The Quarterly Tax Preparation Excel Template for Freelancers streamlines the process of tracking income and expenses, ensuring accurate tax calculations. This template helps freelancers stay organized, meet IRS deadlines, and avoid penalties by providing a clear overview of quarterly tax obligations. Utilizing this tool improves financial management and simplifies tax filing tasks throughout the year.

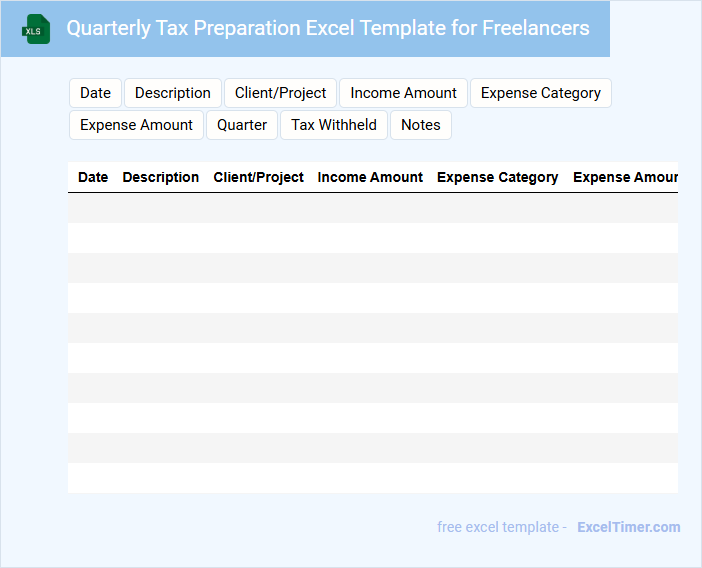

Quarterly Tax Preparation Excel Template for Freelancers

A Quarterly Tax Preparation Excel Template for freelancers is designed to organize income and expense data efficiently, helping to track financial performance throughout the year. This document usually includes sections for income sources, deductible expenses, and tax calculation summaries to ensure accurate quarterly filings.

Such templates are essential for managing estimated tax payments and avoiding penalties by maintaining up-to-date records. It is important to regularly update the template with all financial transactions and consult a tax professional to ensure compliance with current tax laws.

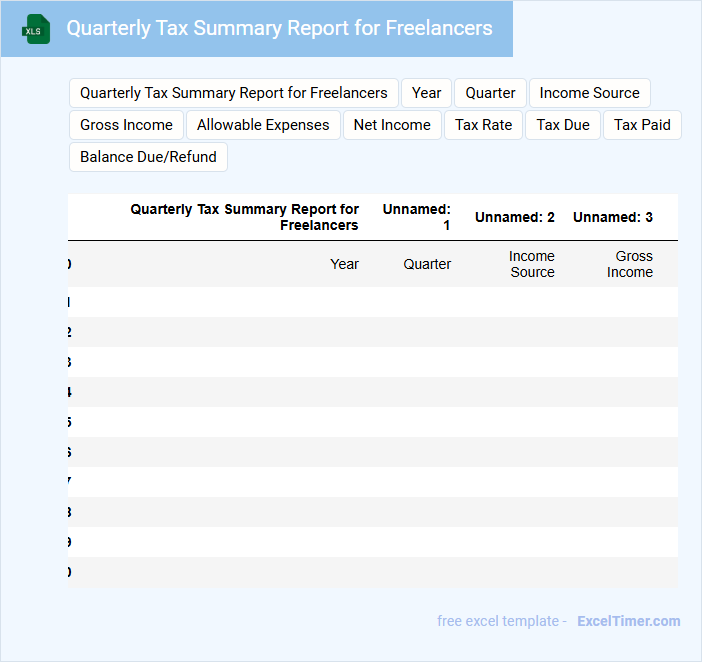

Quarterly Tax Summary Report for Freelancers

A Quarterly Tax Summary Report for Freelancers typically contains detailed financial information about income and expenses within a specific quarter. It helps freelancers accurately track their tax obligations and prepare for tax payments.

- Include all sources of income and categorize expenses clearly.

- Summarize tax payments made and any outstanding amounts.

- Provide notes on deductions, credits, and important deadlines.

Tax Deduction Tracker with Quarterly Overview for Freelancers

A Tax Deduction Tracker with a quarterly overview is a crucial document for freelancers to systematically record all deductible expenses throughout the year. This type of document typically includes categorized expense entries, dates, amounts, and receipts references to ensure accurate tax filing. Maintaining this tracker helps freelancers optimize their tax savings by providing clear evidence during audits and simplifying quarterly tax estimates.

