The Quarterly Tax Preparation Excel Template for Self-Employed simplifies tracking income, expenses, and estimated tax payments, ensuring accurate and timely filings. This customizable tool helps self-employed individuals organize financial data, calculate quarterly tax obligations, and avoid penalties for underpayment. Efficient use of this template enhances financial planning and supports compliance with tax deadlines.

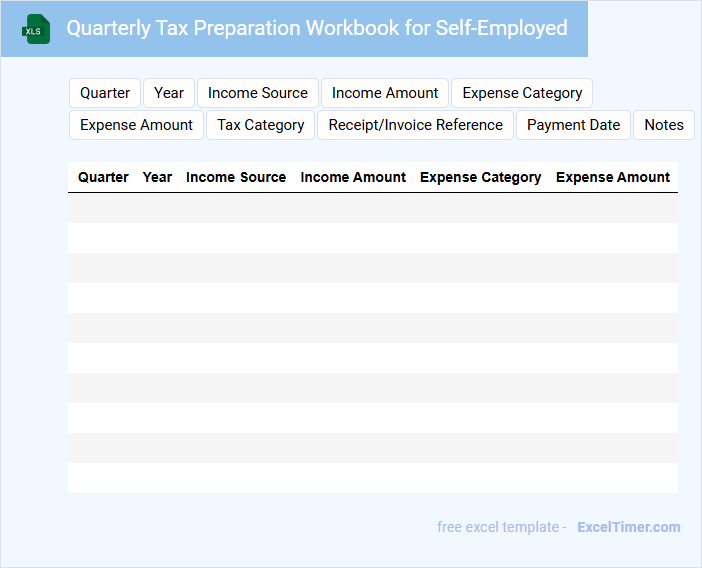

Quarterly Tax Preparation Workbook for Self-Employed

A Quarterly Tax Preparation Workbook for self-employed individuals is a structured document designed to organize and track income, expenses, and tax obligations every quarter. It typically contains sections for recording earnings, deductible expenses, estimated tax payments, and important tax deadlines. This workbook helps ensure accurate record-keeping and timely tax submissions to avoid penalties.

Excel Sheet for Quarterly Tax Report for Freelancers

An Excel Sheet for Quarterly Tax Report for Freelancers typically contains detailed income and expense records, along with tax calculations. It helps freelancers accurately track their financial activities and prepare taxes timely.

- Include categorized income sources and deductible expenses for clear financial overview.

- Incorporate formulas to automatically calculate taxes owed and estimated payments.

- Maintain separate sections for each fiscal quarter to organize data efficiently.

Self-Employed Quarterly Tax Filing Tracker with Deductions

This document is typically used by self-employed individuals to track their quarterly tax payments and relevant deductions systematically. It helps in organizing financial information to ensure accurate tax filing and maximize deductions.

- Include detailed income records and payment dates for each quarter.

- Log all deductible business expenses to reduce taxable income.

- Regularly update the tracker to avoid missed deadlines and penalties.

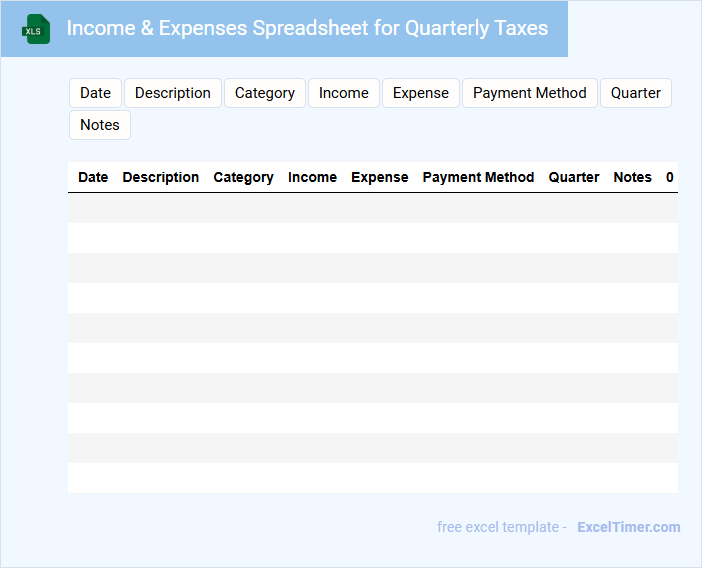

Income & Expenses Spreadsheet for Quarterly Taxes

What information is typically included in an Income & Expenses Spreadsheet for Quarterly Taxes? This document usually contains detailed records of all income received and expenses incurred within a fiscal quarter, categorized by type and date. It helps in accurately calculating taxable income and preparing tax payments on time.

