The Quarterly Profit and Loss Excel Template for Cafes is designed to help cafe owners track revenue, expenses, and net profit over each quarter efficiently. It includes customizable categories tailored for cafe operations, such as food and beverage sales, payroll, rent, and supplies. Accurate financial tracking with this template supports informed business decisions and improves overall profitability management.

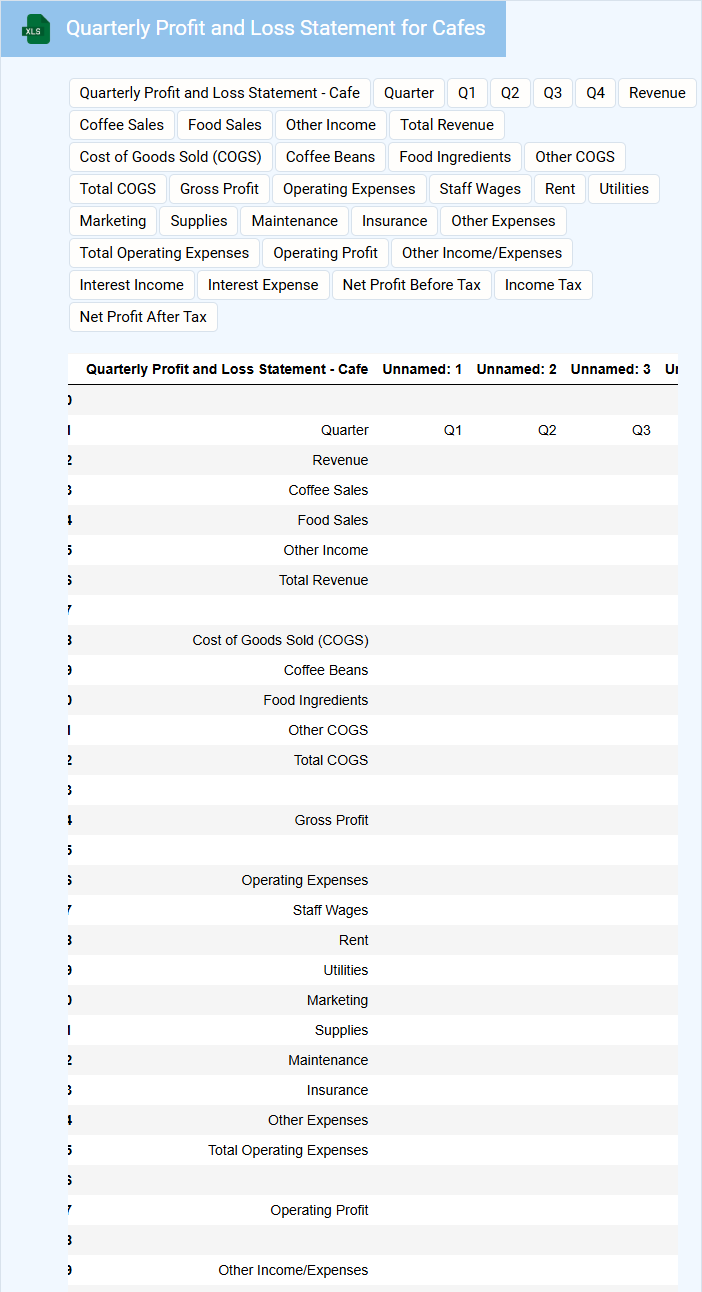

Quarterly Profit and Loss Statement for Cafes

A Quarterly Profit and Loss Statement is a financial document that summarizes the revenues, costs, and expenses incurred by a business within a three-month period. For cafes, this statement provides insight into operational efficiency and profitability by highlighting key income streams and expenditures such as sales, food costs, and labor. Ensuring accuracy in categorizing sales and expenses is vital for making informed decisions and planning future growth.

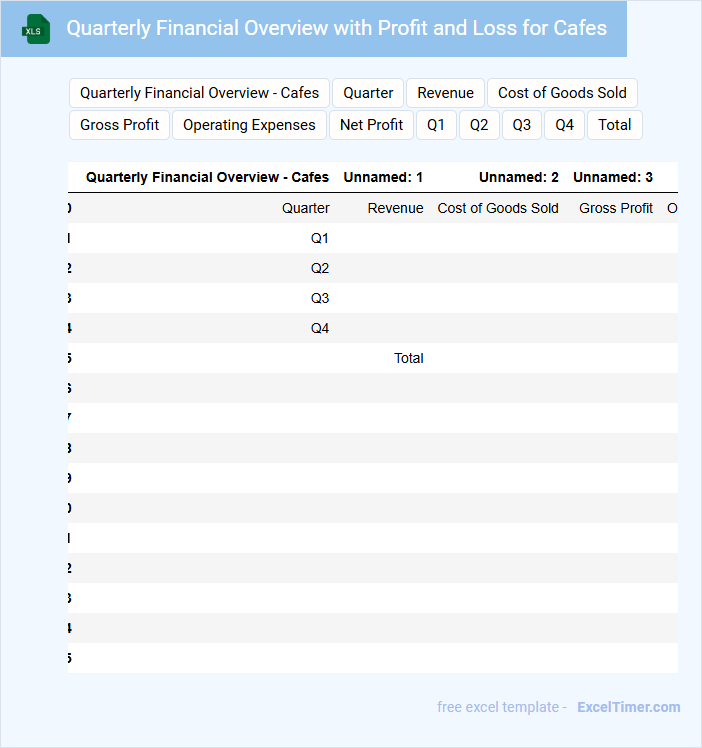

Quarterly Financial Overview with Profit and Loss for Cafes

The Quarterly Financial Overview document typically contains detailed insights into a cafe's revenue, expenses, and net profit over the past three months. It highlights key financial metrics such as sales trends, cost of goods sold, and operational costs, providing a snapshot of overall profitability. This report is essential for identifying areas to improve financial performance and guide strategic decision-making.

