The Quarterly Invoice Summary Excel Template for Consultants efficiently consolidates invoices over a three-month period, helping track billable hours and payments received. It simplifies financial management by organizing client details, invoice dates, amounts, and payment statuses in one easy-to-use spreadsheet. This template is essential for consultants aiming to streamline their invoicing process and maintain accurate financial records.

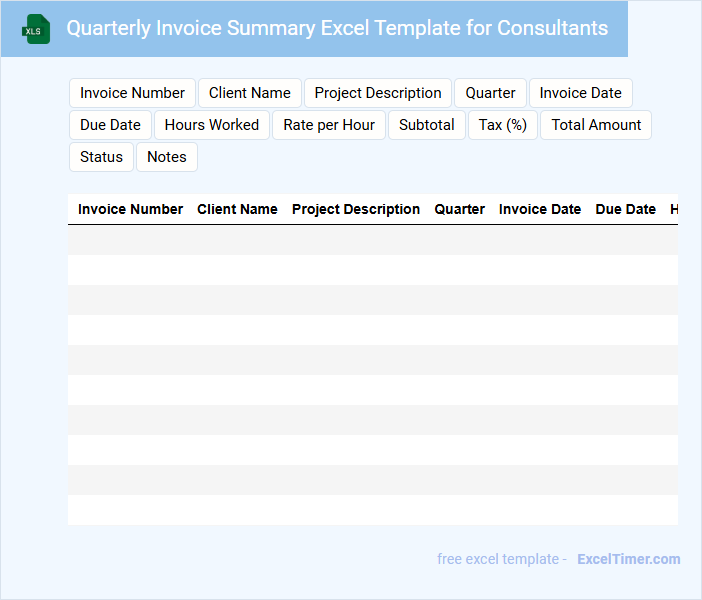

Quarterly Invoice Summary Excel Template for Consultants

A Quarterly Invoice Summary Excel Template for consultants typically contains detailed information about invoices issued over a three-month period. It includes columns for invoice dates, client names, services rendered, amounts billed, and payment statuses. This document helps consultants keep track of financial transactions, ensuring accurate and timely billing. For optimal use, it is important to regularly update the template with new invoices and verify the accuracy of amounts to maintain clear financial records. Additionally, including a summary section that aggregates total amounts per client and quarter can improve quick financial analysis. Proper categorization of services and payment tracking enhances overall efficiency and financial management.

Quarterly Billing Overview with Invoice Tracker for Consultants

This document typically contains an organized summary of quarterly billing activities and an invoice tracking system designed specifically for consultants.

- Invoice Summary: A detailed list of all issued invoices including amounts and dates.

- Payment Status: Clear indicators showing which invoices are paid, pending, or overdue.

- Consultant Breakdown: Individual billing details for each consultant for easy tracking and analysis.

Consultant Quarterly Invoice Dashboard for Excel

What information is typically included in a Consultant Quarterly Invoice Dashboard for Excel? This type of document usually contains a summary of all invoices issued by a consultant within a quarter, including client names, dates, invoice numbers, amounts, and payment statuses. It helps track financial performance, monitor outstanding payments, and streamline billing processes for efficient financial management.

What important features should be considered when creating this dashboard? It's essential to include clear visualizations of invoice totals, payment timelines, and outstanding balances. Additionally, incorporating filters by client or date range and automated calculations for totals and overdue amounts enhances usability and accuracy.

