The Quarterly Expense Report Excel Template for Small Businesses helps track and organize expenses efficiently over each quarter. It provides customizable categories and automated calculations to simplify financial analysis and budgeting. Ensuring accurate expense monitoring supports better decision-making and cash flow management for small business owners.

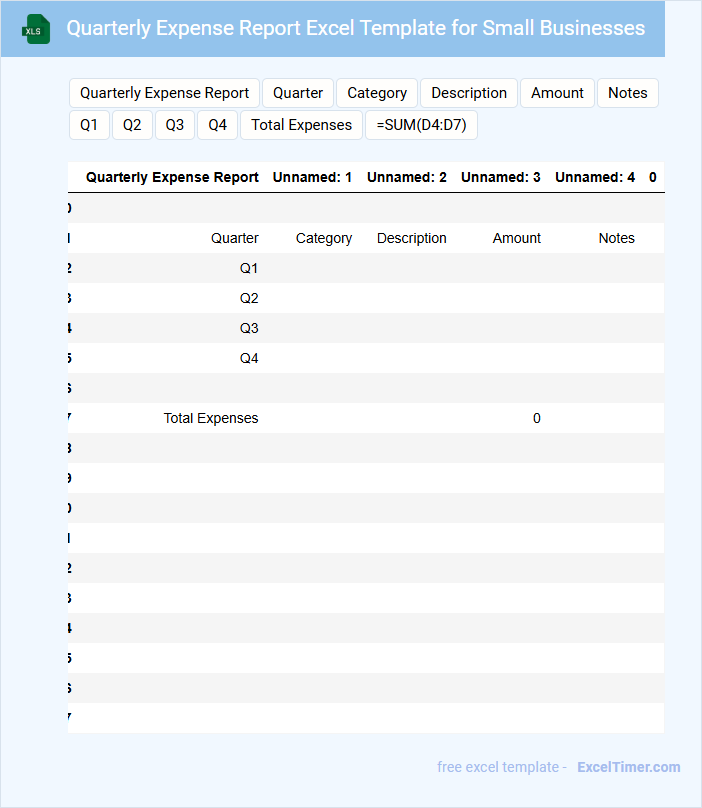

Quarterly Expense Report Excel Template for Small Businesses

A Quarterly Expense Report Excel Template for small businesses typically contains detailed records of all expenses incurred over a three-month period. It includes categorized spending data such as utilities, salaries, office supplies, and marketing costs to help track financial performance. This template aids in budgeting, financial analysis, and preparing for tax filings.

To maximize its effectiveness, ensure the template is regularly updated with accurate data entries and includes clear categories for each expense type. Incorporate visual charts or graphs for quick insights and decision-making. Additionally, protect sensitive information by securing the spreadsheet with passwords or restricted access.

Quarterly Financial Analysis with Expense Tracking

Quarterly Financial Analysis with Expense Tracking is a comprehensive document that reviews the company's financial performance and monitors expenditures over a three-month period.

- Accurate Revenue Reporting: Ensure detailed and precise recording of all income sources to track profitability effectively.

- Expense Categorization: Organize expenses into clear categories to identify cost-saving opportunities and manage budgets efficiently.

- Trend Analysis: Analyze financial trends and variances compared to previous quarters to inform strategic decision-making.

Quarterly Expense Summary Report for Small Business Owners

The Quarterly Expense Summary Report is a crucial document that helps small business owners track and analyze their expenses over a three-month period. It typically contains detailed breakdowns of various cost categories such as operational expenses, payroll, and supplies. This report enables owners to identify spending patterns and make informed financial decisions.

For optimal use, it is important to ensure the report is accurate, comprehensive, and updated regularly. Including visual aids like charts or graphs can enhance understanding and make trends more apparent. Regularly reviewing this report helps in budget adjustments and improves overall financial management.

