The Quarterly Loan Repayment Excel Template for Landlords simplifies tracking and managing loan payments by organizing data into clear, easy-to-read spreadsheets. It helps landlords monitor principal and interest payments, ensuring timely repayments and accurate financial records. This template enhances budgeting precision and assists in forecasting future cash flows related to property investments.

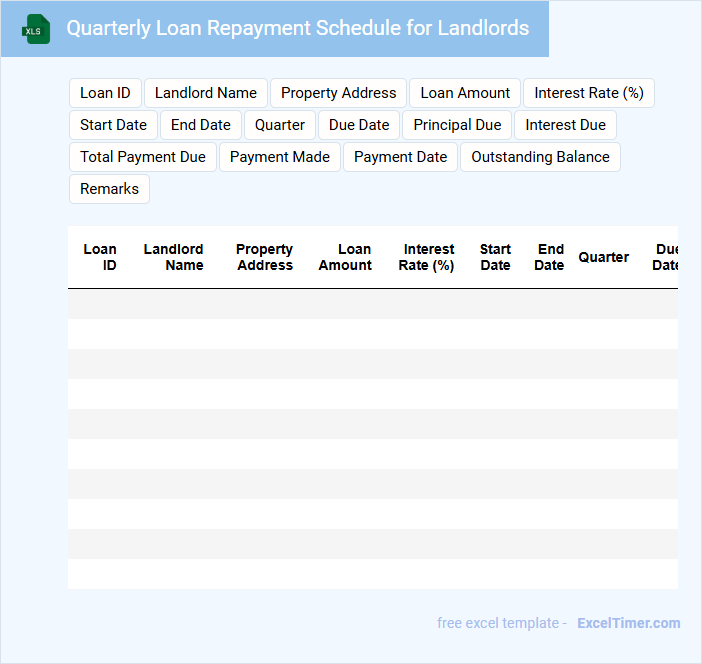

Quarterly Loan Repayment Schedule for Landlords

The Quarterly Loan Repayment Schedule for landlords typically contains detailed information about loan repayment dates, amounts due each quarter, and the total outstanding balance. It helps landlords manage their finances by providing clear timelines for repayments, ensuring timely payments. This document is essential for maintaining transparency between lenders and landlords.

Important considerations include accurately tracking due dates to avoid penalties, keeping records of payments made, and reviewing the schedule regularly for any changes in terms. Additionally, landlords should verify the interest rates and loan conditions stated in the document. Proper management of this schedule ensures financial stability and effective loan servicing.

Excel Tracker for Quarterly Loan Repayment of Rental Properties

An Excel tracker for quarterly loan repayment of rental properties is a document used to monitor and manage loan payments systematically over each quarter. It helps landlords or property managers keep track of repayment schedules and outstanding balances efficiently.

- Include detailed columns for payment dates, amounts paid, and remaining loan balance.

- Incorporate formulas to automatically calculate totals and overdue payments.

- Use color coding or conditional formatting to highlight upcoming or missed repayments.

