The Quarterly Loan Amortization Excel Template for Real Estate Investors simplifies tracking loan payments by breaking down principal and interest on a quarterly basis. This tool helps investors accurately forecast cash flow and manage loan repayment schedules efficiently. Customizable fields allow users to input varying interest rates and loan terms specific to real estate investments.

Quarterly Loan Amortization Schedule for Real Estate Investors

What information is typically included in a Quarterly Loan Amortization Schedule for Real Estate Investors? This document usually contains detailed breakdowns of loan payments, including principal and interest amounts, payment dates, and remaining balances for each quarter. It helps investors track their loan repayment progress and plan their financial strategies effectively.

What important elements should be considered in this schedule? It is crucial to accurately reflect interest rates, payment frequency, and any additional fees or prepayments to ensure precise forecasting. This allows investors to manage cash flow, anticipate future obligations, and optimize their investment decisions.

Real Estate Investor Quarterly Loan Repayment Tracker

A Real Estate Investor Quarterly Loan Repayment Tracker is a financial document used to monitor and record loan repayments over a three-month period. It helps investors keep track of payment schedules, amounts, and balances for multiple loans.

- Include detailed loan information such as principal, interest rate, and payment due dates.

- Track each payment's status to ensure timely repayments and avoid penalties.

- Summarize quarterly totals to analyze cash flow and investment performance.

Excel Template for Quarterly Loan Amortization in Real Estate

An Excel Template for Quarterly Loan Amortization in Real Estate is typically used to track loan repayments and interest calculations over time. It provides a clear financial overview assisting in budget planning and investment analysis.

- Include columns for principal, interest, and remaining balance per quarter.

- Incorporate formulas to automatically calculate interest based on the outstanding loan balance.

- Ensure clear labeling and formatting for ease of understanding and presentation.

Loan Amortization with Quarterly Payments for Real Estate Assets

A Loan Amortization document typically outlines the repayment schedule of a loan, detailing principal and interest payments over time. For real estate assets, it emphasizes the periodic payments required to retire the loan balance, often incorporating adjustments for property-related expenses. Quarterly payments indicate that installments are due every three months, affecting cash flow and budgeting considerations.

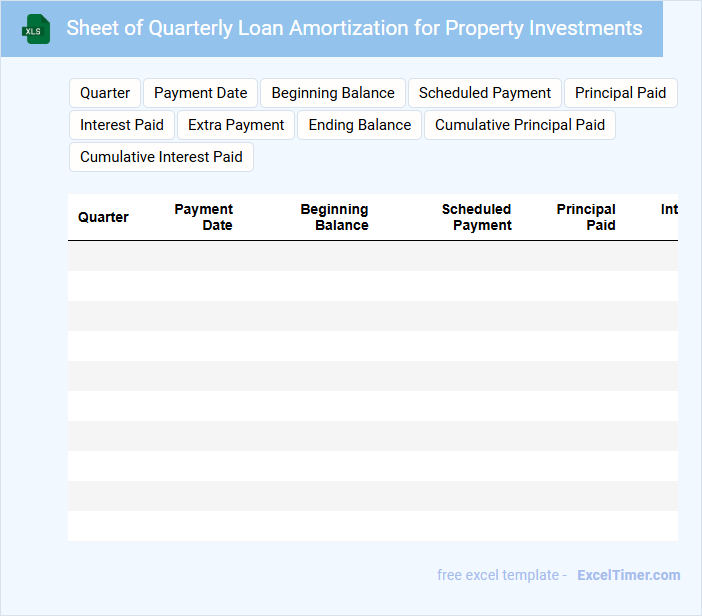

Sheet of Quarterly Loan Amortization for Property Investments

A Sheet of Quarterly Loan Amortization typically contains detailed schedules outlining the repayment of loans over each quarter, including principal, interest, and remaining balance. It is essential for property investors to track their loan payments accurately to manage cash flow and forecast future expenses. Ensuring the document includes clear quarterly summaries and the impact on equity can greatly improve financial decision-making.

