The Quarterly Expense Report Excel Template for Freelancers provides a streamlined way to track and categorize expenses over a three-month period, helping freelancers manage their finances efficiently. It includes sections for income, business expenses, and savings, making tax season preparation simpler and reducing financial stress. Using this template ensures accurate record-keeping and enhances budget planning for freelance professionals.

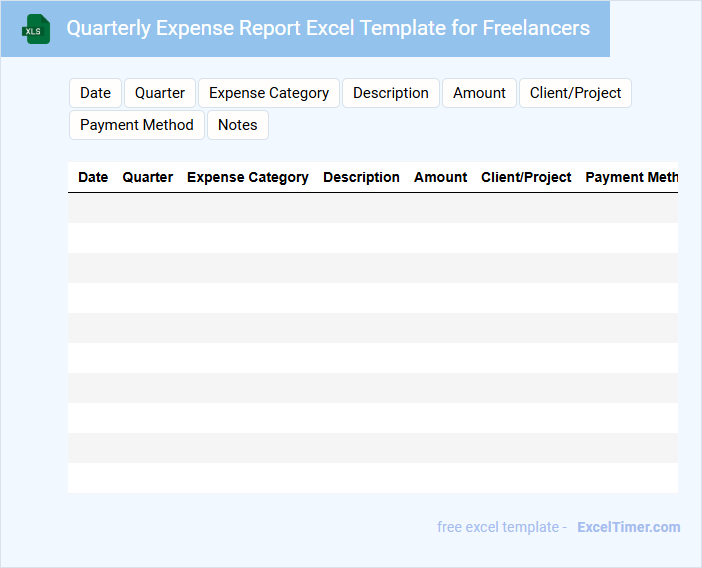

Quarterly Expense Report Excel Template for Freelancers

A Quarterly Expense Report Excel Template for freelancers is designed to track and organize financial transactions over a three-month period. It typically includes categories for income, expenses, receipts, and mileage, helping freelancers monitor their budget effectively.

This document is crucial for accurate tax preparation and financial planning, ensuring all deductible expenses are accounted for. One important suggestion is to regularly update the template to maintain up-to-date records and avoid last-minute inaccuracies.

Freelancers’ Quarterly Expense Tracking Sheet with Charts

A Freelancers' Quarterly Expense Tracking Sheet is a document designed to help independent professionals monitor their expenses over a three-month period. It typically includes detailed categories such as office supplies, travel costs, and software subscriptions to ensure comprehensive financial tracking.

These sheets often feature charts and graphs, providing visual insights into spending patterns and helping freelancers identify areas for budget optimization. Incorporating automated calculations and clear labeling can enhance accuracy and usability.

Excel Template for Quarterly Business Expenses of Freelancers

What information is typically included in an Excel template for quarterly business expenses of freelancers? This type of document usually contains categories for various expense types such as equipment, software, travel, and office supplies, organized by date and amount. It helps freelancers track their spending effectively and prepare accurate financial reports for tax and budgeting purposes.

What is an important feature to include in this template for better financial management? Including automatic calculations and summary totals can save time and reduce errors, while customizable categories ensure the template adapts to different freelancers' unique expense needs.