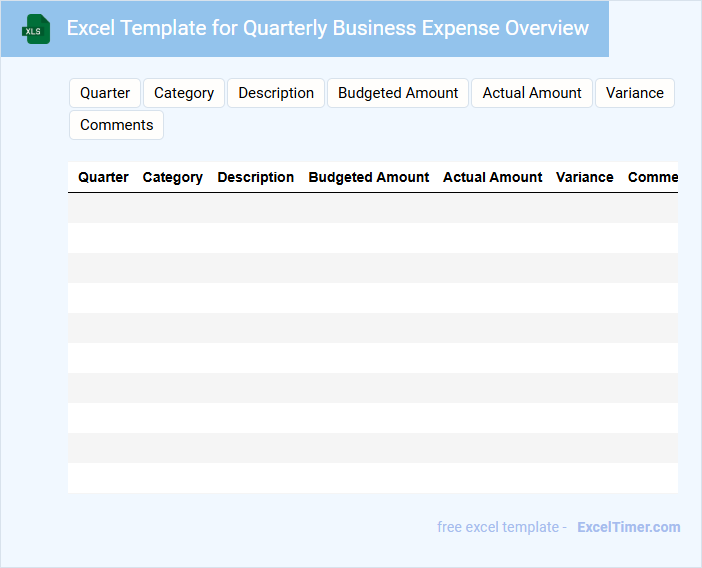

Excel Template for Quarterly Business Expense Overview

This document typically contains a structured format to record, review, and analyze business expenses on a quarterly basis. It helps in tracking financial performance and budgeting effectively over three months.

- Include clear categories for various expense types to ensure organized data entry.

- Incorporate automated formulas to calculate totals and variances for quicker analysis.

- Provide space for notes or comments to explain significant deviations or trends.

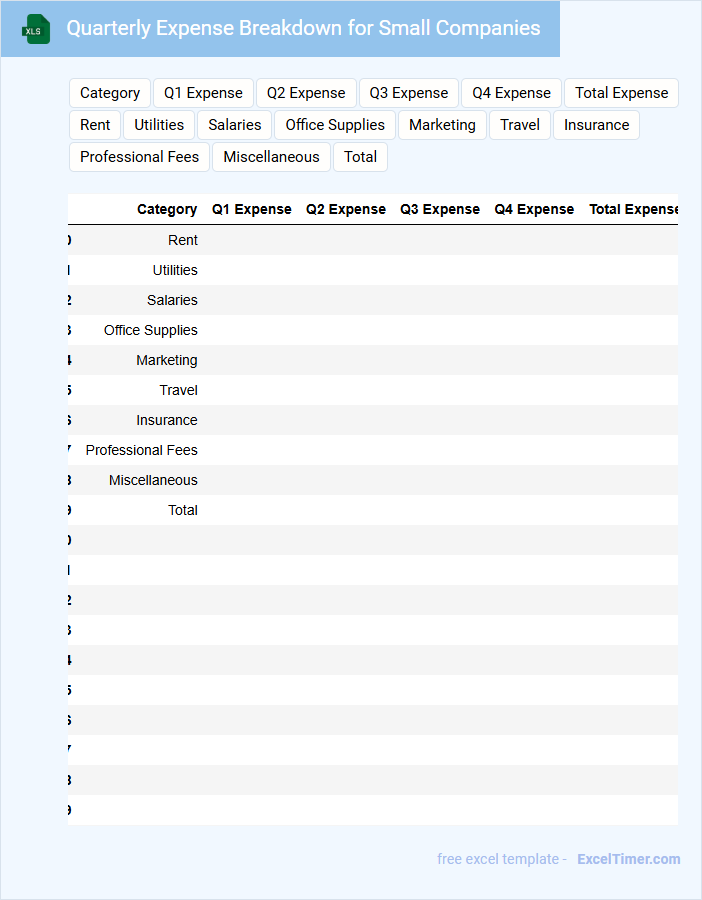

Quarterly Expense Breakdown for Small Companies

A Quarterly Expense Breakdown for Small Companies typically details the financial outflows over a three-month period, highlighting where the company allocates resources. This document is essential for budgeting and financial analysis.

- Include categories such as payroll, operating expenses, and marketing costs for clarity.

- Ensure accuracy and consistency in reporting for effective comparison across quarters.

- Use visual aids like charts or graphs to enhance understanding of expense trends.

Small Business Quarterly Expense Tracker with Charts

A Small Business Quarterly Expense Tracker document typically contains a detailed record of all expenses incurred by the business within a three-month period. It often includes categorized expense entries, dates, amounts, and payment methods to ensure accurate financial tracking. Visual charts, such as pie or bar graphs, are incorporated to provide a clear overview of spending patterns and facilitate easier decision-making.

