The Quarterly Loan Amortization Excel Template for Real Estate Agents simplifies tracking loan payments by breaking down principal and interest every quarter, enhancing financial planning. It offers customizable fields to match specific loan terms, ensuring accurate forecasting and budgeting for property investments. This template is essential for real estate agents seeking efficient and organized loan management.

Quarterly Loan Amortization Tracker for Real Estate Agents

This document typically contains a detailed schedule outlining loan repayments over a quarter. It helps real estate agents monitor principal and interest amounts along with outstanding balances. Keeping an accurate tracker ensures timely payments and financial clarity.

For effective use, it is important to include updated loan terms and payment dates. Emphasizing precise calculations of amortization helps avoid errors. Regular review of this tracker supports better loan management and client communication.

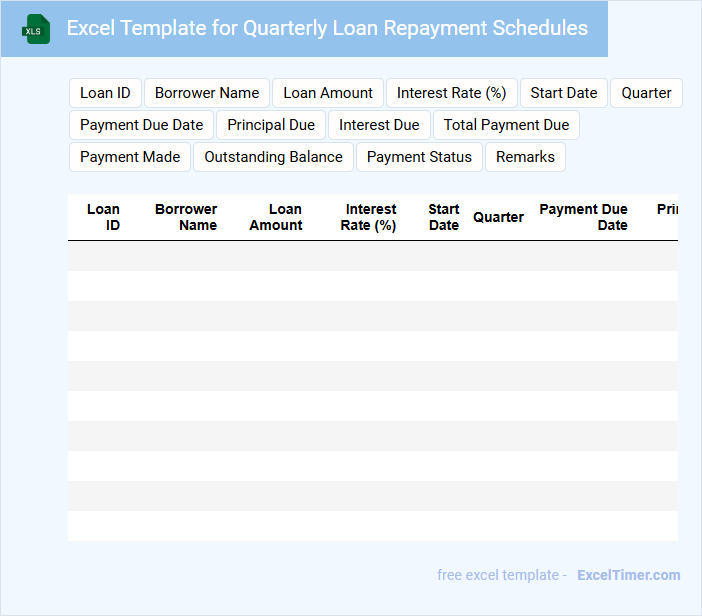

Excel Template for Quarterly Loan Repayment Schedules

An Excel Template for Quarterly Loan Repayment Schedules typically contains detailed breakdowns of loan amounts, interest rates, and payment dates. It helps borrowers and lenders track payment progress efficiently over each quarter.

This document usually includes columns for principal, interest, total payment, and remaining balance, making it easy to manage financial planning. For accuracy, it's important to regularly update the template with actual payment information and adjust for any changes in loan terms.

