The Quarterly Client Billing Excel Template for Legal Firms streamlines invoice preparation by organizing billable hours, expenses, and rates efficiently within a single spreadsheet. It ensures accuracy in financial records and simplifies tracking client payments over each quarter. Customizable features allow legal professionals to adapt the template to specific case details and billing preferences, enhancing overall productivity.

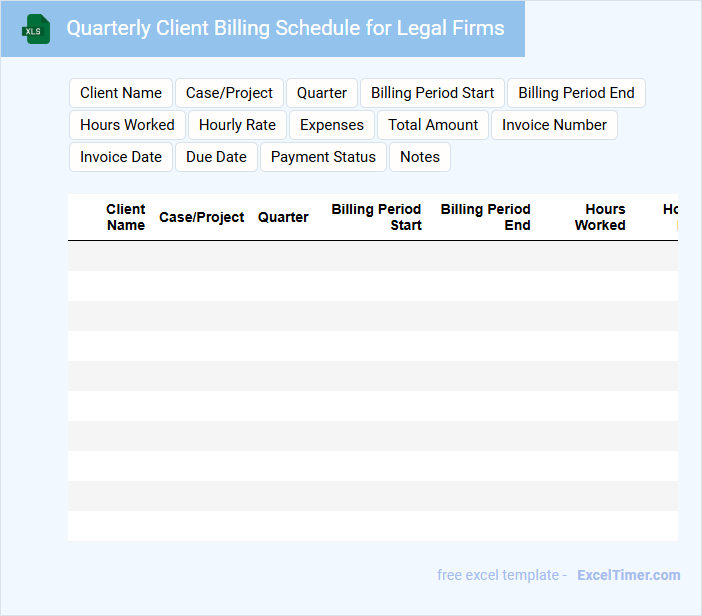

Quarterly Client Billing Schedule for Legal Firms

A Quarterly Client Billing Schedule for legal firms typically outlines the timing and process for invoicing clients every three months. It includes detailed billing cycles, payment deadlines, and the allocation of legal fees and expenses. This document ensures consistent cash flow management and clear communication between the firm and its clients.

Client Invoice Tracker with Quarterly Summaries

A Client Invoice Tracker is a vital document that records and organizes all client invoices to monitor payments efficiently. It typically includes client details, invoice numbers, dates, amounts, and payment statuses. To enhance financial oversight, integrating Quarterly Summaries provides a clear snapshot of outstanding and received payments over specific periods.

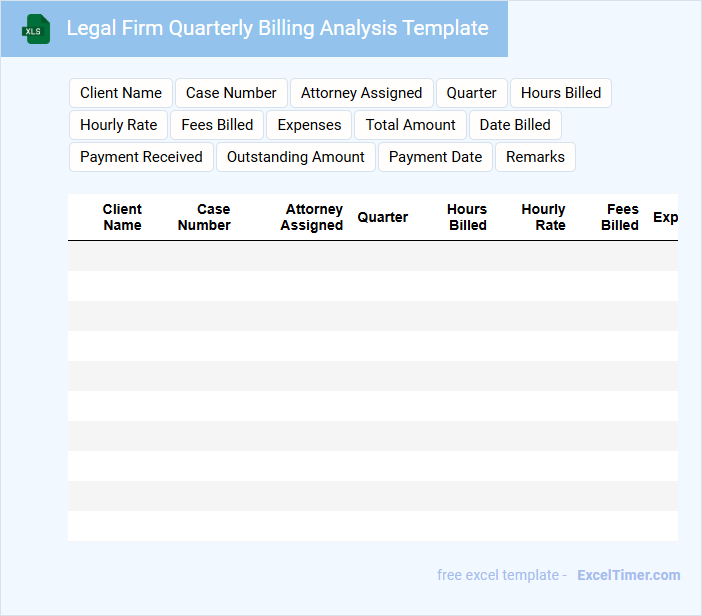

Legal Firm Quarterly Billing Analysis Template

A Legal Firm Quarterly Billing Analysis Template is typically used to track and evaluate the billing performance of a law firm over a three-month period. It contains detailed records of invoices, hours billed by attorneys, and revenue generated. This document helps identify trends, outstanding payments, and areas for financial improvement.

