The Quarterly Financial Statement Excel Template for Startups provides a streamlined way to track income, expenses, and profits every three months, essential for managing cash flow and making informed business decisions. Designed specifically for startups, this template simplifies complex financial data into clear, actionable insights, helping founders monitor financial health and plan growth effectively. Accurate quarterly reporting ensures compliance with investor expectations and supports strategic financial planning.

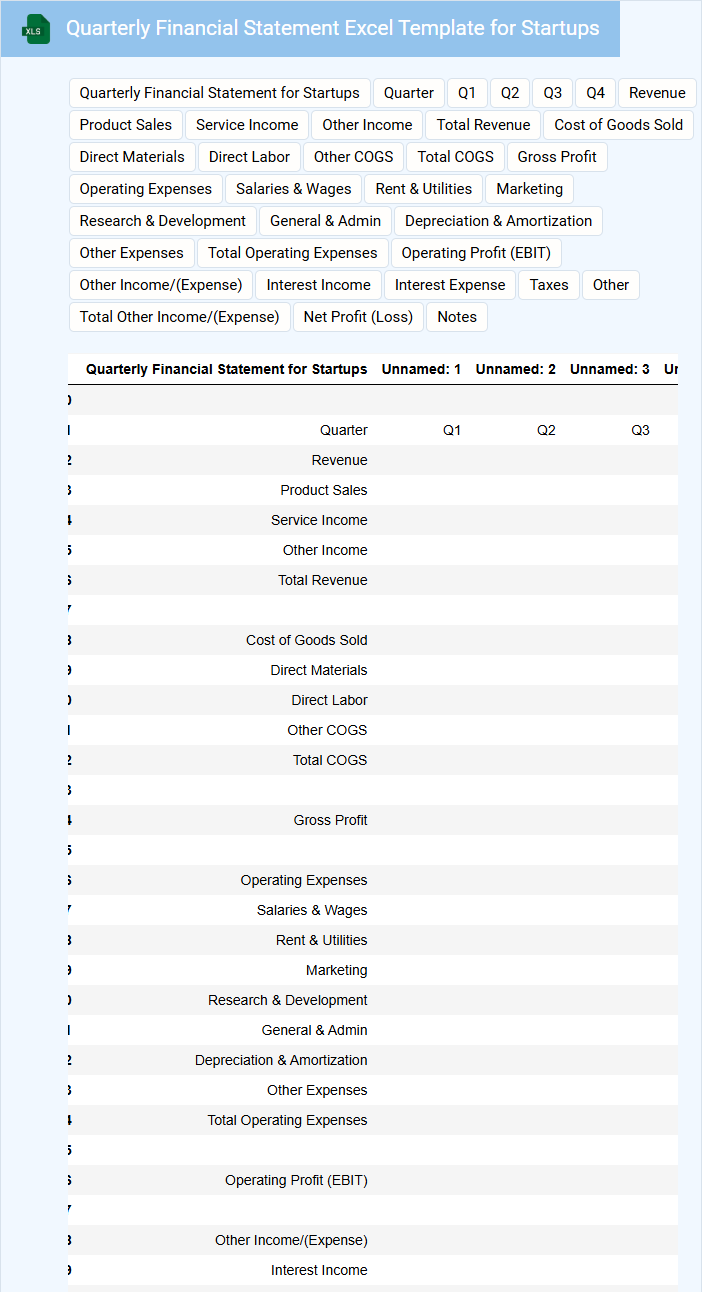

Quarterly Financial Statement Excel Template for Startups

The Quarterly Financial Statement Excel Template is designed to help startups organize and present their financial data clearly. It typically contains income statements, balance sheets, and cash flow statements for a specific quarter. The template provides a structured format to track financial performance over time.

Including accurate revenue and expense details is crucial to reflect the true financial health of the startup. Additionally, the template should allow for easy updates and comparisons across quarters. Ensuring data accuracy and consistency will enhance decision-making and investor confidence.

