![]()

The Quarterly Stock Portfolio Tracker Excel Template for Investors provides an organized way to monitor stock performance, dividends, and overall portfolio growth every three months. It simplifies data entry and automatically calculates key metrics such as returns, risk, and allocation percentages to help investors make informed decisions. Customizable features and visual charts make tracking investment progress efficient and clear.

Quarterly Stock Portfolio Tracker Excel Template for Investors

This Quarterly Stock Portfolio Tracker Excel Template is designed to help investors monitor their stock investments efficiently. It usually contains sections for stock tickers, purchase dates, quantities, prices, and quarterly performance metrics. For optimal use, ensure to update the data regularly and include dividend information for a comprehensive overview.

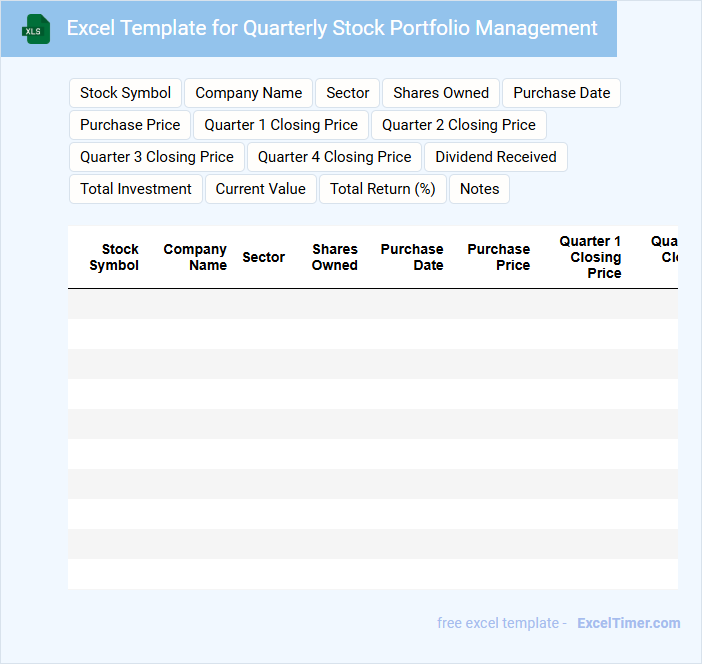

Excel Template for Quarterly Stock Portfolio Management

An Excel Template for Quarterly Stock Portfolio Management typically contains sections for tracking stock purchases, sales, dividends, and quarterly performance metrics. It helps investors organize their portfolio by allowing easy input of stock symbols, transaction dates, quantities, and prices.

This document often includes automated calculations for portfolio value, returns, and risk assessments to assist in decision-making. It's important to regularly update the data and review diversification to optimize investment outcomes each quarter.

Quarterly Investment Tracking Spreadsheet for Stockholders

A Quarterly Investment Tracking Spreadsheet for Stockholders is a document designed to monitor and analyze the performance of investments over a three-month period. It helps stockholders make informed decisions by providing clear and organized financial data.

- Include detailed records of stock purchases, sales, dividends, and market values.

- Track the overall portfolio growth and quarterly returns accurately.

- Incorporate visual aids such as charts or graphs to highlight trends and changes.

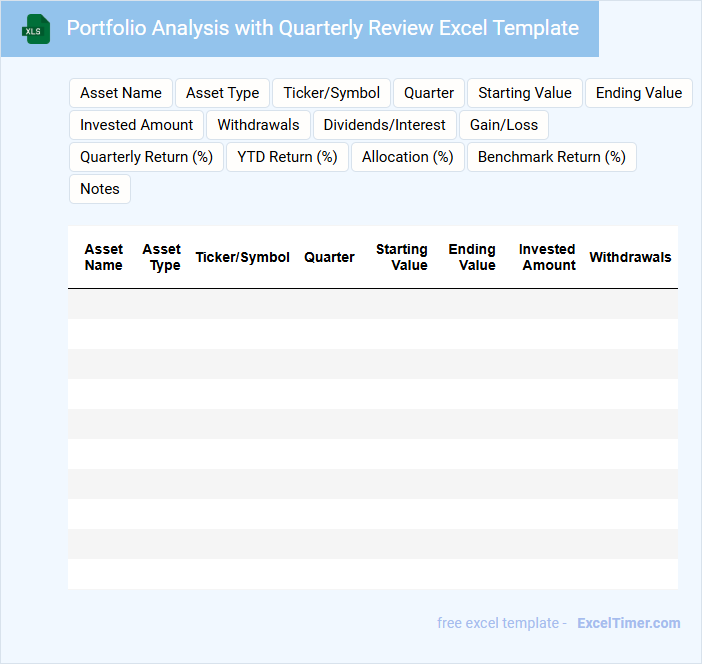

Portfolio Analysis with Quarterly Review Excel Template

Portfolio Analysis with Quarterly Review Excel Template typically contains financial data, performance metrics, and strategic insights to track and evaluate investment portfolios quarterly.

