The Quarterly Cash Flow Excel Template for Nonprofits offers a structured way to track and manage cash inflows and outflows every quarter, ensuring better financial oversight. It helps nonprofit organizations maintain liquidity, plan budgets effectively, and avoid cash shortages during critical periods. This template is essential for transparent reporting and aids in meeting donor and regulatory requirements consistently.

Quarterly Cash Flow Statement with Income and Expense Tracker

A Quarterly Cash Flow Statement with an Income and Expense Tracker is a financial document used to monitor the inflows and outflows of cash over a three-month period. It typically contains detailed records of all income sources and expenses, allowing businesses or individuals to assess their financial health regularly. This report helps in identifying trends, managing budgets, and making informed financial decisions.

Quarterly Cash Flow Analysis Template for Nonprofits

A Quarterly Cash Flow Analysis Template for Nonprofits typically contains essential financial data to monitor and manage the organization's liquidity and operational sustainability every three months.

- Cash Inflows: Detailed records of all incoming funds such as donations, grants, and fundraising revenues.

- Cash Outflows: Comprehensive tracking of all expenses including program costs, salaries, and administrative fees.

- Net Cash Position: Clear calculation of the difference between inflows and outflows to assess financial health and plan for future activities.

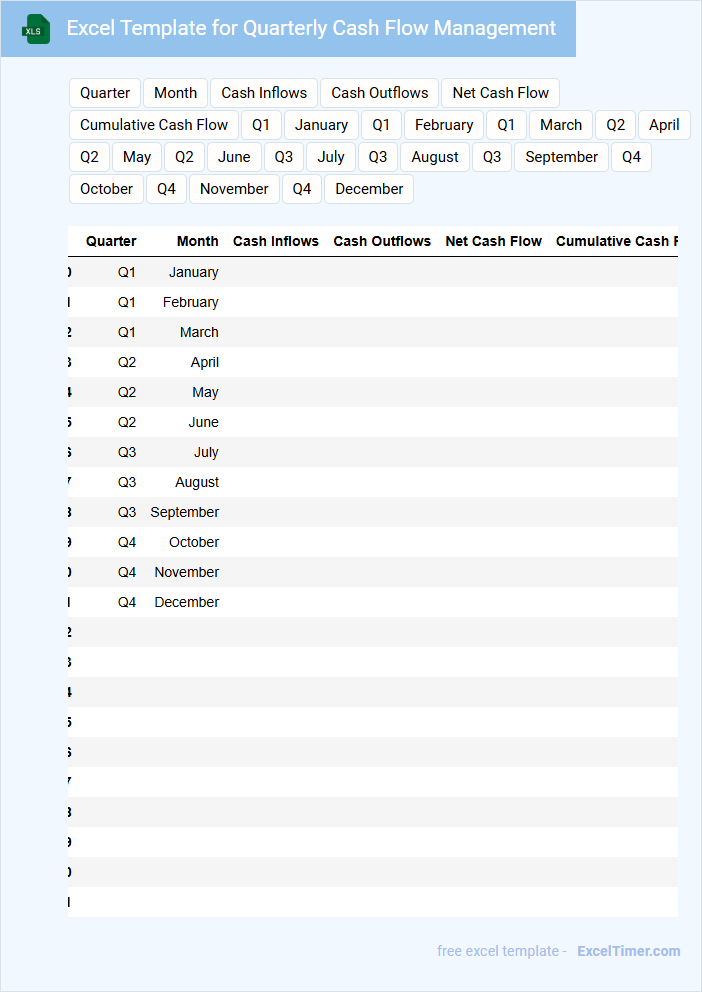

Excel Template for Quarterly Cash Flow Management

An Excel Template for Quarterly Cash Flow Management typically contains sections for tracking cash inflows, outflows, and net cash position across three months. It includes predefined formulas to automatically calculate totals and variances, aiding in accurate and timely financial analysis. A well-designed template helps businesses anticipate cash shortages and make informed financial decisions. For optimal use, ensure the template allows for customizable categories that reflect your specific income and expense streams. Incorporate visual elements like charts or graphs for quick cash flow trend assessments. Regularly update the template with actual figures to maintain accurate forecasts and strengthen financial planning.