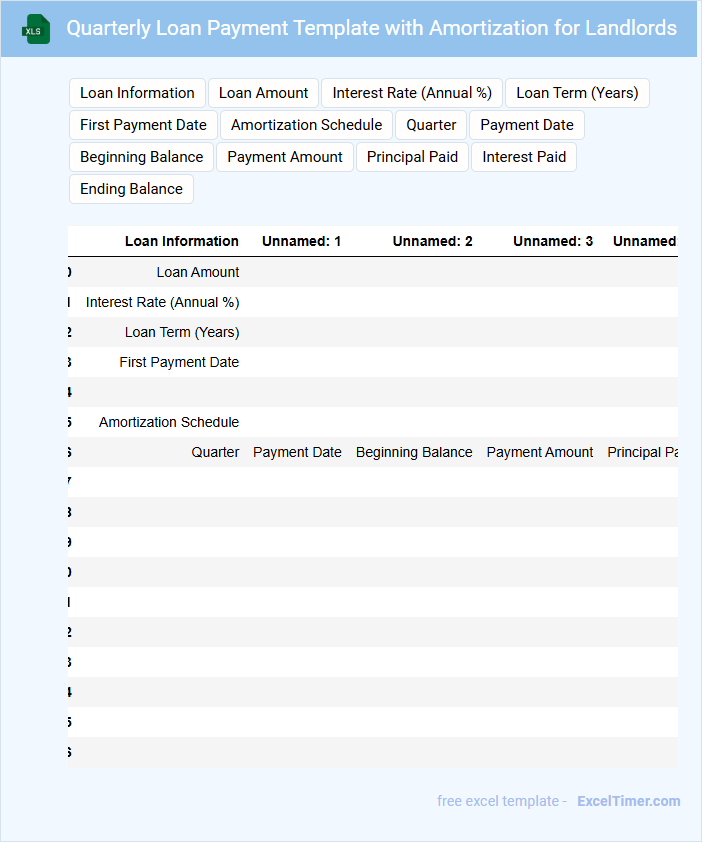

Quarterly Loan Payment Template with Amortization for Landlords

A Quarterly Loan Payment Template with Amortization for Landlords typically contains detailed schedules of loan repayments broken down by principal and interest for each quarter.

- Payment Breakdown: It clearly lists each quarterly payment separating principal and interest amounts.

- Amortization Schedule: It includes a timeline showing the gradual reduction of the loan balance over the term.

- Important Dates: It highlights due dates to ensure timely payments and avoid penalties.

Loan Repayment Tracker with Quarterly Overview for Landlords

This Loan Repayment Tracker with Quarterly Overview is designed to help landlords monitor their loan payments effectively over time. It typically contains detailed schedules of installment amounts, due dates, and remaining balances for each loan.

The tracker also provides a summary of payments made each quarter, highlighting any missed or late payments for better financial management. Including columns for interest rates and payment status is essential for comprehensive tracking and timely decision-making.

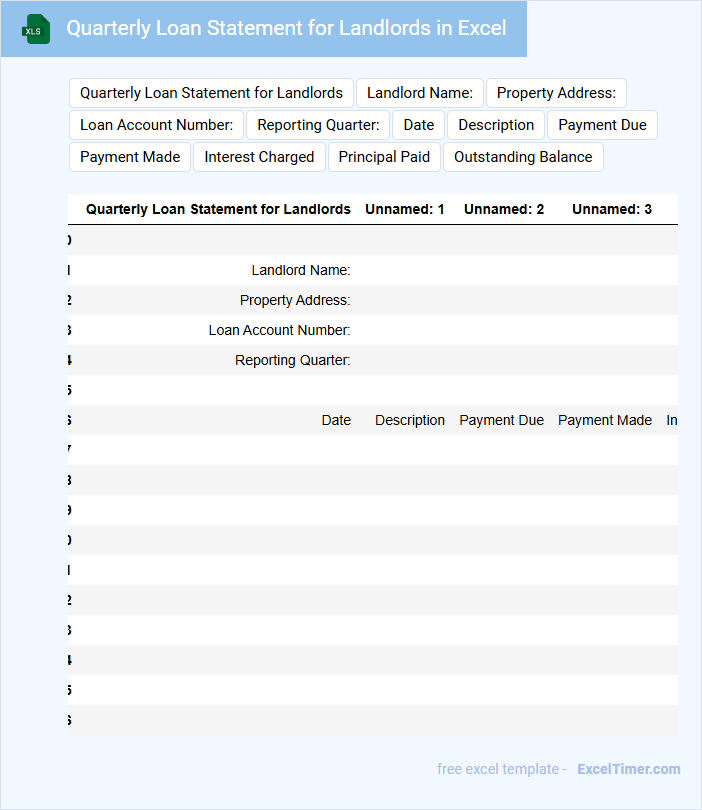

Quarterly Loan Statement for Landlords in Excel

This document typically summarizes the financial transactions related to loans over a quarter, specifically tailored for landlords. It provides a clear view of loan amounts, repayments, and outstanding balances.

