The Quarterly Payroll Summary Excel Template for HR Consultants simplifies payroll management by consolidating employee wages, tax deductions, and benefits into a clear, easy-to-read format. This template enhances accuracy and efficiency, allowing HR consultants to quickly generate comprehensive reports for each quarter. Tracking payroll data consistently helps ensure compliance with labor laws and supports financial planning.

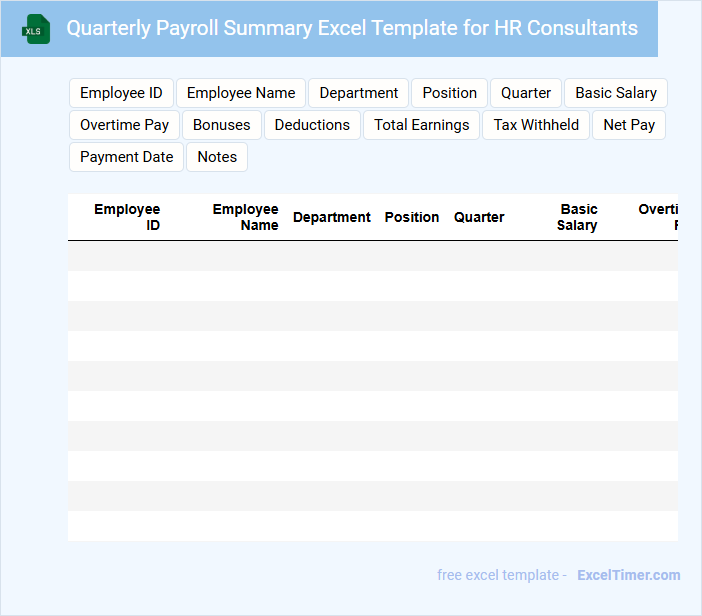

Quarterly Payroll Summary Excel Template for HR Consultants

The Quarterly Payroll Summary Excel Template is a vital document that consolidates employee salary details, tax deductions, and benefits for a specific quarter. It enables HR consultants to track payment accuracy and compliance efficiently. This summary helps in streamlining payroll audits and financial reporting processes.

For HR consultants, maintaining data accuracy and up-to-date employee information is crucial when using this template. Timely updates ensure that payroll discrepancies are minimized and legal obligations are met. Always include clear notes on any adjustments or anomalies in the payroll data for transparency.

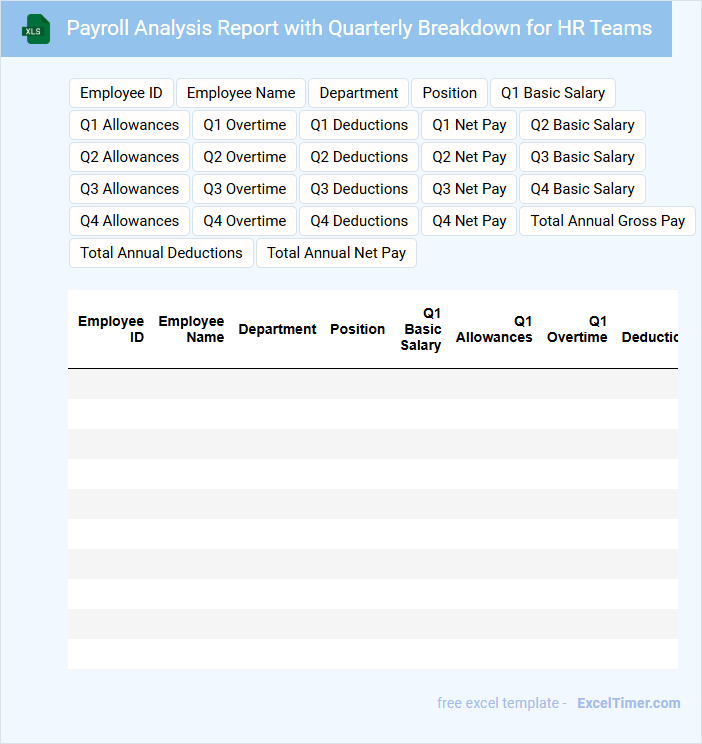

Payroll Analysis Report with Quarterly Breakdown for HR Teams

A Payroll Analysis Report typically contains detailed information on employee compensation, including salaries, bonuses, deductions, and taxes. It provides a comprehensive view of payroll expenses and trends over a specific period, often segmented quarterly for clearer financial insights. For HR teams, it's crucial to focus on accuracy, compliance, and identifying any discrepancies or unusual patterns within the data.

