The Quarterly Cash Flow Excel Template for Restaurants provides a streamlined way to track income, expenses, and net cash flow over three months. This template helps restaurant owners manage their finances efficiently by highlighting key cash inflows and outflows, ensuring accurate budgeting and forecasting. Accurate cash flow monitoring through this tool is essential for maintaining liquidity and making informed business decisions.

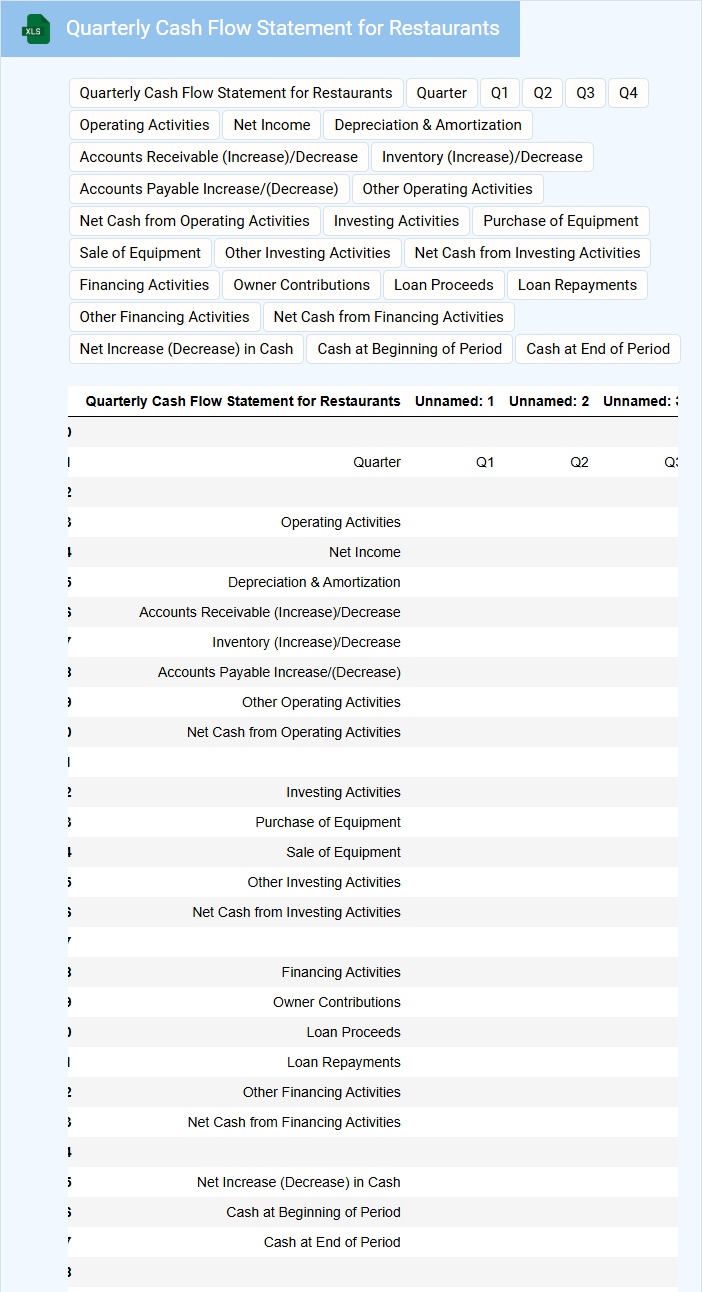

Quarterly Cash Flow Statement for Restaurants

A Quarterly Cash Flow Statement for Restaurants typically contains detailed records of cash inflows and outflows over a three-month period to assess liquidity and financial health.

- Operating Activities: Track cash generated or spent from daily restaurant operations including sales, wages, and supplies.

- Investing Activities: Record cash transactions related to the purchase or sale of assets like kitchen equipment or property.

- Financing Activities: Include cash received from loans or investments and payments of debts or dividends.