Key components include:

- Detailed records of loan disbursements and repayments for tenant management.

- Summary of accrued interest and fees to assess loan cost over time.

- Clear identification of outstanding balances to monitor loan status effectively.

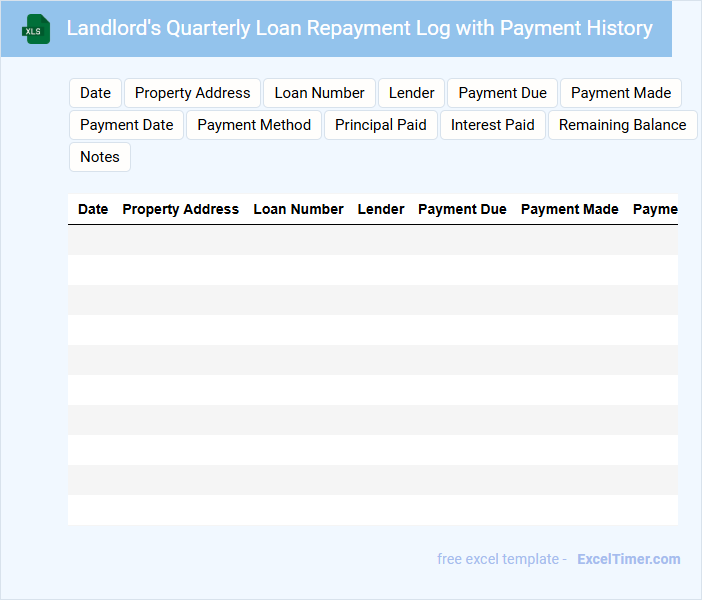

Landlord's Quarterly Loan Repayment Log with Payment History

A Landlord's Quarterly Loan Repayment Log typically contains detailed records of loan payments made by the landlord over a quarter, including dates, amounts paid, and remaining balances. It serves as an essential financial document for tracking the repayment history of loans related to property ownership or management. Maintaining accurate logs aids in financial planning and ensures transparency during audits or disputes.

Important elements to include are clear payment dates, total amounts paid per installment, and updated outstanding loan balances. Additionally, it is advisable to note any missed or late payments and include references to loan agreements or contracts for clarity. Keeping this document organized and up-to-date supports effective loan management and legal compliance.

Excel Sheet for Tracking Quarterly Loan Repayment of Landlords

This document typically contains detailed records of landlords' loan repayments tracked quarterly to ensure accurate financial management.

- Loan Amount: The initial amount of the loan provided to each landlord for precise tracking.

- Repayment Schedule: A clear timeline of quarterly payment deadlines to monitor timely repayments.

- Outstanding Balance: The remaining loan amount after each repayment for updated financial status.