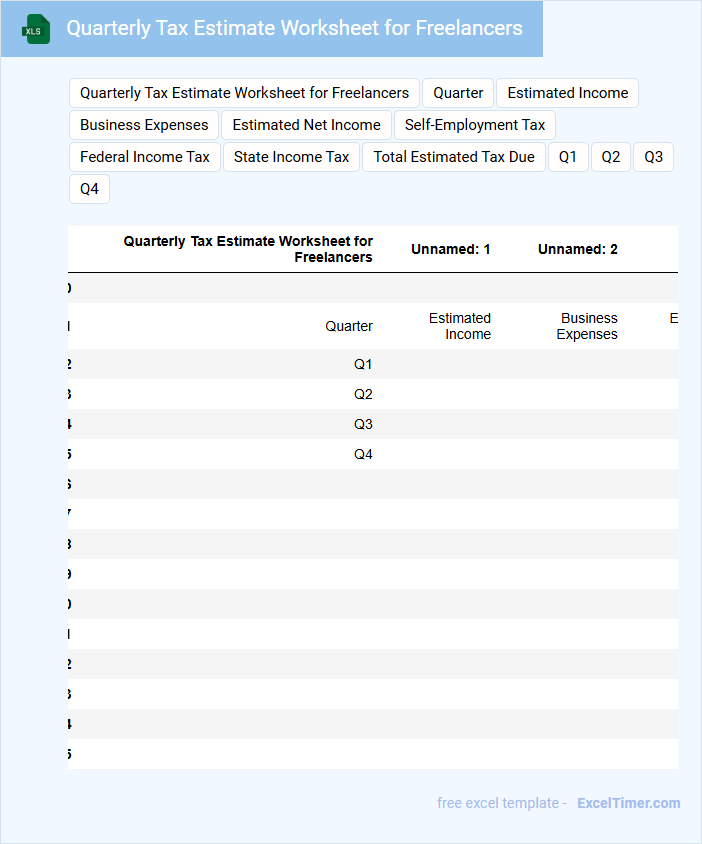

Quarterly Tax Estimate Worksheet for Freelancers

The Quarterly Tax Estimate Worksheet for freelancers typically includes income projections, deductible expenses, and tax payments made during the quarter. It helps freelancers calculate their estimated tax obligations to avoid underpayment penalties. Accurate record-keeping is essential for precise estimates.

Important factors to consider are tracking all sources of income and allowable deductions related to business expenses. The worksheet also assists in planning for tax deadlines and managing cash flow effectively. Staying organized throughout the quarter simplifies the tax filing process.

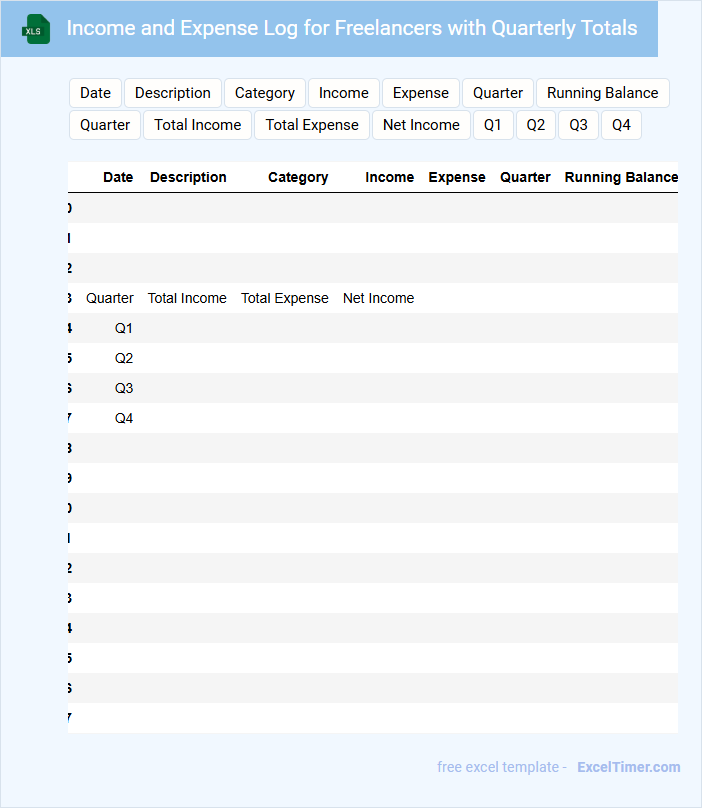

Income and Expense Log for Freelancers with Quarterly Totals

This document typically contains detailed records of all income and expenses incurred by freelancers, organized with quarterly totals for better financial tracking and tax preparation.