Quarterly Payroll Expense Tracking Sheet for Consultants

The Quarterly Payroll Expense Tracking Sheet is a document designed to systematically record and monitor payroll expenses for consultants over a three-month period. It typically contains detailed entries of consultant names, hours worked, rates, and total payments made each month within the quarter. This sheet helps organizations maintain financial accuracy and budget control for external consulting costs.

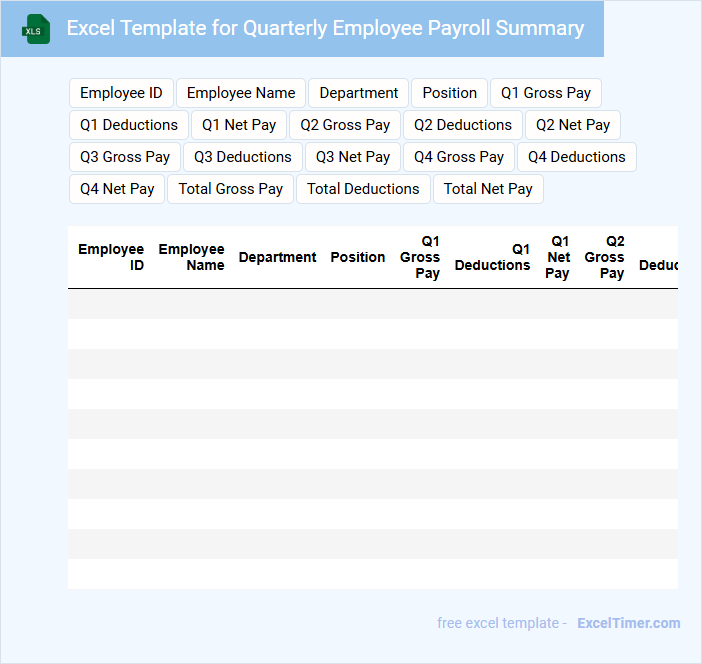

Excel Template for Quarterly Employee Payroll Summary

This Excel Template for Quarterly Employee Payroll Summary typically contains detailed financial data including employee wages, taxes, and deductions over a three-month period. It organizes payroll information in a structured manner, facilitating accurate and efficient record-keeping. Essential components often include employee names, hours worked, gross pay, net pay, and tax withholdings. For optimal use, ensure data validation is in place to minimize errors and implement formulas for automatic calculations. Additionally, incorporating clear headers and a summary section enhances readability and quick data analysis. Regularly updating tax rates and compliance details is crucial to maintain the document's accuracy.

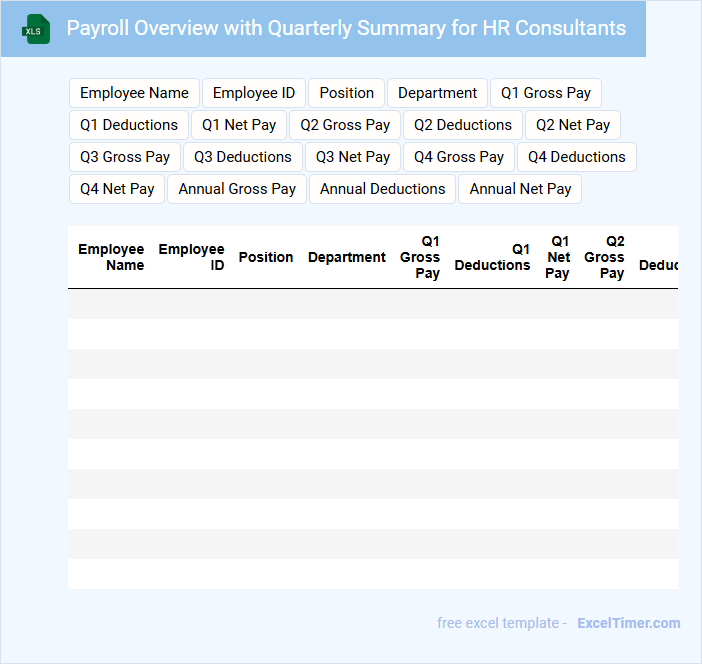

Payroll Overview with Quarterly Summary for HR Consultants

What information is typically included in a Payroll Overview with Quarterly Summary for HR Consultants? This document usually contains detailed payroll data such as employee earnings, deductions, tax withholdings, and net pay for each quarter. It provides HR consultants with a clear and concise summary to ensure compliance, accurate reporting, and efficient payroll management.

