The Quarterly Financial Statement Excel Template for Freelancers streamlines tracking income, expenses, and profits every three months, ensuring accurate financial records. It helps freelancers maintain organized bookkeeping, simplifying tax preparation and financial decision-making. Customizable fields and automatic calculations save time and improve financial clarity.

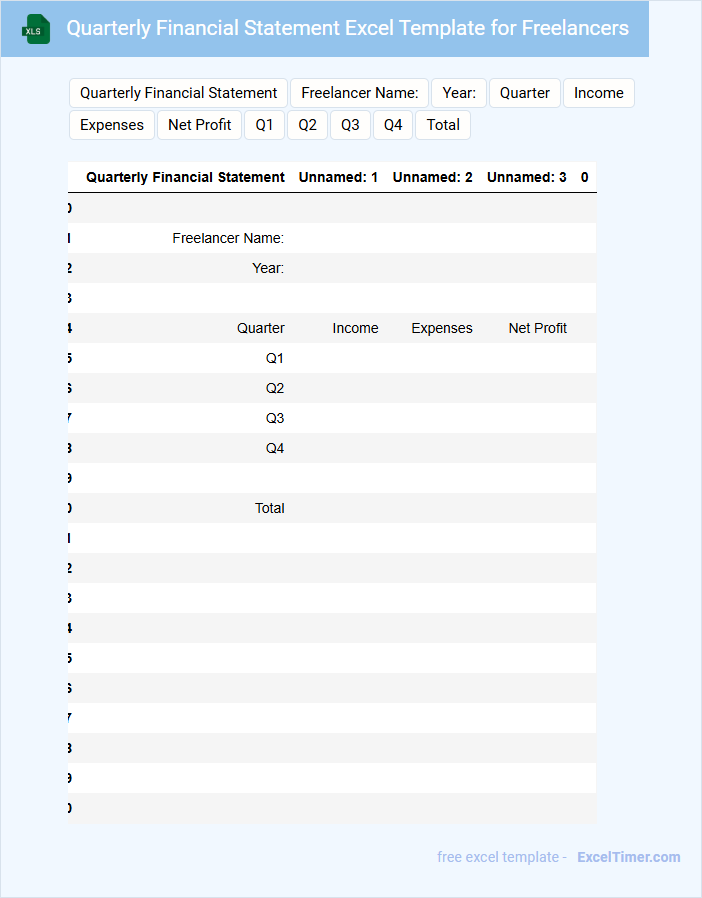

Quarterly Financial Statement Excel Template for Freelancers

A Quarterly Financial Statement Excel Template for freelancers typically contains detailed records of income, expenses, and net profit over a three-month period. This document helps freelancers track their financial health and prepare for tax filings efficiently.

Important sections include categorized income streams, expense tracking, and a summary of profits or losses. Regularly updating this template ensures accurate financial management and better budgeting for upcoming projects.

Income and Expenses Tracker with Quarterly Summary for Freelancers

What information does an Income and Expenses Tracker with Quarterly Summary for Freelancers typically contain? This document usually includes detailed records of all income and expenses incurred by a freelancer divided by categories and dates. It summarizes financial data quarterly, helping freelancers monitor cash flow and assess profitability over specific periods.

What important aspects should freelancers consider when using this tracker? It is crucial to maintain accurate and timely entries for all transactions to ensure reliability. Additionally, regularly reviewing the quarterly summary helps identify trends, manage budgets effectively, and prepare for tax obligations.