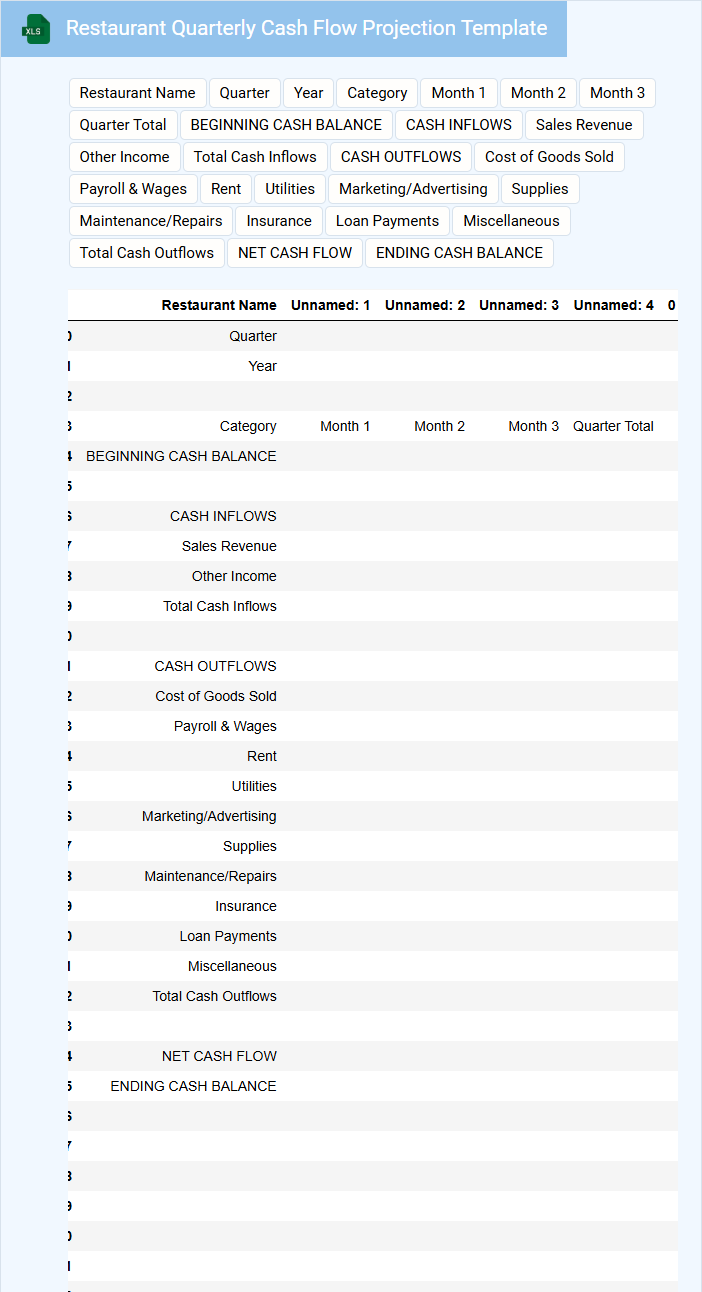

Restaurant Quarterly Cash Flow Projection Template

A Restaurant Quarterly Cash Flow Projection Template is a financial document used to estimate the inflows and outflows of cash over a three-month period for a restaurant. It typically contains sections for projected sales, operating expenses, and capital expenditures to help forecast the liquidity position. This template is essential for managing cash flow and ensuring the business remains solvent throughout the quarter.

Key components to include are detailed sales forecasts broken down by revenue streams, fixed and variable expense estimates, and anticipated loan payments or investments. It is crucial to update the template regularly with actual figures to compare against projections and adjust future forecasts accordingly. Including a contingency buffer in cash reserves can help the restaurant handle unexpected costs or seasonal fluctuations.

For optimal use, entrepreneurs should integrate this template with their overall business plan and use it to inform strategic decisions, such as staffing, inventory purchases, and marketing activities. Accurate cash flow forecasting can prevent liquidity crises and support sustainable growth. Regular review and adjustment of the projection ensure realistic financial planning.

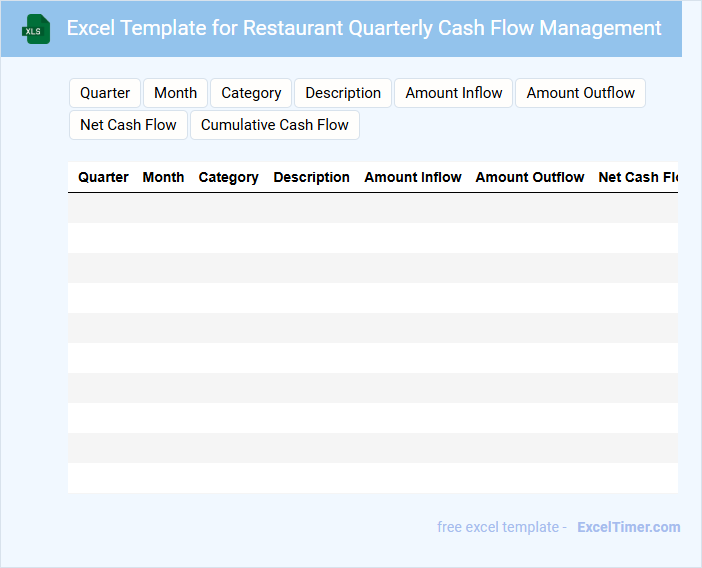

Excel Template for Restaurant Quarterly Cash Flow Management

This Excel template is designed to help restaurants efficiently track and manage their cash flow over a quarterly period. It provides a structured way to monitor income, expenses, and net cash position to ensure financial stability.

- Include detailed categories for revenue streams such as dine-in, takeout, and catering.

- Incorporate expense tracking for payroll, inventory, and operating costs.

- Provide visual summaries like charts or graphs for quick financial insights.

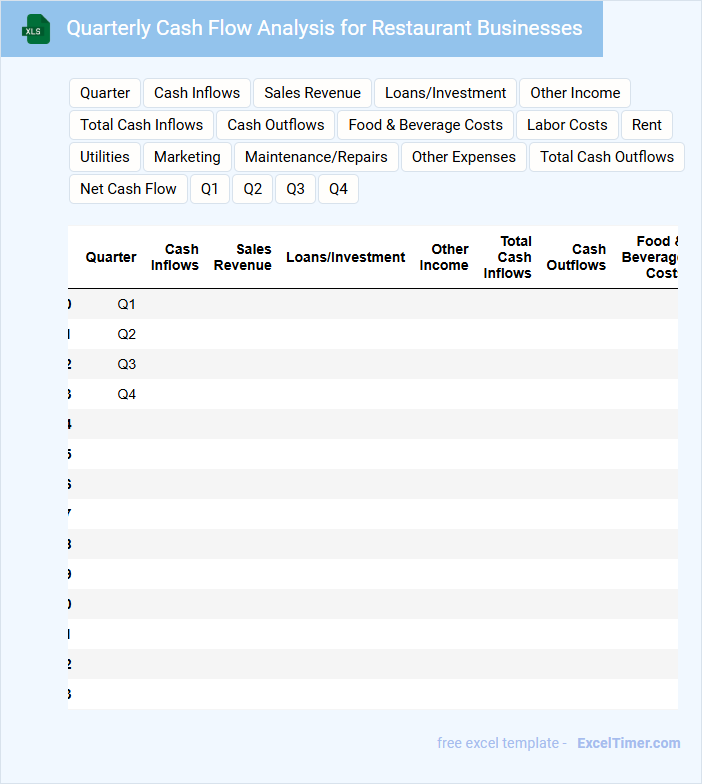

Quarterly Cash Flow Analysis for Restaurant Businesses

The Quarterly Cash Flow Analysis document for restaurant businesses typically contains detailed records of cash inflows and outflows over a three-month period. It highlights the restaurant's operating, investing, and financing activities to provide insights into financial health. This analysis helps in identifying trends, managing liquidity, and making informed budgeting decisions.

