The Quarterly Tax Preparation Excel Template for Consultants streamlines tracking income, expenses, and estimated tax payments to ensure accurate quarterly filings. It features user-friendly sections for categorizing deductions and calculating tax liabilities, helping consultants avoid penalties and maintain compliance. Regular use of this template enhances financial organization and simplifies tax season preparation.

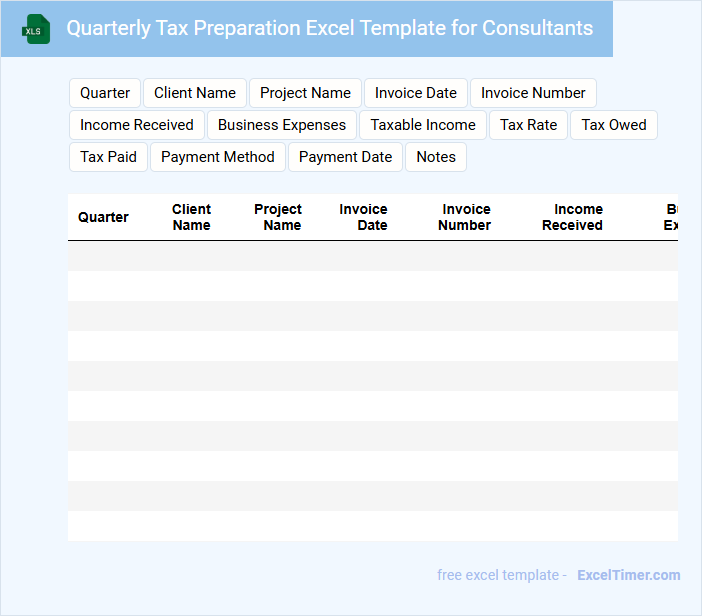

Quarterly Tax Preparation Excel Template for Consultants

A Quarterly Tax Preparation Excel Template for Consultants is a structured spreadsheet designed to help consultants track income and expenses for accurate tax filing. It simplifies the process of calculating quarterly tax liabilities and managing financial records efficiently.

- Include sections for income, deductible expenses, and estimated tax payments.

- Incorporate formulas to automatically calculate tax owed based on current tax rates.

- Provide space for notes or reminders about tax deadlines and required documents.

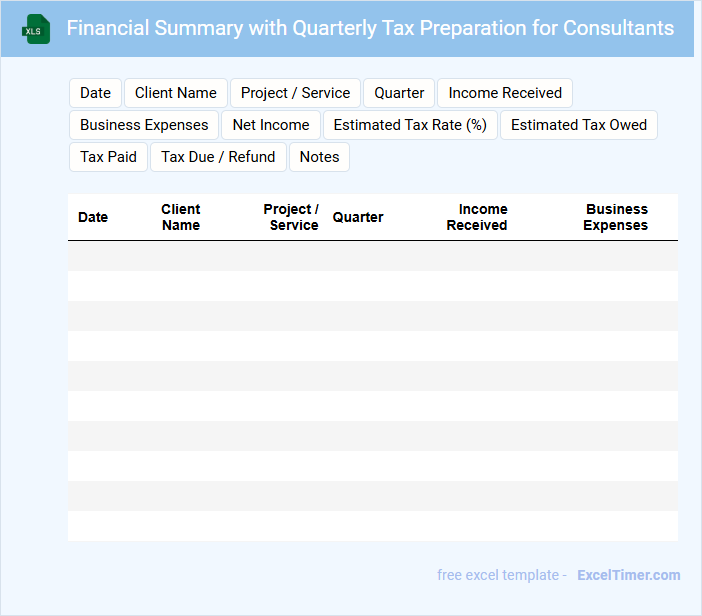

Financial Summary with Quarterly Tax Preparation for Consultants

A Financial Summary for consultants typically contains a detailed overview of income, expenses, and net profit generated each quarter. It highlights key financial metrics to monitor business health and ensures accurate quarterly tax preparation. This document is essential for tracking financial performance and meeting tax compliance requirements efficiently.