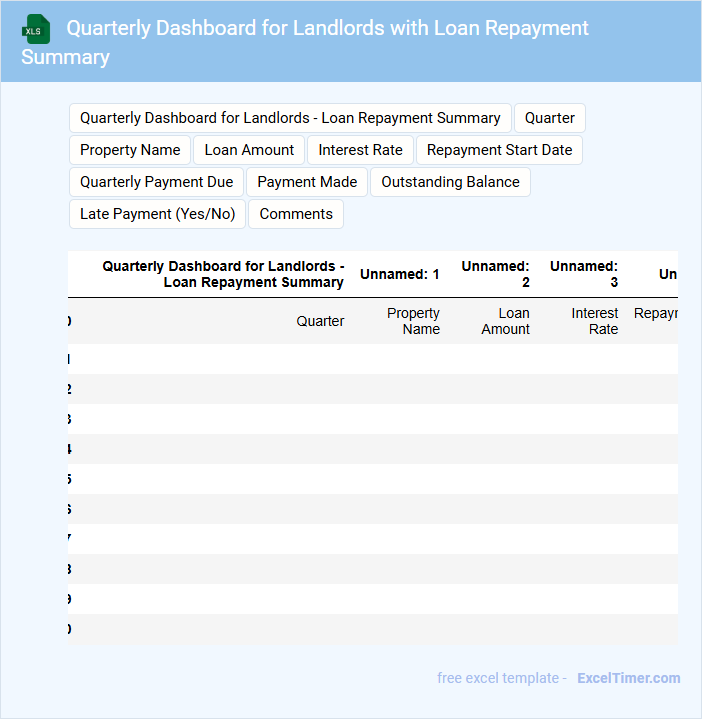

Quarterly Dashboard for Landlords with Loan Repayment Summary

A Quarterly Dashboard for Landlords with Loan Repayment Summary typically contains an overview of rental income, loan repayment status, and property performance metrics.

- Income Tracking: Displays detailed rental income received during the quarter to monitor cash flow.

- Loan Repayment Status: Summarizes outstanding loan amounts, payment history, and upcoming due dates for financial planning.

- Property Performance Metrics: Highlights occupancy rates, expenses, and ROI to assess investment health.

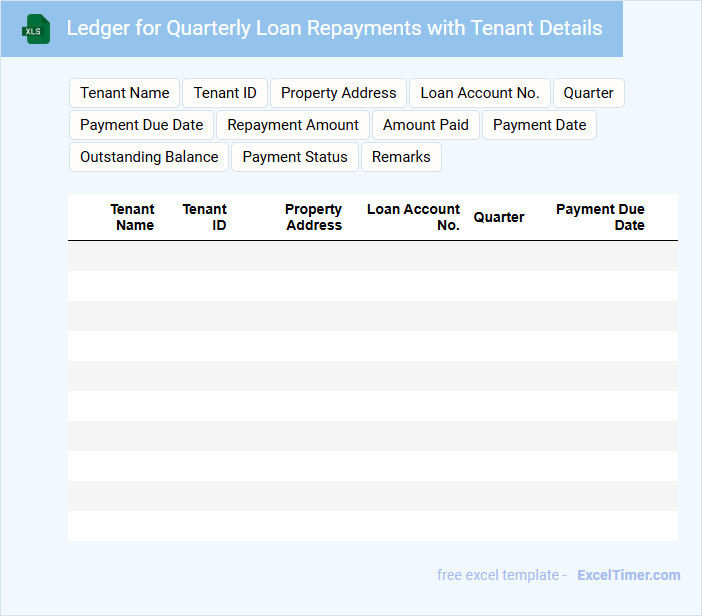

Ledger for Quarterly Loan Repayments with Tenant Details

What information is typically included in a Ledger for Quarterly Loan Repayments with Tenant Details? This type of document usually contains records of loan repayment schedules segmented into quarterly periods, alongside specific tenant information such as names, contact details, and payment history. It helps landlords or loan officers track financial transactions efficiently while maintaining transparent communication with tenants.