For optimal use, ensure the template includes clear client names, billing rates, and payment statuses. Regular updates and accuracy in data entry are important to maintain reliable financial insights. Additionally, incorporating visual charts can enhance the understanding of billing patterns and profitability.

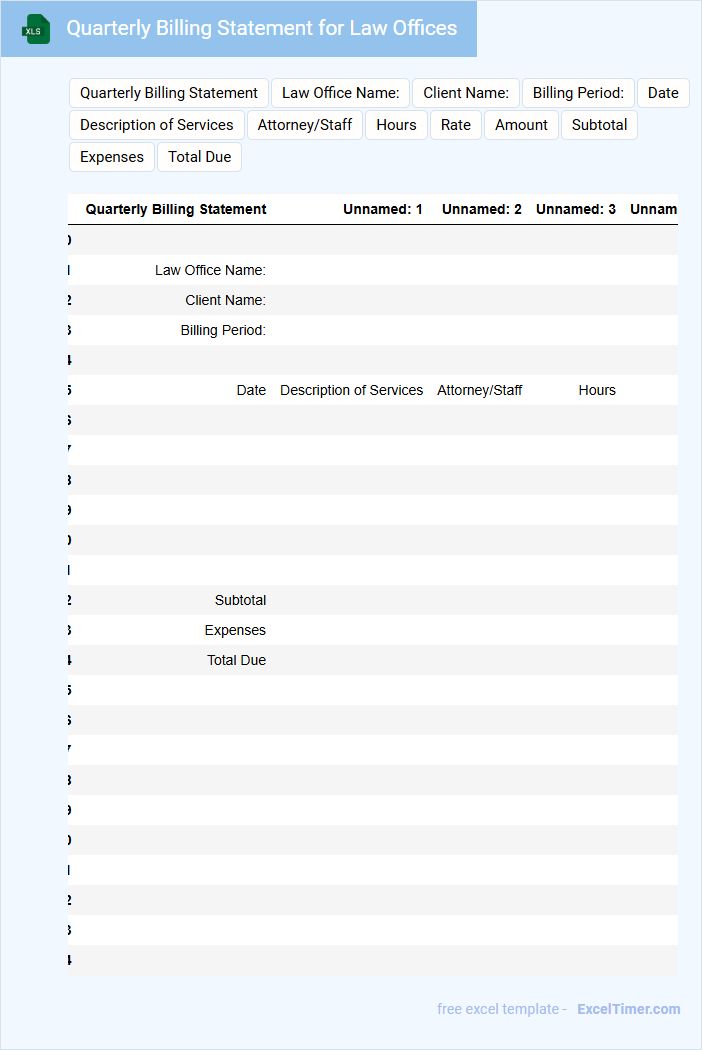

Quarterly Billing Statement for Law Offices

A Quarterly Billing Statement for Law Offices typically contains detailed records of billed services provided to clients over a three-month period. It serves as an official document for tracking payment status and managing financial records.

- Include a clear breakdown of fees by case or service type.

- Highlight any outstanding balances or past due amounts.

- Provide client contact information and payment instructions.

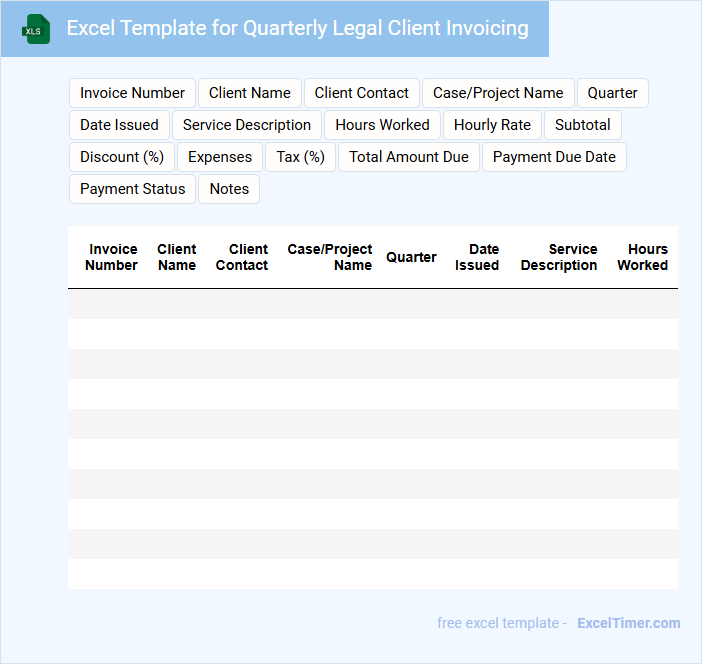

Excel Template for Quarterly Legal Client Invoicing

This document is typically an Excel template designed to streamline and organize quarterly legal client invoicing.

