The Quarterly Profit and Loss Excel Template for Freelancers provides a structured and easy way to track income and expenses over three months, helping freelancers manage their finances efficiently. It includes customizable categories for revenue streams and costs, enabling accurate financial analysis and tax readiness. Using this template ensures clear visibility into profitability and aids in making informed business decisions.

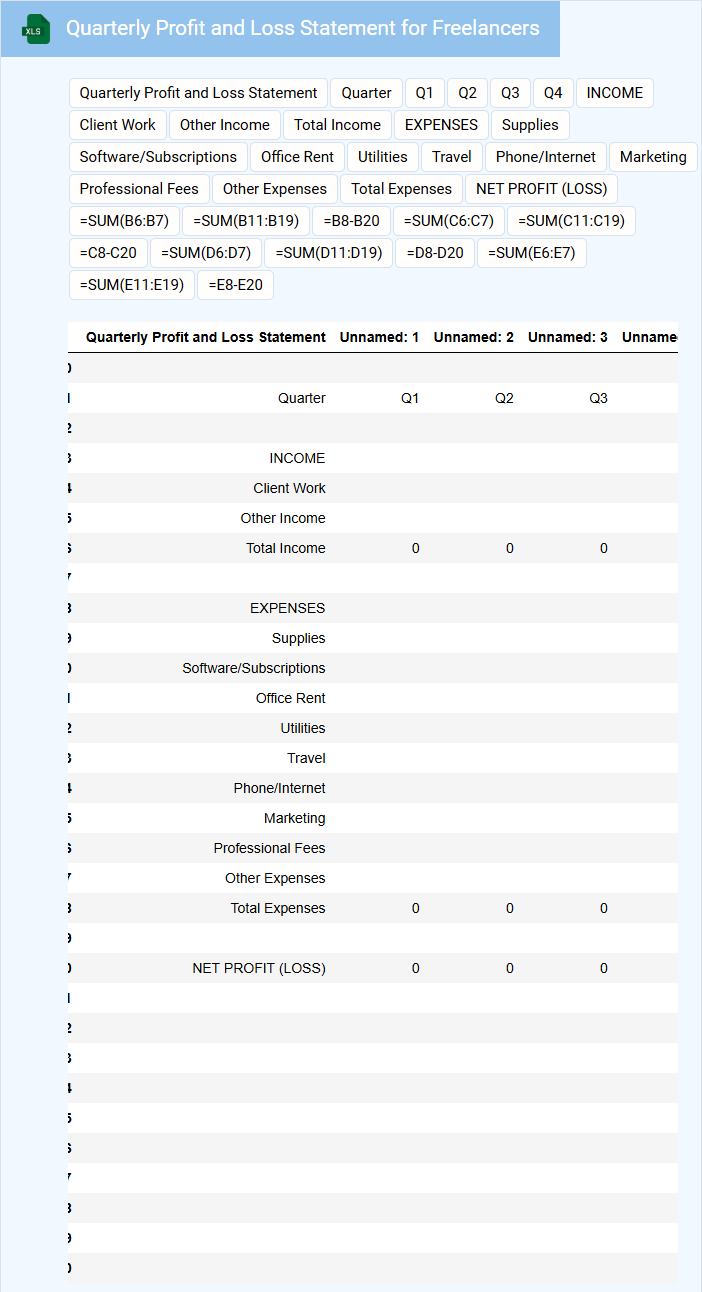

Quarterly Profit and Loss Statement for Freelancers

The Quarterly Profit and Loss Statement for freelancers is a financial document summarizing income and expenses over a three-month period. It provides insight into profitability and helps track business performance. Essential components include revenue streams, operating costs, and net profit.

Key suggestions include maintaining detailed records of all transactions, categorizing expenses accurately, and reviewing the statement regularly to identify trends. Freelancers should also consider setting aside funds for taxes and reinvestment. This document is crucial for informed financial planning and growth management.