Why is it important to maintain this spreadsheet regularly? Consistently updating the spreadsheet ensures accurate financial tracking and prevents errors or missed deductions during tax filing. Additionally, including clear descriptions and receipts for each entry enhances the credibility and audit-readiness of the records.

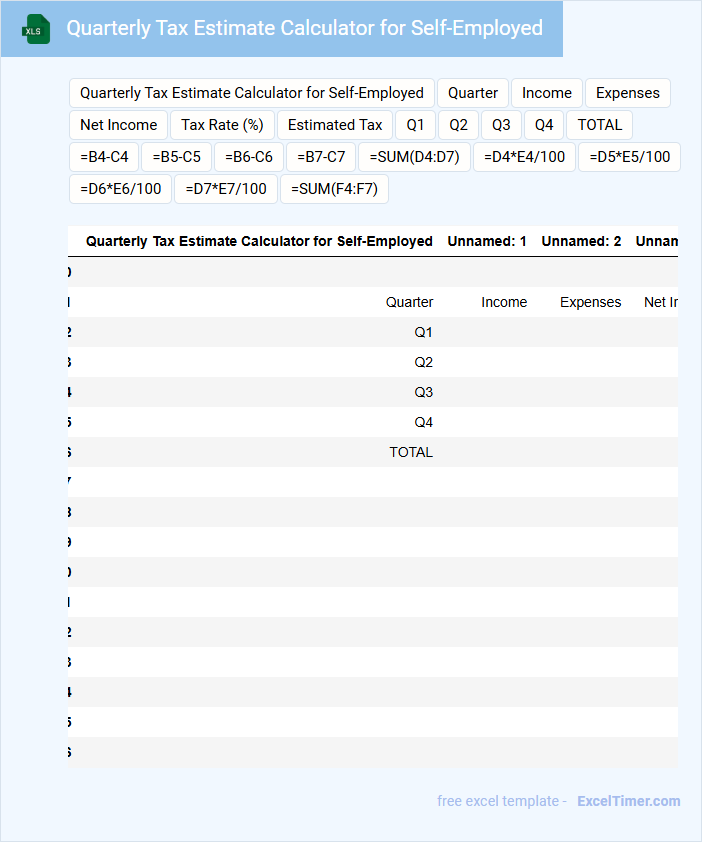

Quarterly Tax Estimate Calculator for Self-Employed

What information does a Quarterly Tax Estimate Calculator for Self-Employed typically contain? These documents usually include fields for entering estimated income, business expenses, and tax deductions to provide an accurate tax liability estimate. They help self-employed individuals plan their tax payments throughout the year to avoid penalties and manage cash flow effectively.

What important details should be considered when using this calculator? It is essential to input accurate and up-to-date financial data, including adjusted gross income and applicable tax credits. Additionally, regularly updating your estimates each quarter ensures compliance with tax laws and prevents underpayment.