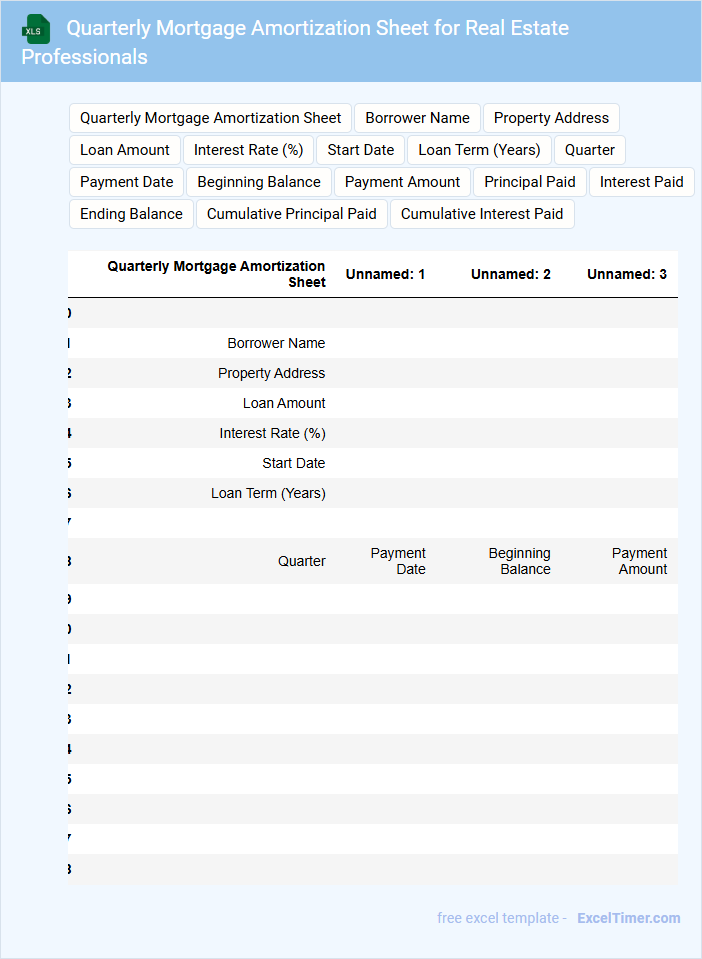

Quarterly Mortgage Amortization Sheet for Real Estate Professionals

A Quarterly Mortgage Amortization Sheet is typically used to track the gradual repayment of a mortgage over time. It details principal and interest breakdowns for each payment within a specific quarter. This document helps real estate professionals monitor loan progress and forecast future payments.

Important elements include accurately listing payment dates, amounts applied to principal versus interest, and remaining balance after each payment. Ensuring clarity and consistency in these details supports effective financial planning and client advising. Regularly updating the sheet is essential for maintaining precise records and informed decision-making.

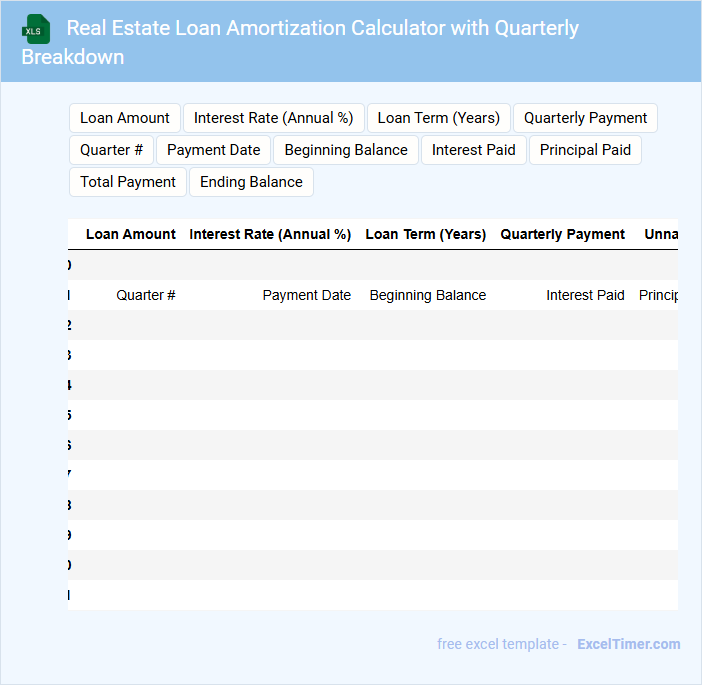

Real Estate Loan Amortization Calculator with Quarterly Breakdown

This document typically contains detailed information and calculations related to loan repayment schedules and interest accruals for real estate financing.

- Loan Principal and Interest: It clearly specifies the initial loan amount and the interest rates applied.

- Quarterly Payment Breakdown: It provides a detailed schedule of payments, showing how much goes toward principal and interest every quarter.

- Total Amortization Period: It outlines the overall timeline for loan repayment, including the number of quarters and the final payoff date.

Property Loan Repayment Tracker with Quarterly Summaries

A Property Loan Repayment Tracker is a document used to monitor and record loan payments specifically for property or real estate financing. It usually contains detailed entries of payment dates, amounts, and outstanding balances to ensure accurate tracking of loan progress. Including quarterly summaries helps in reviewing payment trends and planning future finances effectively.

