The Quarterly Expense Audit Excel Template for Healthcare Clinics streamlines financial tracking by organizing and categorizing clinic expenditures efficiently. It helps identify cost-saving opportunities and ensures compliance with budgeting standards. Regular use of this template enhances financial transparency and supports informed decision-making in healthcare management.

Quarterly Expense Audit Log for Healthcare Clinics

A Quarterly Expense Audit Log for Healthcare Clinics is a document that tracks and reviews all expenses incurred within a three-month period to ensure accuracy and compliance. It helps identify discrepancies and maintain financial transparency in the clinic's operations.

- Include detailed records of all purchases, invoices, and payments made during the quarter.

- Highlight any unusual or unexpected expenses for further investigation.

- Ensure documentation is aligned with healthcare regulations and internal policies.

Excel Template for Quarterly Clinic Expense Audit

An Excel Template for Quarterly Clinic Expense Audit typically contains detailed financial records, categorized expense items, and summary tables for quick review. It helps clinics systematically track and analyze their spending patterns over each quarter. Ensuring accuracy and completeness of data entries is crucial for effective audit results and informed decision-making.

Quarterly Expense Analysis with Audit Checklist for Healthcare Clinics

A Quarterly Expense Analysis with Audit Checklist for Healthcare Clinics is a detailed financial report designed to monitor spending, ensure compliance, and identify cost-saving opportunities.

- Expense Tracking: Detailed categorization of clinic expenses to detect irregularities and optimize budget allocation.

- Compliance Verification: Regular audit checkpoints to ensure adherence to healthcare regulations and internal policies.

- Performance Insights: Analysis of expense trends to support strategic decision-making and improve financial health.

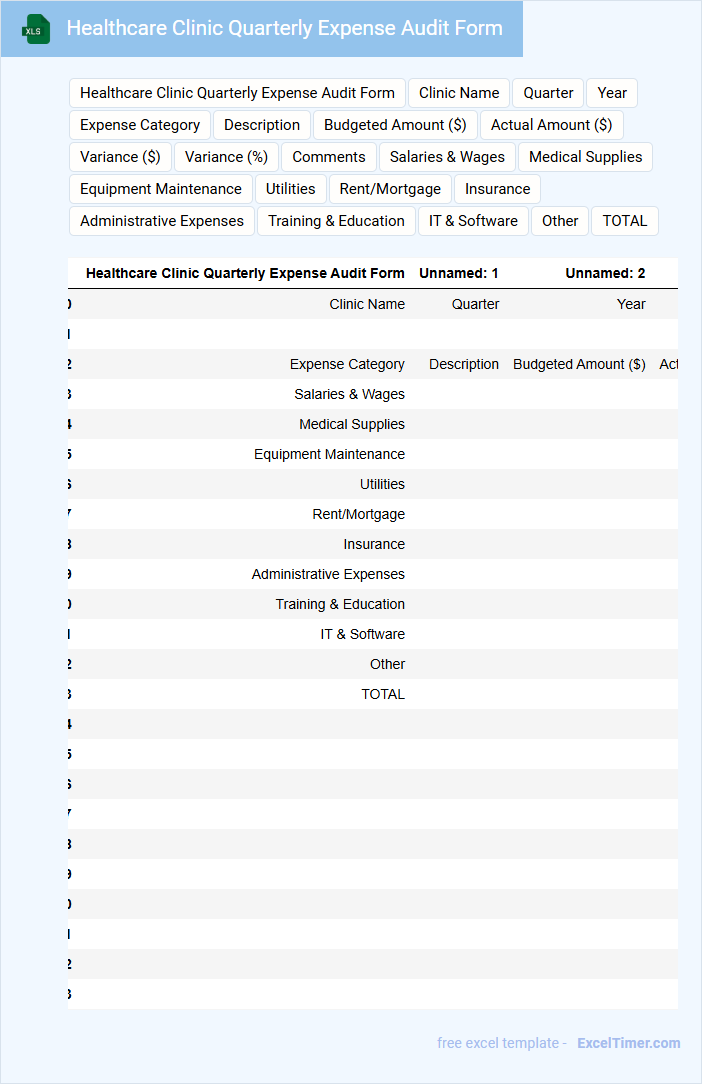

Healthcare Clinic Quarterly Expense Audit Form

The Healthcare Clinic Quarterly Expense Audit Form is a document that tracks and reviews the financial expenditures of a healthcare facility over a three-month period. It typically contains detailed entries for various expense categories such as medical supplies, staff salaries, equipment maintenance, and administrative costs. This form is essential for ensuring accurate financial reporting and identifying areas where cost efficiency can be improved.