- Data Accuracy: Ensure all financial inputs are precise to maintain reliable performance analysis.

- Visual Elements: Use charts and graphs for clear representation of portfolio trends and comparisons.

- Regular Updates: Frequently update the template with new quarterly data to reflect the current status and enable timely decision-making.

Quarterly Stock Performance Tracker for Investors in Excel

The Quarterly Stock Performance Tracker in Excel is a document designed to monitor and analyze stock price movements and dividends on a quarterly basis. It typically contains data tables, charts, and formulas to calculate returns and visualize trends. Investors use this tracker to make informed decisions by reviewing past performance and identifying potential investment opportunities.

Important elements to include are clear headers for each quarter, automated updates for stock prices, and comparison metrics such as percentage gain/loss. It is also crucial to incorporate graphical representations like line or bar charts to quickly assess performance patterns. Ensuring accuracy and ease of use will enhance the tracker's effectiveness for any investor.

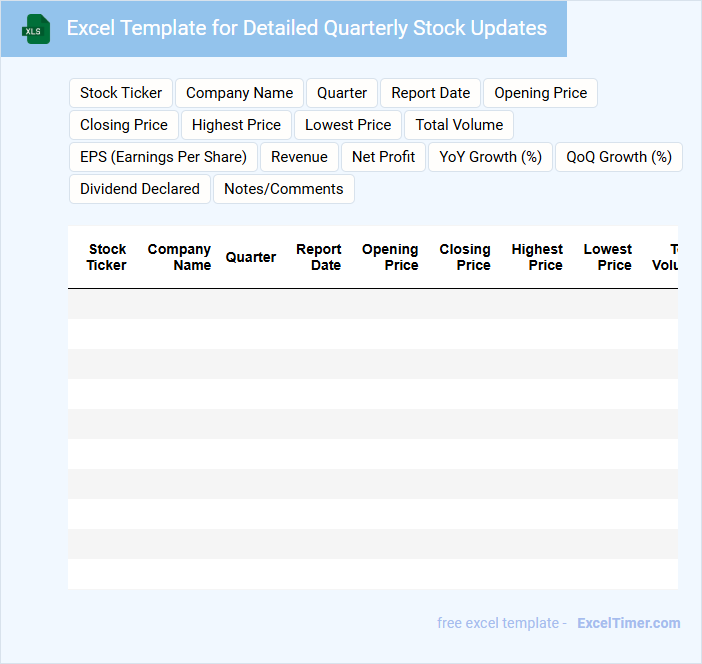

Excel Template for Detailed Quarterly Stock Updates

An Excel Template for Detailed Quarterly Stock Updates typically contains organized data on stock performance, including sales figures, inventory levels, and market trends. It is designed to facilitate easy tracking and comparison across different quarters for better analysis.

Important elements include clear headings, precise formulas, and visual charts to enhance data interpretation. Including a summary section with key insights is suggested to improve decision-making efficiency.

Quarterly Report of Stock Holdings Tracker for Investors

A Quarterly Report of Stock Holdings Tracker for Investors typically contains detailed summaries of an investor's stock portfolio changes over the three-month period. It highlights performance metrics, gains or losses, and any significant transactions or reallocations. Including transparent and up-to-date data is crucial for informed decision-making and tracking investment progress.

