The Quarterly Cash Flow Excel Template for Property Managers streamlines tracking rental income, expenses, and net cash flow over three-month periods. This template enhances financial visibility and helps property managers make informed decisions by providing clear, organized quarterly reports. Accurate cash flow projections are essential for budgeting and maintaining profitable property operations.

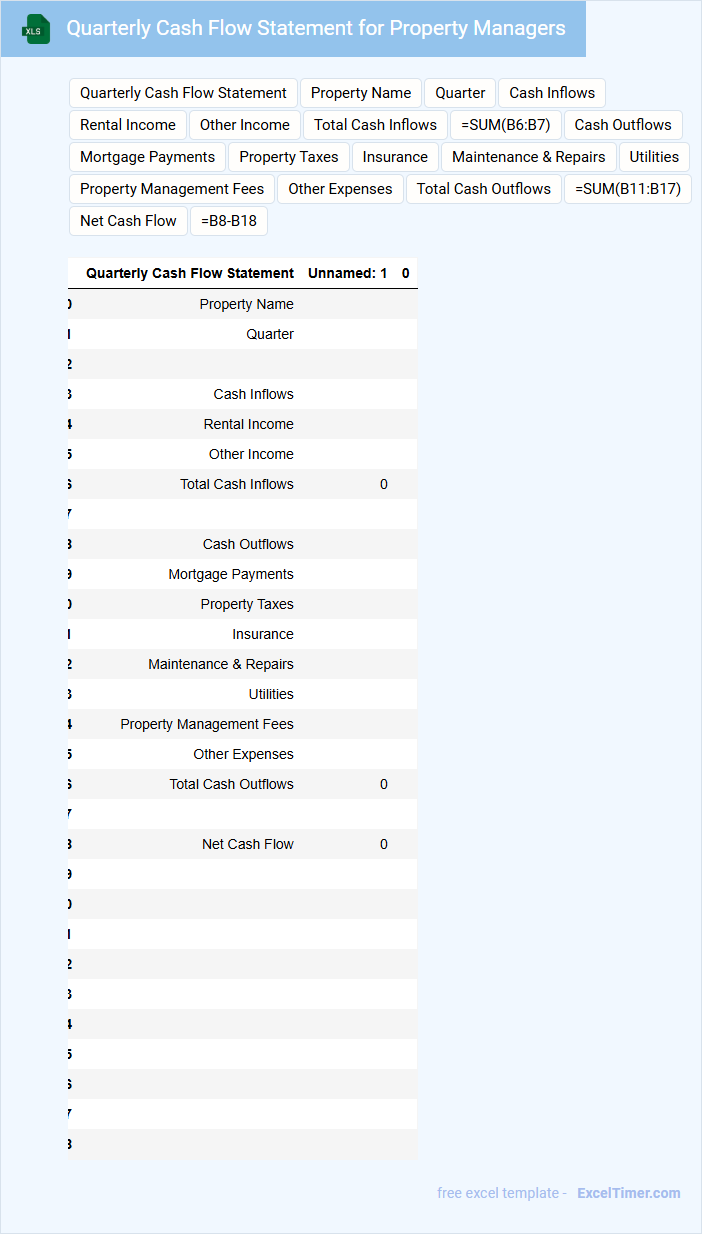

Quarterly Cash Flow Statement for Property Managers

The Quarterly Cash Flow Statement for Property Managers typically contains detailed records of all cash inflows and outflows related to property operations. It highlights income from tenants, maintenance expenses, and any capital expenditures incurred during the quarter.

These statements are crucial for monitoring the financial health of property portfolios and ensuring sufficient liquidity. Property managers should prioritize accurate tracking of rent collections and timely payment of operating costs to maintain financial stability.

Excel Template for Quarterly Cash Flow Tracking of Rental Properties

An Excel template for quarterly cash flow tracking of rental properties typically contains detailed financial data including income, expenses, and net cash flow. It helps landlords and property managers monitor the profitability and financial health of their investments over each quarter. Key components often include rent received, maintenance costs, mortgage payments, and other relevant cash inflows and outflows.