What important aspects should HR consultants focus on when reviewing this document? HR consultants should pay close attention to any discrepancies in employee payments, tax liabilities, and compliance with labor laws. Additionally, they should verify that all payroll data aligns with company policies and statutory requirements to prevent errors and potential penalties.

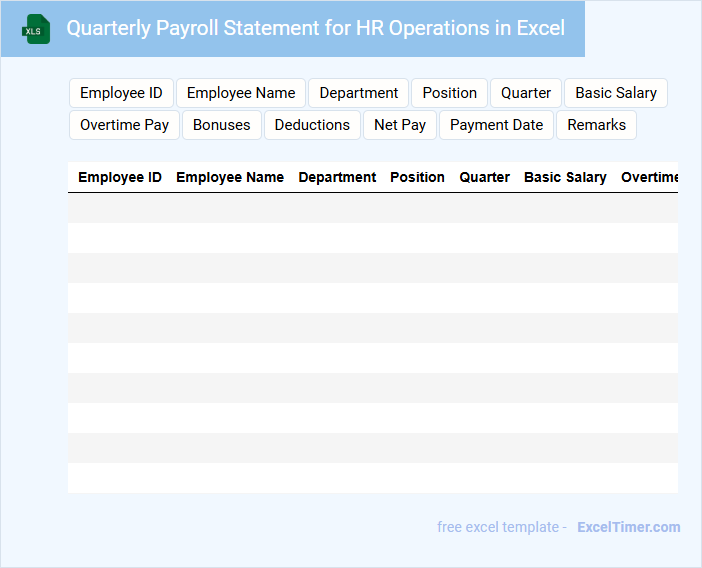

Quarterly Payroll Statement for HR Operations in Excel

The Quarterly Payroll Statement is a comprehensive document used by HR Operations to summarize employee compensation over a three-month period. It typically contains details such as gross pay, deductions, taxes, and net pay for each employee. Ensuring accuracy and compliance with legal standards is crucial when preparing this statement in Excel.

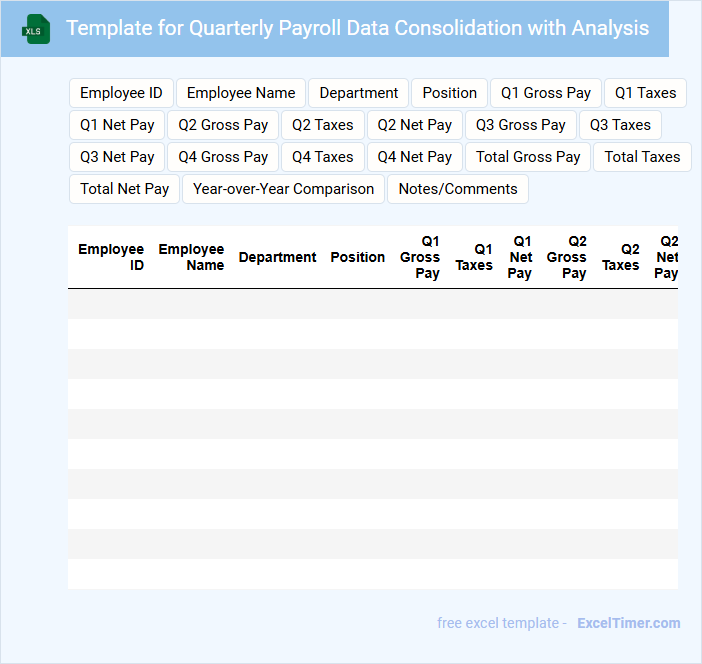

Template for Quarterly Payroll Data Consolidation with Analysis

The Template for Quarterly Payroll Data Consolidation with Analysis is designed to systematically gather and organize payroll information from various departments or locations. It typically contains employee salary details, tax deductions, bonuses, and overtime calculations. This document is crucial for ensuring accurate payroll processing and compliance with financial regulations.