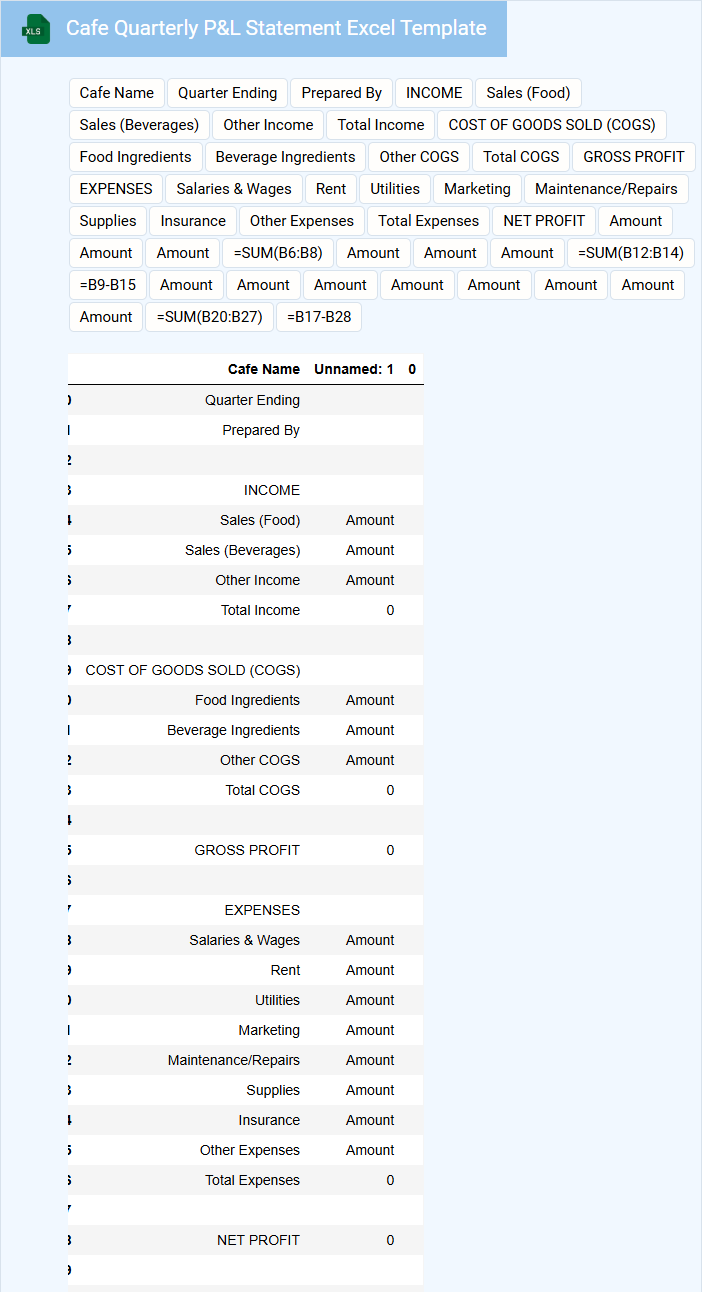

Cafe Quarterly P&L Statement Excel Template

What information is typically included in a Cafe Quarterly P&L Statement Excel Template? This document usually contains detailed financial data such as revenue, costs, and expenses over a quarter. It is designed to help cafe owners analyze profitability and manage financial performance effectively.

What is an important consideration when using this template? Accuracy in inputting sales and cost figures is crucial to generate reliable results. Additionally, regularly updating the template ensures better financial tracking and informed decision-making.