To optimize its usefulness, ensure the template allows for easy data entry and automatic calculations to reduce errors. Including visual charts and summaries can provide quick insights into trends and performance. Additionally, it's important to regularly update the template to reflect changing expenses and rental income for accurate tracking.

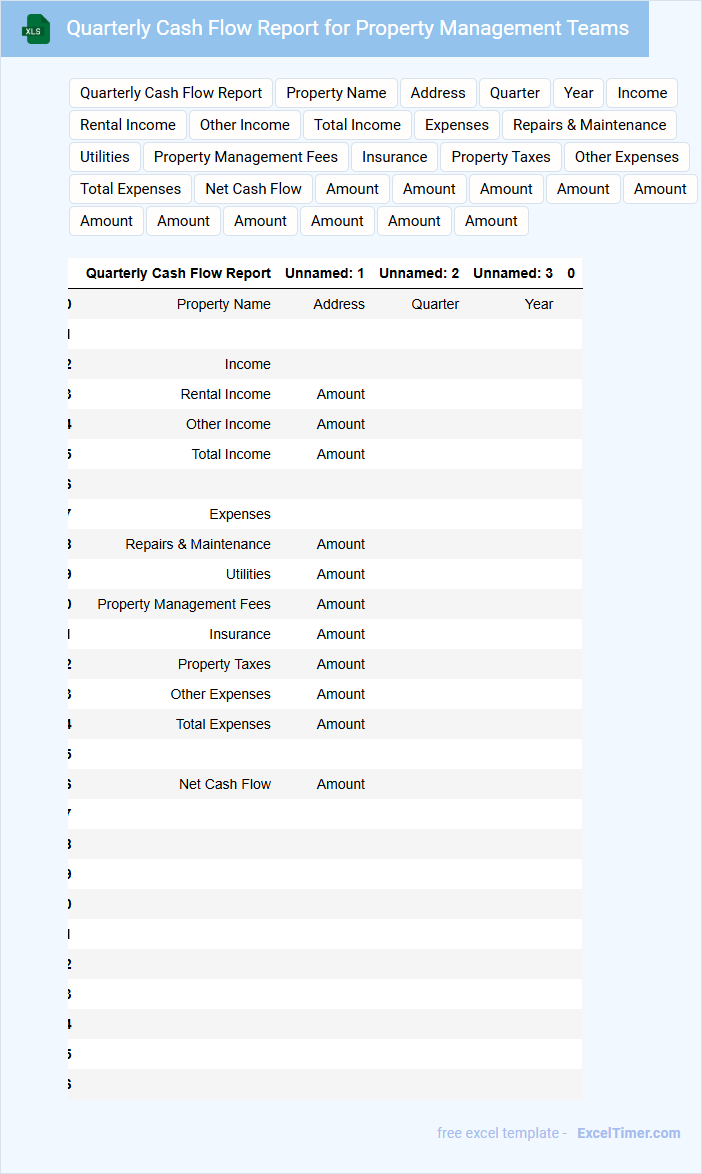

Quarterly Cash Flow Report for Property Management Teams

The Quarterly Cash Flow Report typically contains detailed records of income and expenses related to property management activities over a three-month period. It provides insights into the financial performance and liquidity status of managed properties.

This document helps property management teams track rent collections, operating costs, and maintenance expenditures. Accurate data entry and timely updates are crucial for effective financial planning and decision-making.

