The Quarterly Cash Flow Excel Template for Consultants simplifies financial tracking by organizing income, expenses, and net cash flow over three months. It provides clear visuals and automatic calculations to help consultants manage their finances efficiently. Key features include customizable categories and easy-to-use formatting to ensure accurate quarterly cash flow analysis.

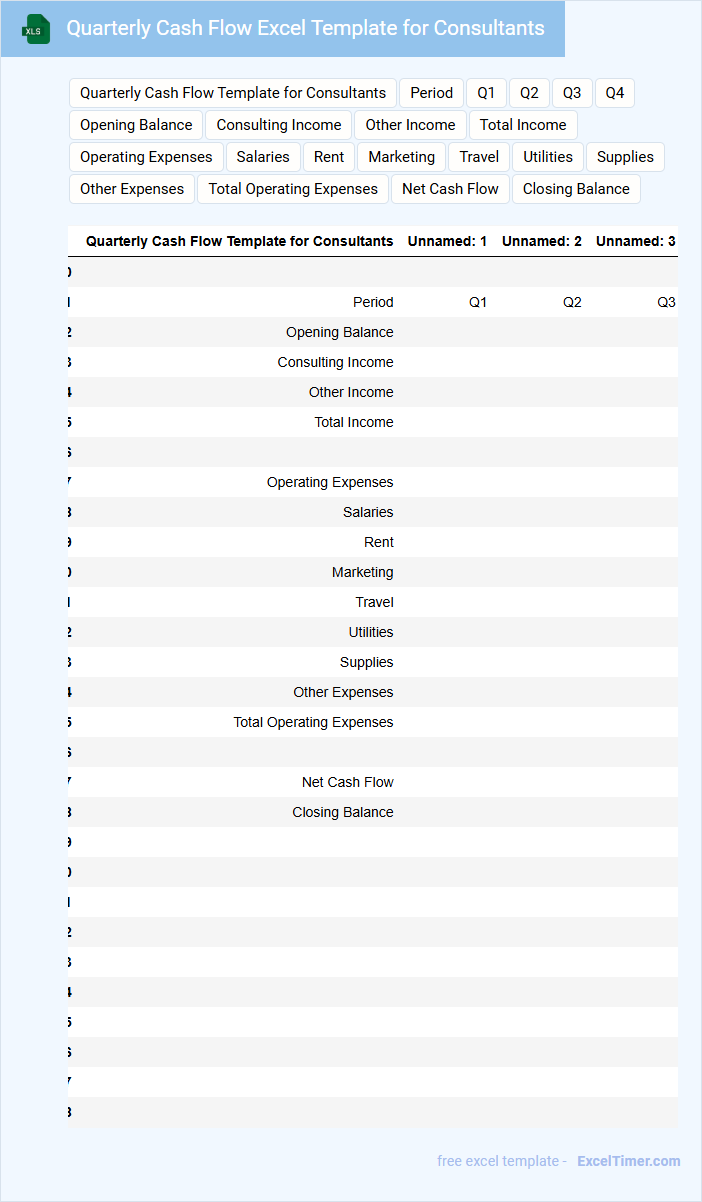

Quarterly Cash Flow Excel Template for Consultants

A Quarterly Cash Flow Excel Template for consultants is designed to track income and expenses over three months. It helps professionals visualize their cash inflows and outflows clearly and manage finances efficiently. This document typically contains detailed sections for revenue streams, operational costs, and net cash flow summaries. Important suggestions include regularly updating the template with accurate transaction data, forecasting future cash flows based on past trends, and using built-in formulas to automate calculations for better financial decision-making.