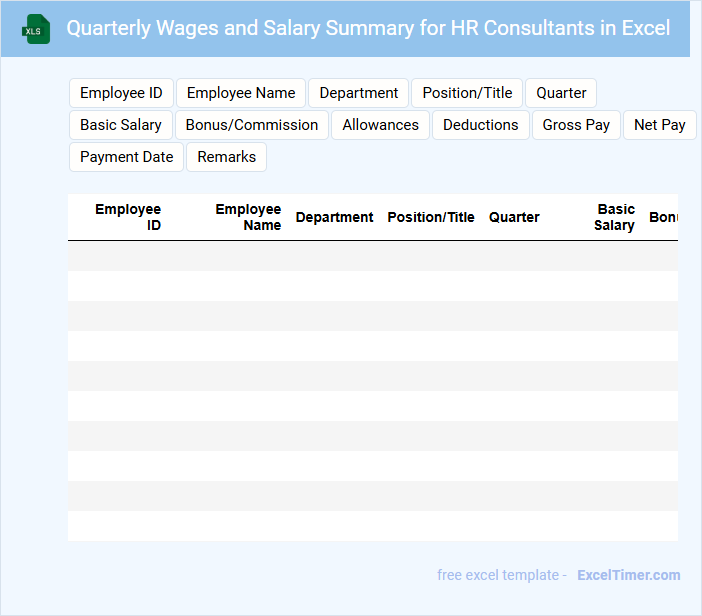

Quarterly Wages and Salary Summary for HR Consultants in Excel

The Quarterly Wages and Salary Summary document typically contains detailed records of employee earnings, including base salaries, bonuses, and deductions for a specific quarter. It helps HR consultants analyze payroll trends and ensure compliance with financial regulations. For accuracy, it's crucial to include comprehensive employee data along with clear categorization of wages and benefits in the Excel sheet.

Payroll Summary with Quarterly Deductions Tracker for HR

What information is typically included in a Payroll Summary with Quarterly Deductions Tracker for HR? This document usually contains detailed records of employee earnings, tax withholdings, benefits deductions, and other payroll-related transactions for each quarter. It helps HR professionals monitor compliance with tax regulations and manage employee compensation efficiently.

What is an important consideration when using this tracker? Ensuring accuracy in recording all deductions and timely updates is crucial to avoid payroll errors and maintain proper tax filing. Additionally, integrating the tracker with payroll software enhances data consistency and simplifies quarterly reporting.

Excel Report of Quarterly Staff Payroll for HR Consulting Firms

An Excel Report of Quarterly Staff Payroll is a detailed document that summarizes employee compensation, including salaries, bonuses, and deductions, over a three-month period. It typically contains individual payroll data, department-wise expense summaries, and tax withholdings. Ensuring accuracy and confidentiality is crucial for HR consulting firms to maintain compliance and support financial decision-making.

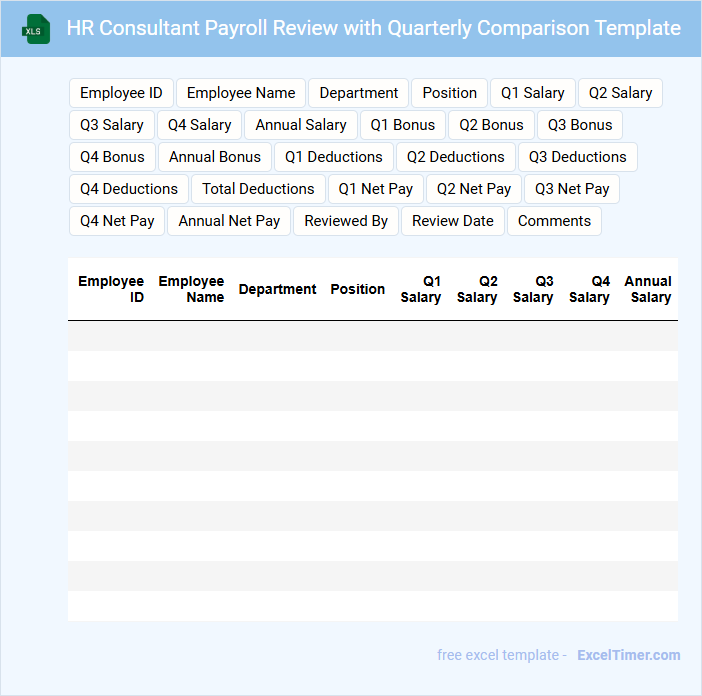

HR Consultant Payroll Review with Quarterly Comparison Template

What key information is typically included in an HR Consultant Payroll Review with Quarterly Comparison Template? This document usually contains detailed payroll data across multiple quarters, highlighting employee wages, deductions, and tax withholdings. It is designed to help HR consultants identify payroll trends, discrepancies, and ensure compliance with labor laws.