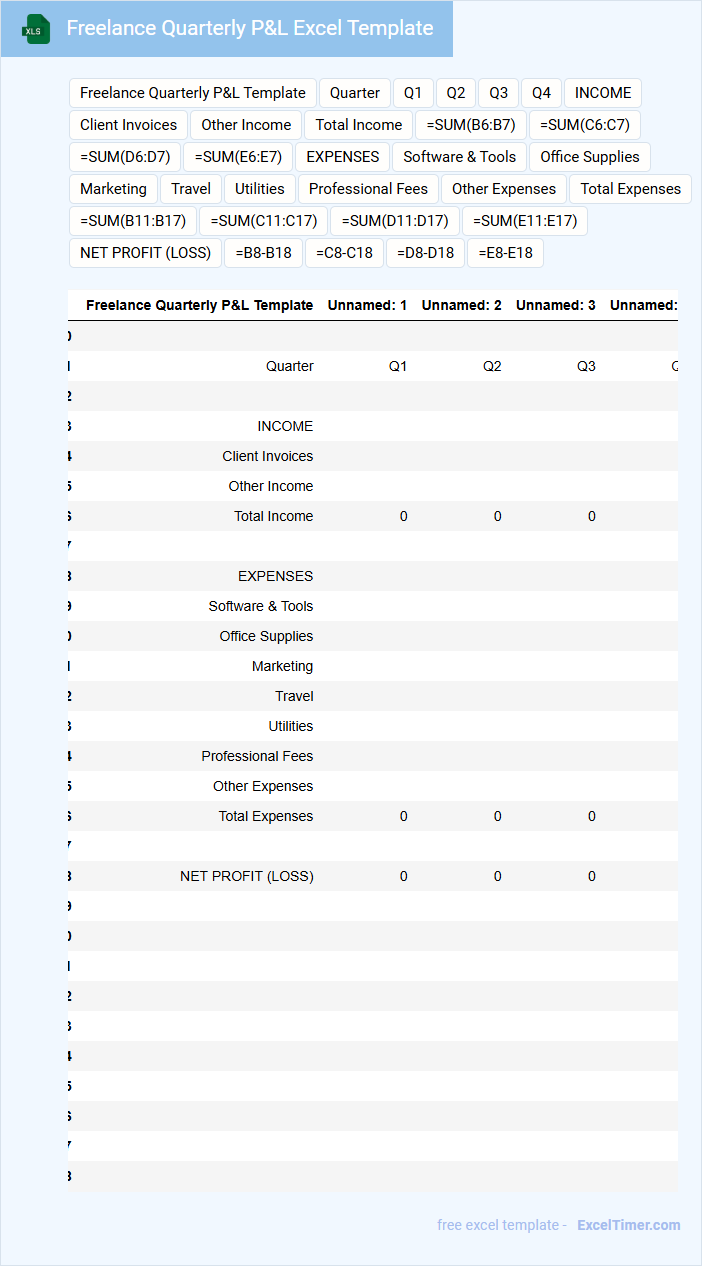

Freelance Quarterly P&L Excel Template

What information is typically included in a Freelance Quarterly P&L Excel Template?

This document usually contains detailed records of income, expenses, and overall profitability for a freelancer over a three-month period. It helps track financial performance, manage taxes, and make informed business decisions.

It is important to ensure accurate categorization of income and expenses, regularly update entries, and review the template to identify trends and areas for cost savings.

