![]()

The Quarterly Expense Tracking Excel Template for Startups simplifies budgeting by organizing expenses into clear categories for each quarter. This template ensures accurate financial monitoring, helping startups control costs and improve cash flow management. Its user-friendly design enables efficient data entry and automatic calculation of quarterly totals.

Quarterly Expense Tracking Excel Template for Startups

What information is typically included in a Quarterly Expense Tracking Excel Template for Startups? This type of document usually contains detailed records of all expenses incurred by the startup within a quarter, categorized by type such as marketing, salaries, utilities, and operational costs. It helps startups monitor their spending patterns, manage budgets efficiently, and identify areas where cost reductions are possible.

What is an important aspect to focus on when using this template? Ensuring accuracy and consistency in data entry is crucial for reliable financial analysis, and including clear categories and subcategories makes expense tracking more organized and insightful. Additionally, incorporating visual elements like graphs or charts can help startups quickly interpret their financial status and make informed decisions.

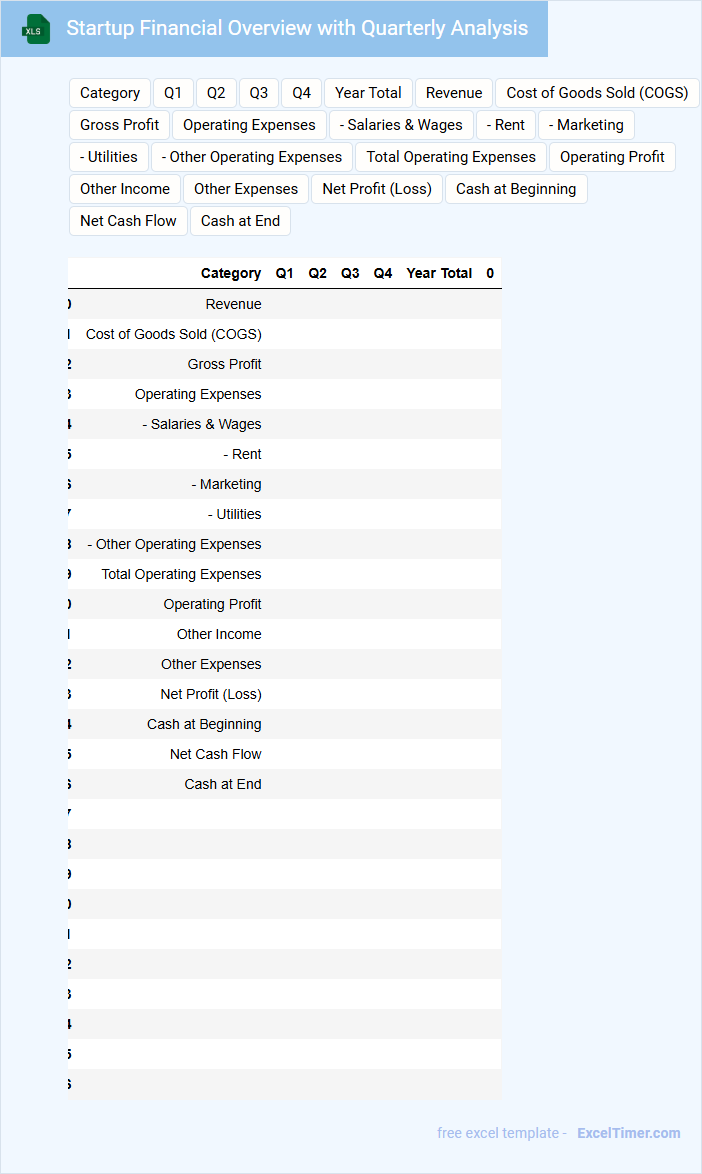

Startup Financial Overview with Quarterly Analysis

A Startup Financial Overview document typically contains key financial statements such as the balance sheet, income statement, and cash flow statement, providing a snapshot of the company's financial health. It also includes quarterly revenue, expenses, and profitability trends to track performance over time.