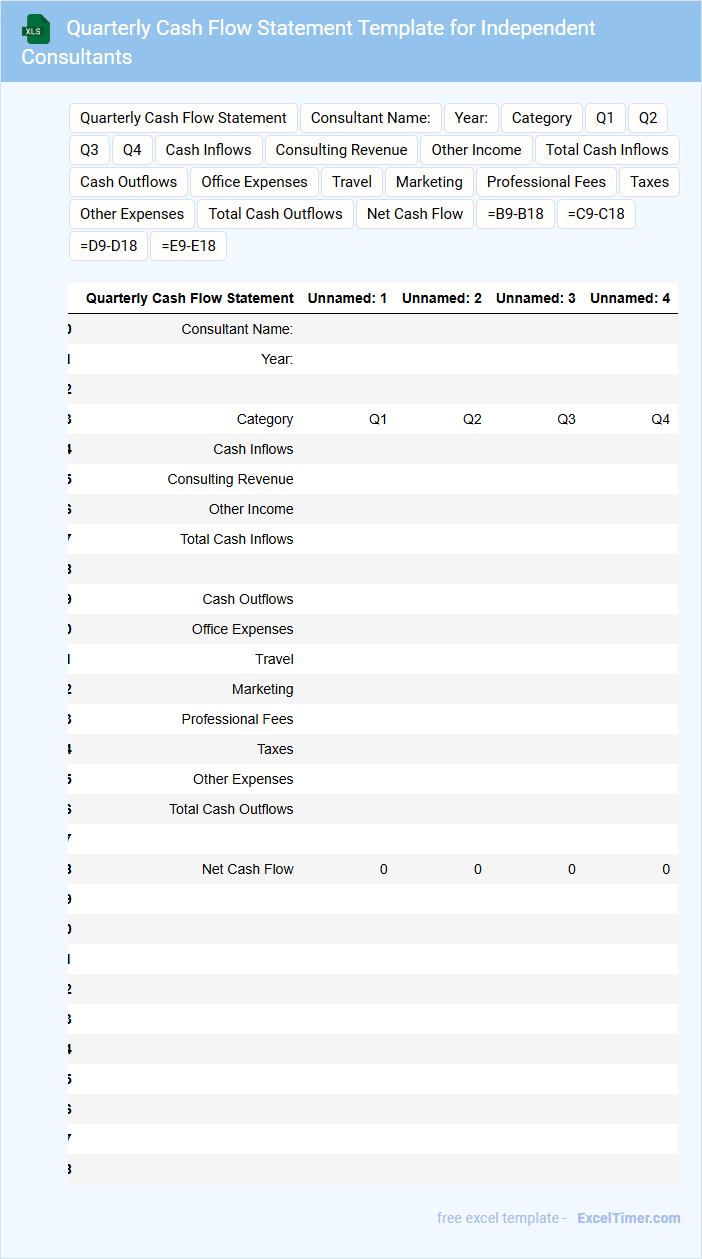

Quarterly Cash Flow Statement Template for Independent Consultants

What information is typically included in a Quarterly Cash Flow Statement Template for Independent Consultants? This document usually contains detailed records of cash inflows and outflows over a three-month period, categorizing items such as operating expenses, client payments, and investment activities. It helps consultants track liquidity, manage expenses, and make informed financial decisions to ensure business sustainability.

What is an important consideration when using this template? It is essential to regularly update the template with accurate and timely data to reflect current financial status. Additionally, including a section for notes or explanations on irregular cash movements can enhance clarity and support strategic planning.