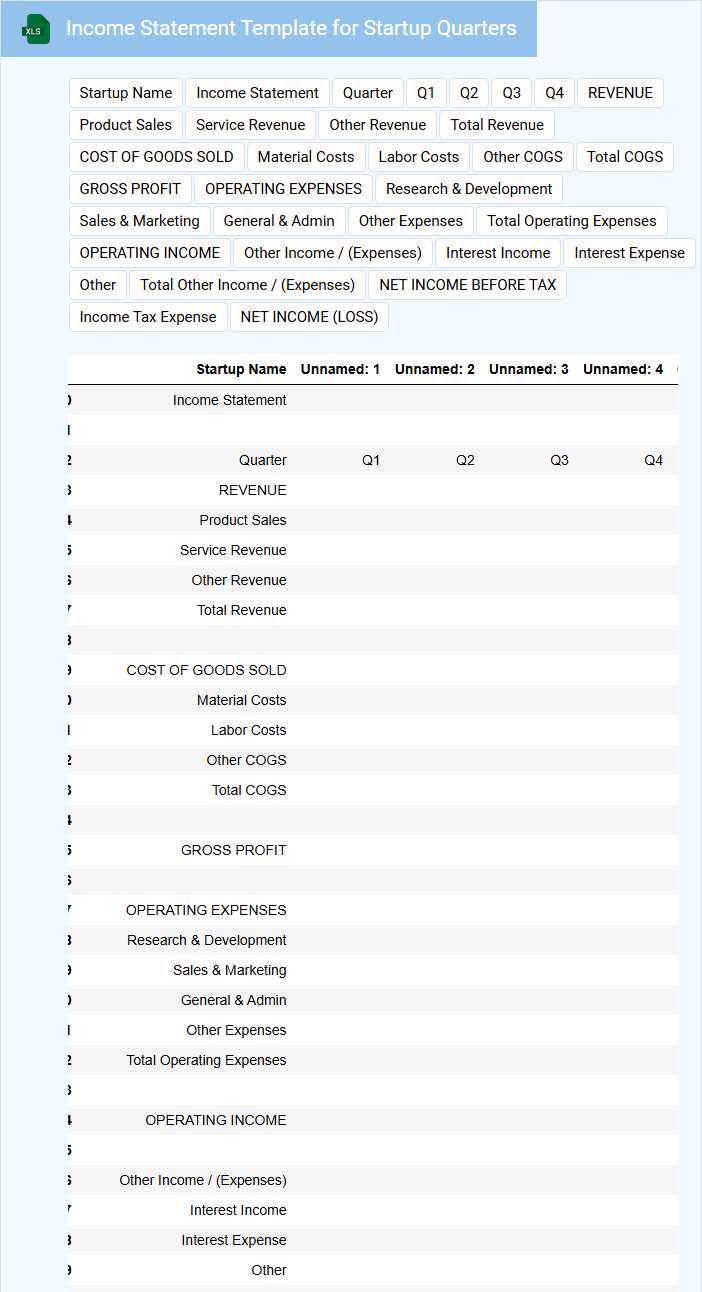

Income Statement Template for Startup Quarters

An Income Statement Template for startup quarters typically contains financial data outlining revenue, expenses, and net profit over specific three-month periods. It helps startups track their financial performance and make informed business decisions. Including detailed line items such as operating expenses, cost of goods sold, and gross profit is crucial for accuracy and clarity.

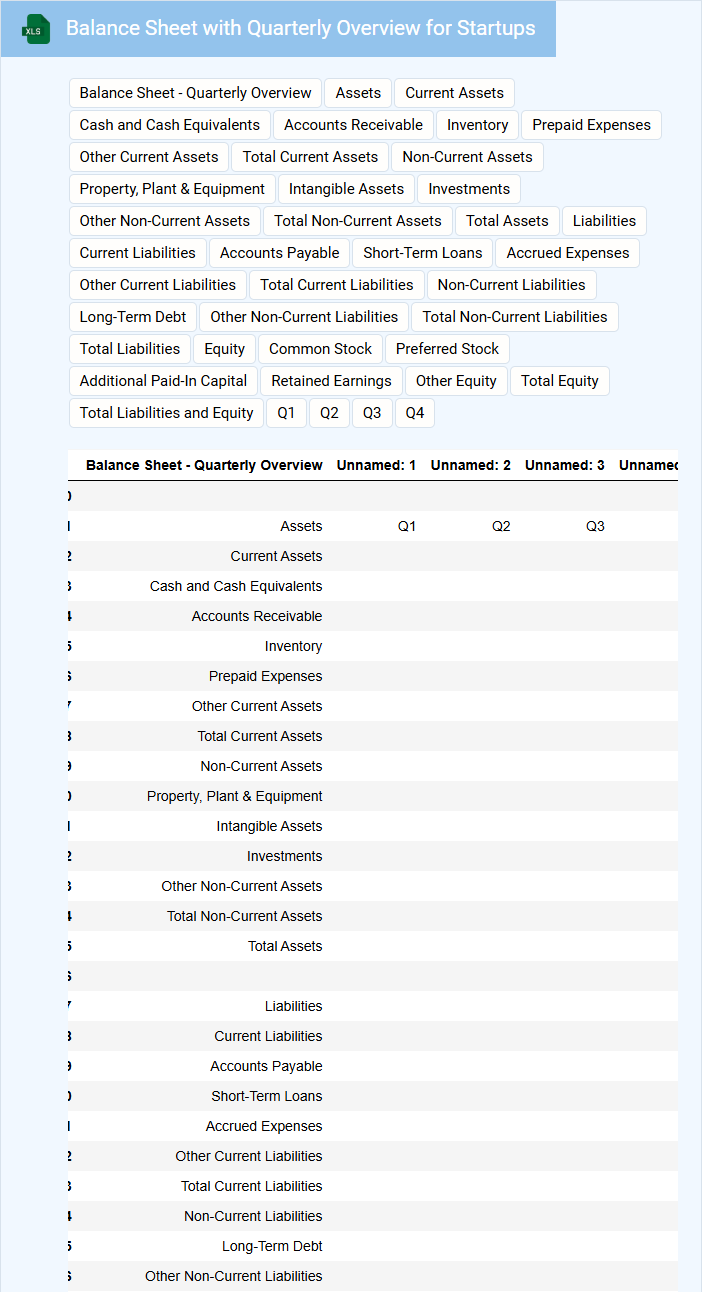

Balance Sheet with Quarterly Overview for Startups

A Balance Sheet with a quarterly overview for startups typically includes assets, liabilities, and shareholders' equity to provide a snapshot of the company's financial position over time. It details changes in financial status across quarters to help track growth and financial stability. For startups, it's important to highlight cash flow management and equity changes in each quarter to attract investors and plan for future funding rounds. Including notes on significant fluctuations can improve transparency and decision-making.

