The Quarterly Cash Flow Excel Template for Real Estate Investors is designed to accurately track and analyze rental income, expenses, and net cash flow every three months. It helps investors monitor property performance, forecast future cash flows, and make informed decisions based on detailed financial data. Key features include customizable input fields, automated calculations, and clear visual summaries for effective portfolio management.

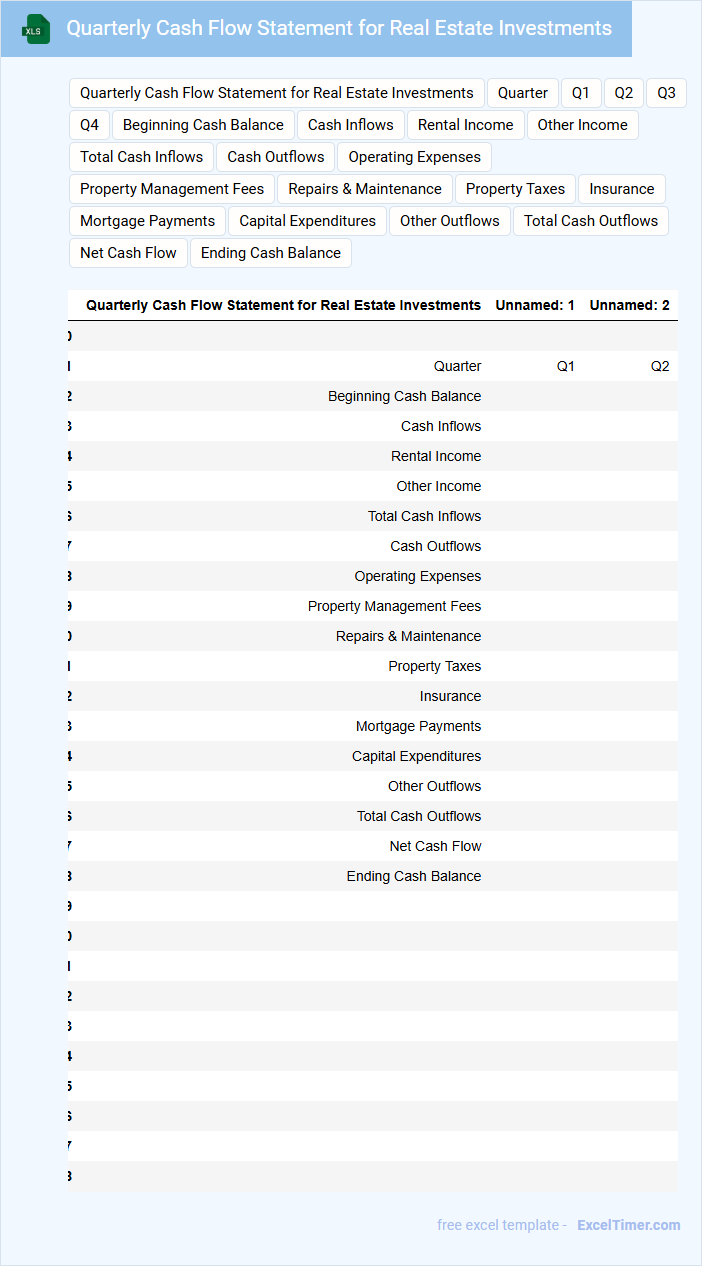

Quarterly Cash Flow Statement for Real Estate Investments

The Quarterly Cash Flow Statement for real estate investments provides a detailed summary of cash inflows and outflows related to property transactions over a three-month period. This document typically includes rental income, operating expenses, financing costs, and capital expenditures. It helps investors and stakeholders assess the liquidity and financial health of their real estate portfolio.

Important considerations include ensuring accurate recording of all revenue streams, distinguishing between operating and non-operating cash flows, and regularly reconciling with bank statements. Additionally, highlighting significant variances from previous quarters can provide valuable insights for decision-making and future investment planning.

Cash Flow Tracking Template for Real Estate Properties

A Cash Flow Tracking Template for real estate properties typically contains detailed records of income and expenses related to property management. It helps investors monitor rental income, mortgage payments, maintenance costs, and other financial activities to ensure profitability.