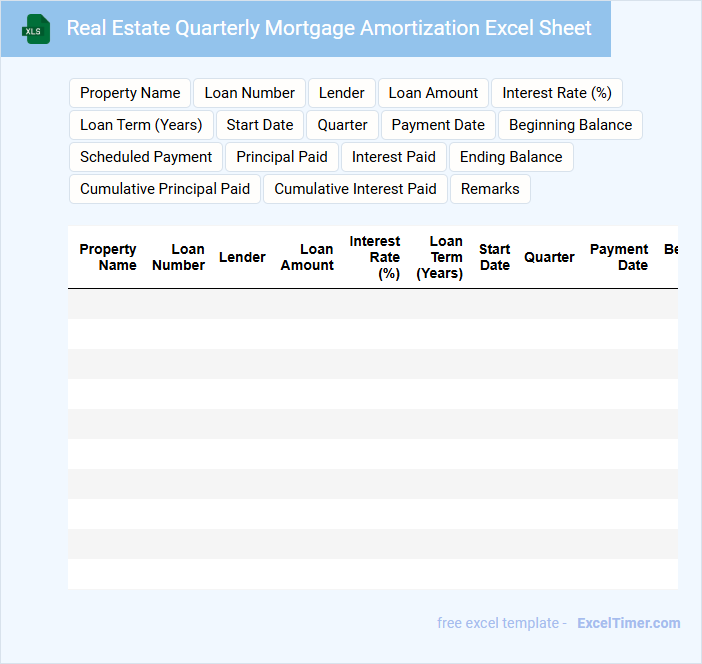

Real Estate Quarterly Mortgage Amortization Excel Sheet

This type of document typically contains a detailed breakdown of mortgage payments over a quarter, illustrating principal and interest components.

- Payment Schedule: Clearly outlines each payment date and amount to track timely repayments.

- Interest vs Principal: Distinguishes between interest paid and principal reduced for financial clarity.

- Total Outstanding Balance: Shows the remaining loan balance after each payment to monitor progress.

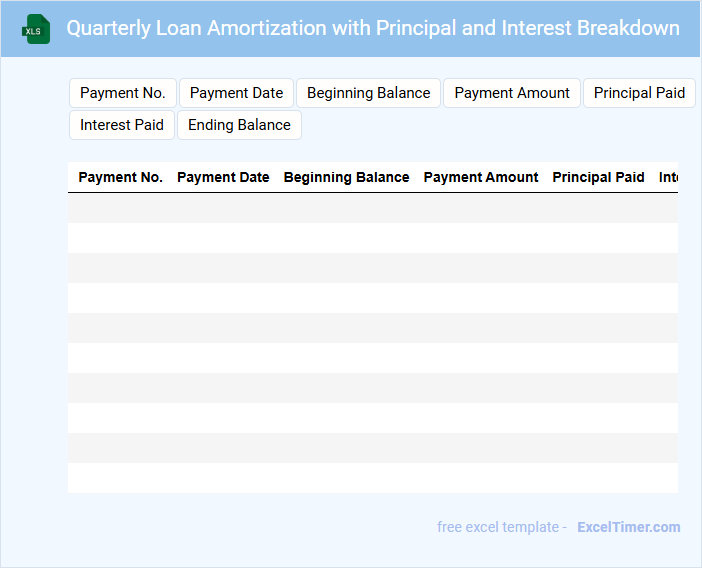

Quarterly Loan Amortization with Principal and Interest Breakdown

A Quarterly Loan Amortization document typically outlines the scheduled loan repayments, detailing principal and interest components for each quarter.

- Payment Schedule: Clearly lists payment dates and amounts for effective financial planning.

- Principal vs. Interest Breakdown: Distinguishes the portions of each payment applied to loan balance and interest accrued.

- Remaining Balance: Shows outstanding loan amount after each payment for accurate tracking of debt reduction.