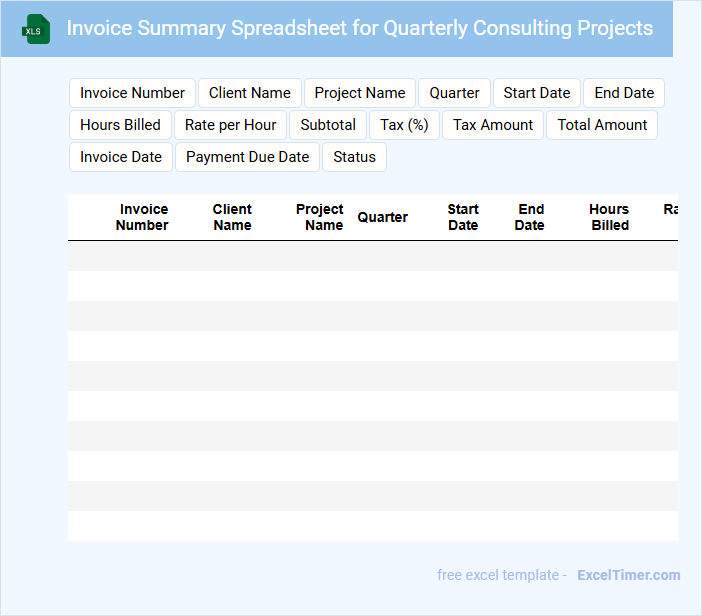

Invoice Summary Spreadsheet for Quarterly Consulting Projects

An Invoice Summary Spreadsheet for Quarterly Consulting Projects typically contains detailed billing information, project timelines, and payment statuses to track consulting services over a quarter.

- Project Details: Include comprehensive descriptions and codes for each consulting project.

- Financial Summary: Summarize invoice amounts, taxes, and payment due dates.

- Status Tracking: Highlight payment status to monitor received and pending invoices.

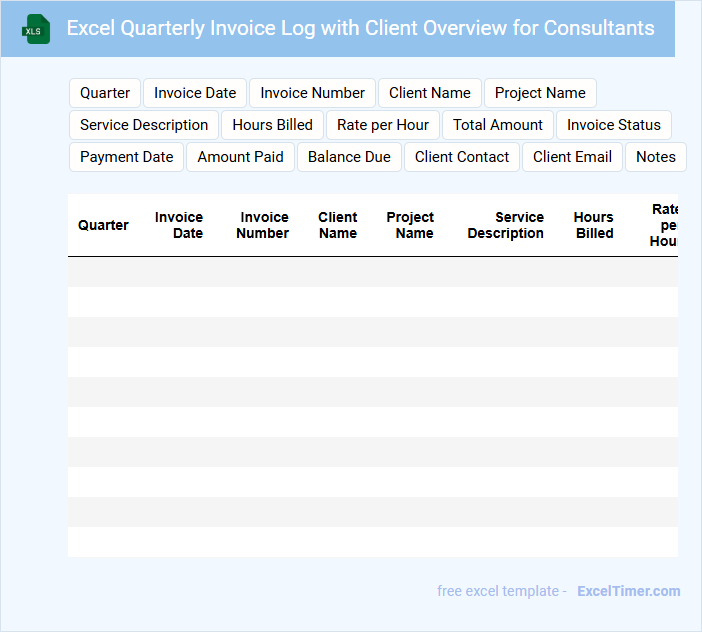

Excel Quarterly Invoice Log with Client Overview for Consultants

An Excel Quarterly Invoice Log is a structured document designed to track invoices generated over a three-month period. It helps consultants systematically record billing details, payment statuses, and transaction dates.

Including a Client Overview section consolidates key client information such as contact details and contract summaries. This enhances efficiency in managing client relationships and invoicing accuracy.

For optimal use, ensure regular updates and clear categorization of invoices to maintain transparency and support timely financial reconciliation.

