![]()

The Quarterly Expense Tracker Excel Template for Freelancers allows efficient management of income and expenses every quarter, helping freelancers stay organized and financially aware. It simplifies budgeting by categorizing costs and provides visual summaries like charts for quick analysis. Regular use of this template ensures better tax preparation and financial decision-making throughout the year.

Quarterly Expense Tracker Excel Template for Freelancers

A Quarterly Expense Tracker Excel Template for freelancers typically contains detailed records of income and expenses organized by categories and dates. It helps users monitor their financial health, track billable hours, and manage tax deductions efficiently. Ensuring accurate data entry and regularly updating the template are crucial for maintaining an effective expense tracking system.

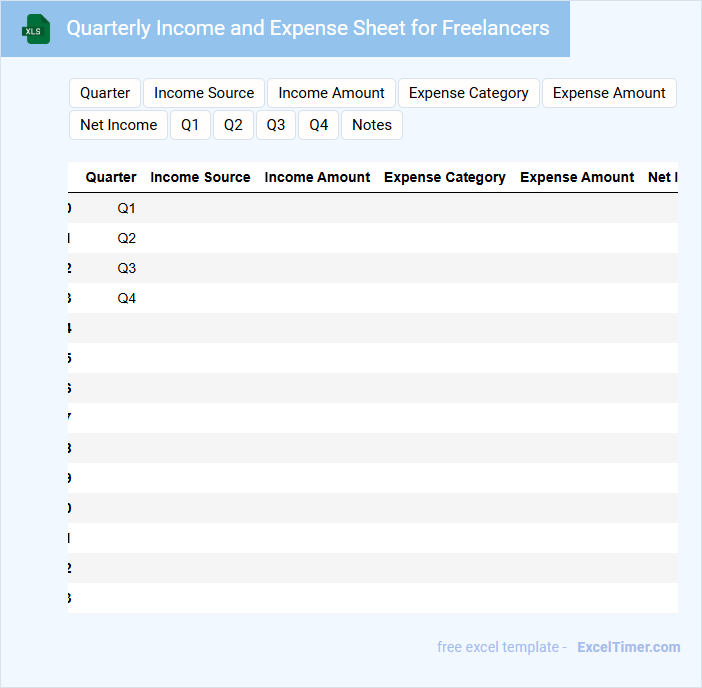

Quarterly Income and Expense Sheet for Freelancers

The Quarterly Income and Expense Sheet for freelancers typically contains detailed records of all revenues earned and expenditures incurred over a three-month period. This document helps in tracking financial performance and understanding profit margins.

It usually includes categories for income sources, business expenses, taxes owed, and any reimbursements. An important suggestion is to consistently update entries and categorize transactions accurately for smooth tax filing and financial analysis.

Freelance Business Expense Log for Each Quarter

A Freelance Business Expense Log for Each Quarter is a document that tracks all expenses incurred by a freelancer during a three-month period. It helps in organizing financial records for tax purposes and budgeting.

- Include dates, descriptions, and amounts for each expense.

- Categorize expenses to identify deductible business costs.

- Regularly update the log to maintain accurate and timely records.