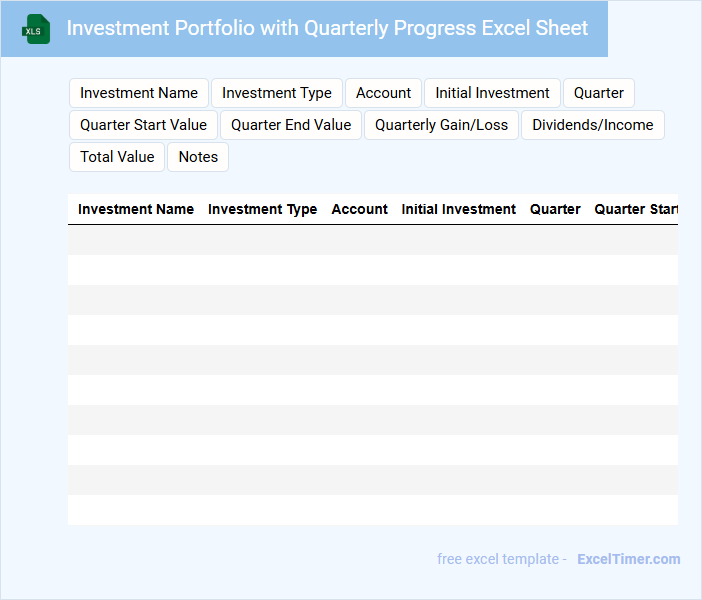

Investment Portfolio with Quarterly Progress Excel Sheet

What information is typically included in an Investment Portfolio with Quarterly Progress Excel Sheet? This document usually contains detailed records of all investments, including initial amounts, current values, and quarterly changes. It helps investors track performance over time, analyze trends, and make informed decisions for future investments.

What are important aspects to focus on when using this document? Ensuring accurate and up-to-date data entry is crucial, along with clear categorization of assets and consistent formatting for ease of analysis. Additionally, including visual aids like charts or graphs can enhance understanding of portfolio progress and trends.

Quarterly Stock Returns Tracker for Portfolio Management

A Quarterly Stock Returns Tracker is a financial document used to monitor and analyze the performance of stocks over specific three-month periods. It typically contains data on stock prices, dividends, and overall returns, which help investors assess their portfolio's growth. Accurate tracking of these returns is crucial for informed decision-making in portfolio management.

Excel Dashboard for Quarterly Stock Portfolio Tracking

What information is typically included in an Excel Dashboard for Quarterly Stock Portfolio Tracking? This type of document usually contains summarized data about stock performance, portfolio allocation, and key financial metrics such as returns and risks for the quarter. It is designed to provide a clear overview of investment status and facilitate informed decision-making.

What important aspects should be considered when creating this dashboard? It is crucial to include interactive charts and real-time data updates to accurately reflect market changes. Additionally, incorporating clear visual indicators like color-coded performance metrics helps quickly identify trends and potential issues in the portfolio.

Quarterly Equity Portfolio Tracker for Individual Investors

What information does a Quarterly Equity Portfolio Tracker for Individual Investors typically include? This document usually contains detailed summaries of stock holdings, including purchase prices, current values, and dividends received during the quarter. It helps investors monitor portfolio performance, assess risk, and make informed decisions about buying or selling equities to optimize returns.

What is an important consideration when maintaining this tracker? Accuracy and timely updates are essential to reflect market fluctuations and portfolio changes, enabling investors to respond promptly to market trends and opportunities. Additionally, incorporating clear visualizations such as charts and graphs enhances understanding and strategic planning.

Quarterly Stock Growth Tracking Sheet for Investors

What information does a Quarterly Stock Growth Tracking Sheet for Investors typically contain? This document usually includes detailed records of stock prices, percentage growth, dividends, and key financial metrics for each quarter. It helps investors visually track performance trends and make informed decisions over time.

Why is it important to include concise notes and comparison charts in the tracking sheet? Adding brief annotations clarifies unusual fluctuations or market factors affecting growth, while comparison charts highlight performance relative to industry benchmarks or competitors. These elements enhance analysis and strategic planning for investment portfolios.

Excel Template for Quarterly Monitoring of Stock Portfolios

An Excel template for quarterly monitoring of stock portfolios typically contains detailed sections for tracking stock performance, dividends, and portfolio allocation. It includes charts and tables to visualize gains, losses, and overall portfolio growth over time.

This document helps investors systematically review their investments, analyze risk, and make informed decisions. Ensure the template includes customizable fields for transaction dates, stock symbols, and quarterly benchmarks to provide accurate and actionable insights.

Tracker for Quarterly Changes of Stock Investments in Excel

A Tracker for Quarterly Changes of Stock Investments in Excel is a document designed to monitor and analyze the performance of stock portfolios over specific three-month periods. It typically contains data such as stock symbols, purchase prices, quantities, quarterly price changes, and calculated returns. This tool helps investors make informed decisions by visualizing trends and identifying significant portfolio fluctuations.

