The Quarterly Income and Expense Excel Template for Consultants offers a streamlined way to track revenue and costs over each quarter, providing clear insights into financial performance. It includes customizable categories specifically tailored for consulting services, ensuring accurate expense categorization and income reporting. Using this template helps consultants maintain organized financial records, improve budgeting, and prepare for tax season efficiently.

Quarterly Income and Expense Tracker for Consultants

What information is typically included in a Quarterly Income and Expense Tracker for Consultants? This document usually contains detailed records of all income received and expenses incurred over a three-month period, organized by categories such as client payments, project costs, and office supplies. It helps consultants monitor their financial performance, manage budgets effectively, and prepare accurate tax reports.

What important factors should be considered when using this tracker? It is crucial to keep entries consistent and up-to-date to ensure accuracy, categorize transactions clearly to identify deductible expenses, and review the data regularly for financial planning and identifying cost-saving opportunities.

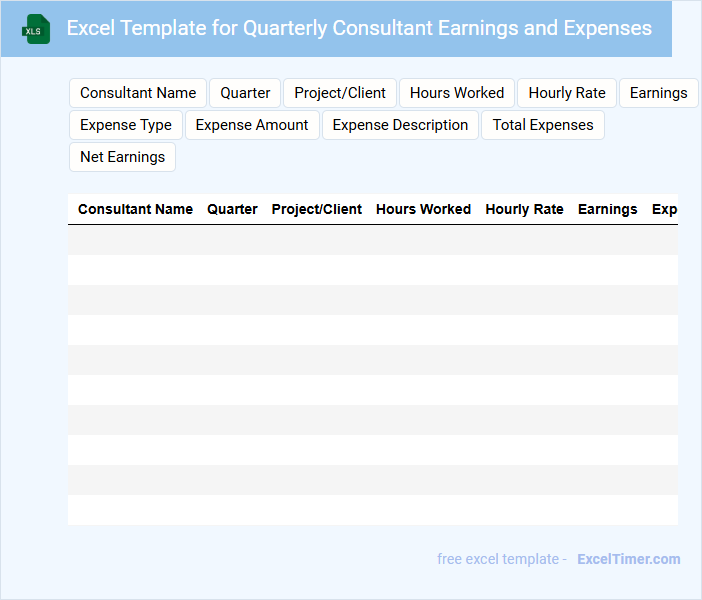

Excel Template for Quarterly Consultant Earnings and Expenses

This Excel template typically contains detailed records of consultant earnings and expenses organized by quarter to streamline financial tracking and reporting.

- Income Sources: Clearly list and categorize all earnings from various consulting projects.

- Expense Tracking: Include all incurred expenses with dates and descriptions for accurate reimbursement and budgeting.

- Summary Reports: Provide quarterly summaries and visual charts for quick performance review and financial analysis.