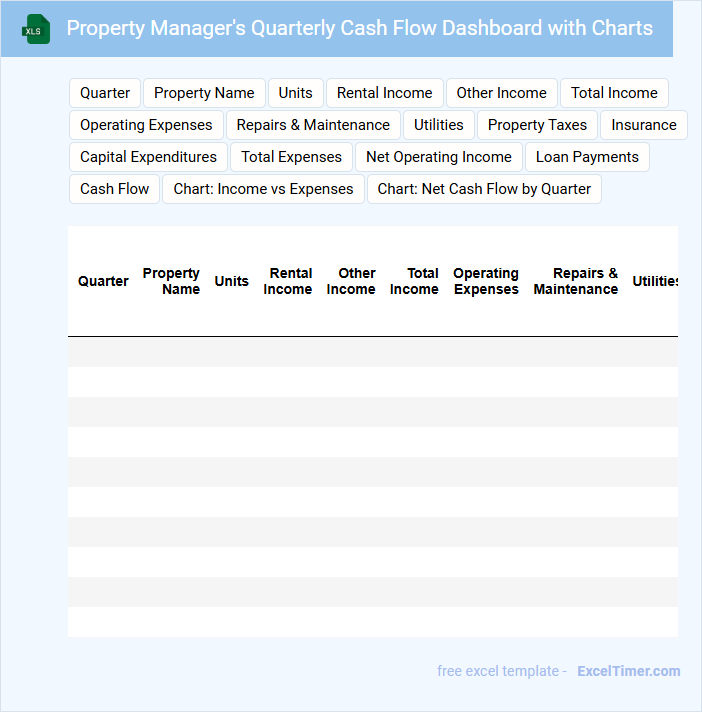

Property Manager's Quarterly Cash Flow Dashboard with Charts

The Property Manager's Quarterly Cash Flow Dashboard typically contains detailed financial data, including income, expenses, and net cash flow related to property management. It includes visual elements like charts to help stakeholders quickly grasp financial health and trends.

This document is essential for tracking the quarterly performance of properties, assisting in budgeting and strategic planning. Including key performance indicators (KPIs) and comparison against previous quarters enhances its usefulness significantly.

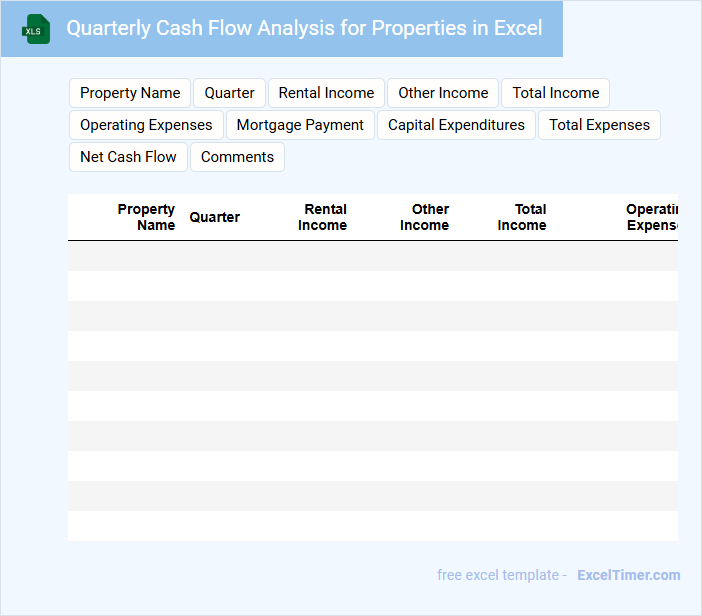

Quarterly Cash Flow Analysis for Properties in Excel

A Quarterly Cash Flow Analysis document typically includes detailed records of income and expenses related to properties over a three-month period. It highlights revenue streams such as rent, along with operational costs and maintenance expenses to assess financial performance.

In Excel, this analysis allows for dynamic calculations and visual representation through charts and graphs. A critical suggestion is to ensure accuracy in data entry and regularly update projections based on recent trends to maintain reliability.

