The Quarterly Financial Statement Excel Template for Nonprofits provides a structured format to track income, expenses, and cash flow every three months, ensuring transparency and accurate financial reporting. This template includes pre-formatted sheets and formulas that simplify budgeting and highlight key financial metrics relevant to nonprofit organizations. Maintaining timely and precise quarterly statements supports compliance with regulatory requirements and aids in strategic decision-making.

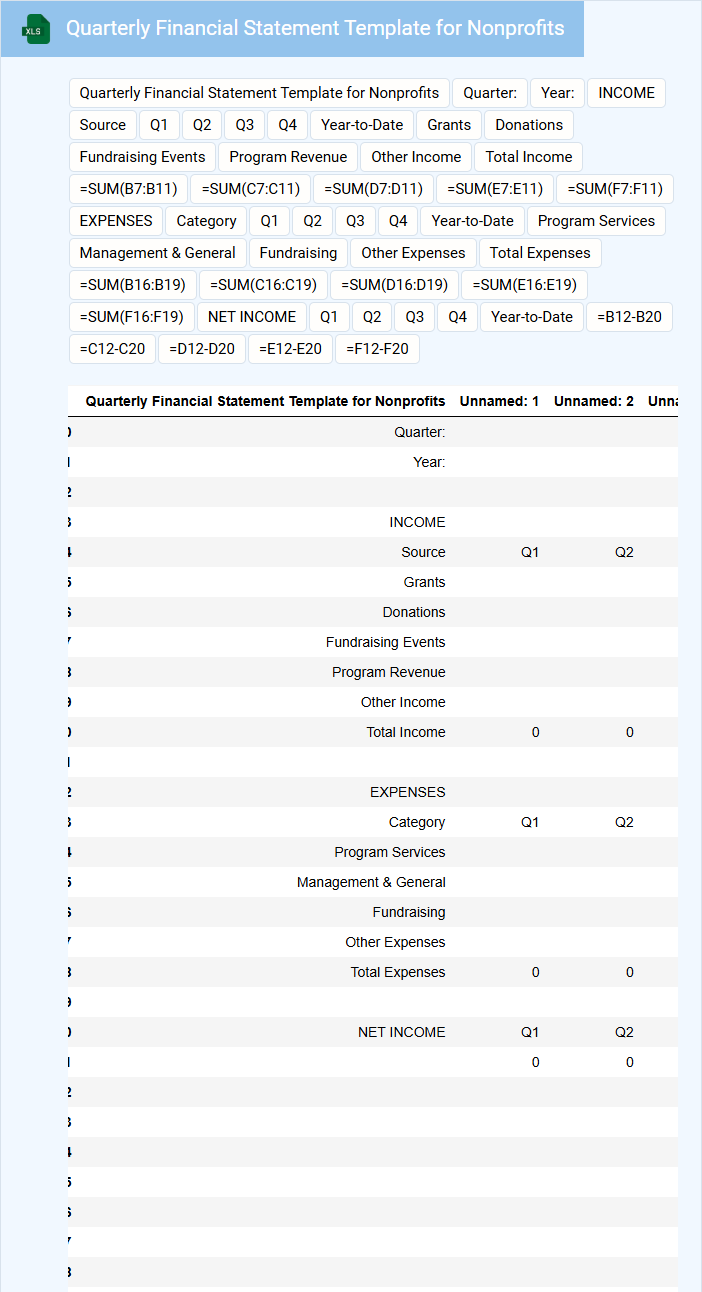

Quarterly Financial Statement Template for Nonprofits

A Quarterly Financial Statement Template for nonprofits typically contains detailed financial information, including income, expenses, and fund balances. It provides a snapshot of the organization's financial health over a three-month period. Ensuring accuracy and clarity in this document is crucial for transparency and informed decision-making.

Important elements to include are revenue sources, program expenses, administrative costs, and any fundraising activities. Highlighting variances from the budget helps stakeholders understand financial performance. Additionally, maintaining compliance with accounting standards and regulatory requirements is essential for nonprofit accountability.

Quarterly Income & Expense Report for Nonprofits

What information does a Quarterly Income & Expense Report for Nonprofits typically contain? This type of report usually includes a detailed breakdown of the organization's income and expenses over a three-month period, highlighting revenue sources such as donations, grants, and fundraising events. It also categorizes expenses by program services, administrative costs, and fundraising activities, providing a clear picture of financial health and resource allocation.