To optimize its use, ensure the tracker includes automated calculations for gains and losses, clear categorization by sectors or industries, and graphical representations like charts for quick insights. Consistent data updates and error-checking mechanisms are important to maintain accuracy. Additionally, incorporating notes or comments on market events affecting stocks can provide valuable context for quarterly changes.

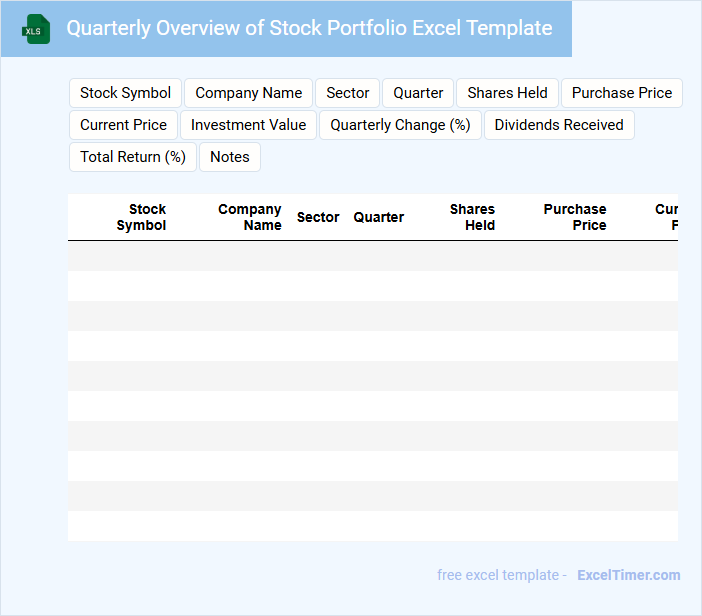

Quarterly Overview of Stock Portfolio Excel Template

A Quarterly Overview of Stock Portfolio Excel Template typically contains detailed records of stock transactions, portfolio performance metrics, and comparative quarterly analyses. It helps investors track gains, losses, and dividend incomes within a specific quarter to make informed decisions. Additionally, the template often includes visual aids like charts and graphs for easier data interpretation.

Important elements to include are a summary of key financial indicators, up-to-date stock prices, and a section for notes on market trends or investment strategies. Emphasizing data accuracy and usability is crucial for effective portfolio management. Regular updates and backups ensure that the quarterly data remains reliable and accessible for future reference.

What are the essential columns to include for tracking stock performance in a quarterly portfolio tracker?

Include columns for Stock Symbol, Company Name, Purchase Date, Number of Shares, Purchase Price, Current Price, Market Value, Quarterly Dividend, Dividend Yield, and Quarterly Return Percentage. Track Performance Metrics like Price Change, Percentage Gain/Loss, and Total Return for comprehensive quarterly analysis. Adding Sector and Market Capitalization helps evaluate portfolio diversification and risk exposure.

How can you use Excel formulas to automatically calculate quarterly returns for each stock?

Use Excel formulas like =(Ending_Price - Starting_Price) / Starting_Price to calculate quarterly returns for each stock. Incorporate Excel functions such as INDEX and MATCH to automatically reference stock prices from different dates. Employ array formulas or dynamic ranges to handle multiple stocks and quarters efficiently in the portfolio tracker.

Which Excel features assist in visually analyzing portfolio diversification by sector or industry?

Excel features like PivotTables and PivotCharts enable investors to categorize and visually analyze portfolio diversification by sector or industry. Conditional Formatting highlights key data trends and sector performance for quick insights. Slicers offer dynamic filtering, allowing focused analysis on specific industries or time periods within the portfolio.

How should you organize transaction history to ensure accurate quarterly performance reporting?

Organize your transaction history by recording each trade with details including date, stock symbol, quantity, price, and transaction type. Use a consistent format to enable seamless integration with your Quarterly Stock Portfolio Tracker. Accurate, chronological entries help ensure precise calculation of gains, losses, and portfolio performance.

What methods can be used in Excel to set and monitor quarterly investment goals for the portfolio?

Use Excel formulas like SUMIFS and conditional formatting to track quarterly investment goals against actual portfolio performance. PivotTables help analyze quarterly returns and asset allocation to identify trends and rebalance opportunities. Setting data validation rules ensures Your input accuracy, enabling precise monitoring of progress toward financial targets.