Important elements to include are categorized income and expense reports, estimated tax payments, and documentation for deductible business expenses. Consultants should maintain organized records of invoices, receipts, and tax forms throughout the quarter. Regularly updating and reviewing this summary helps prevent last-minute tax filing issues and optimizes tax liabilities.

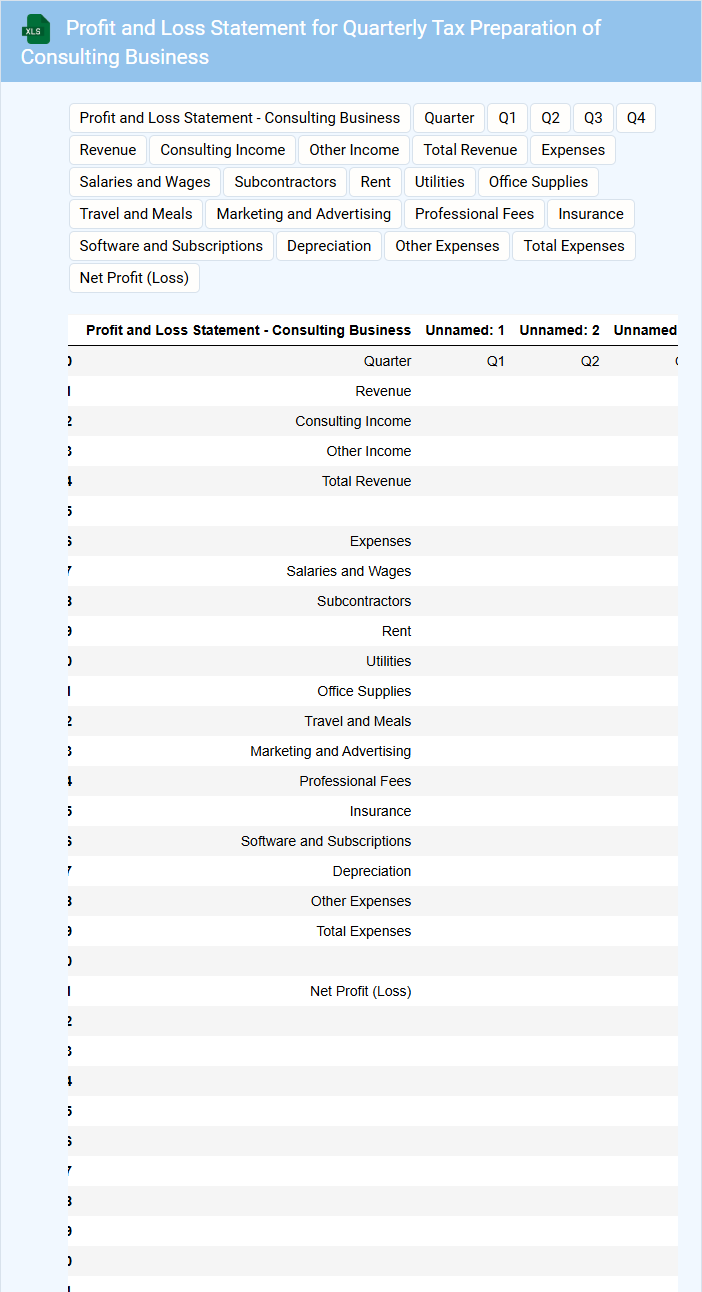

Profit and Loss Statement for Quarterly Tax Preparation of Consulting Business

A Profit and Loss Statement for quarterly tax preparation typically contains a summary of revenues, expenses, and net profit or loss for the consulting business within the specified quarter. It highlights income sources such as consulting fees and deductible expenses like office supplies, travel, and salaries. This document is essential for accurately calculating taxable income and ensuring compliance with tax regulations.