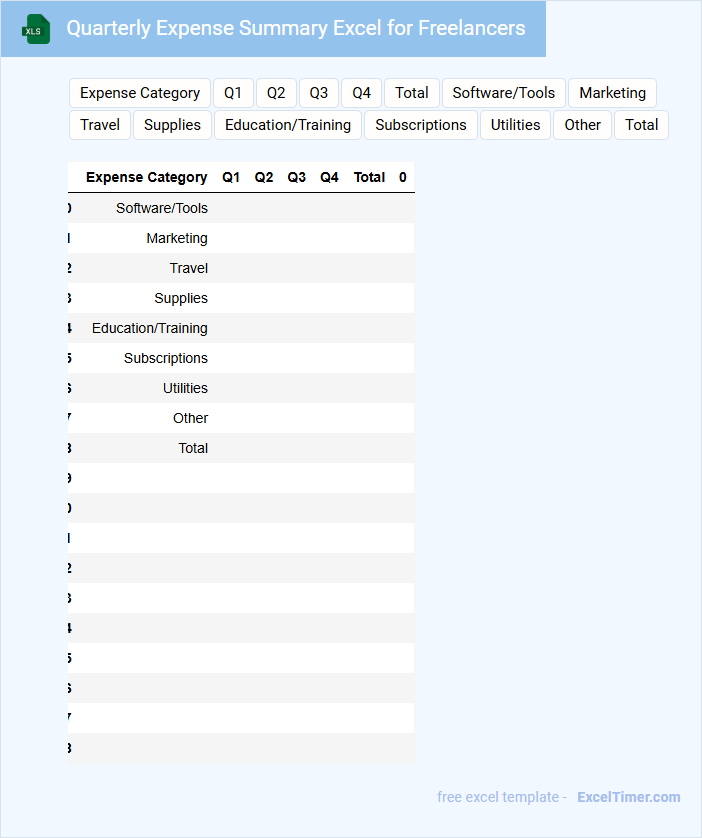

Quarterly Expense Summary Excel for Freelancers

The Quarterly Expense Summary document is an essential tool for freelancers to track and organize their expenditures over a three-month period. It typically contains detailed records of various expense categories, payment dates, and total amounts to help monitor cash flow effectively. Keeping this summary updated ensures accurate financial reporting and simplifies tax preparation.

Important elements to include are categorized expenses, dates of transactions, and total amounts, along with notes on business versus personal expenses for clarity. Utilizing formulas to automatically calculate totals and subtotals can save time and reduce errors. Additionally, maintaining receipts linked or referenced can support expense verification during audits.

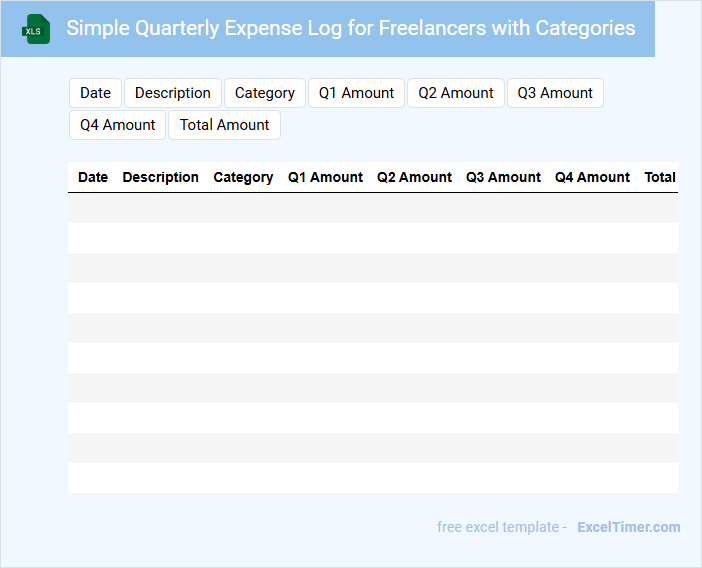

Simple Quarterly Expense Log for Freelancers with Categories

A Simple Quarterly Expense Log is a document designed to track and categorize expenses over a three-month period, specifically tailored for freelancers. It typically includes categories such as office supplies, travel, software subscriptions, and client-related costs to simplify financial management. Maintaining accurate and organized records in this log helps freelancers optimize tax deductions and budget effectively.

