The Quarterly Billing Excel Template for Law Firms streamlines financial tracking by organizing billable hours, client information, and payment schedules into a clear, easy-to-read format. It helps law firms improve accuracy in invoicing and ensures timely payments by providing customizable fields tailored to legal services. Efficient use of this template can significantly enhance cash flow management and client billing transparency.

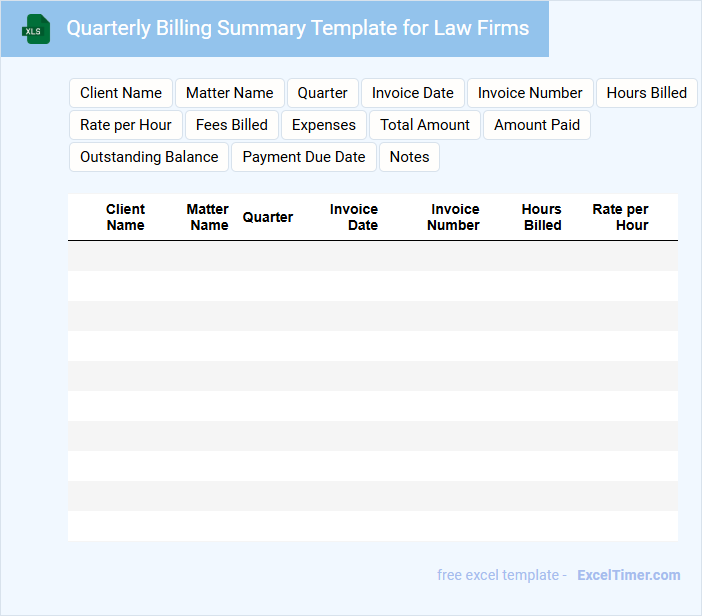

Quarterly Billing Summary Template for Law Firms

A Quarterly Billing Summary Template for Law Firms typically contains detailed financial information regarding client billing and payments for a three-month period.

- Accurate Client Details: Ensure each client's billing information is clearly specified to avoid confusion.

- Itemized Services: Provide a breakdown of legal services rendered for transparent invoicing.

- Payment Status: Highlight outstanding balances and payment deadlines to streamline collections.

Law Firm Quarterly Invoice Tracker with Payment Status

A Law Firm Quarterly Invoice Tracker is a document used to organize and monitor invoices generated over a three-month period. It typically contains details like invoice numbers, client names, service descriptions, amounts due, and payment statuses. This tool is essential for maintaining accurate financial records and ensuring timely collections.

Excel Quarterly Billing Statement Template for Attorneys

The Excel Quarterly Billing Statement Template for attorneys is typically used to organize detailed billing information over a three-month period. It includes client details, services rendered, hours worked, and corresponding fees to ensure transparent financial tracking.

This document helps attorneys present clear and professional invoices to clients while maintaining accurate records for accounting purposes. It is important to include precise time entries, payment terms, and contact information for efficient communication and prompt payments.

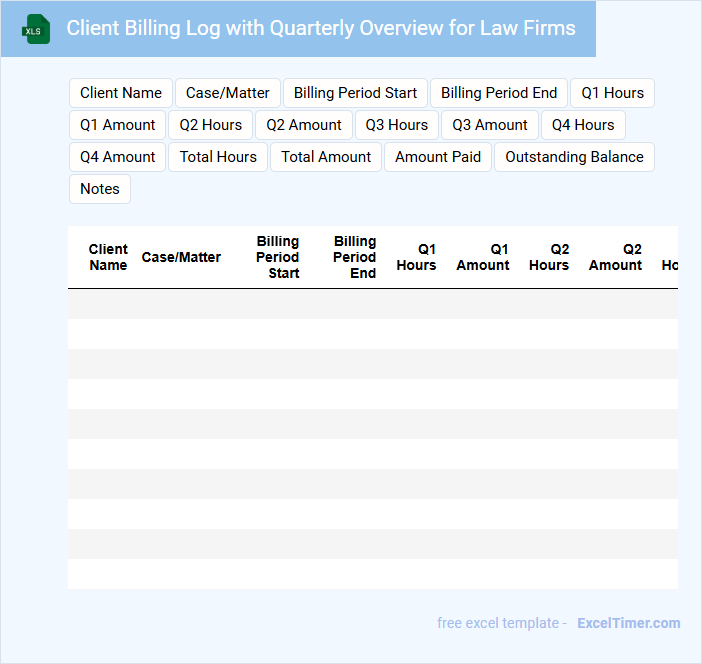

Client Billing Log with Quarterly Overview for Law Firms

This type of document typically serves as a comprehensive client billing log that records all invoiced services and payments received. It includes a detailed quarterly overview summarizing billable hours and total revenue generated per client. The document is essential for tracking financial performance and ensuring transparency between law firms and their clients.