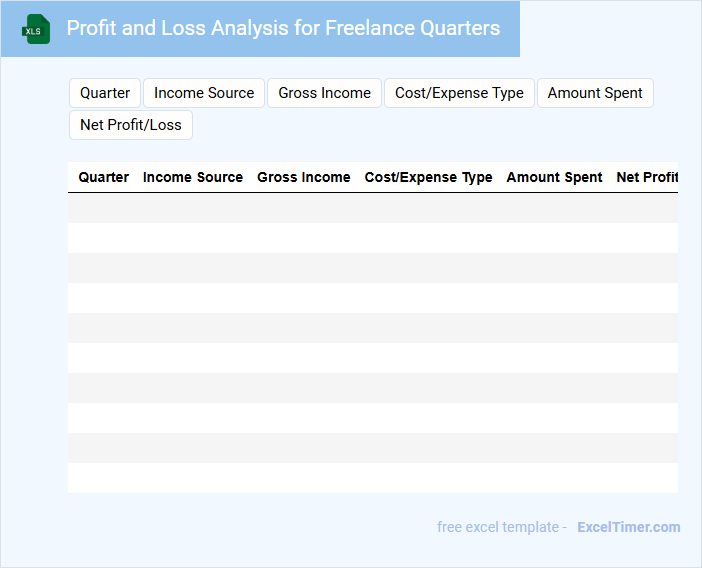

Profit and Loss Analysis for Freelance Quarters

A Profit and Loss Analysis document typically contains a detailed record of revenues, expenses, and net profit over a specific period. It provides insight into financial performance and helps identify areas of strength and weakness.

For freelance quarters, this analysis should highlight income from various clients and categorize expenses such as software, marketing, and taxes. Accurately tracking these elements ensures better budgeting and financial planning.

It is important to regularly update the document to monitor trends and make informed business decisions that enhance profitability.

Quarterly Earnings and Expense Tracker for Freelancers

A Quarterly Earnings and Expense Tracker helps freelancers organize their income and costs systematically. It provides a clear overview of financial performance every three months.

This document usually contains sections for recording earnings, expenses, invoices, and tax-related notes. Regularly updating it ensures accurate financial management and easier tax preparation.

Including a summary section with total profits and tax deductions is important for efficient financial planning.

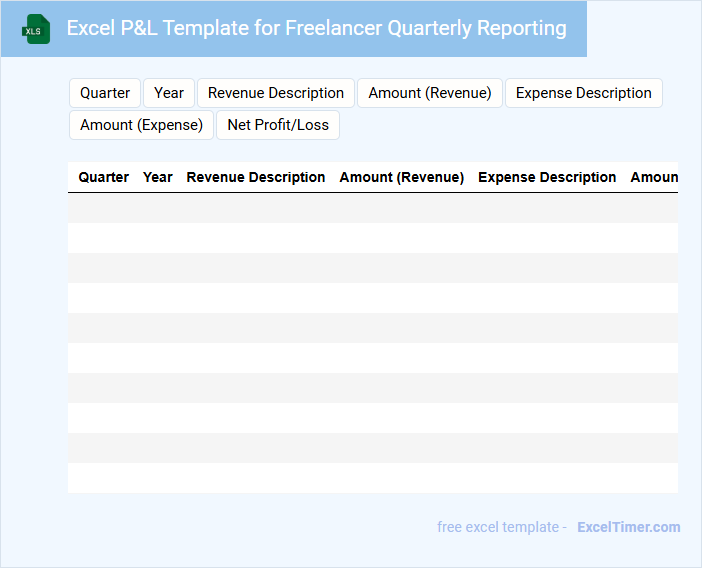

Excel P&L Template for Freelancer Quarterly Reporting

This document typically contains financial data organized to track income and expenses over a quarter, providing freelancers with a clear overview of their profitability. It helps in summarizing earnings and costs to facilitate tax preparation and financial planning.

- Include detailed categories for income and various expenses to ensure accurate tracking.

- Incorporate formulas to automatically calculate totals and net profit for efficiency.

- Use clear labels and sections to improve readability and ease of use.

Quarterly Profit Tracking Sheet for Freelancers

The Quarterly Profit Tracking Sheet for freelancers typically contains detailed records of income and expenses separated by projects or clients, allowing for precise financial analysis over each quarter. It often includes sections for revenue, operational costs, taxes, and net profit calculations, providing a comprehensive overview of financial health. Consistent updating ensures freelancers can make informed decisions based on real-time data.

Key components to emphasize are accurate categorization of earnings and expenses to avoid confusion and ensure tax compliance. Additionally, incorporating visual aids like charts or graphs can enhance understanding of profit trends over the quarter. Regular reviews using this document help in efficient budgeting and financial planning for upcoming projects.