To optimize the effectiveness of this tracker, it is important to maintain consistent and timely data entry to avoid discrepancies. Incorporating automatic calculations and trend analysis in the charts can help identify cost-saving opportunities. Regularly reviewing and updating the tracker ensures it remains a valuable tool for budgeting and financial planning.

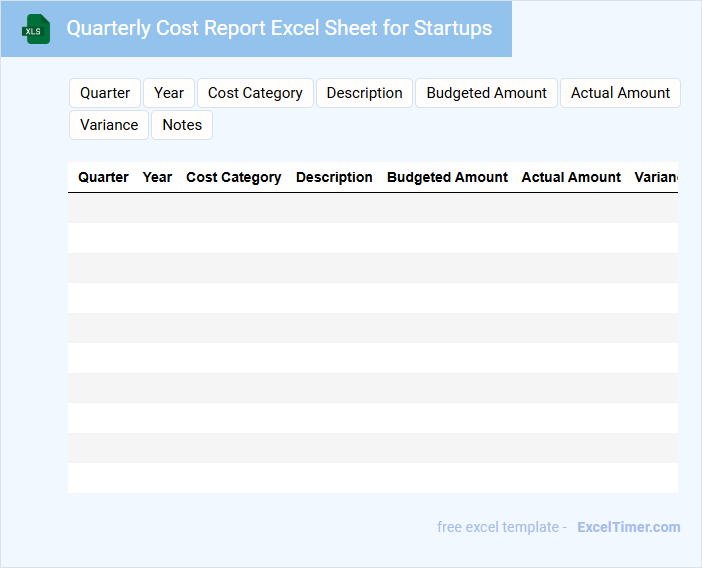

Quarterly Cost Report Excel Sheet for Startups

A Quarterly Cost Report Excel Sheet for Startups is typically used to track and analyze expenses over a three-month period, helping founders monitor financial health efficiently. This document provides essential insights into spending patterns and budget adherence.

- Include detailed categories for fixed and variable costs to ensure comprehensive tracking.

- Incorporate graphs or charts for quick visual analysis of cost trends.

- Regularly update the sheet to maintain accurate and actionable financial data.

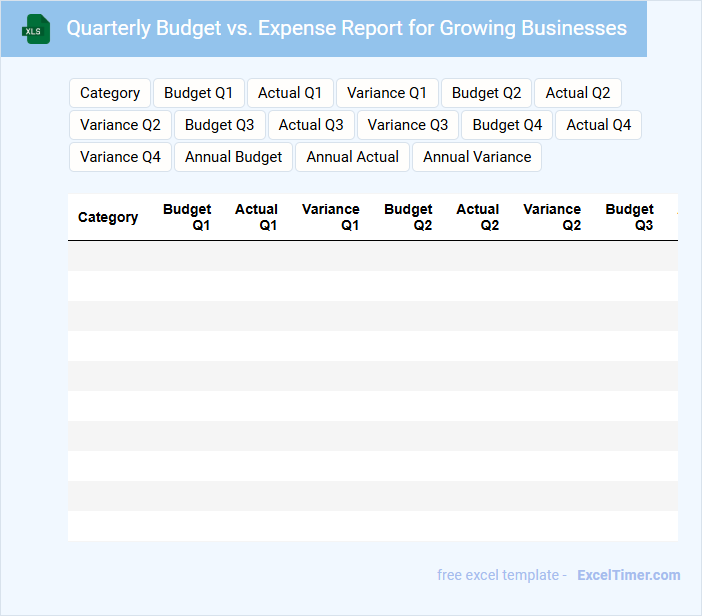

Quarterly Budget vs. Expense Report for Growing Businesses

What is typically included in a Quarterly Budget vs. Expense Report for growing businesses? This document usually contains detailed projections of expected income and expenditures alongside actual spending data to provide a clear financial overview. It helps businesses compare their planned budget against real expenses, identify variances, and make informed decisions for future financial planning.