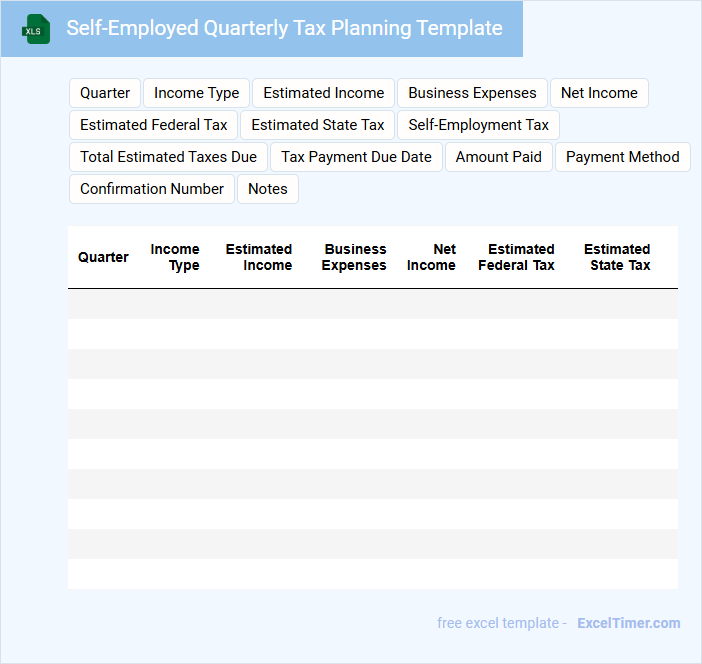

Self-Employed Quarterly Tax Planning Template

The Self-Employed Quarterly Tax Planning Template is a crucial document designed to help freelancers and independent contractors organize their tax obligations systematically. It typically includes sections for tracking income, expenses, estimated tax payments, and deadlines. Utilizing this template ensures timely and accurate tax filing, minimizing the risk of penalties.

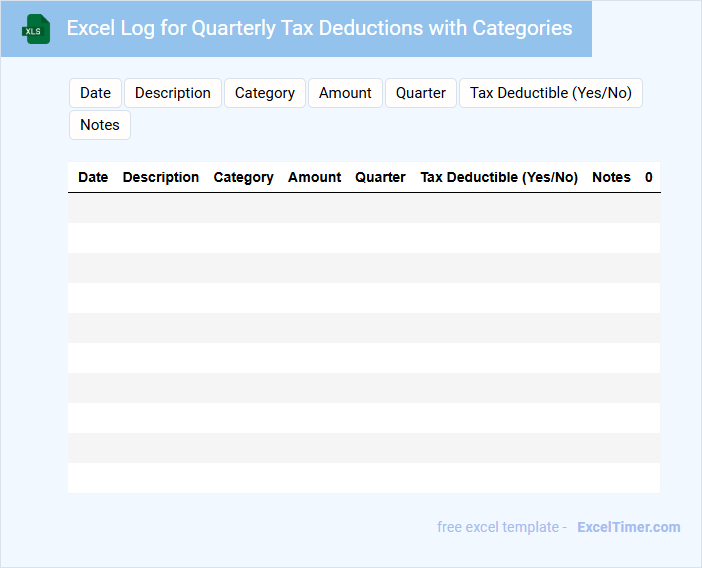

Excel Log for Quarterly Tax Deductions with Categories

An Excel Log for Quarterly Tax Deductions is typically a structured spreadsheet used to track and categorize various tax-related expenses throughout the quarter. It usually contains columns for dates, deduction categories, amounts, and descriptions, allowing for organized record-keeping. This document helps ensure accurate tax reporting and simplifies preparation for quarterly tax filings.

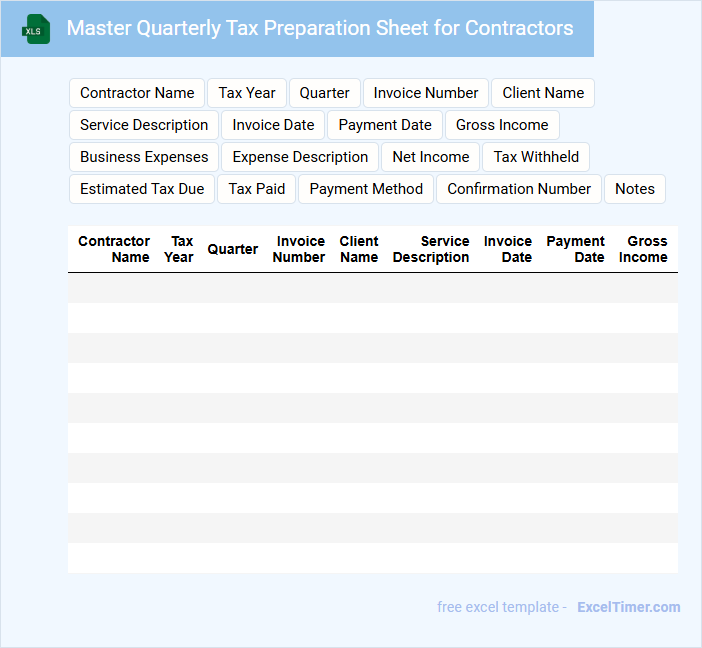

Master Quarterly Tax Preparation Sheet for Contractors

What information is typically included in a Master Quarterly Tax Preparation Sheet for Contractors? This document usually contains detailed records of all income, expenses, and tax deductions relevant to the contractor's business activities during the quarter. It helps ensure accurate calculation of estimated quarterly taxes and facilitates organized financial reporting to tax authorities.