Important considerations include accurately tracking seasonal variations and unexpected expenses, ensuring detailed categorization of cash sources and expenditures, and regularly comparing actual cash flow against projections. Restaurant owners should pay special attention to inventory costs, labor expenses, and revenue from different service segments. Consistent documentation and timely review of this analysis aid in sustaining profitability and optimizing financial strategies.

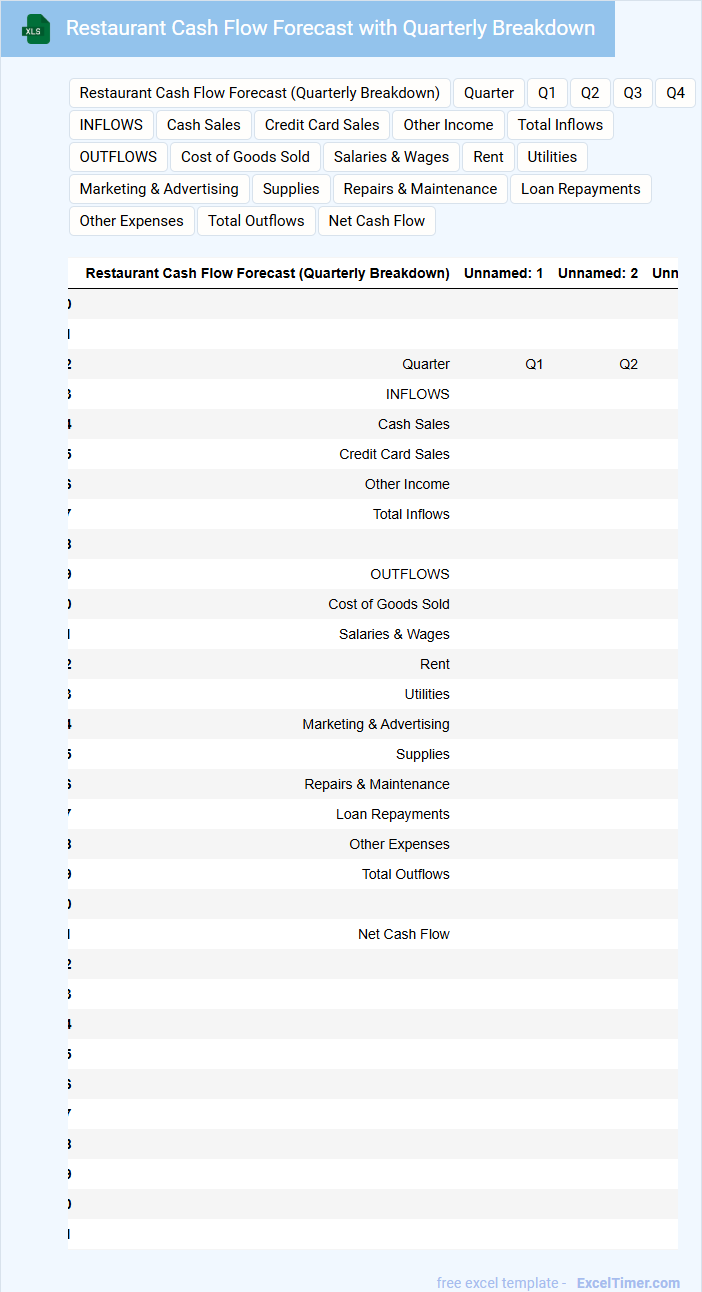

Restaurant Cash Flow Forecast with Quarterly Breakdown

A Restaurant Cash Flow Forecast with a quarterly breakdown is a financial document that outlines expected revenue and expenses over three-month periods to help manage liquidity. It typically includes projections of sales, operational costs, and cash inflows and outflows, enabling proactive financial planning. The quarterly segmentation aids in identifying seasonal trends and adjusting strategies accordingly.

Important considerations include accurately estimating variable costs such as food and labor, accounting for peak and off-peak seasons, and regularly updating the forecast based on actual performance. Incorporating contingency plans for unexpected expenses and aligning the forecast with marketing campaigns can enhance financial stability. Moreover, maintaining clear documentation of assumptions improves the reliability and usefulness of the forecast.