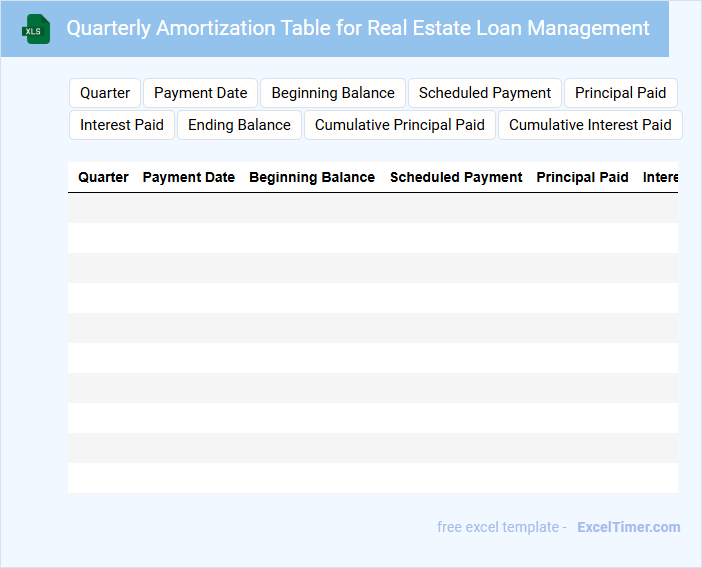

Quarterly Amortization Table for Real Estate Loan Management

What information is typically included in a Quarterly Amortization Table for Real Estate Loan Management? This document usually contains a detailed schedule showing the breakdown of each loan payment into principal and interest components over quarterly periods. It helps borrowers and lenders track the remaining loan balance, payment dates, and interest accrued, facilitating effective loan management and financial planning.

What are important considerations when using or creating a Quarterly Amortization Table for Real Estate Loans? It's crucial to ensure accurate calculations reflecting the loan terms, such as interest rates, repayment schedules, and any prepayment options. Additionally, regularly updating the table to reflect actual payments and changes ensures transparency and precise tracking of loan progress.