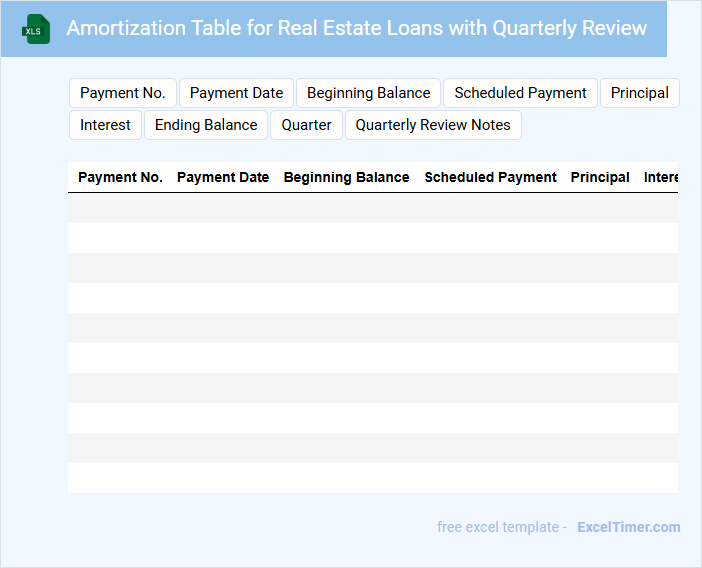

Amortization Table for Real Estate Loans with Quarterly Review

An Amortization Table for real estate loans provides a detailed breakdown of each payment over the loan's life, showing principal and interest amounts. It is typically reviewed quarterly to track loan repayment progress and assess financial standing. Important factors to consider include remaining balance, interest rate fluctuations, and payment schedule adjustments.

Investment Property Quarterly Loan Amortization Tracker

Investment Property Quarterly Loan Amortization Trackers typically contain detailed schedules of loan repayments specific to investment properties, helping owners monitor their financial obligations over time.

- Accurate Payment Records: Ensuring each payment's principal and interest breakdown is precisely documented.

- Quarterly Updates: Regularly reviewing the amortization to adjust for interest rate changes or additional payments.

- Investment Performance Insight: Using the tracker to evaluate how loan payments impact overall property return on investment.

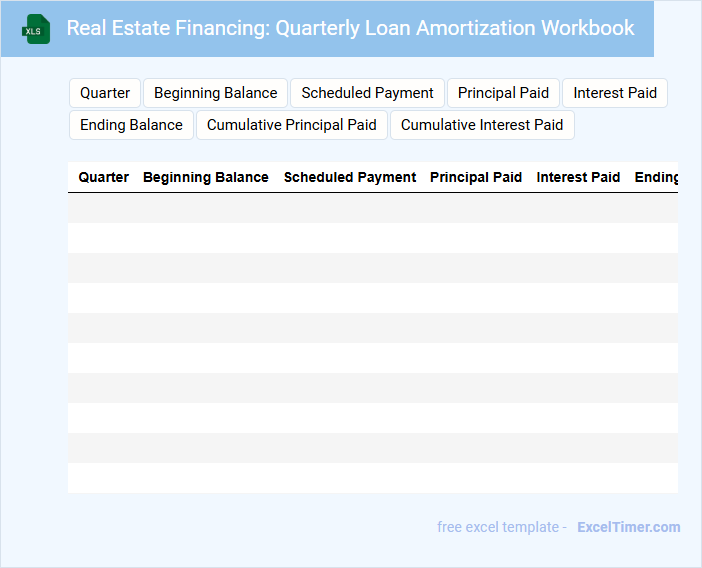

Real Estate Financing: Quarterly Loan Amortization Workbook

The Real Estate Financing Quarterly Loan Amortization Workbook typically contains detailed schedules outlining loan repayment plans, including principal and interest breakdowns. It helps borrowers and lenders track outstanding balances and payment timelines effectively.

This document is essential for managing cash flow and ensuring timely loan servicing in real estate projects. Regular updates and accuracy in data entry are crucial for maintaining financial clarity and planning.

Excel Tracker for Quarterly Amortization of Real Estate Loans

This type of document typically contains detailed financial data and schedules to monitor the amortization process of real estate loans on a quarterly basis.

- Loan Details: It includes principal, interest rates, payment dates, and outstanding balances essential for accurate tracking.

- Amortization Schedule: A systematic breakdown of payments showing principal and interest allocation over time.

- Summary Reports: Quarterly summaries highlight the total payments made, interest accrued, and remaining loan balance.