The Quarterly Analysis offers detailed insights into growth drivers, budget variances, and forecast adjustments based on recent data. Highlighting cash runway and burn rate is crucial for understanding the startup's sustainability. This document aids investors and stakeholders in making informed decisions.

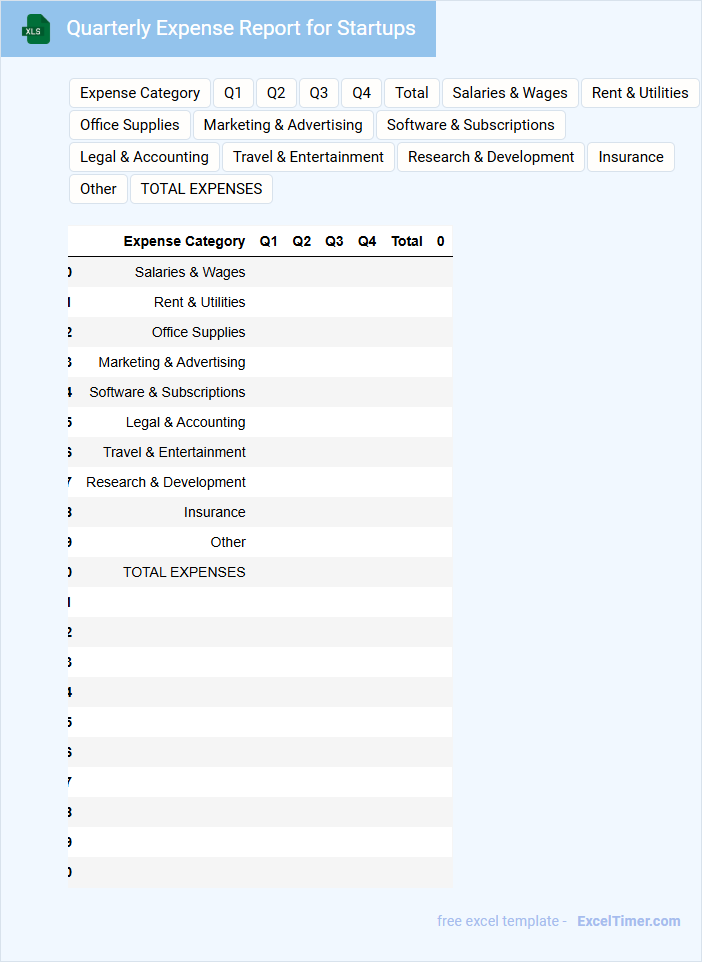

Quarterly Expense Report for Startups

A Quarterly Expense Report for Startups typically contains detailed financial data summarizing the expenses incurred over a three-month period to help track budgeting effectiveness and financial health.

- Expense Categories: Clearly categorize all expenses such as payroll, marketing, and operational costs.

- Comparison with Budget: Include comparisons against the initial budget to identify variances and areas of overspending.

- Summary and Insights: Provide a concise summary highlighting key trends, notable changes, and recommendations for cost management.