What is important to include in a Quarterly Income & Expense Report for Nonprofits? It is essential to ensure accuracy and transparency by including all sources of income and itemized expenses, as well as comparing actual figures to budgeted amounts. Additionally, including notes on significant financial changes or variances helps stakeholders understand the organization's financial performance and supports informed decision-making.

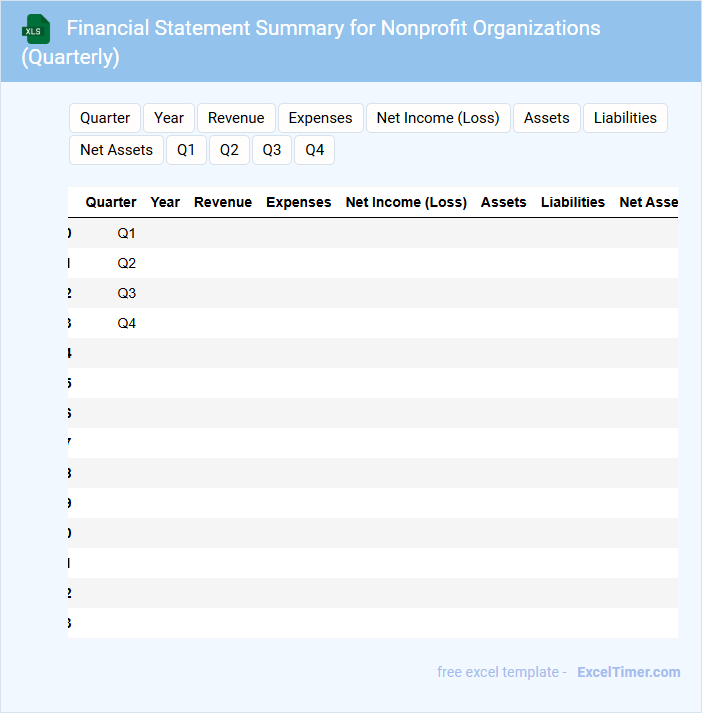

Financial Statement Summary for Nonprofit Organizations (Quarterly)

Financial Statement Summaries for Nonprofit Organizations typically present a concise overview of financial activities and position for a specific quarter, enabling stakeholders to quickly assess fiscal health and resource allocation. These documents play a crucial role in transparency and informed decision-making for donors, board members, and management.

- Include a clear breakdown of income sources and expenditures to demonstrate financial stewardship.

- Highlight any significant variances from the budget or prior periods to identify trends or concerns.

- Ensure the summary aligns with reporting standards and provides context for financial figures.

Quarterly Budget vs Actuals Spreadsheet for Nonprofits

This document, commonly known as a Quarterly Budget vs Actuals Spreadsheet, is essential for nonprofits to track their financial performance over a three-month period. It typically contains budgeted amounts compared against actual expenditures and revenues, helping organizations identify variances. This tool aids in ensuring fiscal responsibility and making informed decisions about resource allocation.

