The Quarterly Investment Portfolio Excel Template for Individuals helps track and analyze investment performance over each quarter, providing a clear overview of asset allocation and returns. It simplifies monitoring stocks, bonds, and other assets while calculating gains and losses automatically. Regular use ensures informed decision-making and optimized portfolio growth.

Quarterly Investment Portfolio Tracker for Individuals

A Quarterly Investment Portfolio Tracker is a document that typically contains a comprehensive overview of an individual's investment assets, including stocks, bonds, mutual funds, and other securities. It summarizes the portfolio's performance, showing gains, losses, and asset allocation over the past quarter. This document is essential for monitoring progress towards financial goals and making informed investment decisions.

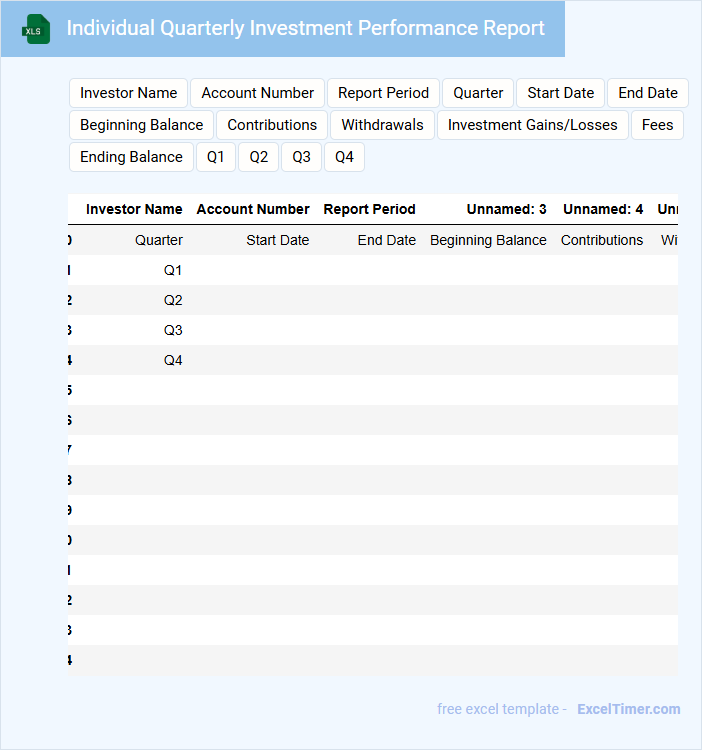

Individual Quarterly Investment Performance Report

What information is typically included in an Individual Quarterly Investment Performance Report? This type of document usually contains a detailed summary of an individual's investment portfolio performance over a three-month period. It highlights key metrics such as total returns, asset allocation, and benchmark comparisons to provide clear insights into investment progress and risks.

Why is it important to focus on accurate data and clear visualization in this report? Ensuring the accuracy of data helps maintain trust and allows for effective decision-making. Additionally, incorporating charts and graphs can enhance readability and enable investors to quickly grasp performance trends and make informed adjustments to their investment strategies.

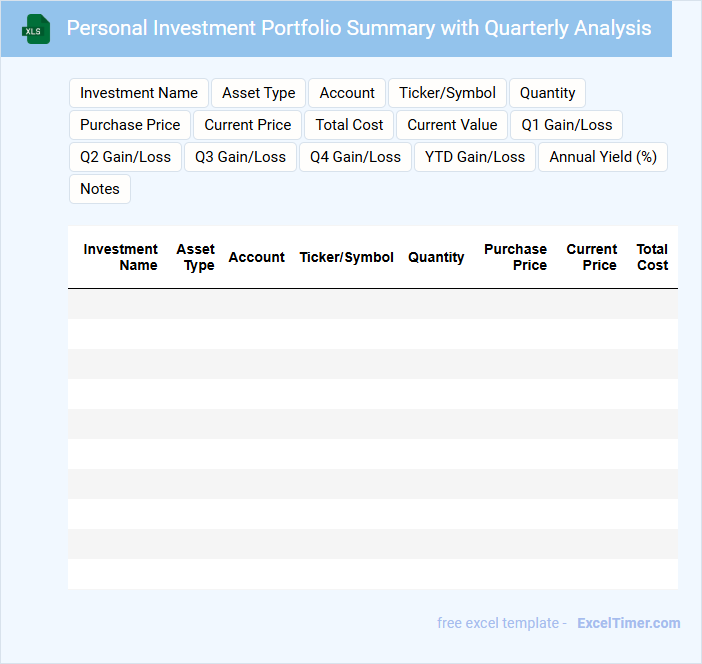

Personal Investment Portfolio Summary with Quarterly Analysis

A Personal Investment Portfolio Summary typically contains an overview of assets, recent transactions, and current valuations for individual investments. It provides a consolidated snapshot of the portfolio's performance over a specified period, often including quarterly analysis to highlight trends and changes. Key components often include asset allocation, returns breakdown, and risk assessment to guide informed decision-making.