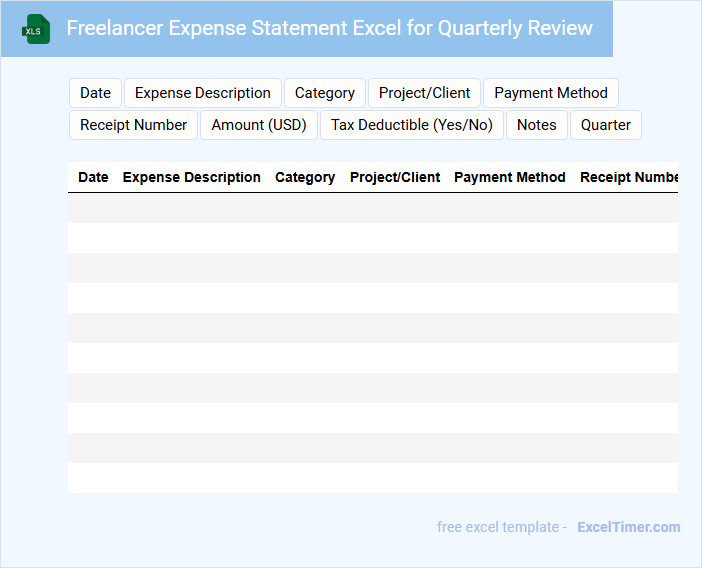

Freelancer Expense Statement Excel for Quarterly Review

A Freelancer Expense Statement Excel is typically a detailed record of all business-related expenses incurred by a freelancer during a specific period. It includes categories such as travel, supplies, software subscriptions, and client-related costs.

This document is essential for accurate quarterly financial review and tax preparation, ensuring all deductible expenses are properly tracked. Regular updates and proper categorization in the spreadsheet improve clarity and compliance.

To optimize its use, freelancers should consistently log every expense with relevant receipts and notes to support claims during audits.

Quarterly Freelance Income and Expense Tracker with Analysis

What information does a Quarterly Freelance Income and Expense Tracker with Analysis typically contain? This document usually includes detailed records of all income earned and expenses incurred over a three-month period, categorized for clarity. It also provides an analysis section that summarizes profitability trends and highlights areas for financial improvement.

Why is it important to maintain this tracker? Maintaining accurate and thorough records helps freelancers manage cash flow, prepare for taxes, and make informed business decisions. It is crucial to regularly update entries and review analysis to identify opportunities for cost reduction and revenue growth.

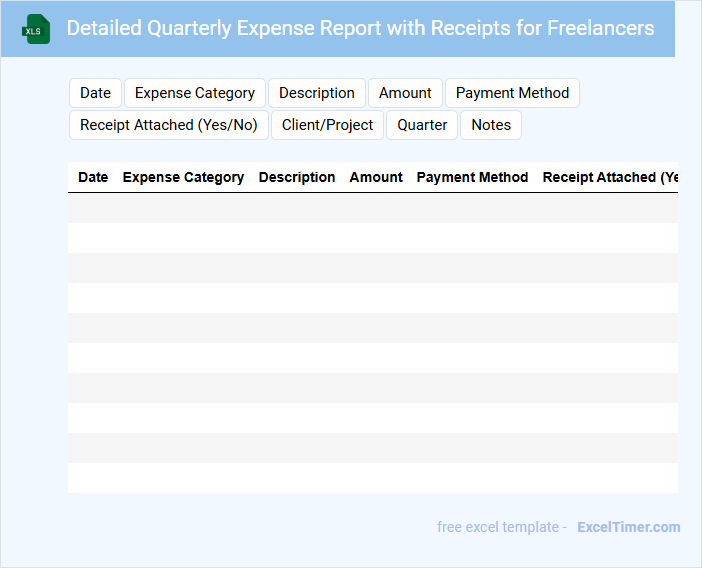

Detailed Quarterly Expense Report with Receipts for Freelancers

A Detailed Quarterly Expense Report for freelancers typically contains a comprehensive list of all business-related expenses incurred over the quarter, categorized by type and date. It includes digital or physical receipts as proof of each expenditure, ensuring transparency and accuracy. This document helps freelancers track spending and prepare for tax filings effectively.

Including essential details such as client names, project descriptions, and payment dates enhances the report's clarity and usefulness. Ensuring all receipts are organized and legible supports quicker reimbursements and smooth auditing processes. Regular updates and consistency are important to maintain financial control and reliability.