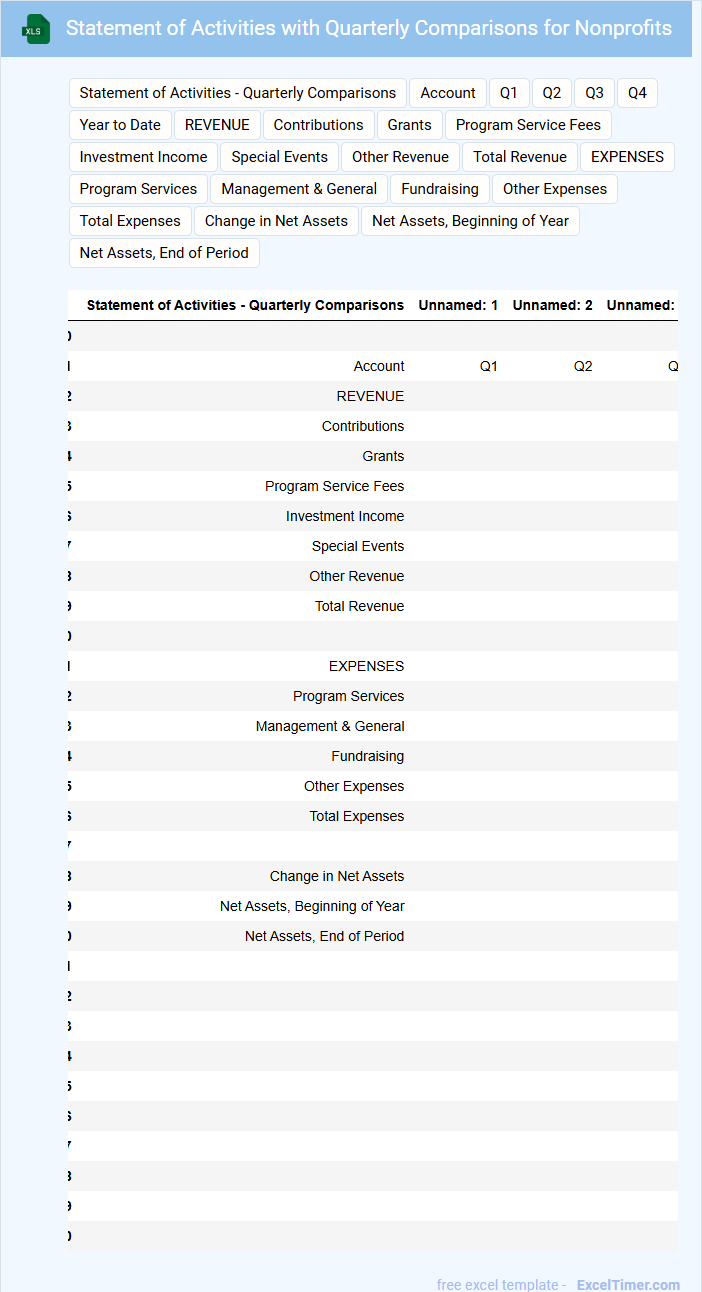

Statement of Activities with Quarterly Comparisons for Nonprofits

A Statement of Activities with Quarterly Comparisons is a financial report commonly used by nonprofits to track income and expenses over each quarter of the fiscal year. This document helps organizations assess financial performance and monitor trends in revenue and expenditures. It is essential for maintaining transparency and informing stakeholders about the nonprofit's financial health.