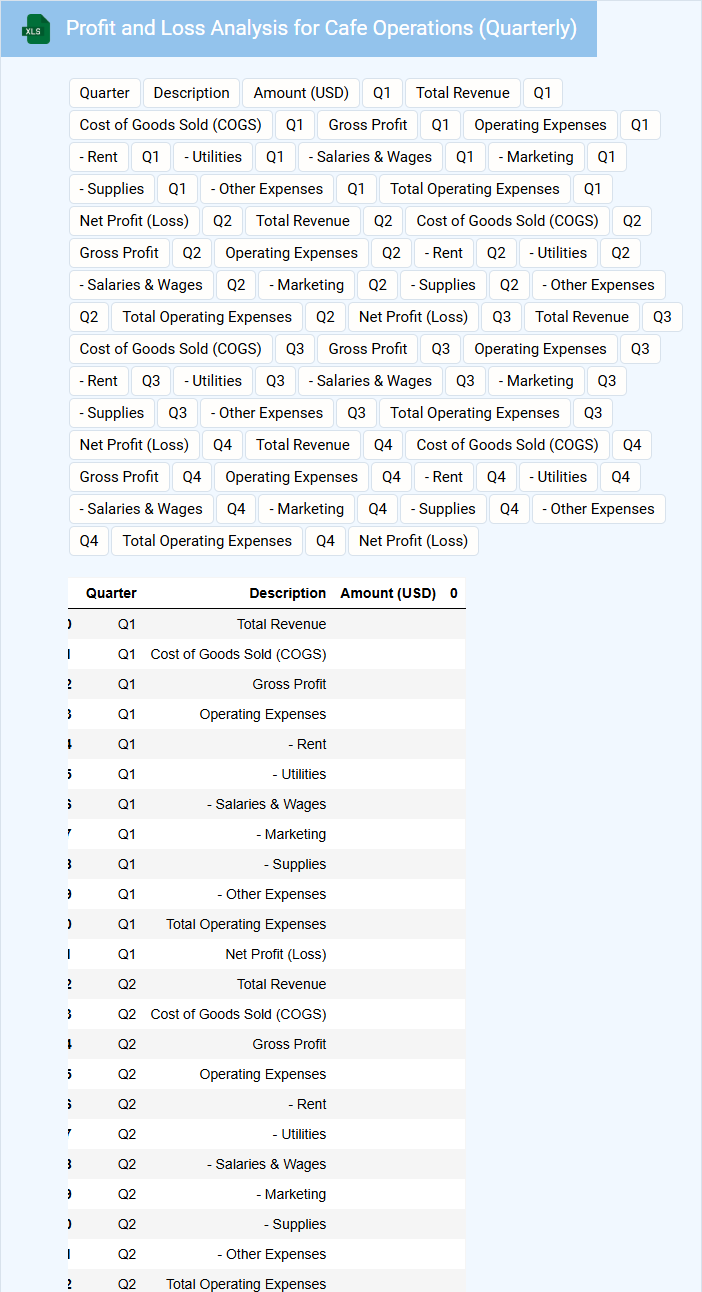

Profit and Loss Analysis for Cafe Operations (Quarterly)

What does a Profit and Loss Analysis for Cafe Operations (Quarterly) typically contain? This document usually includes detailed summaries of revenue, costs, and expenses over a three-month period, helping to measure financial performance. It enables cafe owners to identify trends, control costs, and make informed decisions to improve profitability.

What are important elements to focus on in this analysis? Critical aspects include accurately tracking sales, monitoring cost of goods sold, and analyzing operational expenses to identify inefficiencies and opportunities for growth. Including comparative data from previous quarters can also provide valuable insights into business performance.

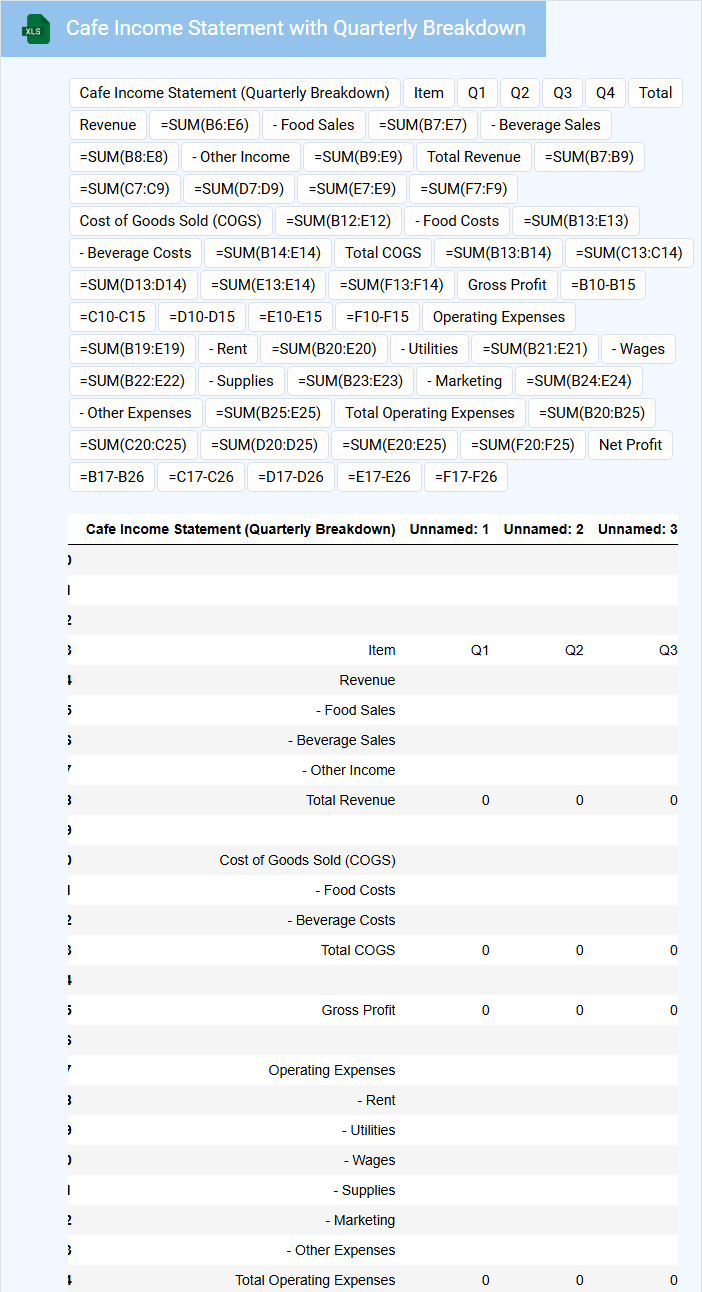

Cafe Income Statement with Quarterly Breakdown

A Cafe Income Statement with a quarterly breakdown is a financial document that summarizes the revenue, expenses, and profits of a cafe over three-month periods. It provides a clear view of the business performance trends throughout the year. This report helps owners and stakeholders make informed decisions by comparing income and costs seasonally.

Key components to include are total sales, cost of goods sold, operating expenses, and net profit for each quarter. Highlighting seasonal variations and significant expense changes is important for accurate analysis. Additionally, noting any extraordinary items or one-time expenses helps maintain clarity in financial reporting.

