![]()

The Quarterly Donation Tracking Excel Template for Charities streamlines the process of recording and analyzing donations received every quarter, allowing organizations to maintain accurate financial records. It includes features like donor details, donation amounts, and summary charts to help track fundraising progress effectively. Ensuring regular updates and data accuracy is crucial for transparent reporting and strategic planning.

Quarterly Donation Tracking Spreadsheet for Charities

What information is typically included in a Quarterly Donation Tracking Spreadsheet for Charities? This document usually contains details such as donor names, donation amounts, dates, and designation of funds to ensure accurate and organized record-keeping. It helps charities monitor donation trends, prepare financial reports, and maintain transparency and accountability with stakeholders.

What is an important consideration when creating this spreadsheet? Ensuring data accuracy and consistent formatting is crucial for reliable tracking and analysis. Additionally, including summary sections and visual charts can enhance the understanding of donation patterns and support strategic planning.

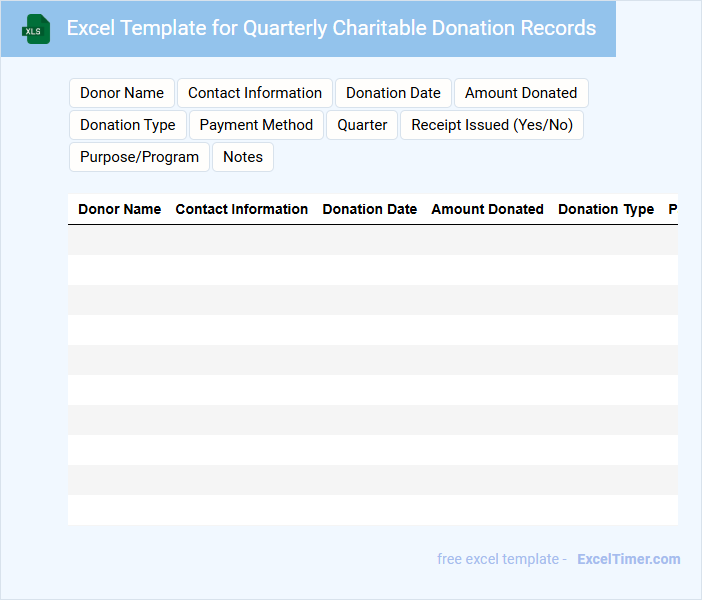

Excel Template for Quarterly Charitable Donation Records

An Excel Template for Quarterly Charitable Donation Records typically contains detailed entries of donations made over a three-month period. This includes donor names, amounts, dates, and purposes of each contribution.

Such a document is essential for tracking giving patterns and ensuring accurate financial reporting. It is important to regularly update the template to maintain compliance with tax regulations.

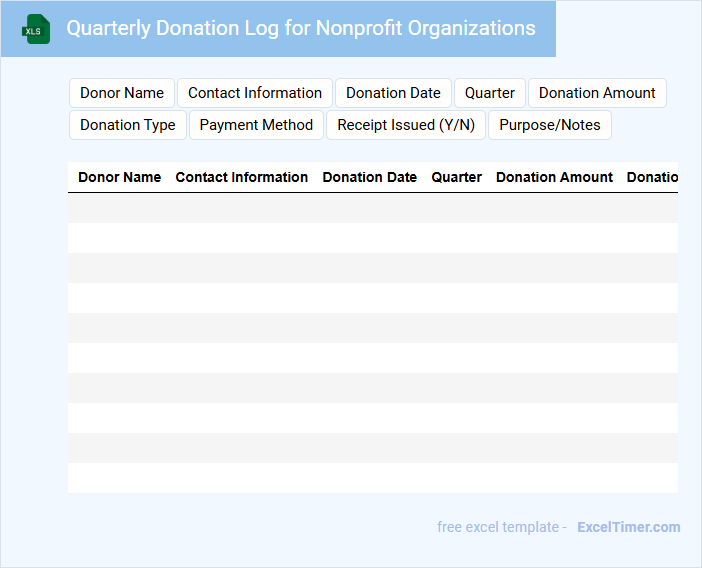

Quarterly Donation Log for Nonprofit Organizations

The Quarterly Donation Log for nonprofit organizations typically contains detailed records of all donations received within a three-month period. It includes donor information, donation amounts, and dates to ensure accurate tracking and accountability. Maintaining a comprehensive and organized log helps nonprofits demonstrate transparency and manage their fundraising efforts effectively.

