The Quarterly Budget Excel Template for Small Businesses is a practical tool designed to help business owners track and manage their expenses and revenues on a quarterly basis. It offers customizable categories, automated calculations, and visual charts for clear financial insights. Maintaining accurate quarterly budgets supports informed decision-making and enhances overall financial stability.

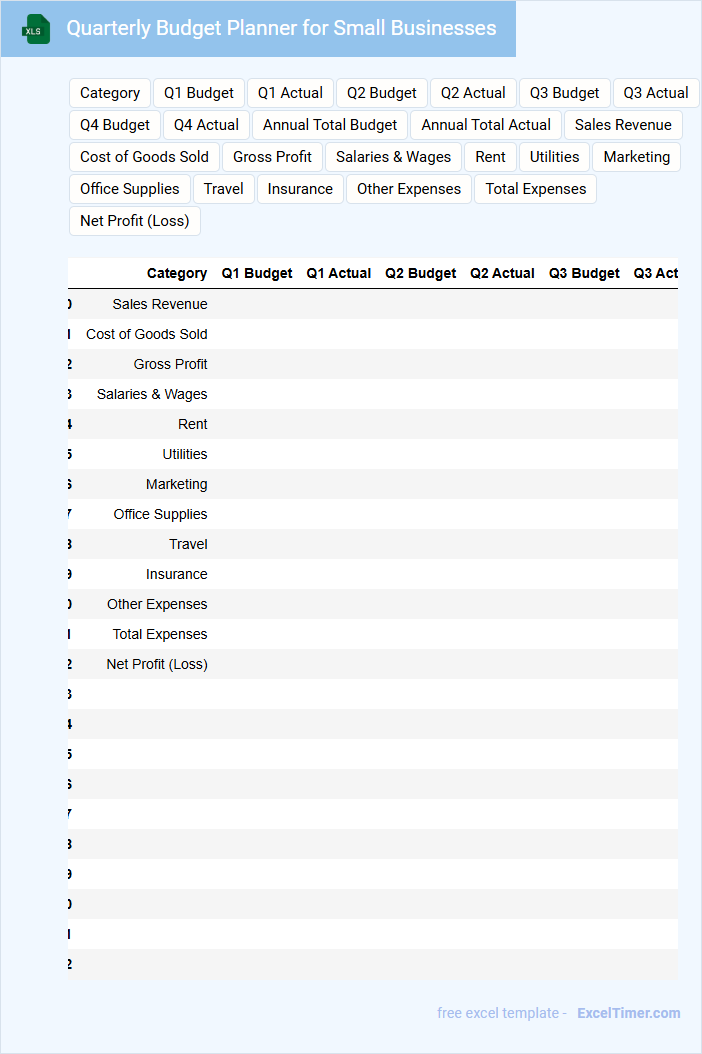

Quarterly Budget Planner for Small Businesses

What information does a Quarterly Budget Planner for Small Businesses typically contain? This document usually includes detailed forecasts of income, expenses, and profit margins for the upcoming quarter to help manage finances effectively. It also outlines spending limits, anticipated revenue streams, and key financial goals, enabling small business owners to monitor their budget and make informed decisions.

What is an important consideration when using a Quarterly Budget Planner for Small Businesses? Maintaining up-to-date and realistic financial data is crucial to ensure accurate budgeting and avoid cash flow problems. Additionally, regularly reviewing and adjusting the planner based on actual performance helps businesses stay on track and adapt to changing market conditions.

Excel Template for Quarterly Business Budget Tracking

An Excel Template for Quarterly Business Budget Tracking is designed to help organizations monitor and manage their financial performance across each quarter. It typically contains sections for income, expenses, projected costs, and variance analysis to maintain budget control. The document is essential for making data-driven decisions and ensuring fiscal responsibility throughout the business cycle.