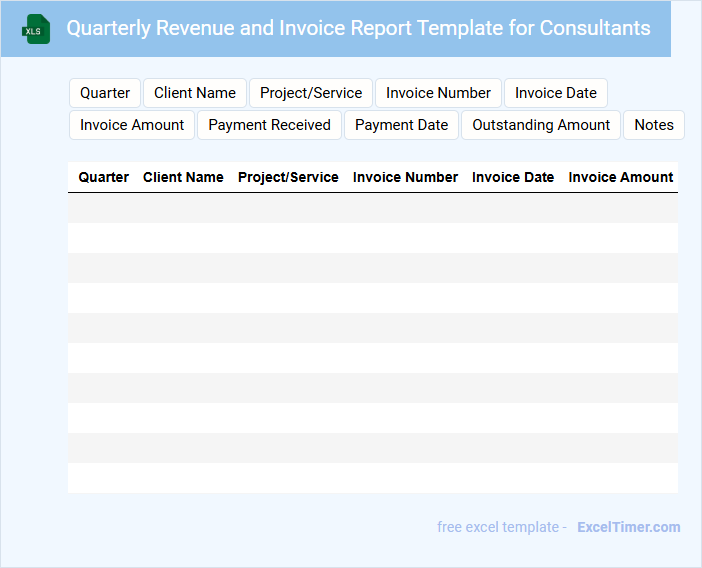

Quarterly Revenue and Invoice Report Template for Consultants

What key information does a Quarterly Revenue and Invoice Report Template for Consultants typically include? This type of document usually contains detailed records of all invoices sent and payments received within the quarter, providing a clear overview of revenue streams. It also includes summaries of billable hours, project descriptions, payment statuses, and client details to help track financial performance efficiently.

What important elements should be considered when creating this report template? It is essential to ensure accuracy in invoice numbers, dates, and amounts, as well as including a section for notes or discrepancies. Additionally, incorporating visual aids like graphs or charts can enhance clarity and make financial trends easier to interpret for both consultants and clients.

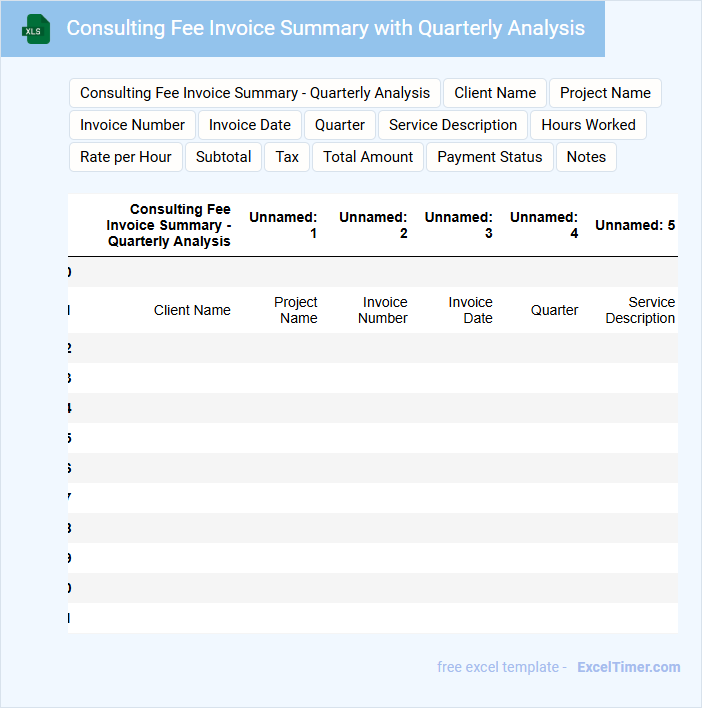

Consulting Fee Invoice Summary with Quarterly Analysis

A Consulting Fee Invoice Summary with Quarterly Analysis typically outlines billing details and summarizes consulting fees over a three-month period. It provides insights into financial transactions related to consulting services rendered during the quarter.

Important considerations include accuracy, clarity, and comprehensive financial tracking to facilitate effective analysis and decision-making.

- Ensure all invoice items are clearly described with corresponding dates and amounts.

- Include a detailed quarterly breakdown to highlight trends and payment schedules.

- Incorporate a summary section for total fees and any outstanding balances.