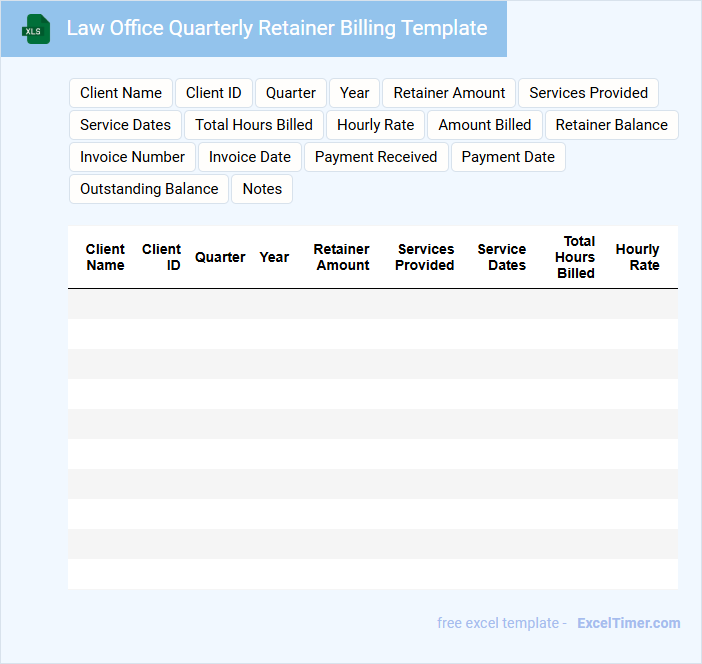

Law Office Quarterly Retainer Billing Template

The Law Office Quarterly Retainer Billing Template typically contains detailed records of legal services provided, retainer balances, and payment schedules. It ensures transparency between the law firm and its clients by outlining all fees and expenses incurred over the quarter.

This document is crucial for accurate financial tracking and maintaining client trust. Regular updates and clear descriptions of billed activities are important for effective use of the template.

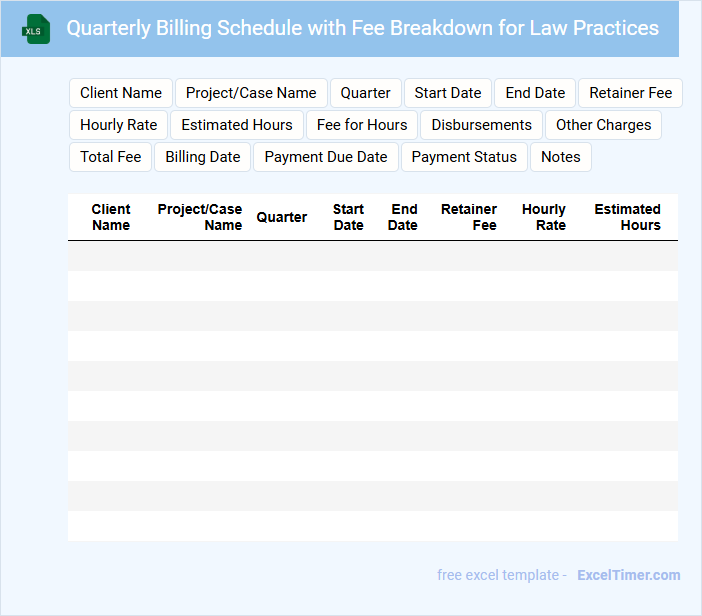

Quarterly Billing Schedule with Fee Breakdown for Law Practices

A Quarterly Billing Schedule with Fee Breakdown for Law Practices typically outlines scheduled payments and itemized fees for legal services rendered over a three-month period.

- Clear Fee Allocation: It provides a detailed breakdown of charges by service type to ensure transparent billing.

- Payment Deadlines: The schedule specifies exact dates for invoice issuance and payment due dates to maintain consistent cash flow.

- Client Communication: It serves as an important tool for setting expectations and facilitates clear communication regarding billing cycles with clients.