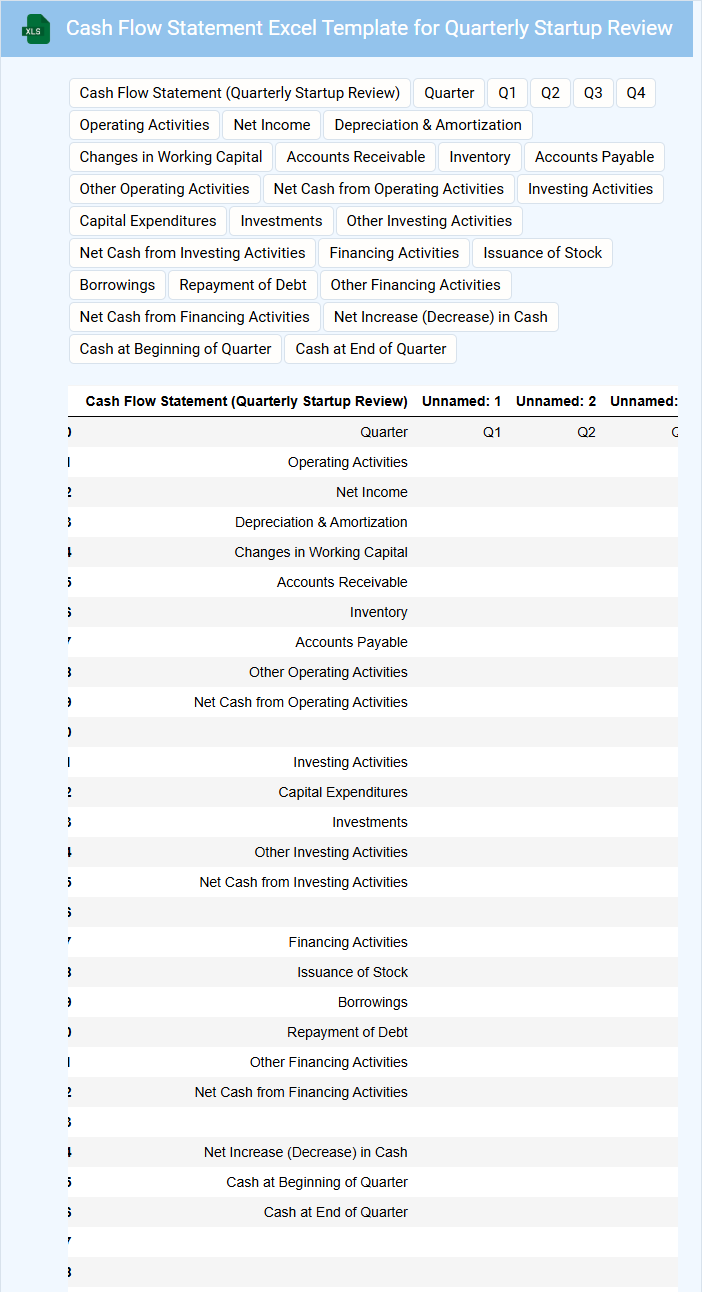

Cash Flow Statement Excel Template for Quarterly Startup Review

What information is typically included in a Cash Flow Statement Excel Template for a Quarterly Startup Review? This document usually contains detailed records of cash inflows and outflows categorized by operating, investing, and financing activities. It provides startups with a clear overview of their liquidity and helps track how cash is generated and used over each quarter to ensure financial stability.

Why is it important to use this template for a quarterly review? Utilizing this template allows startups to identify cash flow trends, anticipate potential funding needs, and make informed financial decisions. Including key metrics such as net cash flow, opening and closing cash balances, and comparison with budgeted figures enhances accuracy and supports strategic planning.

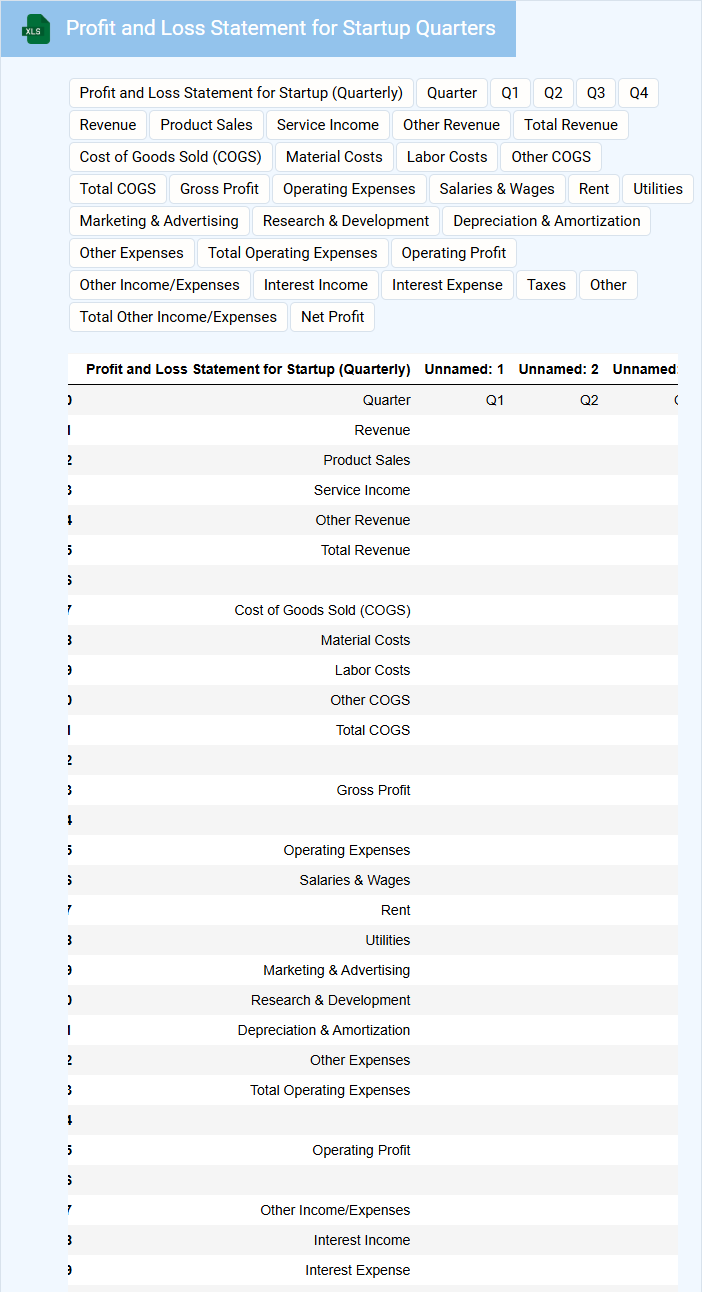

Profit and Loss Statement for Startup Quarters

A Profit and Loss Statement for startup quarters is a financial report that summarizes revenues, costs, and expenses over a specific period. It helps startups assess their financial performance and profitability during the early stages of business. This document typically includes income, cost of goods sold, gross profit, operating expenses, and net profit or loss.