Important elements to include are monthly cash inflows and outflows, as well as net cash flow summaries to provide clear insight into the financial health of the property. Regularly updating this template enables better decision-making and effective property investment management.

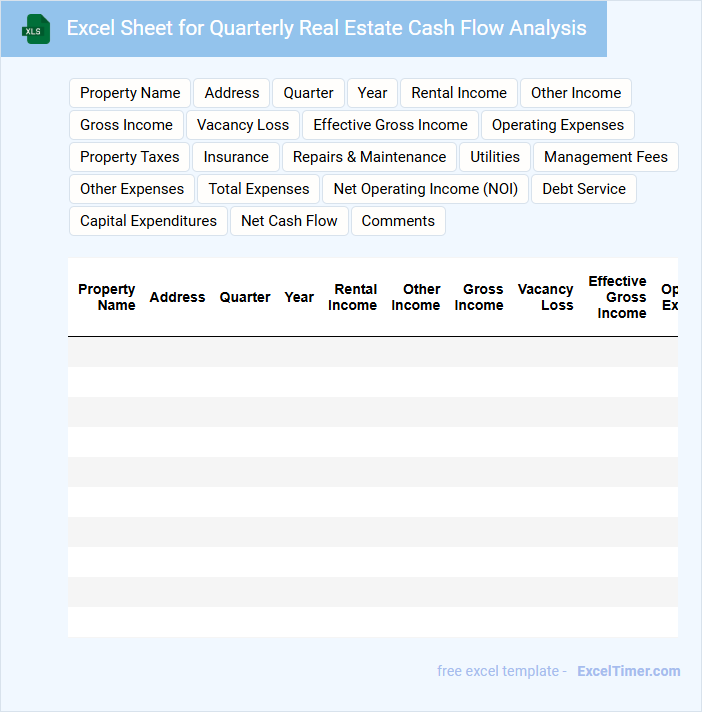

Excel Sheet for Quarterly Real Estate Cash Flow Analysis

An Excel sheet for quarterly real estate cash flow analysis is typically used to track and project income and expenses related to real estate investments over a three-month period. This type of document helps investors and property managers make informed financial decisions by providing a clear snapshot of cash inflows and outflows.

- Include detailed rental income and other revenue sources for accuracy.

- Track all operating expenses such as maintenance, taxes, and management fees.

- Incorporate cash flow summaries to assess overall profitability and liquidity.