Why is maintaining an updated Master Quarterly Tax Preparation Sheet important for contractors? Keeping this sheet current allows contractors to avoid penalties by making timely tax payments and provides a clear overview of their financial position. Additionally, it simplifies year-end tax filing and supports better financial planning and budgeting throughout the year.

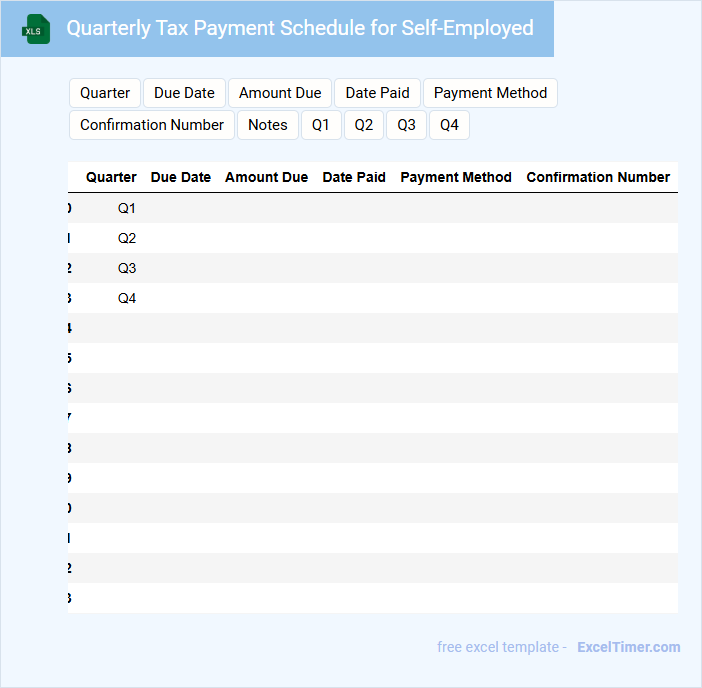

Quarterly Tax Payment Schedule for Self-Employed

The Quarterly Tax Payment Schedule for self-employed individuals outlines the deadlines and amounts due for estimated tax payments throughout the year. This document typically contains important dates, payment instructions, and calculation methods to help manage tax obligations efficiently. Keeping track of this schedule ensures timely payments and helps avoid penalties or interest charges.