Important elements to include are detailed revenue streams, categorization of fixed and variable expenses, and clear identification of one-time costs. Tracking these components accurately aids in forecasting, budgeting, and making informed strategic decisions. Ensuring transparency and consistency in reporting will provide valuable insights for investors and stakeholders.

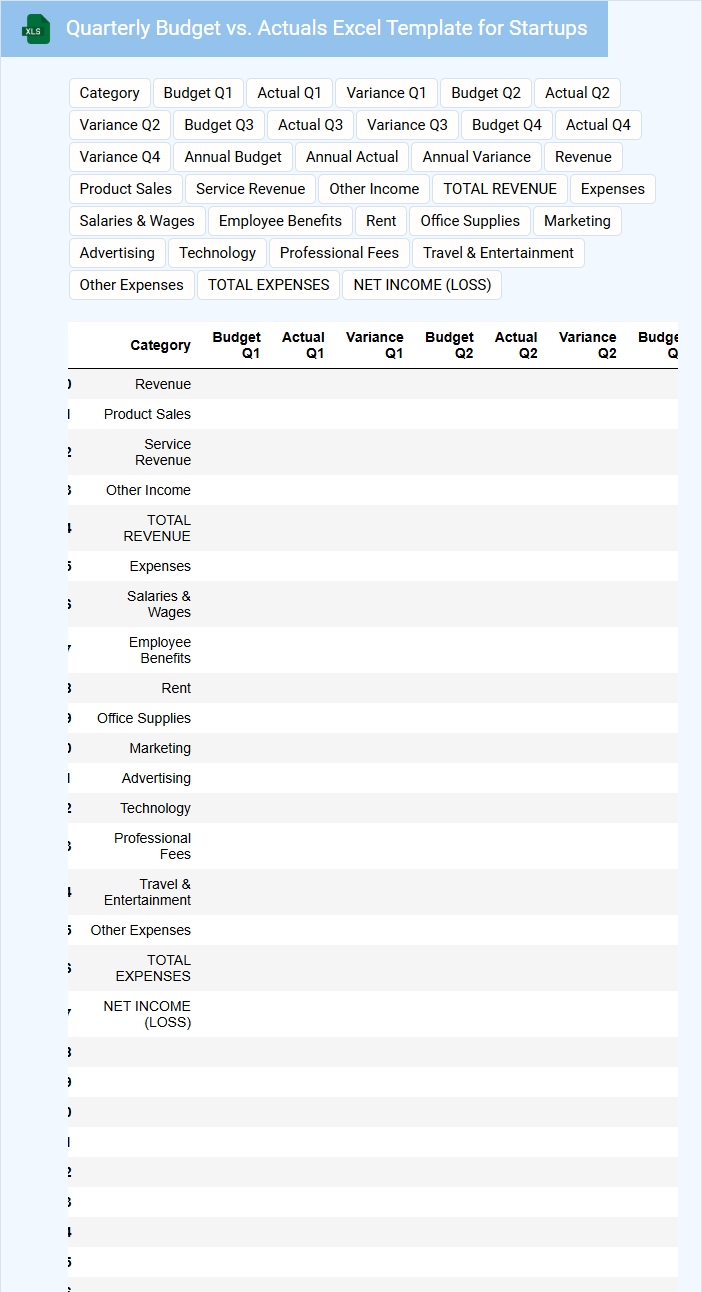

Quarterly Budget vs. Actuals Excel Template for Startups

A Quarterly Budget vs. Actuals Excel Template for Startups is designed to track financial performance by comparing projected budgets against actual spending each quarter. This document helps startups identify variances and make informed financial decisions.

- Include clear categories for revenue, expenses, and capital expenditures for accurate tracking.

- Incorporate formulas to automatically calculate variances and percentage differences.

- Enable visual charts or graphs to highlight financial trends and facilitate quick analysis.

