers' financial planning?

Forecasting future quarters based on past cash flow statements is essential for freelancers' financial planning to ensure accurate budgeting and manage irregular income streams effectively. Your ability to predict cash inflows and outflows helps maintain liquidity and avoid cash shortages during slower periods. This proactive approach supports strategic decision-making and long-term financial stability.