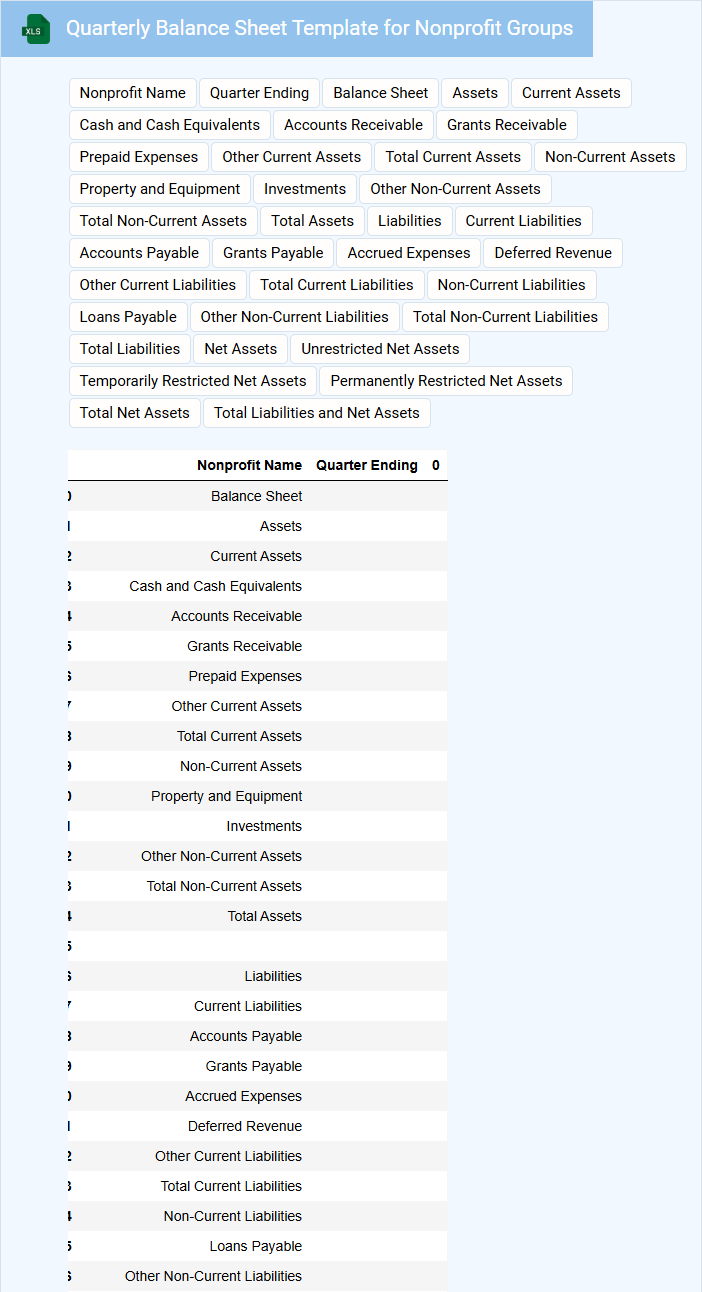

Quarterly Balance Sheet Template for Nonprofit Groups

What information is typically included in a Quarterly Balance Sheet Template for Nonprofit Groups? This document usually contains a detailed summary of an organization's assets, liabilities, and net assets at a specific point in time. It helps nonprofit groups monitor financial health, track changes over the quarter, and ensure transparency and accountability to stakeholders.

What is an important consideration when using this template? It is crucial to ensure accuracy in recording all financial transactions and regularly update the balance sheet to reflect current data. Additionally, including notes or explanations for significant changes improves clarity and supports better financial decision-making.

Quarterly Fund Tracking Excel Template for Nonprofits

The Quarterly Fund Tracking Excel Template is a specialized document designed to help nonprofits monitor their financial inflows and outflows across a three-month period. It systematically organizes donations, grants, and expenses to facilitate clear financial oversight.

Accurate data entry and timely updates are crucial for maintaining the template's effectiveness in budget planning and resource allocation. Regularly reviewing the template ensures transparency and informed decision-making.