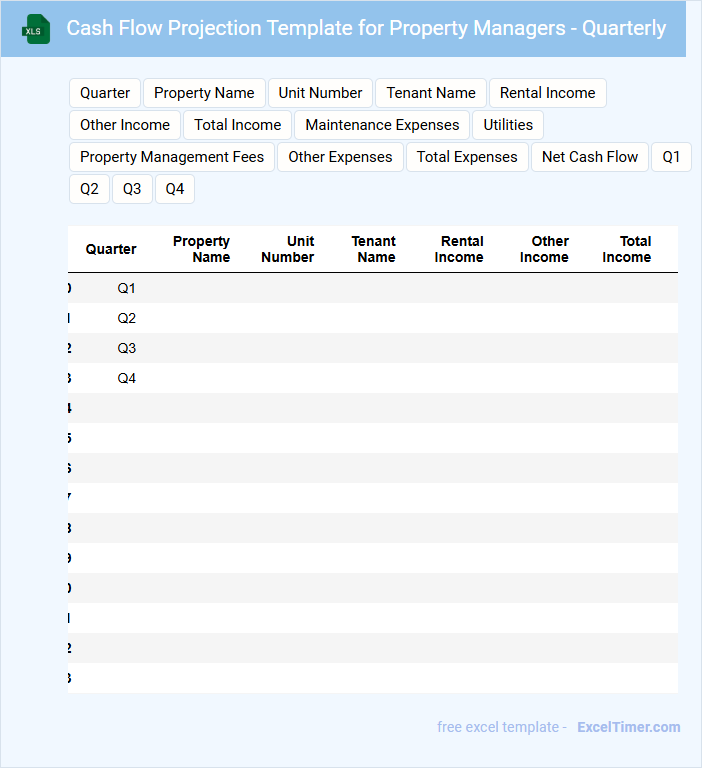

Cash Flow Projection Template for Property Managers - Quarterly

A Cash Flow Projection Template for property managers is an essential document that outlines expected income and expenses over a specified quarter. It helps in planning and managing financial resources to ensure property operations remain profitable and sustainable.

This type of document typically contains detailed sections on rental income, maintenance costs, property taxes, and other operational expenses. Accurate categorization and timely updates in the template are crucial for effective financial forecasting and decision-making.

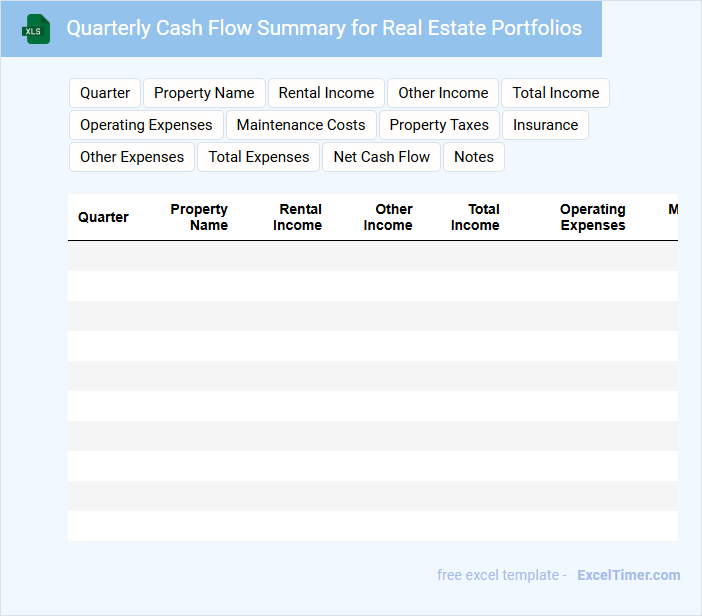

Quarterly Cash Flow Summary for Real Estate Portfolios

The Quarterly Cash Flow Summary for Real Estate Portfolios provides a detailed overview of cash inflows and outflows over a three-month period. This document highlights income from rentals, operating expenses, and financing activities.

It is essential to include accurate portfolio performance metrics and trends to assess liquidity and profitability effectively. A well-prepared summary aids in strategic decision-making and investor reporting.