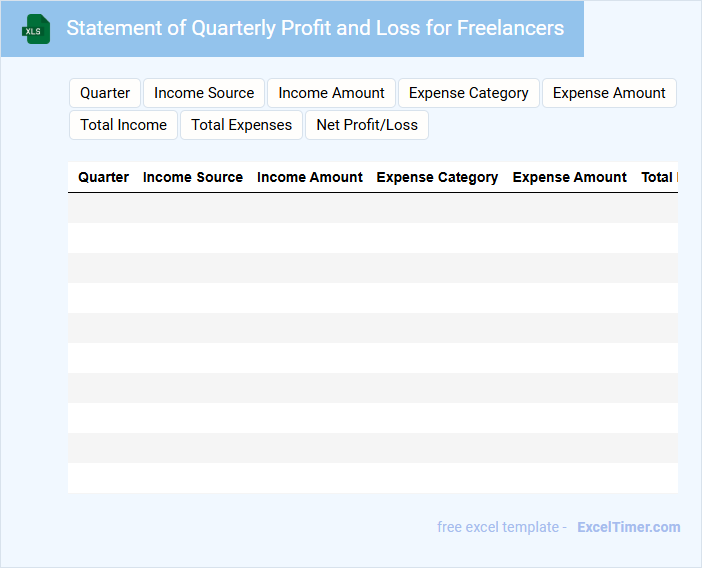

Statement of Quarterly Profit and Loss for Freelancers

A Statement of Quarterly Profit and Loss for freelancers is a financial document that summarizes earnings and expenses over a three-month period. It helps track the profitability of freelance projects by listing all sources of income and deducting related costs. This statement is essential for managing cash flow, budgeting taxes, and evaluating business performance regularly.

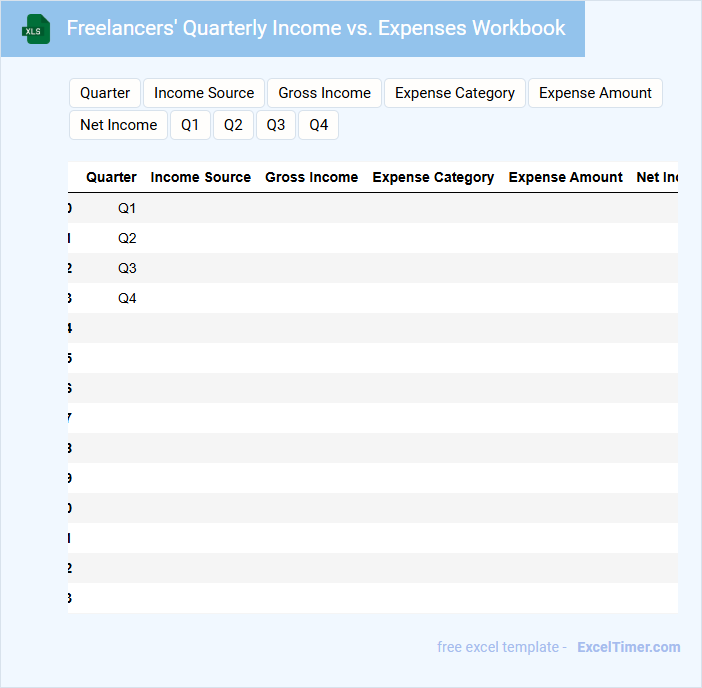

Freelancers' Quarterly Income vs. Expenses Workbook

What information is typically included in a Freelancers' Quarterly Income vs. Expenses Workbook? This document usually contains detailed records of income earned and expenses incurred over a three-month period, helping freelancers track their financial performance. It is designed to facilitate budgeting, tax preparation, and financial planning by providing a clear overview of profits and losses.

What important features should be included in this workbook? Essential elements include categorized income and expense entries, space for noting dates and payment methods, and summary sections for totals and net income. Additionally, incorporating visual aids like charts or graphs can help freelancers easily analyze trends and make informed financial decisions.