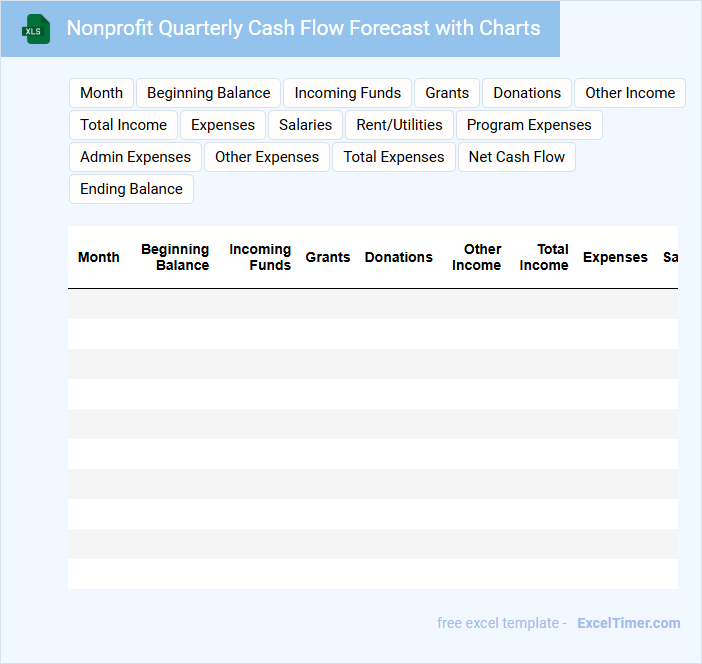

Nonprofit Quarterly Cash Flow Forecast with Charts

The Nonprofit Quarterly Cash Flow Forecast document typically contains detailed projections of inflows and outflows of cash for the upcoming quarter. It helps organizations anticipate financial needs and manage resources effectively.

Important elements include tracking donations, grants, operational expenses, and timing of revenue streams. Visual charts enhance understanding by clearly depicting cash trends and potential shortfalls.

Quarterly Cash Flow Report for Nonprofit Organizations

A Quarterly Cash Flow Report for nonprofit organizations provides a detailed overview of cash inflows and outflows over a three-month period, illustrating the organization's liquidity and financial health. This document typically includes data on donations, grants, expenses, and operational costs. It is essential for budgeting, financial planning, and ensuring transparency to stakeholders.

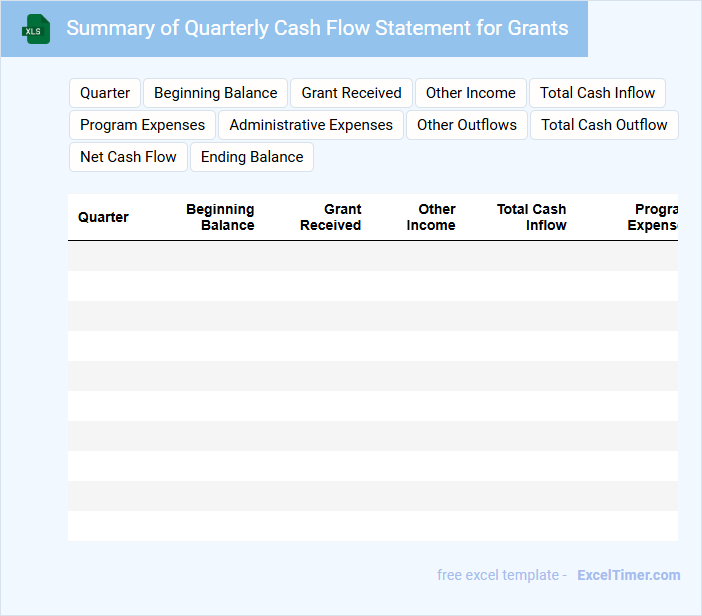

Summary of Quarterly Cash Flow Statement for Grants

The Summary of Quarterly Cash Flow Statement for Grants is a document that provides an overview of the inflows and outflows of grant funds during a specific quarter.

- Grant receipts: Details the total cash received from grantors within the quarter.

- Expenditures: Summarizes the cash spent on grant-related activities and projects.

- Closing balance: Indicates the remaining cash available at the end of the quarter for grant use.