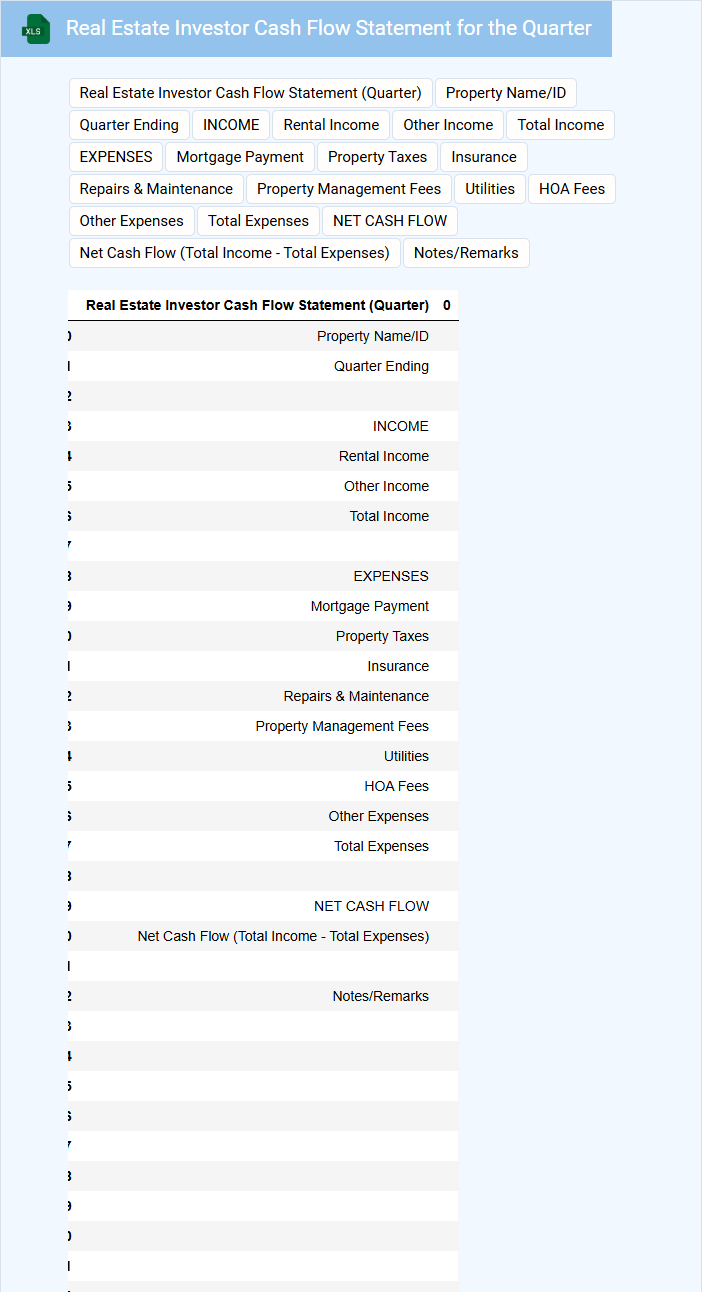

Real Estate Investor Cash Flow Statement for the Quarter

The Real Estate Investor Cash Flow Statement for the quarter presents a detailed record of cash inflows and outflows related to property investments. It highlights rental income, operating expenses, financing costs, and net cash flow over a three-month period.

This document is crucial for assessing the financial health and liquidity of real estate investments, helping investors make informed decisions. Regular review ensures timely identification of profit trends and potential cash shortages.

Ensure accuracy by including all income sources, recurring expenses, loan payments, and reserve funds.