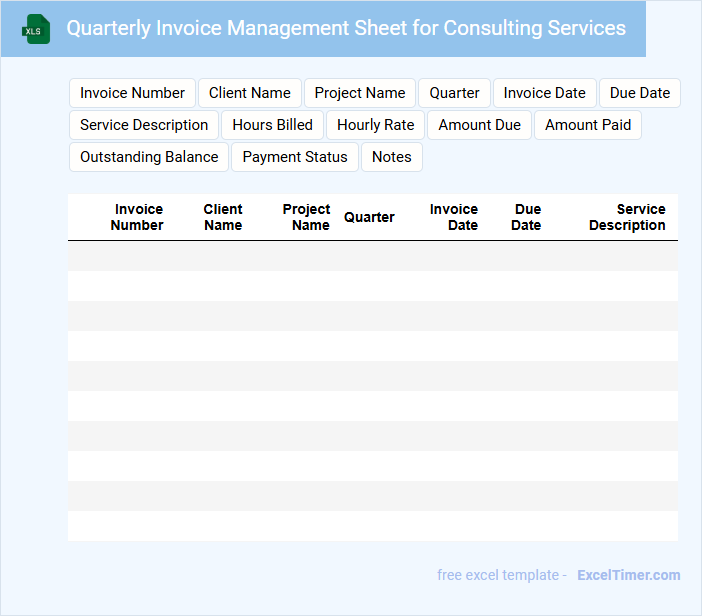

Quarterly Invoice Management Sheet for Consulting Services

A Quarterly Invoice Management Sheet for Consulting Services typically contains detailed records of all invoices issued during the quarter, including client names, invoice dates, and payment statuses. It helps in tracking billed amounts and outstanding payments systematically. This document ensures accurate financial reporting and efficient cash flow management.

Important elements to include are client contact information, service descriptions, invoice numbers, payment deadlines, and notes on any discrepancies or follow-up actions. Consistent updating and reconciliation with accounting records enhance accuracy. Utilizing filters or categorization can simplify data analysis and reporting.

Maintaining confidentiality and secure storage of sensitive financial data is crucial. Periodic reviews and backups safeguard against data loss and errors. Finally, integrating this sheet with accounting software can streamline the invoicing process and improve overall financial oversight.

Excel Tracker of Quarterly Invoices for Independent Consultants

An Excel Tracker of Quarterly Invoices for Independent Consultants typically contains detailed records of invoice dates, amounts, and payment statuses. This document helps in organizing financial transactions, ensuring timely payments, and maintaining accurate bookkeeping. Including columns for invoice number, client information, and payment deadlines is crucial for effective tracking.

Quarterly Invoice and Payment Summary with Status Tracker

A Quarterly Invoice and Payment Summary with Status Tracker document provides a comprehensive overview of all transactions within a quarter, consolidating invoices issued and payments received. It serves as a critical tool for maintaining financial transparency and managing cash flow effectively.

- List all invoices generated in the quarter with corresponding amounts and due dates.

- Track payment statuses including pending, completed, and overdue payments.

- Include notes on payment discrepancies or follow-up actions required.

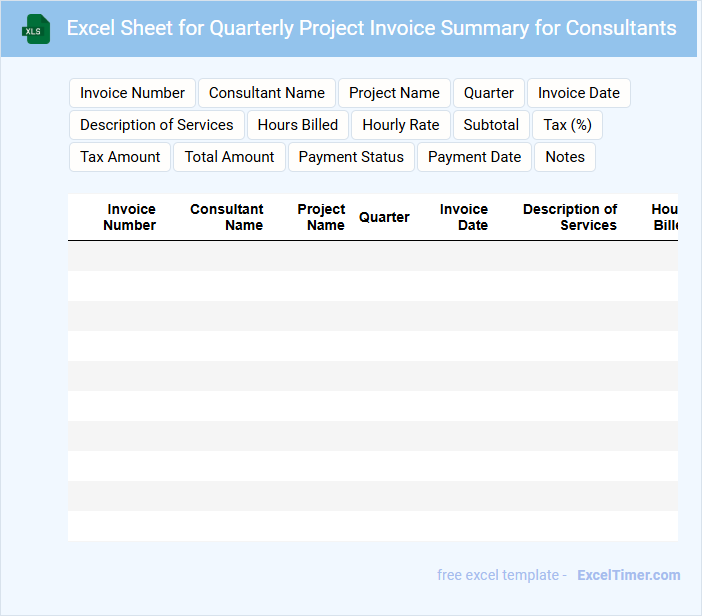

Excel Sheet for Quarterly Project Invoice Summary for Consultants

An Excel Sheet for Quarterly Project Invoice Summary is typically used to consolidate and analyze billing information from consultants over a three-month period. This document contains detailed entries such as invoice dates, amounts, project codes, and payment statuses. It helps organizations track expenditures, manage budgets, and ensure timely payments to consultants.