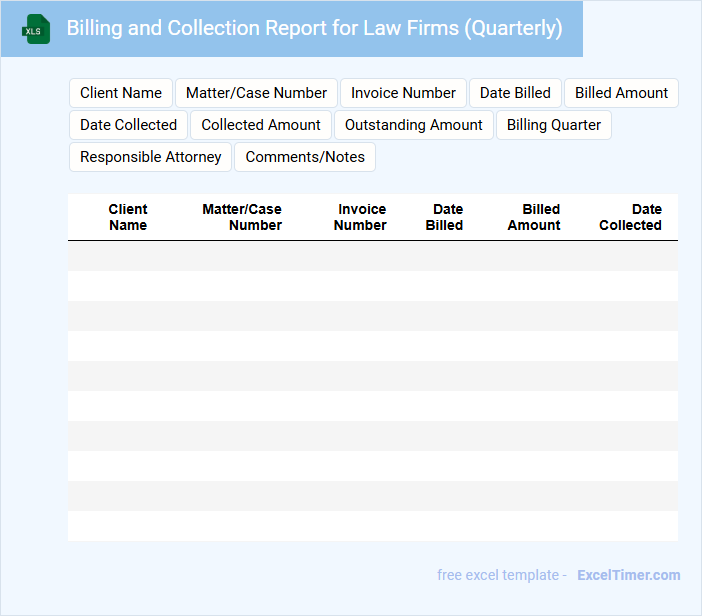

Billing and Collection Report for Law Firms (Quarterly)

The Billing and Collection Report for law firms is a critical document that summarizes financial transactions over a quarter. It typically includes detailed billing records, outstanding collections, and payment status for legal services rendered. This report helps law firms monitor cash flow and identify any delays in client payments.

For an effective quarterly report, ensure accuracy in billing data, categorize receivables by aging periods, and provide clear visualizations of collection trends. Highlight any discrepancies or potential risks early to facilitate timely follow-up actions. Additionally, consider including comparative analyses with previous quarters to track performance improvements.

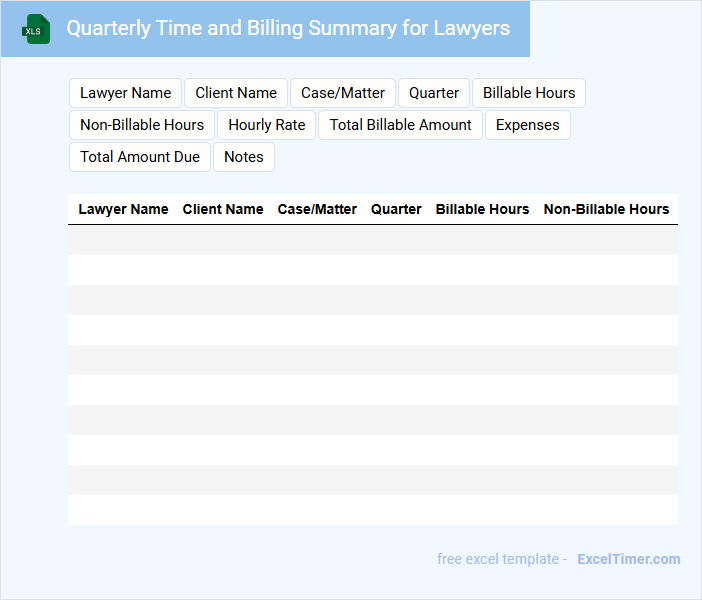

Quarterly Time and Billing Summary for Lawyers

The Quarterly Time and Billing Summary for lawyers typically contains a detailed record of billable hours, case notes, client interactions, and financial transactions for the quarter. It serves as a crucial document to track the efficiency and profitability of legal services provided.

A well-organized summary enhances transparency and supports accurate invoicing and client accountability. To maximize its effectiveness, ensure timely updates and include a clear breakdown of hours worked by case or client.