What is an important consideration when preparing this report? Accuracy in tracking all expenses throughout the quarter is crucial to ensure reliable comparisons, while regularly updating budget forecasts helps adapt to growth and changing business conditions.

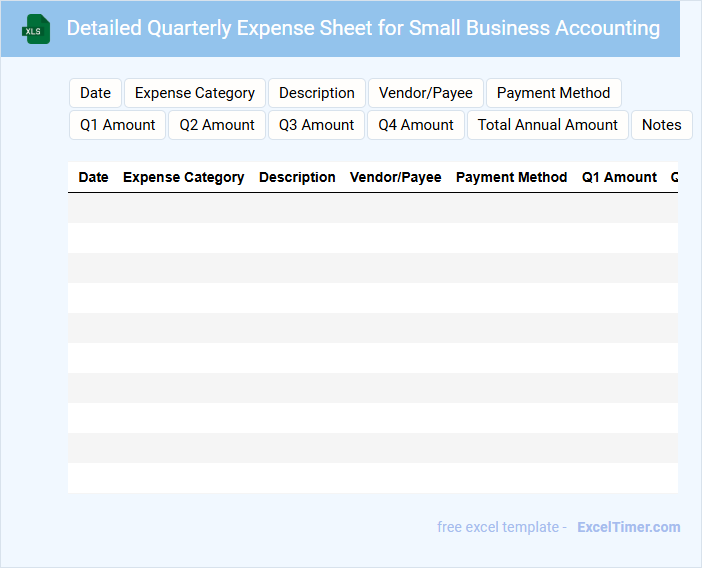

Detailed Quarterly Expense Sheet for Small Business Accounting

A Detailed Quarterly Expense Sheet typically contains an organized record of all expenditures made by a small business within a three-month period. This document helps in tracking spending patterns and preparing accurate financial reports.

It is crucial for managing cash flow and ensuring proper tax compliance. Including categories for different expense types and clear dates enhances its usefulness and clarity.

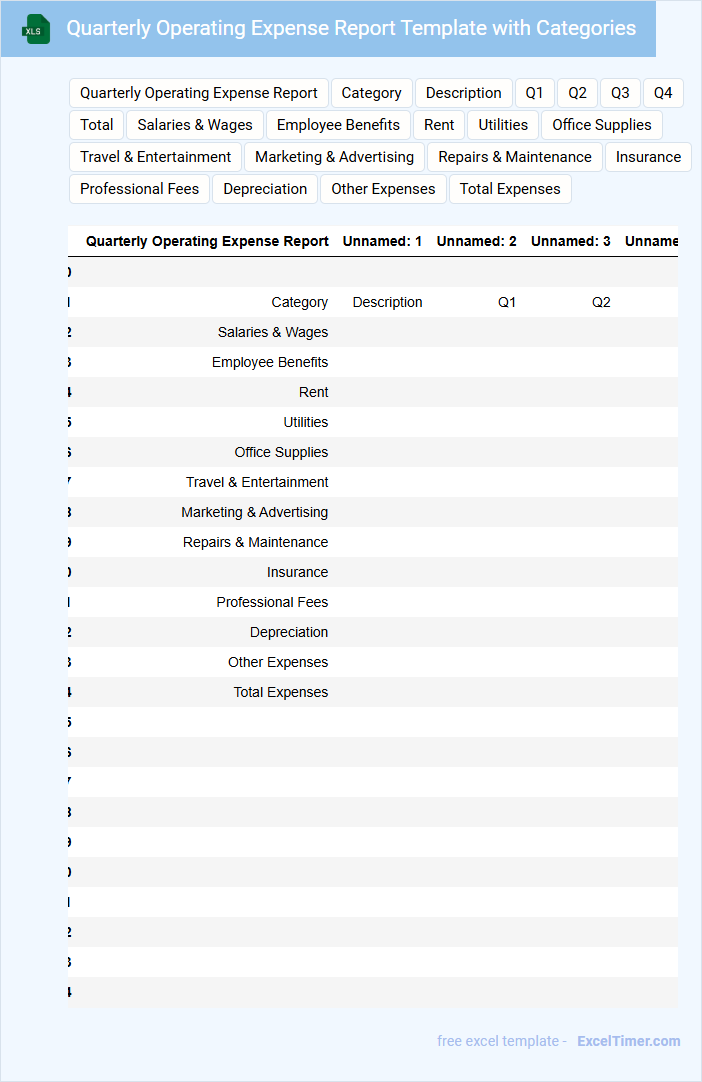

Quarterly Operating Expense Report Template with Categories

The Quarterly Operating Expense Report Template is a structured document that summarizes a company's expenses over a three-month period. It typically includes categorized sections such as payroll, utilities, marketing, and office supplies to provide clarity on spending patterns. This template aids in financial analysis and budget planning by highlighting cost distribution across various departments.