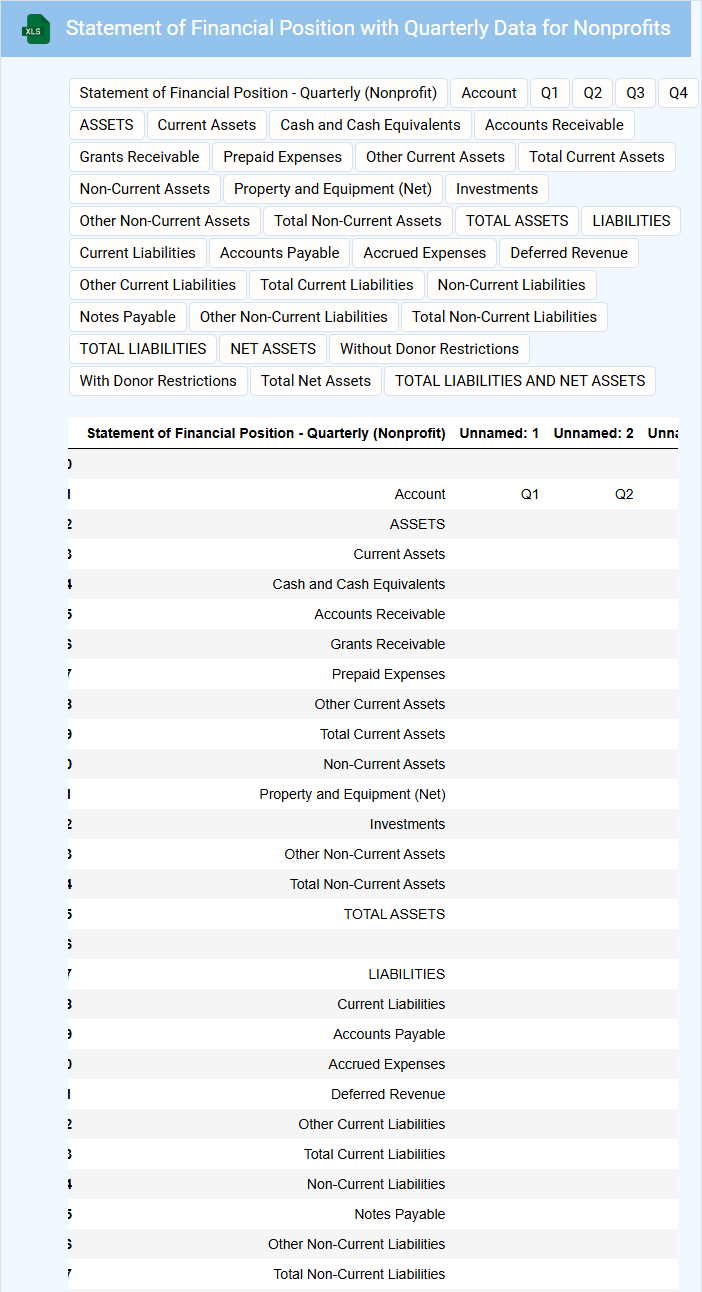

Statement of Financial Position with Quarterly Data for Nonprofits

The Statement of Financial Position with quarterly data for nonprofits provides a snapshot of an organization's assets, liabilities, and net assets at specific intervals within the fiscal year. This document typically includes current and long-term assets, debts, and fund balances, reflecting the nonprofit's financial health and stability. It is essential for stakeholders to review quarterly changes to monitor liquidity, solvency, and overall financial trends for informed decision-making and compliance.

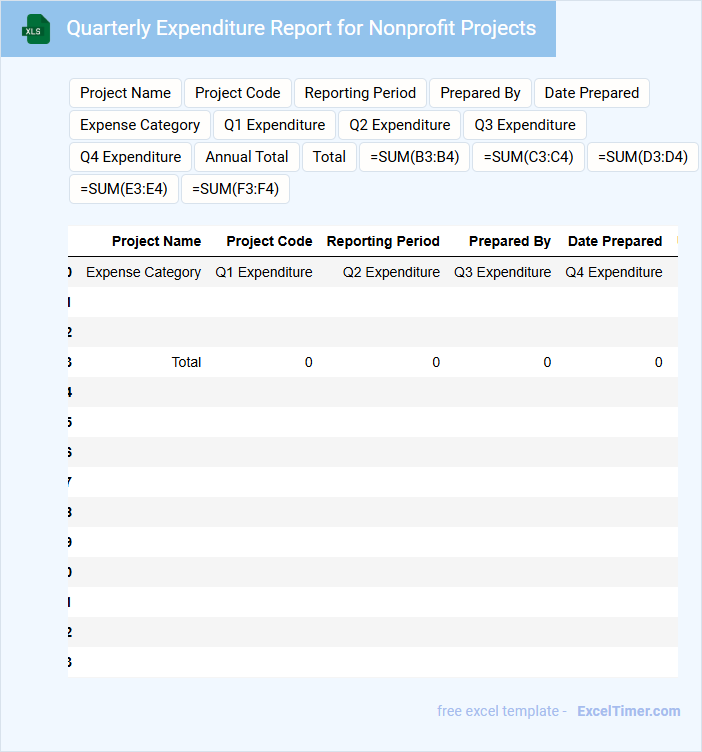

Quarterly Expenditure Report for Nonprofit Projects

A Quarterly Expenditure Report for nonprofit projects typically details the financial outflows during a three-month period, providing transparency on fund allocation and usage. It includes itemized expenses, funding sources, and comparisons to the budget, ensuring accountability and informed decision-making. Emphasizing clear categorization and timely submission is important for maintaining stakeholder trust and compliance.

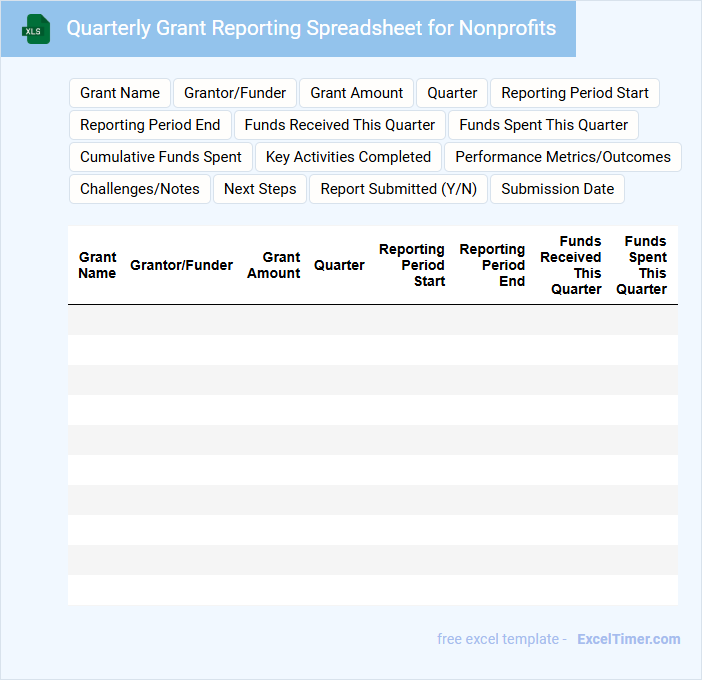

Quarterly Grant Reporting Spreadsheet for Nonprofits

A Quarterly Grant Reporting Spreadsheet for nonprofits is a structured document used to track the allocation and utilization of grant funds over a three-month period. It typically includes detailed entries on expenditures, project progress, and outcome metrics to ensure transparency and accountability. Maintaining accurate and timely data in this spreadsheet is crucial for meeting grant requirements and securing future funding.