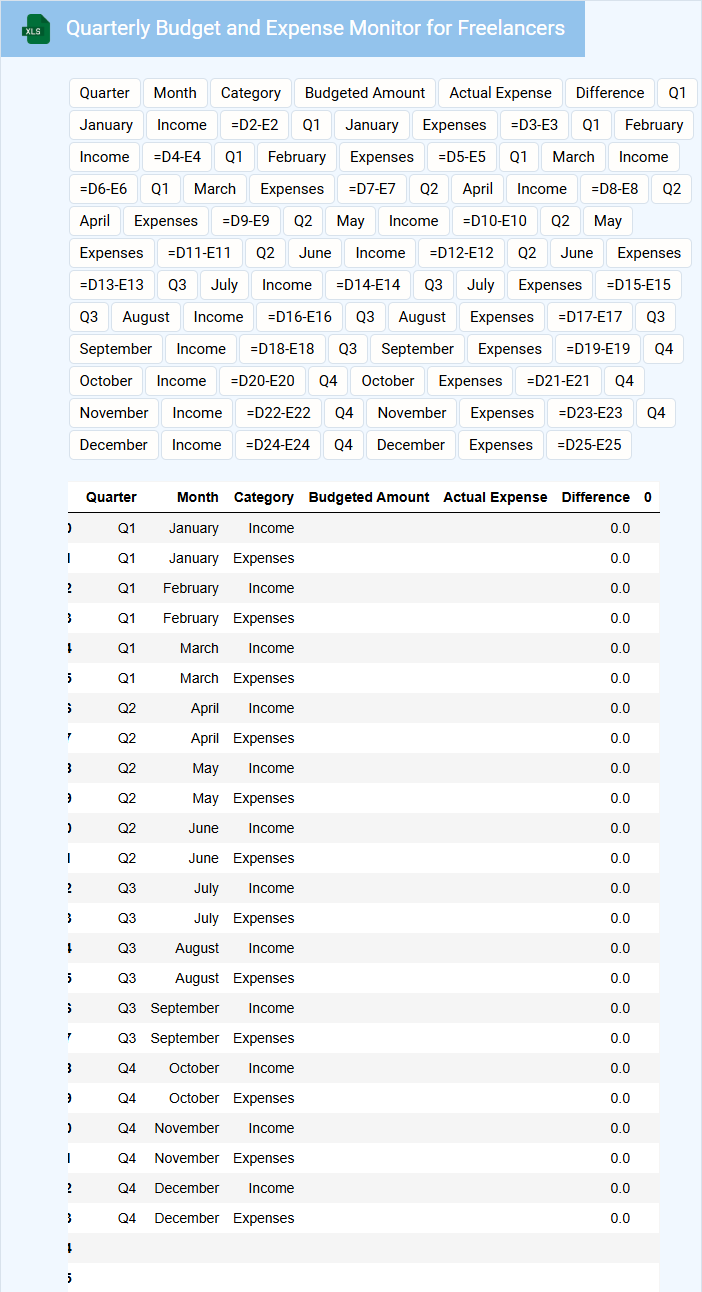

Quarterly Budget and Expense Monitor for Freelancers

The Quarterly Budget and Expense Monitor is a key document that tracks income and expenditures over a three-month period for freelancers. It allows for detailed analysis of spending patterns and financial health.

Important aspects include categorizing expenses accurately and reviewing income sources regularly to maintain profitability. This document helps freelancers make informed decisions and plan future budgets effectively.

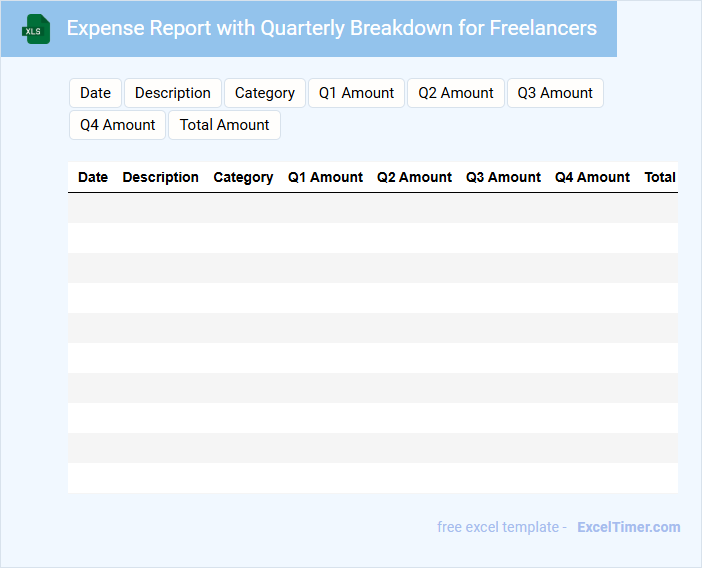

Expense Report with Quarterly Breakdown for Freelancers

An Expense Report with a quarterly breakdown for freelancers typically contains detailed records of all business-related expenses organized by quarter. It helps freelancers monitor their spending patterns, manage budgets effectively, and prepare for tax filing. Including receipts, payment dates, and categorized expenses is crucial for accuracy and financial clarity.