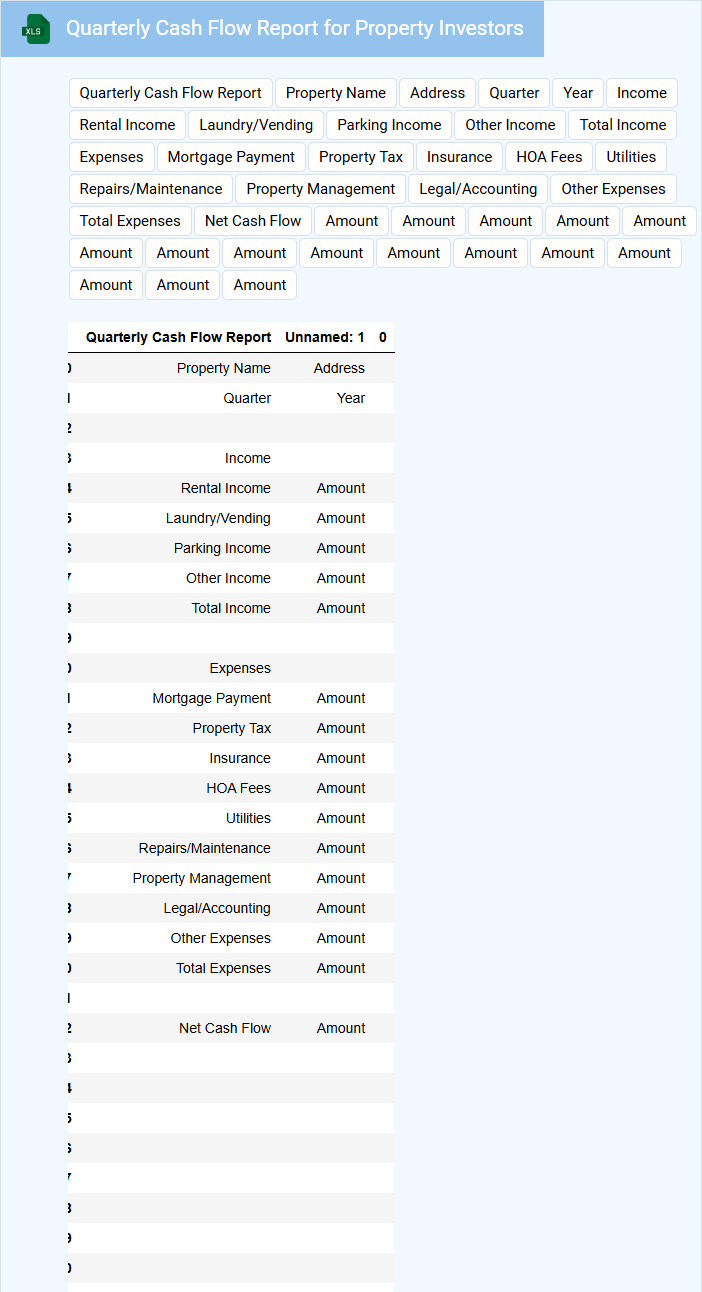

Quarterly Cash Flow Report for Property Investors

A Quarterly Cash Flow Report for property investors typically contains detailed records of income and expenses associated with investment properties over a three-month period. It highlights rental income, maintenance costs, mortgage payments, and other financial activities relevant to the property portfolio.

The report is essential for evaluating the financial performance and liquidity of property investments, helping investors make informed decisions. Regularly reviewing cash flow reports ensures effective management of assets and timely identification of potential issues.

Investors should pay close attention to net cash flow trends and unexpected expenses to maintain a healthy investment strategy.

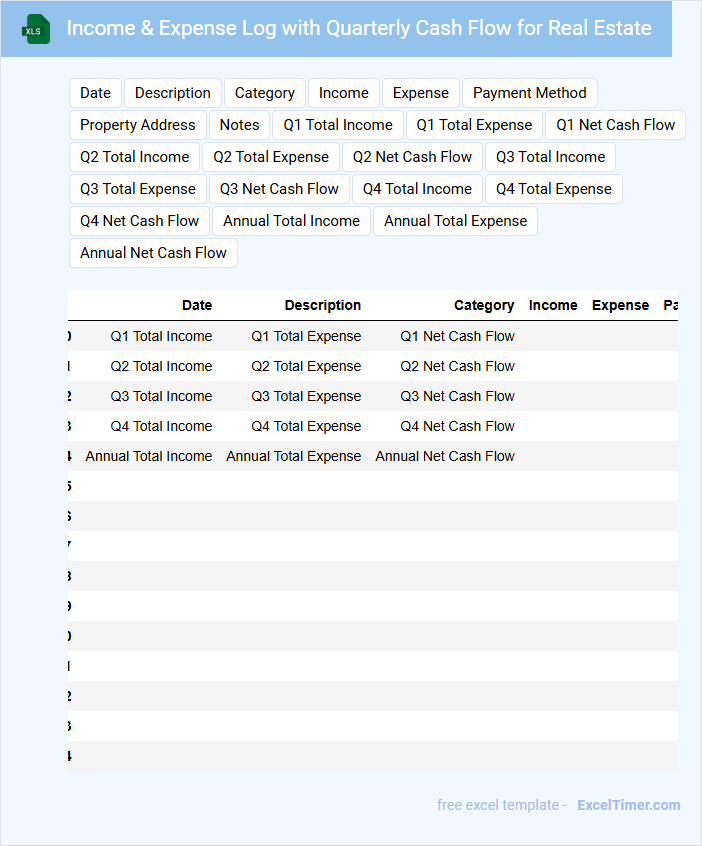

Income & Expense Log with Quarterly Cash Flow for Real Estate

What does an Income & Expense Log with Quarterly Cash Flow for Real Estate typically contain? This document usually includes detailed records of all income sources such as rent payments and other revenues, alongside expenses like maintenance, taxes, and management fees. It also provides a summary of cash flow for each quarter, helping investors track profitability and financial health over time.

Why is it important to maintain accuracy and regular updates in this log? Accurate entries ensure reliable financial analysis and better decision-making for property management and investment strategies. Regular updates also help identify trends in income and expenses, enabling timely adjustments to improve cash flow and overall real estate portfolio performance.

Rental Property Quarterly Cash Flow Tracking Spreadsheet

A Rental Property Quarterly Cash Flow Tracking Spreadsheet is a crucial document used by landlords and property managers to monitor income and expenses on a quarterly basis. It typically contains detailed records of rental income, operating expenses, and net cash flow for each property. This spreadsheet helps in assessing the financial health and profitability of rental investments over time.