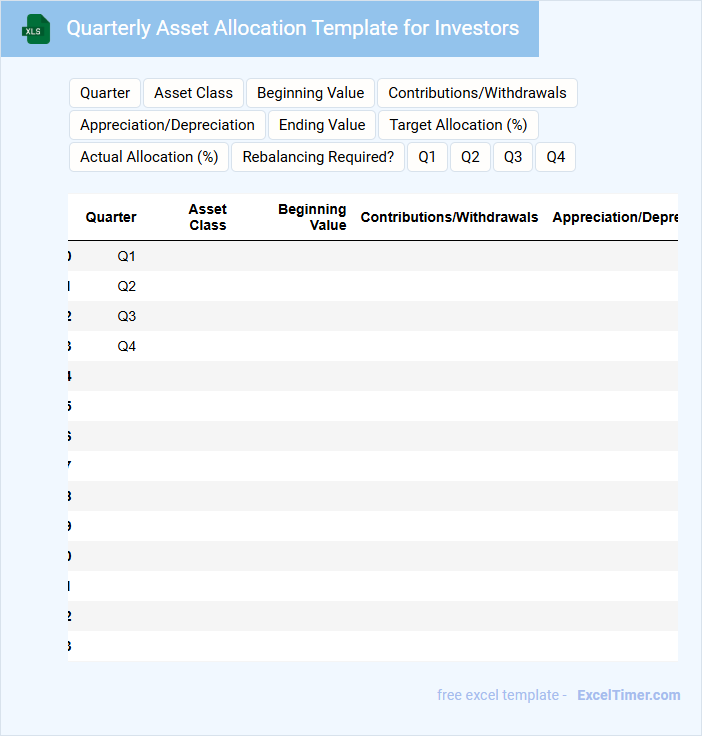

Quarterly Asset Allocation Template for Investors

A Quarterly Asset Allocation Template for Investors typically contains a detailed breakdown of an investor's portfolio across various asset classes, updated every quarter to reflect changes in market conditions and investment goals. It helps investors track performance, rebalance assets, and maintain diversification.

- Include clear categories for asset classes such as equities, bonds, and cash equivalents.

- Incorporate performance metrics and historical comparison to previous quarters.

- Provide space for notes on market outlook and adjustment rationale.

Quarterly Review Sheet for Individual Investment Portfolios

A Quarterly Review Sheet for Individual Investment Portfolios typically contains detailed performance metrics, asset allocation summaries, and recent transaction histories. This document helps investors assess changes in portfolio value and align investments with financial goals. Regular reviews ensure timely adjustments based on market conditions and investment objectives.

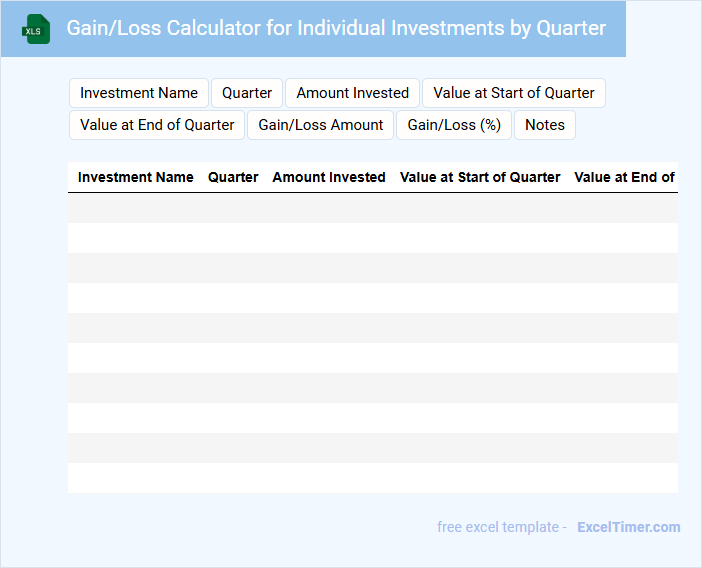

Gain/Loss Calculator for Individual Investments by Quarter

A Gain/Loss Calculator for Individual Investments by Quarter is typically used to track and analyze the performance of personal investment portfolios over specific fiscal periods.

- Accuracy of Input Data: Ensure all transaction dates and amounts are entered precisely to maintain reliable calculations.