Key elements to include are donor contact details, donation category (e.g., monetary, in-kind), and any restrictions or designations on the funds. It's important to regularly update the log and securely store it to comply with legal requirements and build donor trust. Additionally, summarizing donation trends quarterly can assist in strategic planning and reporting.

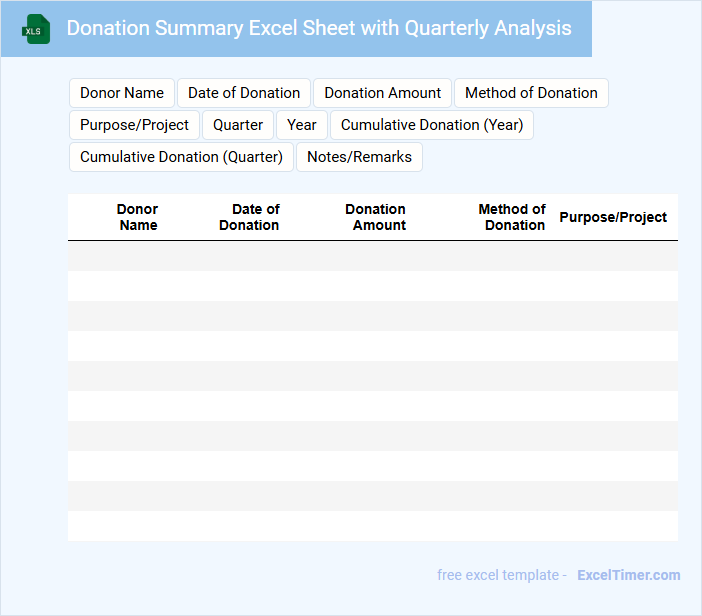

Donation Summary Excel Sheet with Quarterly Analysis

Donation Summary Excel Sheets with Quarterly Analysis typically contain a detailed record of donations received, categorized by time periods for effective tracking and reporting.

- Donation Amounts: Comprehensive tracking of total and individual donor contributions over each quarter.

- Donor Information: Accurate and updated contact details and donation history for better relationship management.

- Quarterly Trends: Analytical insights highlighting patterns, growth, or decline in donation flows each quarter.

Quarterly Gift Tracking Dashboard for Charitable Foundations

The Quarterly Gift Tracking Dashboard is a comprehensive report that consolidates donation data for charitable foundations, enabling stakeholders to monitor giving patterns over time. It typically contains detailed records of donor contributions, categorized by date, amount, and campaign, providing clear insights into fundraising effectiveness. An important consideration is to ensure accurate real-time data updates and graphical representations for easier interpretation and strategic planning.

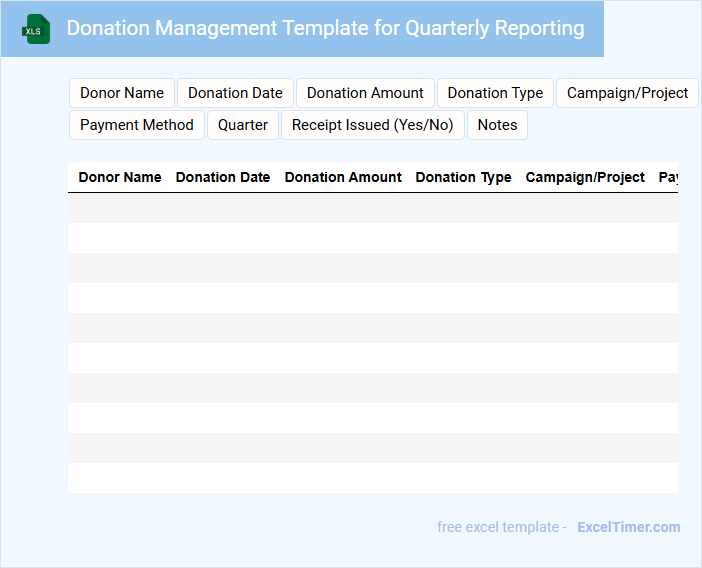

Donation Management Template for Quarterly Reporting

What key information does a Donation Management Template for Quarterly Reporting usually contain? This document typically includes details of all donations received, categorized by source, date, and amount to facilitate accurate tracking. It also summarizes the allocation and utilization of funds to ensure transparency and effective donor communication.