Important elements to include are categorized income and expense entries, formulas for calculating net cash flow, and summary sections for easy reviewing. Ensuring accuracy and consistency in data entry is essential for effective financial analysis. Additionally, incorporating charts or visual aids can enhance the understanding of cash flow trends across quarters.

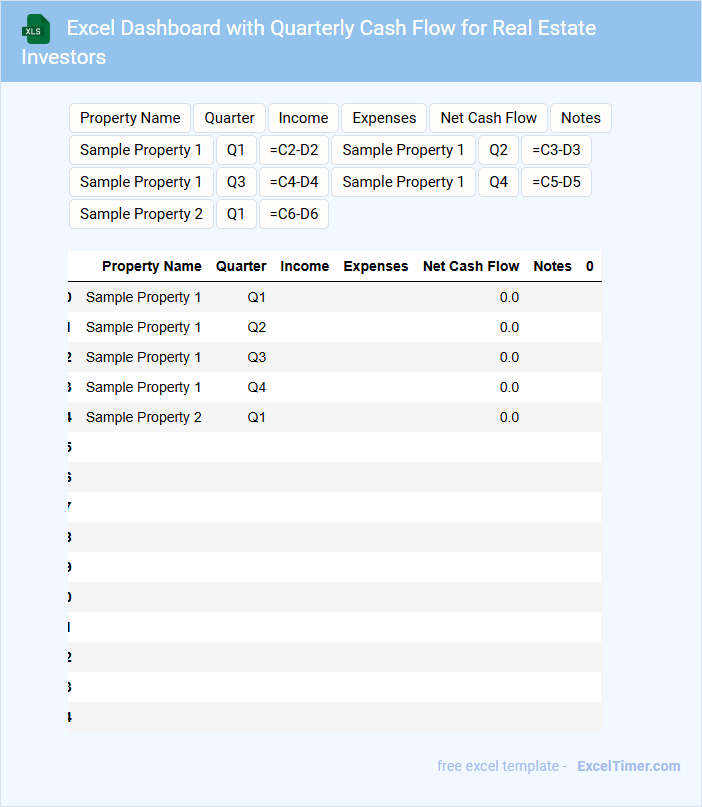

Excel Dashboard with Quarterly Cash Flow for Real Estate Investors

What information does an Excel Dashboard with Quarterly Cash Flow for Real Estate Investors typically contain? This type of document usually includes detailed financial metrics such as income, expenses, net cash flow, and investment performance over each quarter. It provides an at-a-glance summary to help investors make informed decisions about property investments and cash management.

What important elements should be included in this document for maximum effectiveness? Key aspects include clear visualizations like charts and graphs, accurate data updates, and easy navigation between quarters. Additionally, highlighting trends and forecasting future cash flows empowers investors to optimize their strategies and manage risks efficiently.

Quarterly Cash Flow Forecast for Real Estate Portfolios

A Quarterly Cash Flow Forecast for Real Estate Portfolios provides a detailed projection of incoming and outgoing cash flows over a three-month period. This document is essential for managing liquidity and assessing the financial health of real estate investments. The forecast helps stakeholders make informed decisions regarding budgeting, financing, and risk mitigation.

