The Quarterly Tax Planning Excel Template for Self-Employed helps freelancers and independent contractors efficiently track income, expenses, and tax liabilities throughout the year. It simplifies estimating quarterly tax payments, reducing the risk of underpayment penalties and easing year-end tax filing. This tool is essential for maintaining organized financial records and ensuring compliance with IRS tax deadlines.

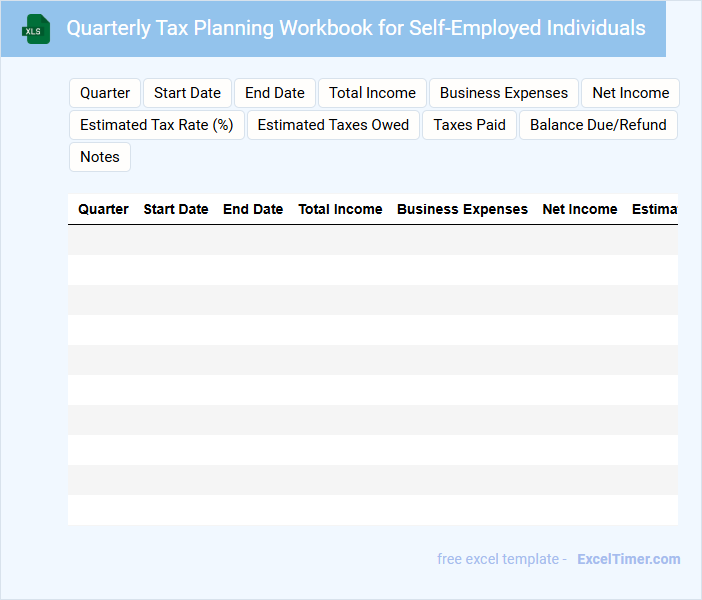

Quarterly Tax Planning Workbook for Self-Employed Individuals

What does a Quarterly Tax Planning Workbook for Self-Employed Individuals typically contain? It usually includes sections for tracking income, expenses, estimated tax payments, and tax deductions to help manage quarterly tax obligations efficiently. The workbook is designed to assist self-employed individuals in organizing financial information to avoid penalties and optimize tax savings.

What important aspect should self-employed individuals focus on when using this workbook? They should consistently update their income and expense records to ensure accurate tax calculations and timely estimated payments. Additionally, identifying deductible expenses and planning for tax liabilities in advance are essential to maintain financial stability throughout the year.

Expense Tracking Sheet for Quarterly Tax Payments

An Expense Tracking Sheet for quarterly tax payments typically contains detailed records of all business-related expenses incurred within a specific quarter. This includes dates, amounts, expense categories, and payment methods to ensure accurate tax reporting.

The sheet helps in calculating deductible expenses and preparing estimated quarterly tax payments. Maintaining consistency and organization in this document is crucial for avoiding tax penalties and optimizing financial management.

Ensure to regularly update the sheet and cross-check entries with receipts and invoices for accuracy.

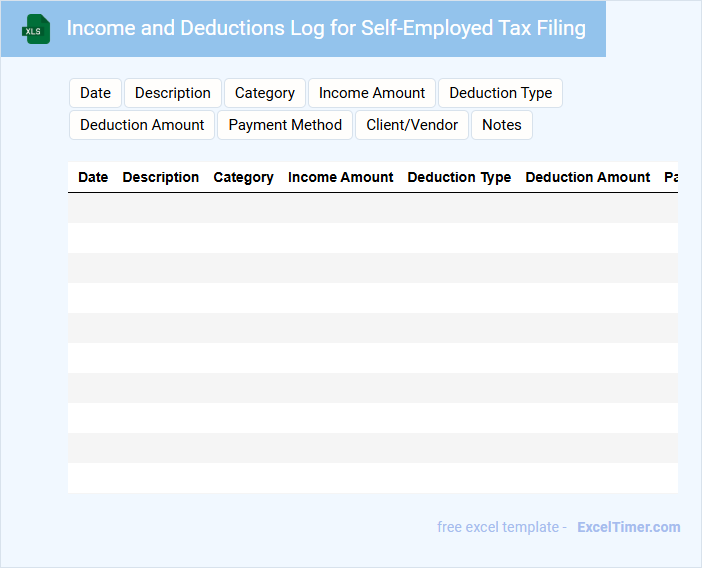

Income and Deductions Log for Self-Employed Tax Filing

The Income and Deductions Log is a crucial document for self-employed individuals, summarizing all earnings and deductible expenses throughout the tax year. It helps ensure accurate tax filing by providing a detailed record of revenue streams and eligible deductions. Maintaining this log minimizes errors and supports compliance with tax regulations.