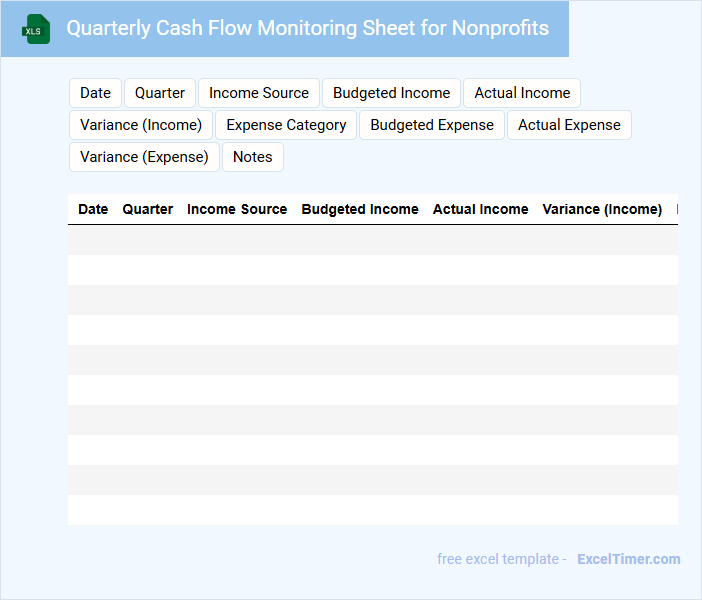

Quarterly Cash Flow Monitoring Sheet for Nonprofits

The Quarterly Cash Flow Monitoring Sheet for nonprofits is a vital document that tracks the inflow and outflow of cash over a three-month period, ensuring financial stability and transparency. It provides a clear snapshot of the organization's liquidity and helps in identifying potential cash shortages.

Key elements include income sources, operational expenses, and any discretionary spending. Regular updates and precise categorization are essential for accurate forecasting and effective financial management.

Excel Template for Tracking Quarterly Cash Inflows and Outflows

An Excel Template for tracking quarterly cash inflows and outflows is designed to efficiently monitor a business's financial health over a three-month period. It typically contains sections for recording income sources, expenses, and net cash flow, allowing for easy comparison and analysis. Regular updates and accuracy in data entry are crucial to ensure reliable financial forecasting and decision-making.

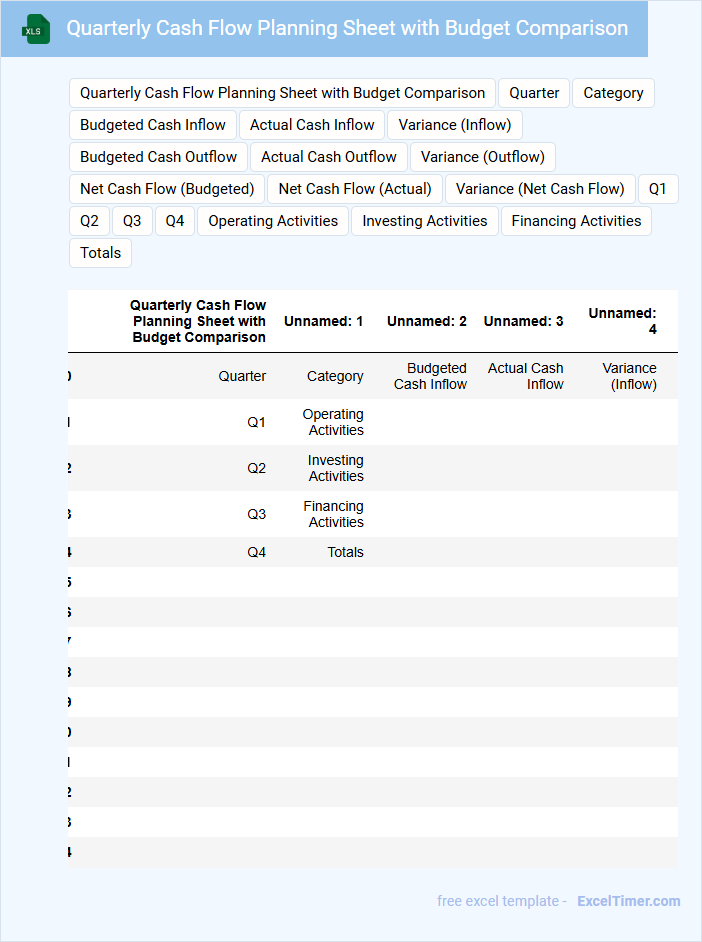

Quarterly Cash Flow Planning Sheet with Budget Comparison

A Quarterly Cash Flow Planning Sheet with Budget Comparison typically contains detailed projections of cash inflows and outflows over a three-month period, alongside budgeted figures for the same timeframe. It serves to monitor financial health by highlighting variances between actual and planned cash movements. This document is essential for making informed decisions and ensuring liquidity management aligns with company goals.