For optimal use, it is important to maintain clear categorization of invoices by project and consultant to facilitate quick cross-referencing. Incorporating formulas for automatic calculation of totals and outstanding balances improves accuracy and saves time. Additionally, including a section for notes or comments on invoice discrepancies can enhance communication and issue resolution.

Consultant Income Statement with Quarterly Invoice Summary

What information is typically found in a Consultant Income Statement with Quarterly Invoice Summary? This document usually contains detailed records of all consultant earnings, categorized by invoices issued each quarter, allowing for clear tracking of income over time. It also summarizes billable hours, payments received, and outstanding invoices to provide a comprehensive financial overview for consultants.

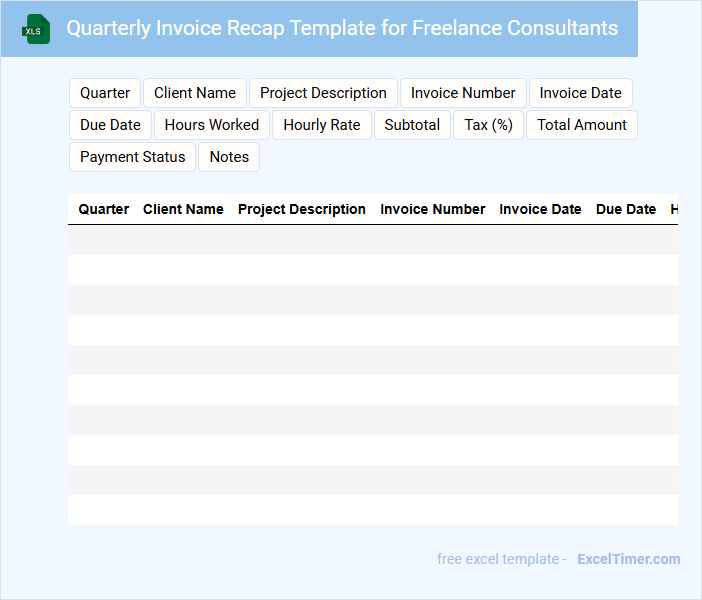

Quarterly Invoice Recap Template for Freelance Consultants

A Quarterly Invoice Recap Template for Freelance Consultants typically contains a summary of billable hours, payments received, and outstanding invoices over a three-month period.

- Invoice Summary: A detailed list of all invoices issued during the quarter including dates and amounts.

- Payment Status: Information on payments received and any outstanding balances.

- Consulting Services Rendered: A brief description of services provided to justify charges.

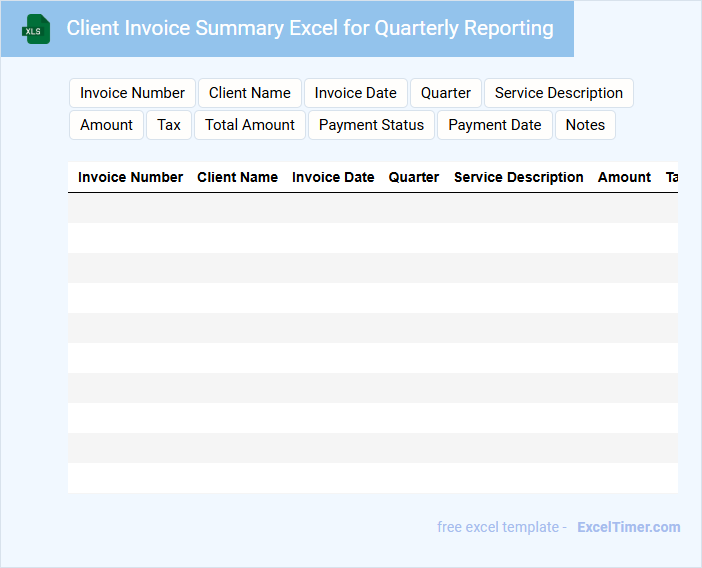

Client Invoice Summary Excel for Quarterly Reporting

What information is typically contained in a Client Invoice Summary Excel for Quarterly Reporting? This document usually includes detailed records of all client invoices issued within the quarter, such as invoice numbers, dates, amounts, and payment statuses. It helps in tracking revenue, managing accounts receivable, and providing a clear financial overview for the quarterly reporting period.