Ensuring the data is precise and consistently formatted across quarters improves readability and usefulness. Including a brief commentary on quarterly performance can provide valuable insights. Accurate quarterly breakdowns assist in budgeting, forecasting, and strategic planning for the cafe business.

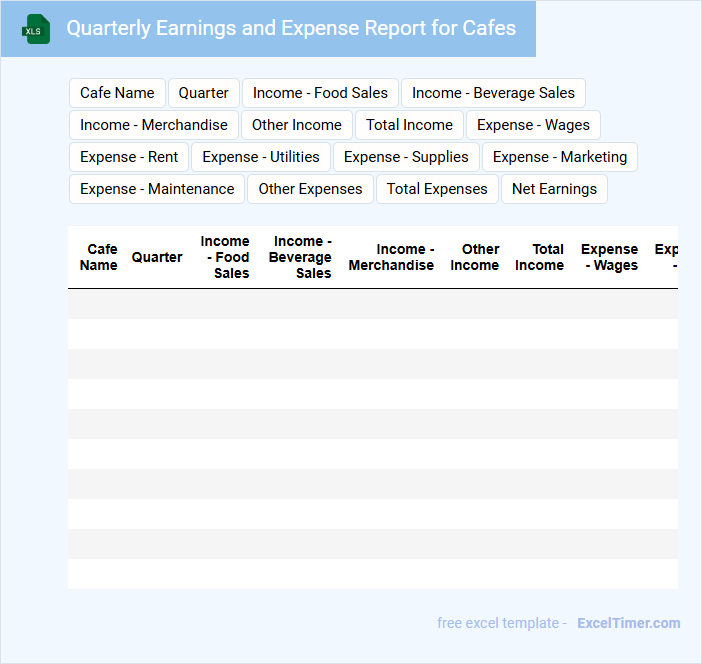

Quarterly Earnings and Expense Report for Cafes

The Quarterly Earnings and Expense Report is a comprehensive document that details the financial performance of cafes over a three-month period. It typically includes revenue, operating costs, and net profit analyses to provide insight into the business's profitability. This report is essential for tracking growth, managing expenses, and making informed financial decisions.

Cafe Business with Quarterly Profit and Loss Tracking

What information is typically included in a document for a Cafe Business with Quarterly Profit and Loss Tracking? Such a document usually contains detailed financial statements that outline revenues, costs, and expenses for each quarter. It helps in evaluating the cafe's financial performance, identifying trends, and making informed business decisions.

What important aspects should be considered when managing quarterly profit and loss for a cafe? It is crucial to accurately track all income sources such as sales from beverages and food, as well as fixed and variable expenses like rent, labor, and supplies. Regular analysis of this data aids in controlling costs, optimizing pricing, and improving overall profitability.

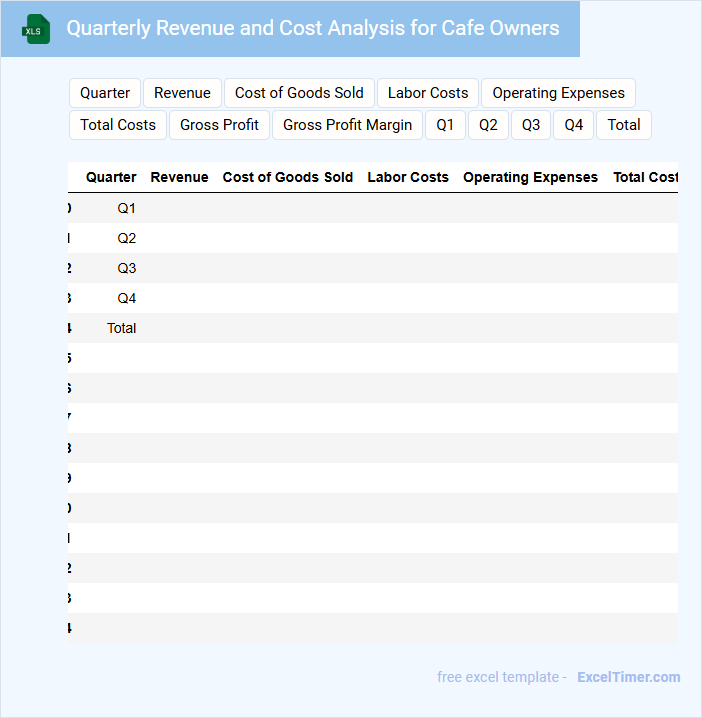

Quarterly Revenue and Cost Analysis for Cafe Owners

A Quarterly Revenue and Cost Analysis document typically contains detailed financial data outlining income and expenses over a three-month period. It helps cafe owners track profitability by comparing revenues against operational costs. Key components often include sales figures, cost of goods sold, and overhead expenses.

For optimal use, cafe owners should focus on identifying trends in high and low-performing months to adjust strategies accordingly. Highlighting variable and fixed costs separately aids in precise budgeting and cost control. Regularly updating this document fosters informed decision-making and supports sustainable business growth.