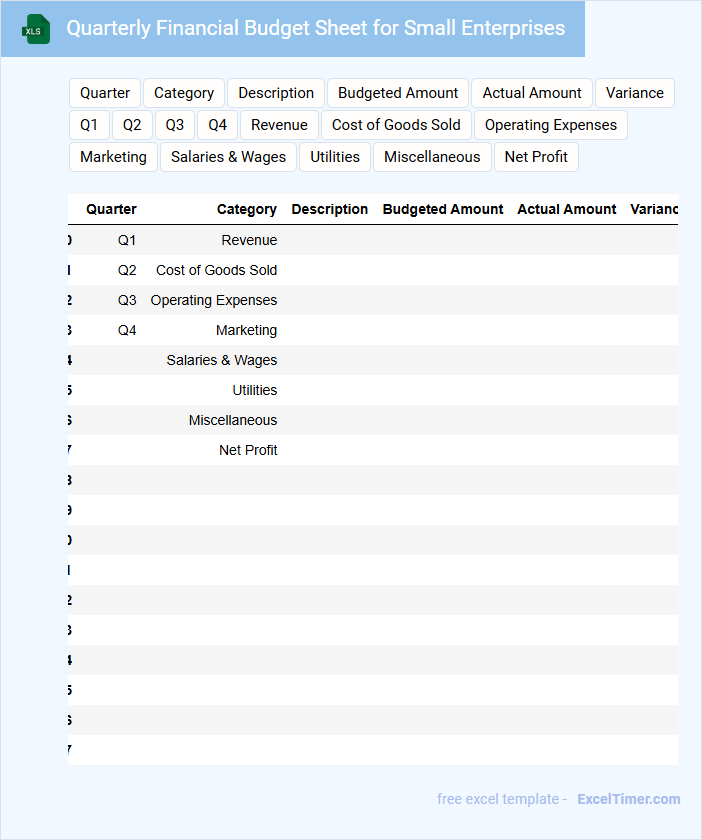

Quarterly Financial Budget Sheet for Small Enterprises

A Quarterly Financial Budget Sheet is a critical document used by small enterprises to plan and monitor their financial activities over a three-month period. It typically contains estimated revenues, projected expenses, and cash flow statements to ensure fiscal discipline. Including accurate and realistic forecasts is essential for effective budget management and informed decision-making.

Business Expense Tracker with Quarterly View

What does a Business Expense Tracker with Quarterly View typically contain and why is it important?

A Business Expense Tracker with Quarterly View usually contains detailed records of business expenditures categorized by type, date, and amount, organized into quarterly periods. This structure helps in monitoring spending trends, budgeting efficiently, and preparing for tax reporting. An important suggestion is to include clear categories and regular updates to ensure accuracy and easy financial analysis.

Small Business Quarterly Revenue and Expense Tracker

A Small Business Quarterly Revenue and Expense Tracker is a document designed to monitor the financial performance of a business over a three-month period. It typically contains summaries of income, expenses, and profit margins to provide a clear financial overview. This tracker helps business owners make informed decisions and plan for future growth.

It is important to include detailed categories for both revenues and expenses to ensure accuracy and ease of analysis. Regular updates and reconciliation with bank statements enhance the reliability of the data. Using clear labels and consistent formatting can improve readability and usability for all stakeholders.