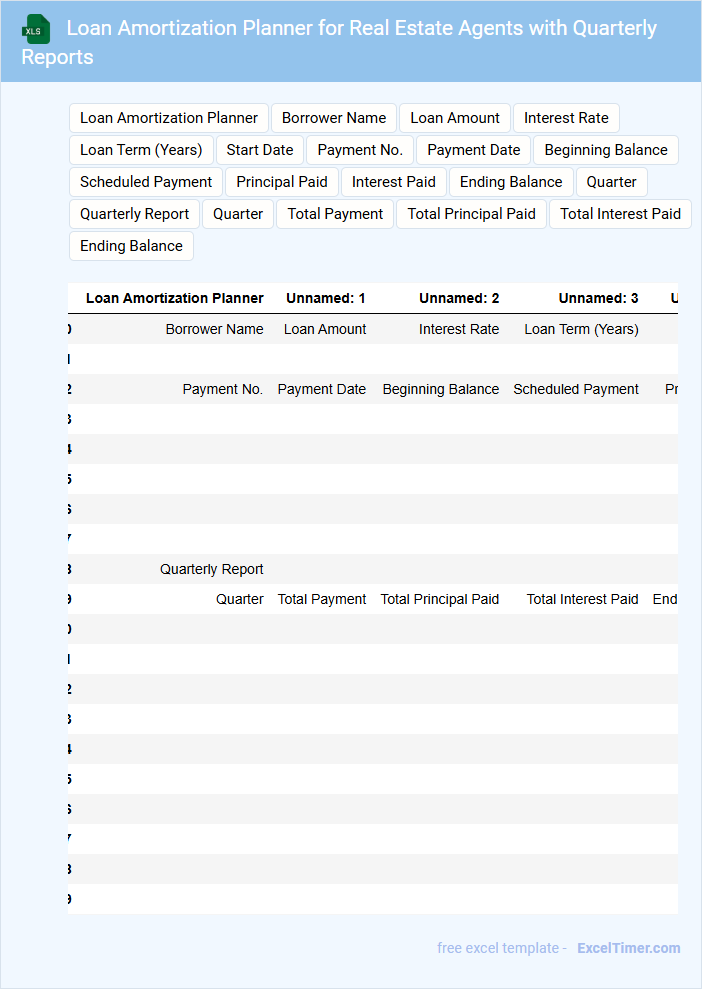

Loan Amortization Planner for Real Estate Agents with Quarterly Reports

Loan Amortization Planners for Real Estate Agents with Quarterly Reports typically contain detailed schedules of loan repayments, interest calculations, and performance summaries to assist in financial planning and client advisory.

- Comprehensive Loan Breakdown: Includes principal, interest, and total payment details for clarity.

- Quarterly Financial Performance: Provides summarized reports to track loan progress and market trends.

- Actionable Insights: Highlights key dates and payment adjustments to optimize client strategies.

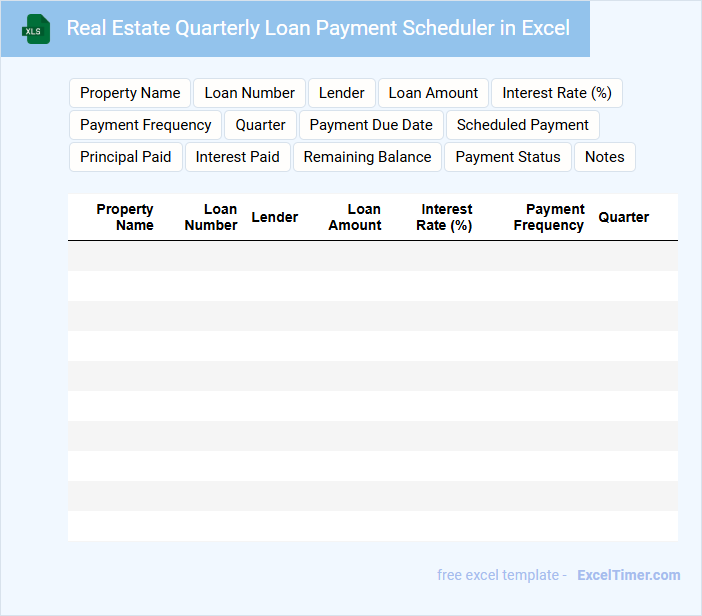

Real Estate Quarterly Loan Payment Scheduler in Excel

A Real Estate Quarterly Loan Payment Scheduler in Excel is a document designed to organize and track loan payments made every quarter for real estate investments. It typically contains columns for payment dates, amounts due, amounts paid, interest rates, and remaining balances. Efficient management of this scheduler ensures timely payments and accurate financial forecasting.

Amortization Schedule with Quarterly Payment Tracking for Agents

What information does an Amortization Schedule with Quarterly Payment Tracking for Agents typically contain? It usually includes details of the loan repayment breakdown, showing principal and interest payments each quarter. Additionally, it tracks the progress of payments over time to ensure accurate and timely monitoring by agents.