- Accurate Entries: Ensure all income and expenses are recorded promptly to maintain precise financial data.

- Categorization: Classify transactions by type (e.g., client payments, office supplies) to simplify analysis and reporting.

- Quarterly Summaries: Review and reconcile totals each quarter to prepare for tax filings and budget adjustments.

Freelance Payments Schedule with Quarterly Tax Tracking

A Freelance Payments Schedule with Quarterly Tax Tracking is a detailed document that outlines payment dates, amounts, and methods for freelance work. It also includes a systematic approach to monitoring tax liabilities on a quarterly basis, ensuring compliance and financial accuracy. This document helps freelancers manage cash flow while staying organized for tax reporting deadlines.

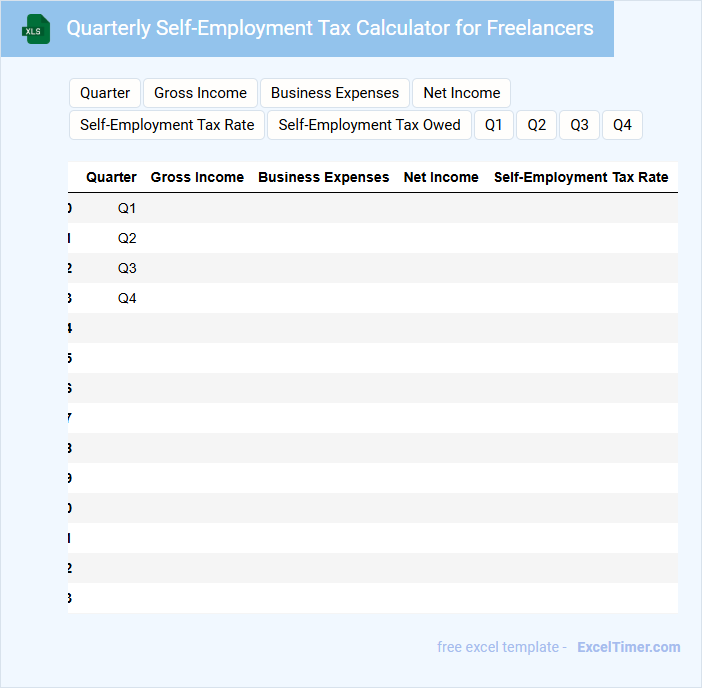

Quarterly Self-Employment Tax Calculator for Freelancers

This document is typically used to estimate the quarterly self-employment tax obligations for freelancers. It helps in planning and managing tax payments throughout the year to avoid penalties.

- Include an accurate record of quarterly income and deductible expenses.

- Provide a clear breakdown of the self-employment tax rate and calculation method.

- Highlight important deadlines to ensure timely tax payments.

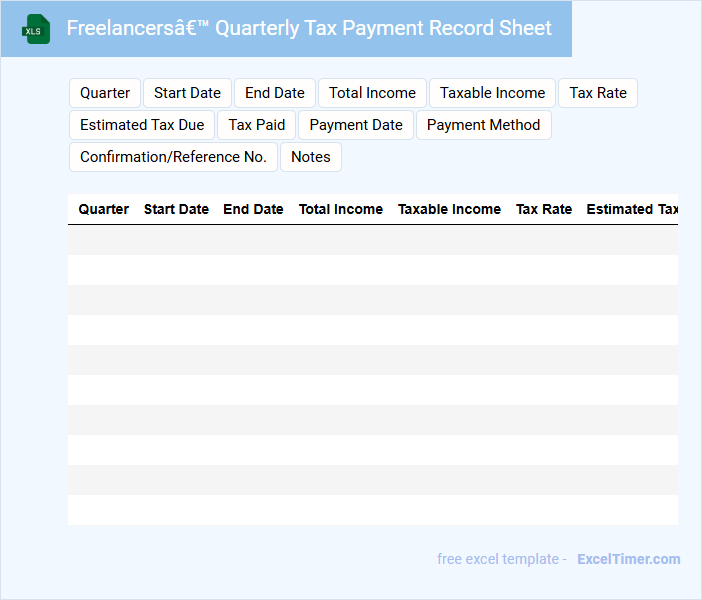

Freelancers’ Quarterly Tax Payment Record Sheet

A Freelancers' Quarterly Tax Payment Record Sheet typically contains detailed entries of income earned, taxes withheld, and payments made during each quarter. It helps freelancers systematically track their financial obligations to avoid penalties and ensure compliance. Keeping accurate records is crucial for timely tax filing and financial planning.