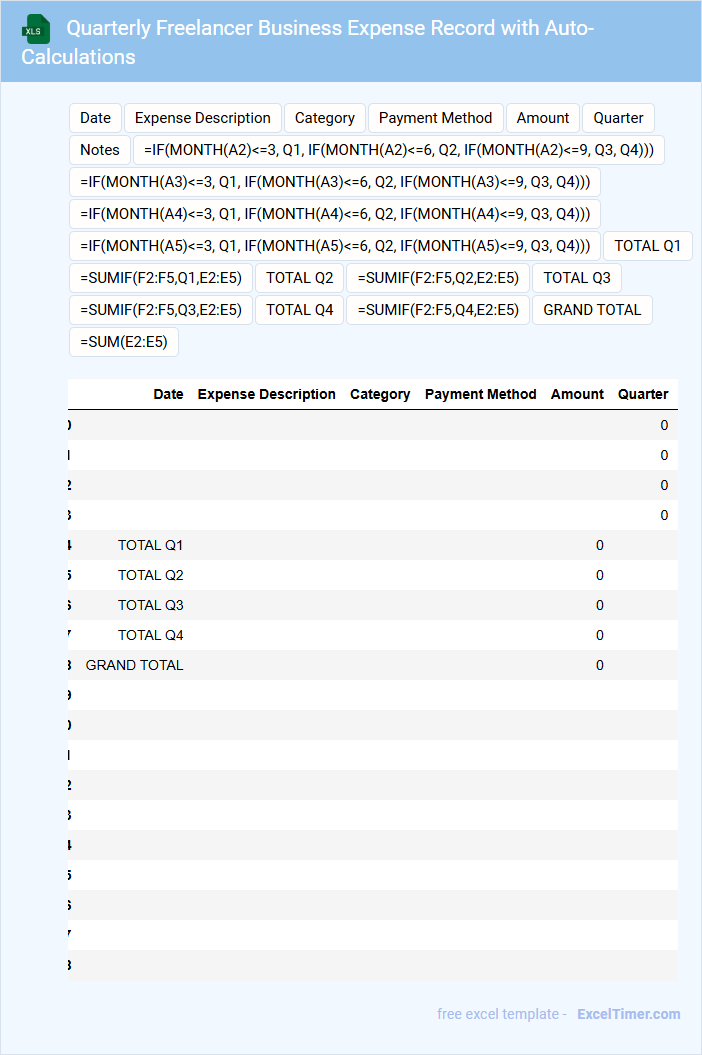

Quarterly Freelancer Business Expense Record with Auto-Calculations

This Quarterly Freelancer Business Expense Record typically contains detailed entries of all business-related expenses incurred over a three-month period. It includes categories such as office supplies, travel costs, and client meals, with auto-calculations to streamline financial tracking. Maintaining accurate records helps freelancers manage budgets, prepare taxes, and analyze spending patterns effectively.

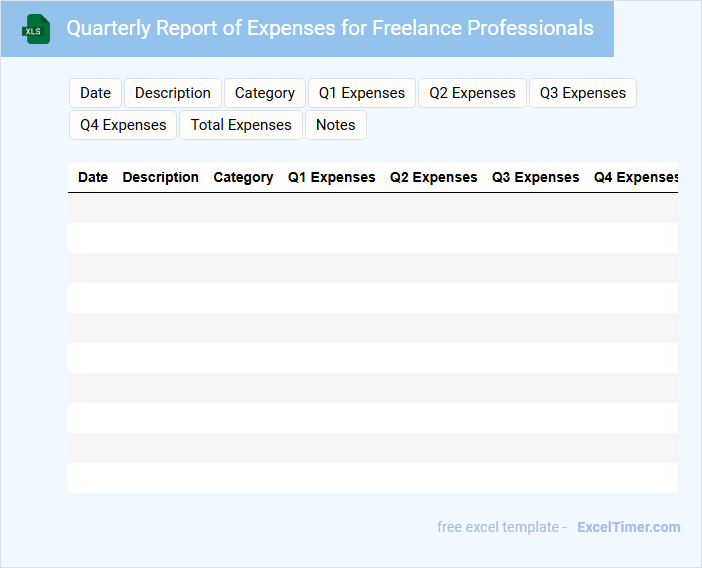

Quarterly Report of Expenses for Freelance Professionals

A Quarterly Report of Expenses for Freelance Professionals typically contains a detailed summary of all business-related expenditures incurred within a three-month period. This document includes categories like office supplies, travel costs, software subscriptions, and client-related expenses. It is essential for accurate financial tracking and tax preparation to ensure all deductible expenses are recorded properly.