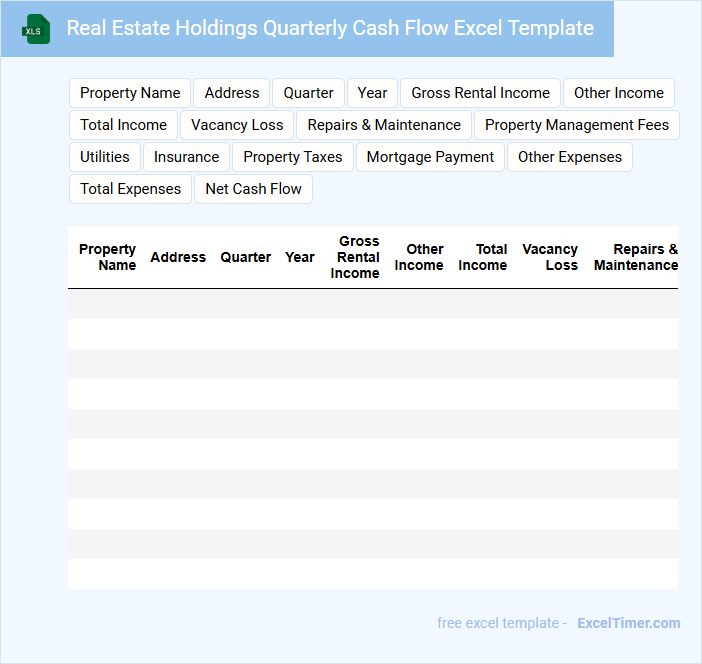

Real Estate Holdings Quarterly Cash Flow Excel Template

The Real Estate Holdings Quarterly Cash Flow Excel Template is designed to help property investors and managers track and analyze cash inflows and outflows over a three-month period. This type of document typically contains detailed sections for rental income, operating expenses, mortgage payments, and net cash flow calculations. It enables users to forecast financial performance and make informed decisions regarding their real estate portfolios.

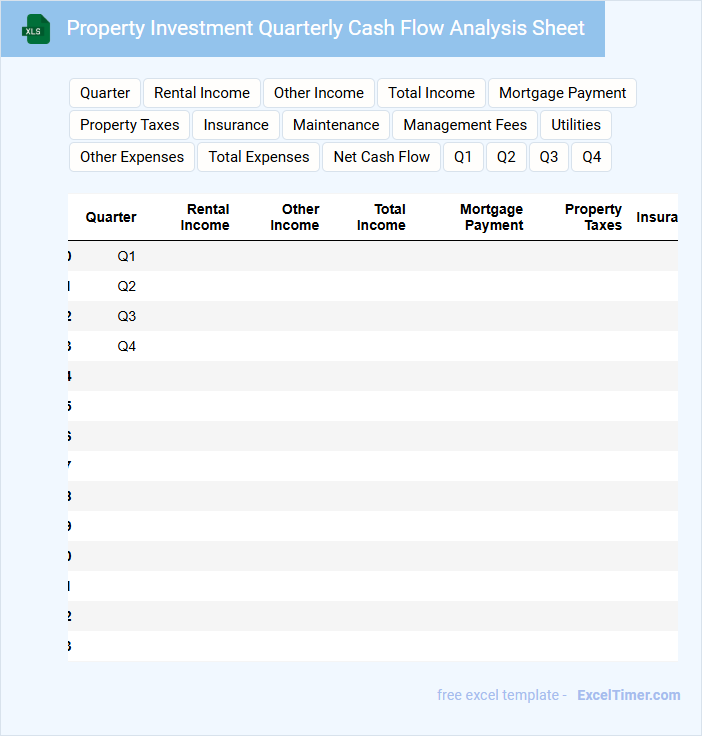

Property Investment Quarterly Cash Flow Analysis Sheet

What information is typically contained in a Property Investment Quarterly Cash Flow Analysis Sheet? This document usually includes detailed records of rental income, expenses, mortgage payments, and net cash flow for a specific property over a quarter. It helps investors understand the financial performance and liquidity of their investment by summarizing inflows and outflows.

What important factors should be considered when preparing this analysis? Key elements include accurately tracking all income sources and expenses, accounting for seasonal or market fluctuations, and regularly updating the sheet to reflect changes in interest rates, taxes, or maintenance costs. This ensures a realistic picture of the property's profitability and aids in making informed investment decisions.