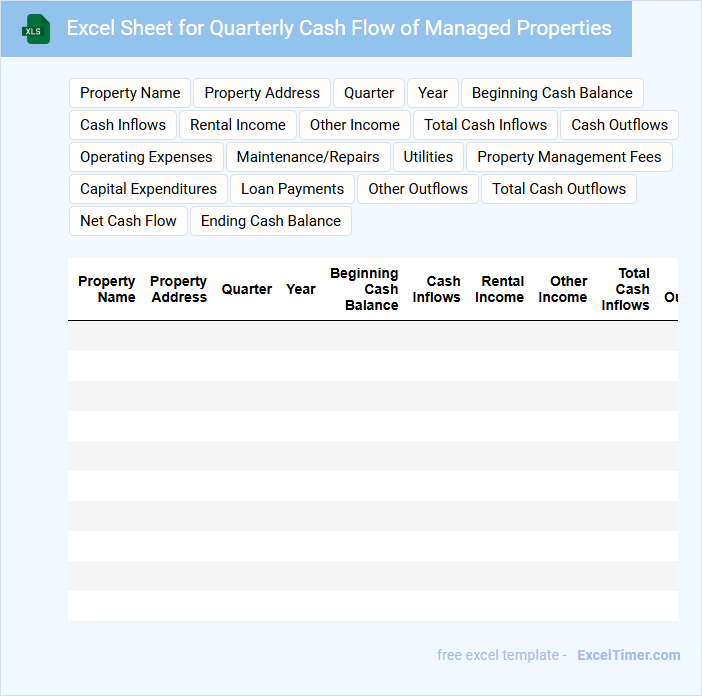

Excel Sheet for Quarterly Cash Flow of Managed Properties

An Excel Sheet for Quarterly Cash Flow of managed properties typically includes detailed records of income and expenses related to property management. This document helps in tracking rental income, operating costs, and net cash flow over a three-month period. Accurate data entry and categorization are crucial for meaningful financial analysis and decision-making.

Quarterly Rental Income and Expense Tracker for Property Managers

The Quarterly Rental Income and Expense Tracker is an essential document for property managers to monitor financial performance over a three-month period. It typically contains detailed records of rental income received, various property-related expenses, and net profit or loss calculations. Accurate tracking helps in budgeting, tax preparation, and improving overall property management efficiency.

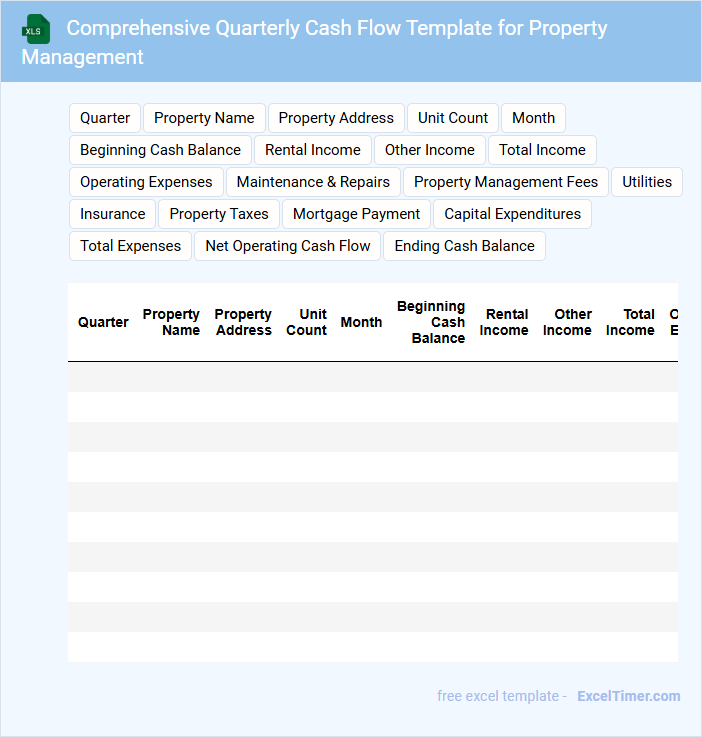

Comprehensive Quarterly Cash Flow Template for Property Management

What information is typically included in a Comprehensive Quarterly Cash Flow Template for Property Management? This document usually contains detailed records of all property-related income, expenses, and net cash flow over a quarter. It helps property managers track financial performance, plan budgets, and ensure accurate forecasting for operational success.