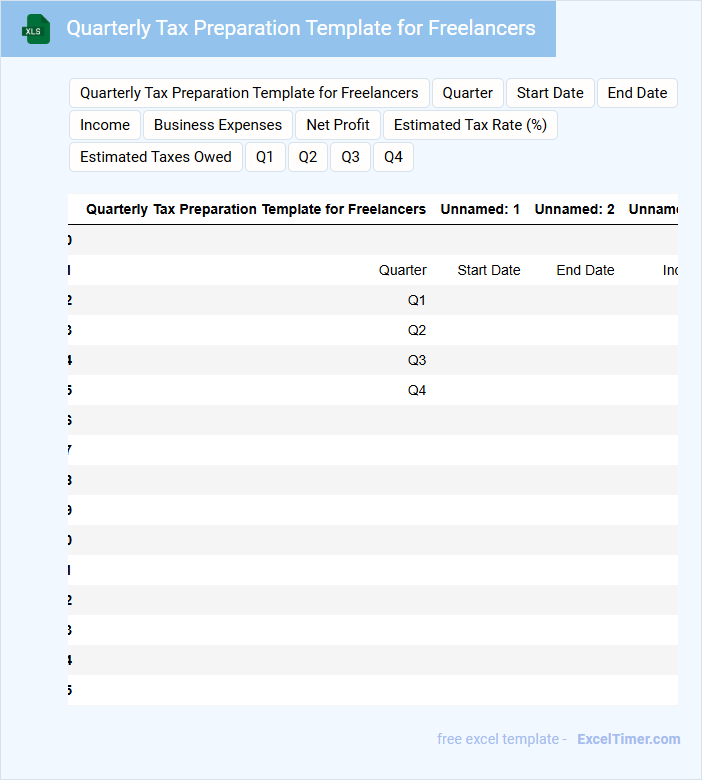

Quarterly Tax Preparation Template for Freelancers

A Quarterly Tax Preparation Template for freelancers is a structured document designed to organize income, expenses, and tax liabilities every quarter. It typically contains sections for tracking invoices, deductible expenses, estimated tax payments, and relevant financial summaries. This template helps freelancers stay compliant with tax regulations and avoid penalties by ensuring timely and accurate tax filings.

Freelance Project Expense Tracker with Quarterly Summary

A Freelance Project Expense Tracker is a document used to record and monitor all costs associated with freelance projects, ensuring accurate financial management. It typically includes detailed entries for expenses like materials, software, travel, and other project-specific costs. Additionally, a Quarterly Summary provides an overview of total expenditures, helping freelancers assess their spending patterns and manage budgets effectively.

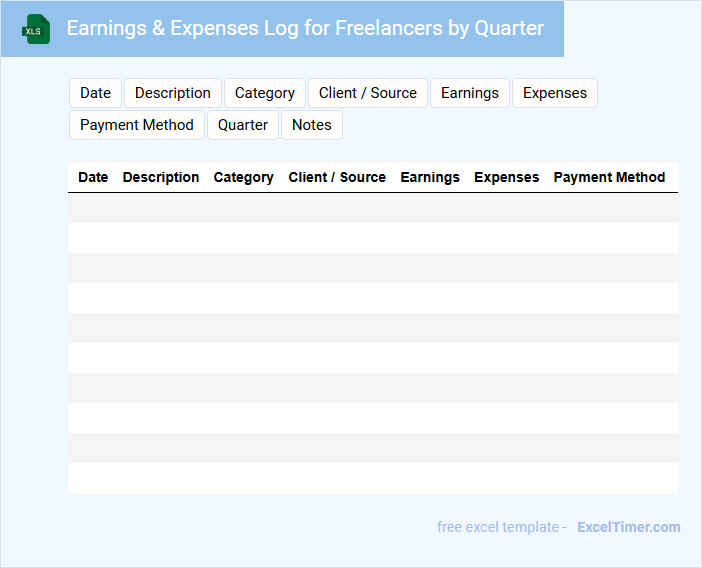

Earnings & Expenses Log for Freelancers by Quarter

An Earnings & Expenses Log for Freelancers by Quarter is a document used to systematically track income and costs over a three-month period. It typically includes sections for recording payments received, business-related expenses, and any applicable tax deductions. Maintaining this log helps freelancers monitor their financial health and prepare accurate tax filings.