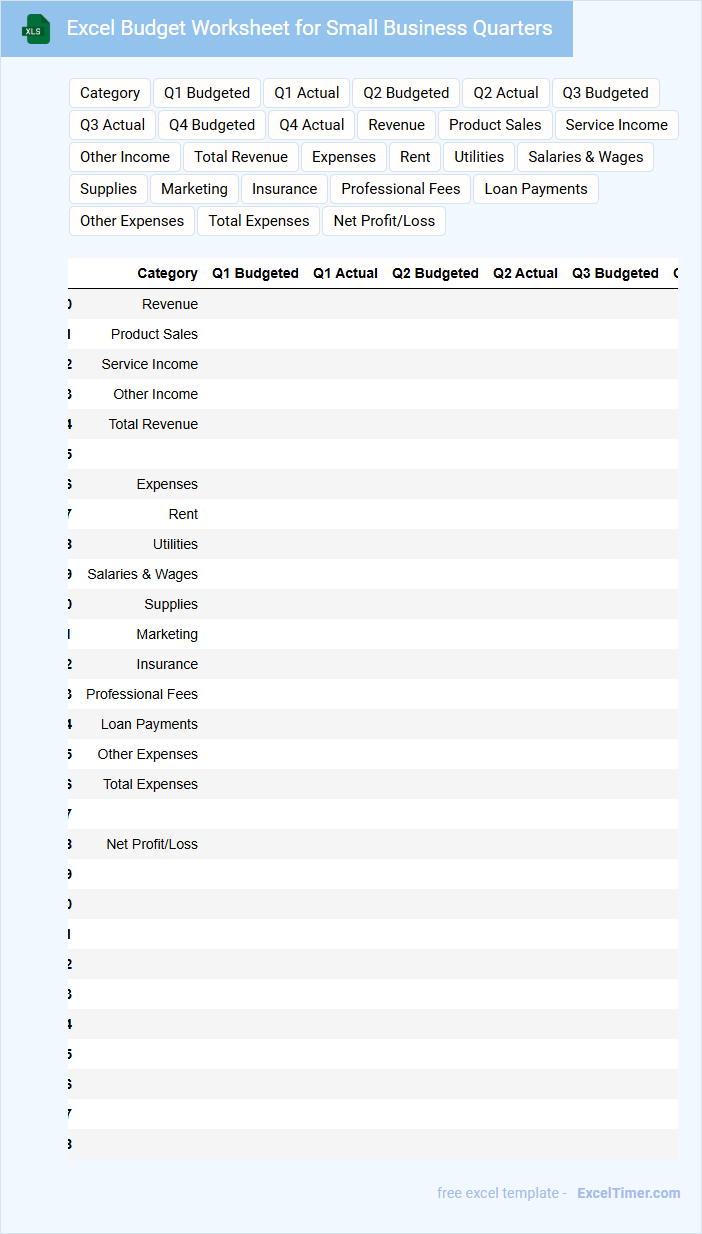

Excel Budget Worksheet for Small Business Quarters

An Excel Budget Worksheet for small business quarters typically contains detailed financial data organized by months or weeks within each quarter. It includes income, expenses, and profit tracking columns to help business owners monitor cash flow effectively. Additionally, this document features projections and variance analysis to assist with strategic planning.

For optimal use, ensure the worksheet has clear categorization of costs and revenues to facilitate accurate forecasting and decision-making. Incorporate formulas that automatically update totals and differences to save time and reduce errors. Finally, regularly review and adjust the worksheet to reflect actual performance against budgeted figures for improved financial control.

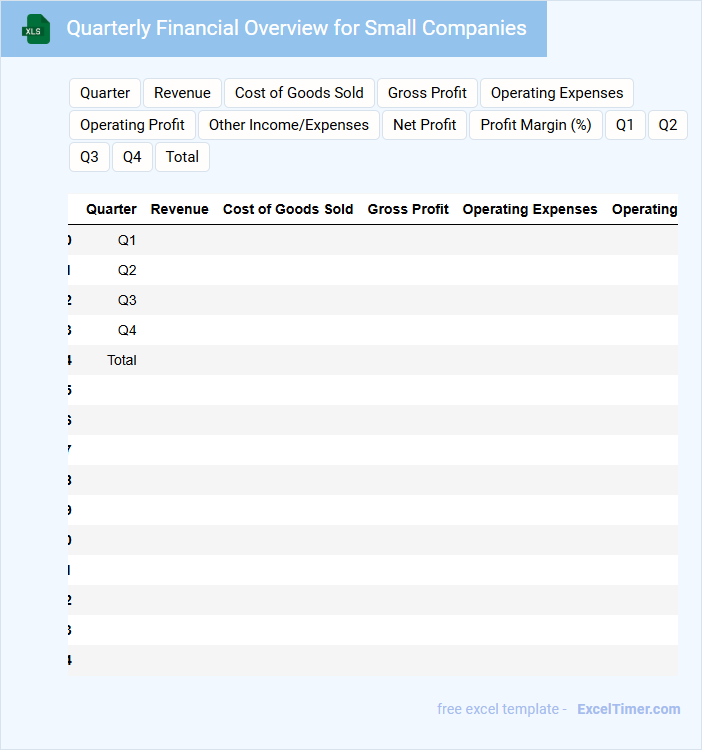

Quarterly Financial Overview for Small Companies

A Quarterly Financial Overview for small companies typically contains key financial statements, including the income statement, balance sheet, and cash flow statement. This document highlights important financial metrics such as revenue, expenses, profit margins, and liquidity. It provides stakeholders with a concise summary of the company's financial performance over the quarter.