- Client Details: It requires accurate input of client names and billing addresses.

- Invoice Breakdown: It provides sections for detailed listing of services, hours, and rates.

- Payment Tracking: It includes fields to record payment status, due dates, and amounts received.

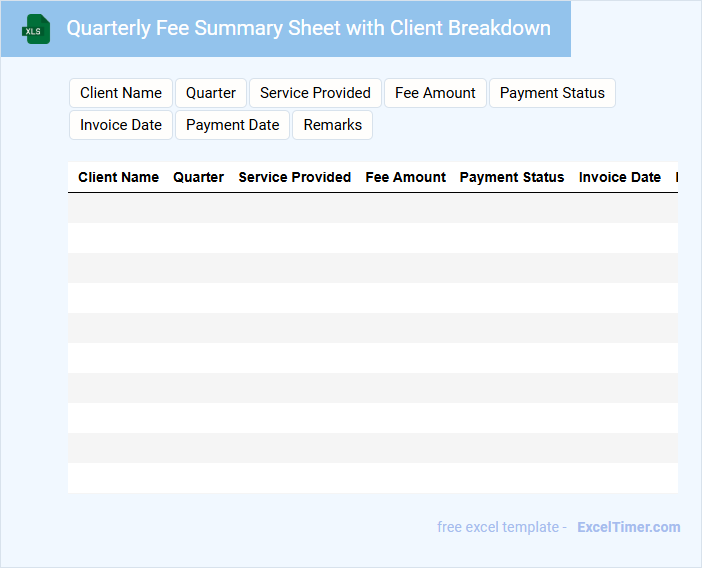

Quarterly Fee Summary Sheet with Client Breakdown

The Quarterly Fee Summary Sheet provides a structured overview of fees charged over a three-month period, offering clear financial insights. It typically includes detailed transactions, fee calculations, and payment statuses.

Client Breakdown highlights individual client contributions and outstanding balances, ensuring transparency and accountability. This helps in monitoring client-specific revenue and managing accounts receivable effectively.

Important considerations include accuracy in fee calculations, timely updates, and clear categorization of clients for better financial analysis.

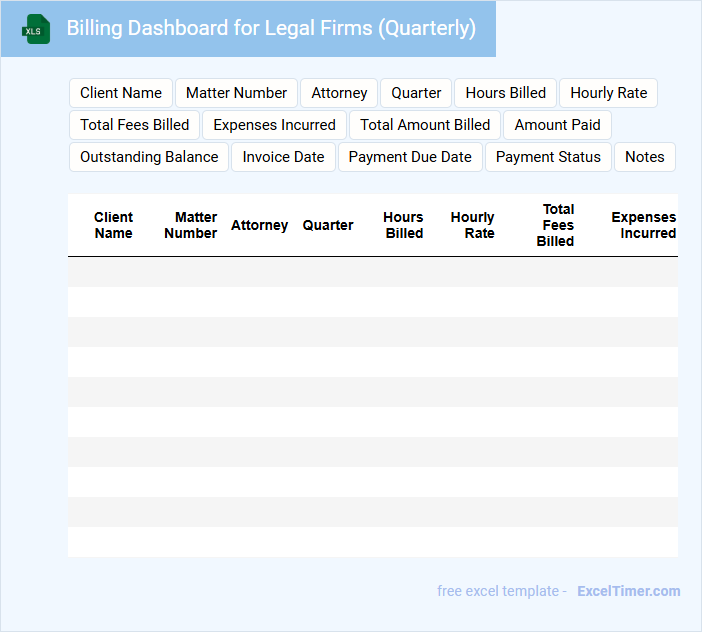

Billing Dashboard for Legal Firms (Quarterly)

A Billing Dashboard for Legal Firms (Quarterly) typically contains financial summaries and performance metrics to track legal billing activities over the quarter.