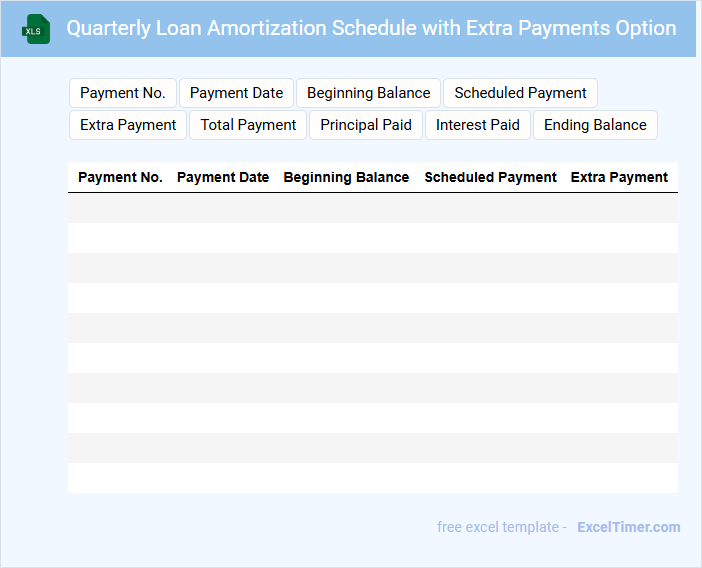

Quarterly Loan Amortization Schedule with Extra Payments Option

A Quarterly Loan Amortization Schedule with Extra Payments Option typically contains a detailed breakdown of loan payments, including principal and interest, on a quarterly basis and allows for adjustments reflecting additional payments.

- Payment Schedule: Clearly outlines payment dates and amounts for each quarter.

- Balance Tracking: Displays remaining loan balance after each payment to monitor progress.

- Extra Payments Impact: Shows how additional payments reduce the principal and shorten the loan term.

Sheet for Quarterly Loan and Interest Tracking for Investors

A Quarterly Loan and Interest Tracking Sheet typically contains detailed records of loan amounts, disbursement dates, interest rates, and payment schedules. It helps investors monitor the performance and returns on their loan investments over specific periods.

This type of document also includes calculations of accrued interest and outstanding balances to provide transparency and accuracy. Ensuring timely updates and reconciling entries are important practices for effective tracking.

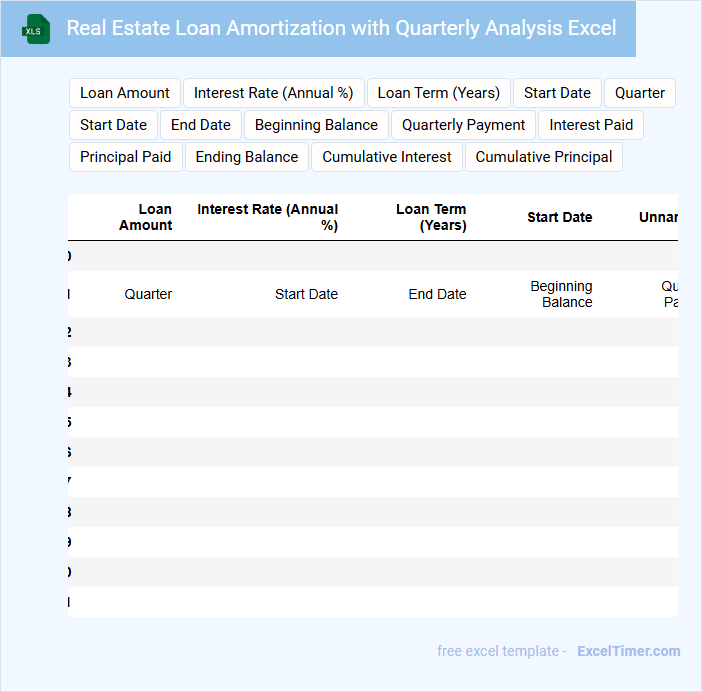

Real Estate Loan Amortization with Quarterly Analysis Excel

A Real Estate Loan Amortization document typically contains a detailed schedule of loan repayments, breaking down each payment into principal and interest components over time. It often includes a comprehensive analysis of the loan balance at quarterly intervals to help track progress and financial impact. This type of document is essential for borrowers and lenders to understand payment schedules, interest costs, and loan payoff timelines effectively.