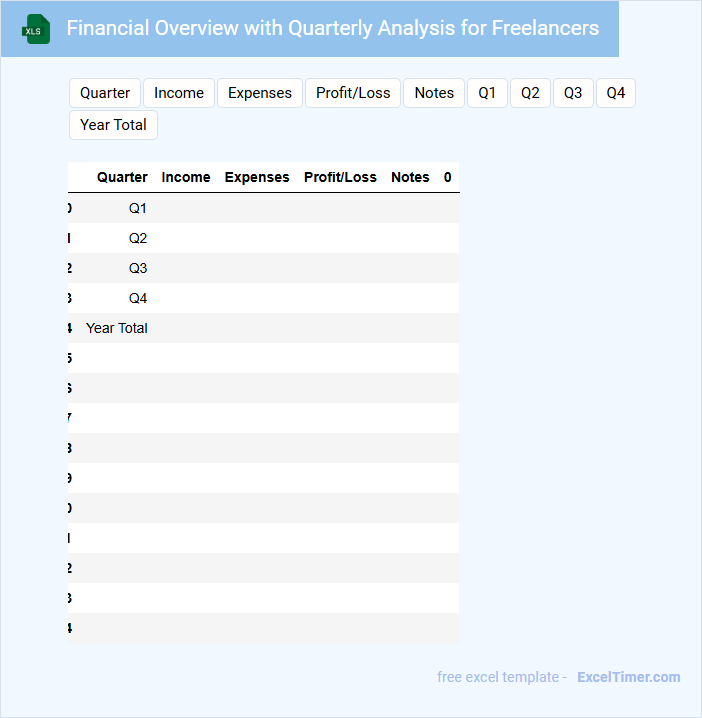

Financial Overview with Quarterly Analysis for Freelancers

What information is typically contained in a Financial Overview with Quarterly Analysis for Freelancers? This document usually includes detailed income and expense reports, profit margins, and cash flow statements broken down by each quarter. It provides freelancers with insights into their financial performance and helps track trends over time.

Why is it important to include a quarterly analysis in this financial overview? Quarterly analysis allows freelancers to identify seasonal fluctuations and adjust their budgeting or project acquisition strategies accordingly. It also helps in setting financial goals and ensuring long-term sustainability.

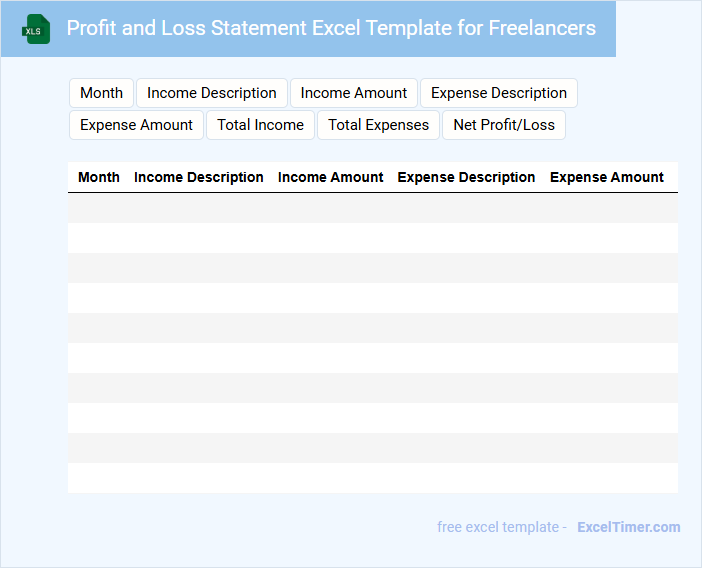

Profit and Loss Statement Excel Template for Freelancers

What information is typically included in a Profit and Loss Statement Excel Template for Freelancers? This type of document generally contains detailed records of income and expenses, allowing freelancers to track their financial performance over a specific period. It summarizes revenue streams and deducts corresponding costs to calculate net profit or loss, providing clear insight into business profitability.

What important elements should be considered when using this template? Ensuring accurate categorization of income and expenses is crucial for meaningful analysis, and regularly updating the template helps maintain an up-to-date financial overview. Additionally, incorporating formulas to automate calculations enhances efficiency and reduces errors in financial reporting.