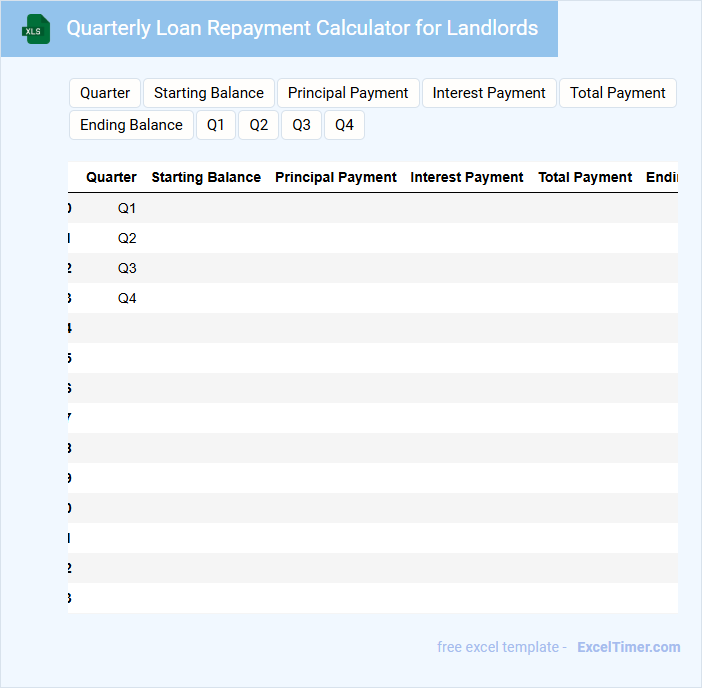

Quarterly Loan Repayment Calculator for Landlords

What information is typically included in a Quarterly Loan Repayment Calculator for Landlords? This type of document usually contains details such as the loan amount, interest rate, repayment term, and the schedule of quarterly payments. It helps landlords estimate their financial obligations and manage cash flow effectively throughout the loan period.

What important factors should landlords consider when using this calculator? Landlords should ensure they input accurate loan terms and interest rates, take into account possible changes in market conditions, and consider potential rental income fluctuations to maintain a realistic repayment plan.

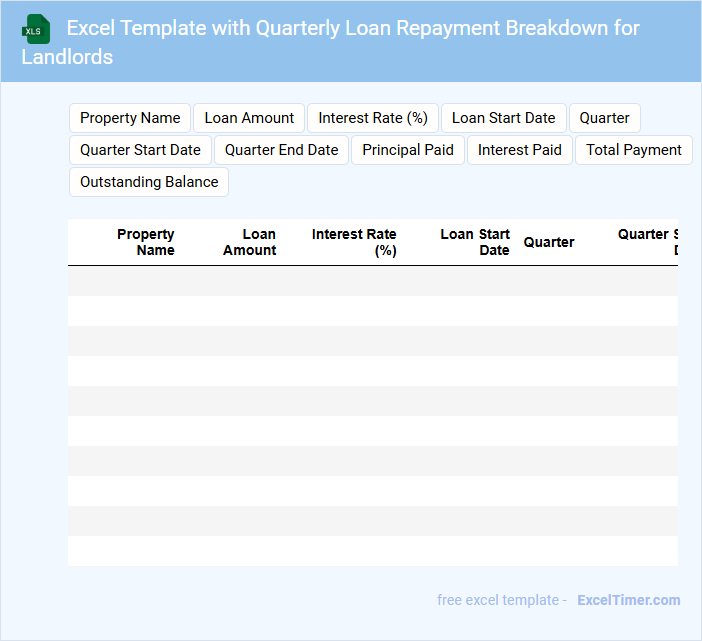

Excel Template with Quarterly Loan Repayment Breakdown for Landlords

An Excel Template with Quarterly Loan Repayment Breakdown for Landlords typically contains detailed sections for loan principal, interest payments, and outstanding balances. It is designed to help landlords efficiently track their loan repayment schedule over each quarter.

This document often includes space for inputting loan terms, interest rates, and payment dates to ensure accurate calculations. For optimal use, landlords should regularly update the template with actual payment data to maintain clear financial records.