Quarterly Profit and Loss Template for Small Business

A Quarterly Profit and Loss Template for small businesses typically contains detailed records of income, expenses, and net profit or loss over a three-month period. This document helps businesses track financial performance and identify trends for better decision-making.

Important elements include revenue streams, cost of goods sold, operational expenses, and taxes. Consistently updating the template ensures accurate financial analysis and supports strategic planning.

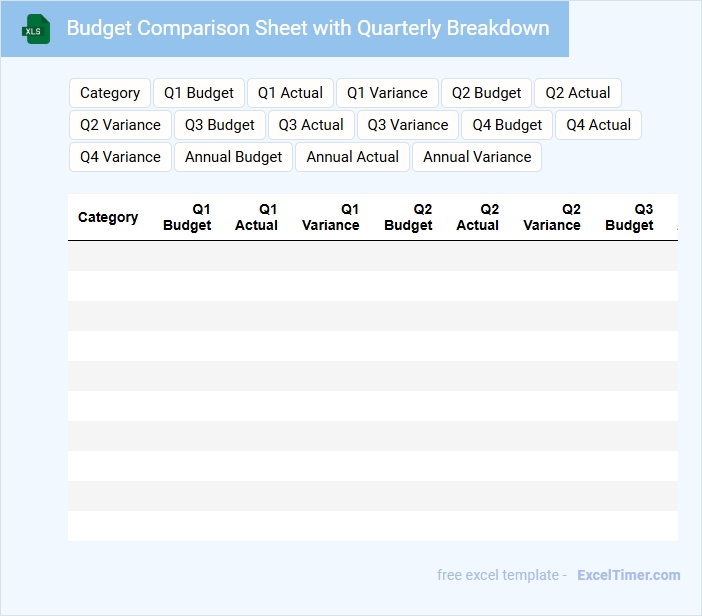

Budget Comparison Sheet with Quarterly Breakdown

A Budget Comparison Sheet typically contains detailed financial data contrasting planned budgets against actual expenditures over specific periods. It often includes a quarterly breakdown to highlight seasonal trends and fiscal performance across different quarters. This document is essential for identifying discrepancies and guiding strategic financial decisions.