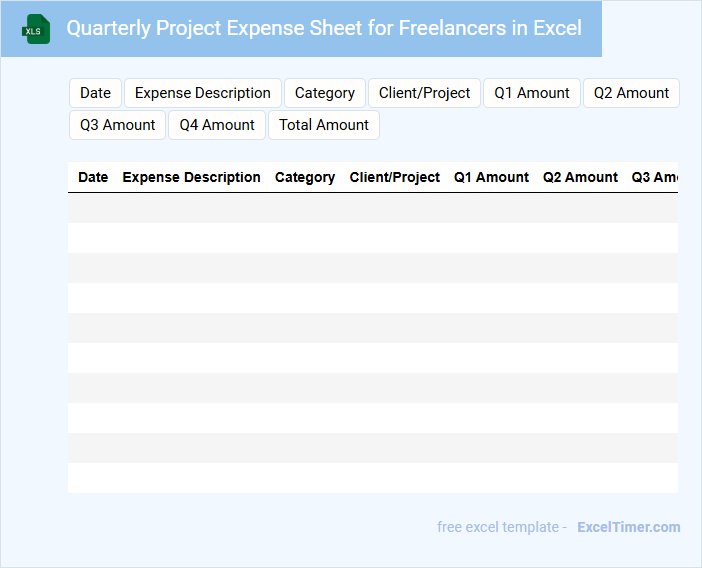

Quarterly Project Expense Sheet for Freelancers in Excel

A Quarterly Project Expense Sheet for freelancers in Excel typically contains detailed records of all project-related expenditures over a three-month period. It includes sections for date, description, category of expense, amount, and payment method to track spending accurately. This document is essential for budgeting, tax deductions, and financial analysis of freelance projects. Important elements to include are clear categorization of expenses, formulas for automatic totals, and notes for each entry to provide context. Ensuring the sheet is regularly updated and backed up helps maintain accuracy and prevents data loss. Additionally, integrating charts can visually summarize spending patterns for better decision-making.

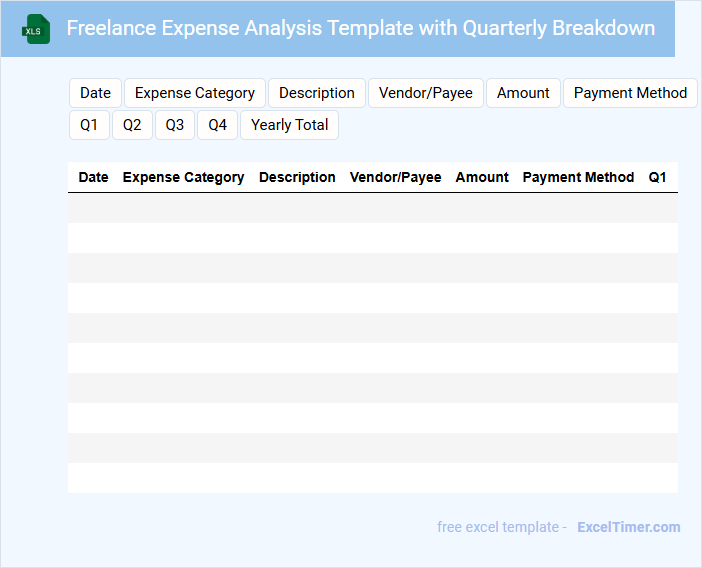

Freelance Expense Analysis Template with Quarterly Breakdown

A Freelance Expense Analysis Template helps track and categorize all business-related expenses incurred by freelancers, providing clarity on spending habits. It often includes sections for various expense types such as equipment, software, travel, and office supplies.

Incorporating a Quarterly Breakdown allows freelancers to monitor their expenses over specific periods, helping identify trends and manage budgets effectively. This periodic analysis supports better financial planning and tax preparation.