Important considerations include maintaining clear and organized records, ensuring all entries are supported by valid receipts or invoices, and regularly updating the form to capture real-time financial data. It is also crucial to involve relevant stakeholders, such as the finance and management teams, for thorough review and approval. Lastly, incorporating automated tools or software can enhance accuracy and streamline the audit process.

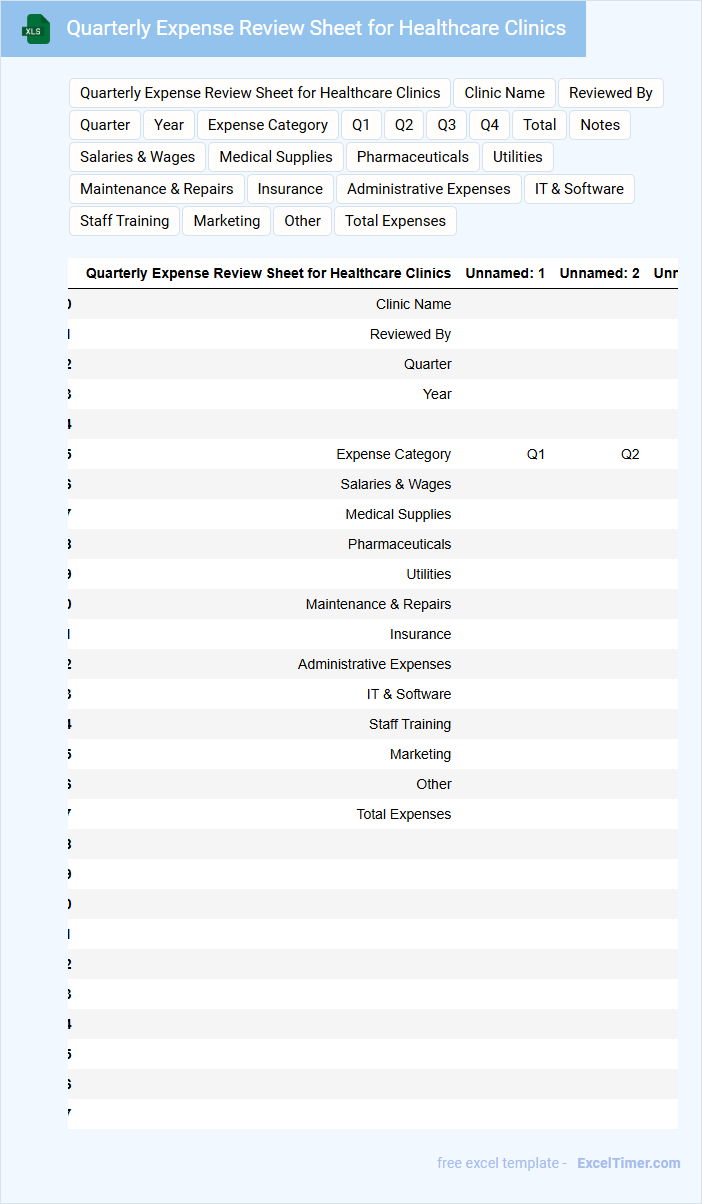

Quarterly Expense Review Sheet for Healthcare Clinics

The Quarterly Expense Review Sheet for healthcare clinics typically contains detailed records of all expenditures made during the quarter, including salaries, medical supplies, and facility maintenance costs. This document aids in tracking financial performance and identifying areas where cost-efficiency can be improved. Accurate and thorough data entry is essential for ensuring effective budgeting and resource allocation.