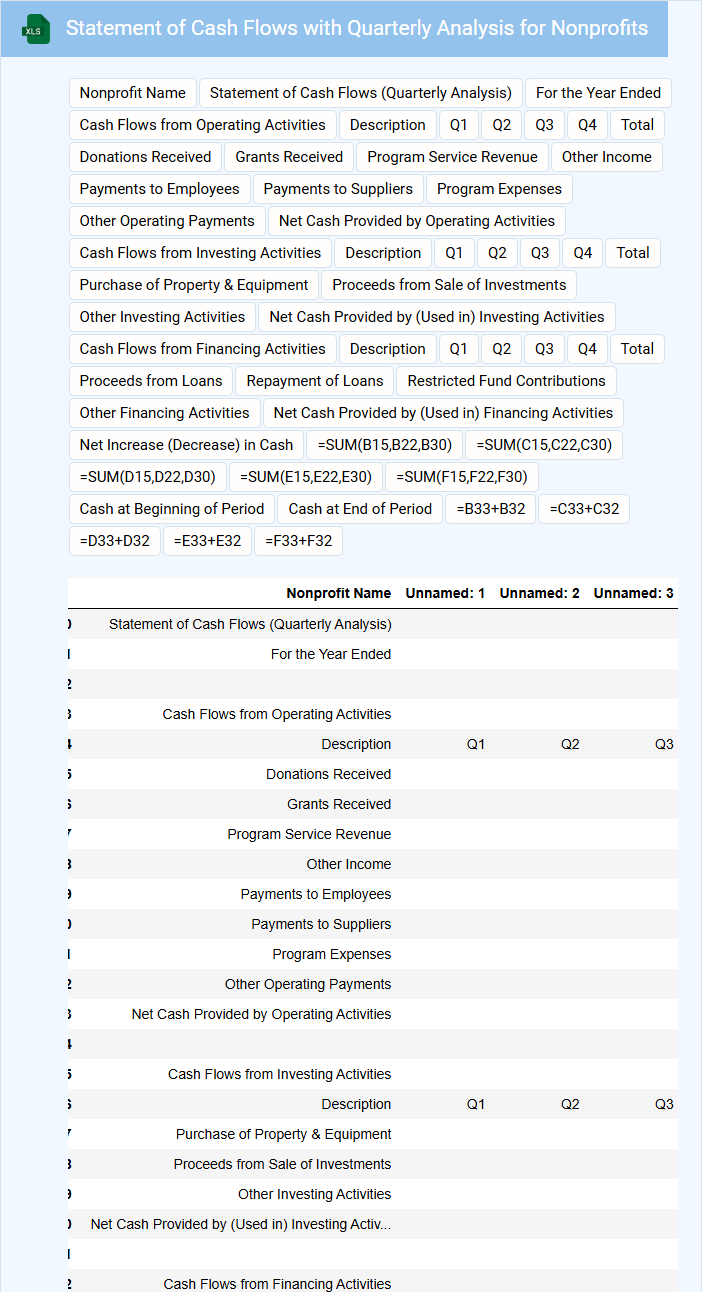

Statement of Cash Flows with Quarterly Analysis for Nonprofits

The Statement of Cash Flows for nonprofits is a financial report that details the inflows and outflows of cash over a specific period, typically categorized into operating, investing, and financing activities. It helps organizations understand their liquidity and how well they manage cash to support their mission-driven activities.

Quarterly analysis of this statement provides timely insights into cash management trends and potential funding gaps or surpluses within the nonprofit. Consistently monitoring cash flow ensures the organization maintains financial stability and compliance with donor restrictions.

An important consideration is to ensure transparency in reporting restricted versus unrestricted cash and to highlight any significant changes in cash position that could impact program delivery.