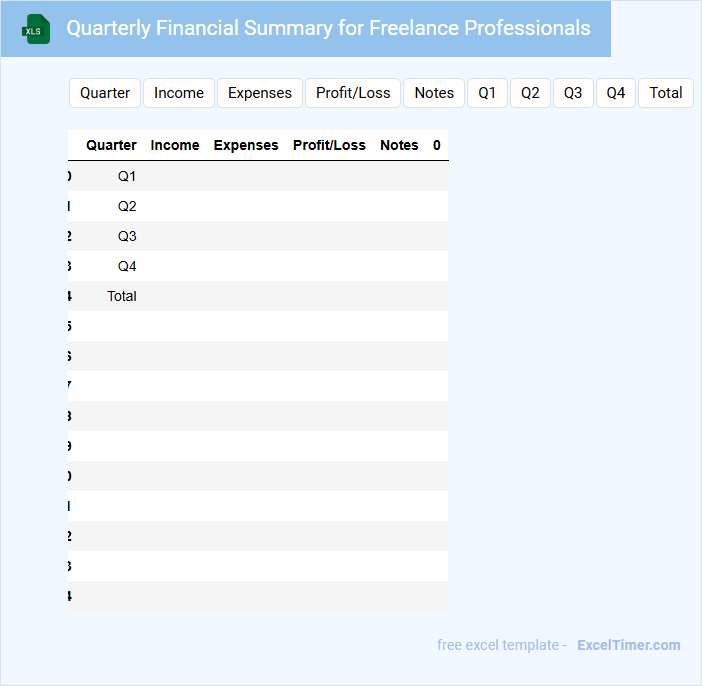

Quarterly Financial Summary for Freelance Professionals

A Quarterly Financial Summary for freelance professionals typically includes an overview of income, expenses, and net profit for the three-month period. This document helps freelancers track their financial health and make informed business decisions. It is essential to regularly update this summary to ensure accurate tax reporting and budgeting.

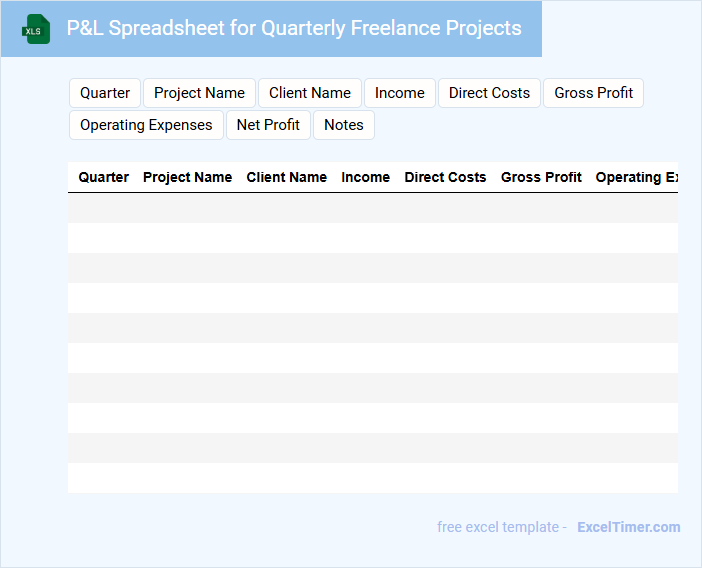

P&L Spreadsheet for Quarterly Freelance Projects

What information is typically included in a P&L spreadsheet for quarterly freelance projects? This type of document usually contains detailed records of income earned from various projects and all related expenses incurred during the quarter. It helps freelancers track profitability and manage financial performance effectively over time.

What is an important consideration when creating a P&L spreadsheet for freelance projects? Ensuring accurate categorization of income and expenses is crucial for clear financial insights and tax preparation. Regularly updating the spreadsheet also helps maintain up-to-date records and supports better decision-making.