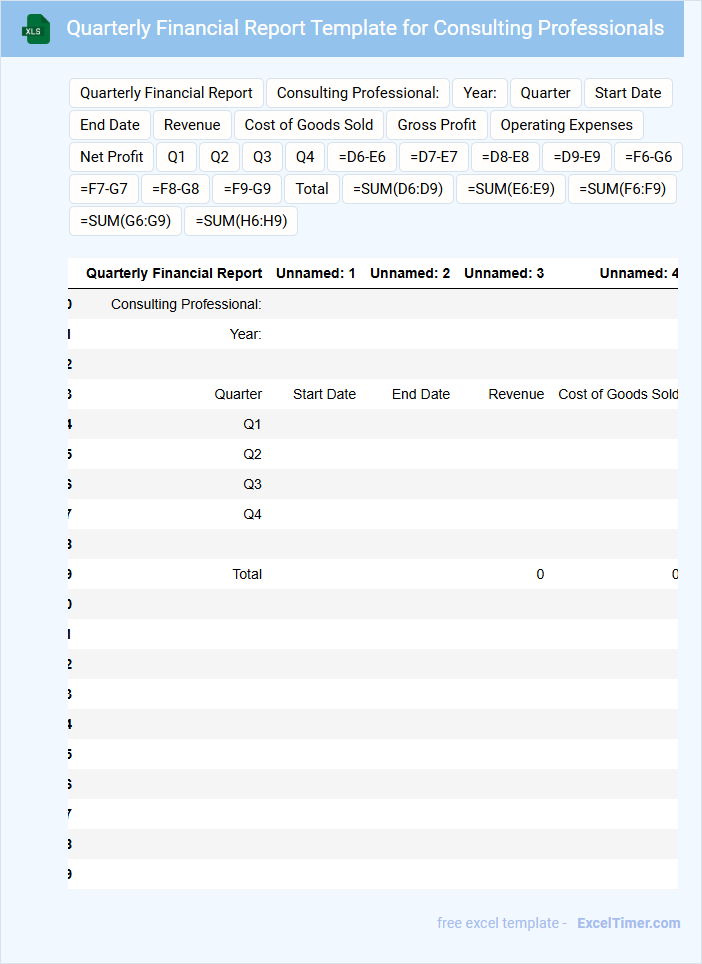

Quarterly Financial Report Template for Consulting Professionals

What information is typically included in a Quarterly Financial Report Template for Consulting Professionals?

This document usually contains detailed financial statements, including income statements, balance sheets, and cash flow analyses for the quarter. It also highlights revenue streams, expenses, and key financial performance indicators to help consultants track business profitability and operational efficiency.

What important elements should be considered when creating this report?

It is crucial to ensure accuracy in financial data and clarity in presentation, enabling easy interpretation by stakeholders. Including comparative analysis with previous quarters and succinct summaries of financial trends enhances informed decision-making for consulting professionals.