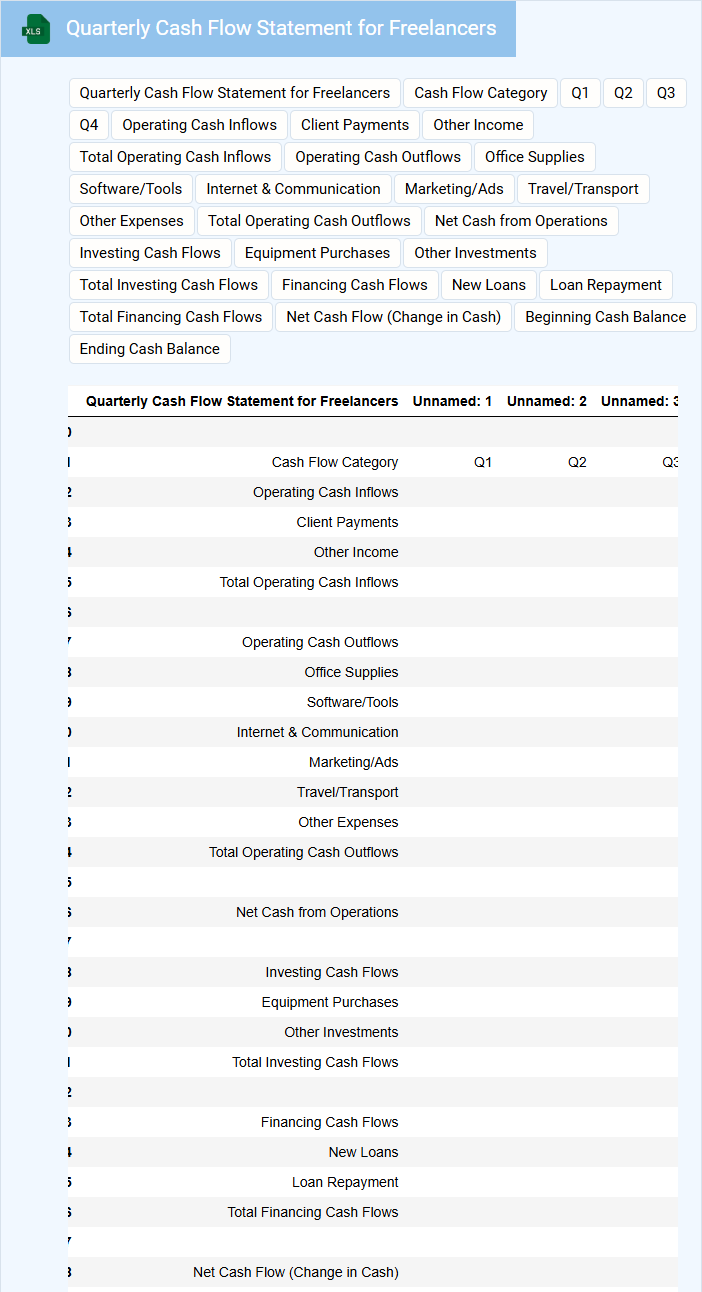

Quarterly Cash Flow Statement for Freelancers

The Quarterly Cash Flow Statement for freelancers is a financial document that tracks the inflow and outflow of cash over a three-month period. It typically contains details about earnings from various projects, expenses for business activities, and the net cash position. This statement helps freelancers monitor their liquidity and plan for future financial stability.