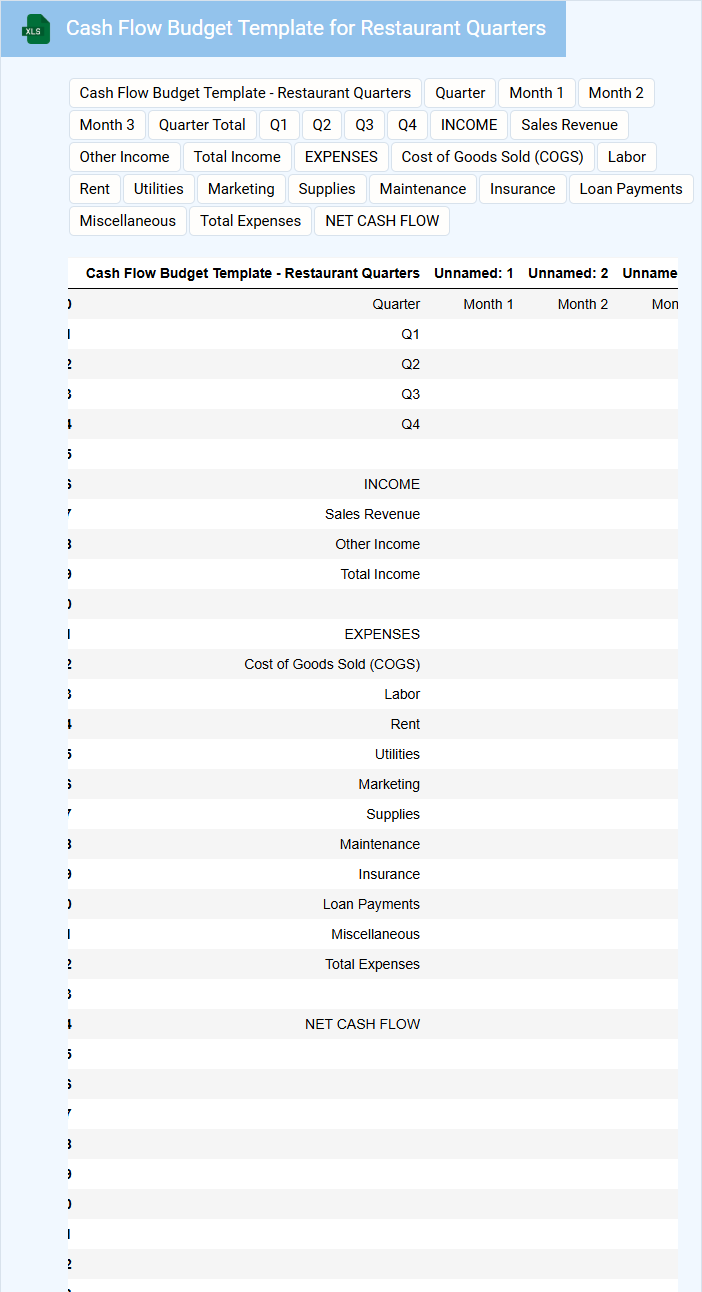

Cash Flow Budget Template for Restaurant Quarters

A Cash Flow Budget Template for restaurant quarters is a financial tool used to project and manage incoming and outgoing cash over specific three-month periods. It typically contains sections for estimated revenues, operating expenses, and net cash flow to help monitor liquidity. This template helps restaurant owners plan for fluctuations in sales and expenses due to seasonality or special events.

Important elements to include are detailed sales forecasts, fixed and variable costs, and contingency funds for unexpected expenses. Ensuring accuracy in estimating monthly cash inflows and outflows is crucial for maintaining operational stability. It also helps identify potential cash shortages early, allowing proactive financial decision-making.

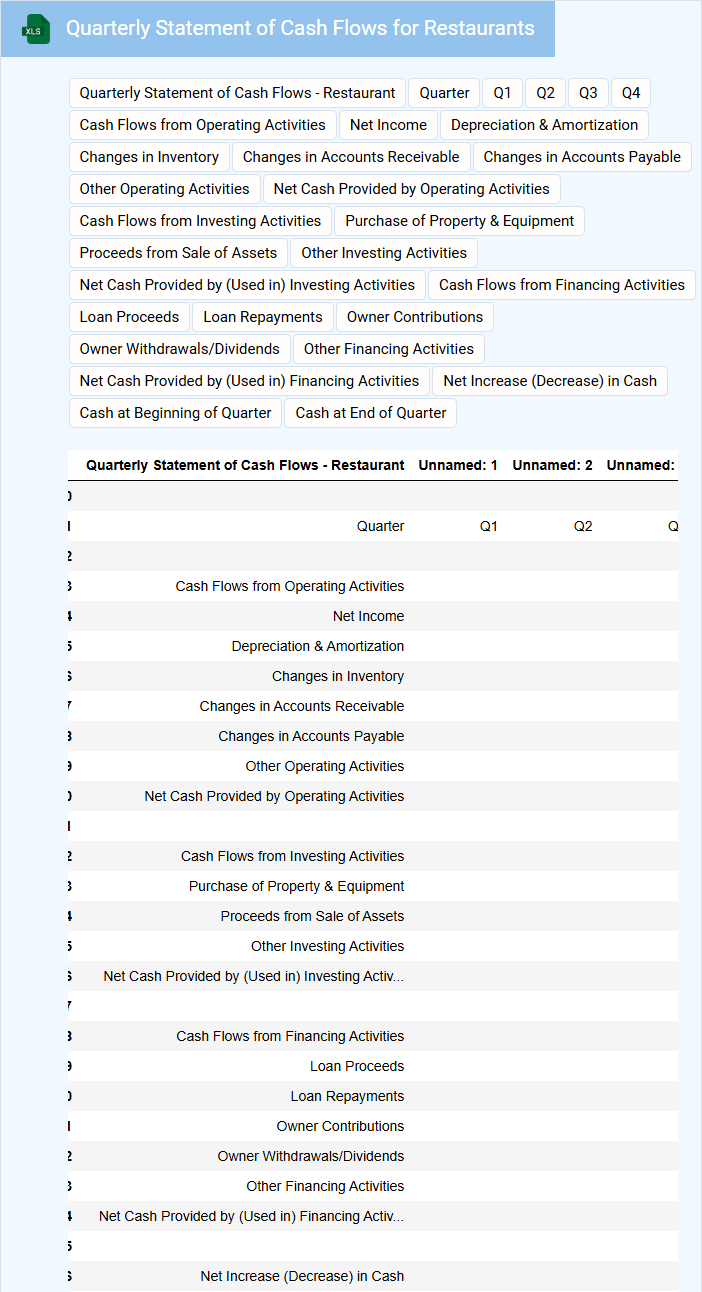

Quarterly Statement of Cash Flows for Restaurants

The Quarterly Statement of Cash Flows for restaurants provides a detailed overview of cash inflows and outflows during a three-month period. It typically includes operational cash from sales, investing activities such as equipment purchases, and financing activities like loan repayments. This document is essential for understanding the liquidity and financial health of a restaurant business.