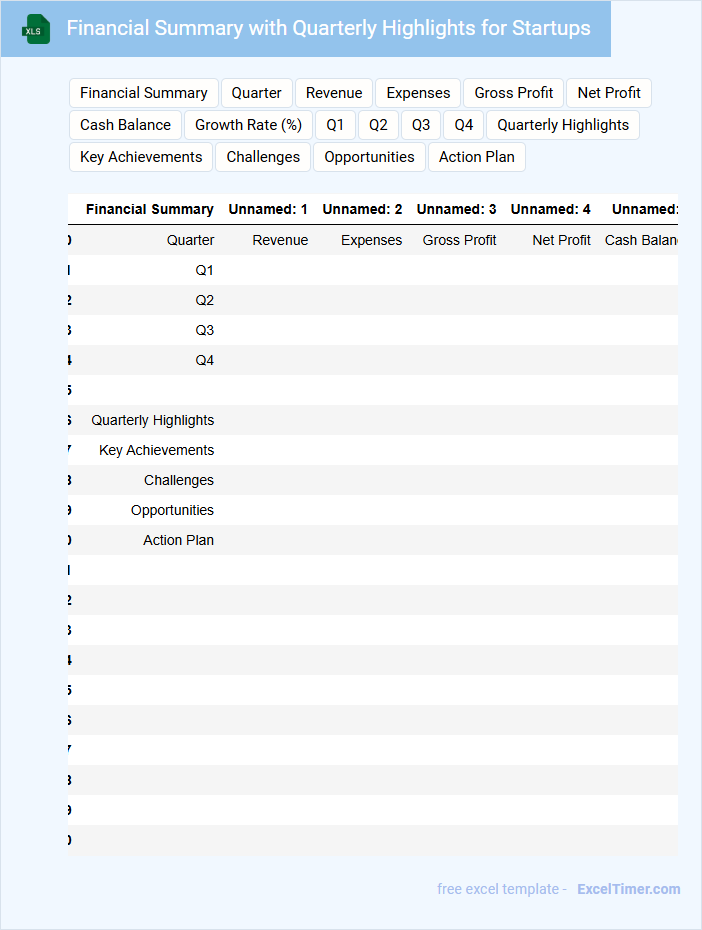

Financial Summary with Quarterly Highlights for Startups

What content is typically included in a Financial Summary with Quarterly Highlights for Startups? This document usually contains key financial metrics such as revenue, expenses, profit margins, and cash flow for the quarter. It also highlights significant business milestones and operational achievements to provide a comprehensive snapshot of the startup's financial health and progress.

What are some important considerations when preparing this report? It is crucial to present clear and accurate financial data supported by visual aids like charts for better understanding. Additionally, emphasizing actionable insights and growth opportunities helps stakeholders make informed decisions and supports transparent communication.

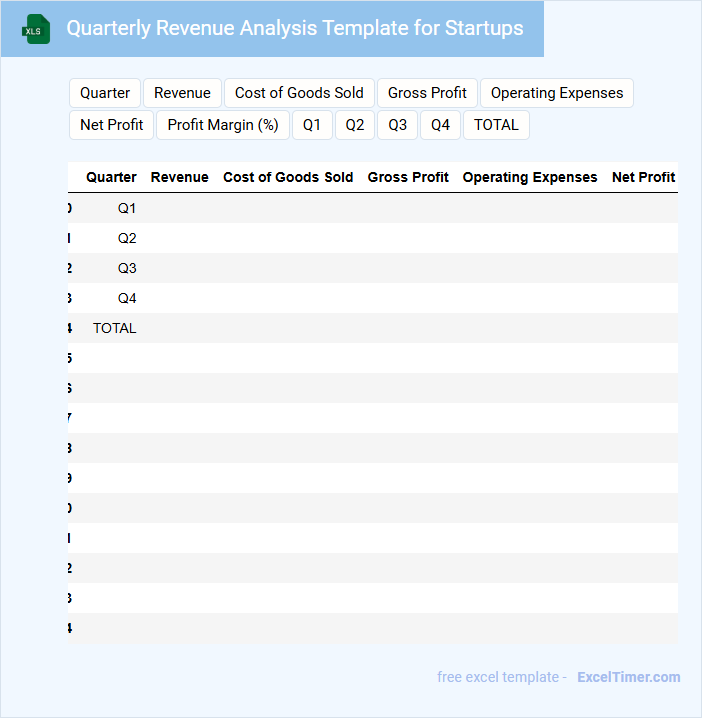

Quarterly Revenue Analysis Template for Startups

Quarterly Revenue Analysis Templates for startups typically contain financial data, performance metrics, and growth insights to help track revenue trends and make informed business decisions.

- Revenue Breakdown: Detailed categorization of income sources to identify key drivers of revenue.

- Performance Comparison: Quarter-over-quarter or year-over-year analysis to highlight growth patterns and potential challenges.

- Forecasting Insights: Projections based on current trends to support strategic planning and investor communications.

Expense Tracking Spreadsheet for Startup Quarters

An Expense Tracking Spreadsheet for Startup Quarters typically contains detailed records of all financial expenditures incurred during the initial phases of a startup. It helps monitor cash flow and budget adherence to ensure financial stability.

- Include categorized expense entries to easily identify spending patterns.

- Update the spreadsheet regularly to maintain accurate financial tracking.

- Use formulas to automate calculations for total and category-wise expenses.