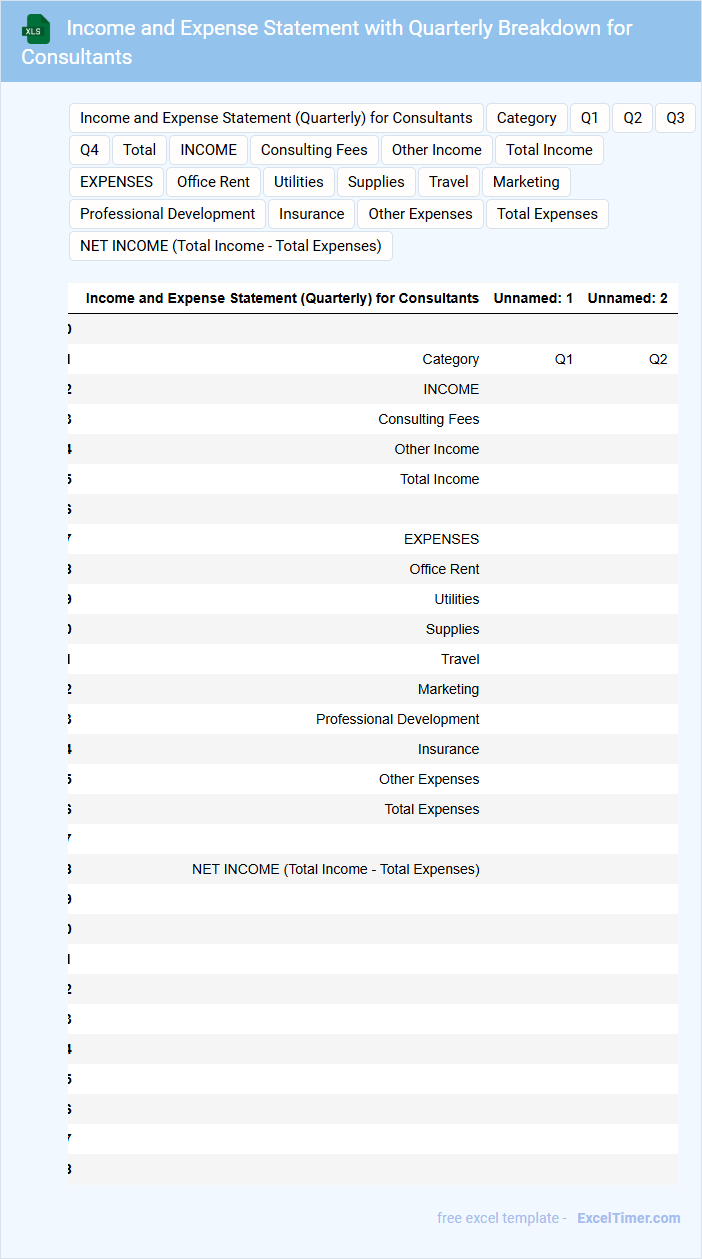

Income and Expense Statement with Quarterly Breakdown for Consultants

An Income and Expense Statement with a quarterly breakdown for consultants typically contains detailed records of all earnings and expenditures over each three-month period. This document is essential for tracking financial performance, understanding cash flow, and preparing for tax obligations. It provides clear visibility into where income is generated and where expenses are allocated throughout the year.

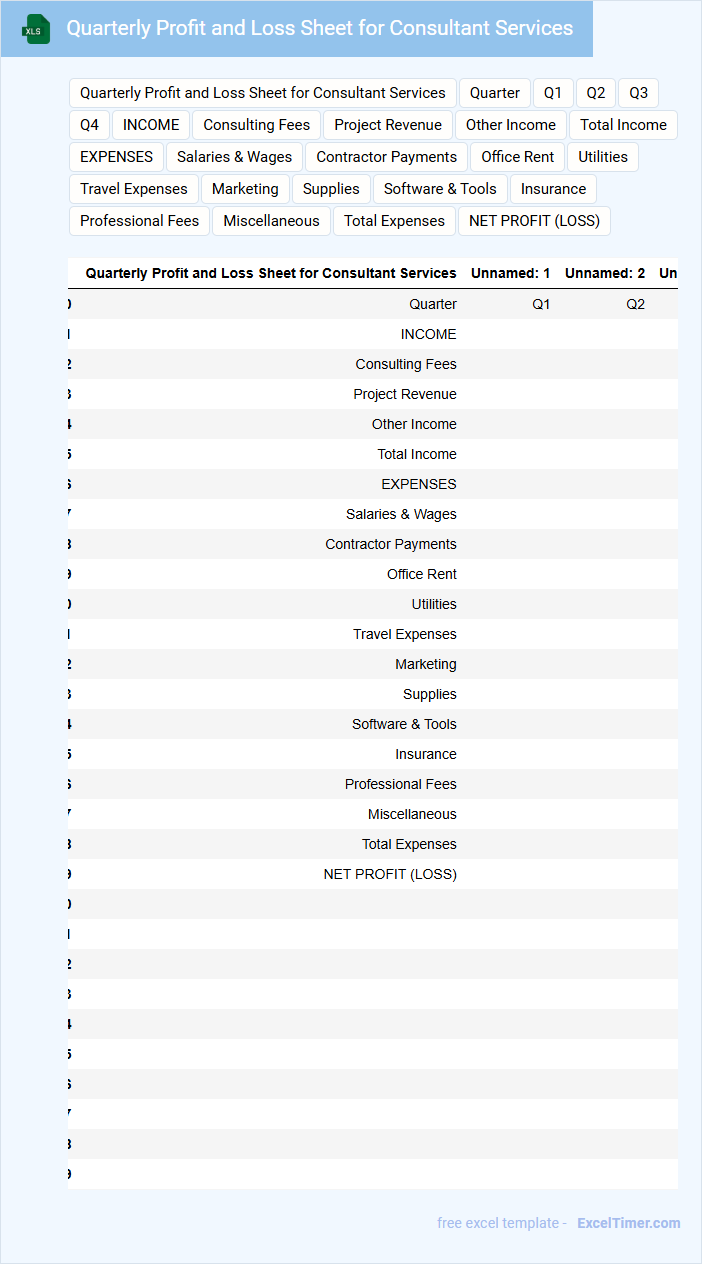

Quarterly Profit and Loss Sheet for Consultant Services

The Quarterly Profit and Loss Sheet for Consultant Services summarizes the revenues, expenses, and net profit over a three-month period. It typically includes detailed entries on service fees, operational costs, and any incidental expenses. Ensuring accuracy in categorizing income and costs is crucial for precise financial analysis and future planning.