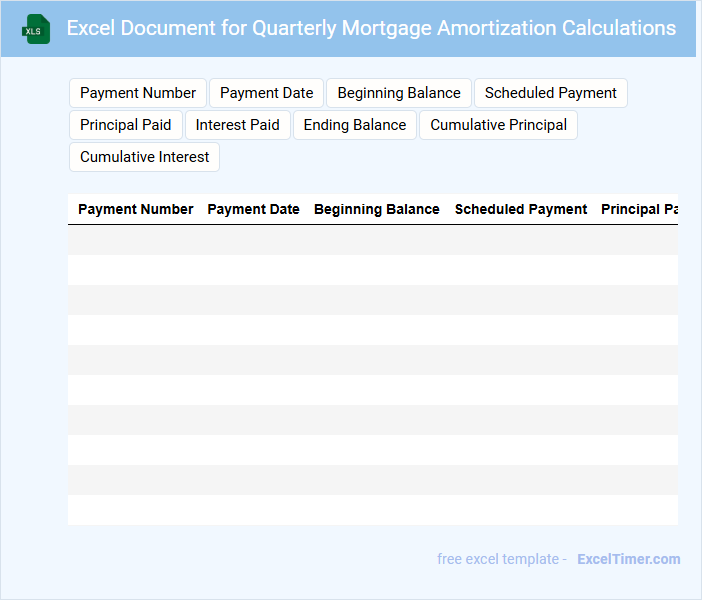

Excel Document for Quarterly Mortgage Amortization Calculations

An Excel document for quarterly mortgage amortization calculations typically contains detailed payment schedules and interest breakdowns to help track loan repayment progress efficiently.

- Amortization Schedule: A comprehensive table outlining each quarterly payment, principal, and interest amounts.

- Interest Calculation: Formulas to accurately compute interest based on the remaining loan balance and payment dates.

- Summary Section: Key metrics such as total interest paid, remaining balance, and loan payoff timeline for easy reference.

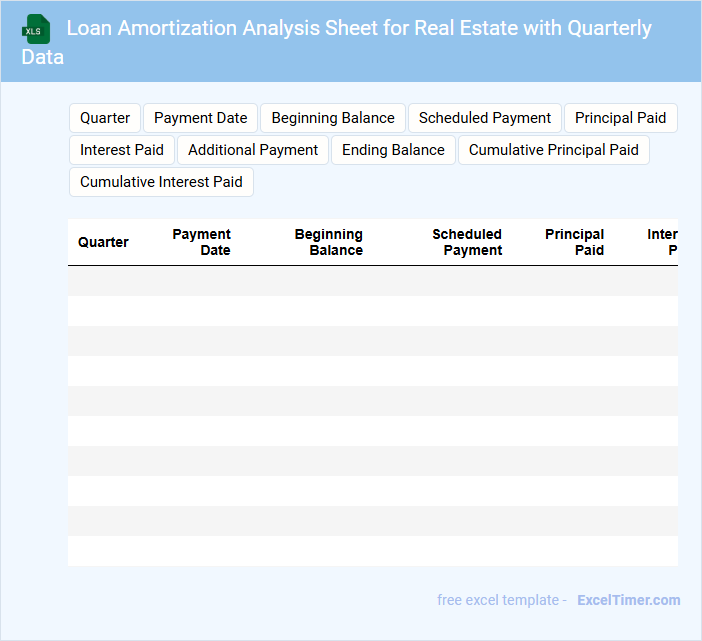

Loan Amortization Analysis Sheet for Real Estate with Quarterly Data

A Loan Amortization Analysis Sheet for Real Estate with Quarterly Data typically contains detailed schedules of loan repayments, interest allocation, and remaining balances updated every quarter.

- Payment Breakdown: It highlights principal and interest portions of each quarterly payment clearly.

- Interest Tracking: It precisely tracks cumulative interest over the loan term for financial planning.

- Balance Updates: It shows quarterly updates of outstanding loan balance to monitor amortization progress.