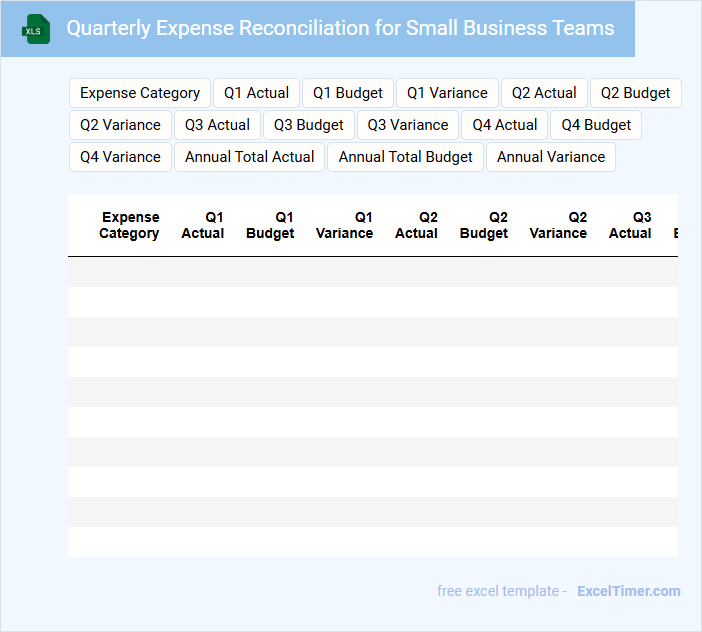

Quarterly Expense Reconciliation for Small Business Teams

A Quarterly Expense Reconciliation document typically contains a detailed summary of all expenses incurred by small business teams during a three-month period. It includes categorized expenses, receipts, and comparison against budgeted amounts to identify discrepancies. This report is essential for maintaining financial accuracy and ensuring accountability within the team.

Important elements to include are clear categorization of expenses, accurate documentation of receipts, and a summary highlighting any variances from expected budgets. Additionally, timely submission and review of this document help in optimizing budget management and forecasting for future quarters.

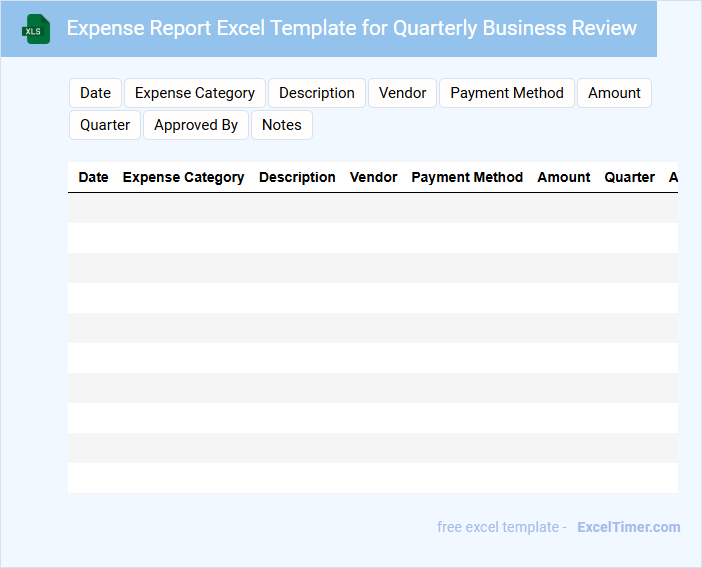

Expense Report Excel Template for Quarterly Business Review

Expense Report Excel Templates for Quarterly Business Review typically contain a detailed record of business expenses organized by category and time period to facilitate financial analysis and decision-making.