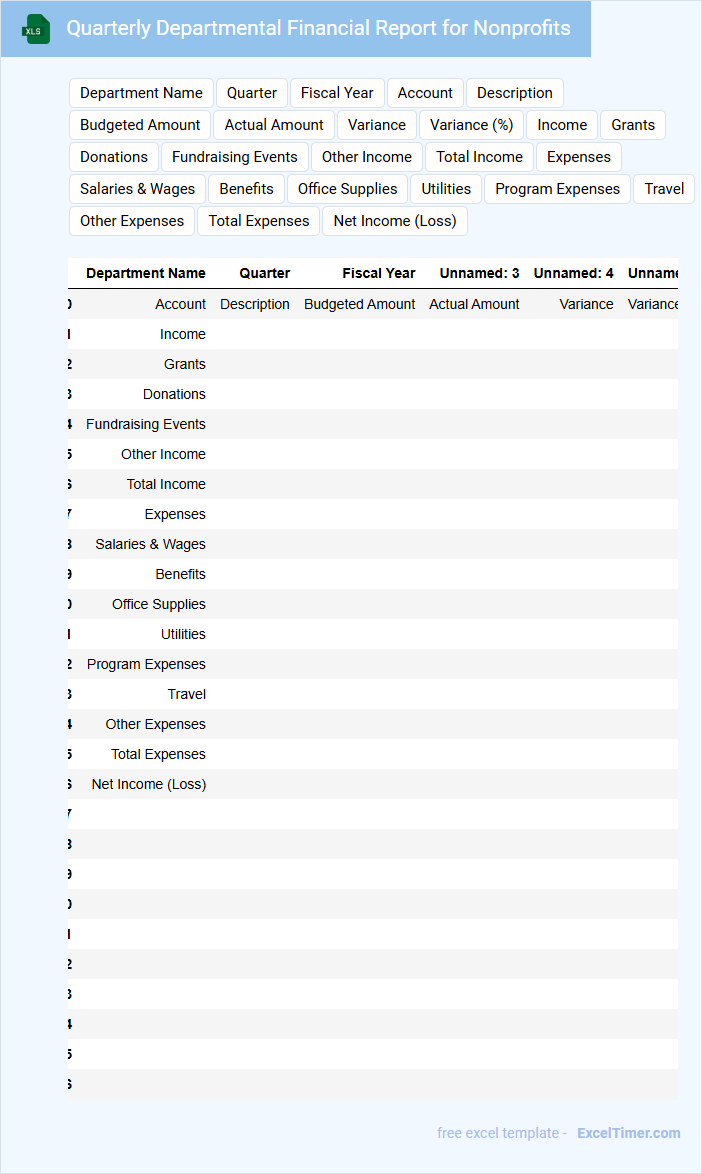

Quarterly Departmental Financial Report for Nonprofits

What information does a Quarterly Departmental Financial Report for Nonprofits typically contain? This type of report usually includes detailed financial data categorized by each department, highlighting income, expenses, and budget variances. It serves to provide transparency and insight into the organization's financial health and resource allocation over the quarter.

Why is accuracy important in this report? Accurate financial reporting ensures donors and stakeholders can trust the nonprofit's fiscal responsibility and helps guide strategic decisions. Including clear explanations for any significant variances and projections for upcoming quarters enhances the report's value and effectiveness.

Donation Tracking Template with Quarterly Summary for Nonprofits

A Donation Tracking Template with Quarterly Summary is an essential tool for nonprofits to accurately record and monitor donor contributions over time. This document typically contains fields for donor information, donation amounts, dates, and campaign sources, allowing for efficient financial oversight. Including a quarterly summary helps organizations evaluate trends and plan fundraising strategies effectively.

To maximize its usefulness, ensure the template is regularly updated and includes categories for donation types, payment methods, and any restrictions on funds. Integration with donor communication logs can also enhance relationship management. Finally, maintaining clear, organized data supports transparency and simplifies reporting to stakeholders and regulatory bodies.