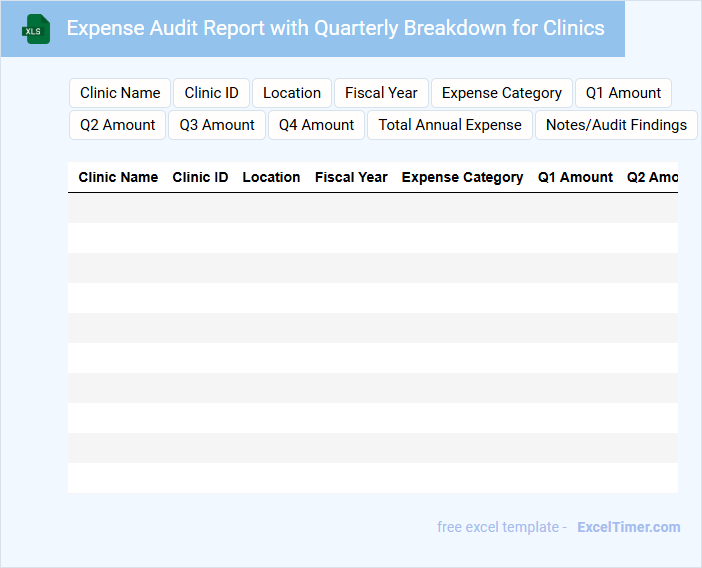

Expense Audit Report with Quarterly Breakdown for Clinics

An Expense Audit Report with Quarterly Breakdown for Clinics typically contains detailed financial data regarding the clinic's expenditures over each quarter. It includes categorized costs such as staffing, equipment, supplies, and operational expenses to ensure accurate tracking and accountability. This report helps identify spending patterns, variances, and areas for potential cost savings.

Key elements to focus on include precise documentation of expenses, clear quarterly comparisons, and identification of any discrepancies or unusual transactions. Ensuring the accuracy of data and transparency in reporting enhances financial management and supports regulatory compliance. Regular auditing and summarizing trends provide actionable insights for better budget planning and resource allocation.

Healthcare Clinic Quarterly Expense Audit Tracker

A Healthcare Clinic Quarterly Expense Audit Tracker typically contains detailed records of all expenses incurred by the clinic during a specific quarter. This document aids in monitoring financial activities, ensuring transparency, and identifying areas for cost optimization.

It usually includes categorized expense entries, budget comparisons, and notes on discrepancies or unusual transactions. To maximize its effectiveness, it is important to regularly update the tracker and review it with the finance team for accurate decision-making.

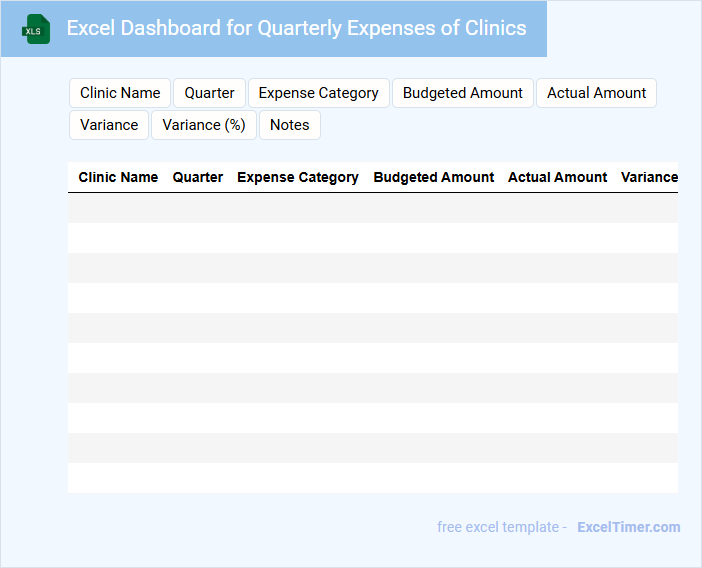

Excel Dashboard for Quarterly Expenses of Clinics

An Excel Dashboard for Quarterly Expenses of Clinics provides a comprehensive overview of financial data, highlighting key expense categories and trends over time. It typically includes charts, tables, and summary KPIs to facilitate quick analysis and decision-making.

This type of document is essential for budgeting, financial planning, and identifying cost-saving opportunities at the clinic level. To optimize its effectiveness, ensure data accuracy, clarity in visualizations, and inclusion of comparative benchmarks.