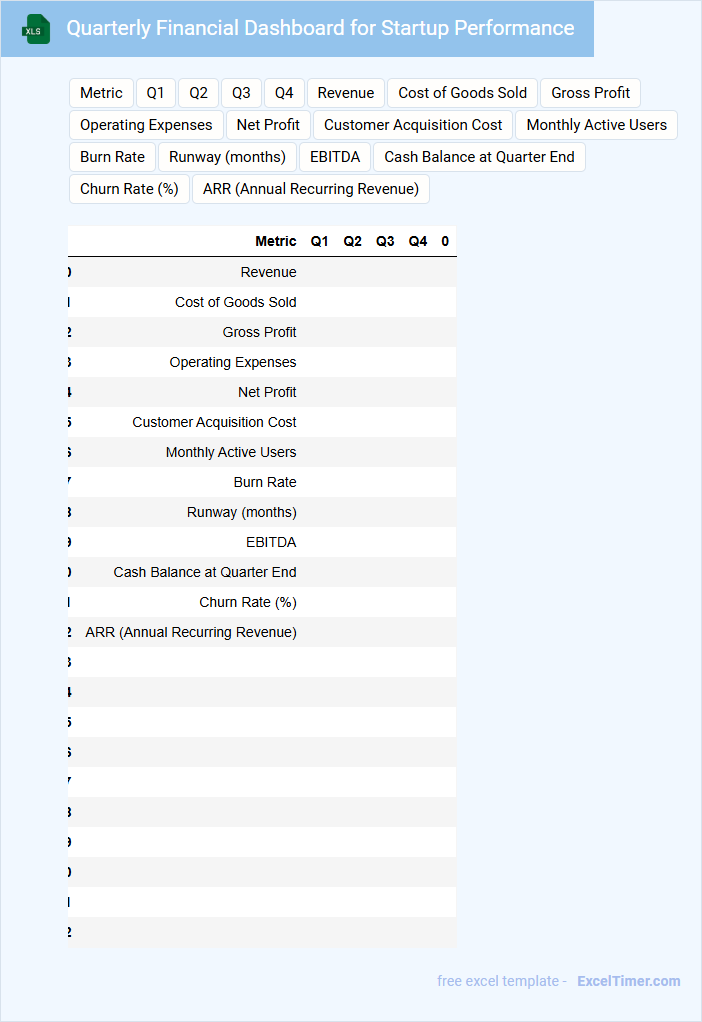

Quarterly Financial Dashboard for Startup Performance

A Quarterly Financial Dashboard for Startup Performance provides a concise overview of a startup's financial health and key metrics over a three-month period. It helps stakeholders quickly assess progress and make informed decisions.

- Include clear visualizations of revenue, expenses, and cash flow trends to highlight financial status.

- Track key performance indicators such as customer acquisition cost, burn rate, and runway duration.

- Ensure data is up-to-date and accurately reflects the startup's operational and financial activities.

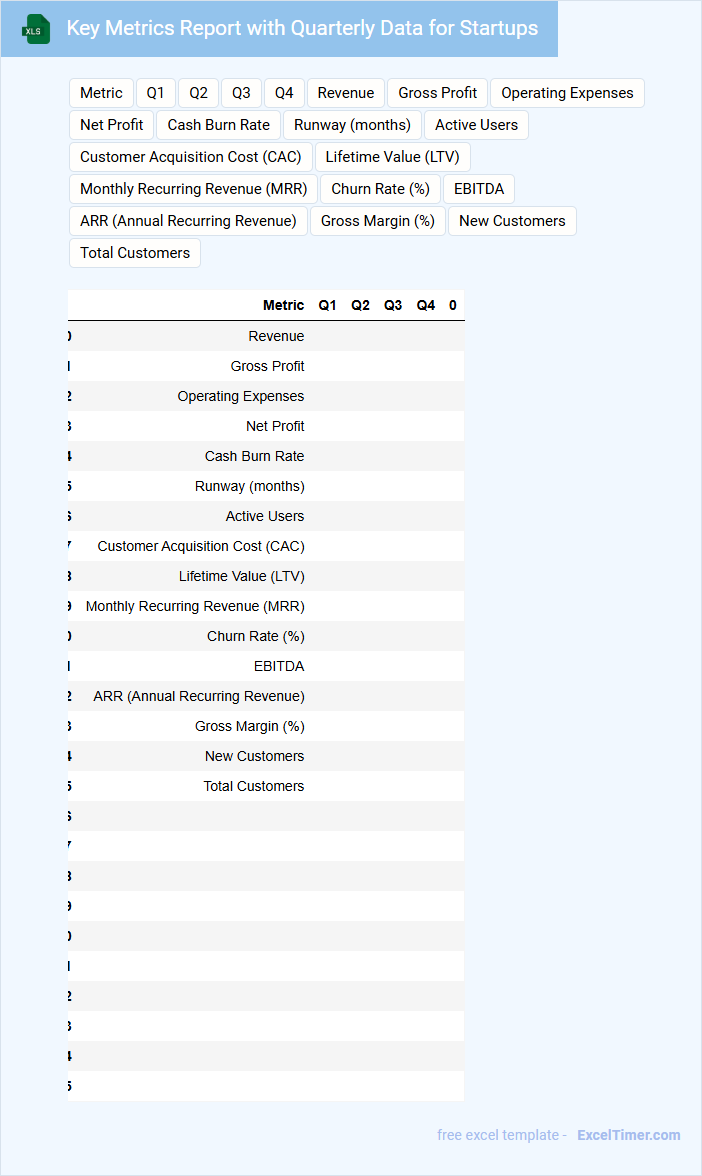

Key Metrics Report with Quarterly Data for Startups

A Key Metrics Report for startups typically contains essential performance indicators such as revenue growth, customer acquisition costs, and churn rates. It includes quarterly data to track progress and identify trends over time. This document helps founders and investors make informed decisions by highlighting areas of success and those needing improvement.

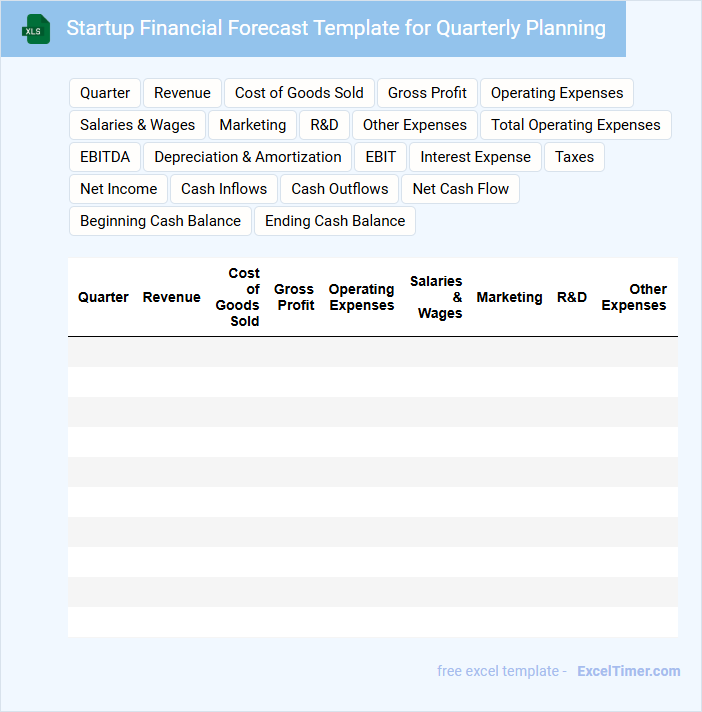

Startup Financial Forecast Template for Quarterly Planning

A Startup Financial Forecast Template is a crucial document that outlines projected revenues, expenses, and cash flow over a specific period, typically quarterly. It helps startups visualize their financial trajectory and make informed decisions to ensure sustainable growth.