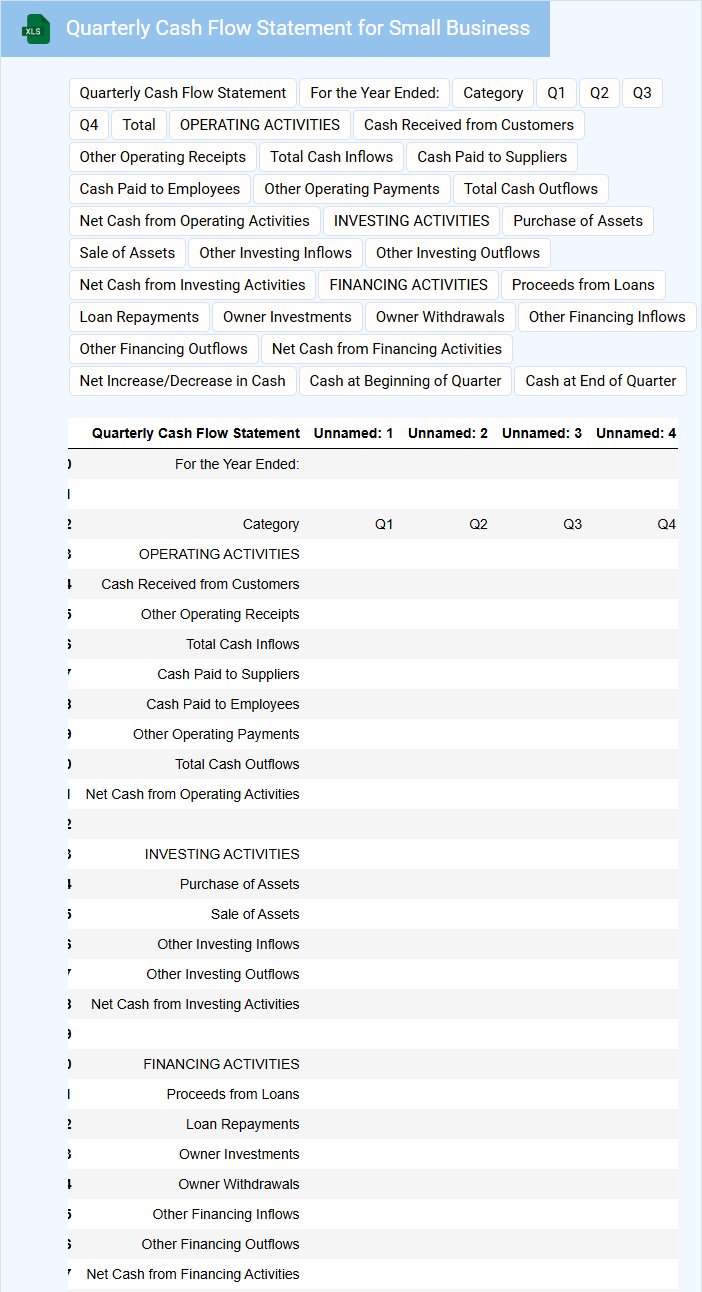

Quarterly Cash Flow Statement for Small Business

What does a Quarterly Cash Flow Statement for a Small Business typically contain? This document usually details all cash inflows and outflows over a three-month period, including operating, investing, and financing activities. It helps business owners track liquidity, manage cash effectively, and make informed financial decisions.

Why is it important to carefully review this statement? Regularly analyzing cash flow allows small businesses to identify potential cash shortages, plan for expenses, and maintain financial stability. Ensuring accuracy in recording all transactions is crucial to gaining reliable insights.

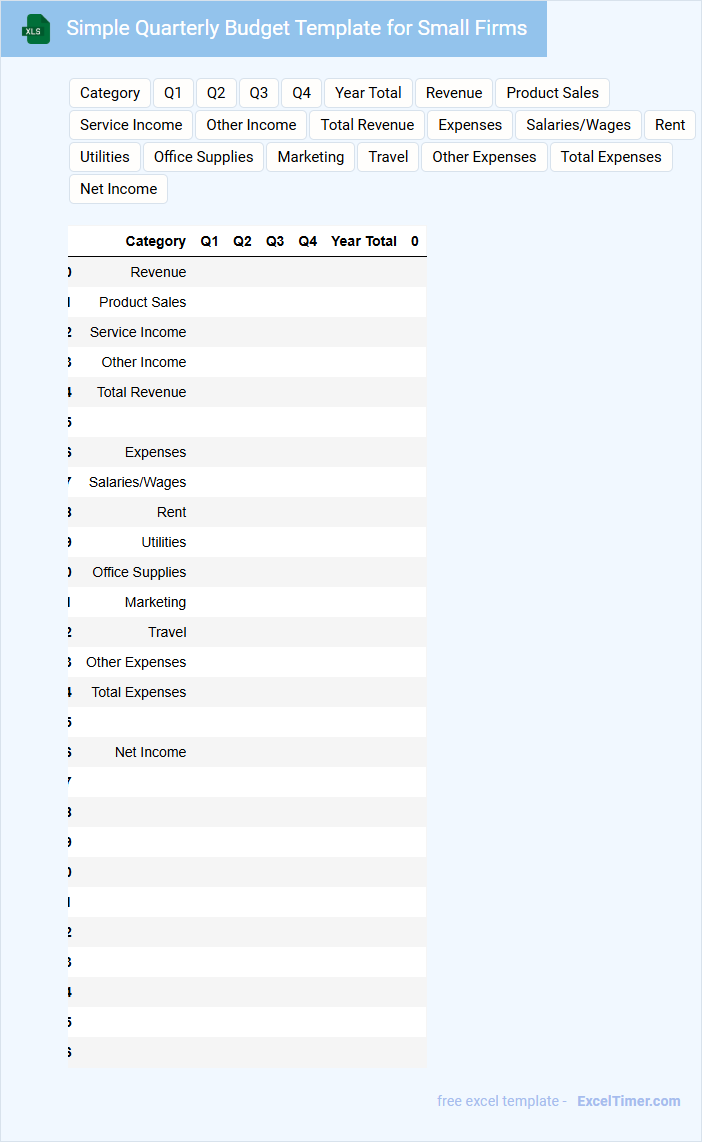

Simple Quarterly Budget Template for Small Firms

A Simple Quarterly Budget Template for small firms typically contains an overview of projected income and expenses categorized by months within a quarter. It helps businesses monitor cash flow and manage financial resources efficiently.