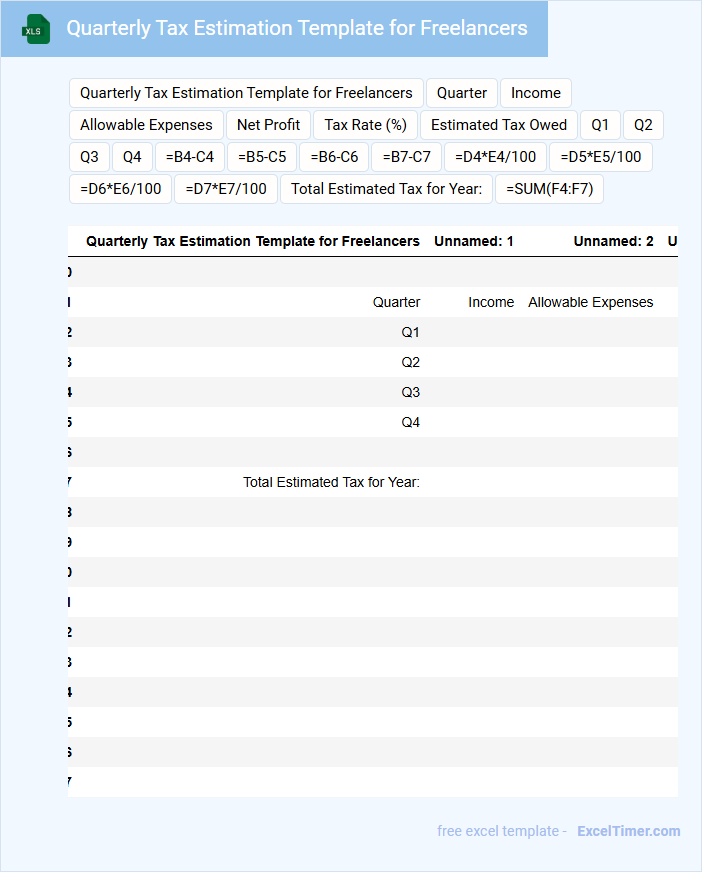

Quarterly Tax Estimation Template for Freelancers

A Quarterly Tax Estimation Template for Freelancers typically contains detailed income records, estimated tax calculations, and payment schedules to help manage tax liabilities efficiently.

- Comprehensive Income Tracking: Ensure all freelance earnings are accurately recorded to avoid underestimating taxes.

- Accurate Expense Deductions: Include all deductible expenses to minimize taxable income legally.

- Clear Payment Deadlines: Mark quarterly tax payment dates to stay compliant and avoid penalties.

Summary of Business Expenses for Quarterly Tax Filing

A Summary of Business Expenses for quarterly tax filing typically includes detailed records of all costs incurred by a business within a specific quarter. This document helps track deductible expenses, ensuring accurate and compliant tax reporting. Including organized receipts, categorized expenses, and total amounts paid is essential for clarity and efficiency.