Quarterly Expense Tracker for Consultants with Tax Categories

A Quarterly Expense Tracker for consultants is a document used to systematically record and monitor expenses incurred during a three-month period. It categorizes these expenses to streamline financial management and simplify tax preparation.

This type of document typically contains sections for listing various expense categories, dates, amounts, and notes related to each transaction. Accurate categorization is crucial for identifying deductible expenses and ensuring compliance with tax regulations.

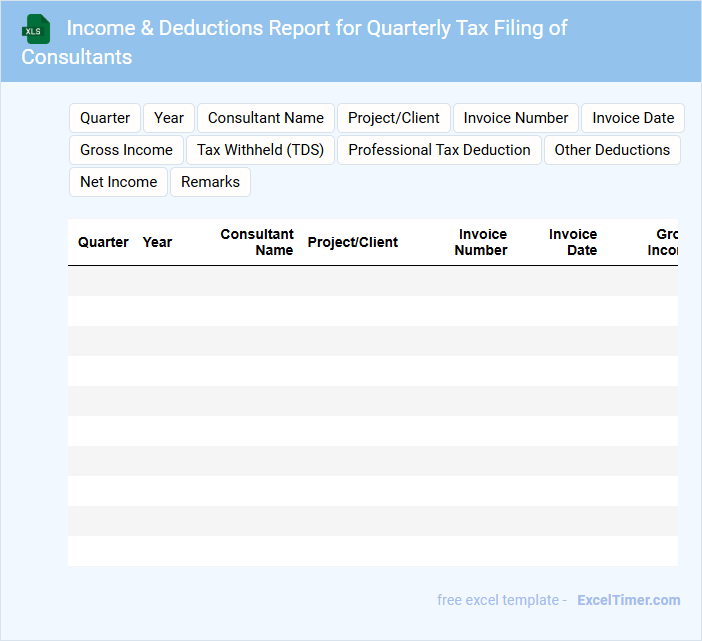

Income & Deductions Report for Quarterly Tax Filing of Consultants

This document typically contains a detailed summary of income earned and deductions claimed by consultants within a fiscal quarter to ensure accurate tax filing.

- Comprehensive Income Records: Include all sources of consultant fees and additional earnings to avoid discrepancies.

- Detailed Deduction Listings: Record every deductible expense such as business costs and allowable write-offs to minimize taxable income.

- Accurate Quarterly Totals: Provide precise totals for both income and deductions to simplify tax calculation and submission.

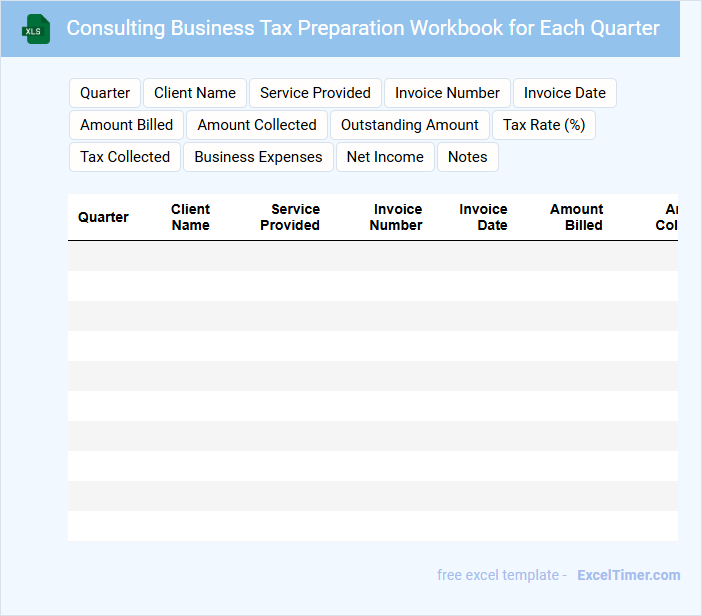

Consulting Business Tax Preparation Workbook for Each Quarter

The Consulting Business Tax Preparation Workbook is a structured document designed to organize financial information for tax purposes each quarter. It typically contains sections for income tracking, expense documentation, and tax deduction calculations. This systematic approach ensures accuracy and compliance with tax regulations throughout the fiscal year.