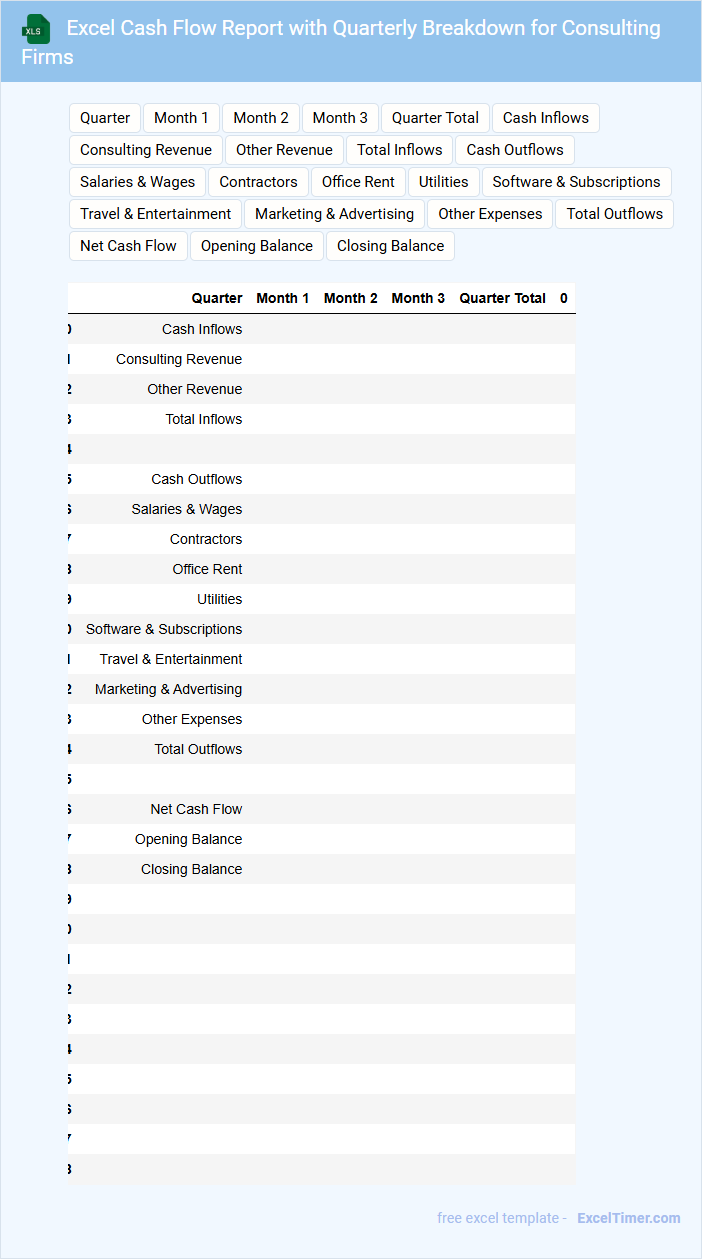

Excel Cash Flow Report with Quarterly Breakdown for Consulting Firms

What information does an Excel Cash Flow Report with Quarterly Breakdown for Consulting Firms typically contain? This document usually includes detailed records of cash inflows and outflows categorized by quarters, allowing for clear visibility of the firm's liquidity and financial health over time. It highlights revenue sources, operational expenses, and investment activities specific to consulting operations, supporting informed decision-making and strategic planning.

What important aspects should be considered when preparing this report? Accuracy in data entry and timely updates are crucial to reflect the current financial status accurately. Additionally, incorporating comparative analysis between quarters and visual aids such as charts enhances readability and helps identify trends or cash flow issues early.

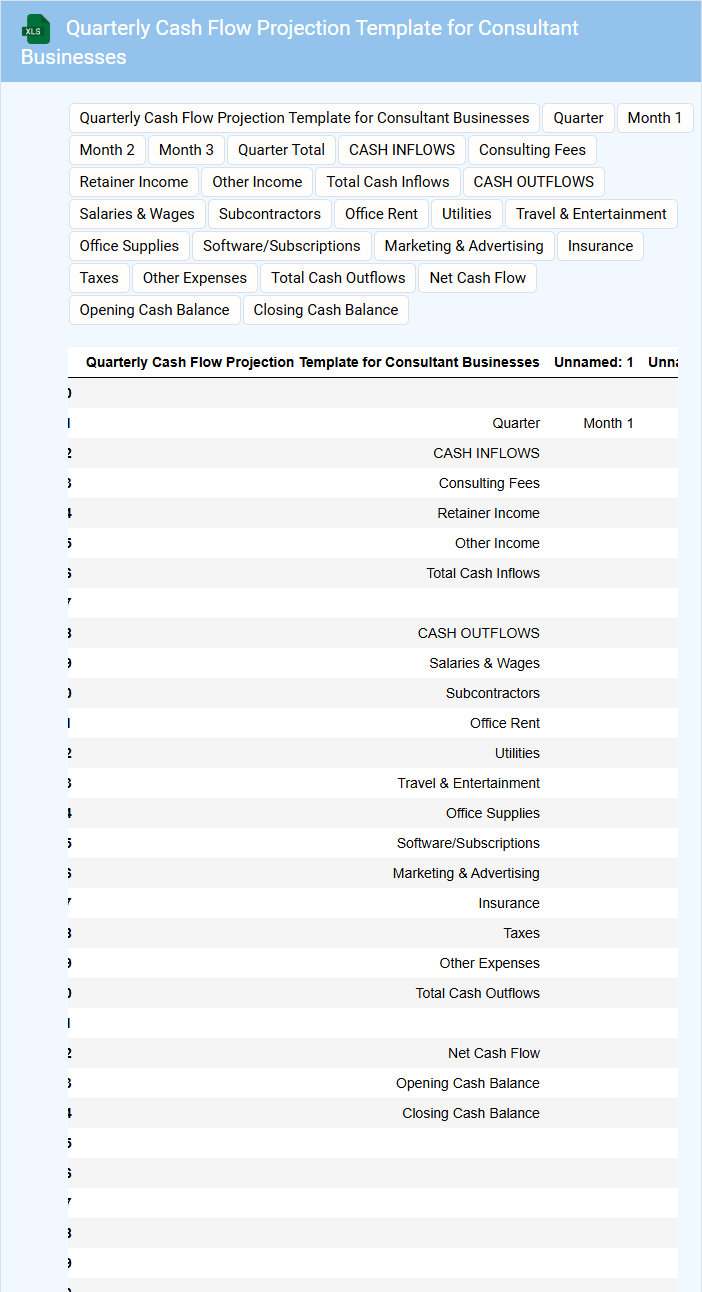

Quarterly Cash Flow Projection Template for Consultant Businesses

What information is typically included in a Quarterly Cash Flow Projection Template for Consultant Businesses? This document usually outlines expected income and expenses over a three-month period, helping consultants anticipate their financial position. It includes detailed sections for revenue from client projects, operational costs, and anticipated cash inflows and outflows to ensure effective financial planning.