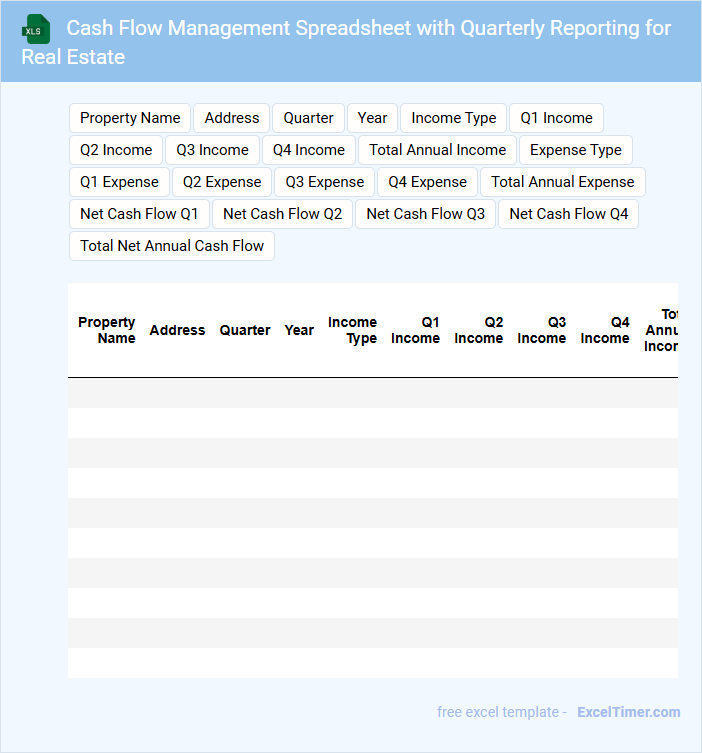

Cash Flow Management Spreadsheet with Quarterly Reporting for Real Estate

A Cash Flow Management Spreadsheet for real estate typically contains detailed tracking of income and expenses related to property investments. It includes sections for recording rental income, maintenance costs, loan payments, and other operational expenses on a quarterly basis. This document is crucial for assessing financial health and making informed investment decisions.

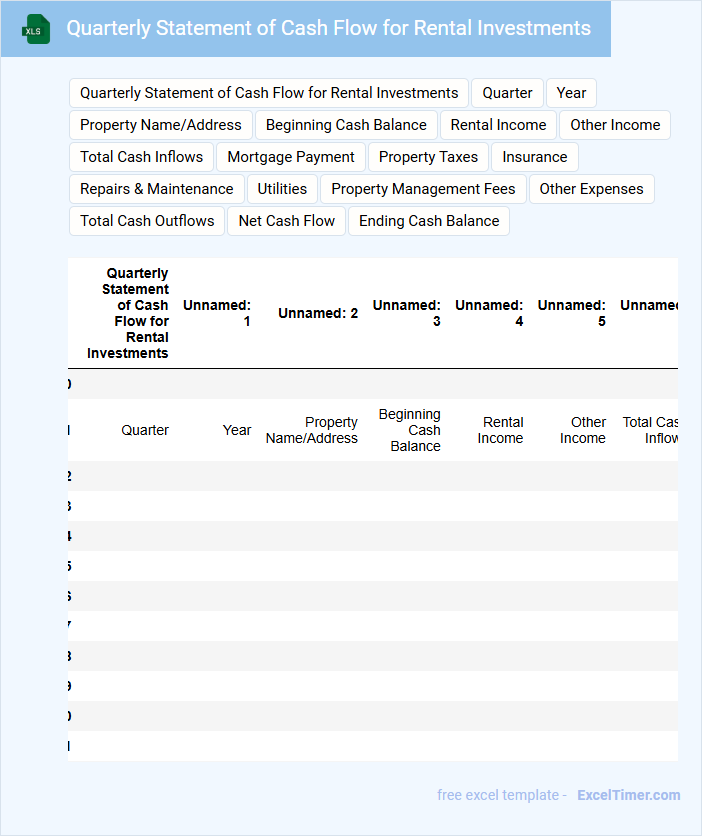

Quarterly Statement of Cash Flow for Rental Investments

The Quarterly Statement of Cash Flow for Rental Investments outlines the inflows and outflows of cash related to rental properties over a three-month period. This document is essential for tracking operating activities such as rental income and maintenance expenses, as well as investing and financing activities. It provides investors and property managers with valuable insights into the liquidity and financial health of their rental portfolio.

Important elements to include are rental income received, operating expenses, loan payments, and capital expenditures. Clear categorization of cash flows-operating, investing, and financing-is critical for accurate financial analysis. Additionally, highlighting significant changes or abnormalities in cash flow assists in making informed management decisions.

Maintaining accurate records and timely updates ensures the statement reflects true cash positions. Consistency with accounting standards and internal policies will enhance reliability. Regular comparison with budget forecasts can also optimize rental investment performance.