- Tax Implications: Include consideration of short-term vs. long-term gains for proper tax reporting.

- Quarterly Summary: Provide a clear breakdown of gains and losses for each quarter to facilitate informed investment decisions.

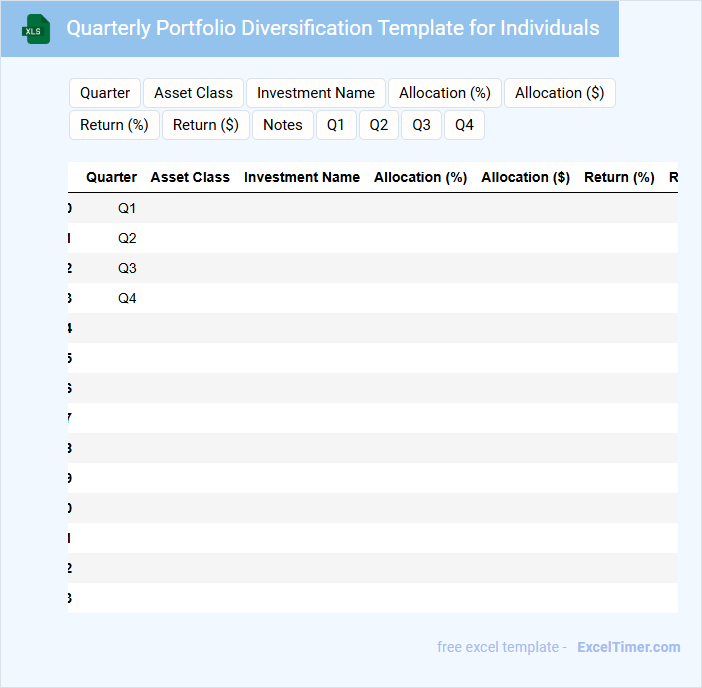

Quarterly Portfolio Diversification Template for Individuals

The Quarterly Portfolio Diversification Template is designed to help individuals track and manage their investment allocation effectively. It typically contains sections for reviewing asset classes, performance metrics, and rebalancing strategies to ensure a balanced portfolio. Regular updates using this document support informed decision-making and risk management.

Important things to include are detailed asset categories, percentage allocations, and performance comparisons against benchmarks. Including notes on market trends and personal investment goals can enhance the template's usefulness. Clear visualization tools such as pie charts or bar graphs also improve comprehension and tracking.

Individual Investment Goals Tracking with Quarterly Updates

This document serves as a comprehensive tracker for monitoring individual investment performance over time. It typically contains detailed records of investment amounts, asset allocations, and returns updated quarterly. Maintaining accurate updates ensures alignment with financial objectives and informed decision-making.

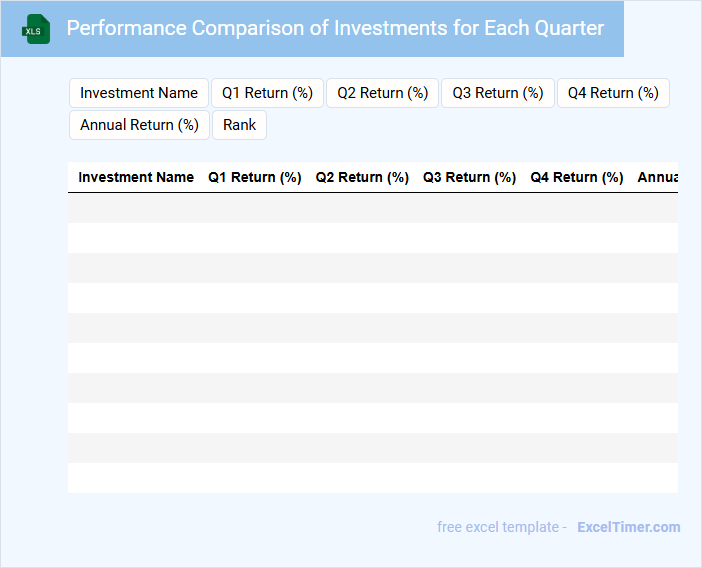

Performance Comparison of Investments for Each Quarter

A Performance Comparison document typically contains detailed data on the returns and growth rates of various investments over specific time periods. It analyzes quarterly trends, highlighting which assets outperformed or underperformed relative to benchmarks. Key metrics such as ROI, volatility, and risk-adjusted returns are crucial for informed decision-making.