What important elements should consultants focus on when using this template? Consultants should prioritize accurate revenue forecasts based on signed contracts and likely client engagements, track variable and fixed expenses meticulously, and regularly update the projections to reflect changes in project timelines or payment delays. This helps maintain healthy cash flow and supports strategic decision-making.

Consultant Quarterly Cash Flow Analysis Spreadsheet

This document usually contains detailed financial data tracking a consultant's cash flow over a quarter.

- Income Sources must be clearly itemized for accurate revenue tracking.

- Expense Categories should be detailed to identify key spending areas.

- Cash Flow Summary is crucial for assessing liquidity and financial health.

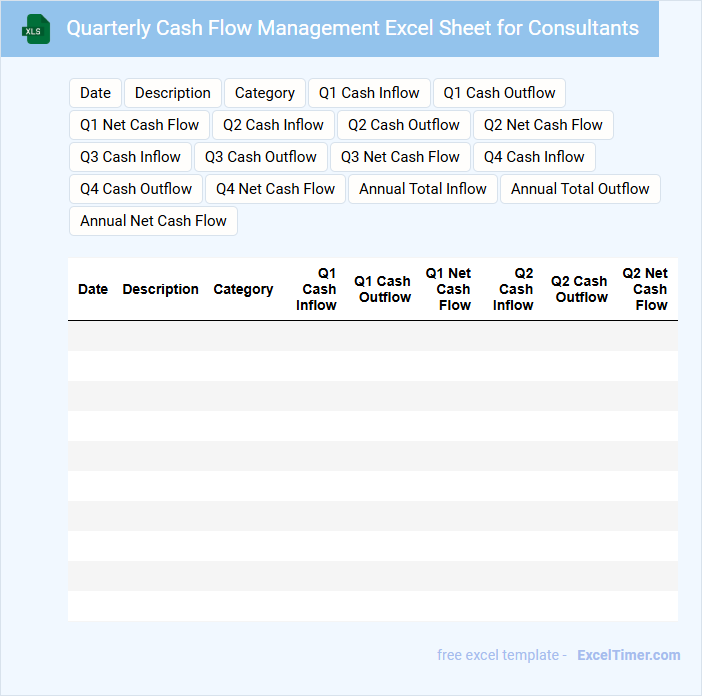

Quarterly Cash Flow Management Excel Sheet for Consultants

The Quarterly Cash Flow Management Excel Sheet for consultants is designed to track and forecast income and expenses over a three-month period. It typically includes sections for tracking payments received, outstanding invoices, and recurring expenses to ensure accurate financial planning. Consultants use this document to maintain a clear overview of their cash inflows and outflows, enabling better decision-making.

Important elements to include are detailed categorization of income sources, expense types, and a summary section highlighting net cash flow and cash reserves. Ensuring the sheet is easy to update regularly and includes formulas for automatic calculations can greatly enhance its effectiveness. Additionally, incorporating a forecast feature based on past quarters helps consultants plan for future financial stability.

Cash Flow Tracker with Quarterly Overview for Consultants

A Cash Flow Tracker with Quarterly Overview for Consultants is a financial document designed to monitor and analyze income and expenses over each quarter.

- Income Tracking: Record all sources of revenue with dates and amounts for accurate cash flow monitoring.

- Expense Categorization: Classify expenses by type to identify spending patterns and control costs.

- Quarterly Summary: Provide a summarized overview each quarter to assess financial health and plan ahead.