Important suggestions include regularly updating the sheet with all income sources, categorizing deductible expenses, and reconciling payments with official tax statements to maintain accuracy and completeness.

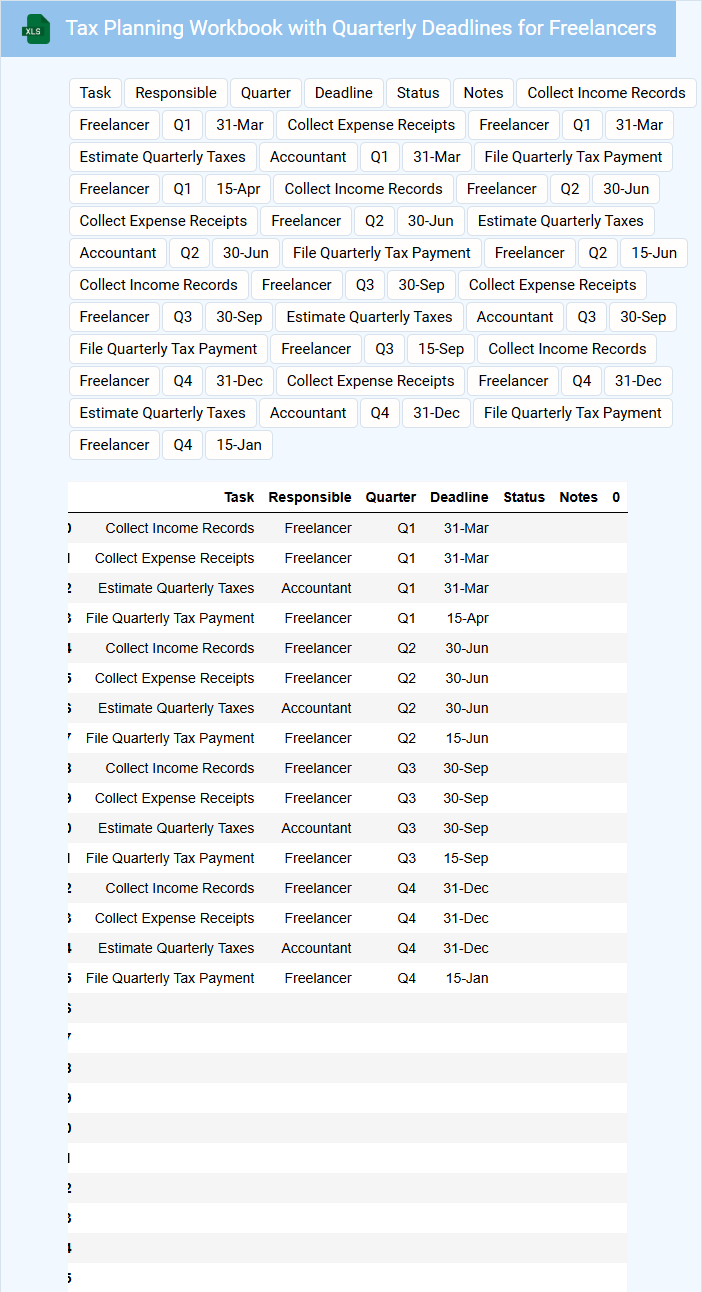

Tax Planning Workbook with Quarterly Deadlines for Freelancers

A Tax Planning Workbook with Quarterly Deadlines for Freelancers is designed to help manage tax obligations efficiently throughout the year. It typically includes schedules, reminders, and financial tracking tools tailored for independent contractors.

- Track income and expenses regularly to stay prepared for tax quarterly filings.

- Mark important tax due dates clearly to avoid late payment penalties.

- Review estimated tax payments each quarter to adjust for income fluctuations.