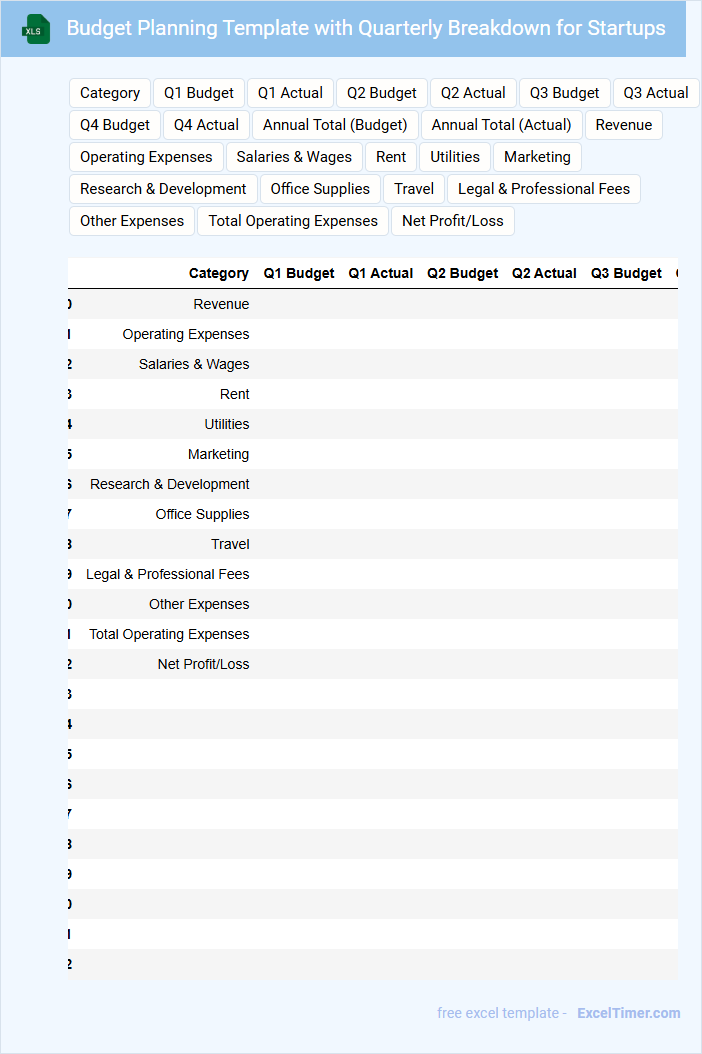

Budget Planning Template with Quarterly Breakdown for Startups

A Budget Planning Template with Quarterly Breakdown for Startups is essential for organizing financial goals and tracking expenses over specific time frames. This document typically contains sections for revenue projections, operational costs, and cash flow estimates divided by quarters. It helps startups allocate resources efficiently and make informed financial decisions throughout the year.

Startup Quarterly Expense Comparison Sheet

What information is typically included in a Startup Quarterly Expense Comparison Sheet? This document usually contains detailed records of all expenditures incurred by the startup within a specific quarter, categorized by departments or expense types. It helps in analyzing spending patterns, identifying cost-saving opportunities, and comparing current expenses against previous quarters or budget forecasts to ensure financial efficiency.

What is an important aspect to focus on when creating this sheet? Accuracy in data entry is crucial to provide a reliable overview of expenses. Additionally, incorporating visual elements like charts or graphs can enhance clarity and make it easier to spot trends or irregularities for informed decision-making.

Quarterly Cost Tracking for Startup Teams

What information does a Quarterly Cost Tracking document for startup teams typically contain?

This document usually includes a detailed record of all expenses incurred by the startup during the quarter, categorized by departments or projects. It helps teams monitor their budget adherence, identify cost-saving opportunities, and make informed financial decisions to ensure sustainable growth.

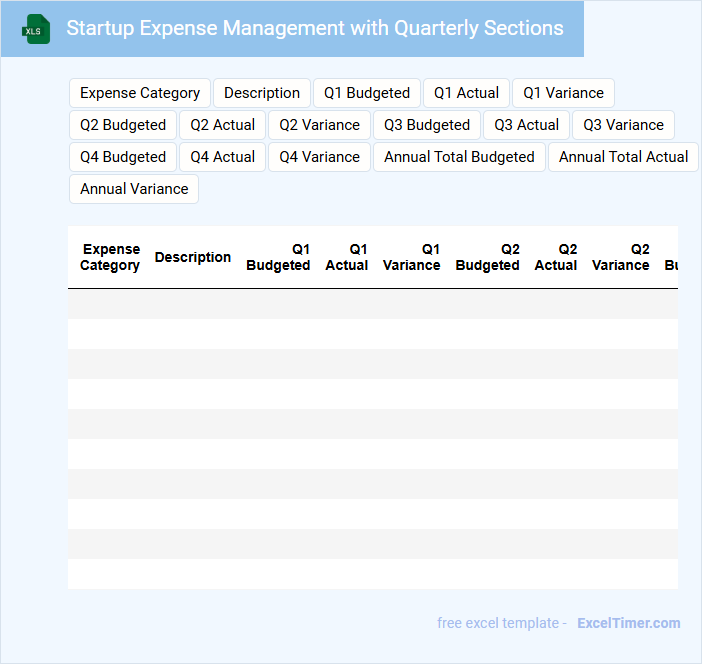

Startup Expense Management with Quarterly Sections

This document typically contains a detailed breakdown of all initial costs incurred by a startup, organized by each quarter to facilitate tracking and budgeting. It includes categories such as equipment, marketing, salaries, and operational expenses to ensure comprehensive expense management. Effective use of quarterly sections allows for strategic financial planning and timely adjustments to optimize cash flow.