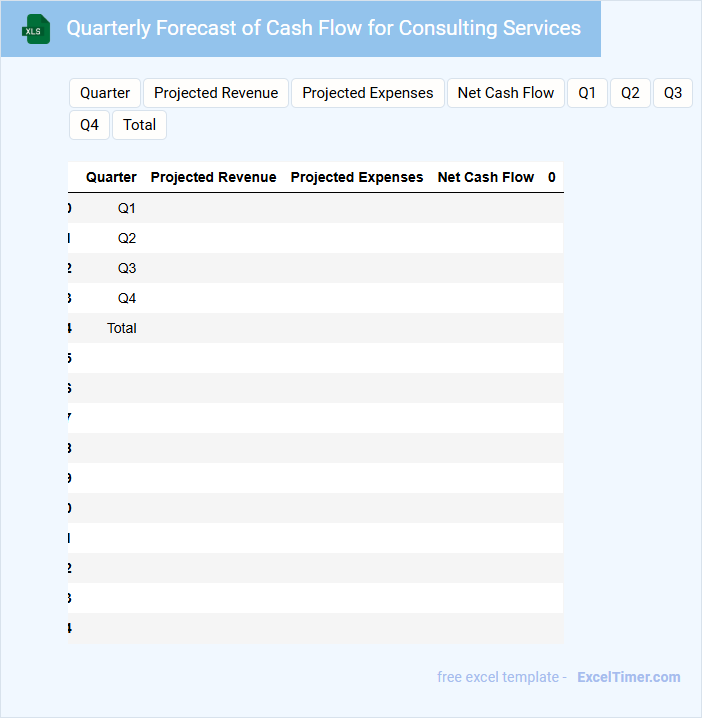

Quarterly Forecast of Cash Flow for Consulting Services

The Quarterly Forecast of Cash Flow for consulting services is a financial document that outlines projected cash inflows and outflows over a three-month period. It typically includes estimates of client payments, operational expenses, and consultant salaries. This forecast helps ensure adequate liquidity and supports strategic planning within the consulting firm.

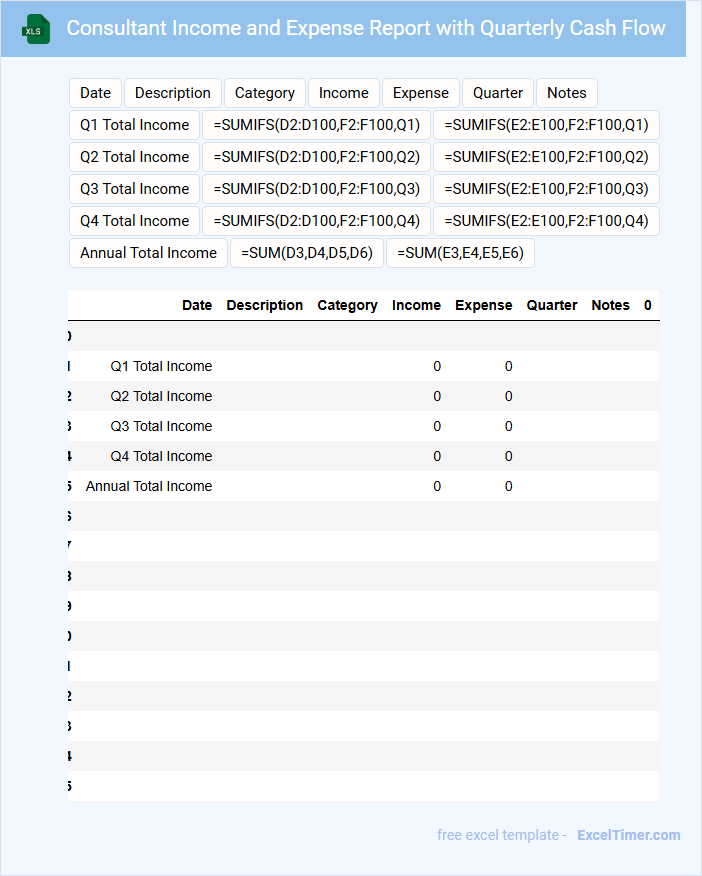

Consultant Income and Expense Report with Quarterly Cash Flow

The Consultant Income and Expense Report typically outlines the earnings and expenditures associated with consulting activities, providing a detailed financial picture over a specified period. It helps in tracking profitability, understanding cost structures, and making informed business decisions.

The Quarterly Cash Flow section forecasts and analyzes incoming and outgoing cash on a quarterly basis, aiding in managing liquidity and ensuring operational stability. Regularly updating this report supports proactive financial planning and risk management.

Ensure accuracy in recording all transactions and include notes on significant variances to enhance the report's usefulness for stakeholders.