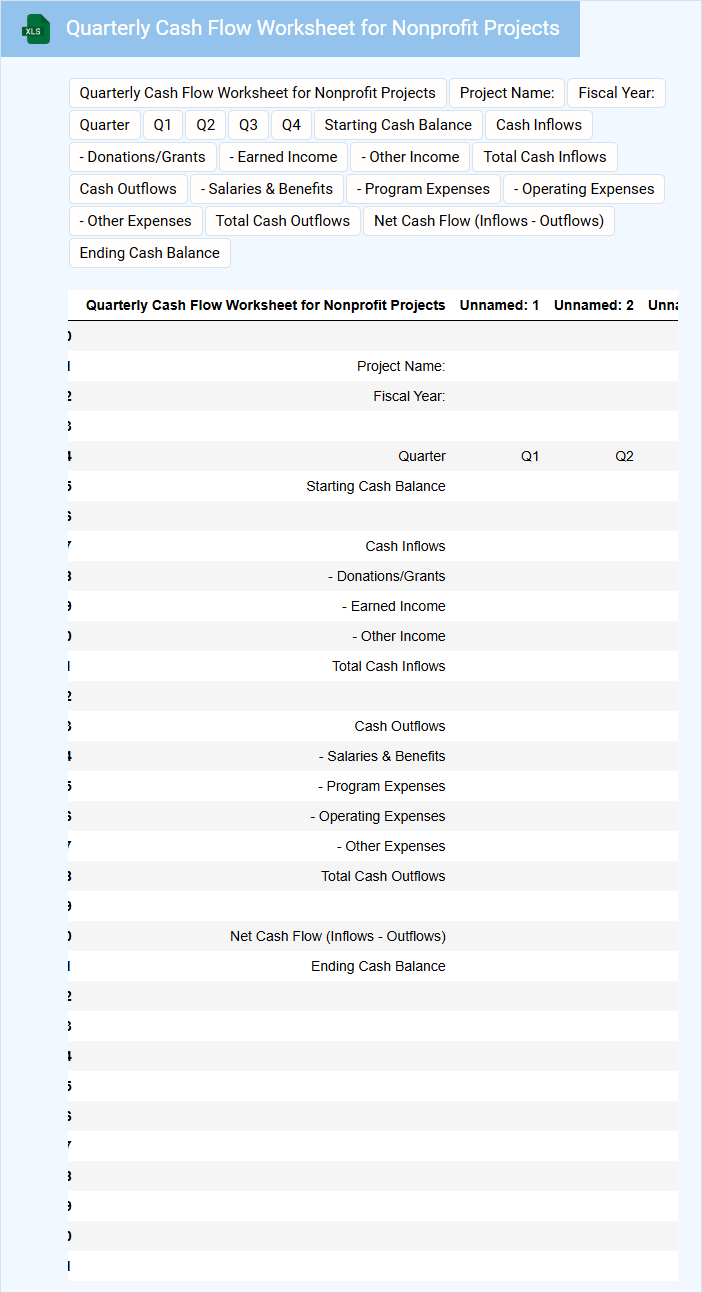

Quarterly Cash Flow Worksheet for Nonprofit Projects

A Quarterly Cash Flow Worksheet for nonprofit projects typically includes detailed records of incoming and outgoing cash over a three-month period. It helps organizations monitor their financial health and ensure sufficient liquidity to support ongoing activities.

Important components often involve tracking donations, grants, expenses, and any restricted funds to maintain transparency and accountability. Regularly updating this worksheet is crucial for accurate forecasting and informed decision-making.