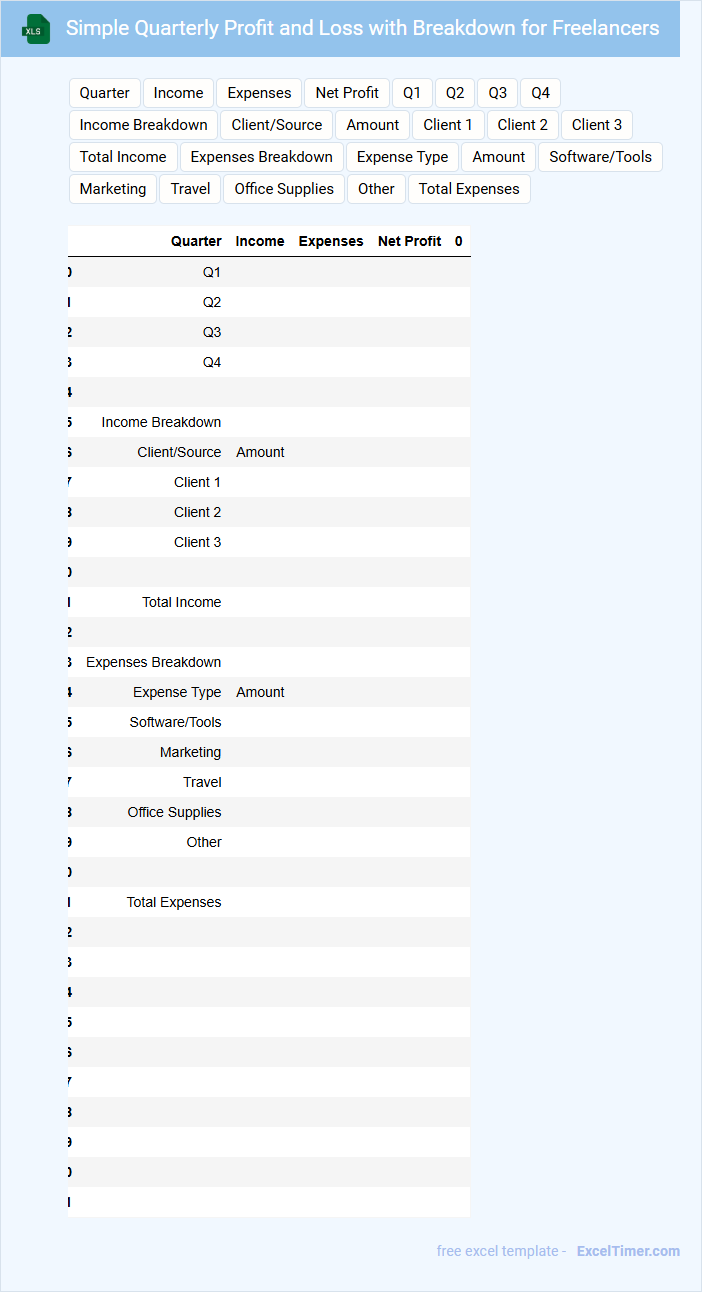

Simple Quarterly Profit and Loss with Breakdown for Freelancers

A Simple Quarterly Profit and Loss document for freelancers typically includes an overview of income, expenses, and net profit for a three-month period. It breaks down earnings and costs by category, helping to track financial health and performance. This summary aids in budgeting, tax preparation, and making informed business decisions.