Important elements include clear sections for revenue, fixed costs, variable costs, and expected profits to ensure accurate tracking. Regular updates and reviewing actual versus planned figures are essential to maintain financial health.

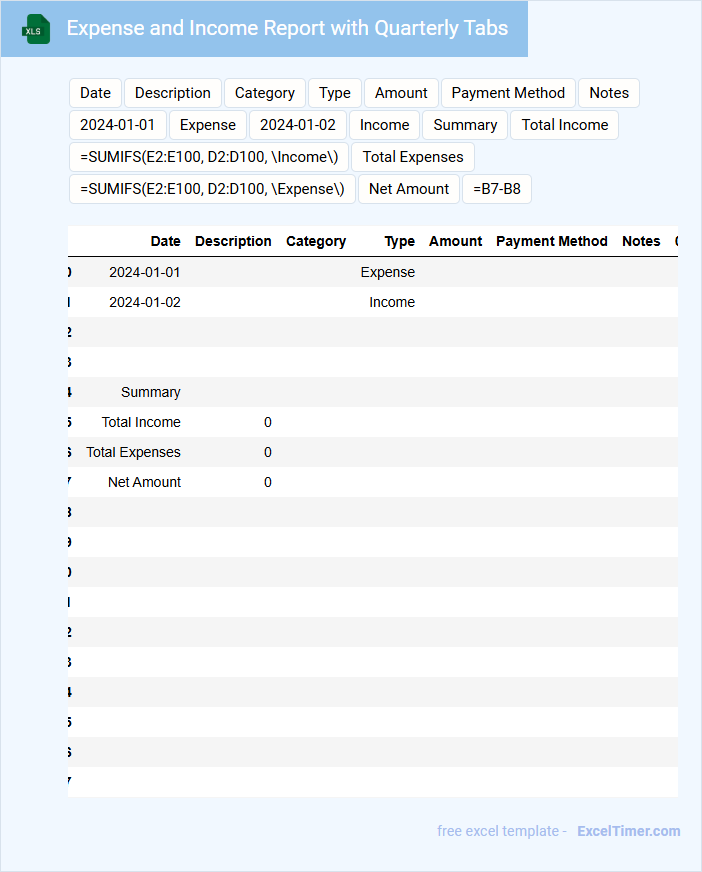

Expense and Income Report with Quarterly Tabs

What information does an Expense and Income Report with Quarterly Tabs typically contain? This type of document usually includes detailed records of all expenses and income categorized by quarters to provide a clear financial overview throughout the year. It helps in tracking financial performance and identifying trends or discrepancies in different time periods.

Why is it important to have quarterly tabs in such reports? Quarterly tabs enable efficient organization and quick access to specific time frames, allowing for better comparison and analysis of financial data. Including summaries and visual charts for each quarter can enhance understanding and decision-making.