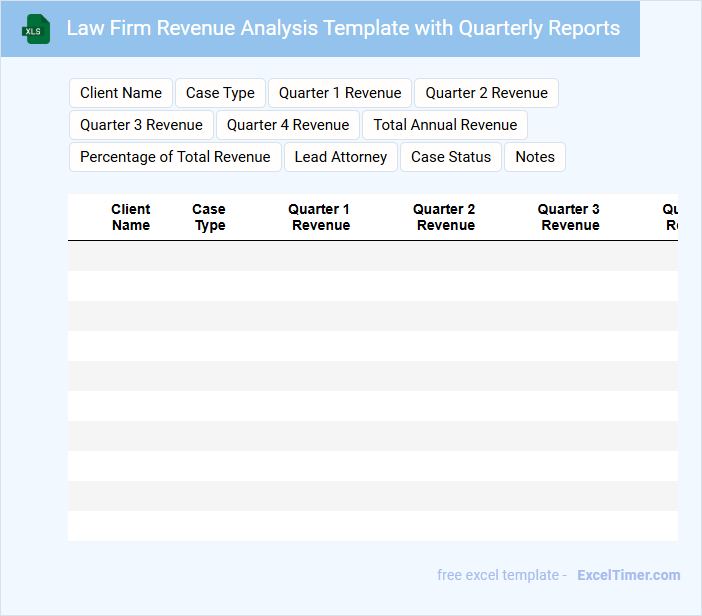

Law Firm Revenue Analysis Template with Quarterly Reports

A Law Firm Revenue Analysis Template is designed to help legal practices systematically track and evaluate their income streams. It typically contains detailed financial data, including fee collections, expenses, and profitability metrics across different practice areas. Incorporating quarterly reports enables firms to identify trends and make informed strategic decisions for growth.

For optimum effectiveness, ensure the template includes customizable fields for various billing arrangements and case types. Also, integrating visual aids such as charts can enhance data interpretation during quarterly reviews. Lastly, maintaining accuracy in data entry and regularly updating the template is crucial for reliable insights.

Excel Quarterly Billable Hours Tracker for Law Firms

An Excel Quarterly Billable Hours Tracker for law firms is a spreadsheet designed to monitor and record the number of hours attorneys bill each quarter. This document typically includes detailed data on individual attorney hours, client engagement time, and project-specific billable activities.

Such trackers help firms ensure accurate billing, improve resource allocation, and enhance financial forecasting. It is important to regularly update the tracker and verify the accuracy of entries to maintain reliable performance metrics.

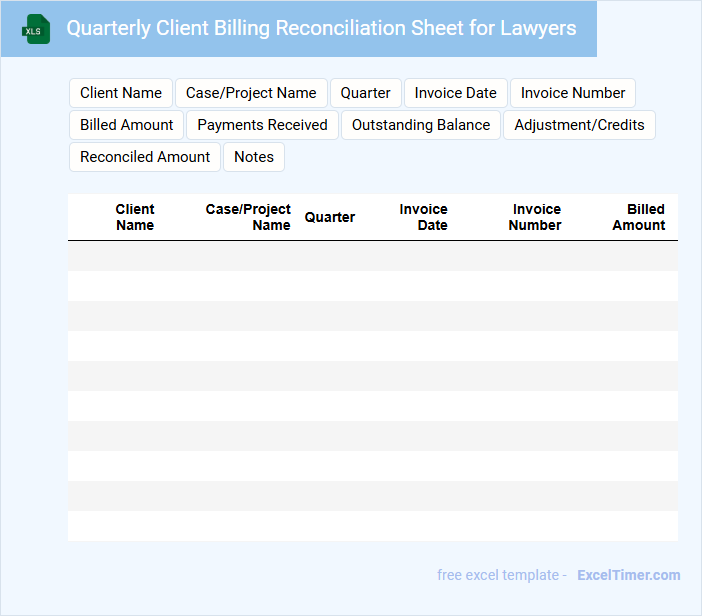

Quarterly Client Billing Reconciliation Sheet for Lawyers

The Quarterly Client Billing Reconciliation Sheet for lawyers is a critical document used to reconcile client billing records against payments received within a specified quarter. This sheet typically contains detailed entries of billed hours, expenses incurred, payments made, and any outstanding balances. Ensuring accuracy in this document helps maintain transparent financial records and supports effective client account management.