Quarterly Holdings Analysis Excel for Individual Investors

What information does a Quarterly Holdings Analysis Excel document typically contain for individual investors? This document usually includes detailed data on the performance of various investment holdings over a specific quarter, such as stock quantities, market values, dividends received, and changes in portfolio allocation. It provides a clear overview to help investors track their investment performance, identify trends, and make informed decisions for portfolio adjustments.

What is important to consider when creating or reviewing a Quarterly Holdings Analysis Excel for individual investors? It is essential to ensure accuracy in data entry and consistency in updating figures each quarter to reflect true portfolio status. Additionally, including visual aids like charts or graphs and summary sections can greatly enhance comprehension and highlight key insights effectively.

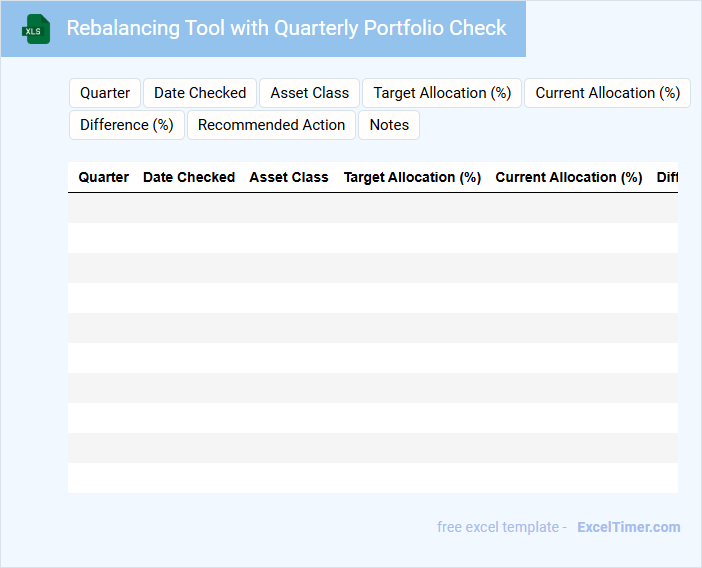

Rebalancing Tool with Quarterly Portfolio Check

A Rebalancing Tool with Quarterly Portfolio Check document typically outlines the process and guidelines for periodically adjusting investment portfolios to maintain desired asset allocations and manage risk.

- Portfolio Overview: Detailed summary of current asset allocations and performance metrics to assess alignment with investment goals.

- Rebalancing Strategy: Clear criteria and rules for when and how to rebalance the portfolio to optimize returns and minimize risk.

- Quarterly Review Process: Scheduled procedure for evaluating portfolio changes, market conditions, and necessary adjustments every quarter.

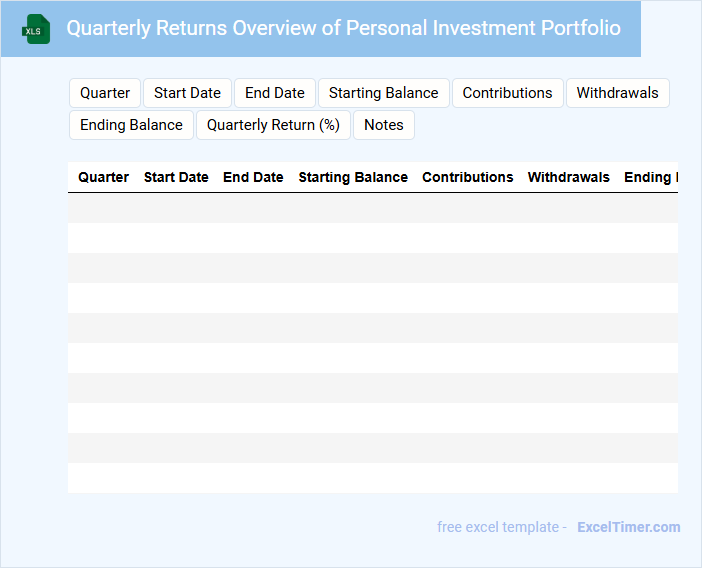

Quarterly Returns Overview of Personal Investment Portfolio

The Quarterly Returns Overview typically summarizes the performance of a personal investment portfolio over a three-month period. It includes detailed information on asset allocation, gains, losses, and overall portfolio growth. This document helps investors assess their investment strategy's effectiveness and make informed decisions.

Dashboard for Quarterly Investment Portfolio Monitoring

A Dashboard for Quarterly Investment Portfolio Monitoring typically contains a comprehensive overview of asset allocation, performance metrics, and risk indicators. It consolidates key financial data such as returns, benchmarks, and portfolio diversification, enabling quick assessment of investment health. Important aspects include real-time data updates, clear visualizations, and alerts for significant deviations or market changes to support informed decision-making.