Important aspects to focus on include cash generated from daily restaurant operations, seasonal fluctuations in revenue, and cash management related to inventory and payroll. Monitoring changes in cash position helps identify potential cash shortages or surpluses. Accurate recording of cash activities ensures better financial planning and informed decision-making for restaurant owners.

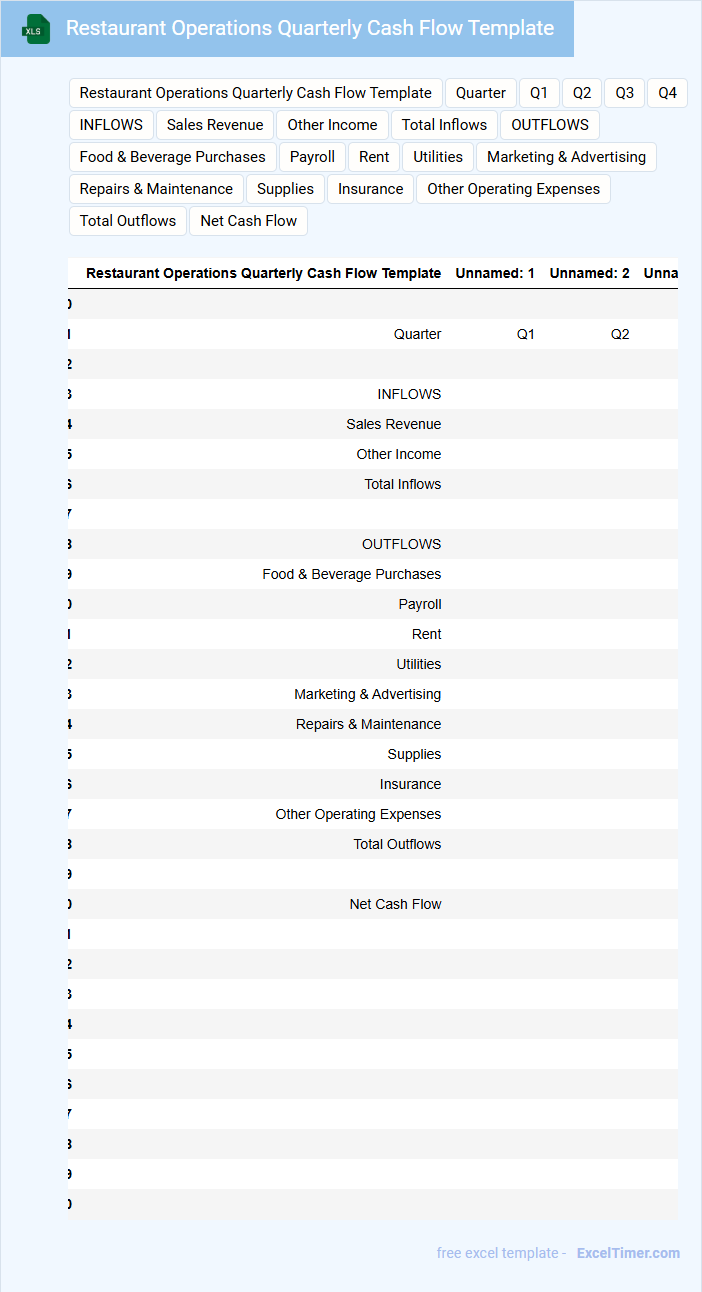

Restaurant Operations Quarterly Cash Flow Template

The Restaurant Operations Quarterly Cash Flow Template is a financial document that tracks the inflow and outflow of cash over a three-month period. It helps restaurant owners monitor liquidity and manage operational expenses effectively.

This template typically contains sections for sales revenue, payroll, inventory costs, and other operational expenditures. Regularly updating this document ensures better financial planning and informed decision-making.

Excel Tracker for Restaurant Quarterly Cash Flow

An Excel Tracker for Restaurant Quarterly Cash Flow is a structured spreadsheet used to monitor and analyze the financial inflows and outflows of a restaurant over a three-month period. It typically includes sections for revenue, expenses, and net cash flow to provide a clear picture of the business's economic health.

Such documents help restaurant owners and managers make informed financial decisions, identify trends, and plan budgets effectively. A crucial suggestion is to include detailed categories for all income sources and expenses to ensure accuracy and comprehensiveness in tracking.