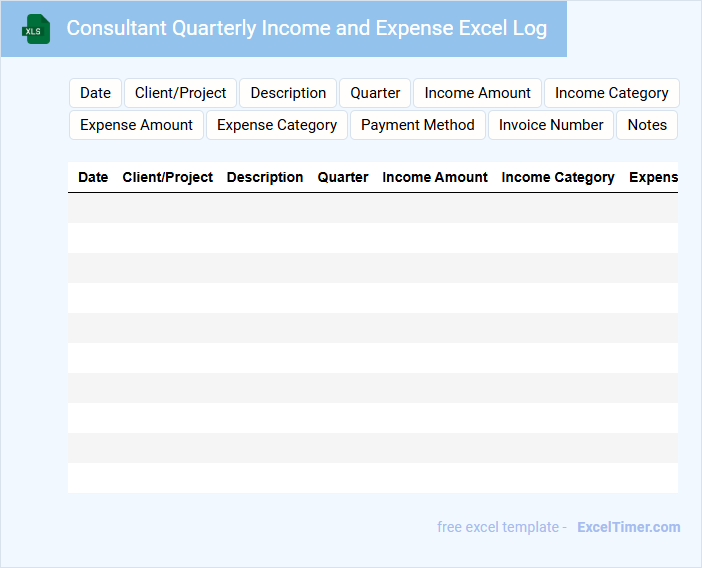

Consultant Quarterly Income and Expense Excel Log

A Consultant Quarterly Income and Expense Excel Log typically contains detailed records of all earnings and expenditures incurred by a consultant throughout the quarter.

- Income Tracking: Accurately records all sources of revenue including client payments and project fees.

- Expense Documentation: Lists all business-related expenses such as travel, software, and office supplies.

- Financial Summary: Provides a clear overview of net profit or loss to assist in financial planning and tax filing.

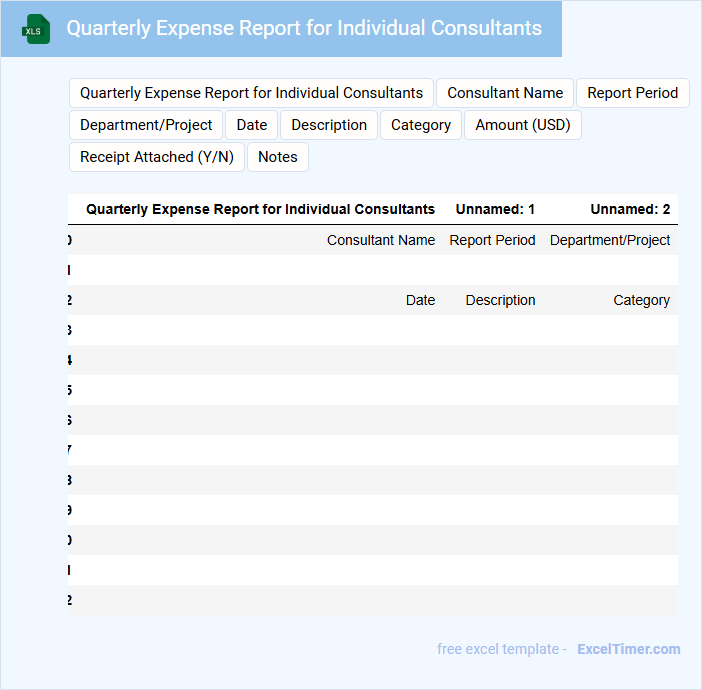

Quarterly Expense Report for Individual Consultants

What information is typically included in a Quarterly Expense Report for Individual Consultants? This type of document usually contains detailed records of all expenses incurred by the consultant over a three-month period, including dates, descriptions, amounts, and categories of spending. It also often includes summaries of total expenses, reimbursement requests, and any supporting receipts or documentation.

Why is accuracy important when preparing a Quarterly Expense Report for Individual Consultants? Accurate reporting ensures proper reimbursement, compliance with company policies, and effective budget management. Consultants should carefully track all expenditures, categorize expenses correctly, and retain all relevant receipts to support their claims.