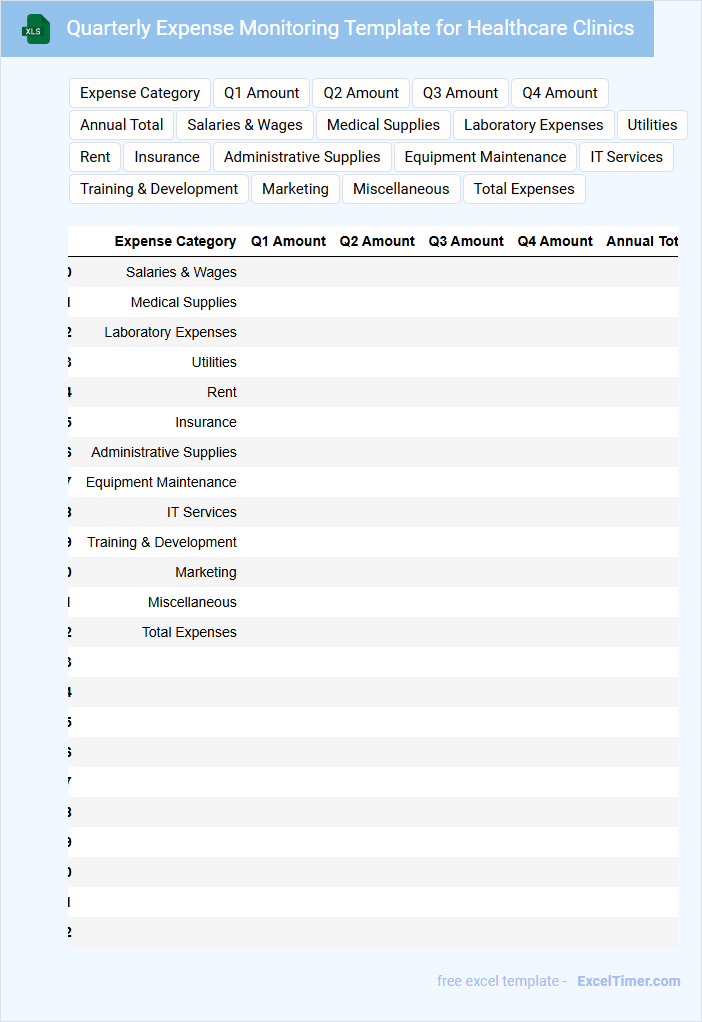

Quarterly Expense Monitoring Template for Healthcare Clinics

The Quarterly Expense Monitoring Template for healthcare clinics is designed to track and analyze financial expenditures over a three-month period. It typically contains detailed categories such as staffing costs, medical supplies, equipment maintenance, and administrative expenses. This document is essential for budgeting, identifying cost-saving opportunities, and ensuring efficient allocation of resources.

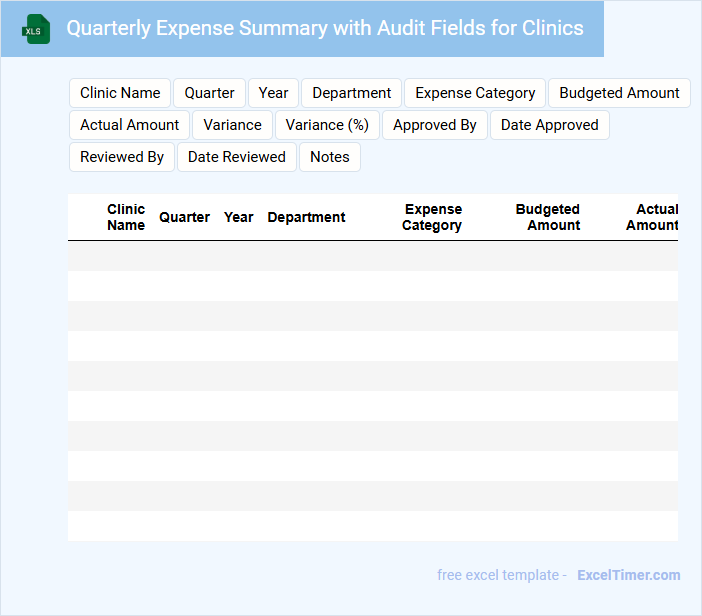

Quarterly Expense Summary with Audit Fields for Clinics

The Quarterly Expense Summary is a crucial document that consolidates all financial transactions related to clinic operations over a three-month period. It typically contains detailed expenses categorized by nature such as salaries, supplies, and utilities, alongside corresponding audit fields for verification. To ensure accuracy and compliance, it's important to include timestamped approvals and a clear audit trail for each entry.