Ensure the template is customizable to fit individual needs and includes clear categories, date fields, and summary charts for easy interpretation.

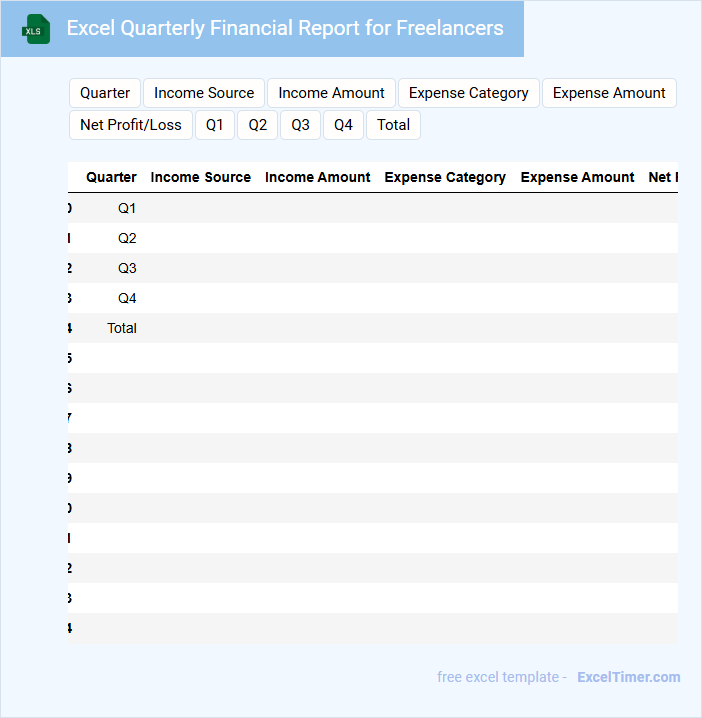

Excel Quarterly Financial Report for Freelancers

The Excel Quarterly Financial Report for freelancers typically contains detailed records of income, expenses, and net profit for the quarter. It provides a clear overview and helps in tracking financial performance over time. Including categorized transactions and summaries ensures better financial management and easy tax preparation.

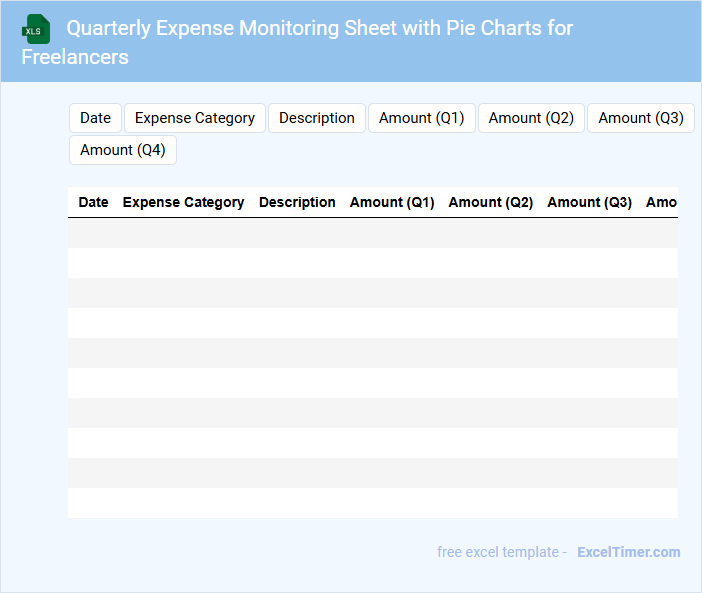

Quarterly Expense Monitoring Sheet with Pie Charts for Freelancers

A Quarterly Expense Monitoring Sheet with Pie Charts for Freelancers typically contains detailed expense categories and visualizations to help track and manage finances efficiently.

- Expense Categories: It lists various spending types such as supplies, software, and travel expenses to organize financial data clearly.

- Pie Charts: These provide a visual summary of expense distribution, making it easier to identify major cost areas and patterns.