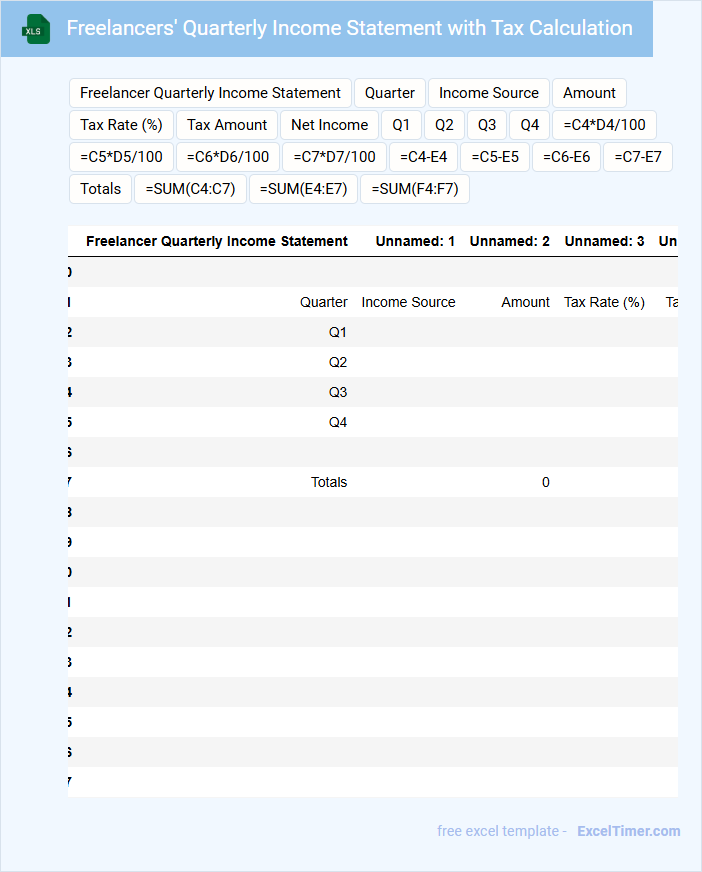

Freelancers' Quarterly Income Statement with Tax Calculation

Freelancers' Quarterly Income Statement with Tax Calculation is a vital financial document that summarizes income and expenses over a three-month period. It provides a clear overview of earnings, helping track net income and manage budget effectively. This statement includes tax calculations to estimate quarterly tax liabilities, ensuring compliance with tax regulations.

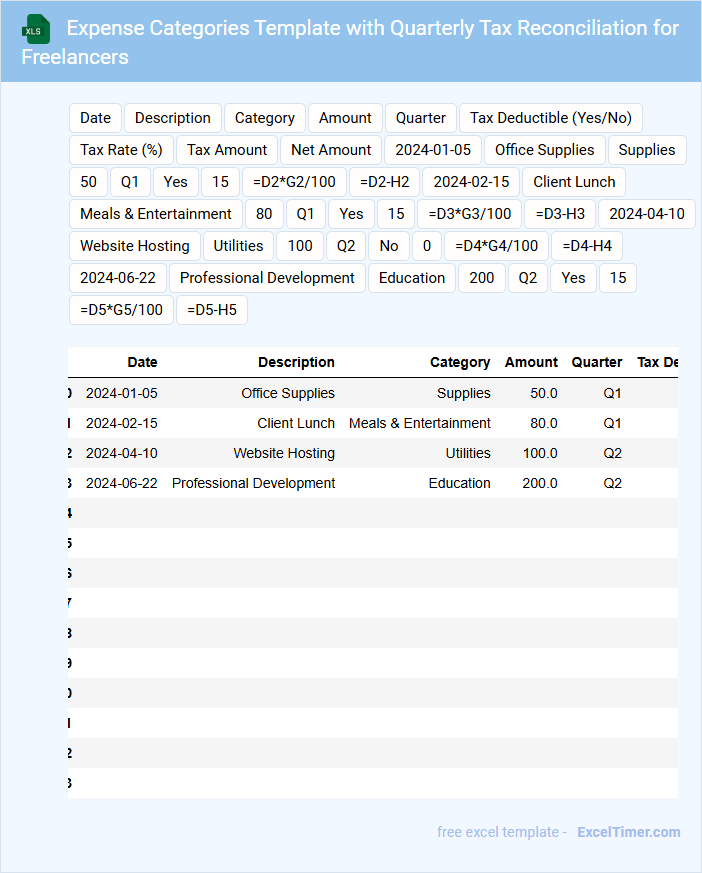

Expense Categories Template with Quarterly Tax Reconciliation for Freelancers

An Expense Categories Template with Quarterly Tax Reconciliation for Freelancers is a structured document designed to help track and organize expenses effectively while preparing for tax filings. It ensures freelancers maintain accurate financial records and stay compliant with tax regulations.