- Invoice Tracking: Detailed records of sent, paid, and pending invoices to monitor cash flow accurately.

- Client Billing Analysis: Breakdown of billable hours and expenses per client to ensure transparency and profitability.

- Revenue Trends: Visual charts showing quarterly revenue trends to identify growth opportunities and potential issues.

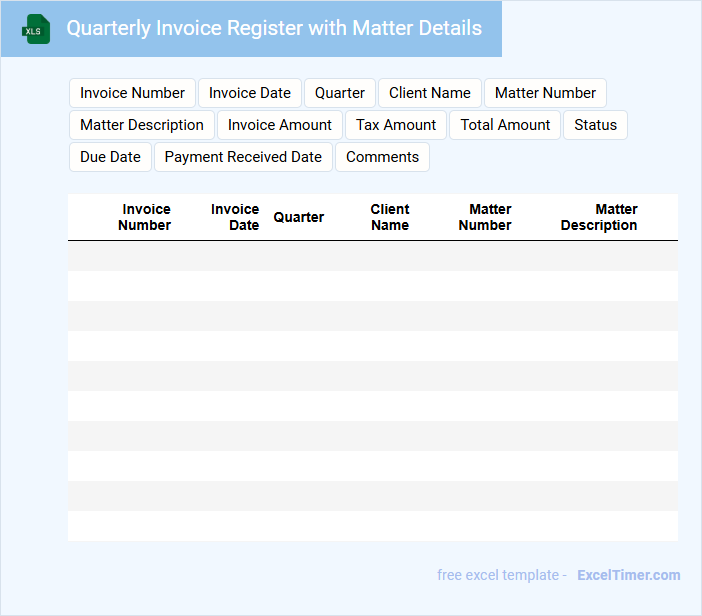

Quarterly Invoice Register with Matter Details

Quarterly Invoice Register with Matter Details is a financial document that consolidates all invoices issued within a quarter, categorized by specific matters or projects. It provides a comprehensive overview of billing activities, helping track revenues and outstanding payments efficiently. Ensuring accuracy in matter details is essential for precise financial reporting and client transparency. This document typically includes invoice numbers, dates, client names, matter descriptions, amounts, and payment statuses. Properly maintaining this register supports effective audit trails and facilitates seamless communication between accounting and legal teams. Regular reconciliation and verifying matter codes are crucial to avoid discrepancies and improve data integrity.

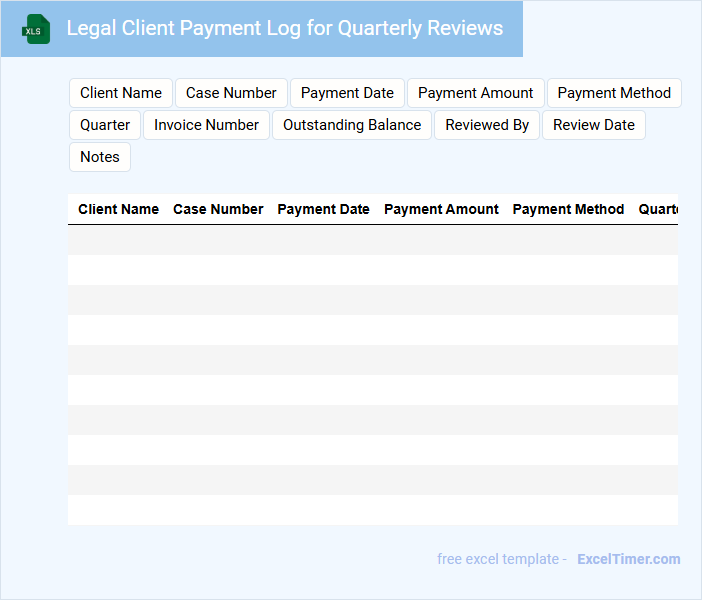

Legal Client Payment Log for Quarterly Reviews

A Legal Client Payment Log for Quarterly Reviews typically contains a detailed record of all client payments received within the quarter, including dates, amounts, and payment methods. It serves as a crucial document for tracking financial transactions related to legal services and ensuring accurate billing. Maintaining this log helps streamline the review process and supports financial accountability and client transparency.