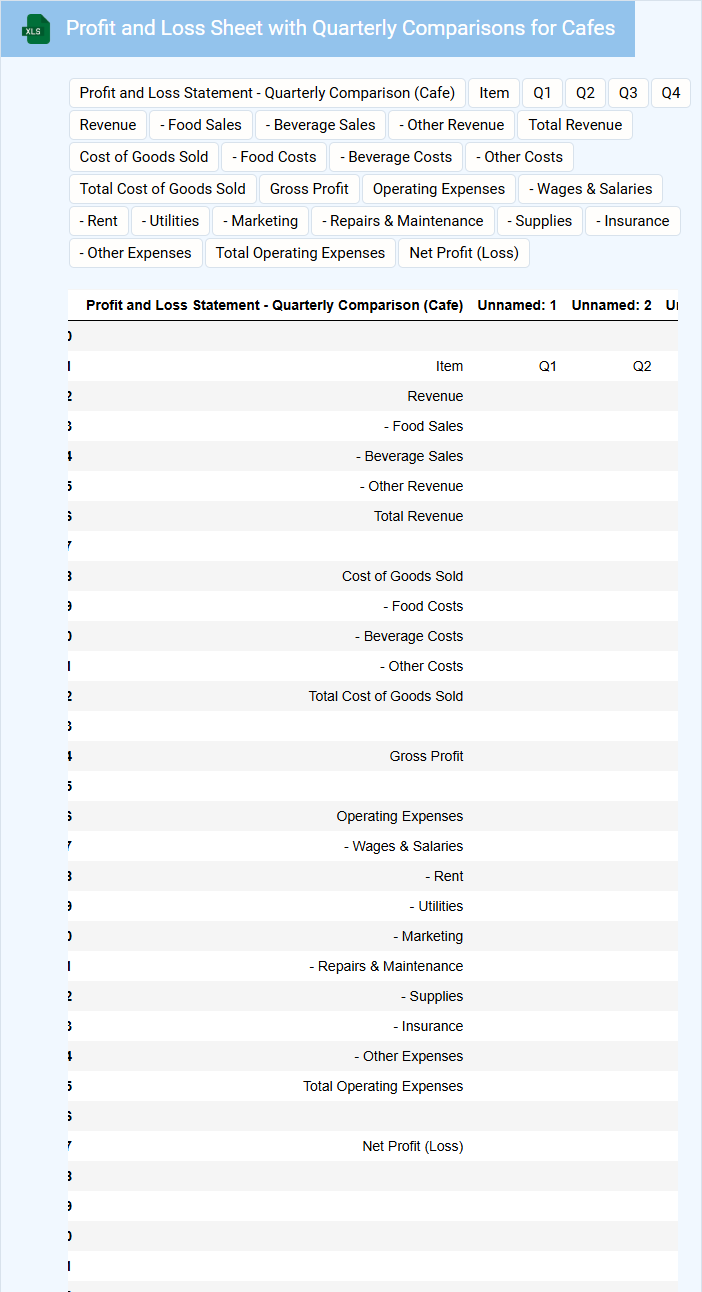

Profit and Loss Sheet with Quarterly Comparisons for Cafes

What information does a Profit and Loss Sheet with Quarterly Comparisons for Cafes usually contain?

This document typically includes detailed revenue, cost of goods sold, operating expenses, and net profit figures broken down by each quarter. It helps cafe owners analyze financial performance trends over time and identify areas for cost control and profit improvement.

What is an important aspect to focus on when reviewing this type of Profit and Loss Sheet?

It is crucial to focus on comparing gross margins and expense ratios quarter by quarter to detect seasonal fluctuations and operational inefficiencies. Consistent monitoring can guide strategic decisions such as menu adjustments, pricing strategies, and marketing efforts to boost profitability.