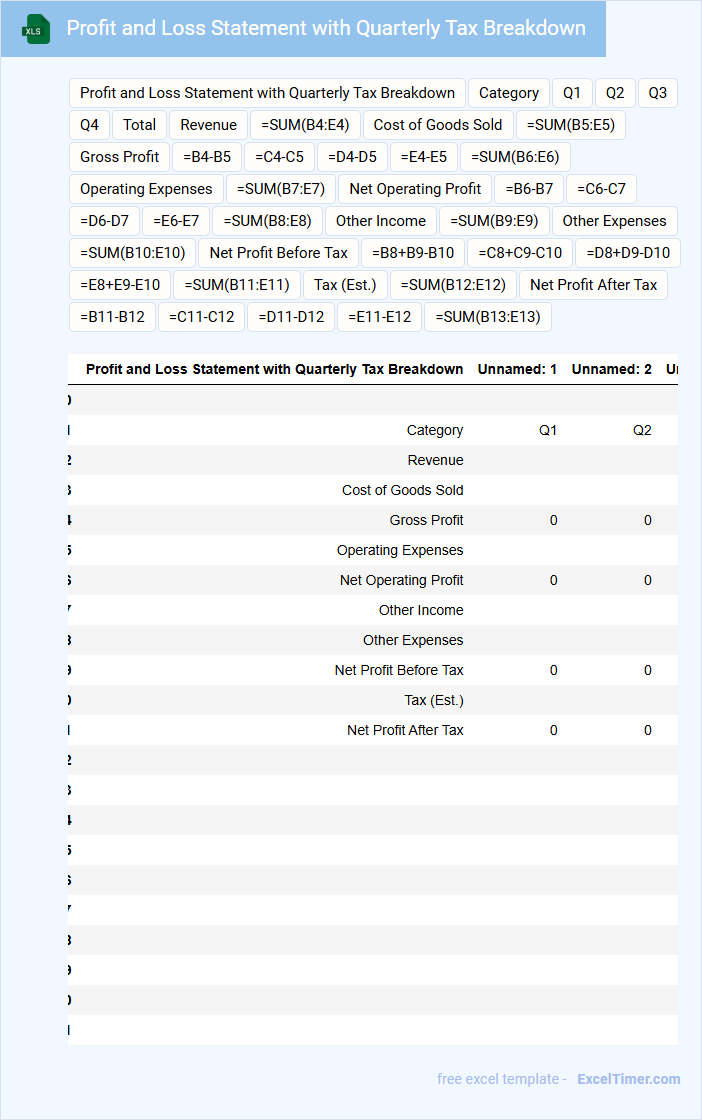

Profit and Loss Statement with Quarterly Tax Breakdown

A Profit and Loss Statement with Quarterly Tax Breakdown provides a detailed overview of a company's revenues, expenses, and net profit over a fiscal period, typically segmented by quarters. This document highlights the business's profitability while giving insights into tax obligations and payments made each quarter. Ensuring accuracy in reported figures and maintaining up-to-date tax records are crucial for financial transparency and compliance.

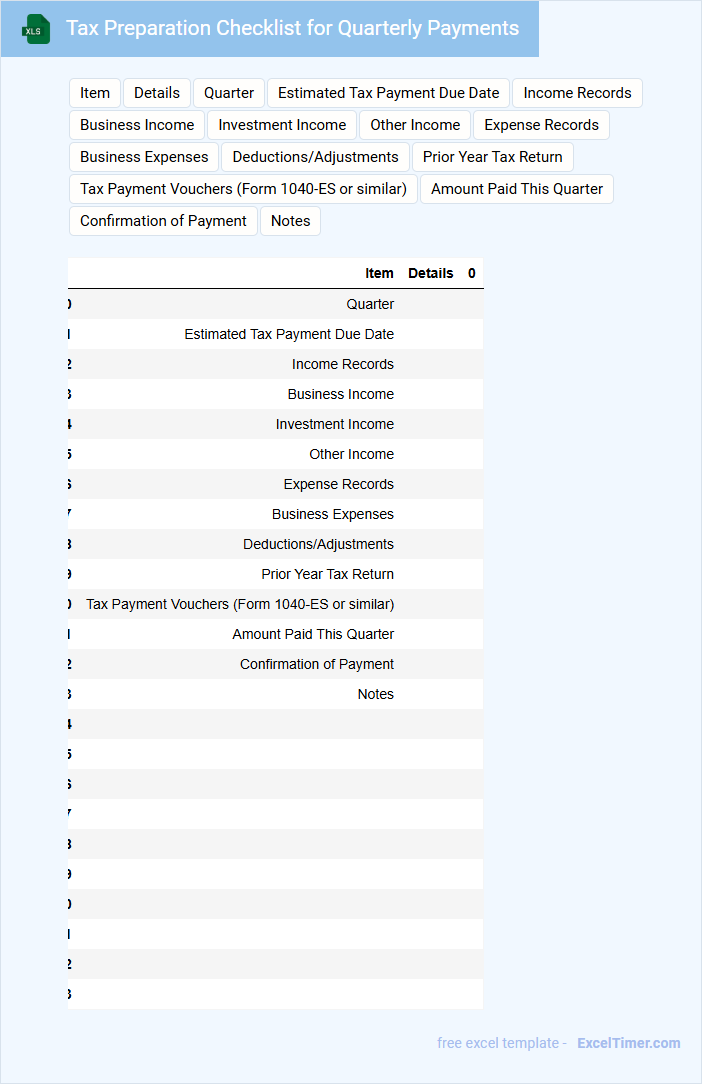

Tax Preparation Checklist for Quarterly Payments

A Tax Preparation Checklist for quarterly payments typically includes essential documents like income records, expense receipts, and estimated tax payment vouchers. These items help ensure accuracy in calculating quarterly tax obligations and prevent underpayment penalties.

Important considerations include organizing financial statements and tracking deadlines for each quarterly payment. Keeping accurate records throughout the year simplifies the filing process and supports compliance with tax regulations.