Tracking Sheet with Quarterly Dividends for Individuals

A Tracking Sheet with Quarterly Dividends for Individuals is a financial document designed to monitor dividend payments from investments on a quarterly basis. It typically contains details such as stock names, dividend amounts, payment dates, and total income received. This sheet helps investors maintain an organized record and analyze their income streams effectively.

Important elements to include are clear columns for stock ticker symbols, dividend yield, ex-dividend dates, payment dates, and cumulative dividends received. Additionally, incorporating notes for dividend reinvestments and tax implications can enhance the sheet's usefulness. Keeping the data updated regularly ensures accurate tracking and better financial planning.

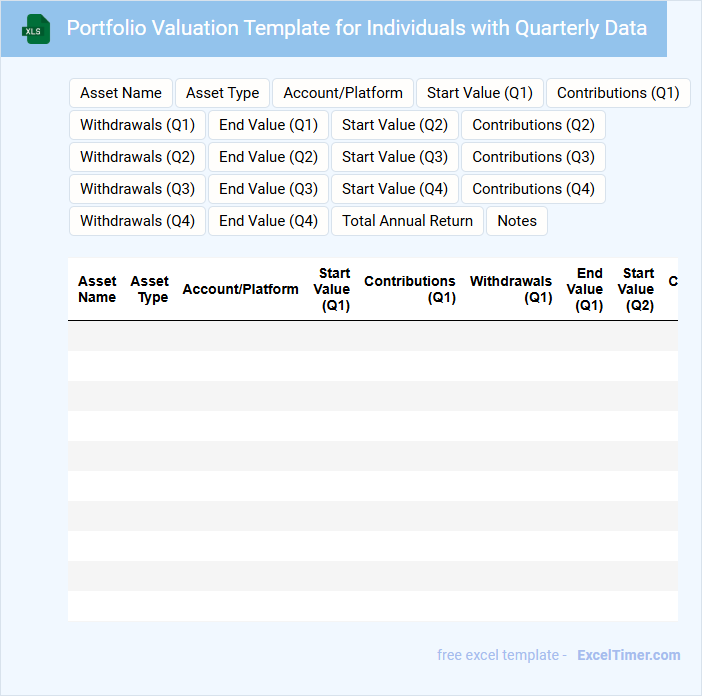

Portfolio Valuation Template for Individuals with Quarterly Data

A Portfolio Valuation Template for individuals with quarterly data typically contains a detailed summary of investment assets, their current market values, and performance trends over each quarter. It helps investors track the growth or decline of their portfolio through systematically organized financial information. Key components often include asset allocation, quarterly returns, and comparison against benchmarks.

What are the key components to include in a quarterly investment portfolio summary for individuals?

A quarterly investment portfolio summary for individuals should include asset allocation breakdown, portfolio performance metrics such as return on investment (ROI) and benchmark comparisons, and transaction history highlighting buys, sells, and dividends received. Risk assessment indicators, including volatility measures and exposure to various sectors or asset classes, provide insight into portfolio stability. Detailed notes on market trends and investment strategy adjustments offer context for portfolio changes and future outlook.

How do you categorize assets and track performance over each quarter in Excel?

Categorize assets in an Excel Quarterly Investment Portfolio by creating separate columns for asset types such as stocks, bonds, real estate, and mutual funds. Use rows to record individual holdings with key data including purchase price, quantity, current value, and acquisition date. Track performance each quarter by calculating metrics like quarterly returns, percentage change, and total portfolio value using formulas and pivot tables.

What essential formulas help calculate quarterly returns and portfolio growth?

Key formulas for a Quarterly Investment Portfolio include calculating quarterly returns using =(Ending Value - Beginning Value) / Beginning Value, and portfolio growth with =SUM(Product(Individual Asset Returns, Asset Weights)). Excel functions like XIRR can also provide precise periodic return calculations based on irregular cash flows.

How can you visualize asset allocation and diversification in a quarterly report?

Visualize asset allocation and diversification in a quarterly investment portfolio report using pie charts to display the percentage distribution of assets across categories such as stocks, bonds, and cash. Utilize bar graphs to track changes in individual asset classes over the quarter, highlighting growth or reduction. Incorporate a diversification index or risk metric to demonstrate portfolio balance and stability.

What risk assessment metrics should be monitored in a quarterly investment portfolio document?

Your quarterly investment portfolio document should monitor risk assessment metrics such as Value at Risk (VaR), beta coefficient, and Sharpe ratio to evaluate potential losses and volatility. Tracking drawdown percentages and standard deviation provides insight into portfolio stability and risk exposure. These metrics enable you to make informed decisions and adjust asset allocation effectively over time.