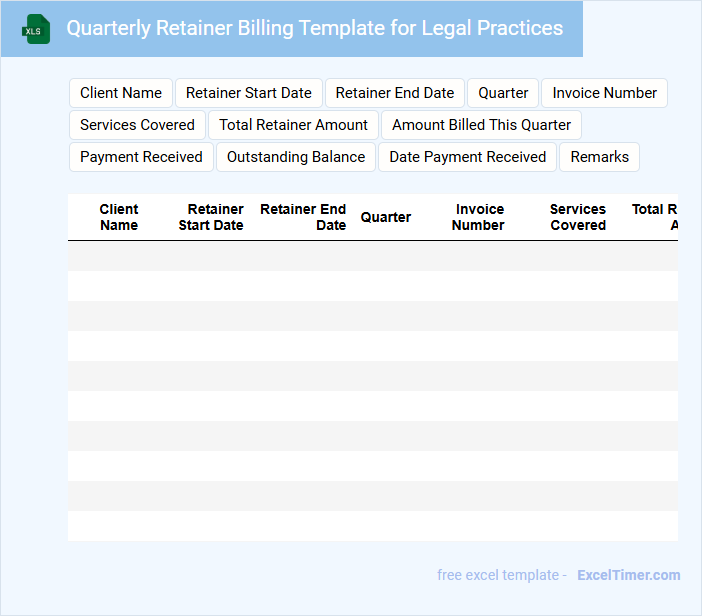

Quarterly Retainer Billing Template for Legal Practices

A Quarterly Retainer Billing Template for Legal Practices typically contains detailed billing information for legal services rendered within a three-month period, ensuring clear communication between attorneys and clients.

- Comprehensive Service Breakdown: Itemizes legal tasks and hours worked to maintain transparency.

- Clear Payment Terms: Specifies retainer fees, due dates, and acceptable payment methods.

- Client and Attorney Information: Includes contact details and engagement specifics for accurate record-keeping.

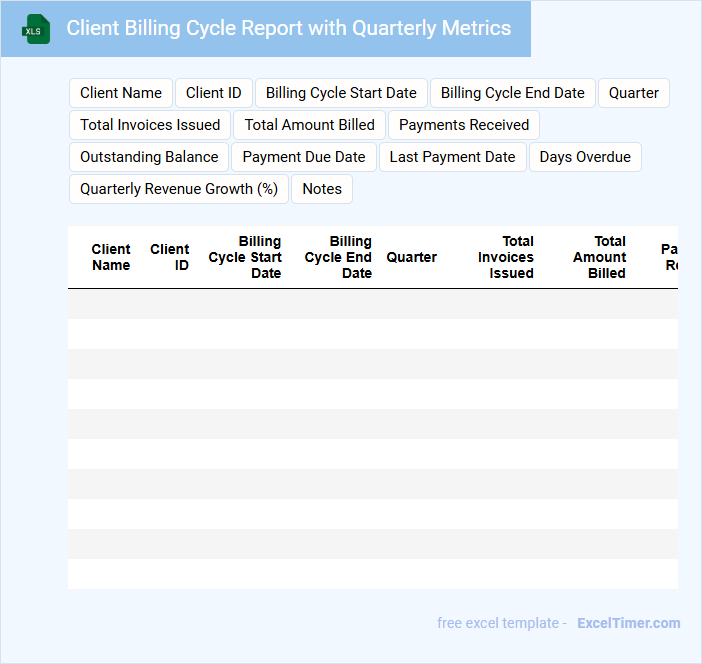

Client Billing Cycle Report with Quarterly Metrics

What information is typically included in a Client Billing Cycle Report with Quarterly Metrics? This document usually contains detailed records of client invoices, payment statuses, and billing timelines for the quarter. It also highlights key financial metrics such as revenue generated, outstanding balances, and trends in client payment behavior to aid in financial analysis and forecasting.

What is an important consideration when preparing this report? Ensuring accuracy and completeness of billing data is crucial, as errors can affect financial reporting and client relationships. Additionally, providing clear visualizations of quarterly metrics helps stakeholders quickly understand performance and make informed decisions.