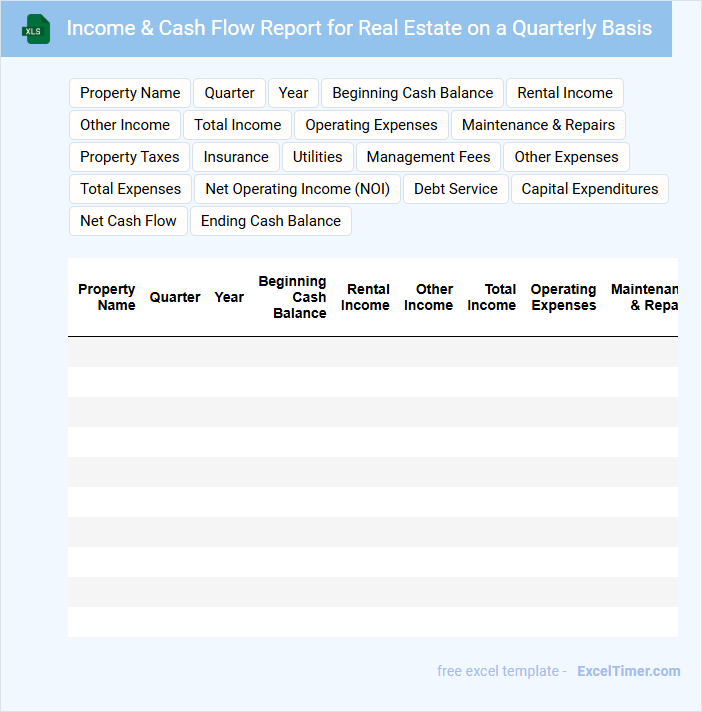

Income & Cash Flow Report for Real Estate on a Quarterly Basis

An Income & Cash Flow Report for Real Estate on a Quarterly Basis provides a detailed overview of the property's financial performance, highlighting income earned and expenses incurred. It is essential for assessing profitability and managing cash flow effectively.

- Include rental income, operating expenses, and net cash flow for the quarter.

- Compare current quarter data with previous periods to identify trends.

- Highlight any significant variances or unusual financial events impacting cash flow.

Excel Template for Tracking Quarterly Cash Flow of Real Estate Assets

This document typically contains a structured Excel template designed to help users efficiently track and manage the quarterly cash flow of real estate assets.

- Income and Expenses: Detailed sections for recording rental income and operating expenses provide clear visibility into cash inflows and outflows.

- Cash Flow Summary: A consolidated summary highlights net cash flow per quarter, allowing easy performance evaluation.

- Asset Breakdown: Individual asset tabs or categories ensure precise tracking and comparison across multiple properties.

What are the primary components of a quarterly cash flow statement in a real estate investment Excel document?

A quarterly cash flow statement for real estate investors primarily includes rental income, operating expenses, and net cash flow. It also details mortgage payments, capital expenditures, and property management fees. This structure enables accurate tracking of investment performance and liquidity.

How do you accurately track income and expenses for each property on a quarterly basis in Excel?

Create separate Excel sheets for each property and categorize income and expenses using predefined rows for rent, maintenance, taxes, and utilities. Use formulas like SUMIFS to aggregate quarterly totals by filtering dates and transaction types. Implement data validation and consistent formatting to ensure accurate and efficient tracking across multiple properties.

Which Excel formulas or functions are most effective for calculating net cash flow per quarter?

To calculate net cash flow per quarter in your Excel document for real estate investors, use the SUM function to add all income streams like rental income and the SUM function to total expenses such as mortgage payments and maintenance costs. Apply the SUBTOTAL function to dynamically adjust calculations when filtering data. The formula =SUM(IncomeRange)-SUM(ExpenseRange) offers a precise net cash flow figure per quarter tailored for real estate investment analysis.

How can Excel be used to visualize quarterly cash flow trends for multiple real estate assets?

Excel can visualize quarterly cash flow trends for multiple real estate assets using dynamic line charts and stacked bar graphs that display cash inflows and outflows over time. Pivot tables summarize cash flow data by asset and quarter, enabling easy comparison and trend analysis. Conditional formatting highlights positive or negative cash flow periods, improving data interpretation and decision-making.

What are the best practices for organizing and updating quarterly cash flow data in an for real estate investors?

Organize quarterly cash flow data in Excel by categorizing income, expenses, and net cash flow with clearly labeled columns and consistent date formats. Use Excel features like tables, named ranges, and formulas to automate calculations and ensure accuracy. Regularly update Your template with new transaction data and reconcile figures against bank statements to maintain reliable and actionable financial insights.