What is an important consideration when using this template? It is essential to regularly update and review all entries for accuracy, including rent collections, maintenance costs, and other expenditures. Consistent monitoring allows for timely identification of cash flow trends and supports effective financial decision-making.

Quarterly Cash Flow Spreadsheet with Property Performance Metrics

A Quarterly Cash Flow Spreadsheet typically contains detailed records of all cash inflows and outflows over a three-month period, providing insight into financial health. It often includes sections for operating income, expenses, and net cash flow to help identify trends and make informed decisions.

In addition, this document integrates Property Performance Metrics such as occupancy rates, rental income, and maintenance costs to assess the economic viability of real estate investments. These metrics allow for a comprehensive view of both financial and operational performance. Including accurate and timely data is crucial for effective analysis and strategic planning.

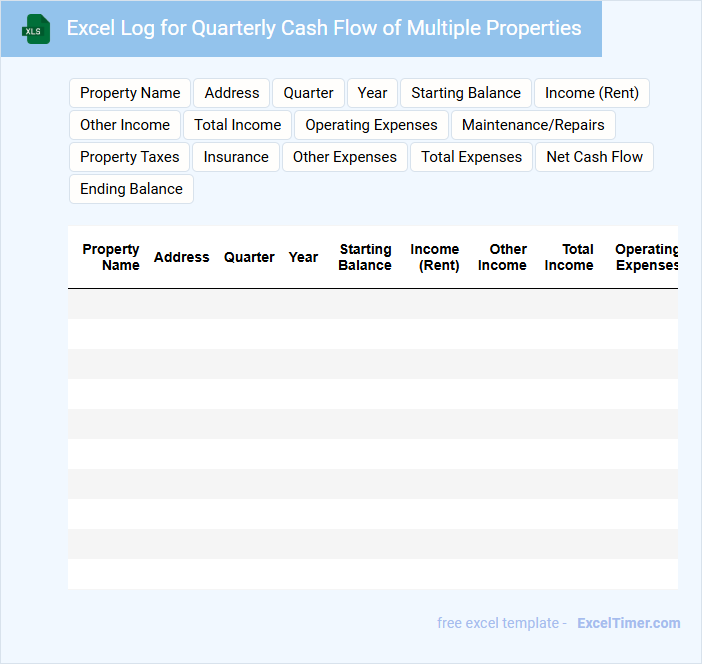

Excel Log for Quarterly Cash Flow of Multiple Properties

What information is typically included in an Excel log for quarterly cash flow of multiple properties? This document usually contains detailed financial data such as income, expenses, and net cash flow for each property on a quarterly basis. It helps property managers and investors track financial performance and make informed decisions.

What is a crucial aspect to consider when maintaining this Excel log? Ensuring accurate categorization of income and expenses is essential for meaningful analysis, alongside consistent updates and clear labeling of each property's data to avoid confusion and maintain clarity over time.