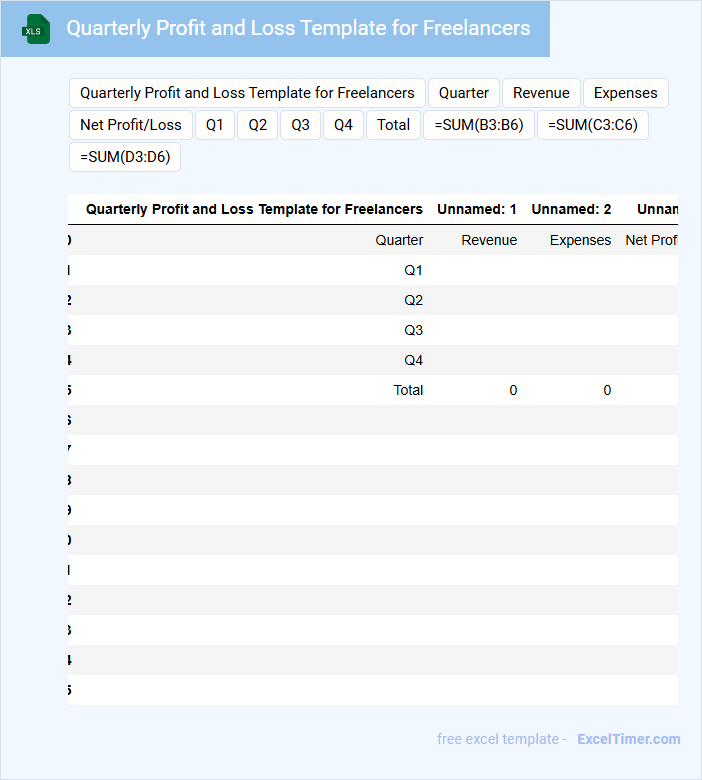

Quarterly Profit and Loss Template for Freelancers

A Quarterly Profit and Loss Template for Freelancers is a document designed to track income and expenses over a three-month period. It helps freelancers understand their financial performance and make informed business decisions.

- Include detailed categories for different income sources and expense types.

- Ensure clear separation between fixed and variable costs for accurate analysis.

- Incorporate summary sections to highlight net profit or loss for the quarter.

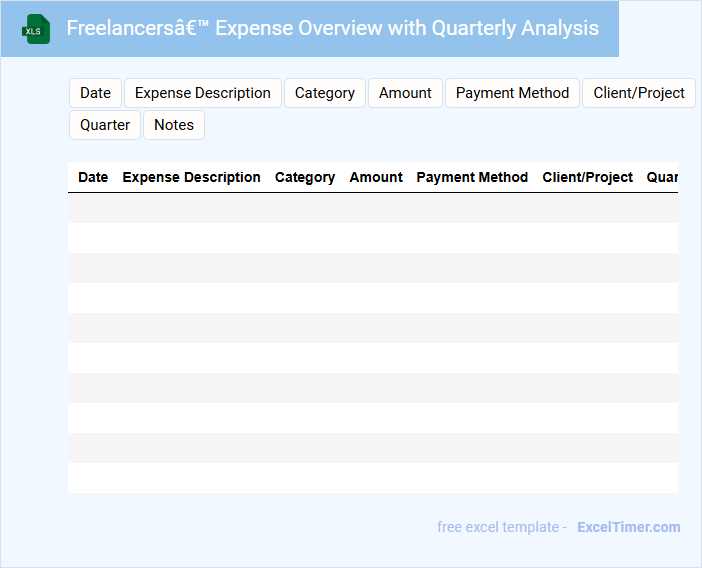

Freelancers’ Expense Overview with Quarterly Analysis

A Freelancers' Expense Overview document typically contains detailed records of all business-related expenses incurred by freelancers throughout a specific period. It includes categorized costs such as software subscriptions, office supplies, travel, and client-related expenditures. This document provides a comprehensive view that helps freelancers manage cash flow and prepare accurate tax filings.

The Quarterly Analysis section offers valuable insights into spending patterns and trends over the past three months. It highlights areas where expenses can be optimized and compares quarterly data to forecast future financial needs. This analysis enables freelancers to make informed budgeting decisions and improve financial sustainability.

Important elements to include are precise categorization of expenses, clear date entries, and supporting receipts or invoices. Using visual aids such as charts or graphs enhances understanding of spending trends. Maintaining consistency and accuracy in records is crucial for tax deductions and financial planning.

Quarterly Personal Expense Tracker for Freelancers

A Quarterly Personal Expense Tracker for freelancers is a document designed to monitor and record income and expenditures over a three-month period. It typically contains categorized expense entries, income sources, and summary reports to assess financial health. This type of tracker is essential for budgeting, tax preparation, and identifying spending patterns to improve financial management.