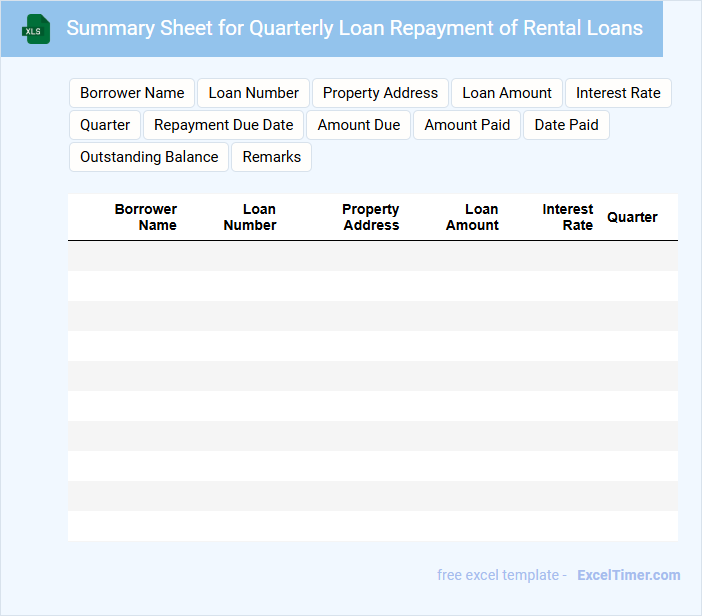

Summary Sheet for Quarterly Loan Repayment of Rental Loans

A Summary Sheet for Quarterly Loan Repayment of Rental Loans typically contains an overview of all loan transactions within the quarter, including principal amounts, interest accrued, and repayment schedules. It serves as a concise financial record that helps borrowers and lenders track payment status and outstanding balances. Keeping this document accurate and up-to-date is crucial for effective loan management and financial planning.

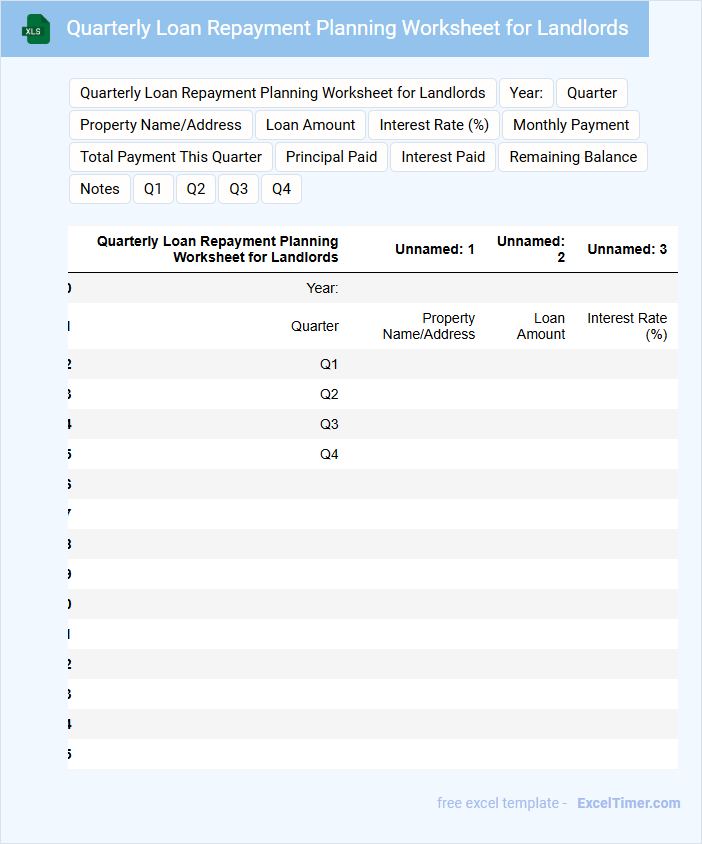

Quarterly Loan Repayment Planning Worksheet for Landlords

A Quarterly Loan Repayment Planning Worksheet for Landlords typically contains detailed financial schedules to help manage loan repayments efficiently over three months. It is designed to track payment dates, amounts, and outstanding balances to ensure timely loan servicing.

- Include a clear summary of loan terms and repayment schedules at the top.

- Break down the repayment amounts by month, showing principal and interest separately.

- Incorporate a section for notes on potential changes or unexpected expenses impacting repayments.