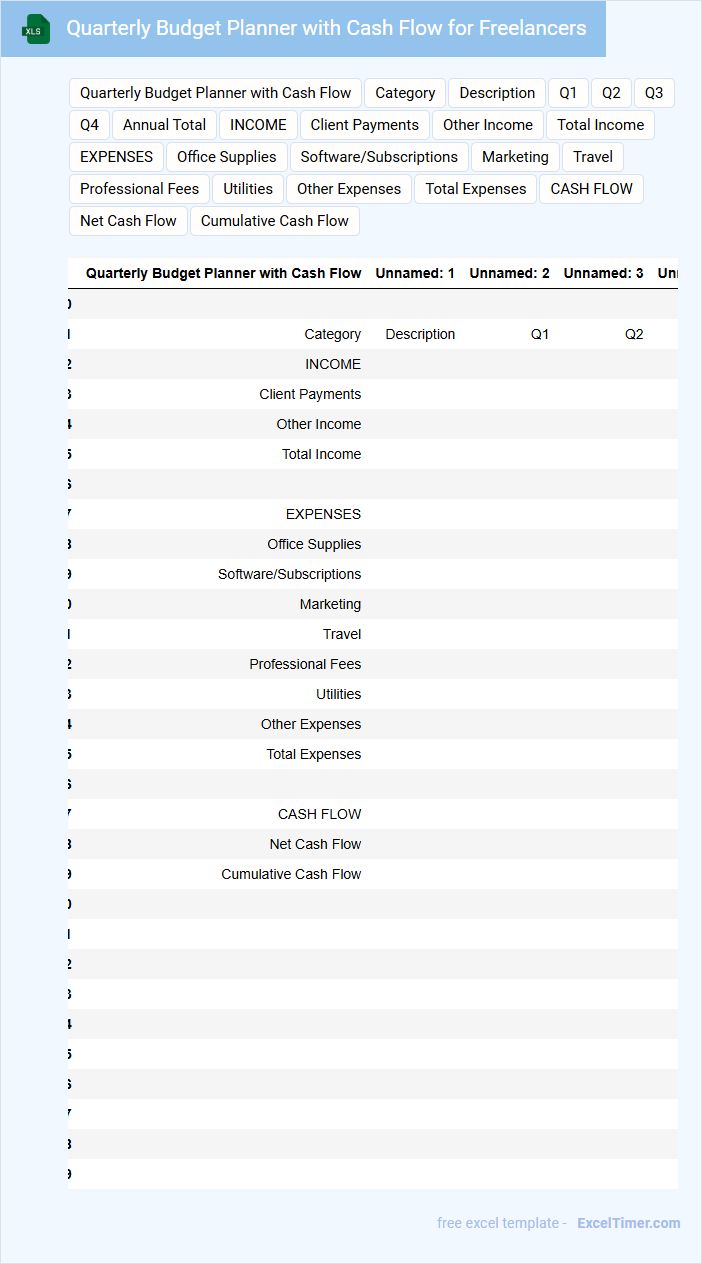

Quarterly Budget Planner with Cash Flow for Freelancers

A Quarterly Budget Planner with Cash Flow for Freelancers is a financial document that helps track income and expenses on a three-month basis. It provides a clear overview of cash inflows and outflows to maintain financial stability.

This document typically contains income forecasts, expense categories, and cash flow statements to manage irregular payments. Accurate tracking helps freelancers anticipate shortfalls and optimize spending.

Including buffer amounts for unexpected expenses is crucial to ensure consistent cash flow and avoid financial stress.

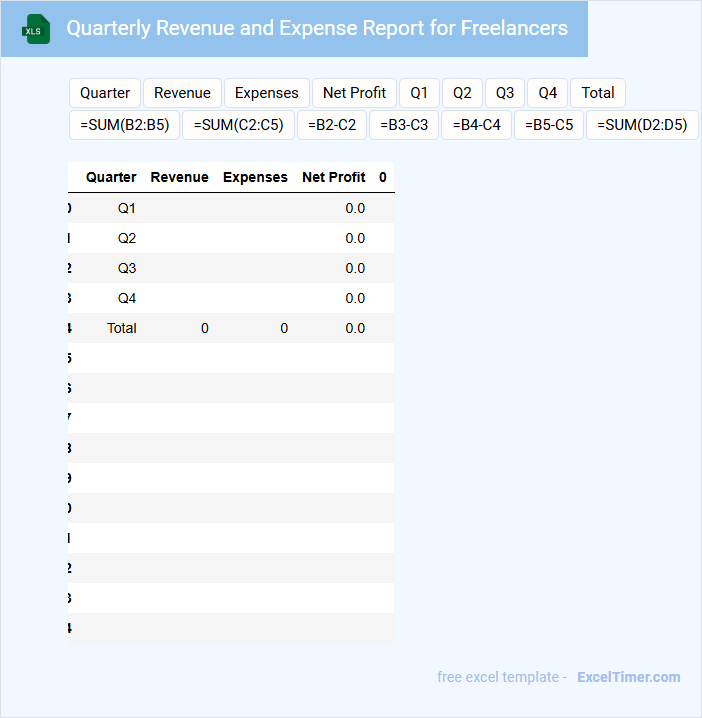

Quarterly Revenue and Expense Report for Freelancers

A Quarterly Revenue and Expense Report for Freelancers typically summarizes income and expenditures over a three-month period to assess financial health. It helps freelancers track profitability and manage cash flow effectively.