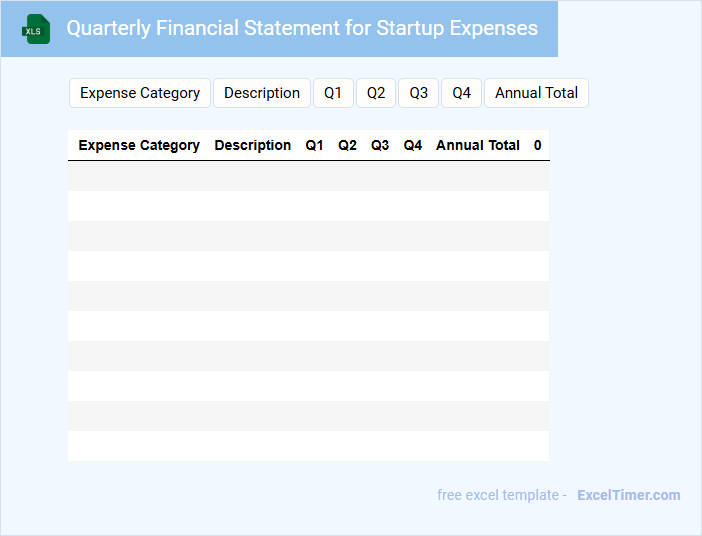

Quarterly Financial Statement for Startup Expenses

A Quarterly Financial Statement for Startup Expenses typically includes detailed records of all expenditures incurred during the startup phase, such as operational costs, marketing expenses, and initial capital investments. This document helps track the financial health and cash flow management of the startup over each quarter. It is essential for stakeholders to monitor how funds are allocated and to ensure transparency in financial reporting.

Startup Expense Analysis with Quarterly Charts

What information is typically included in a Startup Expense Analysis with Quarterly Charts? This type of document usually contains a detailed breakdown of initial and ongoing expenses categorized by quarters, helping to visualize financial trends over time. It also highlights key spending areas, enabling efficient budget management and forecasting for the startup's growth phases.

What is an important consideration when preparing this analysis? Ensuring accurate and consistent data entry is vital to maintain the reliability of quarterly comparisons. Additionally, incorporating clear, easy-to-understand charts enhances stakeholder communication and supports strategic decision-making.

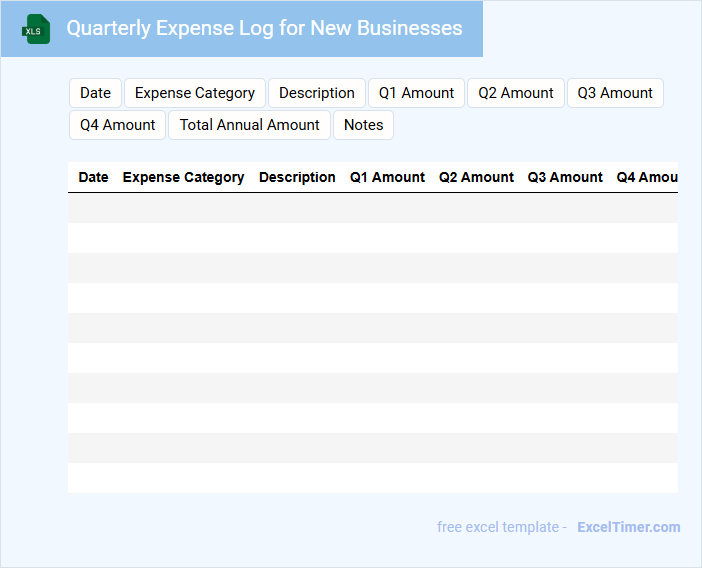

Quarterly Expense Log for New Businesses

A Quarterly Expense Log for new businesses typically contains detailed records of all expenditures over a three-month period. This includes costs such as office supplies, marketing expenses, salaries, and utilities, helping track financial health consistently.