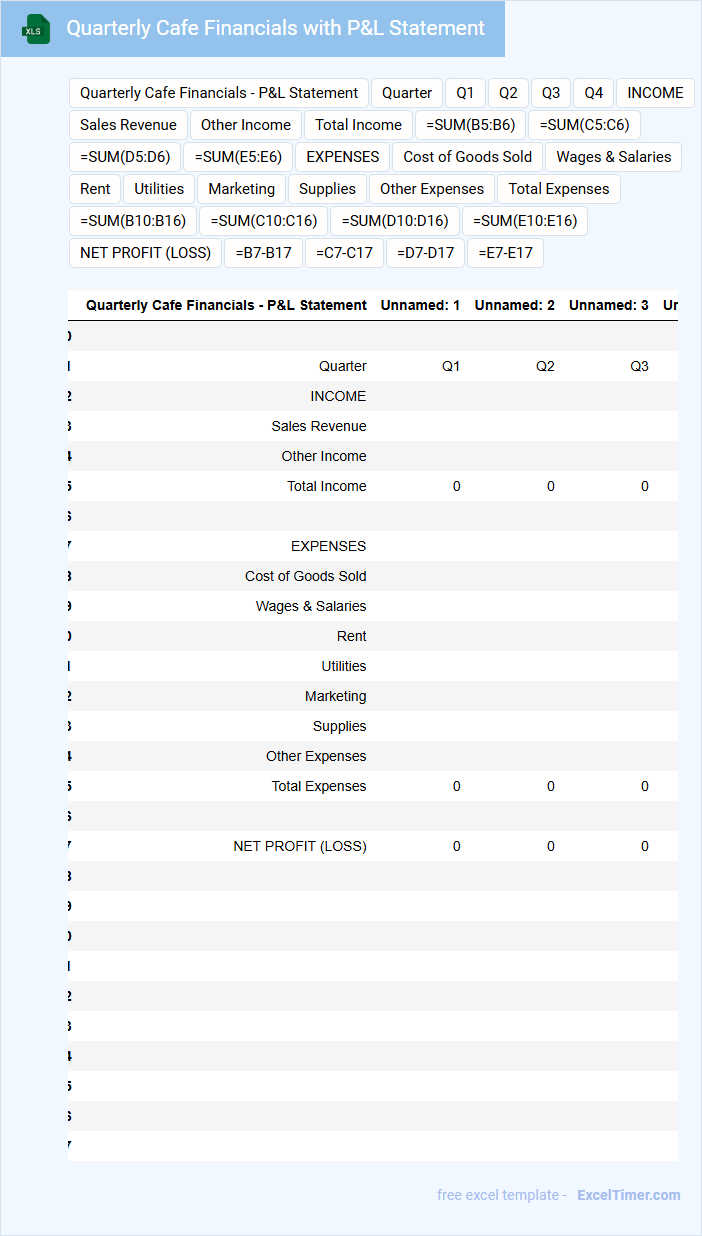

Quarterly Cafe Financials with P&L Statement

The Quarterly Cafe Financials document typically contains detailed records of income, expenses, and profits over a three-month period. It provides a clear snapshot of the cafe's financial health and operational efficiency.

Included within this report is the Profit and Loss (P&L) Statement, which summarizes revenues, costs, and net earnings to evaluate business performance. Regularly reviewing these figures helps identify trends, manage costs, and optimize profitability.

It is important to ensure accuracy in data entry and include all relevant expenses to reflect true financial standing.

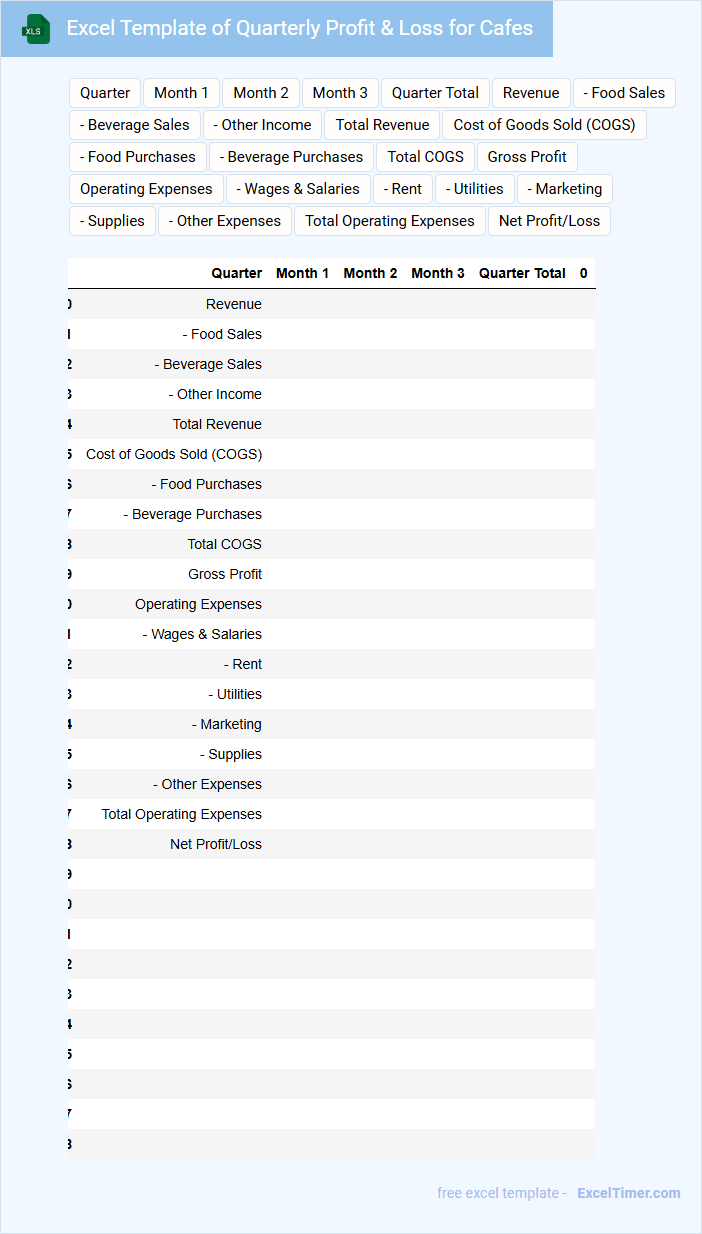

Excel Template of Quarterly Profit & Loss for Cafes

The Excel Template of Quarterly Profit & Loss for Cafes typically contains detailed financial data such as revenues, expenses, and net profit for each quarter. It helps cafe owners track and analyze their financial performance over time, making informed business decisions easier. Key components often include sales breakdown, cost of goods sold, operating expenses, and summary of profit or loss.