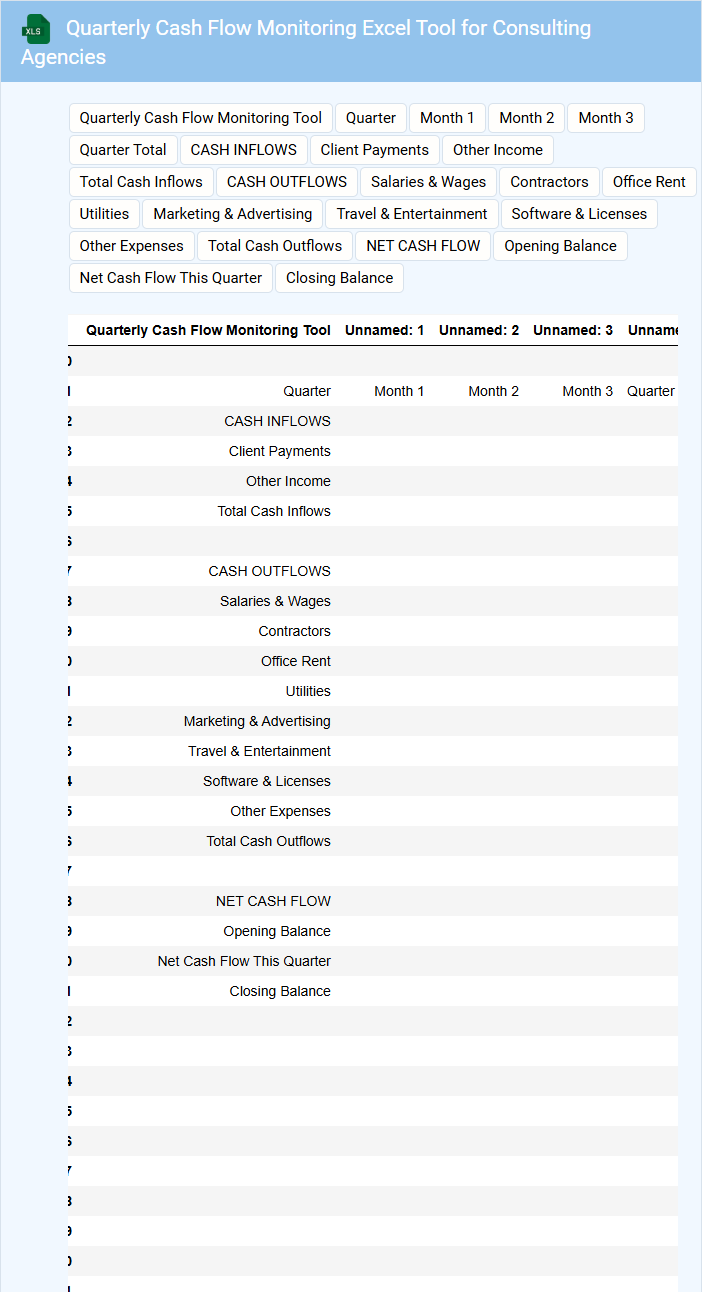

Quarterly Cash Flow Monitoring Excel Tool for Consulting Agencies

This document typically contains detailed records of cash inflows and outflows over a specified quarter, tailored for consulting agencies. It helps monitor financial health by tracking payments from clients and operational expenses. Key elements often include projected versus actual cash flow summaries, client billing details, and expense categorization.

For effective use, ensure the tool includes clear categories for different revenue streams and costs, real-time updating capabilities, and visual dashboards for quick analysis. Regularly updating the data and comparing it against forecasts will help agencies maintain liquidity and make informed financial decisions. Including automated alerts for cash shortages or payment delays enhances proactive cash management.

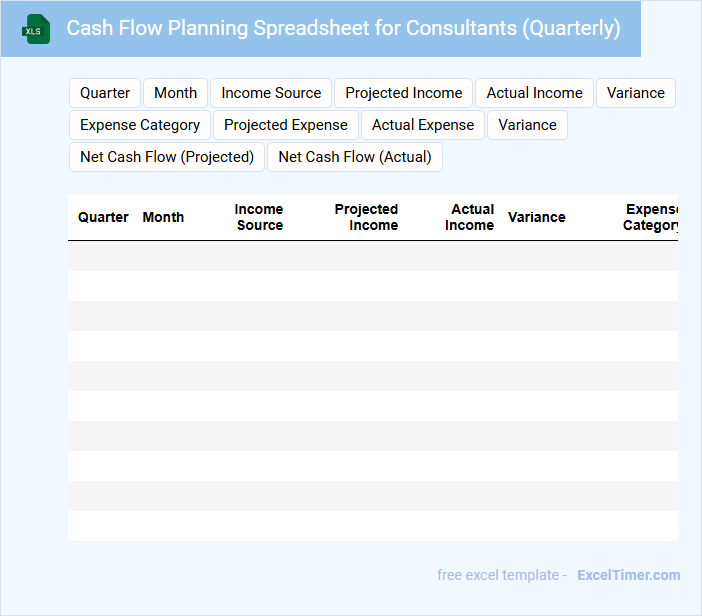

Cash Flow Planning Spreadsheet for Consultants (Quarterly)

A Cash Flow Planning Spreadsheet for consultants is an essential financial tool that helps in tracking income and expenses quarterly. It usually contains sections for projected revenue, operational costs, and net cash flow to ensure comprehensive financial oversight. For optimal use, consultants should regularly update and review this document to anticipate cash shortages and make informed business decisions.