For quarterly planning, this template emphasizes detailed forecasting of sales, operational costs, and investment requirements. Including key performance indicators (KPIs) and regularly updating assumptions is essential for accuracy and strategic adjustments.

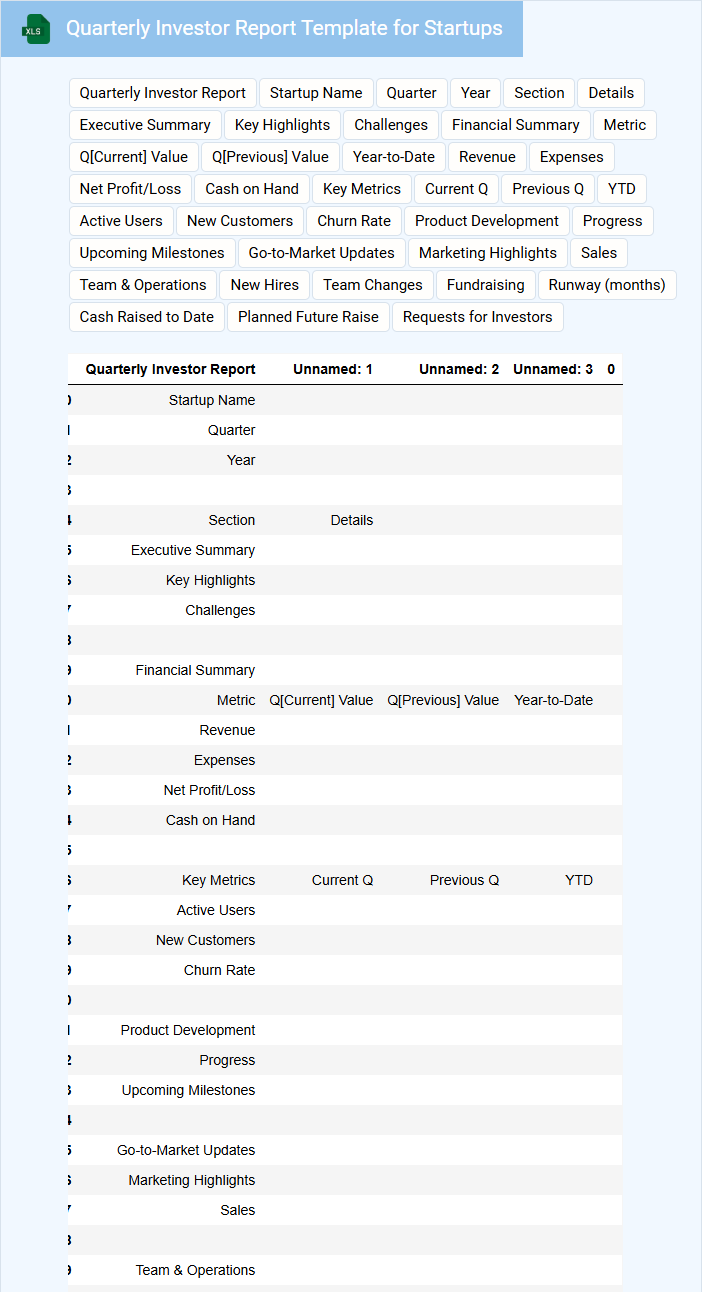

Quarterly Investor Report Template for Startups

A Quarterly Investor Report Template for Startups typically contains key financial metrics and business updates to keep investors informed about the company's progress. It aims to provide a clear snapshot of performance and strategic direction over the past quarter.

- Include concise financial summaries such as revenue, burn rate, and runway.

- Highlight major milestones and product developments achieved during the quarter.

- Address challenges and outline plans for the upcoming quarter to demonstrate transparency and proactive management.