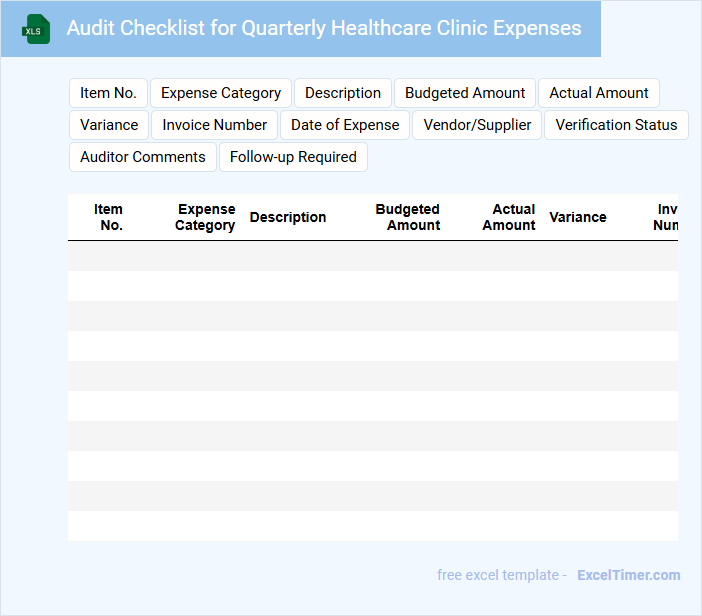

Audit Checklist for Quarterly Healthcare Clinic Expenses

An Audit Checklist for Quarterly Healthcare Clinic Expenses typically includes a detailed review of financial records, expense verification, and compliance with healthcare regulations. It helps ensure transparency and accuracy in the clinic's financial management. Key components often cover payroll, medical supplies, equipment maintenance, and service contracts.

Important considerations include verifying proper documentation for all expenses, ensuring timely approvals, and cross-checking with budget allocations. Additionally, it is crucial to identify any discrepancies or unusual spending patterns early. Regular audits support improved financial control and regulatory compliance within healthcare operations.

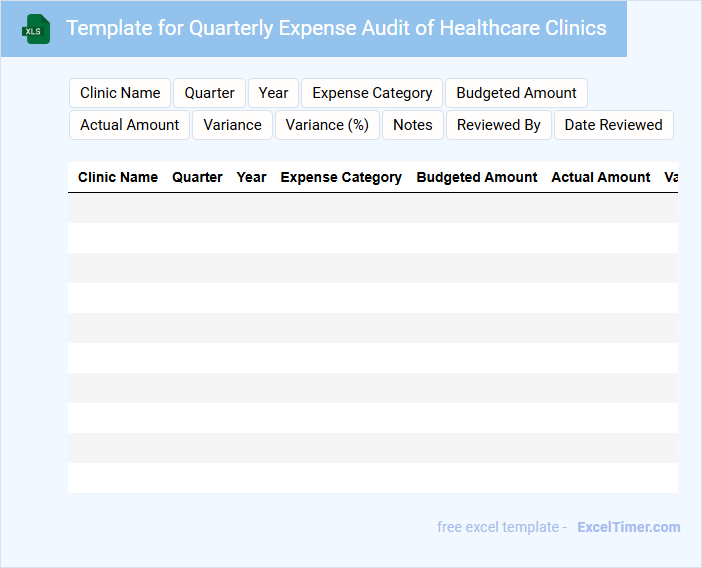

Template for Quarterly Expense Audit of Healthcare Clinics

This document typically contains detailed financial records and audit findings for healthcare clinics across a quarter.

- Expense Categorization: Clearly define and separate different types of expenses such as medical supplies, salaries, and utility costs.

- Compliance Checks: Ensure all expenses meet regulatory and internal policy standards to maintain transparency and accountability.

- Discrepancy Reporting: Highlight and investigate any unusual or inconsistent expenses to prevent fraud or errors.