- Quarterly Summary: A consolidated view of expenses over three months assists freelancers in budgeting and making informed financial decisions.

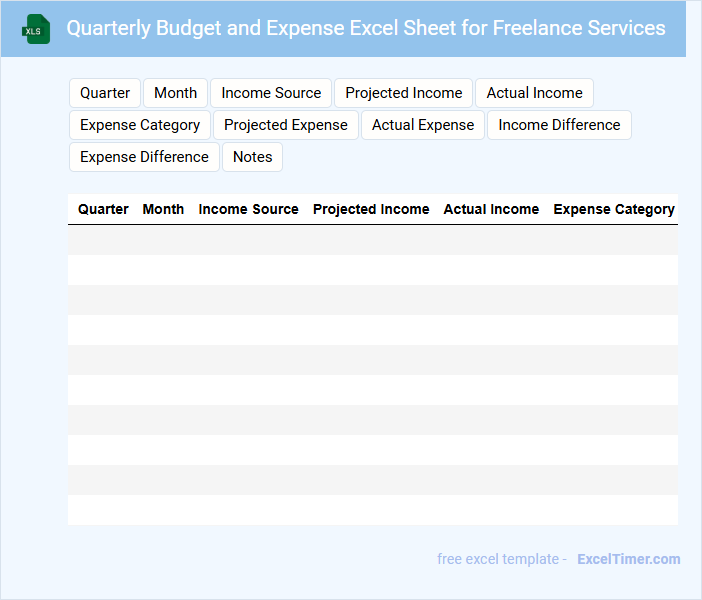

Quarterly Budget and Expense Excel Sheet for Freelance Services

What information is typically included in a Quarterly Budget and Expense Excel Sheet for Freelance Services? This document usually contains detailed records of income, planned budgets, and actual expenses categorized by project or service for a specific quarter. It helps freelancers track financial performance, manage cash flow, and identify areas for cost optimization over time.

What important elements should be considered when creating this Excel sheet? It is essential to include clear categories for different types of income and expenses, maintain accurate date entries, and use formulas to automatically calculate totals and variances. Additionally, incorporating visual charts or summaries can provide quick insights into spending patterns and budget adherence.

What are the essential categories to include in a freelancer's quarterly expense report?

A freelancer's quarterly expense report should include essential categories such as software and subscriptions, office supplies, travel expenses, marketing and advertising costs, professional development, and communication tools. Tracking these categories ensures accurate financial management and tax deductions. Including detailed receipts and payment dates enhances transparency and record accuracy.

How do you organize and track recurring versus one-time expenses each quarter in Excel?

You can organize and track recurring versus one-time expenses each quarter in Excel by creating separate columns or tabs labeled accordingly. Use Excel's filtering and conditional formatting features to categorize and highlight recurring expenses like subscriptions and one-time costs such as equipment purchases. Implement formulas like SUMIFS to calculate totals for each expense type, ensuring accurate quarterly financial analysis.

Which Excel formulas or functions best automate summing and analyzing quarterly expenses?

Excel formulas like SUMIFS and SUMPRODUCT efficiently automate summing quarterly expenses by filtering data based on specific criteria such as dates and categories. Functions including PIVOT TABLES and FILTER enable detailed analysis, allowing you to quickly segment and visualize your freelancer expense data. Your Excel document benefits from integrating these tools to streamline financial tracking and reporting.

How can you visualize expense trends by quarter using Excel charts for client reports?

Use Excel line charts or stacked bar charts to visualize quarterly expense trends for freelancers, highlighting categories like software, travel, and supplies. Apply data labels and color coding to distinguish expense types clearly for client reports. Incorporate trendlines to showcase overall spending patterns across quarters effectively.

What key details (date, vendor, category, amount) should each row in a quarterly expense report contain for tax and audit purposes?

Each row in your quarterly expense report should include the date of the expense, the vendor name, the expense category, and the exact amount spent. Capturing these key details ensures accurate tracking for tax deductions and audit compliance. Proper documentation helps simplify financial management and supports your freelancing business's accountability.