Its primary purpose is to monitor spending patterns and identify areas where costs can be reduced or better managed. Maintaining accuracy and regular updates is essential for effective financial planning and reporting.

For new businesses, it is important to include clear categories and date stamps for each expense to ensure precise analysis and budgeting.

Operating Expense Tracker with Quarterly Totals for Startups

An Operating Expense Tracker is a crucial document for startups to monitor their monthly and quarterly spending efficiently. It typically contains detailed records of all operational costs such as rent, utilities, salaries, and marketing expenses. By summarizing expenses with quarterly totals, startups can better manage cash flow and make informed financial decisions.

To optimize its use, ensure the tracker is regularly updated, categorized clearly, and includes comparison with budgeted amounts. Incorporating visual summaries like charts can enhance quick understanding of spending patterns. Finally, linking the tracker with forecasting tools helps predict future expenses and supports strategic planning.

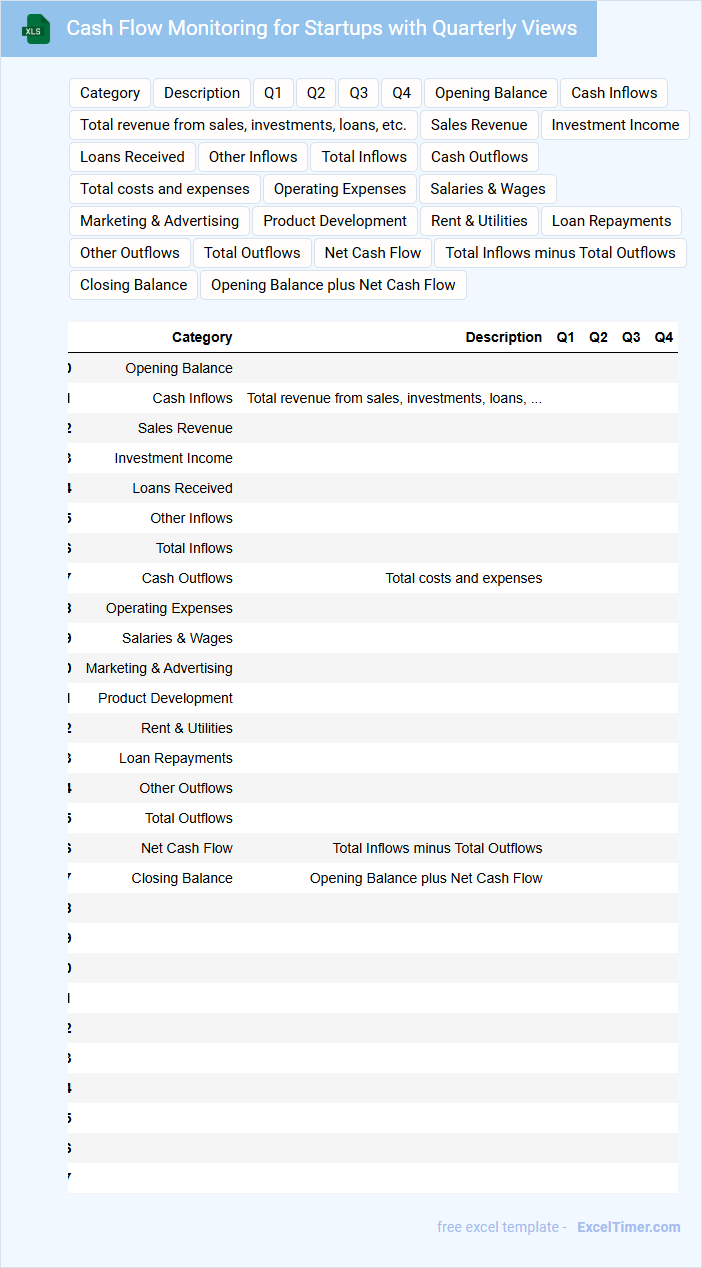

Cash Flow Monitoring for Startups with Quarterly Views

This document focuses on cash flow monitoring, which is essential for startups to track the inflow and outflow of funds systematically. It typically contains detailed quarterly financial summaries, projections, and comparisons to help identify trends and manage liquidity effectively. Regular review within this framework enables proactive decision-making to ensure financial health and sustainability.