Payment Calendar with Quarterly Loan Repayment Tracking for Landlords

A Payment Calendar with Quarterly Loan Repayment Tracking for Landlords is a structured document designed to monitor and manage loan repayments systematically over each quarter. It typically includes detailed dates for payment due, amounts payable, and outstanding balances to ensure timely financial planning. Additionally, it helps landlords avoid late fees and maintain clear records for financial accountability.

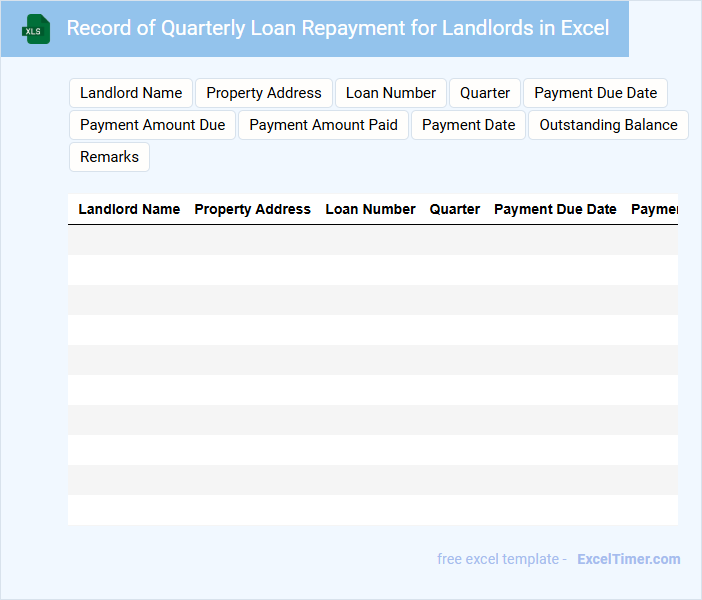

Record of Quarterly Loan Repayment for Landlords in Excel

A Record of Quarterly Loan Repayment for landlords in Excel typically contains detailed information about loan amounts, repayment dates, and outstanding balances. This document helps landlords track their financial obligations accurately over specific quarterly periods. It is essential for maintaining transparency and ensuring timely loan management.

Important elements to include are loan start dates, repayment schedules, interest rates, and payment status. Incorporating formulas to calculate remaining balances and total paid enhances efficiency. Regular updates and backups of the Excel sheet are crucial to prevent data loss.

What is the total quarterly loan repayment amount due for each property?

The total quarterly loan repayment amount due for each property is calculated by summing all individual loan repayments listed for that property within the quarter. This includes principal and interest payments scheduled for the three months of the quarter. Accurate tracking ensures landlords can manage cash flow and meet their financial obligations on time.

How are interest and principal portions separated in the quarterly repayment schedule?

The quarterly loan repayment schedule for landlords clearly separates interest and principal portions by calculating interest on the outstanding loan balance at the start of each quarter. Principal repayment is the difference between the total quarterly payment and the interest portion. This structure helps landlords track loan amortization and interest expense accurately over time.

Which properties have overdue or outstanding quarterly loan repayments?

The Excel document identifies several landlord properties with overdue quarterly loan repayments, including 123 Maple Street and 456 Oak Avenue. Outstanding repayments are clearly marked with the due date and amount owed for each property. The report also highlights properties with partial payments pending, ensuring precise tracking of all quarterly loan statuses.

What are the payment due dates for each quarterly loan repayment?

Quarterly loan repayments for landlords are typically due on the last day of each quarter: March 31, June 30, September 30, and December 31. These dates ensure timely payments aligned with the fiscal calendar. Landlords should verify specific due dates in their loan agreement to avoid penalties.

How does early or late repayment affect the outstanding loan balance for each quarter?

Early repayment reduces Your outstanding loan balance each quarter, decreasing interest accrual and shortening the loan term. Late repayment increases the balance due to added interest and possible penalties, extending the repayment period. Tracking these changes quarterly ensures accurate financial planning for landlords.