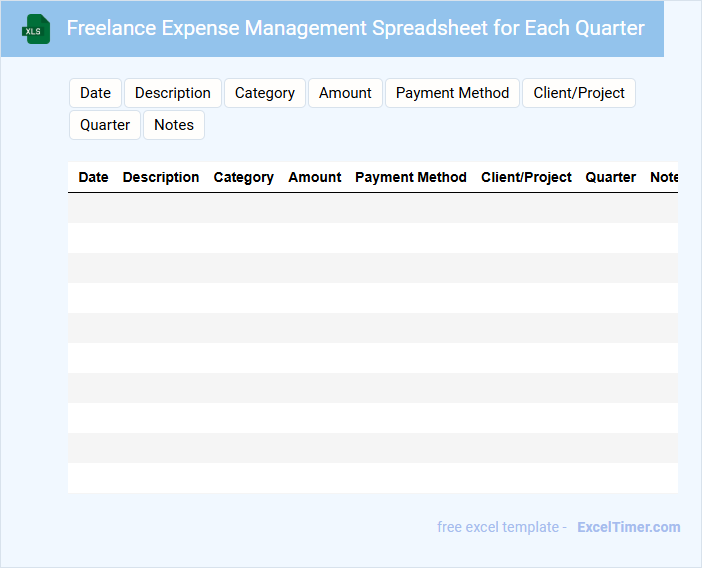

Freelance Expense Management Spreadsheet for Each Quarter

A Freelance Expense Management Spreadsheet is a tool designed to track and organize all expenses incurred during each quarter. It helps freelancers maintain a clear record of spending, ensuring accurate financial management and budgeting.

This document usually contains categorized expenses, total amounts, dates, and payment methods. For effective use, it is important to regularly update the spreadsheet and reconcile it with bank statements for accuracy.

Quarterly Overhead and Cost Tracker for Freelancers

What information is typically included in a Quarterly Overhead and Cost Tracker for Freelancers? This document usually contains detailed records of all business-related expenses and overhead costs incurred over a quarter, such as software subscriptions, office supplies, utilities, and travel expenses. It helps freelancers monitor their spending patterns, manage budgets effectively, and prepare accurate financial reports for tax purposes or business analysis.

What important aspects should freelancers consider when maintaining this tracker? Freelancers should ensure that all expenses are categorized clearly and consistently, keep receipts or proof of payment for validation, and regularly update the tracker to avoid missing any costs. Additionally, setting budget limits and reviewing the tracker quarterly aids in optimizing spending and improving profitability.

Freelancers’ Quarterly Financial Tracker with Categories

What information does a Freelancers' Quarterly Financial Tracker with Categories typically include?

This type of document usually contains detailed records of income, expenses, and tax obligations organized by various categories such as client projects, operational costs, and tax deductions. It helps freelancers monitor their financial health, prepare accurate tax filings, and manage budgets effectively.

For optimal use, it is important to consistently update the tracker with all transactions, categorize expenses properly for better tax benefits, and review the summary quarterly to adjust financial goals and plan for future projects.

What key categories should be included in a quarterly expense tracker for freelancers?

A quarterly expense tracker for freelancers should include key categories such as Income, Operating Expenses, Equipment Costs, Marketing, Taxes, and Miscellaneous Expenses. Your tracker can also benefit from sections for Invoice Tracking and Payment Receipts. Organizing these categories ensures accurate financial management and easier tax preparation.

How can you use Excel formulas to automate totaling and summarizing expenses by month and quarter?

Excel formulas like SUMIF and SUMIFS enable you to automate totaling expenses by month and quarter in your Quarterly Expense Tracker for Freelancers. Utilizing DATE and TEXT functions helps categorize expenses accurately, while PivotTables offer dynamic summarization options. Your tracker becomes more efficient by applying these tools to analyze spending patterns effortlessly.

What methods can be applied in Excel to distinguish between billable and non-billable expenses?

Use Excel's conditional formatting to color-code billable and non-billable expenses based on categories you define. Create drop-down lists with data validation for easy selection of expense types, ensuring consistency in entries. Your spreadsheet can also utilize pivot tables to summarize and analyze billable versus non-billable costs each quarter.

How can you visualize spending trends over the quarter using Excel charts or conditional formatting?

Visualize quarterly spending trends in Excel by creating line or column charts with expense categories on the X-axis and amounts on the Y-axis to identify patterns. Use conditional formatting with color scales to highlight high and low expenses within each month for instant visual insights. PivotTables combined with slicers offer dynamic filtering to analyze spending trends across different categories and time periods efficiently.

What essential data validation techniques ensure accurate and consistent entry of expenses in your tracker?

Implementing dropdown lists for expense categories enhances consistency by limiting entries to predefined options. Using date pickers or setting date range restrictions ensures valid and timely expense dates. Applying numeric validation with minimum and maximum limits prevents incorrect or unrealistic expense amounts.