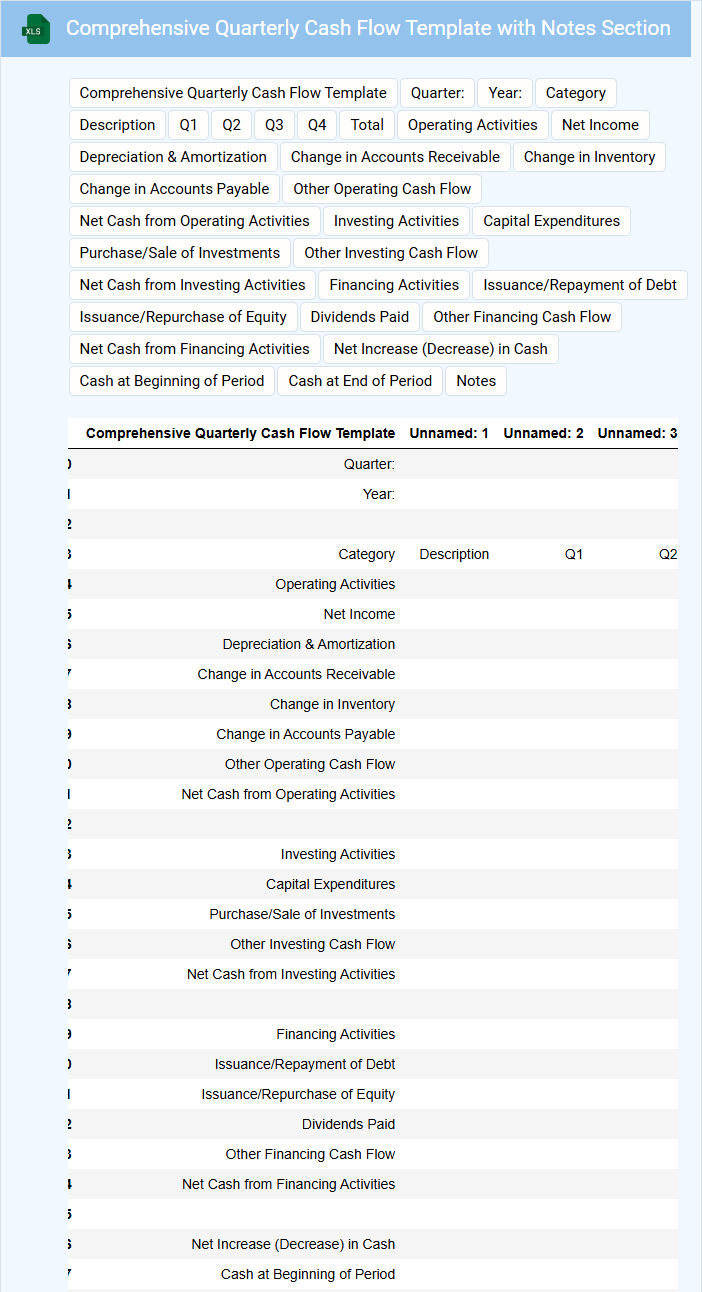

Comprehensive Quarterly Cash Flow Template with Notes Section

What does a Comprehensive Quarterly Cash Flow Template with Notes Section typically contain? This document usually includes detailed records of cash inflows and outflows over a three-month period, providing a clear view of financial health and liquidity. The notes section allows for explanations and additional context to better understand fluctuations and anomalies in cash flow.

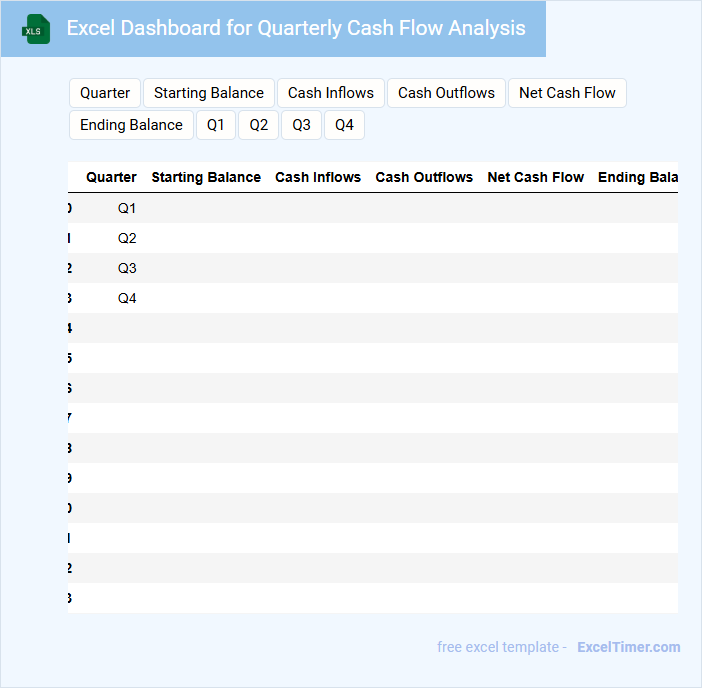

Excel Dashboard for Quarterly Cash Flow Analysis

An Excel Dashboard for Quarterly Cash Flow Analysis typically contains summarized data and visual representations of cash inflows and outflows over a three-month period. It helps stakeholders quickly assess financial health and make informed decisions.