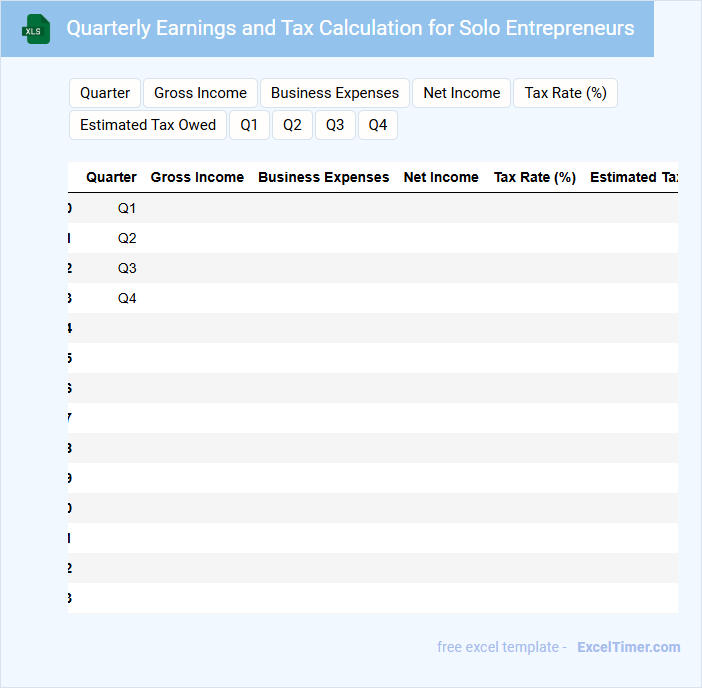

Quarterly Earnings and Tax Calculation for Solo Entrepreneurs

What information is typically included in a Quarterly Earnings and Tax Calculation document for solo entrepreneurs? This document usually contains detailed records of income, expenses, and net earnings for a specific quarter. It also includes estimated tax obligations, helping solo entrepreneurs track their financial performance and prepare for tax payments efficiently.

Simple Quarterly Tax Tracking Template with Auto Calculations

What information does a Simple Quarterly Tax Tracking Template with Auto Calculations typically contain?

This type of document usually includes sections for income, expenses, tax rates, and calculated tax liabilities. It is designed to automatically update totals and generate accurate tax amounts based on entered data.

Important elements to consider when using this template are ensuring accurate data entry for all financial transactions and regularly verifying the tax calculation formulas. Keeping the template updated with current tax rates is essential for precise tracking and reporting.

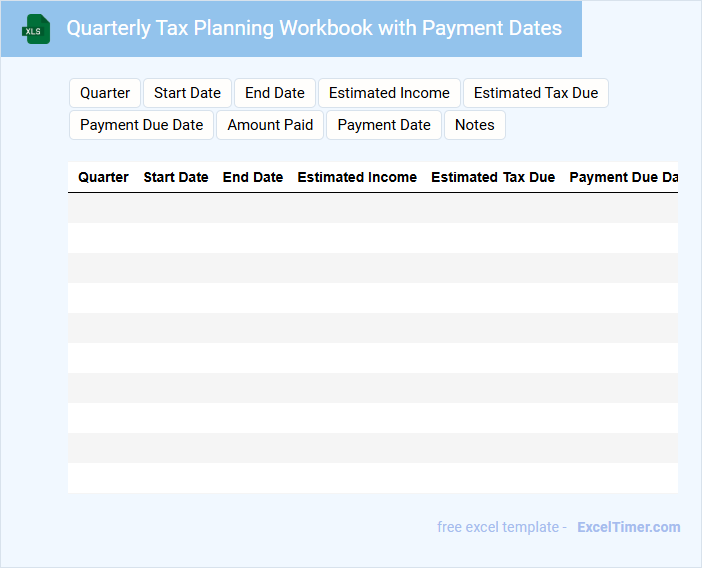

Quarterly Tax Planning Workbook with Payment Dates

A Quarterly Tax Planning Workbook typically contains detailed financial data and projected tax obligations for each quarter. It helps businesses or individuals systematically organize their estimated tax payments and track key payment dates. Including reminders and calculation tools ensures timely submissions and minimizes the risk of penalties.