- Includes categorized lists of common business expenses to simplify bookkeeping.

- Incorporates sections for quarterly income and expense summaries to facilitate tax calculations.

- Provides spaces for notes on tax deductions, payments made, and upcoming due dates.

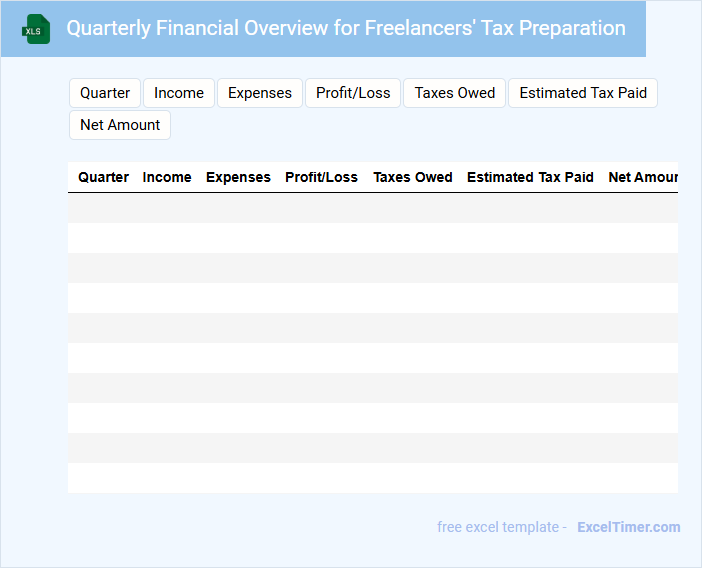

Quarterly Financial Overview for Freelancers' Tax Preparation

The Quarterly Financial Overview is a document that summarizes income, expenses, and profits for freelancers over a three-month period. It typically contains detailed records of invoices, receipts, and tax deductions relevant to that quarter. This overview helps freelancers accurately estimate taxes owed and plan for future financial obligations.

Freelance Clients Invoice Tracker with Quarterly Tax View

What information is typically included in a Freelance Clients Invoice Tracker with Quarterly Tax View? This document usually contains detailed records of invoices sent to clients, including dates, amounts, and payment statuses. It also integrates tax calculations and summaries organized by quarters to help freelancers manage their tax obligations efficiently.

What is an important feature to include in this type of tracker? Incorporating an automated tax calculation based on invoice data is essential to reduce errors and save time during tax season. Additionally, having a clear summary of outstanding payments and due dates ensures accurate financial planning and timely follow-ups with clients.

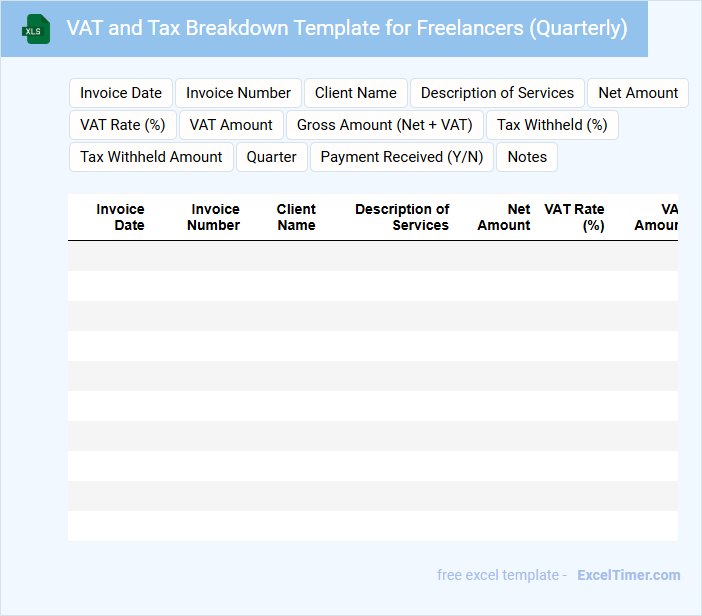

VAT and Tax Breakdown Template for Freelancers (Quarterly)

A VAT and Tax Breakdown Template for freelancers is a structured document designed to simplify the process of tracking and managing quarterly tax obligations. It typically contains detailed sections for income declarations, VAT calculations, and deductible expenses organized by month. This template helps in ensuring accurate tax submissions and financial transparency.