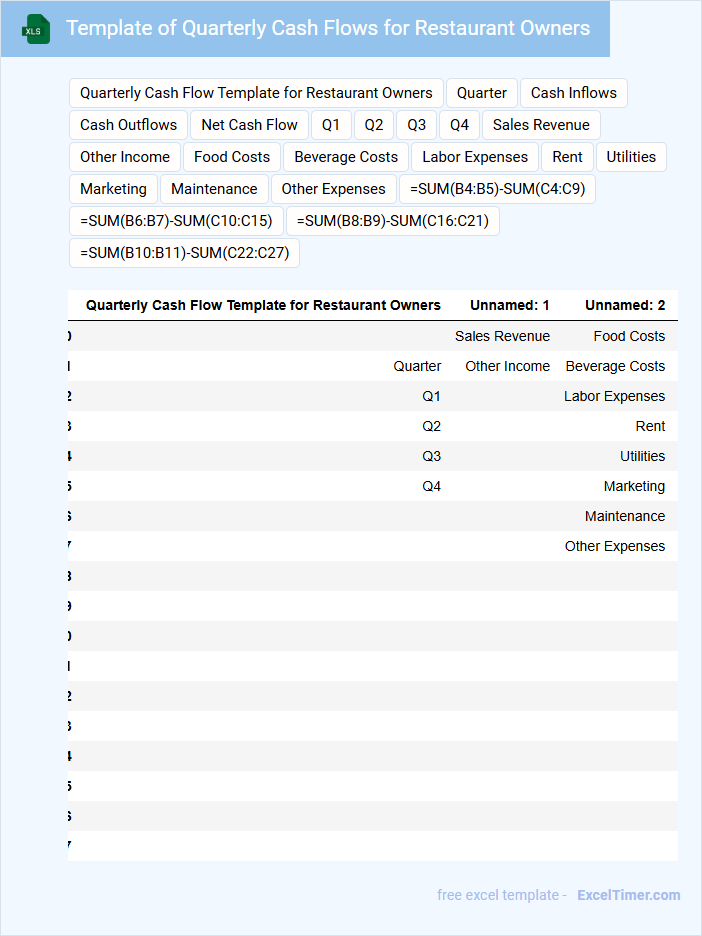

Template of Quarterly Cash Flows for Restaurant Owners

What information is typically included in a Template of Quarterly Cash Flows for Restaurant Owners? This document usually contains detailed breakdowns of cash inflows and outflows over a three-month period, including sales revenue, operating expenses, payroll, and capital expenditures. It helps restaurant owners monitor financial health, forecast future cash needs, and make informed decisions to sustain profitability.

Why is it important for restaurant owners to regularly update and review their cash flow templates? Regular updates ensure accurate tracking of earnings and expenses, enabling owners to identify trends, manage liquidity, and avoid cash shortages. Consistent review supports strategic planning, budgeting adjustments, and ultimately contributes to the long-term success of the business.

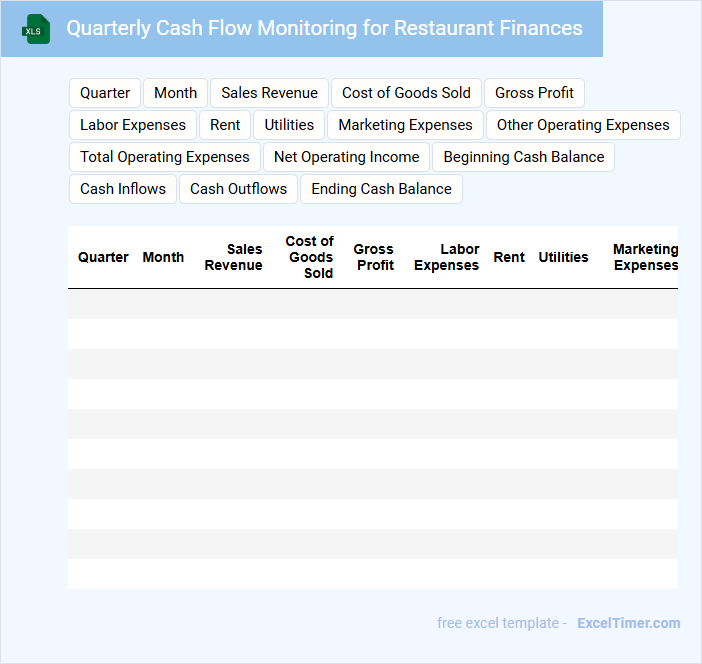

Quarterly Cash Flow Monitoring for Restaurant Finances

Quarterly Cash Flow Monitoring is a crucial financial document that tracks the inflow and outflow of cash within a restaurant over a three-month period. It typically contains detailed records of revenue, expenses, and net cash flow to provide a clear picture of the restaurant's liquidity and operational health. This document helps management make informed decisions regarding budgeting, cost control, and investment opportunities.