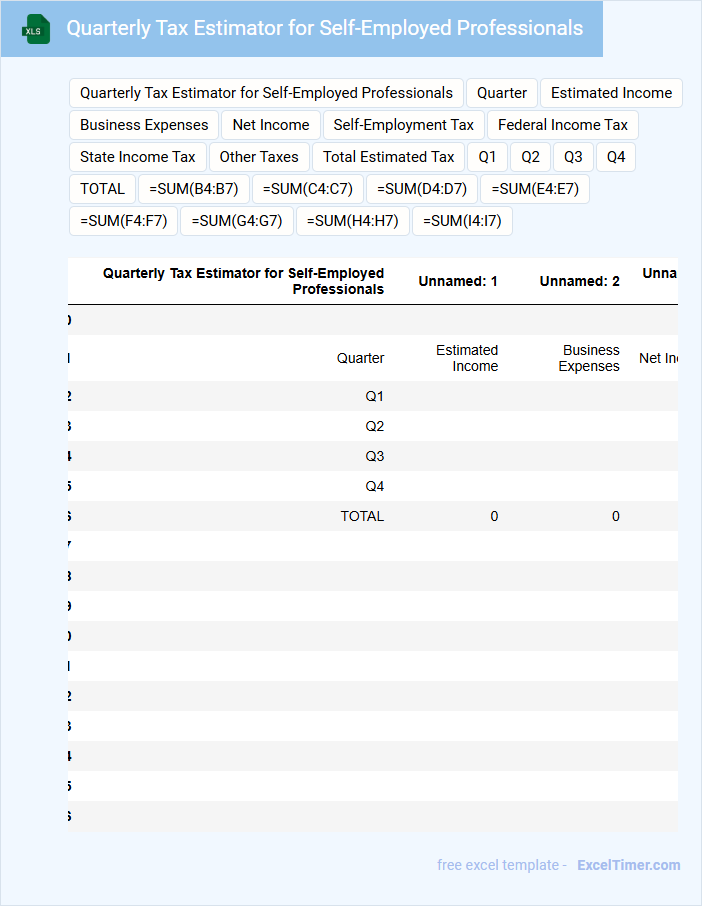

Quarterly Tax Estimator for Self-Employed Professionals

A Quarterly Tax Estimator for Self-Employed Professionals typically contains detailed income summaries, estimated tax calculations, and payment schedules to help manage tax obligations throughout the year.

- Accurate Income Tracking: Maintain precise records of all earnings to ensure correct tax estimations.

- Expense Documentation: Include deductible business expenses to reduce taxable income effectively.

- Timely Payment Reminders: Set alerts for quarterly deadlines to avoid penalties and interest charges.

How do you accurately track and categorize business income and expenses in Excel for quarterly tax calculations?

Accurately track and categorize business income and expenses in Excel by creating separate columns for income streams, expense types, dates, and payment methods. Use Excel functions like SUMIFS and PivotTables to organize data by quarter and category, ensuring precise calculation for tax reporting. Maintain detailed transaction logs and regularly update records to support accurate quarterly tax estimates for self-employed individuals.

What formulas or functions can be used in Excel to estimate quarterly tax payments for self-employed individuals?

Excel functions such as SUM(), IF(), and PMT() help calculate estimated quarterly tax payments by totaling income, applying tax brackets, and computing installment amounts. The formula can incorporate SELF-EMPLOYMENT_TAX_RATE and ESTIMATED_INCOME to predict payments accurately. Using these functions streamlines tax preparation and ensures compliance with IRS quarterly requirements for self-employed individuals.

How can you organize Excel sheets to separate personal and business finances for IRS compliance during quarterly tax preparation?

Organize your Excel workbook by creating separate sheets titled "Personal Finances" and "Business Finances" to track income, expenses, and deductions distinctly. Use clear headers and categories like "Revenue," "Operational Costs," and "Personal Expenses" to ensure accurate data segmentation for IRS compliance. Regularly update each sheet with relevant transactions to simplify quarterly tax reporting for self-employed individuals.

Which Excel features help in forecasting future quarterly tax liabilities based on past financial data?

Excel features like Forecast Sheet, Trendlines in charts, and PivotTables help analyze past financial data to predict your future quarterly tax liabilities efficiently. Using functions such as TREND, LINEST, and SUMIF allows precise calculation and segmentation of income and expenses. These tools enable better tax preparation by providing data-driven forecasts tailored to self-employed financial patterns.

What methods can be used in Excel to set reminders and monitor due dates for quarterly estimated tax payments?

Excel offers methods like conditional formatting to highlight upcoming quarterly tax payment due dates and data validation to set alerts for missing information. You can also create formulas using TODAY() to track deadlines dynamically and employ VBA macros to generate automated reminder pop-ups. These tools help ensure your quarterly estimated tax payments are monitored effectively.