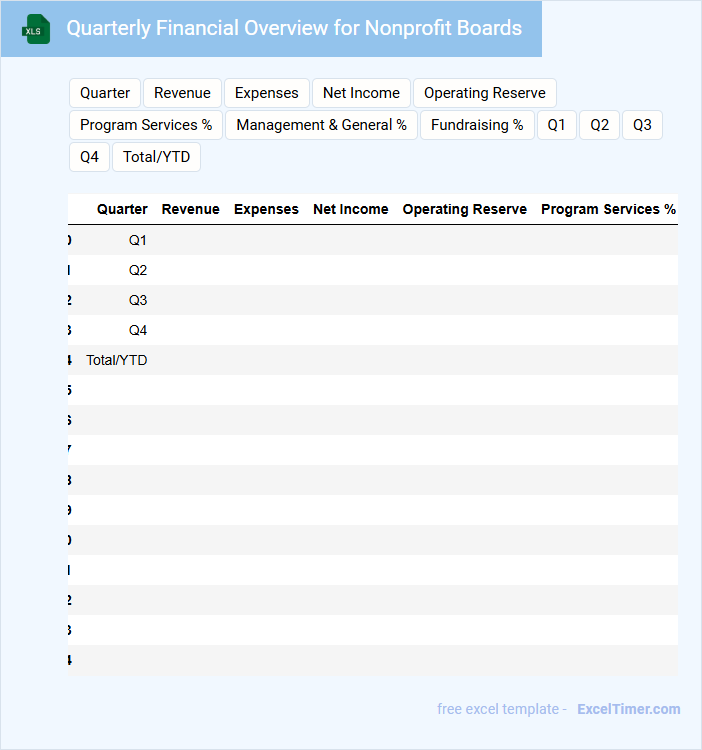

Quarterly Financial Overview for Nonprofit Boards

The Quarterly Financial Overview document typically contains a summary of the organization's financial performance over the past three months, including income, expenses, and cash flow. It provides nonprofit boards with essential data to assess financial health and make informed decisions. Key elements often include budget variances, funding sources, and financial forecasts.

Membership Dues With Quarterly Financial Statement for Nonprofits

Membership dues with quarterly financial statements for nonprofits typically include a detailed report of income generated through member contributions and the financial activities during the quarter. These documents provide transparency and accountability to members, highlighting key financial metrics and expenses. It is essential to maintain clear records and timely distribution to ensure member trust and regulatory compliance.

What are the key components that should be included in a nonprofit's quarterly financial statement in Excel?

A nonprofit's quarterly financial statement in Excel should include key components such as the Statement of Financial Position, detailing assets, liabilities, and net assets; the Statement of Activities, showing revenues, expenses, and changes in net assets; and the Statement of Cash Flows, summarizing cash inflows and outflows. Additionally, program service expenses, fundraising and administrative expenses, and budget versus actual comparisons provide critical insights. Clear labeling with dates, account categories, and notes sections enhances accuracy and transparency for stakeholders.

How do you categorize and present revenue streams specific to nonprofits (e.g., donations, grants, program income) in your Excel document?

Your Excel document categorizes nonprofit revenue streams into distinct columns for donations, grants, and program income, enabling clear tracking and analysis. Each revenue type is itemized by source and date to maintain transparency and facilitate accurate quarterly reporting. Visual charts and pivot tables summarize data trends, enhancing financial insights for stakeholders.

What Excel functions or formulas are essential for tracking restricted vs. unrestricted funds in a quarterly report?

Essential Excel functions for tracking restricted vs. unrestricted funds in a quarterly nonprofit financial statement include SUMIFS to aggregate amounts based on fund type and date criteria, and IF statements to categorize transactions automatically. VLOOKUP or INDEX-MATCH help reference fund codes or grant details, ensuring accurate classification. PivotTables summarize data dynamically, enabling clear visibility of financial positions each quarter.

How do you ensure accuracy when reconciling quarterly expenditures and allocations across different programs in Excel?

You can ensure accuracy in reconciling quarterly expenditures and allocations across nonprofit programs by using Excel's PivotTables to summarize data, employing built-in formulas like SUMIFS for precise allocation tracking, and setting up data validation rules to prevent input errors. Cross-referencing transaction logs with budget forecasts minimizes discrepancies and enhances financial clarity. Regularly reviewing these elements guarantees reliable quarterly financial statements.

What are best practices for visualizing quarterly financial trends for nonprofit stakeholders using Excel charts or dashboards?

Use line charts to display quarterly revenue and expense trends, highlighting key fluctuations to provide clear financial insights. Incorporate bar charts or stacked columns for comparing program-specific expenditures across quarters, enhancing stakeholder understanding of resource allocation. Design interactive dashboards with slicers and timeline controls in Excel to enable stakeholders to filter data by program, time period, or fund type for customized analysis.