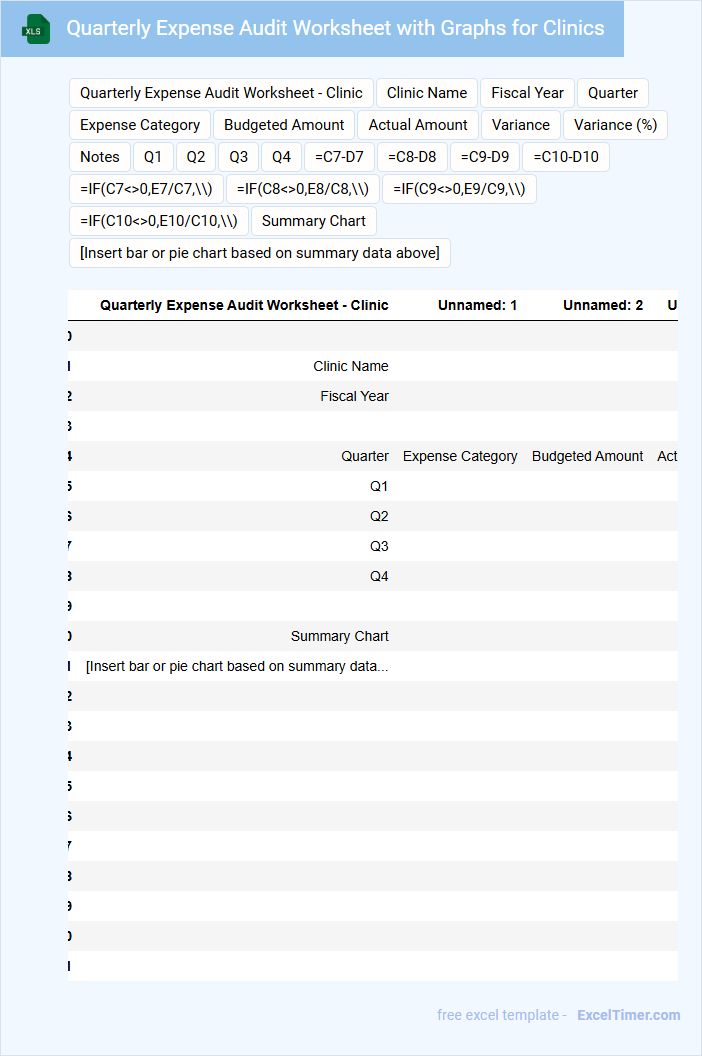

Quarterly Expense Audit Worksheet with Graphs for Clinics

The Quarterly Expense Audit Worksheet is a vital document that details the financial outflows of a clinic over a three-month period, ensuring accuracy and accountability. It typically contains categorized expenses, comparison tables, and summarized totals for easy reference.

Graphs play an important role by visually representing trends and anomalies in spending, aiding in quick decision-making. Including clear legends and consistent data points enhances the clarity and usefulness of these visuals in clinic financial management.

For optimal functionality, it is essential to regularly update the worksheet with verified data and cross-check with invoices to maintain a reliable expense tracking system.

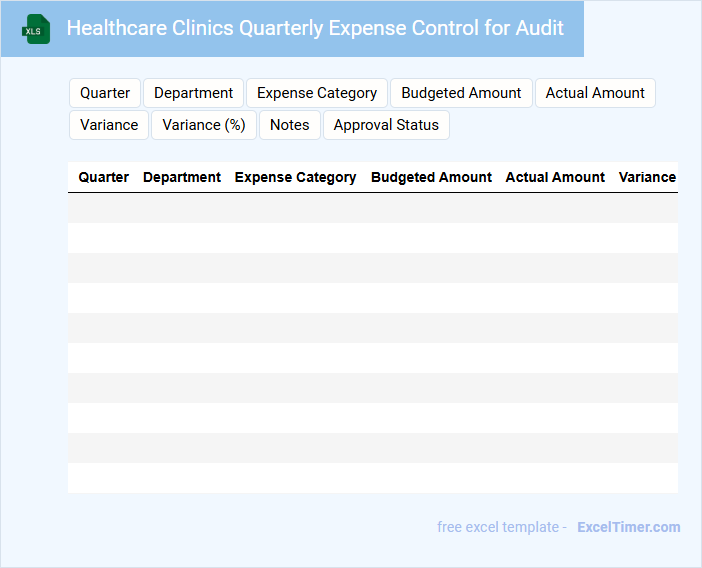

Healthcare Clinics Quarterly Expense Control for Audit

What information does a Healthcare Clinics Quarterly Expense Control document typically contain? This document usually includes detailed records of all expenses incurred by the clinic during the quarter, categorized by departments or types of services. It also provides summaries and analyses to help identify cost-saving opportunities and ensure compliance with budgetary guidelines.