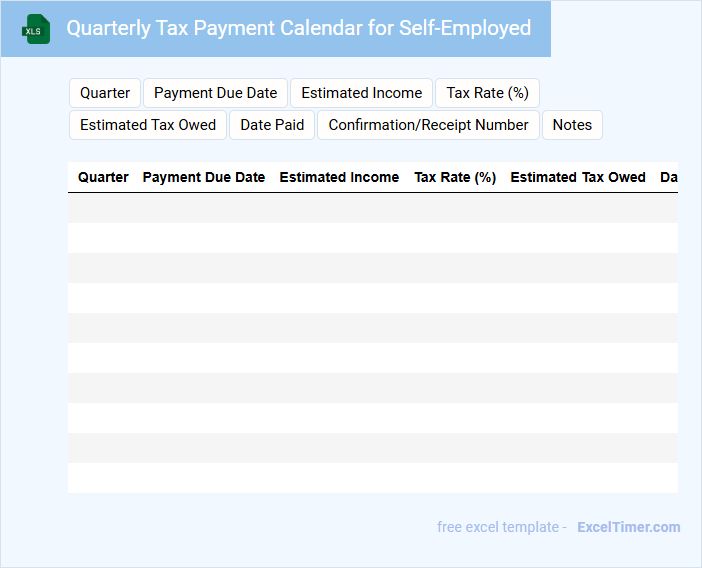

Quarterly Tax Payment Calendar for Self-Employed

The Quarterly Tax Payment Calendar for self-employed individuals typically contains critical deadlines for submitting estimated tax payments to the IRS. It outlines specific dates each quarter when taxes should be paid to avoid penalties and interest. This document also includes reminders for keeping track of income and expenses to ensure accurate tax filings.

An important suggestion is to mark all payment dates clearly on your personal calendar and set reminders well in advance. Additionally, keeping detailed records of all business-related transactions throughout the quarter helps streamline the tax payment process. Staying proactive with tax planning can prevent surprises during tax season and maintain compliance with IRS regulations.

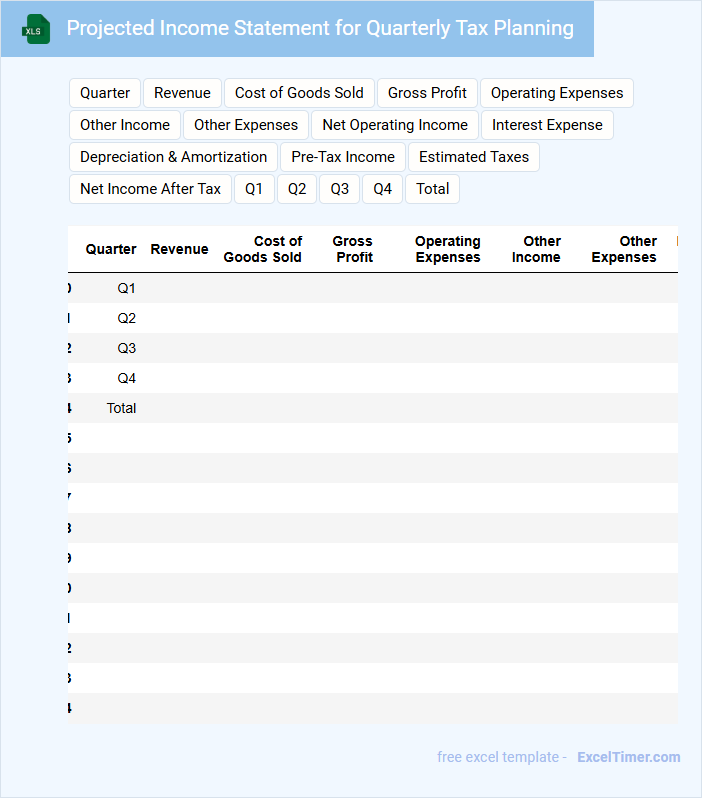

Projected Income Statement for Quarterly Tax Planning

A Projected Income Statement for Quarterly Tax Planning outlines the expected revenues, expenses, and profits over a specific period. This document helps estimate taxable income and tax liabilities to ensure timely tax payments.

It typically includes detailed forecasts of sales, costs, and operating expenses broken down by quarter. For accuracy, regularly update assumptions and incorporate any anticipated financial changes.