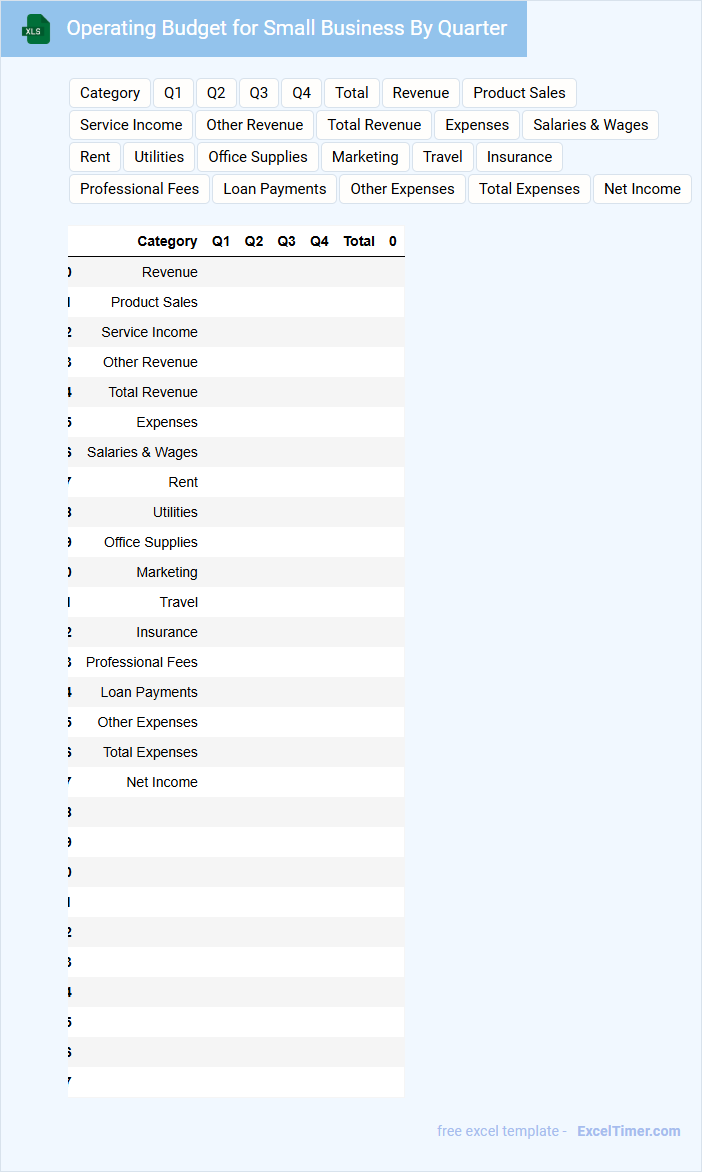

Operating Budget for Small Business By Quarter

An Operating Budget for a small business by quarter outlines projected income and expenses over a three-month period. It serves as a financial roadmap that helps manage cash flow and allocate resources effectively.

This document usually contains revenue forecasts, fixed and variable expenses, and anticipated profits for each quarter. Including detailed monthly breakdowns and contingency plans is crucial for accuracy and preparedness.

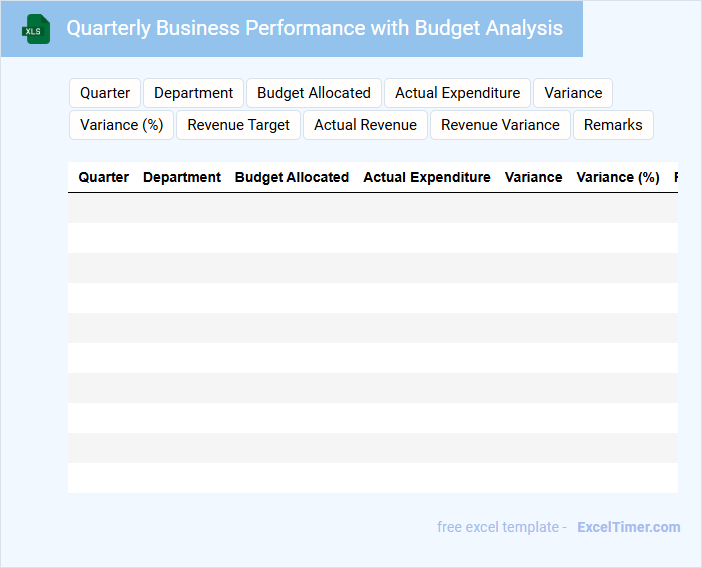

Quarterly Business Performance with Budget Analysis

What does a Quarterly Business Performance with Budget Analysis document typically contain? This document usually includes detailed financial results, key performance indicators, and comparisons against the budget for the quarter. It provides insights into revenue, expenses, profitability, and highlights areas of variance to inform strategic decision-making.

Why is it important to conduct a thorough budget analysis in such reports? Accurate budget analysis identifies discrepancies between planned and actual financial outcomes, helping businesses to adjust forecasts and control costs effectively. It ensures alignment with organizational goals and supports improved financial planning for future periods.