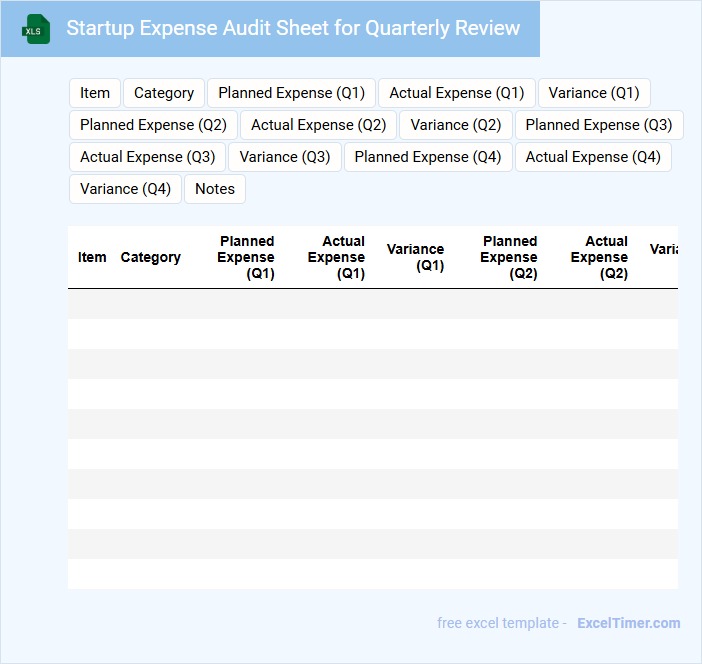

Startup Expense Audit Sheet for Quarterly Review

A Startup Expense Audit Sheet is a financial document used to track and review all expenditures related to the business startup phase. It helps ensure accurate record-keeping and accountability. Regular updates facilitate better budgeting and financial planning. For a Quarterly Review, this sheet highlights significant expenses and identifies any discrepancies or unexpected costs. It is crucial for maintaining transparency with stakeholders and optimizing resource allocation. Always include dates, descriptions, amounts, and categories for clarity.

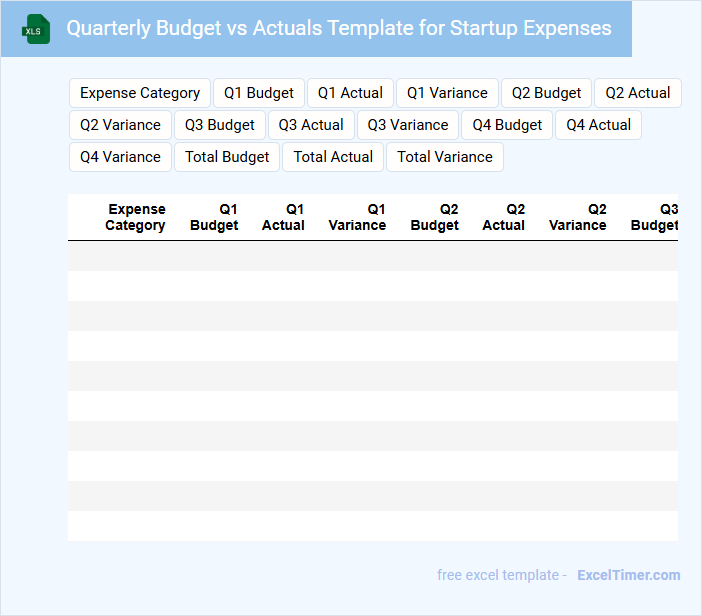

Quarterly Budget vs Actuals Template for Startup Expenses

A Quarterly Budget vs Actuals Template for startup expenses is a financial document used to compare the planned budget against the actual spending over a three-month period. It helps startups monitor their financial performance, ensuring that resources are allocated efficiently and waste is minimized.