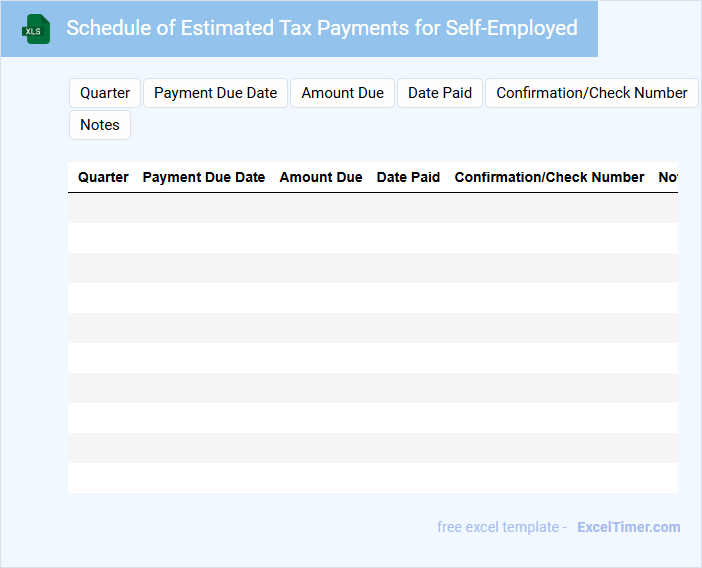

Schedule of Estimated Tax Payments for Self-Employed

The Schedule of Estimated Tax Payments for self-employed individuals outlines the deadlines and amounts for quarterly tax payments. This document is crucial for managing tax liabilities without penalties.

It typically contains payment dates, estimated tax amounts, and instructions for calculation. Maintaining accurate income records is an important aspect of preparing these payments efficiently.

Cash Flow Tracker with Quarterly Tax Planning

A Cash Flow Tracker with Quarterly Tax Planning is a financial document that helps monitor income and expenses regularly. It ensures that businesses or individuals maintain liquidity while preparing for upcoming tax obligations.

This type of document typically contains detailed records of cash inflows, outflows, and projected tax payments by quarter. Regular updates to this tracker improve accuracy and support strategic financial decisions.

For best results, consistently input accurate transaction data and review tax deadlines to avoid penalties.

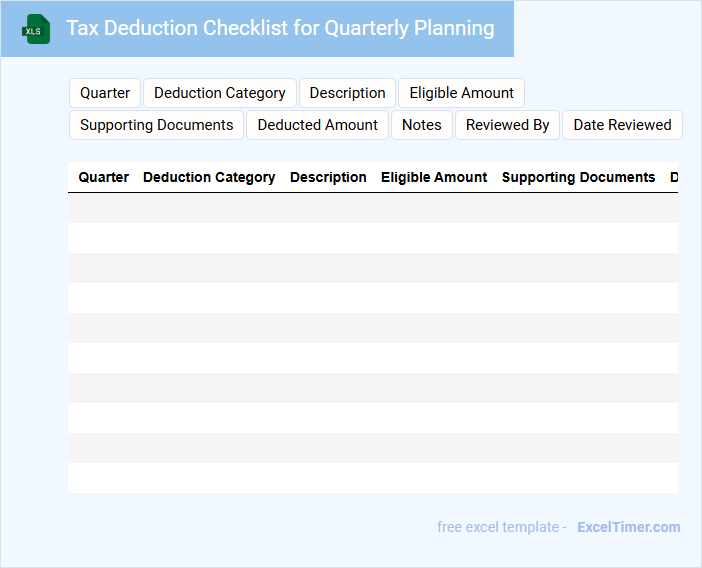

Tax Deduction Checklist for Quarterly Planning

This document typically contains a detailed list to help individuals and businesses systematically prepare for tax deductions during quarterly planning.

- Comprehensive Expense Tracking: Records all deductible expenses to maximize tax benefits.

- Deadline Awareness: Highlights important dates to ensure timely submissions and avoid penalties.

- Verification of Eligibility: Confirms which deductions qualify to prevent audit issues.

Quarterly Invoice and Payment Tracker for Freelancers

A Quarterly Invoice and Payment Tracker for Freelancers is a document designed to monitor and organize financial transactions over a three-month period.

- Invoice Details: It includes comprehensive records of all invoices issued, specifying dates, amounts, and client information.

- Payment Status: It tracks payment receipts and outstanding balances to ensure timely follow-ups and cash flow management.

- Financial Summary: It provides a summary of total billed and received payments to evaluate quarterly income and plan taxes.