Important elements to include are precise income entries categorized by client, VAT rates applied to each transaction, and a summary of deductible expenses to optimize tax benefits. Additionally, having a section for notes or adjustments can be useful for addressing any discrepancies or changes in tax law. Regular updates and accuracy in recording transactions are crucial for compliance and smooth financial management.

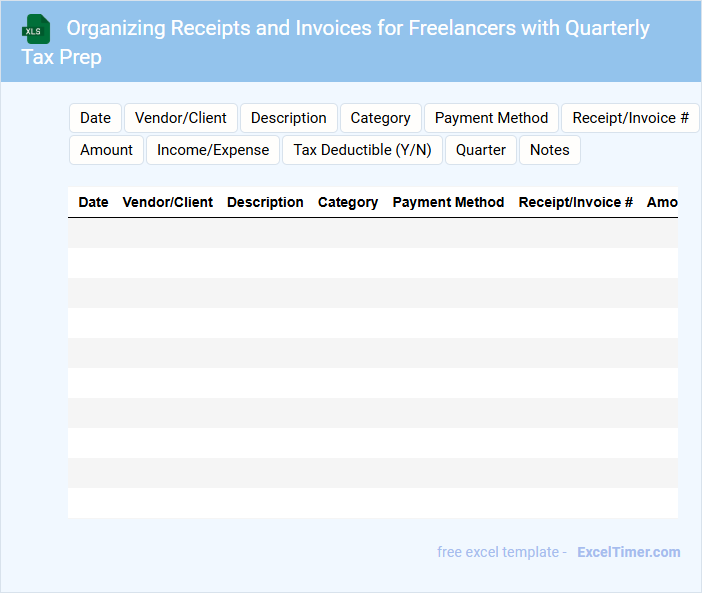

Organizing Receipts and Invoices for Freelancers with Quarterly Tax Prep

Organizing receipts and invoices is crucial for freelancers to maintain accurate financial records and streamline quarterly tax preparation. This type of document typically contains detailed lists of expenses and income, providing proof of transactions essential for tax deductions and compliance. Maintaining an organized system helps freelancers avoid costly errors and ensures timely filing of tax returns.

What are the key IRS deadlines for quarterly estimated tax payments as a freelancer?

Freelancers must submit quarterly estimated tax payments to the IRS by April 15, June 15, September 15, and January 15 of the following year. Missing these deadlines can result in penalties and interest charges on unpaid taxes. Properly tracking income and expenses each quarter ensures accurate tax payments and compliance.

Which income and expenses should be tracked in your Excel document for accurate quarterly tax calculations?

Track all freelance income sources, including client payments, project fees, and royalties, in your Excel document for accurate quarterly tax calculations. Record deductible expenses such as office supplies, software subscriptions, travel costs, and home office deductions to reduce taxable income. Ensure each entry includes dates, amounts, and descriptions for precise tax reporting and audit preparedness.

How do you use Excel formulas to estimate self-employment tax versus federal income tax owed each quarter?

Use Excel formulas like =SUM() to calculate your net self-employment income by subtracting expenses from earnings. Apply the self-employment tax rate of 15.3% to this net income in Excel to estimate your quarterly self-employment tax. Estimate federal income tax owed by applying your applicable tax bracket rate to your taxable income using Excel's IF() function for accurate quarterly tax preparation.

What supporting documentation and digital records should be attached or referenced within your tax Excel spreadsheet?

Your quarterly tax preparation Excel spreadsheet should include digital copies of income statements, expense receipts, and 1099 forms. Attach records of mileage logs, business-related utility bills, and invoices to substantiate deductions. Referencing bank statements and previous tax returns enhances accuracy and audit readiness.

How can you set up data validation and error checking in Excel to minimize mistakes in quarterly tax preparation?

Set up data validation in Excel by creating dropdown lists for predefined tax categories, limiting input to acceptable ranges for income and expenses, and using custom formulas to flag inconsistent entries. Enable error checking rules to automatically highlight cells with invalid or missing data, helping you catch mistakes before submission. Your spreadsheet becomes a reliable tool that minimizes errors and streamlines quarterly tax preparation for freelancers.