This template typically contains categorized expense items, budgeted amounts, actual costs, variances, and summary analysis. It is important to regularly update and review this document to identify discrepancies early and adjust financial strategies accordingly.

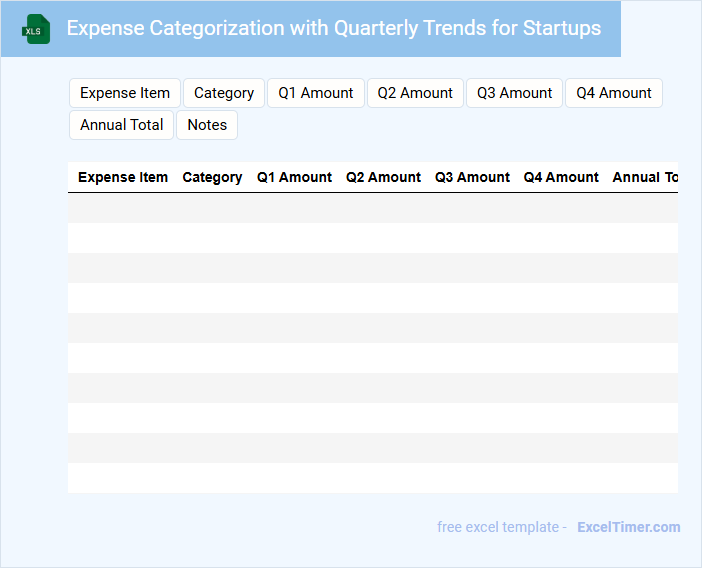

Expense Categorization with Quarterly Trends for Startups

This document typically contains a systematic breakdown of startup expenses categorized by various types such as operational, marketing, and development costs. It highlights quarterly trends to help analyze spending patterns and identify areas for financial optimization. The report is essential for budgeting, forecasting, and strategic financial decision-making in startups.

What are the key categories to include when tracking quarterly expenses for startups in Excel?

When tracking quarterly expenses for startups in Excel, include key categories such as Payroll, Marketing, Office Supplies, Rent, Utilities, Software Subscriptions, and Travel. Your spreadsheet should also have sections for Taxes, Legal Fees, and Miscellaneous Costs to capture all financial outflows. Organizing expenses into these categories helps you monitor spending patterns and optimize your budget efficiently.

How can you automate recurring expense entries in your Excel quarterly tracking sheet?

Automate recurring expense entries in your Excel quarterly tracking sheet by using formulas like OFFSET combined with DATE functions to generate expense dates and amounts automatically. Implement Excel's built-in features such as macros or Power Query to load and repeat recurring transactions each quarter without manual input. Set up named ranges for expense categories and link them to dynamic tables to ensure accurate, consistent updates in your startup's quarterly expense tracking.

Which Excel functions/formulas are most effective for analyzing trends in quarterly spending?

Excel functions such as SUMIFS, AVERAGEIFS, and TREND are highly effective for analyzing trends in quarterly spending by startups. PivotTables enable dynamic aggregation and visualization of expenses across multiple periods. Combining these tools helps identify spending patterns and forecast future costs accurately.

How do you set up conditional formatting to flag overspending in specific categories each quarter?

To set up conditional formatting for quarterly overspending in your Excel expense tracker, select the category expense cells and apply a rule using a formula comparing each value to its predefined budget limit. Use a formula like =B2>Budget to highlight cells exceeding allocated quarterly budgets, where B2 represents the expense amount. This visual flag enables you to quickly identify and manage budget overruns in your startup's expense categories.

What methods can be used to visualize quarterly expense data for stakeholders within Excel?

Excel offers multiple visualization methods for quarterly expense data, including bar charts, line graphs, and pie charts, which clearly depict spending trends and category distributions. PivotTables combined with slicers enable dynamic data exploration, allowing stakeholders to filter and analyze expenses by quarter or department. Conditional formatting highlights key anomalies or thresholds directly within expense tables, enhancing data-driven decision-making.