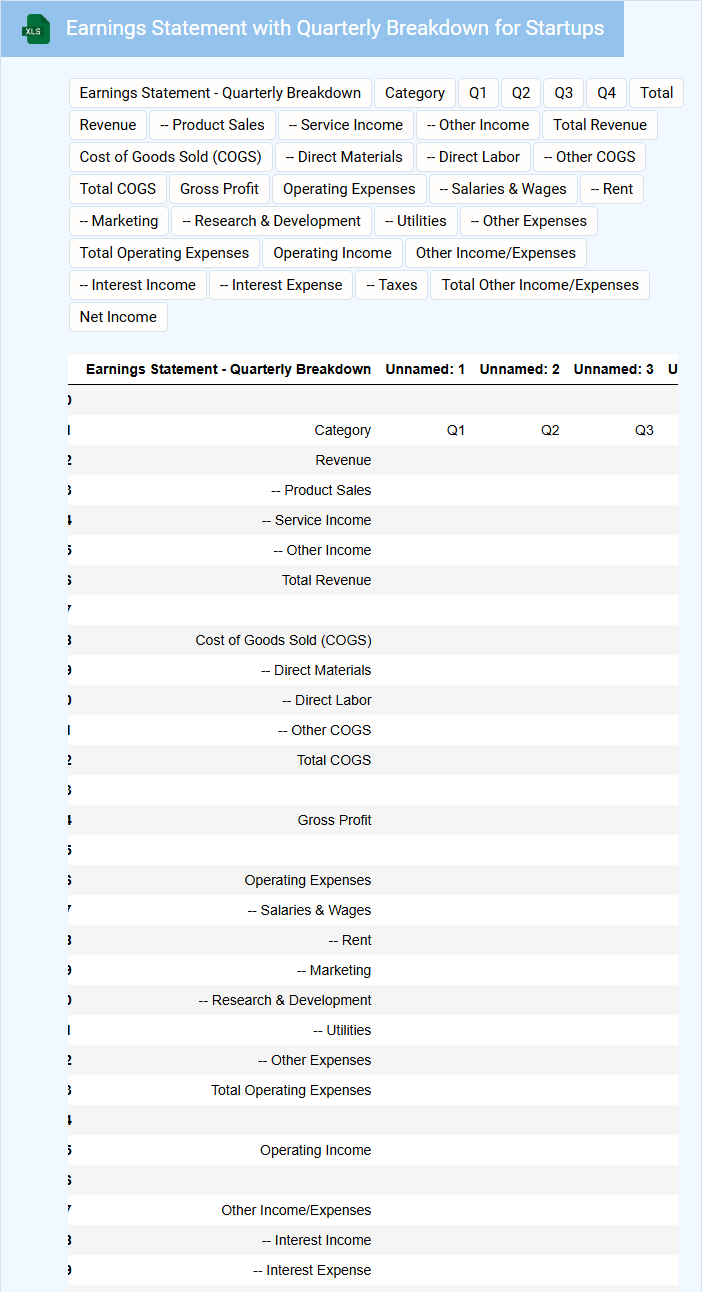

Earnings Statement with Quarterly Breakdown for Startups

What information is typically included in an Earnings Statement with Quarterly Breakdown for Startups? This document usually contains detailed financial data for each quarter, including revenue, expenses, and net income. It helps stakeholders track the startup's financial performance and growth trends over time.

What important things should be highlighted in this type of earnings statement? It is crucial to emphasize clear segmentation of quarterly results, key performance indicators, and any significant variances or trends. Additionally, providing context for unusual expenses or extraordinary income can offer a better understanding of the startup's financial health.

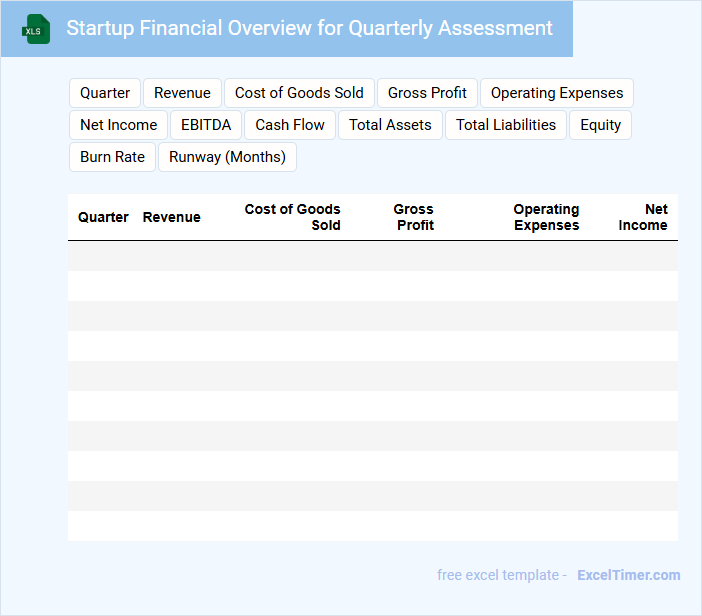

Startup Financial Overview for Quarterly Assessment

A Startup Financial Overview for a quarterly assessment typically contains detailed information on revenue, expenses, and cash flow to provide a clear snapshot of the company's financial health. It highlights key financial metrics such as burn rate, runway, and profit margins to help stakeholders understand current performance and sustainability. Including forecast comparisons and variance analysis is crucial for identifying trends and making informed strategic decisions.

What are the key financial components typically included in a quarterly financial statement for startups?

A quarterly financial statement for startups typically includes the income statement, balance sheet, and cash flow statement. Key components are revenue, expenses, net profit or loss, assets, liabilities, and cash flows from operating, investing, and financing activities. These elements provide essential insights into the startup's financial health and operational performance.

How does a quarterly financial statement help startups track cash flow and operational performance?

A quarterly financial statement provides startups with detailed insights into cash inflows and outflows, enabling precise cash flow management. It highlights key performance indicators such as revenue growth, expenses, and profitability to evaluate operational efficiency. Regular analysis supports informed decision-making and strategic adjustments for sustainable growth.

Why is accurate revenue recognition important in quarterly reports for startups?

Accurate revenue recognition in quarterly financial statements for startups ensures compliance with accounting standards and provides a true representation of financial performance. It helps attract investors by demonstrating financial transparency and reliability. Precise revenue data also enables better cash flow management and strategic decision-making essential for startup growth.

What role do expense categorization and cost tracking play in quarterly financial statements?

Expense categorization and cost tracking are crucial for accurate quarterly financial statements, enabling clear identification of spending patterns and profitability. Your ability to classify expenses correctly ensures precise budget management and meaningful financial analysis. This detailed financial insight helps startups make informed decisions to optimize cash flow and growth strategies.

How can quarterly financial statements assist startups in communicating growth and funding needs to investors?

Quarterly financial statements provide startups with clear, data-driven insights into revenue, expenses, and cash flow, reflecting their financial health and growth trajectory. By presenting this information concisely, you can effectively demonstrate progress and justify funding requirements to investors. Regular updates build investor confidence and support strategic decision-making.