What important elements should be included for optimal use? It is essential to ensure accuracy in data entry, maintain consistent formatting for easy analysis, and include summary totals and visual charts to quickly convey financial trends and outstanding payments. Additionally, categorizing invoices by client or service type can enhance clarity and decision-making.

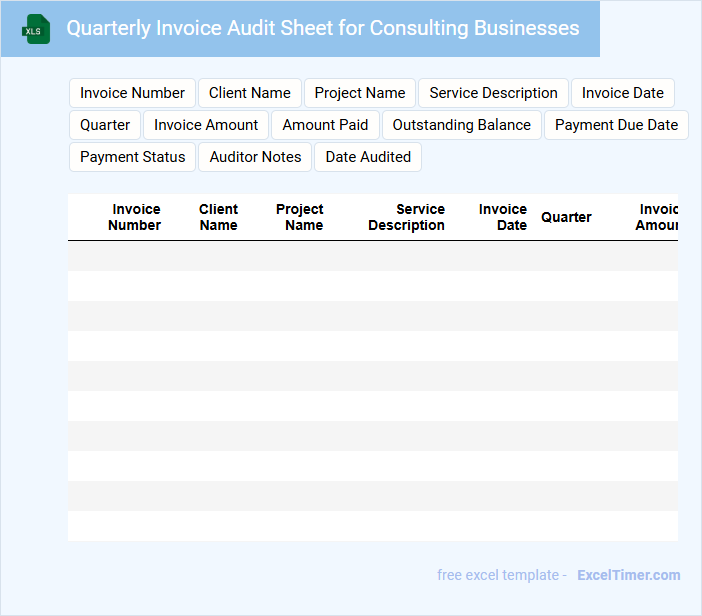

Quarterly Invoice Audit Sheet for Consulting Businesses

The Quarterly Invoice Audit Sheet is a critical document for consulting businesses, summarizing all invoices issued within the quarter. It ensures that billing is accurate and aligned with contract terms to maintain financial integrity.

This document typically contains client names, invoice dates, amounts, payment statuses, and notes on discrepancies. Regular audits help identify errors, prevent revenue loss, and support transparent financial reporting.

What key data fields must be included in a Quarterly Invoice Summary for consultants in Excel?

A Quarterly Invoice Summary for consultants in Excel must include key data fields such as Consultant Name, Invoice Date, Invoice Number, Project or Client Name, Hours Worked, Hourly Rate, Total Billed Amount, Payment Status, and Invoice Due Date. Including these fields ensures accurate tracking of consultant services, billing amounts, and payment timelines. This structured data enables efficient review and financial analysis of consulting activities for the quarter.

How should invoice periods be formatted to accurately reflect quarterly reporting?

Invoice periods should be formatted using clear quarterly date ranges, such as "Q1 2024: Jan 1 - Mar 31," to ensure precise tracking within your Quarterly Invoice Summary for Consultants. Each period must cover exactly three months, aligned with calendar quarters to maintain consistency. Accurate formatting enhances data clarity and supports efficient financial review and reporting.

What Excel formulas can be used to summarize total billed amounts per consultant each quarter?

Use the SUMIF formula to total billed amounts per consultant by specifying the consultant's name as the criteria. Apply the SUMIFS formula to sum invoices within specific date ranges that define each quarter for each consultant. Combine these with DATE function criteria to accurately capture quarterly periods in your Excel invoice summary.

How can invoice status (paid, pending, overdue) be effectively tracked within the summary?

Track invoice status by categorizing each entry as paid, pending, or overdue using clear, color-coded labels. Use formulas to automatically update totals and highlight overdue invoices for prompt action. This approach ensures your Quarterly Invoice Summary provides a precise overview of consultant payments and outstanding balances.

What methods ensure the summary allows for easy filtering and analysis of consultant performance by quarter?

Your Quarterly Invoice Summary in Excel uses pivot tables and structured tables to enable easy filtering and analysis of consultant performance by quarter. Data validation ensures consistent input, while slicers provide interactive filtering options. These methods streamline data organization and enhance clarity in performance review.