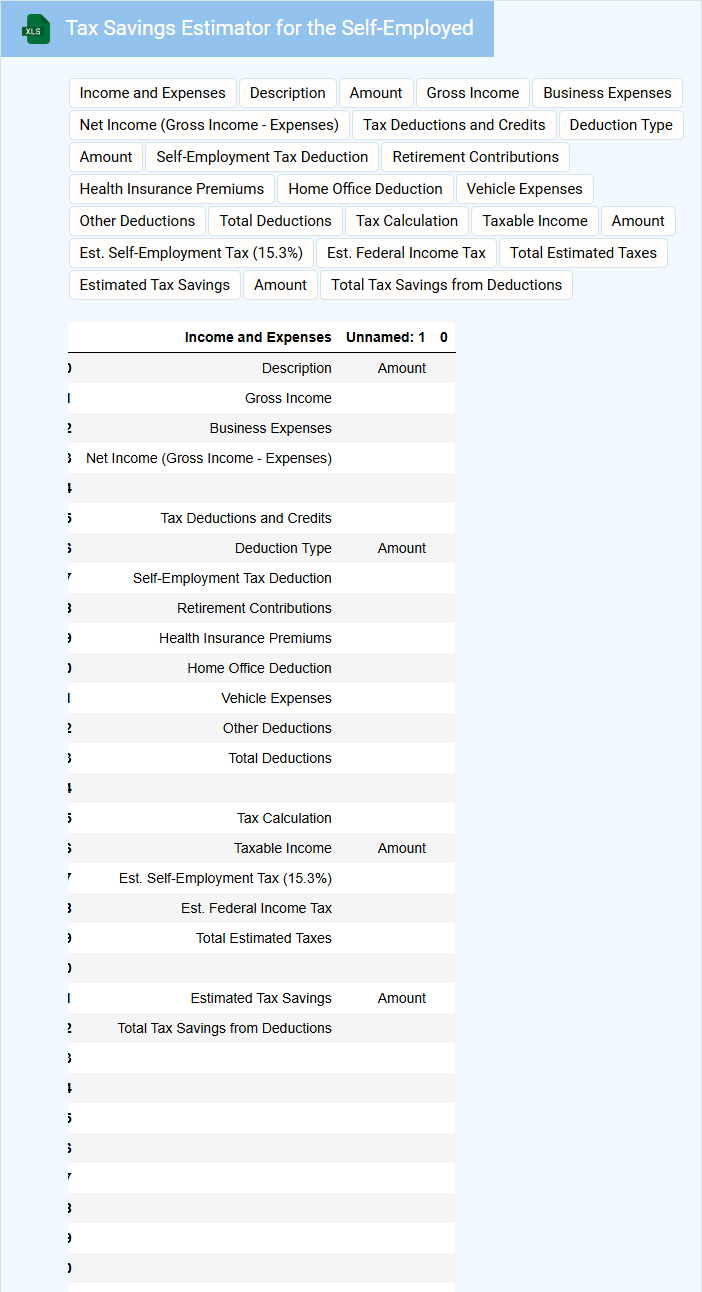

Tax Savings Estimator for the Self-Employed

A Tax Savings Estimator for the self-employed is a crucial document designed to help freelancers and independent contractors calculate potential tax deductions and credits. It typically contains sections for income input, deductible expenses, and estimated tax liabilities. Utilizing this tool can guide self-employed individuals in optimizing their tax savings effectively.