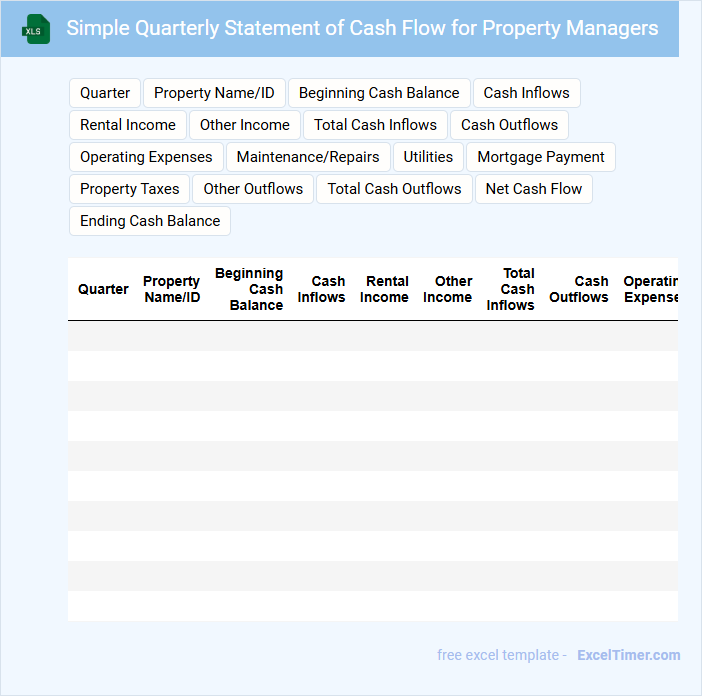

Simple Quarterly Statement of Cash Flow for Property Managers

A Simple Quarterly Statement of Cash Flow for Property Managers summarizes the inflows and outflows of cash within a three-month period. It helps property managers track liquidity and assess the financial health of their properties.

- Include cash receipts from rent and other income sources.

- Record cash disbursements such as maintenance, utilities, and management fees.

- Compare net cash flow to previous quarters to identify trends and adjust budgets.

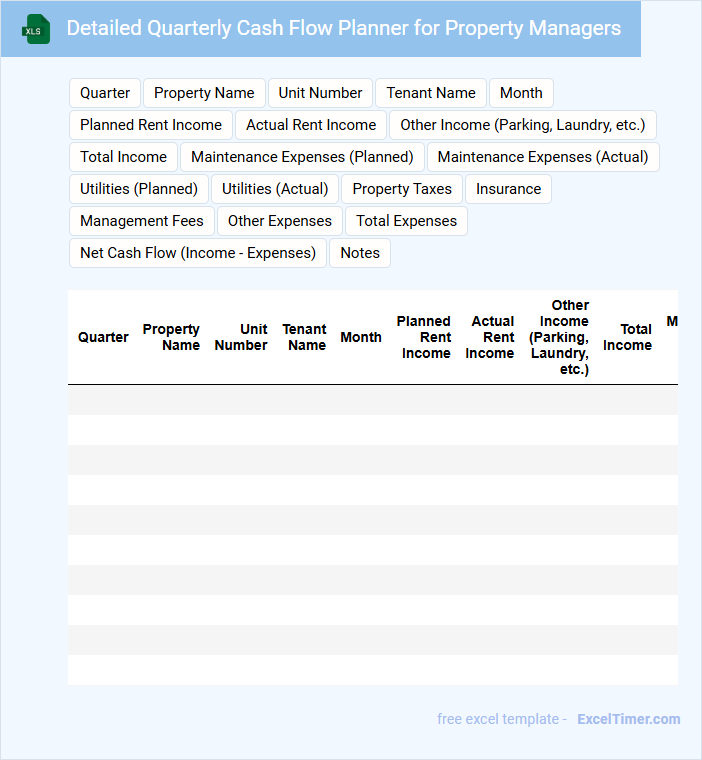

Detailed Quarterly Cash Flow Planner for Property Managers

What information does a Detailed Quarterly Cash Flow Planner for Property Managers typically contain? It usually includes detailed projections of income and expenses related to property management activities over three months, helping managers track rent collections, maintenance costs, and other financial transactions. This document provides a clear overview of cash inflows and outflows to ensure effective budget planning and financial stability.

What important elements should be considered when creating this planner? It's crucial to include accurate rent schedules, anticipated upkeep expenses, and reserves for unexpected costs. Additionally, regularly updating the planner with actual figures ensures better forecasting and aids in identifying financial trends or issues early.