Cash Flow Tracker with Quarterly Tax Worksheet for Consultants

A Cash Flow Tracker is essential for monitoring income and expenses over time, providing clear insight into financial health. It helps consultants manage their finances effectively by categorizing cash inflows and outflows accurately.

The Quarterly Tax Worksheet assists in calculating estimated tax payments, ensuring consultants stay compliant and avoid penalties. It organizes deductions, invoices, and taxable income systematically for timely submissions.

Including detailed transaction logs, anticipated expenses, and tax deadlines can significantly enhance the utility of this document for financial planning and tax preparedness.

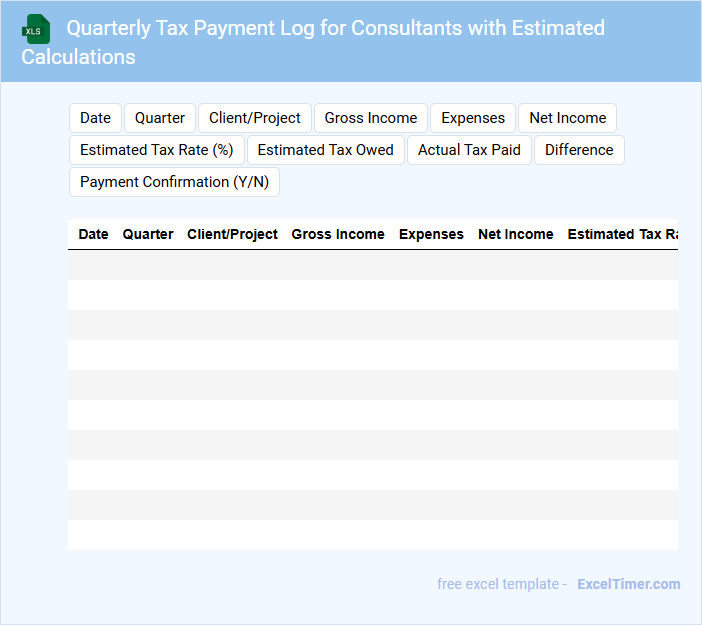

Quarterly Tax Payment Log for Consultants with Estimated Calculations

A Quarterly Tax Payment Log for consultants typically contains detailed records of payments made towards estimated taxes each quarter. It helps in tracking deadlines, amounts paid, and outstanding balances to ensure compliance with tax regulations.

The document also includes estimated tax calculations based on projected income and deductions for accurate payment planning. Regularly updating the log is crucial for avoiding penalties and managing cash flow effectively.

It is recommended to integrate both payment tracking and estimated calculations to maintain clear and organized financial records throughout the year.