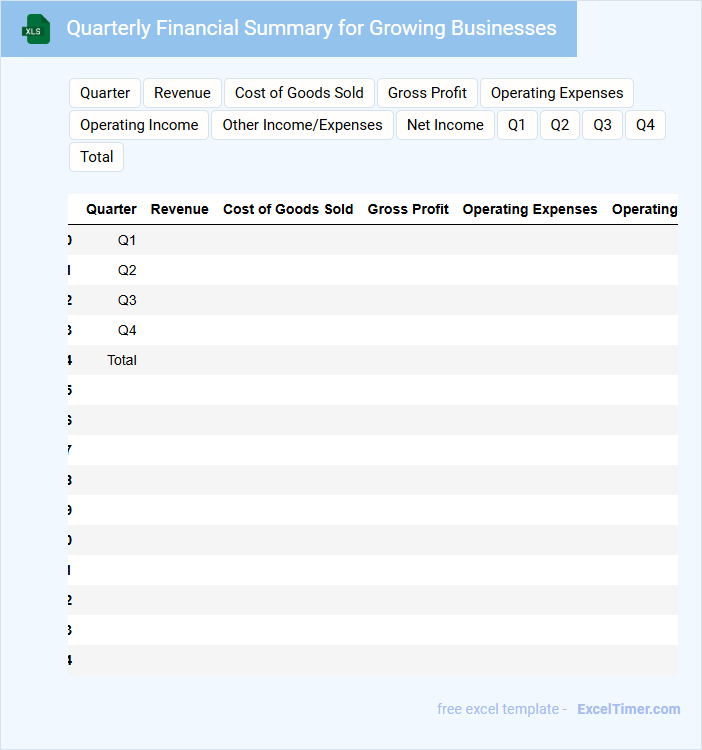

Quarterly Financial Summary for Growing Businesses

A Quarterly Financial Summary for Growing Businesses typically contains key financial data and performance metrics over the past quarter. It gives a clear overview of profitability, expenses, and growth trends.

- Include detailed revenue and profit analysis to track financial health.

- Highlight significant expenses and any variances from budgeted amounts.

- Provide forward-looking insights to inform strategic planning and investments.

What are the essential categories to include in a small business quarterly budget spreadsheet?

A small business quarterly budget spreadsheet should include essential categories like revenue, fixed expenses, variable expenses, and capital expenditures. Tracking these categories helps you monitor cash flow and manage financial performance effectively. Incorporate sections for taxes, payroll, and emergency funds to ensure comprehensive budgeting.

How can you accurately forecast revenue trends for each quarter in Excel?

To accurately forecast revenue trends for each quarter in Excel, use historical sales data combined with Excel's built-in functions like TREND, FORECAST.ETS, or regression analysis tools. Create dynamic charts and pivot tables to visualize quarterly patterns and adjust assumptions based on market conditions. Your detailed quarterly budget will reflect reliable revenue projections, improving financial planning and decision-making.

What Excel functions or formulas are most effective for tracking and analyzing quarterly expenses?

SUMIFS and AVERAGEIFS in Excel efficiently track quarterly expenses by summing or averaging amounts based on date ranges and categories. The VLOOKUP or INDEX-MATCH functions help retrieve budgeted versus actual expense data for comparison. PivotTables provide dynamic analysis and visualization of quarterly spending trends for small businesses.

How do you use Excel charts to visualize budget versus actual performance over a quarter?

Use Excel charts like clustered column or line charts to compare budgeted versus actual expenses and revenues across each month in the quarter. Incorporate data labels and color-coded series to highlight variances clearly, enabling quick assessment of financial performance. Apply dynamic ranges and slicers for interactive exploration of specific budget categories or time periods.

Which Excel features help automate recurring quarterly budget calculations for small business operations?

Excel features such as PivotTables automate quarterly budget data summarization for small businesses by efficiently grouping expenses and revenues. The use of formulas like SUMIFS and IFERROR streamlines repetitive budget calculations, reducing manual errors in financial tracking. Conditional Formatting highlights budget variances, enabling quick identification of overspending within recurring quarterly budgets.