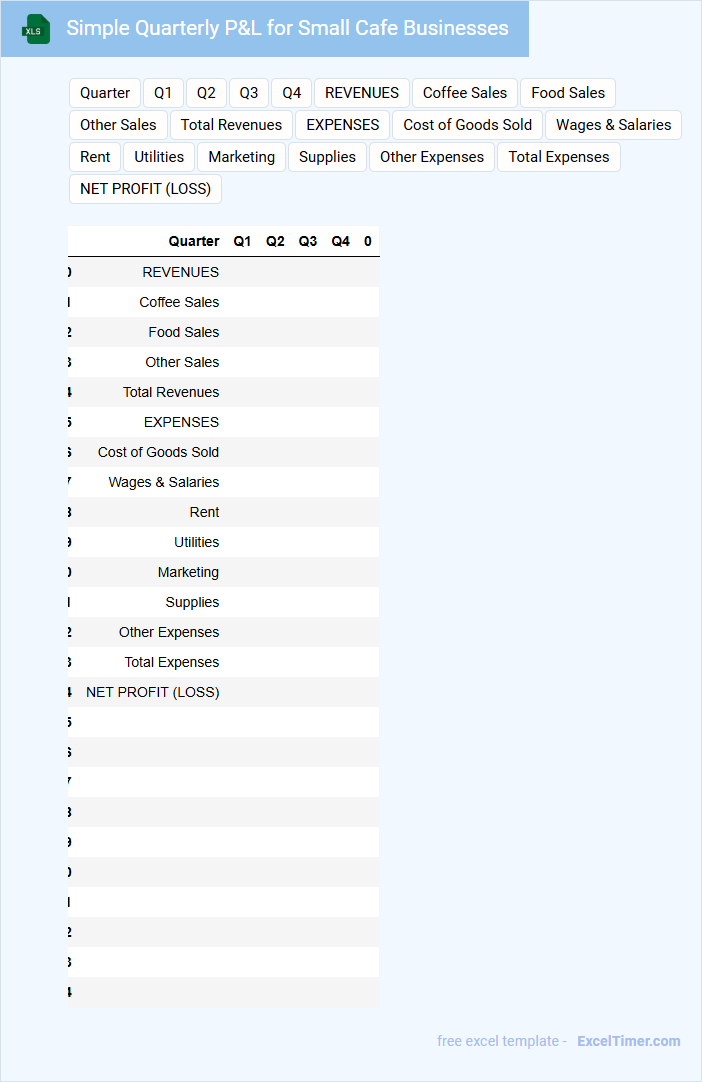

Simple Quarterly P&L for Small Cafe Businesses

The Simple Quarterly P&L document for small cafe businesses typically contains summarized financial data including total revenue, cost of goods sold, and operating expenses. It provides a clear snapshot of profitability over a three-month period.

This report often highlights key metrics such as gross profit, net profit, and major expense categories to help owners track financial health. Regular review of this document supports informed decision-making and efficient cost management.

It is important to include consistent revenue tracking and detailed expense categorization to improve accuracy and usefulness of the report.

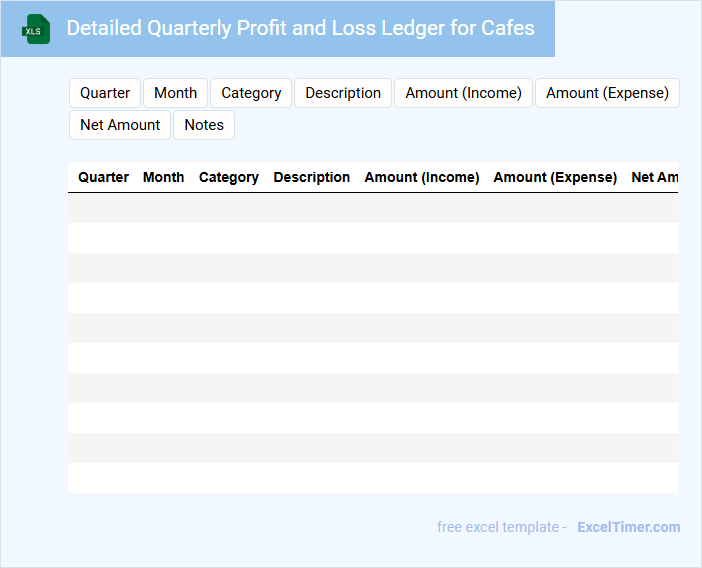

Detailed Quarterly Profit and Loss Ledger for Cafes

A Detailed Quarterly Profit and Loss Ledger for cafes is a comprehensive financial document that tracks income and expenses over a three-month period. It provides insights into revenue streams, cost of goods sold, and operating expenses, enabling effective financial management. This ledger is essential for identifying trends, controlling costs, and improving overall profitability.