Why is organizing and regularly updating a Donation Management Template important? Keeping this template current helps in generating timely reports for stakeholders and supports compliance with financial regulations. It also aids in evaluating fundraising strategies and planning future campaigns effectively.

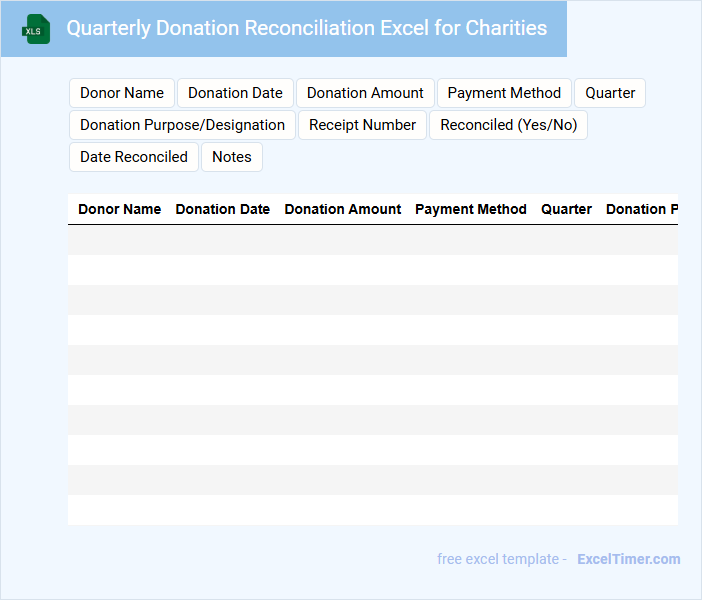

Quarterly Donation Reconciliation Excel for Charities

The Quarterly Donation Reconciliation document is essential for charities to ensure accurate tracking of incoming funds over a three-month period. It typically contains detailed records of donations received, categorized by source and date. Maintaining this document helps organizations verify financial integrity and prepare for audits.

Financial Tracking for Quarterly Donations Excel

This document typically contains detailed records of donations received each quarter to assist in financial tracking and reporting.

- Donor Information: Includes names, contact details, and contribution amounts for accurate record-keeping.

- Quarterly Totals: Summarizes donations by quarter to monitor trends and cash flow.

- Expense Tracking: Records any related expenses to ensure proper budget management and transparency.

Excel Tracker with Quarterly Contributions for Nonprofits

An Excel Tracker with Quarterly Contributions for Nonprofits is a document designed to monitor and organize financial donations over quarterly periods. It typically contains detailed records of donor names, contribution amounts, and dates, facilitating easy tracking of fundraising progress. This tool helps nonprofits maintain transparency, accountability, and strategic planning for future campaigns.

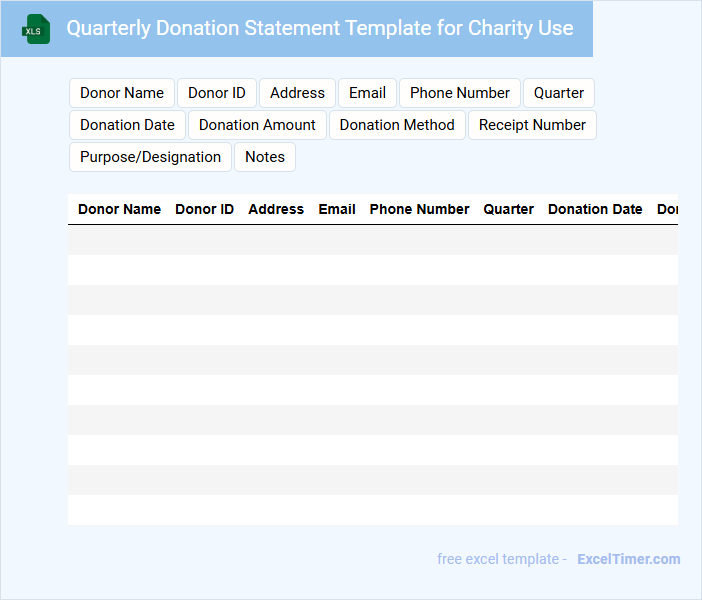

Quarterly Donation Statement Template for Charity Use

The Quarterly Donation Statement is a crucial document for charities that provides donors with a detailed summary of their contributions over a three-month period. It typically includes the donor's name, donation amounts, dates, and any relevant tax information.