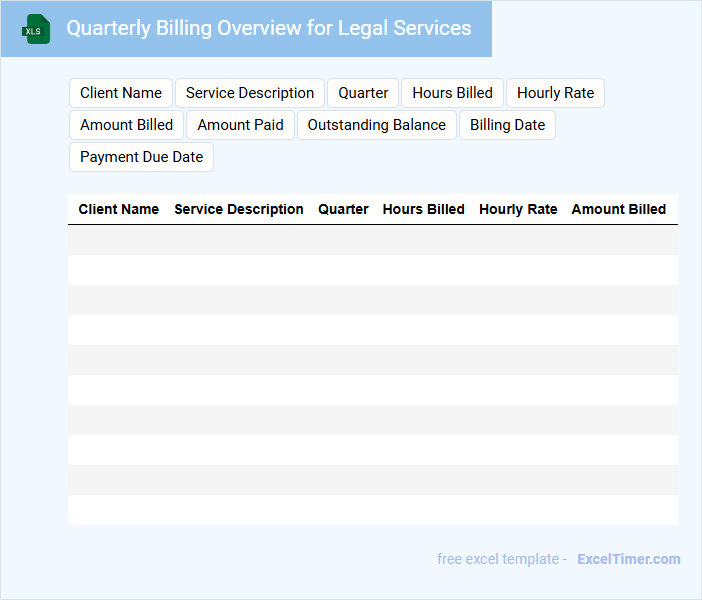

Quarterly Billing Overview for Legal Services

A Quarterly Billing Overview for Legal Services typically contains detailed summaries of invoices, payment statuses, and service descriptions rendered during the billing period. It highlights the total costs incurred and any adjustments or discounts applied. This document ensures transparency and aids in financial reconciliation between the client and the legal service provider.

Important elements to include are clear itemization of legal services, accurate time tracking, and a concise summary of outstanding balances. Additionally, incorporating graphs or charts can enhance clarity for better client understanding. Timely delivery of this overview supports effective budget planning and fosters trust in professional relationships.

Law Firm Quarterly Revenue Tracking Sheet

This document typically contains detailed financial data to monitor a law firm's revenue performance on a quarterly basis.

- Accurate revenue entries: Ensure all sources of income are correctly recorded for precise tracking.

- Quarterly comparison: Analyze revenue trends by comparing results across different quarters.

- Expense and profit insights: Include related costs to evaluate net profitability effectively.

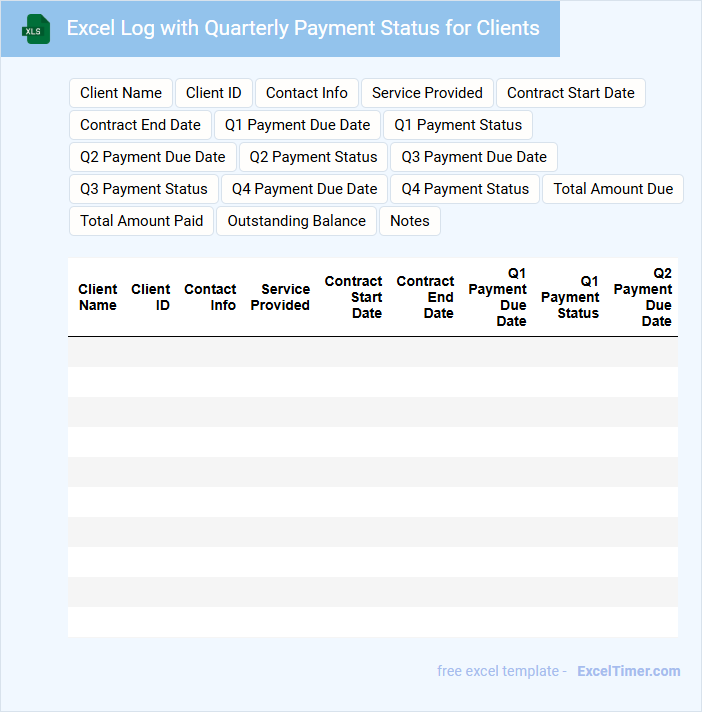

Excel Log with Quarterly Payment Status for Clients

This document typically contains a detailed record of client payments tracked on a quarterly basis to ensure timely financial management.