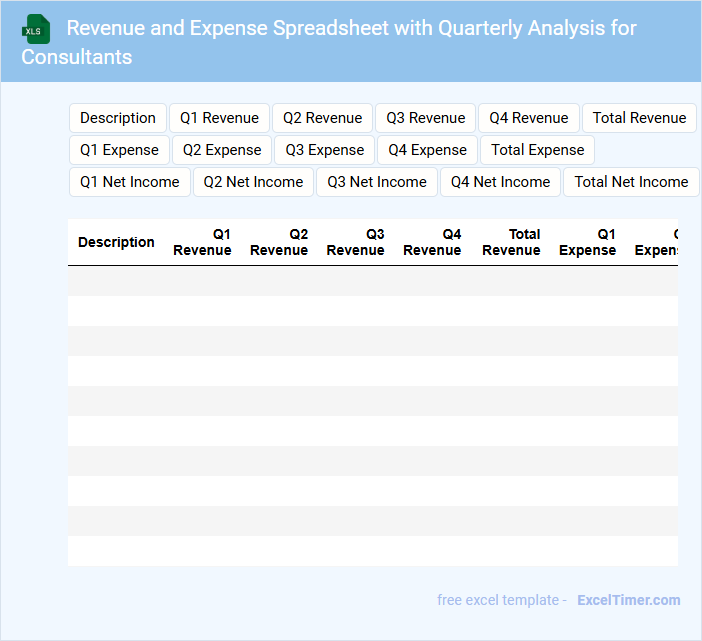

Revenue and Expense Spreadsheet with Quarterly Analysis for Consultants

This document is a Revenue and Expense Spreadsheet designed specifically for consultants, providing a detailed record of all income and expenditures related to their projects. It includes a quarterly analysis that helps in tracking financial performance over time and identifying trends. The primary goal is to assist consultants in budgeting, forecasting, and making informed financial decisions.

Consulting Business Quarterly Income and Expense Template

The Consulting Business Quarterly Income and Expense Template is designed to track and manage financial transactions over a three-month period. It typically contains detailed records of income sources and various operating expenses. This template helps consultants monitor profitability and make informed budgeting decisions.

Important elements to include are clear categories for revenue streams, fixed and variable expenses, and summaries for net income. Accurate date entries and consistent updating ensure reliable financial insights. Integrating visual charts can enhance understanding of financial trends and cash flow.

Quarterly Tracking Sheet of Income and Expenses for Freelance Consultants

A Quarterly Tracking Sheet of Income and Expenses for Freelance Consultants is a structured financial document that records earnings and expenditures over a three-month period. It helps monitor cash flow, enabling better budgeting and tax preparation. Maintaining accurate entries ensures freelancers can analyze profitability and make informed business decisions.