- Include detailed income sources and amounts to understand revenue streams.

- List all expenses with dates and categories for accurate cost tracking.

- Summarize net profit or loss to evaluate overall financial performance.

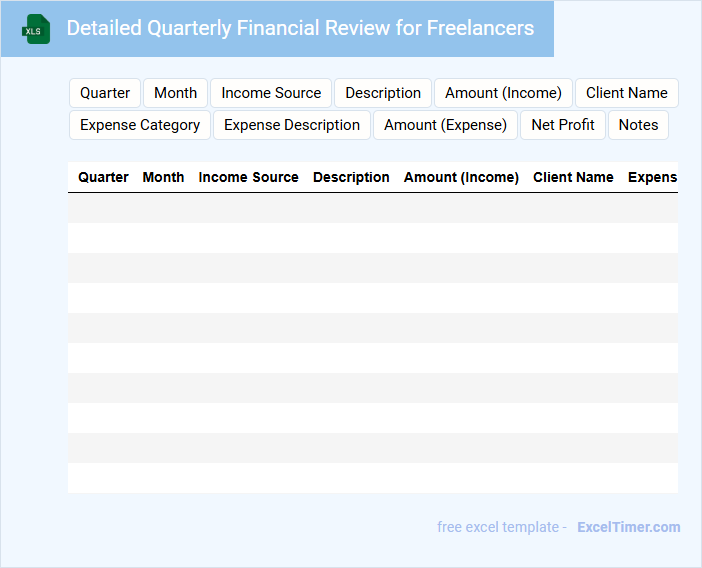

Detailed Quarterly Financial Review for Freelancers

This document typically contains a comprehensive analysis of income, expenses, and profit margins recorded over the quarter. It helps freelancers track their financial performance and identify trends. Using clear charts and categorized statements enhances understanding.

An important aspect is the breakdown of tax obligations and estimated payments to avoid surprises during tax season. It also includes cash flow statements to manage liquidity effectively. Regularly updating this review supports better financial planning and decision-making.

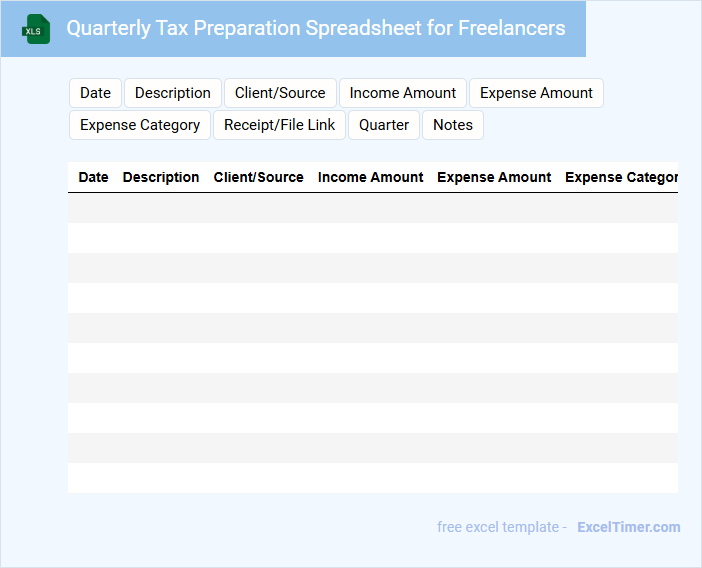

Quarterly Tax Preparation Spreadsheet for Freelancers

The Quarterly Tax Preparation Spreadsheet for freelancers is a vital document that helps organize income, expenses, and tax deductions on a regular basis. It ensures accurate tracking of financial transactions relevant to tax filings every quarter.

This spreadsheet typically contains detailed sections for categorizing income sources, business expenses, estimated tax payments, and deadlines. It is important to update this document consistently to avoid penalties and ensure timely tax submissions.