For an Excel version with Quarterly Analysis, ensure it clearly separates each quarter's payments and interest calculations, includes formulas for accurate automatic updates, and provides a summary dashboard for quick financial insights. Visual aids like charts depicting remaining balance trends and interest vs. principal proportions enhance user understanding. Prioritize ease of input and flexibility to adjust loan terms such as interest rates or payment frequencies.

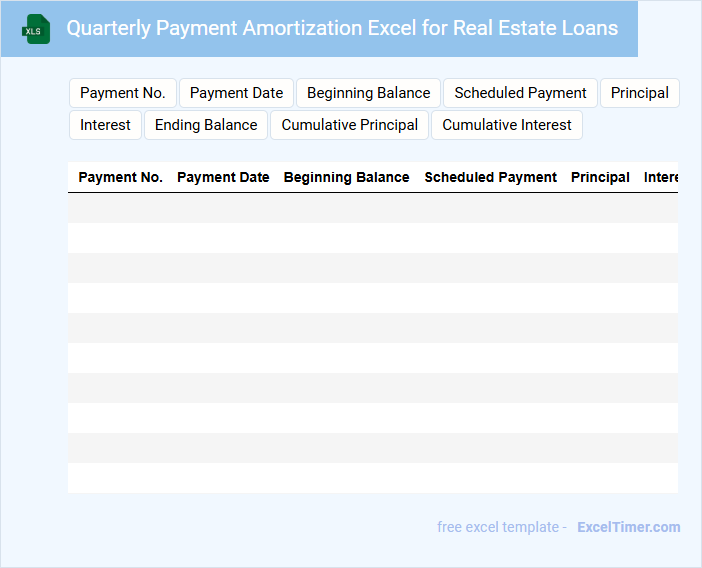

Quarterly Payment Amortization Excel for Real Estate Loans

Quarterly Payment Amortization Excel for Real Estate Loans typically contains detailed schedules showing payment amounts, interest calculations, and principal balances over the loan term.

- Payment Schedule: A clear breakdown of quarterly payments including both principal and interest.

- Interest Calculation: Accurate formulas to compute interest accrued on the outstanding loan balance each quarter.

- Balance Tracking: An updated loan balance after each payment to monitor amortization progress.

What is the purpose of a quarterly loan amortization schedule in analyzing real estate investments?

A quarterly loan amortization schedule helps real estate investors track principal and interest payments over time, providing clear insight into remaining loan balances. It enables accurate cash flow forecasting by detailing payment amounts every quarter, critical for investment viability analysis. This schedule supports financial planning by highlighting how debt service impacts overall investment returns and equity growth.

How does changing the interest rate impact the quarterly principal and interest payments on an amortization sheet?

Changing the interest rate directly affects your quarterly principal and interest payments by altering the cost of borrowing over the loan term. Higher interest rates increase the interest portion, raising each payment amount and extending the loan amortization period. Lower rates reduce interest expenses, allowing more of each payment to apply toward the principal and shortening the total repayment timeline.

Which Excel functions can be used to calculate remaining loan balance after each quarter?

Use the Excel function PMT to calculate the quarterly loan payment based on interest rate, loan amount, and loan term. Apply the IPMT function to determine the interest portion of each payment for a specific quarter. Calculate the remaining loan balance with the PPMT function or use the CUMPRINC function to find cumulative principal paid until a specific quarter, then subtract from the original loan amount.

What key columns should be included in a quarterly amortization table for real estate loans?

A quarterly loan amortization table for real estate investors should include the following key columns: Payment Date, Beginning Loan Balance, Quarterly Payment Amount, Principal Paid, Interest Paid, and Ending Loan Balance. Including an Interest Rate column helps clarify the cost of borrowing, while an Accrued Interest column provides insights into interest accumulation between payments. These columns offer a comprehensive view of loan repayment progression and cost distribution over each quarter.

How does the loan amortization schedule help project future cash flow and profit for real estate investors?

The Quarterly Loan Amortization schedule provides a detailed breakdown of principal and interest payments, enabling real estate investors to accurately forecast loan balances and interest expenses over time. This information helps you project future cash flow by identifying periods of higher or lower debt obligations, improving budgeting and investment decisions. Understanding amortization impacts profit calculation by clarifying how much of each payment contributes to equity growth versus interest costs.