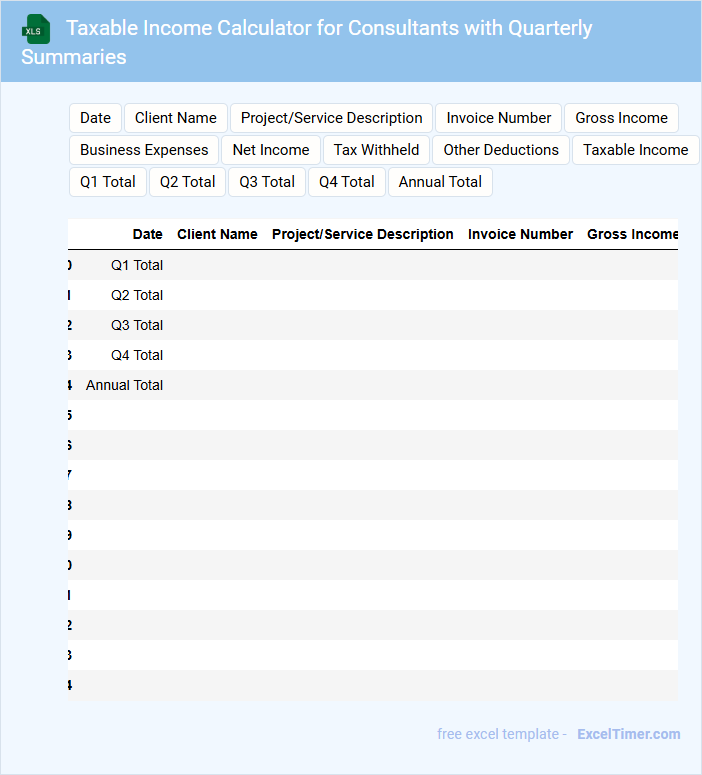

Taxable Income Calculator for Consultants with Quarterly Summaries

What information is typically included in a Taxable Income Calculator for Consultants with Quarterly Summaries? This document usually contains detailed income entries, deductible expenses, and tax rates applied per quarter to accurately calculate taxable income. It also summarizes earnings and deductions quarterly to help consultants monitor their financial standing and prepare for tax submissions.

Why is it important to include quarterly summaries in this calculator? Quarterly summaries provide a clear overview of income fluctuations and tax liabilities throughout the year, enabling timely adjustments and better cash flow management. They help consultants avoid penalties by ensuring estimated taxes are paid on time and in correct amounts.

Invoice Tracking Spreadsheet for Quarterly Tax Preparation of Consultants

What information does an Invoice Tracking Spreadsheet for Quarterly Tax Preparation of Consultants usually contain? This type of document typically includes detailed records of all invoices issued and received by consultants, covering dates, amounts, client details, payment status, and tax-related data. It helps consultants systematically organize financial transactions for accurate quarterly tax filing and ensures compliance with tax regulations.

What is an important consideration when using this spreadsheet? Accuracy in entering invoice data and timely updates are crucial to avoid errors in tax calculations and deadlines. Additionally, incorporating categories for deductible expenses and clearly distinguishing between paid and pending invoices optimizes the efficiency of tax preparation.

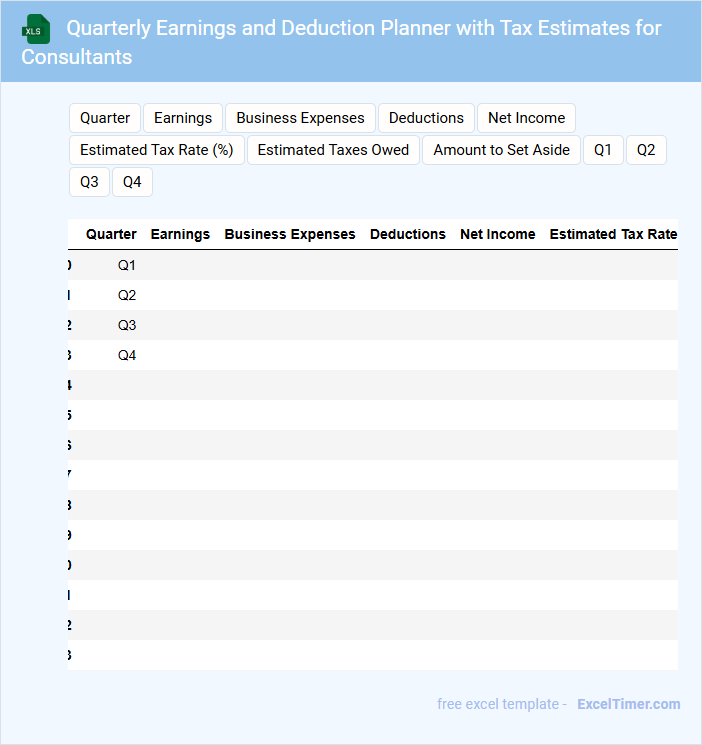

Quarterly Earnings and Deduction Planner with Tax Estimates for Consultants

This document typically contains a detailed overview of quarterly earnings, planned deductions, and tax estimates specifically tailored for consultants. It serves as a financial guide to help manage income and anticipate tax liabilities throughout the fiscal quarter.