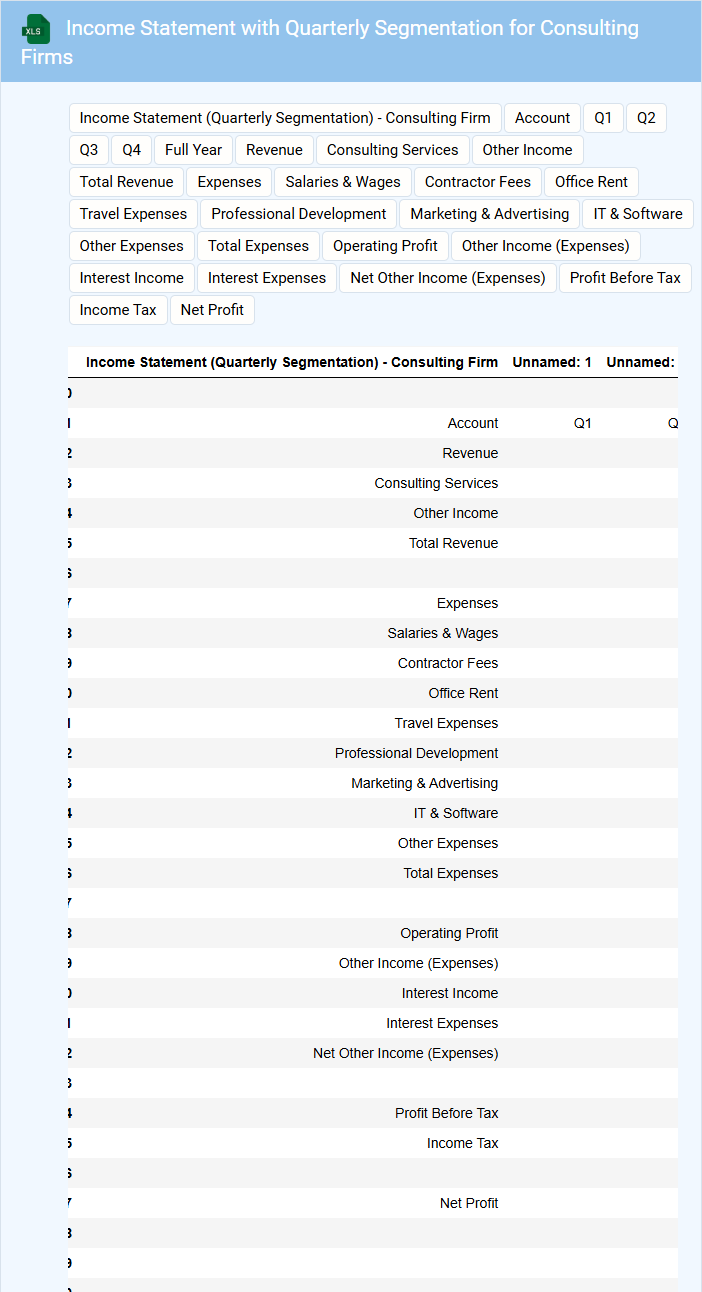

Income Statement with Quarterly Segmentation for Consulting Firms

An Income Statement with quarterly segmentation for consulting firms typically contains detailed financial data organized by three-month periods. This document highlights revenues, expenses, and net income, providing insights into the firm's financial performance over each quarter. It is crucial for tracking profitability trends and making informed business decisions.

Important elements to focus on include accurate revenue recognition by quarter, distinguishing between fixed and variable expenses, and monitoring gross profit margins. Consulting firms should ensure clear segmentation to identify seasonality effects and project-based income variations. Additionally, including comparative quarterly data from previous years enhances trend analysis and forecasting accuracy.

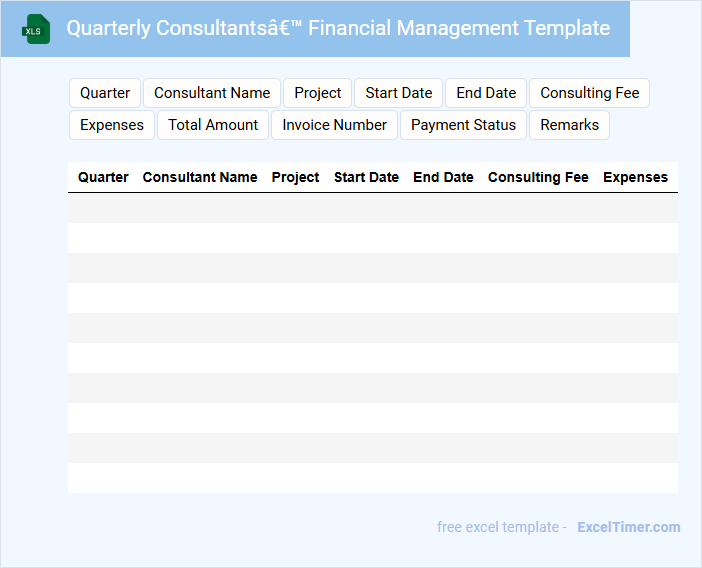

Quarterly Consultants’ Financial Management Template

This type of document typically contains detailed financial reports outlining revenue, expenses, and profit margins for each quarter. It also includes budget forecasts and variance analyses to track financial performance effectively.