What important factors should be considered when preparing this document for an audit? Accuracy and completeness of all financial entries are crucial, along with proper documentation and justification for each expense. Clear categorization and adherence to regulatory requirements enhance transparency and facilitate a smooth audit process.

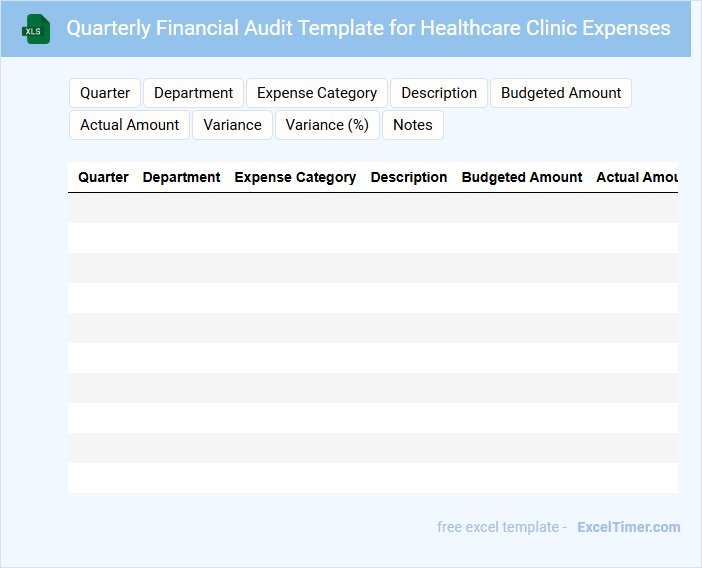

Quarterly Financial Audit Template for Healthcare Clinic Expenses

What does a Quarterly Financial Audit Template for Healthcare Clinic Expenses usually contain? This document typically includes detailed records of all clinic expenses categorized by departments or services, along with corresponding financial statements and reconciliation reports. It helps ensure transparency and accuracy in financial reporting, facilitating compliance with healthcare regulations and efficient budget management.

What is an important suggestion for using this template effectively? It is crucial to regularly update expense entries and verify all supporting documents such as invoices and receipts to maintain data integrity. Additionally, including notes for any unusual or exceptional expenses can provide clarity during the audit review process.

What are the key categories of expenses to track in a quarterly audit for healthcare clinics?

Key expense categories to track in a quarterly audit for healthcare clinics include salaries and wages, medical supplies and equipment, facility rent and utilities, insurance premiums, and administrative costs. Monitoring these categories helps ensure accurate budgeting and cost control aligned with healthcare regulations. Tracking travel and training expenses also aids in optimizing operational efficiency.

How do you identify discrepancies or irregularities in clinic expense records using Excel?

Use Excel's built-in functions such as conditional formatting and pivot tables to highlight discrepancies or irregularities in clinic expense records. You can filter and sort data to compare expected versus actual expenses, identifying anomalies quickly. Implement formulas like IF and VLOOKUP to cross-check entries and validate accuracy across quarterly reports.

Which Excel functions are most effective for summarizing and analyzing quarterly expenses?

SUMIFS efficiently calculates total expenses based on specific criteria like clinic location or expense category. PivotTables provide dynamic summaries and insights, enabling quick analysis of expense trends across different quarters. VLOOKUP and INDEX-MATCH assist in cross-referencing expense data with healthcare service codes for accurate auditing.

What methods can be used in Excel to compare quarterly expense trends across multiple periods?

You can use Excel's PivotTables to summarize and compare quarterly expense trends across multiple periods efficiently. Applying conditional formatting highlights significant changes or anomalies in healthcare clinic expenses, improving data visualization. Charts such as line graphs or bar charts provide a clear visual comparison of expense fluctuations over time.

How can Excel help ensure compliance with healthcare financial regulations during quarterly audits?

Excel helps ensure compliance with healthcare financial regulations during quarterly expense audits by providing accurate expense tracking, automated calculations, and customizable templates tailored to healthcare clinics. You can easily analyze spending trends, identify discrepancies, and generate detailed audit reports to meet regulatory standards. Leveraging Excel's data validation and audit trail features reduces errors and supports transparent financial management.