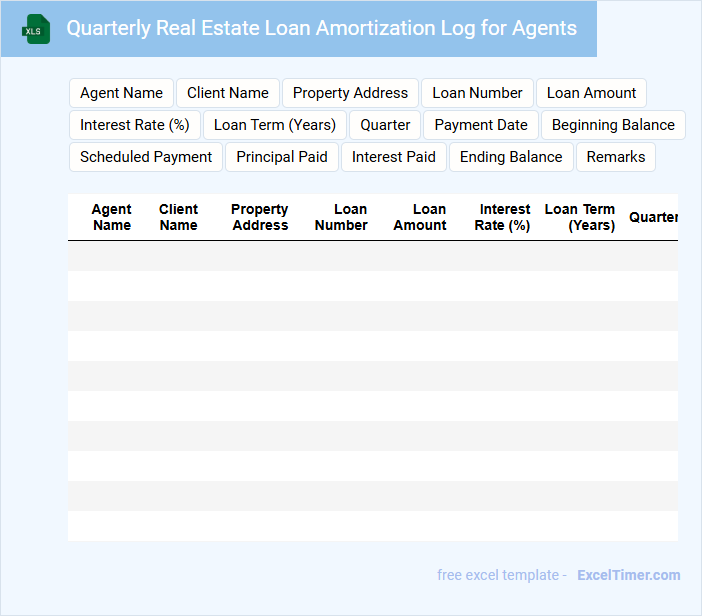

Quarterly Real Estate Loan Amortization Log for Agents

The Quarterly Real Estate Loan Amortization Log for agents is a critical document that tracks the repayment schedule of real estate loans over each quarter. It typically contains detailed information on principal balances, interest payments, and outstanding loan amounts, allowing agents to monitor financial progress accurately. Maintaining this log helps ensure transparency, timely payments, and efficient management of loan portfolios.

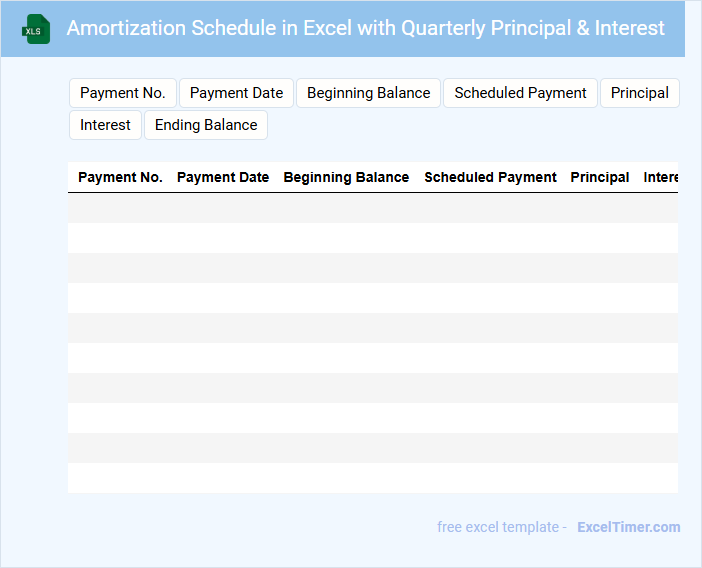

Amortization Schedule in Excel with Quarterly Principal & Interest

An Amortization Schedule in Excel is a detailed table that outlines each loan payment, showing the breakdown between principal and interest over time. It typically includes columns for payment date, payment amount, principal paid, interest paid, and remaining balance.

When structured with quarterly payments, the schedule reflects how the principal and interest are allocated every three months, helping borrowers track their loan progression efficiently. A key element is ensuring accurate formulas that update balances and interest calculations automatically.

It is important to customize the schedule based on the specific loan terms, including interest rate, payment frequency, and loan duration, to provide clear financial insights and facilitate effective loan management.

Quarterly Real Estate Loan Tracker with Amortization Details

A Quarterly Real Estate Loan Tracker is a document that monitors the status of real estate loans on a quarterly basis, including payment schedules, outstanding balances, and interest rates. It helps lenders and borrowers keep track of loan progress and ensures timely payments.

This document often contains detailed amortization schedules, showing how each payment is split between principal and interest over time. Including these details aids in forecasting future payments and financial planning.

For accuracy and effectiveness, it is important to regularly update the tracker and verify all loan terms and payment information.