For consultants, maintaining an accurate cash flow statement is crucial to ensure liquidity and operational efficiency. Regular updates and clear categorization of expenses help in making informed financial decisions.

It is important to include a summary of key financial metrics and actionable insights to support strategic planning and client communications.

Excel for Quarterly Tracking of Consulting Income and Expenses

What does an Excel document for Quarterly Tracking of Consulting Income and Expenses typically contain? It usually includes detailed records of all consulting-related revenues and costs organized by quarter, allowing for clear financial analysis. Important elements to include are categorization of income sources, expense types, and summary tables for quick overview and decision-making.

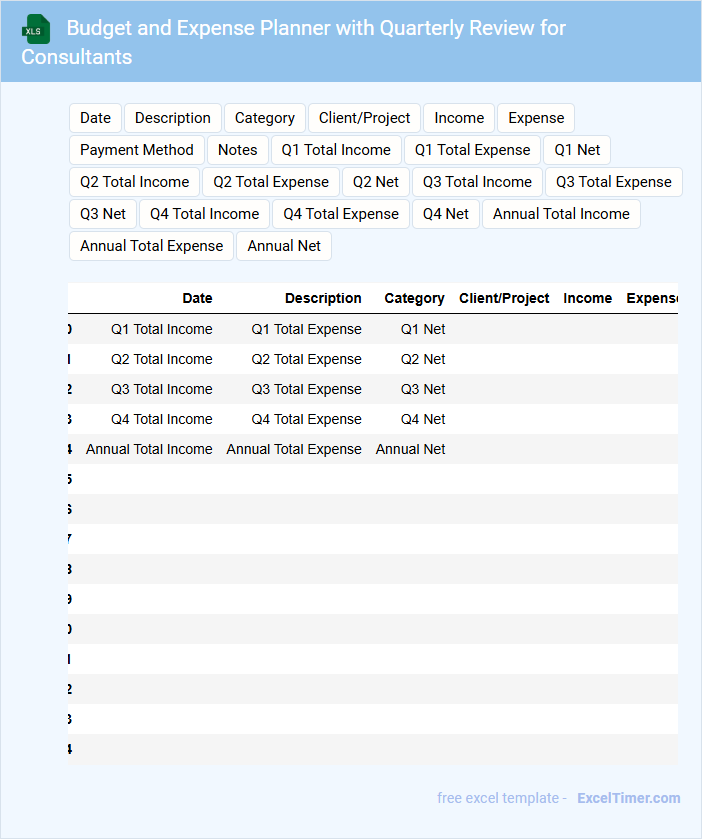

Budget and Expense Planner with Quarterly Review for Consultants

What does a Budget and Expense Planner with Quarterly Review for Consultants typically contain? This document usually includes detailed sections for tracking monthly income, expenses, and budgeting goals tailored to consulting projects. It also incorporates quarterly review segments to analyze financial performance, identify trends, and adjust strategies for improved financial management.

Why is it important for consultants to use such a planner? Using this planner helps consultants maintain clear financial oversight, ensuring they manage cash flow effectively and allocate resources wisely. Additionally, regular quarterly reviews promote informed decision-making and support sustainable business growth.