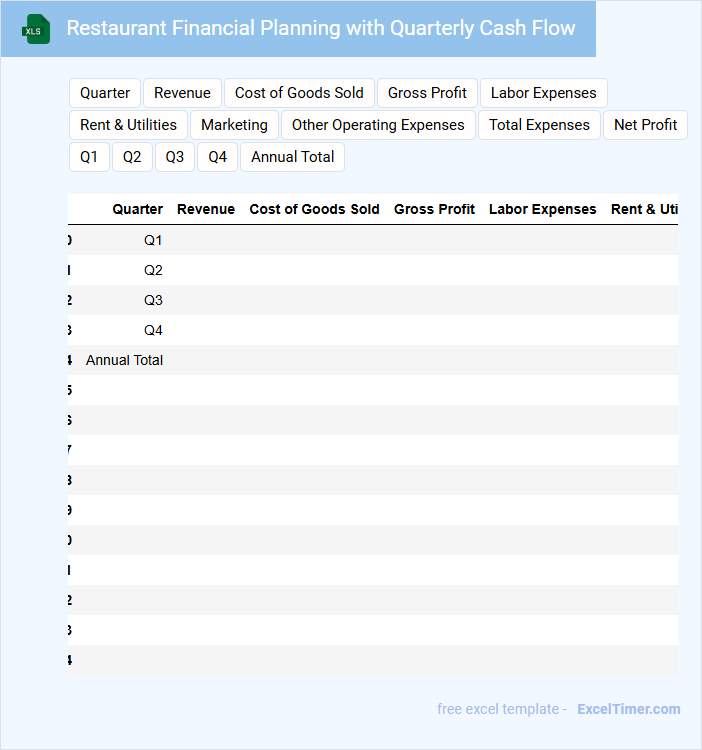

Restaurant Financial Planning with Quarterly Cash Flow

A Restaurant Financial Planning document with Quarterly Cash Flow typically contains detailed projections of income and expenses over a three-month period. It includes key financial statements such as profit and loss forecasts, cash flow statements, and budget allocations. This document is essential for managing the restaurant's liquidity and ensuring sustainable operations throughout the quarters.

Important considerations for this document include accurate sales forecasting based on seasonal trends, monitoring food and labor costs closely, and planning for unexpected expenses. It's crucial to regularly update the projections to reflect actual performance and adjust strategies accordingly. Additionally, maintaining a buffer for capital expenditures and emergency funds enhances the restaurant's financial resilience.

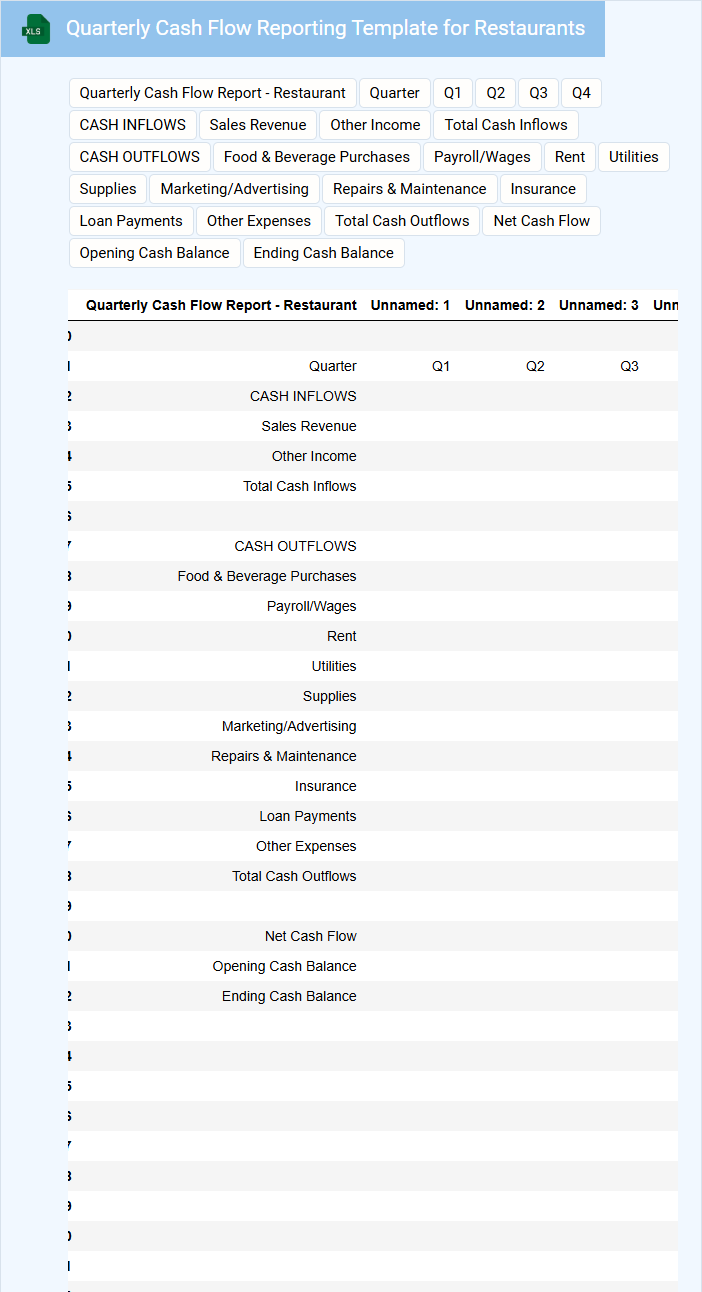

Quarterly Cash Flow Reporting Template for Restaurants

A Quarterly Cash Flow Reporting Template for restaurants typically contains detailed records of all cash inflows and outflows over a three-month period. It includes sections for operating activities, investing activities, and financing activities to provide a clear picture of the restaurant's liquidity.

Accurate tracking of revenues from sales, expenses such as food costs and wages, and capital expenditures are crucial components. For effective use, it is important to regularly update this document and analyze trends to ensure financial stability and informed decision-making.