- Accurately track all sources of income to ensure precise earnings reporting.

- Include anticipated deductions such as business expenses to optimize tax savings.

- Regularly update tax estimates based on current earnings to avoid surprises at tax time.

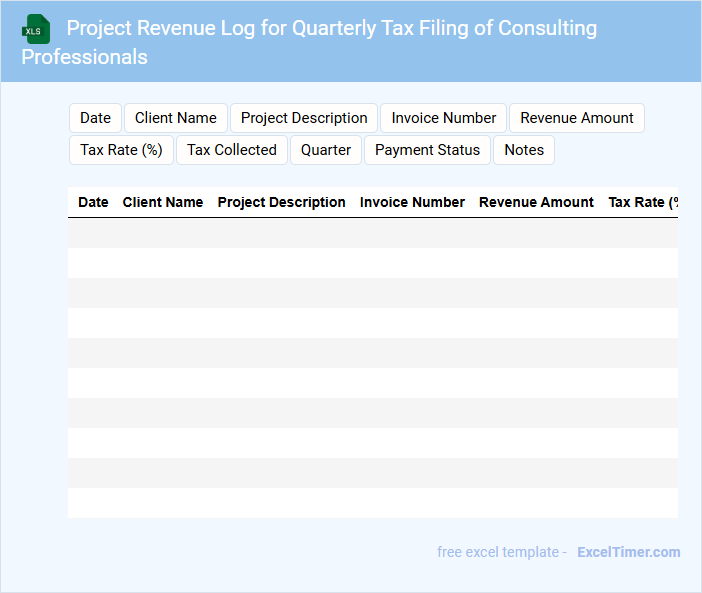

Project Revenue Log for Quarterly Tax Filing of Consulting Professionals

The Project Revenue Log for Quarterly Tax Filing of Consulting Professionals is a detailed record that tracks all income generated from consulting projects within a specific quarter. It typically contains client names, project descriptions, payment dates, and invoice amounts. This document ensures accurate tax reporting and helps in maintaining financial transparency.

Expense and Mileage Tracker for Quarterly Tax Preparation of Consultants

An Expense and Mileage Tracker is a vital document that records all business-related expenditures and travel details. Typically, it contains dates, descriptions, amounts spent, and miles driven for accurate tax calculations. Maintaining this tracker helps consultants streamline quarterly tax preparation and ensures compliance with tax regulations.

Quarterly Tax Organizer Excel Template with Receipts Log for Consultants

What information is typically included in a Quarterly Tax Organizer Excel Template with Receipts Log for Consultants? This type of document usually contains detailed sections for income tracking, expense categorization, and a log for receipts related to business activities. It helps consultants systematically organize their financial data to simplify quarterly tax filing and ensure accurate record-keeping.

Why is it important for consultants to maintain an organized receipts log along with their tax organizer? Keeping a detailed receipts log supports proper expense documentation, which is crucial for maximizing tax deductions and avoiding audit issues. It is recommended to regularly update the template and categorize expenses carefully to maintain clarity and compliance during tax season.