Ensuring transparency and trust, this document helps maintain accurate records and aids in tax deductions for donors. Including a clear summary and a thank-you message is an important suggestion for enhancing donor relations.

Quarterly Fundraising and Donation Tracking for Charities

The Quarterly Fundraising and Donation Tracking document typically contains detailed summaries of funds raised, donor information, and allocation of resources over a three-month period. It helps charities monitor financial progress and identify trends in donor behavior to optimize future campaigns. Ensuring accurate data entry and timely updates is crucial for transparent reporting and effective decision-making.

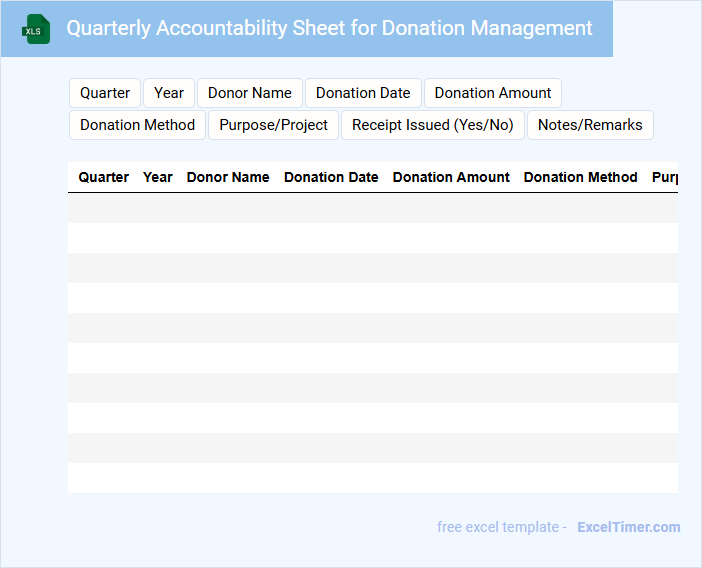

Quarterly Accountability Sheet for Donation Management

A Quarterly Accountability Sheet for Donation Management typically contains detailed records of all donations received and their subsequent allocation over a three-month period. It ensures transparency by documenting donor information, donation amounts, and how funds are utilized. This sheet helps organizations maintain trust and comply with financial regulations. Important elements include accurate transaction logs, clear categorization of funds, and regular reconciliation to prevent discrepancies.

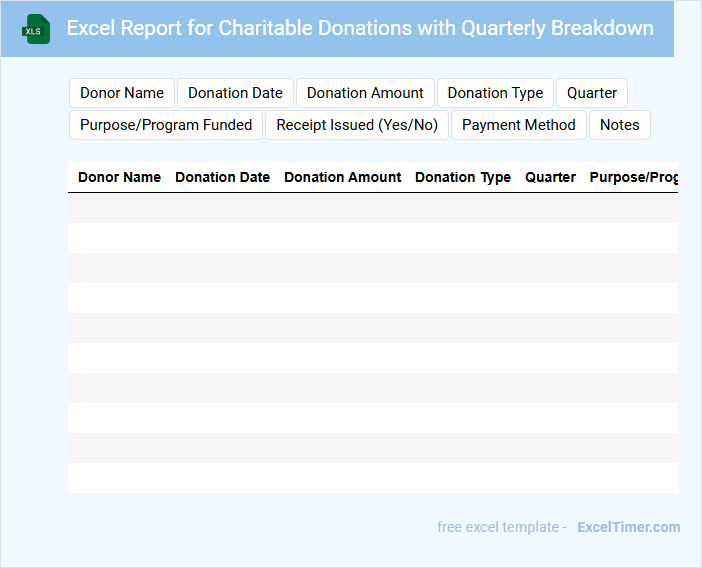

Excel Report for Charitable Donations with Quarterly Breakdown

An Excel report for charitable donations with quarterly breakdown typically summarizes donation data and trends over each quarter to aid in financial analysis and planning.

- Donation Summary: An overview of total donations received, categorized by source or campaign.

- Quarterly Breakdown: Detailed insights into donations collected each quarter to identify seasonal trends or impacts.

- Impact Analysis: Correlation between donation amounts and charitable activities or outcomes to evaluate effectiveness.