- Include key performance indicators such as net cash flow, operating cash flow, and investing cash flow.

- Incorporate charts like line graphs and bar charts to visualize trends and comparisons.

- Ensure data is updated regularly and sources are clearly documented for accuracy.

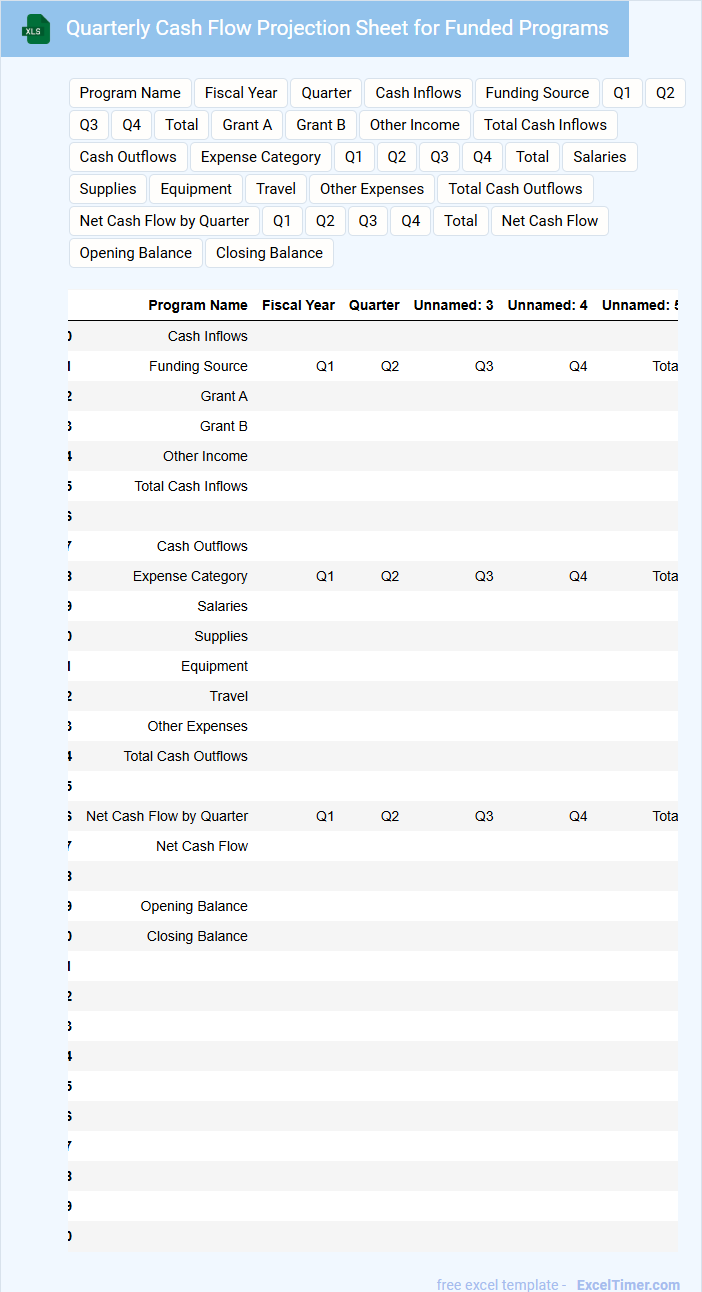

Quarterly Cash Flow Projection Sheet for Funded Programs

The Quarterly Cash Flow Projection Sheet is a financial document that outlines expected inflows and outflows of cash over a three-month period, specifically for funded programs. It helps organizations anticipate funding needs and manage resources efficiently.

This document typically contains detailed estimates of income sources, expenditures, and timing of payments to ensure financial stability. An important suggestion is to regularly update projections to reflect actual performance and changes in funding.