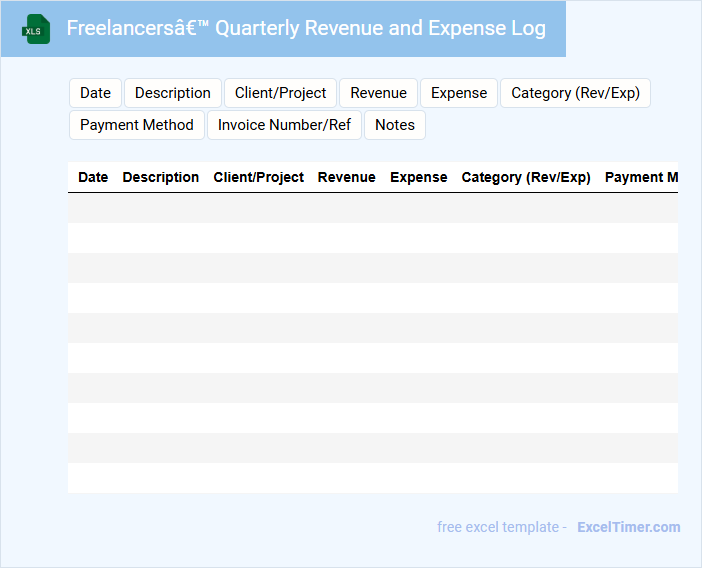

Freelancers’ Quarterly Revenue and Expense Log

What information is typically recorded in a Freelancers' Quarterly Revenue and Expense Log? This document usually contains detailed entries of all income earned and expenses incurred within a three-month period. It helps freelancers keep track of their financial activities for tax purposes, budgeting, and financial analysis.

What is an important aspect to consider when maintaining this log? Accuracy and consistency are crucial to ensure reliable financial records, so freelancers should regularly update entries and categorize them clearly. Additionally, keeping receipts and invoices organized supports verification and simplifies tax filing.

Quarterly Statement of Earnings for Freelancers

The Quarterly Statement of Earnings for freelancers is a documented summary of income received within a specific three-month period. It typically includes detailed records of payments, invoices, and any deductions or expenses. This document is essential for tracking financial performance and preparing for tax obligations.

For accuracy, freelancers should ensure all income sources are recorded and categorized correctly. Important elements to include are client names, payment dates, amounts received, and descriptions of services provided. Maintaining organized records in this statement aids in budgeting and financial planning.

Additionally, freelancers should consider adding notes on outstanding invoices and any anticipated income for the upcoming quarter. This proactive approach helps in better cash flow management and tax preparation. Regular review and updates to the statement improve overall financial transparency and accountability.

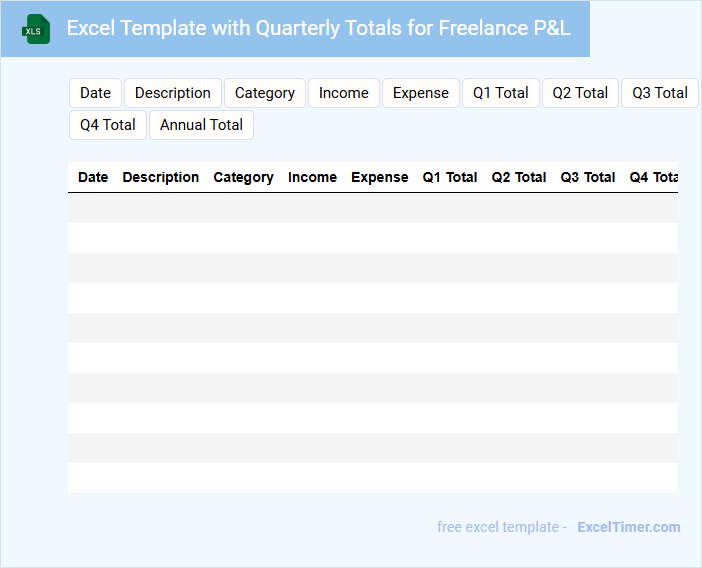

Excel Template with Quarterly Totals for Freelance P&L

An Excel Template with Quarterly Totals for Freelance Profit & Loss (P&L) is designed to help freelancers track their income and expenses efficiently over a quarter. It typically contains sections for recording various revenue streams, operational costs, and calculates net profit or loss. By summarizing financial data quarterly, it enables freelancers to monitor cash flow, plan taxes, and make informed business decisions.

Important elements to include are clear categories for income and expenses, automated quarterly total calculations, and space for notes or explanations. Ensuring accuracy in data entry and regularly updating entries can maximize the template's usefulness. Incorporating visual aids like charts or graphs can also enhance understanding of financial trends.