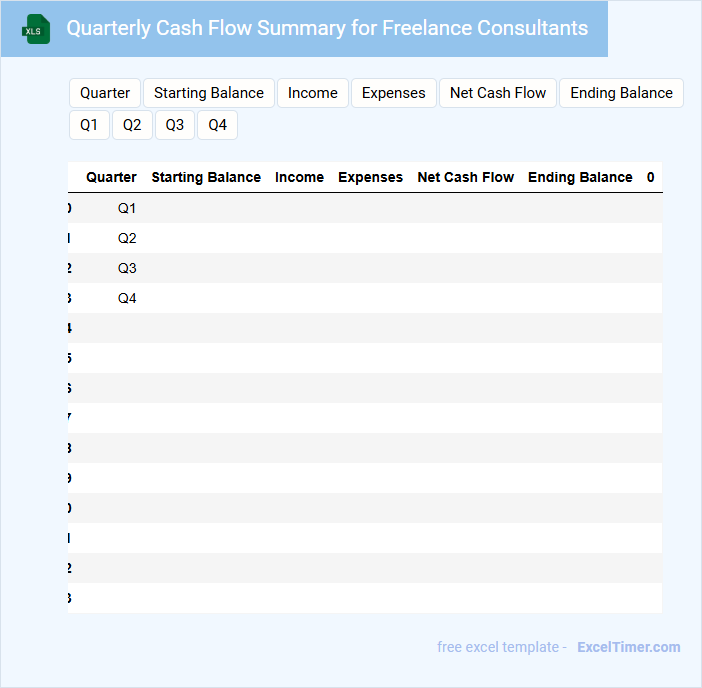

Quarterly Cash Flow Summary for Freelance Consultants

What information does a Quarterly Cash Flow Summary for Freelance Consultants typically contain? This document usually includes details of all cash inflows and outflows over a three-month period, highlighting income from projects and expenses such as software subscriptions or office supplies. It helps consultants monitor their financial health, plan budgets, and manage taxes effectively.

What important aspects should be emphasized in such a summary? Key considerations include tracking payment timelines to ensure consistent cash flow, categorizing expenses accurately for better tax deductions, and regularly updating the summary to identify financial trends and make informed business decisions.

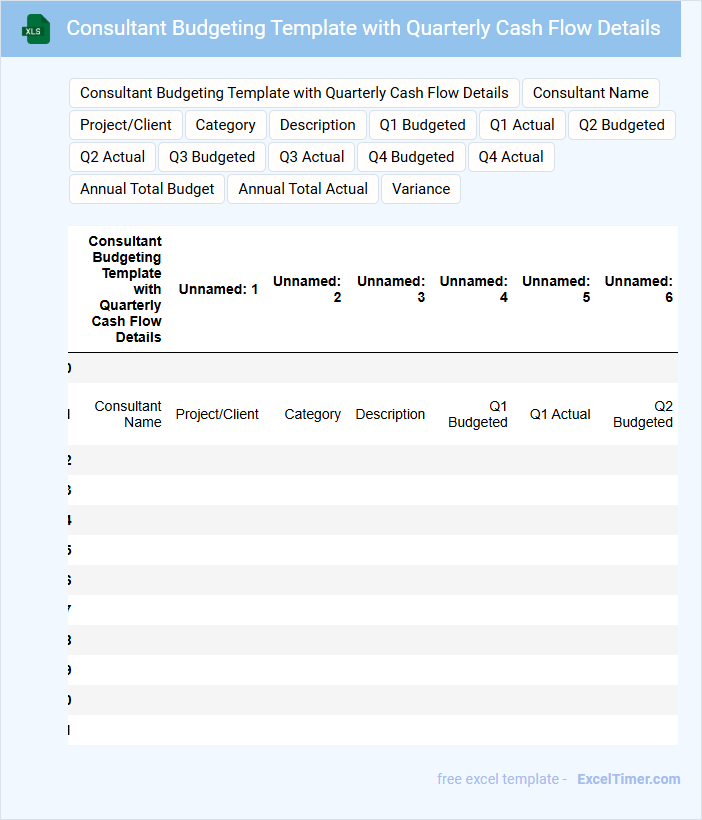

Consultant Budgeting Template with Quarterly Cash Flow Details

The Consultant Budgeting Template typically contains detailed financial projections, including anticipated expenses and revenue streams. It is designed to help consultants manage their finances efficiently throughout a project.