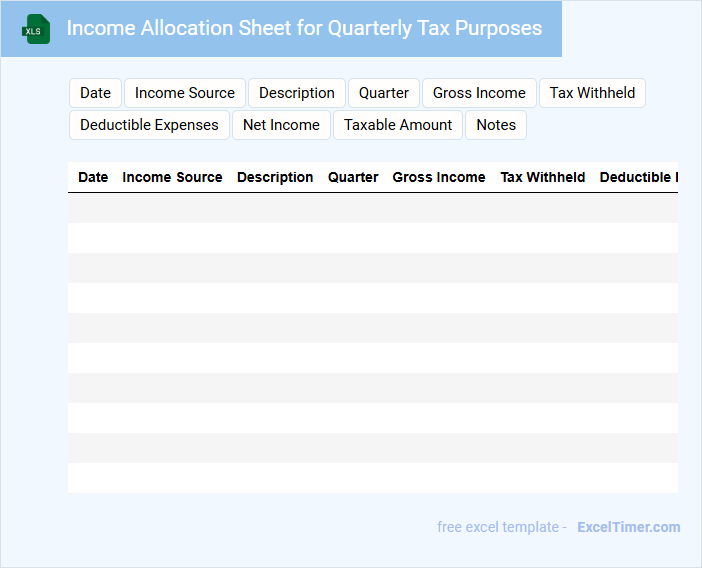

Income Allocation Sheet for Quarterly Tax Purposes

An Income Allocation Sheet for quarterly tax purposes is a financial document used to track and distribute income over specific periods within a fiscal year. It ensures accurate reporting and helps in calculating estimated tax payments owed to tax authorities. This document typically contains income sources, amounts received, and allocation details by quarter.

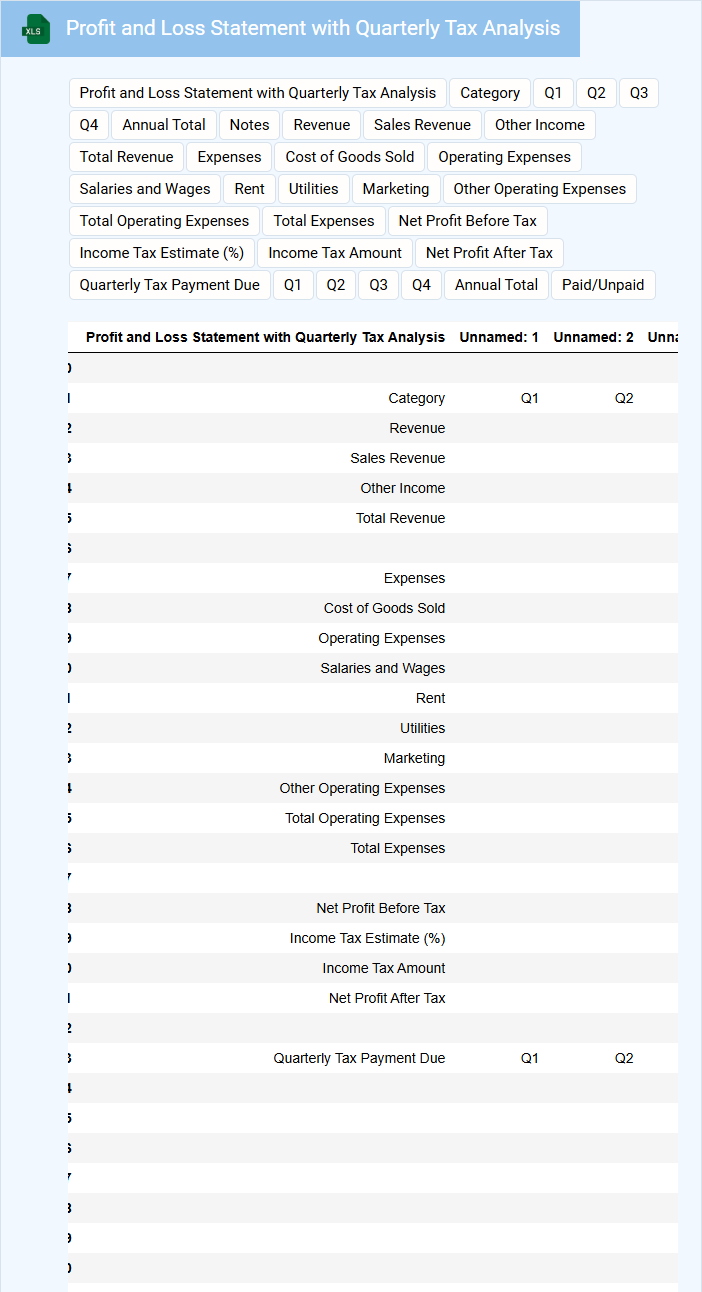

Profit and Loss Statement with Quarterly Tax Analysis

The Profit and Loss Statement summarizes a company's revenues, costs, and expenses over a specific period, showing the net profit or loss. It helps stakeholders assess financial performance and operational efficiency.