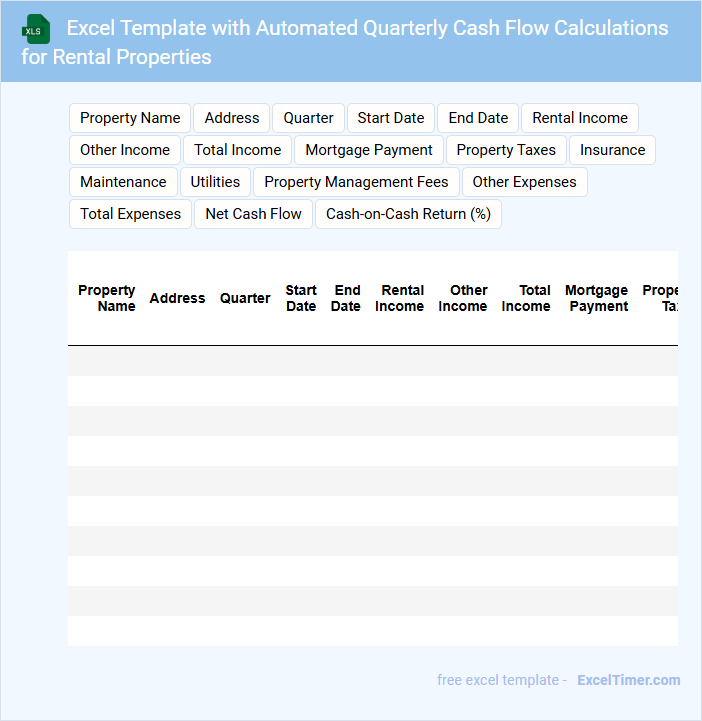

Excel Template with Automated Quarterly Cash Flow Calculations for Rental Properties

This Excel Template is designed to streamline the management of rental property finances by automating quarterly cash flow calculations. It typically contains sheets for income, expenses, and summary reports to track profitability and financial health. Users should ensure all rental income and recurring expenses are accurately entered for precise cash flow analysis.

Important suggestions include regularly updating the template with actual rental payments and maintenance costs to reflect true cash positions. Incorporating dynamic charts can provide visual insights into cash flow trends over time. Additionally, setting up alerts or conditional formatting for negative cash flows can help identify potential financial issues early.

What are the key components to include in a Quarterly Cash Flow statement for property managers in Excel?

A Quarterly Cash Flow statement for property managers in Excel should include rental income, operating expenses such as maintenance and utilities, and financing activities like mortgage payments. Track cash inflows from tenants and outflows including property management fees and capital expenditures. Summarize net cash flow to assess liquidity and profitability for the quarter.

How should incoming rental payments and outgoing expenses be categorized and tracked in the spreadsheet?

Incoming rental payments should be categorized as revenue under the "Income" section, while outgoing expenses such as maintenance, utilities, and property taxes must be recorded under "Expenses" in the Quarterly Cash Flow spreadsheet. Your accurate tracking of these cash flows ensures clear visibility into net operating cash and supports effective property management decisions. Consistently updating each transaction with date, amount, and category enhances the financial accuracy of your report.

What formulas or Excel functions are best for calculating net cash flow each quarter?

Use the SUM function to add total cash inflows and total cash outflows separately each quarter. Calculate net cash flow by subtracting total cash outflows from total cash inflows with the formula =SUM(inflows) - SUM(outflows). The IF function can handle conditional cash items while the SUMIF or SUMIFS functions aggregate specific categories of cash transactions.

How can property managers use Excel charts to visualize cash flow trends over multiple quarters?

Property managers can use Excel charts like line graphs or bar charts to visualize quarterly cash flow trends by plotting income and expenses over time. These visualizations help identify seasonal patterns, track financial health, and make informed budgeting decisions. Excel's data analysis tools enable easy comparison across multiple properties and time periods, enhancing cash flow management.

What measures should be taken in Excel to ensure data accuracy and avoid common errors in cash flow projections?

Ensure data accuracy in your Quarterly Cash Flow Excel document by using data validation to restrict input types and formulas like SUMIFS to automate calculations. Implement error-checking features such as conditional formatting to highlight anomalies and protect critical cells to prevent accidental changes. Regularly audit linked data and use Excel's built-in auditing tools to trace and resolve formula errors for reliable cash flow projections.