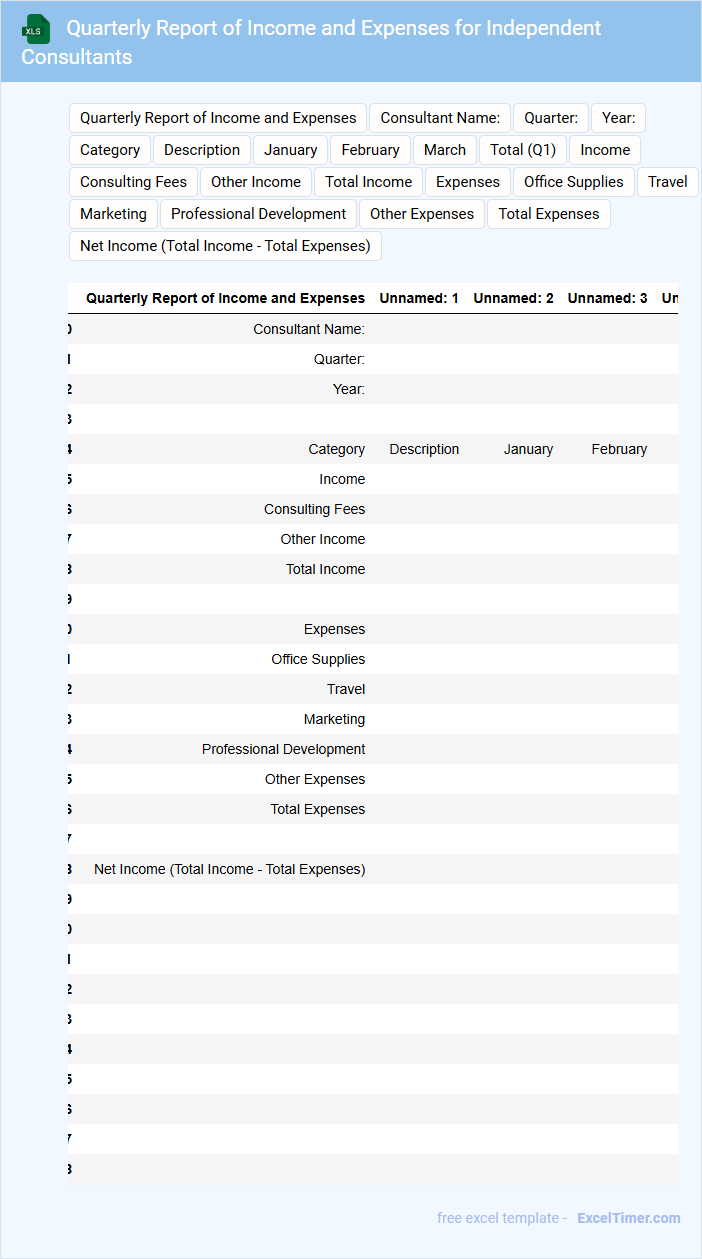

Quarterly Report of Income and Expenses for Independent Consultants

A Quarterly Report of Income and Expenses for Independent Consultants typically contains detailed records of all earnings and expenditures over a three-month period. It highlights the financial performance and cash flow, helping consultants track profitability and manage budgets effectively. Additionally, this document often includes summaries of key projects and upcoming financial expectations to inform strategic decisions.

What are the key components to include in a quarterly income and expense Excel sheet for consultants?

Your quarterly income and expense Excel sheet for consultants should include key components such as client revenues, categorized business expenses, and taxes owed. Track invoice dates, payment status, and expense receipts to ensure accuracy and timely financial analysis. Incorporating graphs or summaries helps visualize cash flow and profit trends each quarter.

How can income sources be categorized to reflect diverse consulting services in the spreadsheet?

Income sources can be categorized by consulting service types such as strategy, technology, marketing, and financial advice within your Quarterly Income and Expense Excel document. Use specific income accounts for each category to track revenue streams accurately and identify trends. This approach ensures your spreadsheet reflects the diversity of consulting services, aiding in detailed financial analysis and reporting.

What Excel formulas or functions help automate the calculation of quarterly profit or loss?

Use the SUM function to total quarterly income and expenses for each consultant. Apply the formula =SUM(Income_Range) - SUM(Expense_Range) to calculate quarterly profit or loss. Employ the IF function to identify positive or negative results, enhancing financial analysis accuracy.

How should recurring and one-time expenses be tracked for accurate quarterly reporting?

You should categorize recurring expenses separately from one-time expenses in your quarterly income and expense Excel document for consultants. Use distinct rows or columns to track each type, ensuring precise aggregation and analysis. This approach enhances accuracy in financial reporting and helps identify spending patterns effectively.

What methods can be used to visualize quarterly financial trends using Excel charts or pivot tables?

You can visualize quarterly financial trends for consultants using Excel charts like line graphs or bar charts to display income and expenses over time. Pivot tables allow quick summarization and comparison of income and expense data by quarter, helping identify trends efficiently. Combining pivot tables with slicers enables dynamic filtering for more detailed quarterly financial analysis.