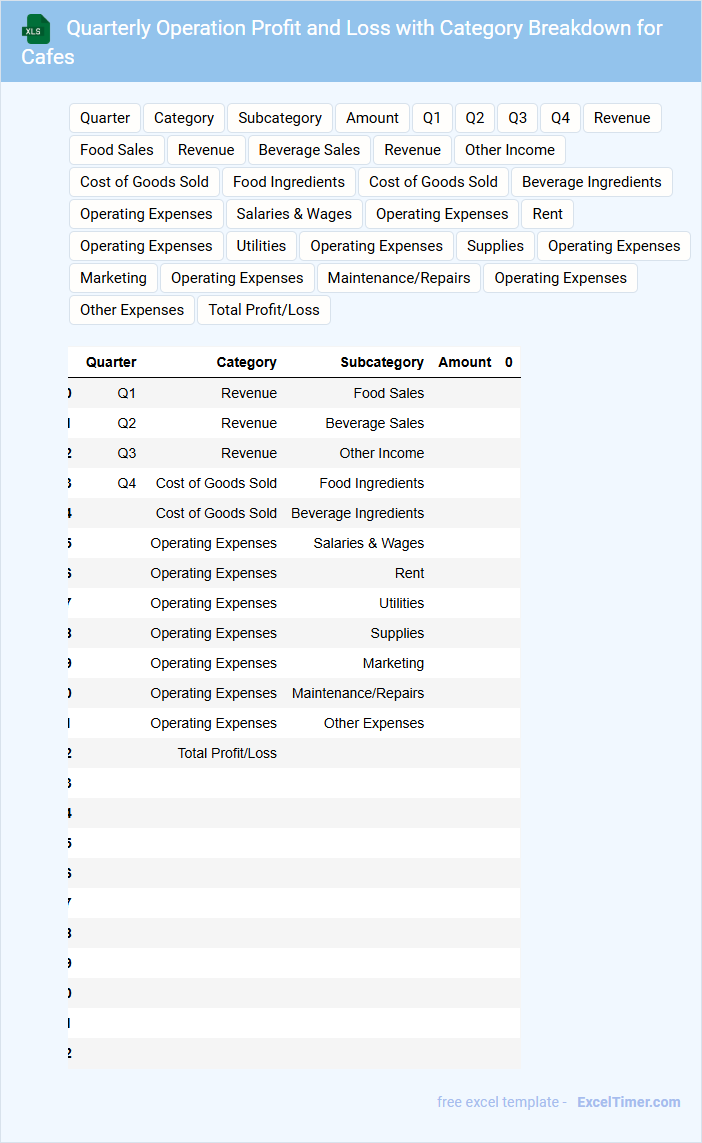

Quarterly Operation Profit and Loss with Category Breakdown for Cafes

What information does a Quarterly Operation Profit and Loss with Category Breakdown for Cafes typically contain? This document usually includes detailed financial data segmented by income and expenses over a three-month period, specifically broken down by categories such as food sales, beverage sales, labor costs, and overhead expenses. It helps cafe owners and managers analyze profitability, identify trends, and make informed operational decisions.

What is an important consideration when preparing or reviewing this document? Ensuring accurate categorization of all revenue and expense items is crucial for clear insights and effective cost control. Additionally, regularly comparing these figures to previous quarters supports strategic adjustments and business growth.

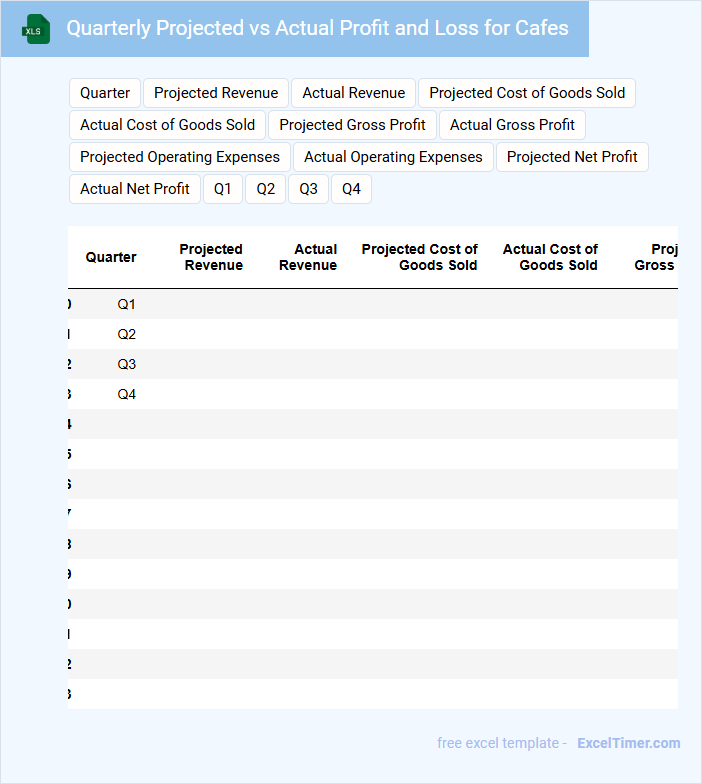

Quarterly Projected vs Actual Profit and Loss for Cafes

The Quarterly Projected vs Actual Profit and Loss document typically contains detailed financial performance data comparing estimated earnings and expenditures against the actual results for a cafe. It highlights variances in revenue streams, costs, and net profit, helping stakeholders understand the financial health of the business. This report is crucial for making informed decisions, budgeting adjustments, and improving operational efficiency.

What are the main revenue streams captured in the quarterly profit and loss statement for the cafe?

The main revenue streams in the cafe's quarterly profit and loss statement include sales from beverages, food items, and merchandise. Additional income sources often comprise catering services and event hosting fees. These streams collectively drive the cafe's overall revenue performance for the quarter.

How are major expenses such as cost of goods sold, labor, and rent categorized and tracked in the document?

In the Quarterly Profit and Loss document for Cafes, major expenses like cost of goods sold, labor, and rent are categorized under operating costs to provide clear financial insights. Your document tracks these expenses by listing them separately to monitor their impact on overall profitability each quarter. Detailed expense categorization ensures accurate budget management and aids in strategic decision-making.

Does the quarterly profit and loss capture seasonal trends or fluctuations in sales and expenses?

The quarterly profit and loss report for cafes reveals seasonal trends by highlighting fluctuations in sales and expenses across different quarters. It captures peak periods, such as increased sales during holidays, and identifies higher costs linked to seasonal menu offerings or staffing changes. This data enables cafes to optimize financial planning and resource allocation according to seasonal demands.

How is net profit (or loss) calculated from gross profit and total operating expenses in the Excel document?

Net profit (or loss) is calculated by subtracting total operating expenses from gross profit. In the Excel document, the formula used is: Net Profit = Gross Profit - Total Operating Expenses. This calculation reflects the remaining earnings after all operating costs are deducted from revenue.

Are actionable insights or key performance indicators highlighted to guide cafe management decisions based on the P&L data?

The Excel document highlights key performance indicators such as gross profit margin, operating expenses ratio, and net profit per quarter to guide cafe management decisions. Actionable insights include trends in sales growth, cost control effectiveness, and seasonal expense fluctuations. These metrics enable targeted strategies to optimize profitability and operational efficiency.