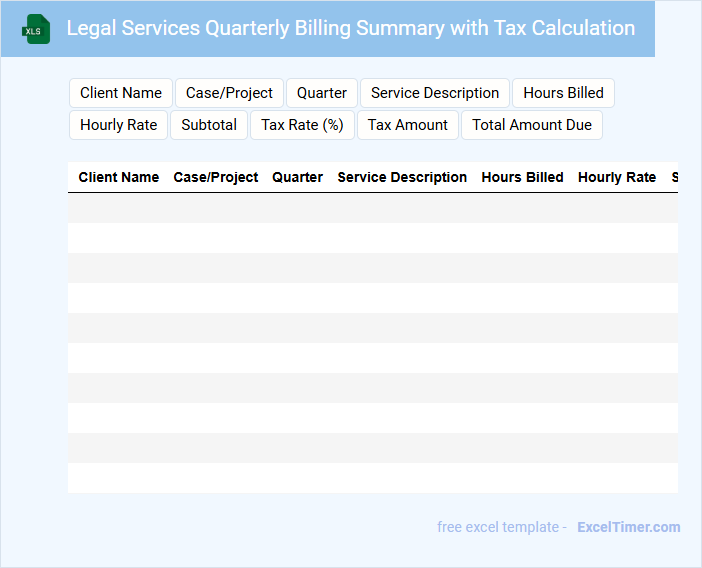

Legal Services Quarterly Billing Summary with Tax Calculation

The Legal Services Quarterly Billing Summary typically contains detailed records of all billable hours and services rendered for a specific quarter. It includes client information, service descriptions, hourly rates, and total charges before tax.

Additionally, the document incorporates a tax calculation section to accurately reflect applicable taxes on the total amount due. Ensuring clarity in tax rates and billing periods is crucial for transparency and compliance.

It is important to verify all entries and include contact information for billing inquiries to facilitate smooth payment processing.

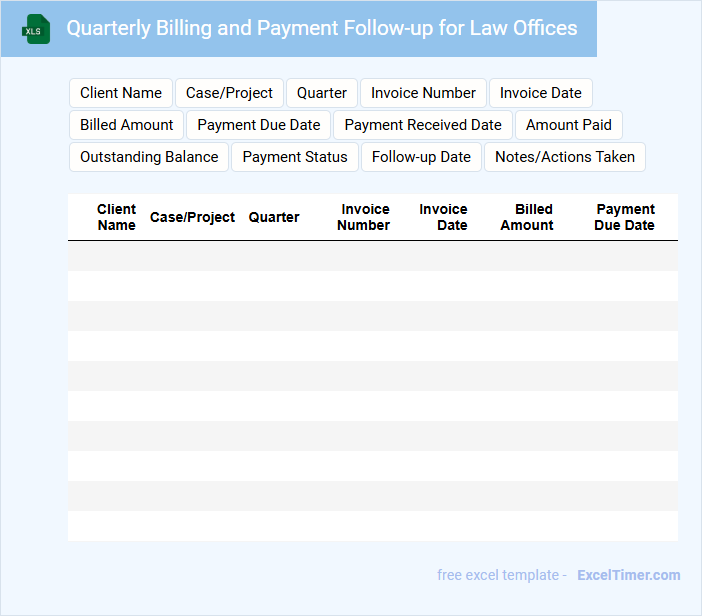

Quarterly Billing and Payment Follow-up for Law Offices

What does a Quarterly Billing and Payment Follow-up document typically contain for law offices? This document usually includes detailed invoices of legal services rendered, payment records, and outstanding balances. It serves to keep both the law office and clients informed about financial transactions and ensure timely payments.

What is an important aspect to focus on in this document? Clear itemization of services, precise payment deadlines, and consistent follow-up reminders are crucial to maintain transparent communication and minimize delayed payments.

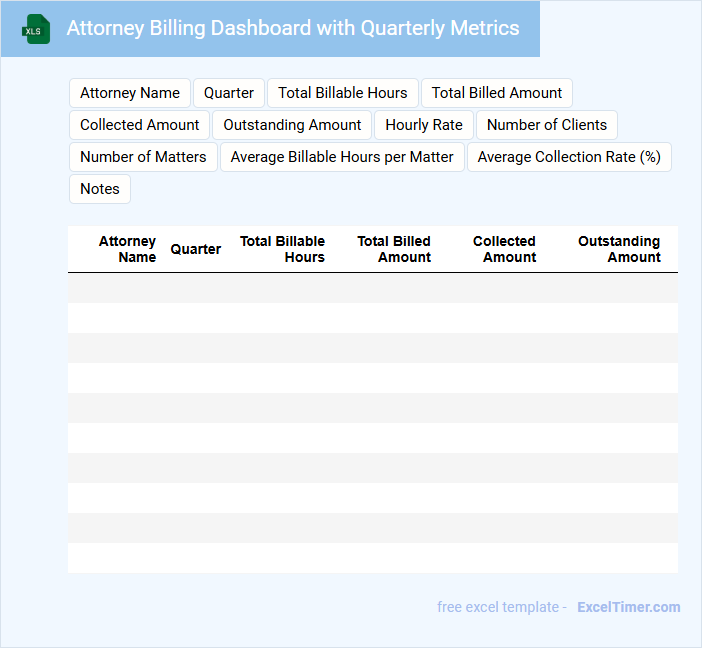

Attorney Billing Dashboard with Quarterly Metrics

What information is typically included in an Attorney Billing Dashboard with Quarterly Metrics? This document usually contains detailed billing data, hours worked, and revenue generated by each attorney, organized by quarter. It provides visual insights through charts and graphs to help track financial performance and identify trends.