What important elements should be considered when using this template? It is essential to verify data accuracy and maintain consistent formatting for easy comparison. Additionally, including visual aids such as graphs and percentage change calculations can enhance the analysis of payroll performance over different quarters.

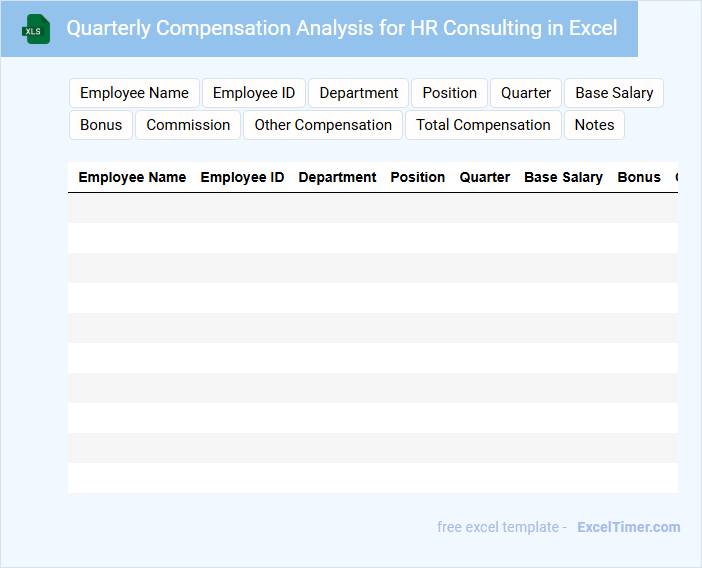

Quarterly Compensation Analysis for HR Consulting in Excel

A Quarterly Compensation Analysis document in Excel typically contains detailed data on employee salaries, bonuses, and overall compensation trends over the past quarter. It is used by HR consulting to assess pay equity, budget alignment, and market competitiveness.

- Include a summary of key compensation metrics and comparisons to previous quarters.

- Highlight any significant changes in pay structures or bonus distributions.

- Ensure clarity with well-organized tables, charts, and a clear legend for data interpretation.

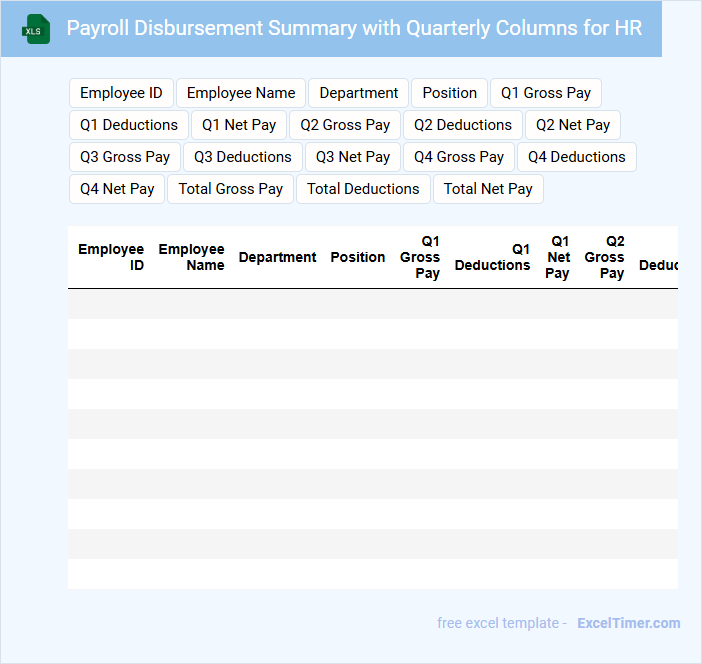

Payroll Disbursement Summary with Quarterly Columns for HR

The Payroll Disbursement Summary is a crucial document that provides an overview of employee payments over a specified period. Typically, it includes total salaries, bonuses, deductions, and taxes, organized into quarterly columns for clear financial tracking. For HR, ensuring accuracy in employee details and timely updates is essential to maintain compliance and support payroll processing.

Quarterly Payroll Contributions Tracking Sheet for HR Consultants

A Quarterly Payroll Contributions Tracking Sheet is a document used to record and monitor all payroll-related contributions made by an organization within a specific quarter. It typically includes details such as employee wages, taxes withheld, employer contributions, and submission dates.

This document is essential for HR Consultants to ensure accurate tax reporting, compliance with labor laws, and timely payments to relevant agencies. Maintaining organized records helps prevent discrepancies and facilitates smooth audits.