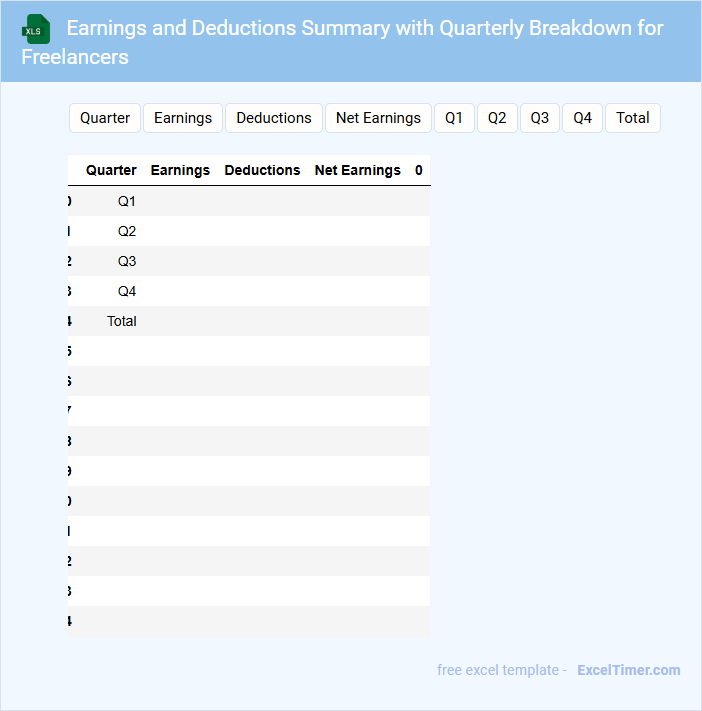

Earnings and Deductions Summary with Quarterly Breakdown for Freelancers

This document provides a detailed summary of a freelancer's earnings and deductions with a quarterly breakdown, helping in accurate financial tracking and tax preparation. It typically includes income from various projects and associated deductible expenses.

- Ensure all income sources and deductible expenses are clearly categorized for accurate reporting.

- Include quarterly totals to monitor cash flow and plan for tax obligations effectively.

- Maintain supporting documentation for all entries to validate the summary during audits or reviews.

Invoicing and Payment Tracker with Quarterly Report for Freelancers

An Invoicing and Payment Tracker is a crucial document for freelancers to monitor their billed projects and received payments efficiently. It helps maintain a clear record of client transactions, ensuring financial transparency.

The Quarterly Report summarizes earnings and outstanding payments, providing insights into cash flow and financial health on a periodic basis. Freelancers can use this data to plan taxes and forecast future income.

Important elements to include are invoice numbers, dates, payment status, client details, and a summary of total earnings and pending amounts for each quarter.

Project Income Tracker with Quarterly Financial Insights for Freelancers

What information is typically included in a Project Income Tracker with Quarterly Financial Insights for Freelancers? This type of document usually contains detailed records of all income received from various projects, categorized by client and project type. It also includes quarterly summaries and financial insights that help freelancers assess their earnings, track trends, and make informed decisions for future planning.

How can freelancers optimize the use of this document for better financial management? It's important to regularly update income entries and review quarterly reports to identify high-performing projects and periods. Additionally, incorporating expense tracking alongside income can provide a clearer picture of overall profitability and support accurate tax preparation.