Why is it important to focus on accuracy and clarity in this type of dashboard? Precise data ensures reliable financial analysis and helps prevent billing disputes. Clear visualization aids quick decision-making and improves transparency for both law firms and clients.

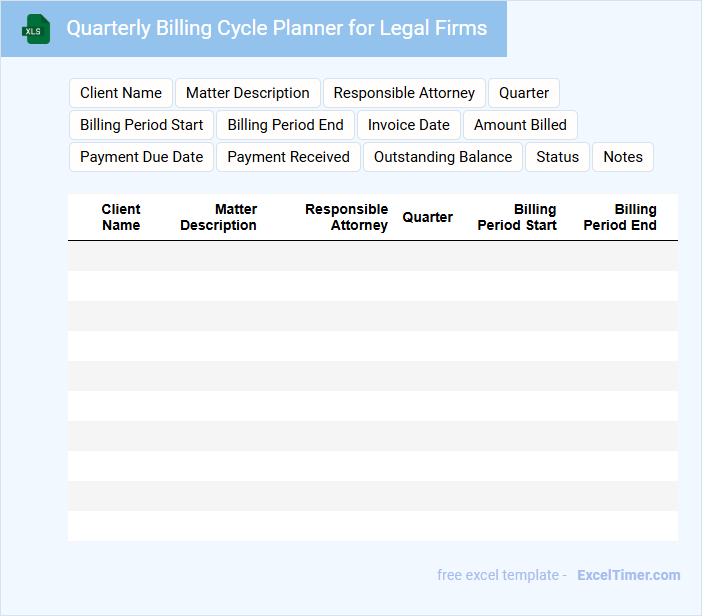

Quarterly Billing Cycle Planner for Legal Firms

A Quarterly Billing Cycle Planner for legal firms typically contains detailed schedules of billing periods, deadlines for invoice submissions, and payment collection dates. It helps in organizing the financial workflow to ensure timely cash flow management. Effective tracking of billable hours and client communications is essential for accuracy.

This document also includes notes on compliance regulations and reminders for quarterly financial reviews to align with firm policies. Prioritizing transparent and consistent billing practices enhances client trust and operational efficiency. It's important to incorporate automated reminders and conflict checks in the planner.

How can I set up automated quarterly billing schedules for clients in Excel?

Create a table with client names, billing amounts, and due dates in Excel. Use Excel's built-in formulas like EDATE to calculate quarterly billing dates automatically. Set reminders or use Excel VBA macros to generate and send billing notifications on schedule.

What Excel formulas help track outstanding payments and due dates for quarterly billing cycles?

Excel formulas like SUMIFS calculate outstanding payments by summing amounts where payment status is "unpaid" within specific quarters. The formula =DATEDIF(TODAY(), DueDate, "d") determines days until due dates, highlighting overdue invoices. Conditional formatting can be applied to flag overdue or upcoming payments based on these formulas for efficient quarterly billing tracking.

How do I summarize billed hours and expenses by quarter within an Excel document?

Use Excel's PivotTable to summarize billed hours and expenses by quarter by selecting the data range including dates, hours, and expenses. Group the date field by quarters to organize the data accordingly. Summarize the hours and expenses fields using sum functions within the PivotTable for a clear quarterly billing overview.

What key columns and data fields should be included for effective quarterly billing management in Excel?

Your Excel document for Quarterly Billing in law firms should include key columns such as Client Name, Matter or Case Number, Billing Period, Hours Worked, Hourly Rate, Total Amount Billed, Payment Status, and Due Date. Including fields for Invoice Number and Payment Received Date helps track payments and outstanding balances efficiently. Capturing detailed time entries linked to specific attorneys and tasks ensures accurate and transparent billing management.

How can I generate and export quarterly invoices from Excel for law firm clients?

To generate and export quarterly invoices from Excel for law firm clients, use predefined invoice templates combined with client billing data organized by quarter. Implement Excel formulas to calculate billable hours, rates, and applicable taxes, then utilize Excel's export feature to save invoices as PDF or CSV files. Automate invoice generation with VBA macros to streamline repetitive billing tasks and ensure accuracy.