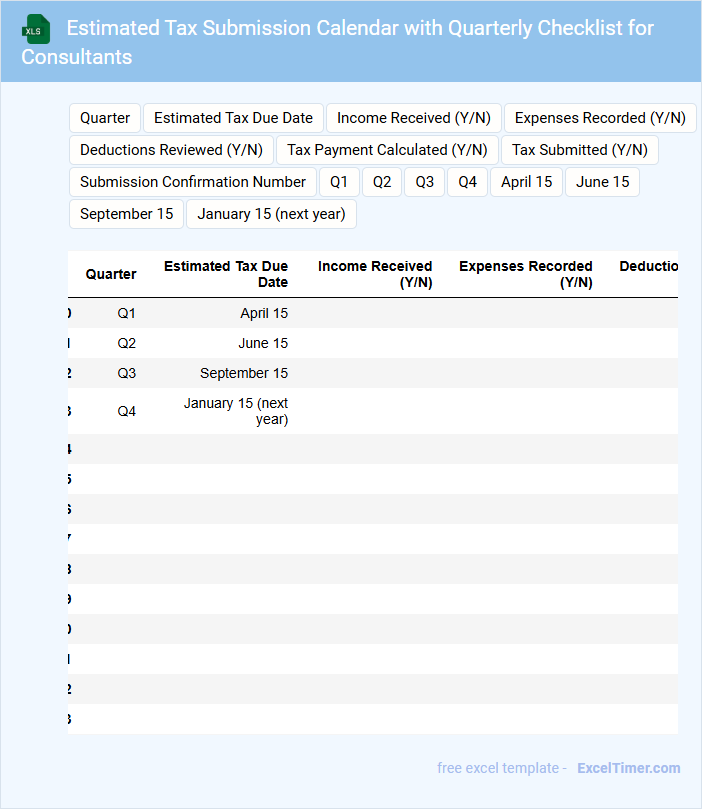

Estimated Tax Submission Calendar with Quarterly Checklist for Consultants

An Estimated Tax Submission Calendar with Quarterly Checklist for Consultants is a structured document detailing key tax deadlines and essential tasks to ensure timely and accurate tax payments throughout the fiscal year.

- Quarterly Deadlines: Highlights critical dates for submitting estimated tax payments to avoid penalties.

- Documentation Checklist: Lists necessary financial documents and records to gather before each submission.

- Compliance Tips: Provides reminders for staying updated on tax law changes relevant to consultants.

What are the essential steps in preparing quarterly tax filings for consultants using Excel?

Preparing quarterly tax filings for consultants using Excel involves organizing income and expense data accurately, categorizing deductible expenses, and calculating estimated tax payments based on current tax rates. You should create detailed spreadsheets that track revenue streams, business deductions, and tax liabilities each quarter. Maintaining up-to-date records in Excel ensures precise tax calculations and timely submission to avoid penalties.

How do you categorize and track deductible business expenses in an Excel document for quarterly tax purposes?

Categorize deductible business expenses in an Excel document by creating separate columns for expense type, date, description, and amount, aligned with IRS categories such as travel, office supplies, and professional fees. Use Excel tables and filters to track and summarize expenses quarterly, facilitating accurate tax deductions and reporting. Incorporate formulas to calculate totals per category and generate quarterly expense reports for precise tax preparation and compliance.

What Excel formulas or templates can automate estimated tax calculations for consultants each quarter?

Your quarterly tax preparation for consultants can be automated using Excel formulas like SUM, IF, and PMT to calculate estimated tax payments based on income and tax rates. Templates designed for consultant income tracking and tax estimation streamline quarterly calculations, ensuring accuracy and compliance. Incorporate formulas such as =SUM(range), =IF(condition, value_if_true, value_if_false), and =PMT(rate, nper, pv) to automate these processes efficiently.

How should income and payments from multiple clients be recorded and organized in Excel for accurate quarterly tax reporting?

Record each client's income and payments in separate rows, categorized by date and client name to ensure clarity. Use Excel formulas to calculate totals for each client and aggregate quarterly amounts for precise tax reporting. Your organized spreadsheet will streamline accurate quarterly tax preparation and help avoid errors.

What supporting documentation should be linked or referenced in your Excel file to ensure IRS compliance during quarterly tax preparation?

Link or reference W-2 and 1099 forms, business expense receipts, and income statements to ensure IRS compliance during quarterly tax preparation. Include estimated tax payment vouchers and previous year's tax return summaries for accurate calculations. Maintain copies of mileage logs, home office expense records, and any relevant invoices within the Excel document.