The Quarterly Cash Flow Details provide a breakdown of cash inflows and outflows on a three-month basis, ensuring accurate tracking of liquidity. This helps in forecasting and maintaining sufficient working capital. It is important to update projections regularly to reflect actual financial performance.

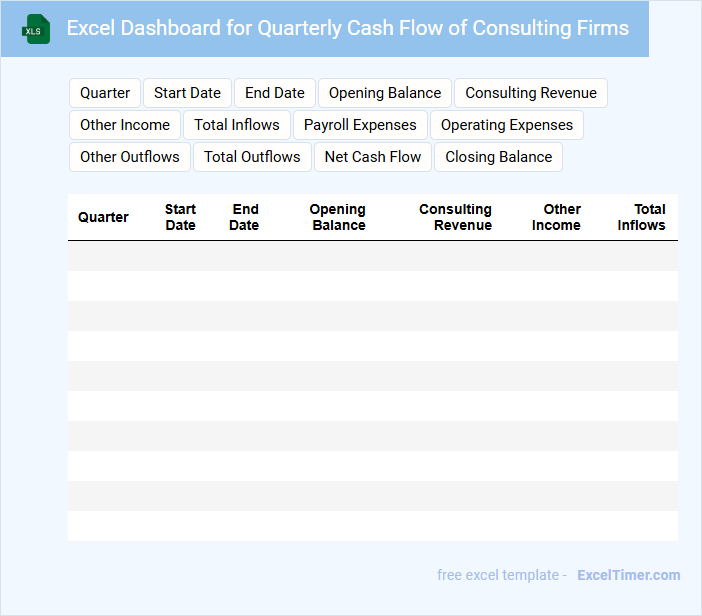

Excel Dashboard for Quarterly Cash Flow of Consulting Firms

An Excel Dashboard for Quarterly Cash Flow of Consulting Firms typically contains a visual summary of income, expenses, and net cash flow to help stakeholders monitor financial health efficiently.

- Revenue Tracking: Displays detailed income sources and amounts for the quarter.

- Expense Breakdown: Categorizes and summarizes operational and project-related costs.

- Cash Flow Analysis: Highlights net cash inflows and outflows, projecting future liquidity.

Quarterly Consultant Cash Flow Calculator with Expense Tracking

What is typically included in a Quarterly Consultant Cash Flow Calculator with Expense Tracking? This document usually contains detailed projections of income and expenses for consultants over a three-month period, helping to manage cash flow effectively. It includes sections for tracking billable hours, client payments, operational costs, and miscellaneous expenses to provide a clear financial overview.

What is an important consideration when using this document? Accuracy in recording both income and expenses is crucial to maintain reliable cash flow forecasts. Regular updates and reconciliation with actual bank statements ensure the consultant can make informed financial decisions and avoid cash shortages.

What key components should be included in a Quarterly Cash Flow Excel document for consultants?

A Quarterly Cash Flow Excel document for consultants should include key components such as cash inflows from client payments, categorized by project or service, and cash outflows covering operational expenses like salaries, software subscriptions, and travel costs. It must also feature opening and closing cash balances for accurate liquidity tracking each quarter. Detailed notes or comments enhance clarity by explaining significant cash flow variances or anticipated future expenses.

How do you categorize income and expenses specific to consulting in a cash flow statement?

In a Quarterly Cash Flow statement for consultants, categorize income under client payments and project fees, while expenses include software subscriptions, travel costs, and office supplies. Track consulting-specific costs such as marketing and subcontractor fees to accurately measure profitability. Your clear categorization ensures precise cash flow analysis and better financial decision-making.

What formulas or functions can be used to automatically calculate net cash flow each quarter?

Your Quarterly Cash Flow for Consultants can be automatically calculated using the SUM function to total cash inflows and outflows. The formula =SUM(Inflows) - SUM(Outflows) effectively computes net cash flow each quarter. Incorporating functions like SUMIFS helps track specific cash categories for precise financial analysis.

How can you track outstanding invoices and receivables in the quarterly cash flow sheet?

Your quarterly cash flow sheet for consultants should include a dedicated section for outstanding invoices and receivables with columns for invoice date, client name, amount due, and due date. Use conditional formatting to highlight overdue invoices for quick identification. Regularly update this section to ensure accurate tracking of cash inflows and improve your financial forecasting.

Which visualization tools (charts/graphs) can best highlight quarterly cash trends and projections?

Line charts effectively highlight quarterly cash flow trends by displaying changes over time for consultants. Bar graphs provide clear comparisons of cash inflows and outflows each quarter, making it easier to identify high and low periods. Stacked area charts visually represent cumulative cash flow alongside individual components, aiding in cash projection analysis.