- Client Information: Each entry should include comprehensive client details for easy identification.

- Payment Status: The log must clearly indicate payment completion, pending amounts, or overdue statuses.

- Quarterly Updates: Regularly updating the log every quarter is essential for accurate financial tracking and reporting.

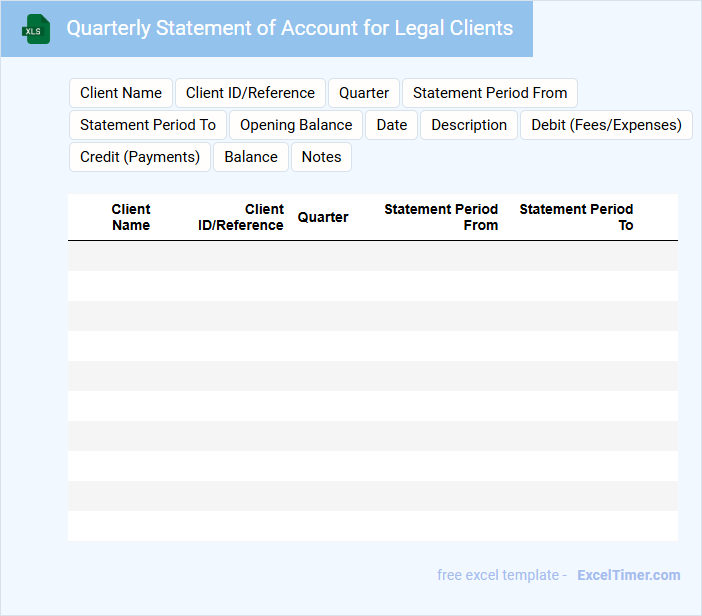

Quarterly Statement of Account for Legal Clients

The Quarterly Statement of Account for legal clients typically contains a detailed summary of all financial transactions conducted within the quarter, including invoices, payments, and outstanding balances. It provides transparency and clarity on billing activities, helping clients track their legal expenses efficiently. Ensuring accuracy and clear breakdowns of charges are crucial for fostering trust and preventing disputes.

What are the essential data fields required in a quarterly client billing Excel sheet for legal firms?

Essential data fields in a quarterly client billing Excel sheet for legal firms include Client Name, Case Number, Billing Period, Service Description, Hours Worked, Hourly Rate, Total Amount Due, Payment Status, and Invoice Date. Including Client Contact Information and Payment Terms ensures clear communication and proper tracking. Your sheet should also feature a column for Notes to capture any special instructions or adjustments.

How do you automate fee calculation and tax application for multiple cases in a quarterly billing cycle?

Automate fee calculation and tax application in your quarterly client billing by using Excel formulas combined with VBA macros to dynamically apply rates per case and tax rules. Implement case-specific fee schedules and tax brackets within separate worksheets to ensure accurate aggregation through pivot tables. This setup streamlines billing across multiple cases, minimizing errors and saving time in your legal firm's accounting process.

What method can you use in Excel to track unpaid balances and overdue invoices for each client?

You can use Excel's PivotTables and conditional formatting to effectively track unpaid balances and overdue invoices for each client. By organizing your Quarterly Client Billing data with filters for payment status and due dates, you can quickly identify outstanding amounts and prioritize follow-ups. Integrating formulas like SUMIF and DATE functions enhances accuracy in monitoring overdue payments.

Which formulas or functions are best for summarizing billed hours and expenses by client and quarter?

To summarize billed hours and expenses by client and quarter in your Excel document, use the SUMIFS function to aggregate data based on client names and date ranges corresponding to each quarter. Pivot Tables offer a robust solution for dynamic grouping and summarizing of quarterly billing data, allowing easy analysis of hours and expenses per client. Implementing these tools will enhance the accuracy and efficiency of your quarterly client billing reports for legal firms.

How can you build a dynamic pivot table to analyze revenues by client, service type, and quarter?

Create a dynamic pivot table by selecting your billing data range and inserting a PivotTable from the Insert tab. Drag Client, Service Type, and Quarter fields into Rows or Columns to organize data, and place Revenue in the Values area to calculate totals. Use filters and slicers to interactively analyze quarterly revenues and identify top-performing clients and services.