Quarterly Donor Contribution Tracker for Nonprofits

What information is typically included in a Quarterly Donor Contribution Tracker for Nonprofits? This document usually contains detailed records of donor contributions received within a quarter, including donor names, donation amounts, dates, and donation types. It helps nonprofits monitor giving patterns, manage donor relationships, and assess fundraising progress.

What is an important feature to include in a Quarterly Donor Contribution Tracker? It is essential to incorporate clear categorization of donation sources, like individual, corporate, or foundation gifts, along with trending visualizations to quickly identify changes in fundraising performance. This ensures effective analysis and strategic planning for future campaigns.

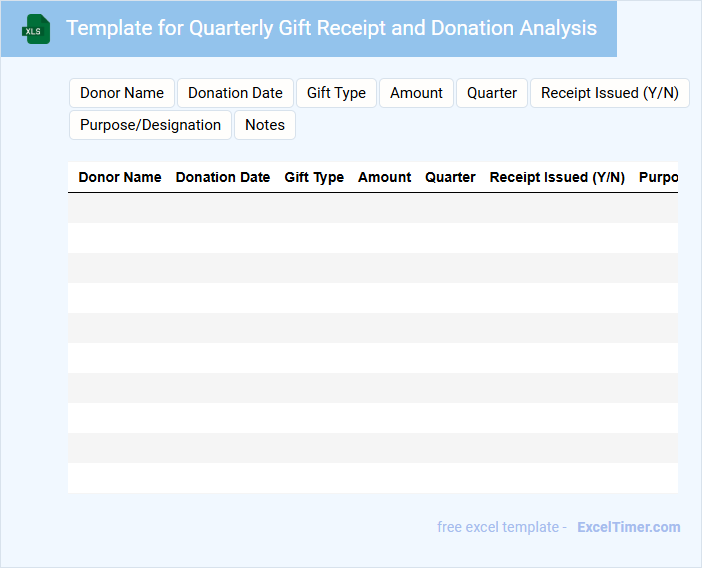

Template for Quarterly Gift Receipt and Donation Analysis

This Template for Quarterly Gift Receipt and Donation Analysis is typically used to systematically record and review contributions received within a specific quarter. It helps organizations track donation amounts, donor details, and the timing of gifts to ensure accurate financial reporting. Including a clear summary of donation trends and any notable changes in donor behavior is essential for strategic planning. For optimal use, ensure the template allows easy data entry, categorization of gift types, and supports visual representations like charts or graphs.

How does the Excel document categorize and summarize donations by quarter for effective tracking?

The Excel document categorizes donations by organizing data into quarterly columns labeled Q1, Q2, Q3, and Q4. It uses formulas to calculate total donations per quarter and overall annual contributions for each charity. Pivot tables and charts summarize the data visually, enhancing the effectiveness of quarterly donation tracking.

What key donor information (e.g., name, contact, donation amount) is recorded for each quarterly entry?

Your quarterly donation tracking includes key donor information such as the donor's full name, contact details (phone number and email), and the exact donation amount. This data is essential for accurate record-keeping and personalized communication with each supporter. Tracking these details quarterly helps charities analyze giving patterns and improve fundraising strategies.

How are running totals and quarterly comparisons visualized within the spreadsheet?

Running totals in the Quarterly Donation Tracking spreadsheet are visualized using cumulative sum columns that update each quarter. Quarterly comparisons are displayed through bar charts and color-coded conditional formatting to highlight increases or decreases. Pivot tables summarize donation trends, providing clear insights into performance across different quarters.

What methods are used in the document to flag missing, duplicate, or suspicious donation entries per quarter?

Your Quarterly Donation Tracking Excel document uses conditional formatting to flag missing donations by highlighting empty cells, applies duplicate value rules to identify repeated entries, and incorporates data validation along with custom formulas to detect suspicious donation amounts or irregular patterns each quarter. These methods enhance data accuracy and streamline review processes for charities. Regular updates ensure ongoing integrity in donation records across all reporting periods.

How does the Excel file facilitate reporting or exporting of quarterly donation data for stakeholders or audits?

The Excel file organizes quarterly donation data into clear, customizable tables and charts, enabling easy generation of detailed reports for stakeholders. You can export the data into multiple formats such as PDF or CSV, ensuring seamless sharing and compliance during audits. Built-in filters and pivot tables enhance accuracy and speed in summarizing donation trends and financial summaries.