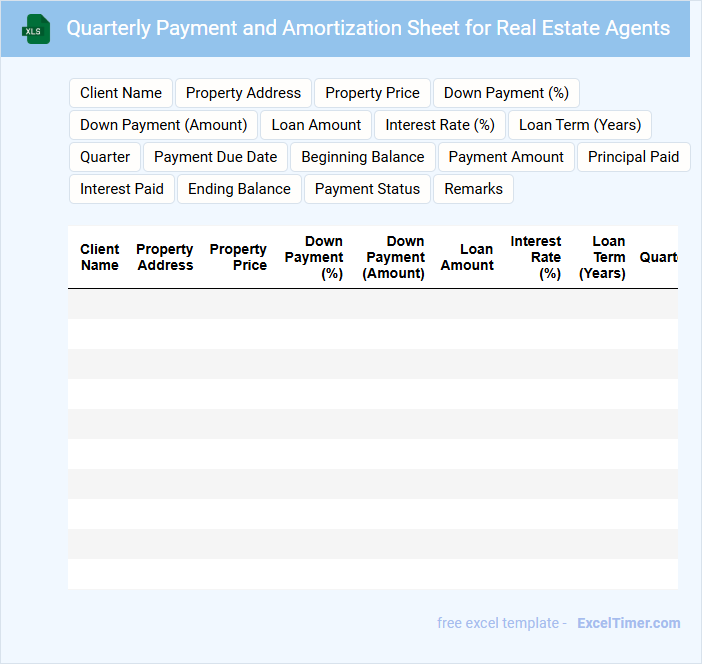

Quarterly Payment and Amortization Sheet for Real Estate Agents

The Quarterly Payment and Amortization Sheet is a vital document for real estate agents that tracks loan payments over a three-month period. It details how much of each payment goes toward principal and interest, providing a clear financial overview. This transparency helps agents manage cash flow and forecast future liabilities effectively.

Key information usually includes the outstanding loan balance, payment due dates, and cumulative interest paid. Accurate record-keeping ensures compliance and aids in financial planning. It is crucial to regularly update the sheet to reflect any changes in payment schedules or interest rates.

What are the key components required to set up a quarterly loan amortization schedule in Excel for real estate clients?

Key components for a quarterly loan amortization schedule in Excel include the loan amount, annual interest rate, loan term in years, and the number of payments per year set to four. The schedule should calculate quarterly payment amounts using the PMT function, then break down each payment into principal and interest portions through IPMT and PPMT functions. A comprehensive amortization table will display payment dates, beginning balance, interest paid, principal paid, and ending balance for each quarter.

How does changing the compounding period from monthly to quarterly affect the interest calculation in an Excel amortization table?

Changing the compounding period from monthly to quarterly in your Excel loan amortization table reduces the frequency of interest application, resulting in less interest accrued over time. This adjustment increases the principal portion of each payment earlier in the schedule. Real estate agents benefit from understanding this shift to accurately forecast loan costs and cash flow.

Which Excel formulas can automate the calculation of quarterly principal and interest payments for a real estate loan?

Excel formulas such as PMT can calculate the total quarterly loan payment based on loan amount, interest rate, and number of periods. IPMT determines the interest portion for each quarter, while PPMT computes the principal portion within the same period. Combining these formulas automates quarterly loan amortization schedules efficiently for real estate agents.

How do real estate agents track remaining loan balances each quarter using an Excel amortization schedule?

Real estate agents track remaining loan balances each quarter using an Excel amortization schedule by entering loan details such as principal, interest rate, and term into structured cells. The schedule automatically calculates payment amounts, interest, principal reduction, and updates the outstanding balance quarterly. Your accurate tracking enables better financial planning and informed decision-making on property investments.

What data visualization techniques in Excel can help real estate agents present quarterly amortization information to clients?

Real estate agents can use Excel charts like line charts to display loan balance trends and stacked bar charts to break down principal versus interest payments each quarter. Pivot tables combined with slicers enable interactive filtering of amortization schedules by specific loan terms or dates. Conditional formatting highlights key milestones such as payment due dates and remaining loan balance thresholds, enhancing client understanding of quarterly amortization.