- Accurate Categorization: Ensure all expenses are categorized correctly for clear financial insights.

- Time Period Consistency: Maintain consistent quarterly dates to align with the business review cycle.

- Summary and Visualization: Include summarized totals and charts for easy interpretation of expense trends.

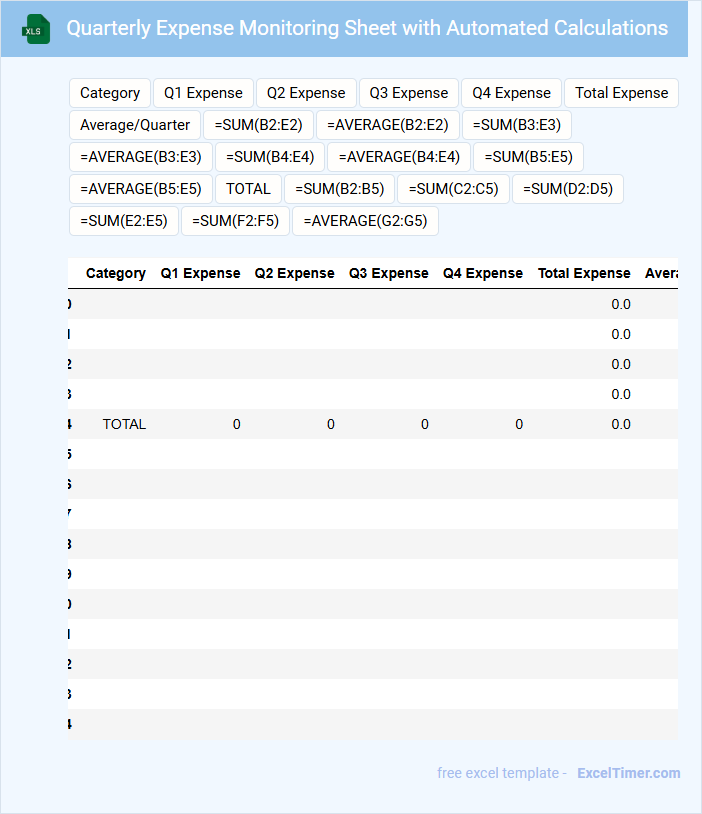

Quarterly Expense Monitoring Sheet with Automated Calculations

A Quarterly Expense Monitoring Sheet with Automated Calculations is a document used to track and analyze expenses over a three-month period efficiently.

- Expense Categories: Clearly define different types of expenses to ensure organized tracking.

- Automated Formulas: Utilize built-in calculations to reduce manual errors and save time.

- Regular Updates: Consistently update the sheet to maintain accuracy and support financial decision-making.

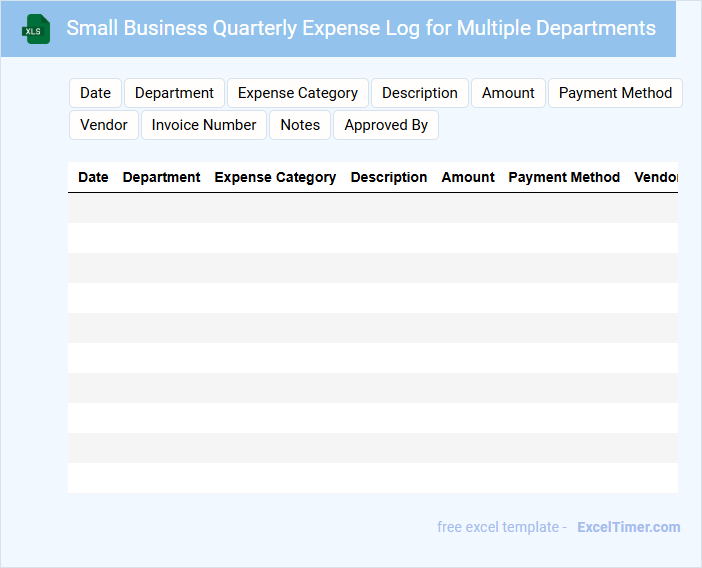

Small Business Quarterly Expense Log for Multiple Departments

The Small Business Quarterly Expense Log for multiple departments is a detailed record used to track spending across various sectors within a company over a three-month period. It typically contains categorized expense entries, dates, amounts, and departmental allocation to ensure accurate financial monitoring. This document is essential for budgeting, identifying cost-saving opportunities, and preparing financial reports.