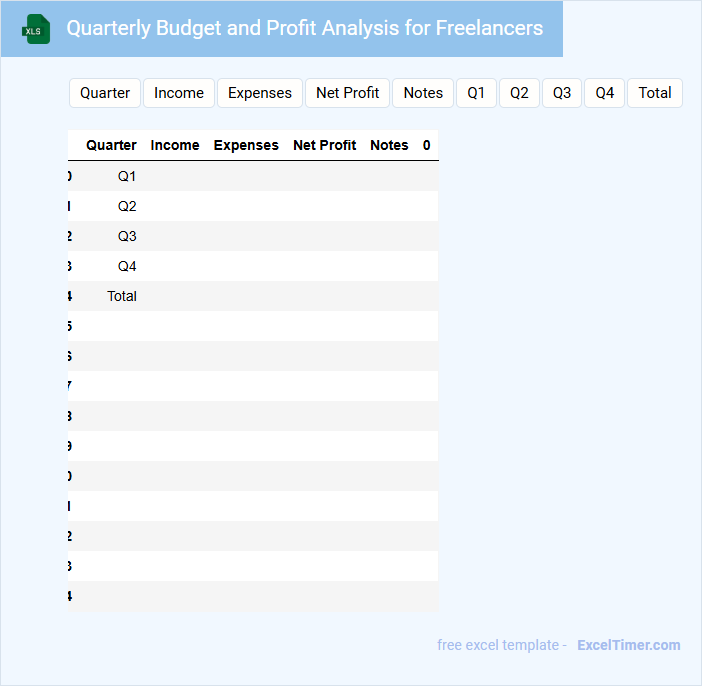

Quarterly Budget and Profit Analysis for Freelancers

What information is typically included in a Quarterly Budget and Profit Analysis for Freelancers? This document usually contains detailed records of income, expenses, and profits over a three-month period, providing a clear financial overview. It helps freelancers track their financial performance, identify spending patterns, and plan for future financial goals effectively.

What important aspects should freelancers focus on in this analysis? Freelancers should pay close attention to identifying variable versus fixed expenses and ensuring that their income consistently exceeds their expenditures. Additionally, setting realistic budget targets and reviewing profit margins regularly can help maintain financial stability and growth.

What key columns should be included in a quarterly profit and loss Excel document for freelancers?

Key columns in a quarterly profit and loss Excel document for freelancers should include Income, Expenses, Project Name or Client, Date, Payment Status, and Net Profit. Tracking these categories ensures clear visibility of your financial performance each quarter. Including Tax Deductions or Estimated Taxes helps manage your tax obligations effectively.

How do you categorize and summarize income sources in a quarterly P&L statement?

In your quarterly Profit and Loss statement for freelancers, categorize income sources by client type, project, or service offered to track revenue streams effectively. Summarize total income by adding each category's earnings to highlight your primary revenue drivers. Organizing income in this way helps identify profitable areas and optimize your freelance business financial planning.

What expenses are essential to track for freelance projects on a quarterly basis?

Track essential expenses such as software subscriptions, marketing costs, office supplies, and client-related travel to maintain accurate quarterly profit and loss records. Monitoring these categories helps you identify trends and manage your freelance business finances effectively. Regularly updating your Excel document ensures precise budget forecasting and tax preparation.

How does quarterly profit comparison help in monitoring financial growth for freelancers?

Quarterly profit comparison allows you to track revenue and expenses over distinct periods, highlighting trends in your freelancing income and costs. Analyzing these data points helps identify peak earning months and areas requiring cost reduction. This financial insight supports strategic planning to maximize profit growth sustainably.

Which formulas in Excel are most effective for automatically calculating quarterly net profit?

Excel formulas such as SUM, SUMIF, and IF combined with cell references are most effective for automatically calculating your quarterly net profit by totaling income and subtracting expenses. The formula =SUM(range) efficiently adds up your total revenue and expenses, while =SUMIF(range, criteria, sum_range) allows you to filter data based on specific categories. Using =IF(condition, value_if_true, value_if_false) helps in applying conditional calculations tailored to your freelance financial data.