Quarterly Tax Analysis involves reviewing tax obligations and payments every three months to ensure compliance and optimal tax planning. Regularly updating this analysis prevents surprises and improves cash flow management.

Including detailed breakdowns of income and expenses, alongside tax liabilities, is crucial for accurate financial insight and strategic decision-making.

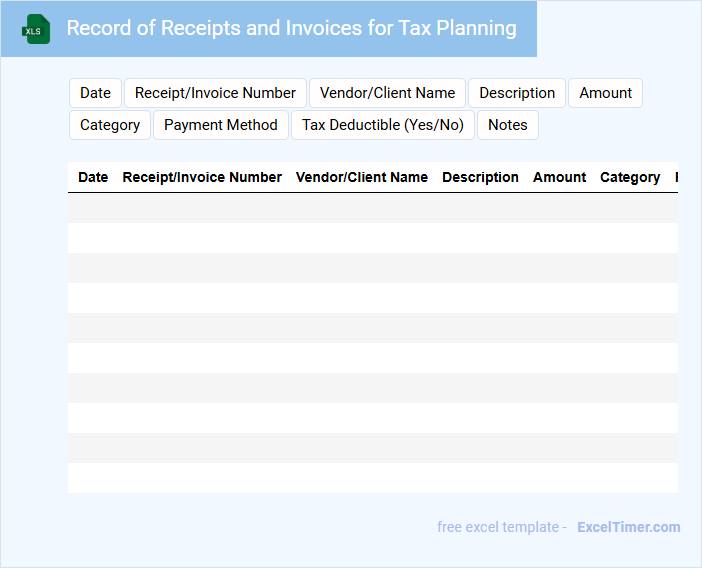

Record of Receipts and Invoices for Tax Planning

What does a Record of Receipts and Invoices for Tax Planning usually contain? This document typically includes detailed lists of all income receipts and invoices issued within a specific period, providing a clear financial trail. It helps ensure accurate tax reporting and identifies deductible expenses for efficient tax planning.

What important aspects should be considered when maintaining this record? It is essential to keep invoices organized by date and type, verify the accuracy of each entry, and regularly update the document to reflect any changes or corrections. Consistent record-keeping supports compliance and maximizes potential tax benefits.

What Excel formulas can help accurately estimate quarterly tax payments for self-employed income?

Excel formulas like SUMPRODUCT can calculate estimated quarterly tax payments by multiplying income by tax rates and deductions. The IF function helps apply different tax brackets based on income thresholds for precise tax liability. Using PMT assists in projecting payment schedules, ensuring accurate quarterly tax planning for self-employed individuals.

How can you categorize and track deductible business expenses in an Excel spreadsheet for quarterly tax planning?

Create separate columns in your Excel spreadsheet for expense categories such as office supplies, travel, and marketing to categorize deductible business expenses effectively. Use date and amount columns to track each transaction and apply filters or pivot tables for quarterly summaries. Your organized data facilitates accurate tax calculations and identifies potential deductions efficiently.

Which s or tools are best suited for forecasting quarterly self-employment taxes?

Excel templates like the "Quarterly Tax Estimator" and "Self-Employment Income Tracker" are best suited for forecasting quarterly self-employment taxes. These tools allow you to input income, expenses, and tax rates to accurately project your tax liabilities. Using such templates helps you maintain precise records and plan your payments efficiently.

How can you use Excel to monitor income fluctuations and adjust projected quarterly tax payments?

Excel enables tracking income fluctuations by using dynamic spreadsheets that record weekly or monthly earnings, highlighting trends with graphs or conditional formatting. Formulas can calculate estimated quarterly tax payments based on updated income data, ensuring more accurate projections. Automated templates allow adjustments of tax liabilities in real time, improving financial planning for self-employed individuals.

What key tax deadlines and payment schedules should be highlighted in an Excel calendar for self-employed individuals?

Highlight key quarterly tax deadlines: April 15, June 15, September 15, and January 15 for estimated tax payments. Include schedule for filing annual returns by April 15 and self-employment tax payments aligned with these dates. Mark reminders for record-keeping and expense tracking throughout each quarter to optimize deductions.