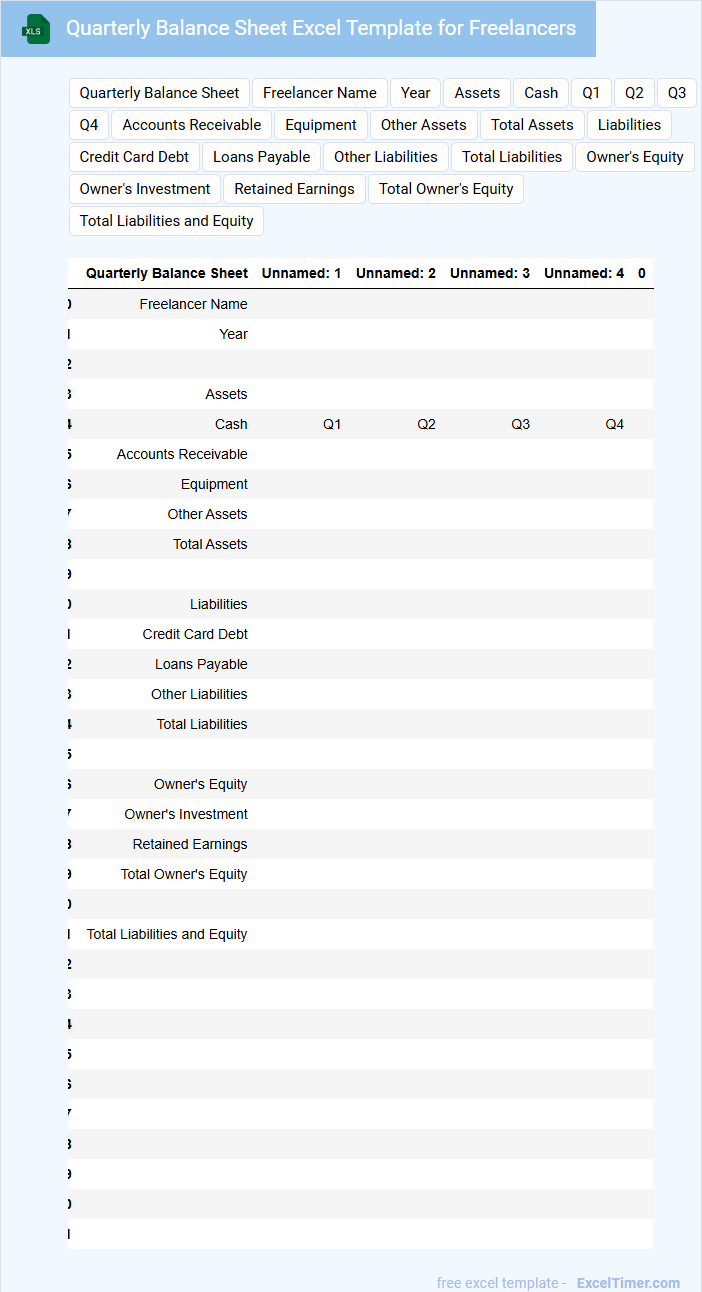

Quarterly Balance Sheet Excel Template for Freelancers

A Quarterly Balance Sheet Excel Template for freelancers is a financial document that summarizes assets, liabilities, and equity at the end of each quarter. It helps freelancers track their financial position and make informed business decisions. This template is essential for monitoring cash flow and managing expenses effectively throughout the year.

Important elements to include are categorized assets, detailed liabilities, and owner's equity sections. Ensure easy customization for various income sources and expense types unique to freelancing. Consistent updating and accurate data entry are crucial for reliable financial insights and tax preparation.

Financial Goals Tracker with Quarterly Updates for Freelancers

A Financial Goals Tracker with quarterly updates is essential for freelancers to monitor their income, expenses, and savings targets effectively. This document typically contains detailed breakdowns of financial objectives, progress metrics, and actionable insights for budget adjustments. Incorporating regular quarterly reviews helps ensure freelancers stay aligned with their long-term financial planning and adaptability.

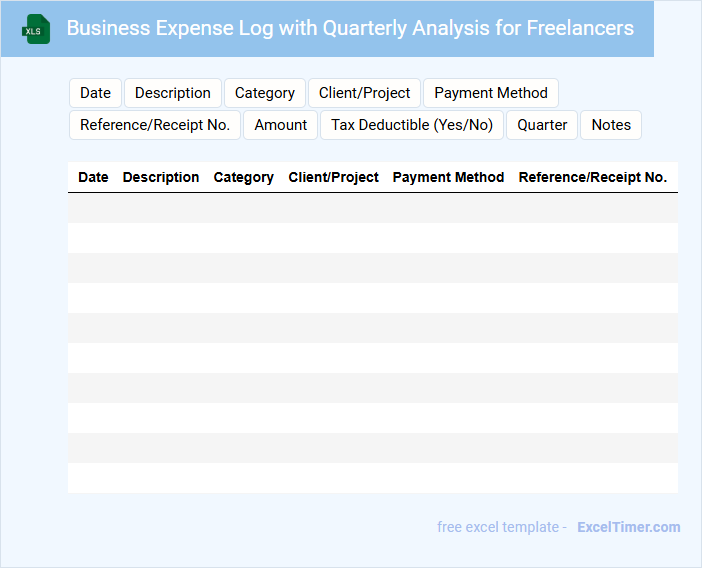

Business Expense Log with Quarterly Analysis for Freelancers

A Business Expense Log with Quarterly Analysis for Freelancers is a document used to record and organize all business-related expenses over a three-month period. It helps freelancers track their spending and prepare for tax filings effectively.