It is important to regularly update the sheet and verify all figures to maintain data accuracy and compliance.

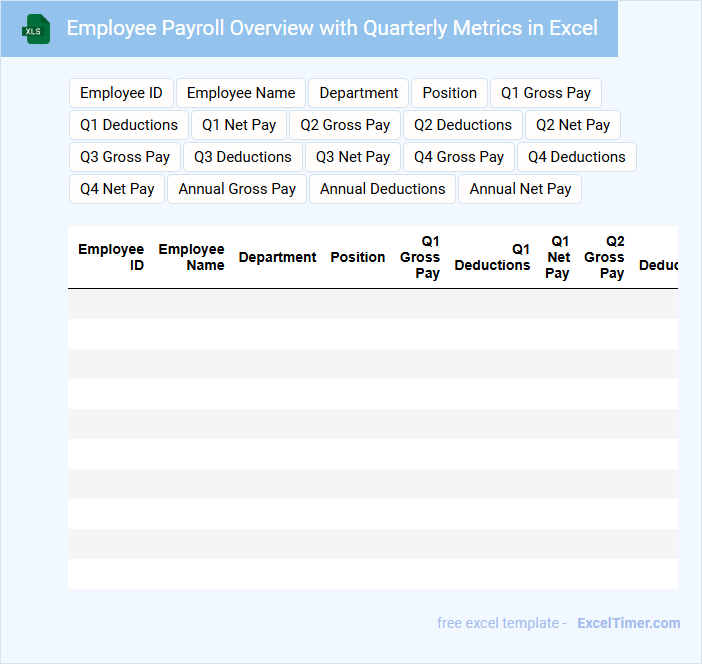

Employee Payroll Overview with Quarterly Metrics in Excel

What information is typically found in an Employee Payroll Overview with Quarterly Metrics in Excel? This type of document usually contains detailed records of employee wages, deductions, bonuses, and overall compensation for each quarter. It also summarizes key payroll metrics such as total payroll expenses, tax liabilities, and overtime costs to help businesses track financial performance and ensure compliance.

What important elements should be included for optimal analysis and clarity? It is crucial to include well-organized tables, clear labels, and consistent formatting to enhance readability. Additionally, incorporating charts or graphs to visualize payroll trends and integrating formulas for automatic calculations can greatly improve the document's usability and accuracy.

What are the essential data fields required in a Quarterly Payroll Summary for HR consultants?

A Quarterly Payroll Summary for HR consultants must include essential data fields such as Employee Name, Employee ID, Pay Period Dates, Total Hours Worked, Hourly Rate or Salary, Gross Pay, Taxes Withheld (federal, state, and local), Deductions (benefits, retirement contributions), and Net Pay. It should also record Employer Contributions like Social Security, Medicare, and unemployment insurance. Clear categorization of regular versus overtime hours and payments ensures accurate payroll reporting and compliance.

How does the summary track total wages, tax withholdings, and employer contributions per quarter?

The Quarterly Payroll Summary for HR Consultants aggregates total wages, tax withholdings, and employer contributions by employee and pay period, then sums these figures for each quarter. It utilizes formulas to automatically calculate cumulative amounts from individual payroll entries, ensuring accurate and up-to-date financial data. This consolidated tracking supports compliance and efficient payroll management across all quarters.

Which filters or columns facilitate analyzing employee compensation trends over multiple quarters?

Filters such as Employee Name, Department, and Job Title enable targeted analysis of compensation patterns. Columns including Gross Pay, Bonuses, and Deductions provide detailed insights into total earnings and variations across quarters. Date or Quarter columns allow for chronological comparison of employee payroll data over multiple periods.

How does the document ensure confidentiality and compliance with legal reporting standards?

The Quarterly Payroll Summary for HR Consultants uses encrypted file protection and role-based access controls to ensure confidentiality. It complies with legal reporting standards by adhering to data privacy regulations such as GDPR and maintaining accurate, auditable payroll records. Automated validation checks are implemented to prevent data errors and ensure regulatory compliance.

What key formulas or pivot tables are used to automate summary calculations and identify discrepancies?

Your Quarterly Payroll Summary in Excel uses SUMIFS and VLOOKUP formulas to automate total wage calculations and match employee data accurately. Pivot tables organize payroll data by department and pay period, enabling quick identification of discrepancies in hours worked or payment amounts. Conditional formatting highlights anomalies for efficient review and correction.