To optimize this document, include clear department labels, consistent formatting, and a summary section highlighting total expenses per department. Utilize tables or spreadsheets for organized data entry and easy analysis. Regular review and updating improve financial accuracy and assist in strategic decision-making.

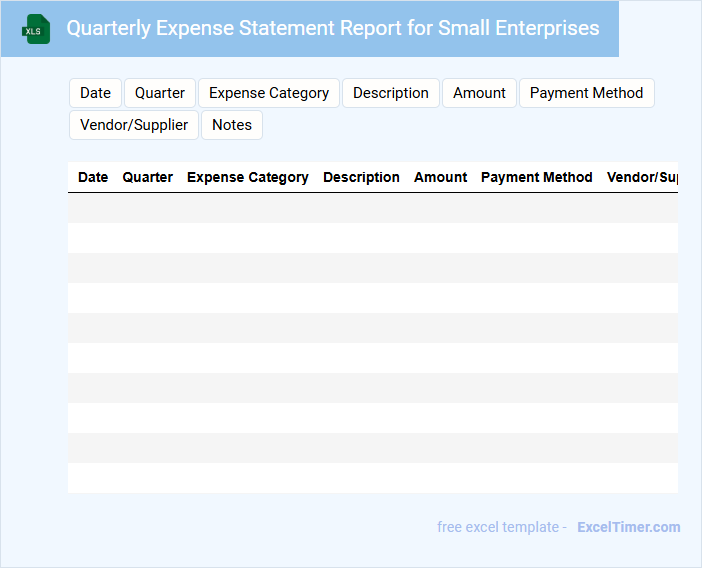

Quarterly Expense Statement Report for Small Enterprises

What information is typically included in a Quarterly Expense Statement Report for Small Enterprises? This type of document usually contains detailed records of all expenses incurred by the enterprise during the quarter, categorized by type such as operational costs, salaries, and miscellaneous expenditures. It helps small business owners track spending patterns, manage budgets effectively, and make informed financial decisions.

What are the key categories typically included in a Quarterly Expense Report for small businesses?

A Quarterly Expense Report for small businesses typically includes key categories such as rent, utilities, payroll, marketing expenses, and office supplies. Tracking these expenses helps you monitor cash flow and identify cost-saving opportunities. Accurate categorization ensures better financial management and reporting compliance.

How can you use Excel formulas to automatically calculate quarterly totals and variances?

Use Excel formulas like SUM to automatically calculate quarterly totals by summing monthly expenses across each quarter. Apply formulas such as =SUM(B2:D2) to total expenses for three months and use variance formulas like =B5-B4 to determine differences between actual and budgeted amounts. Your Quarterly Expense Report becomes more efficient with these automated calculations, enhancing accuracy and saving time.

What steps should be taken to ensure data accuracy and consistency in a Quarterly Expense Report Excel document?

Validate all entries using data validation rules and predefined categories to prevent errors and maintain consistency. Implement formulas and functions such as SUMIFS and VLOOKUP to automate calculations and cross-check expenses. Regularly review and reconcile data against original receipts and invoices to ensure accuracy.

How can Excel charts or pivot tables help visualize quarterly expense trends for small businesses?

Excel charts and pivot tables transform raw quarterly expense data into clear visual trends, allowing your business to quickly identify cost patterns and fluctuations. Pivot tables enable dynamic summarization by categories, while charts illustrate these summaries for easier comparison across quarters. Together, they empower you to make informed budgeting and financial decisions based on accurate, visualized expense insights.

What are best practices for organizing and labeling sheets, columns, and rows in a Quarterly Expense Report Excel file?

Label sheets clearly by quarter and year, using consistent naming conventions such as "Q1 2024 Expenses." Organize columns with standardized headers like "Date," "Expense Category," "Amount," and "Vendor," ensuring each row represents a single transaction for easy tracking. Your clarity in labeling enhances data analysis and simplifies quarterly financial reviews.