- Include detailed expense categories to identify spending patterns.

- Regularly update entries to maintain accurate records.

- Review quarterly summaries to adjust budgets and improve financial planning.

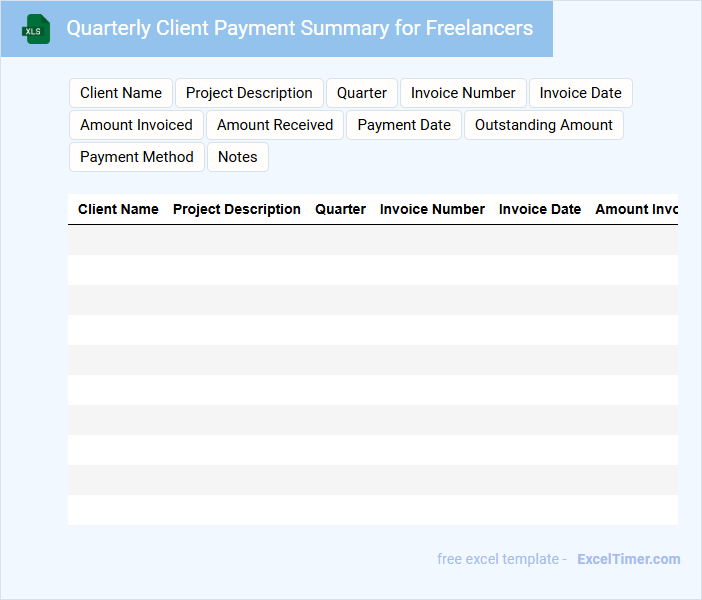

Quarterly Client Payment Summary for Freelancers

A Quarterly Client Payment Summary for Freelancers typically contains detailed records of payments received from clients over a three-month period, including payment dates and amounts. It helps freelancers track their income and manage their finances efficiently.

- Include invoice numbers and payment statuses for clarity.

- Summarize total earnings and any outstanding balances.

- Highlight payment methods and any discrepancies.

What are the essential components of a Quarterly Financial Statement for freelancers in Excel?

A Quarterly Financial Statement for freelancers in Excel should include key components such as income tracking, expense categorization, and net profit calculation. Your statement must also incorporate tax estimates and cash flow analysis to provide a comprehensive financial overview. Detailed data tables and summary charts enable clear insights into your quarterly financial performance.

How do you accurately separate and categorize income and expenses in a quarterly report?

You can accurately separate and categorize income and expenses in your quarterly financial statement by using distinct Excel sheets or columns labeled specifically for income types and expense categories. Employ formulas and Excel functions like SUMIF or pivot tables to organize and summarize data, ensuring precise tracking of all financial transactions. Consistently updating entries with clear descriptions improves clarity and supports accurate financial analysis.

What key formulas should be used in Excel to calculate quarterly profit and loss?

To calculate quarterly profit and loss in Excel, use the SUM formula to total your income and expenses for each quarter. Apply the formula =SUM(IncomeRange) - SUM(ExpenseRange) to find your net profit or loss. Incorporate IF statements to handle exceptions like refunds or adjustments in Your financial data.

How can you track and visualize cash flow trends each quarter using Excel features?

Use Excel's PivotTables and Charts to track and visualize your quarterly cash flow trends effectively. Create a PivotTable by selecting your financial data, then summarize income and expenses by category and quarter. Insert a Line or Bar Chart from the PivotTable to display cash flow fluctuations over time, making it easy to identify trends and plan accordingly.

Which Excel tools or functions help automate tax estimation for quarterly earnings?

Excel functions like SUMIFS and IF can automate tax estimation by calculating taxable income based on quarterly earnings. Using Excel's Data Validation and named ranges helps structure your data for accurate tax rate application. You can enhance automation with built-in functions such as VLOOKUP or XLOOKUP to apply progressive tax brackets effectively.