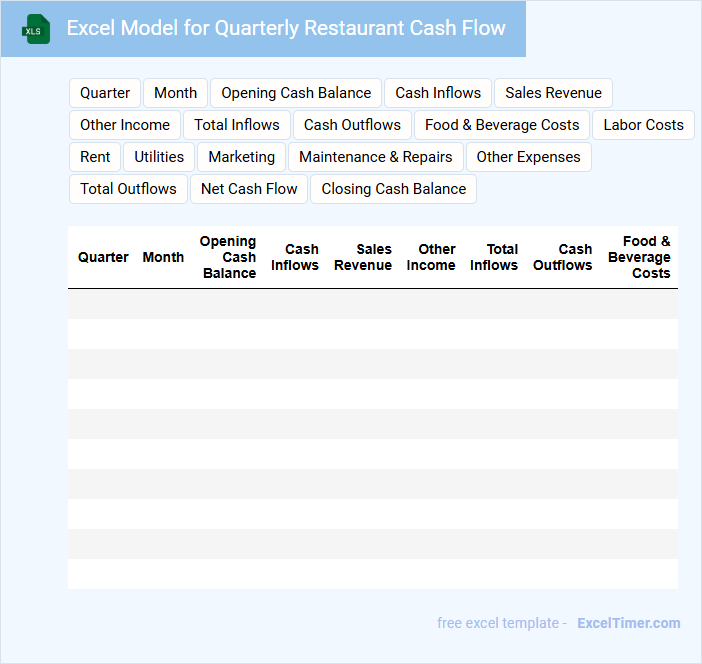

Excel Model for Quarterly Restaurant Cash Flow

An Excel Model for Quarterly Restaurant Cash Flow is a financial tool designed to project and analyze the cash inflows and outflows of a restaurant over a three-month period. It helps restaurant owners and managers make informed decisions regarding budgeting and financial planning.

- Include detailed revenue streams such as dine-in, takeout, and catering sales.

- Incorporate all operating expenses including payroll, inventory, and utilities.

- Track seasonal fluctuations and one-time expenses to maintain accurate cash flow forecasts.

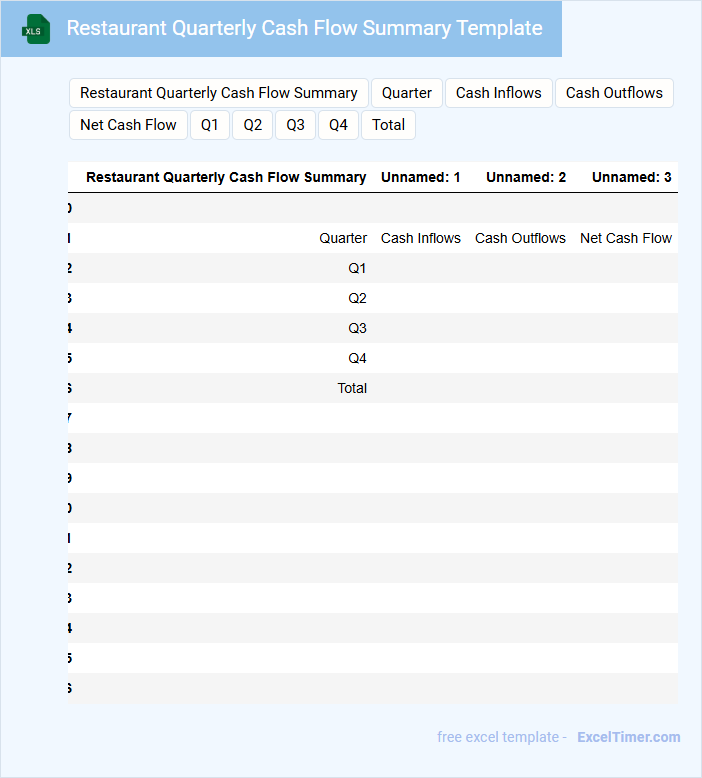

Restaurant Quarterly Cash Flow Summary Template

The Restaurant Quarterly Cash Flow Summary Template typically contains detailed records of cash inflows and outflows over a three-month period, helping to monitor the financial health of the business. It includes sections for revenue from sales, operating expenses, and net cash flow to provide a clear overview of liquidity. Using this template assists restaurant managers in forecasting budgets and making informed decisions.

Important factors to consider when using the template include accurately recording all sources of income and expenses, regularly updating the data to reflect real-time financial status, and analyzing trends to optimize operational costs. Ensuring clarity and consistency in the document enhances its usefulness for quarterly financial reviews and strategic planning.

What are the main components of quarterly cash flow specific to restaurant operations?

Quarterly cash flow for restaurants includes operating cash flow from daily sales, investing cash flow related to equipment purchases or renovations, and financing cash flow involving loans or investor funds. Your focus should be on managing revenue from food and beverage sales, payroll expenses, inventory costs, and seasonal variations. Accurate tracking of these components ensures effective financial planning and sustainable restaurant operations.

How does seasonality affect the quarterly cash flow statements in restaurants?

Seasonality in restaurants causes significant fluctuations in quarterly cash flow, with peak periods generating higher revenue and off-peak quarters experiencing reduced income. Cash inflows often surge during holidays and tourist seasons, while expenses remain relatively fixed, impacting net cash flow variability. Accurate forecasting of seasonal trends is essential for effective cash management and liquidity planning in restaurant businesses.

What methods are used to forecast quarterly cash flow for restaurant businesses?

Quarterly cash flow for restaurant businesses is typically forecasted using historical sales data, expense trends, and seasonal demand analysis. You can enhance accuracy by incorporating inventory turnover rates and labor cost fluctuations. Advanced methods also include regression analysis and scenario planning tailored to restaurant operations.

Which key expenses most significantly impact a restaurant's quarterly cash flow?

Key expenses that most significantly impact your restaurant's quarterly cash flow include food and beverage costs, labor expenses, and rent or lease payments. Monitoring utility bills and equipment maintenance also plays a crucial role in managing cash flow fluctuations. Accurate tracking of these expenses ensures better financial planning and sustainability.

How can analyzing quarterly cash flow help in identifying trends or issues in restaurant profitability?

Analyzing quarterly cash flow reveals patterns in revenue and expenses, highlighting seasonal fluctuations and cost inefficiencies in restaurants. This insight enables early identification of cash shortages or profit declines that affect operational stability. Monitoring these trends supports informed decisions to optimize profitability and manage financial risks.