Quarterly Cash Flow Statement with Donor Contribution Tracking

The Quarterly Cash Flow Statement is a financial document that details the inflows and outflows of cash over a three-month period. It helps organizations understand their liquidity and manage operational expenses effectively.

When combined with Donor Contribution Tracking, the document provides clarity on funds received from donors and their allocation. This ensures transparency and accountability in nonprofit financial management.

Important elements to include are clear categorization of cash sources, detailed donor contribution records, and a comparison of actual versus projected cash flows.

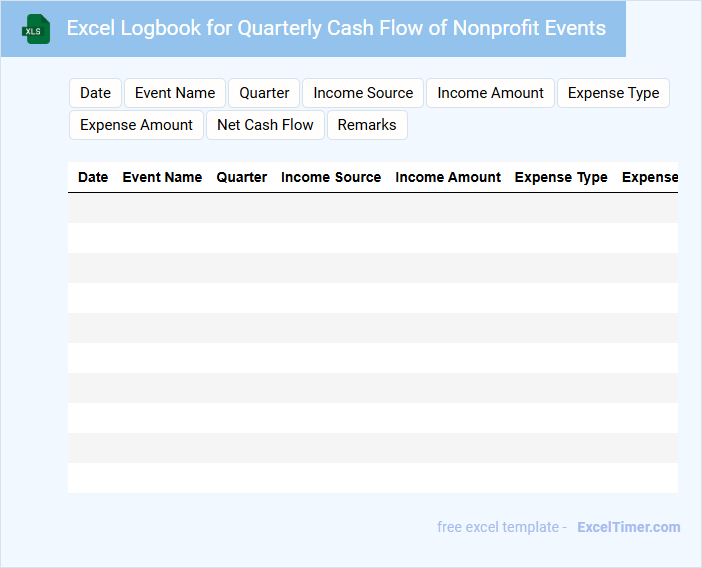

Excel Logbook for Quarterly Cash Flow of Nonprofit Events

An Excel logbook for quarterly cash flow in nonprofit events typically contains detailed financial records, including income, expenses, and net cash flow for each event. It helps track and analyze the financial health of the organization over time. Consistent updating and accurate categorization are important to ensure transparency and effective budgeting.

What are the key components to include in a nonprofit's quarterly cash flow statement?

Your nonprofit's quarterly cash flow statement should include operating activities, like donations and program expenses, investing activities such as asset purchases or sales, and financing activities including grants or loans received. Tracking cash inflows and outflows from these activities provides a clear picture of financial health. Accurate categorization of these components helps identify cash availability and ensures sustainable nonprofit operations.

How does tracking quarterly cash flow help nonprofits manage seasonal funding fluctuations?

Tracking quarterly cash flow helps nonprofits anticipate and manage seasonal funding fluctuations by providing clear insights into revenue and expenses during different times of the year. Accurate quarterly cash flow data allows you to plan budgets effectively, ensuring sufficient funds are available during low-income periods. This financial visibility supports strategic decision-making and sustains nonprofit operations year-round.

Which expenses and income sources should be prioritized in a nonprofit's quarterly cash flow analysis?

A nonprofit's quarterly cash flow analysis should prioritize tracking grant funding, individual donations, and program service fees as primary income sources. Key expenses to focus on include payroll, program expenses, and administrative costs such as rent and utilities. Accurate monitoring of these elements ensures sustainable financial management and strategic allocation of resources.

How do restricted vs. unrestricted funds impact quarterly cash flow projections for nonprofits?

Restricted funds in nonprofits are designated for specific purposes, limiting their use and often causing fluctuations in quarterly cash flow projections. Unrestricted funds provide flexibility, enabling nonprofits to cover operational expenses and respond to unexpected costs, which stabilizes cash flow forecasts. Accurate cash flow projections require distinguishing between these fund types to ensure financial plans align with donor-imposed restrictions and organizational needs.

What common cash flow challenges do nonprofits face each quarter, and how can they be addressed in Excel documentation?

Nonprofits often face cash flow challenges such as irregular donation income, timing gaps between grant payments, and unexpected expenses each quarter. Your Excel documentation can address these issues by implementing detailed cash flow forecasts, integrating donation schedules, and tracking expense categories for accurate financial planning. Utilizing pivot tables and conditional formatting in Excel helps visualize cash flow trends and identify potential shortfalls early.