The Quarterly Bookkeeping Reconciliation Excel Template for Accountants streamlines financial review by organizing transactions and matching them with bank statements every quarter. It minimizes errors and ensures accurate financial reporting, which is crucial for timely tax preparation and auditing processes. Accountants benefit from its user-friendly format and automated formulas that save time and enhance efficiency.

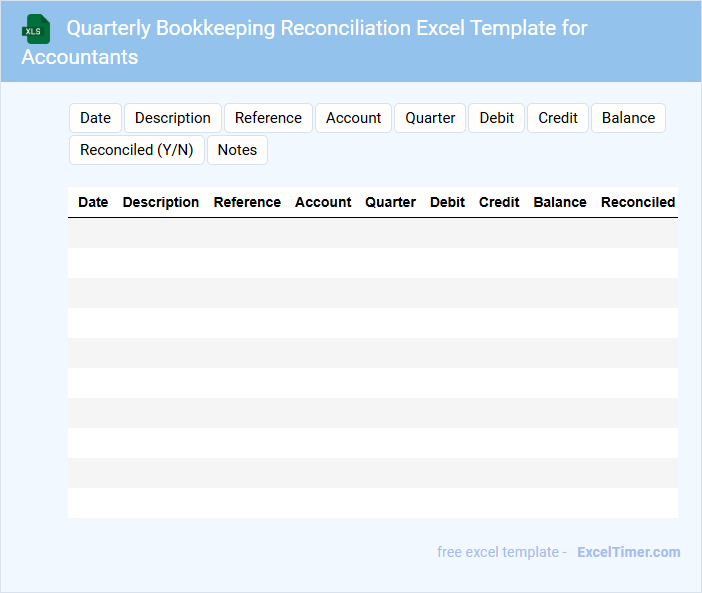

Quarterly Bookkeeping Reconciliation Excel Template for Accountants

The Quarterly Bookkeeping Reconciliation Excel Template is designed to streamline the accounting process by summarizing financial transactions every three months. This document usually contains detailed records of income, expenses, and balances, ensuring accuracy in financial statements. For accountants, it is vital to maintain consistency and verify all entries for errors to support precise quarterly reporting.

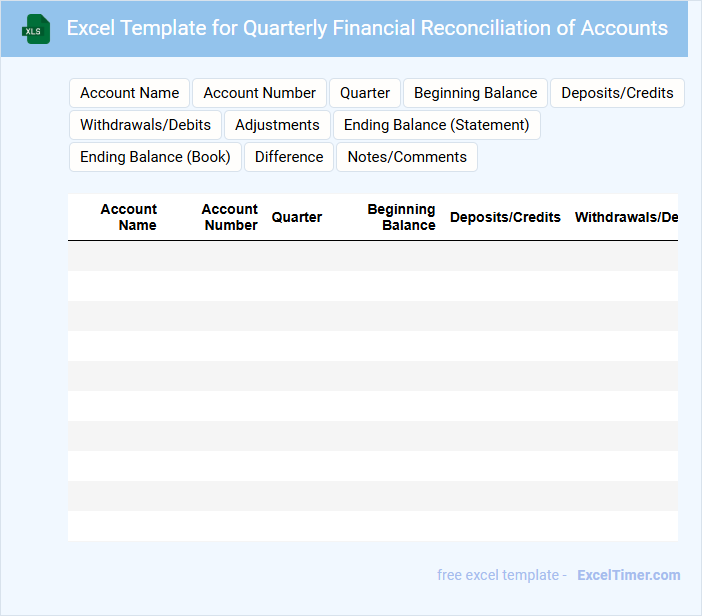

Excel Template for Quarterly Financial Reconciliation of Accounts

What does an Excel Template for Quarterly Financial Reconciliation of Accounts typically contain? This type of document usually includes detailed entries of financial transactions, balances from different accounts, and summary tables to compare and verify data consistency. It helps in identifying discrepancies and ensuring accuracy in the financial statements for each quarter.

What is an important suggestion when using this template? It is crucial to maintain consistent data input and regularly update the template with accurate figures to facilitate effective reconciliation. Additionally, incorporating automated formulas and clear labeling can significantly reduce errors and improve clarity during financial reviews.

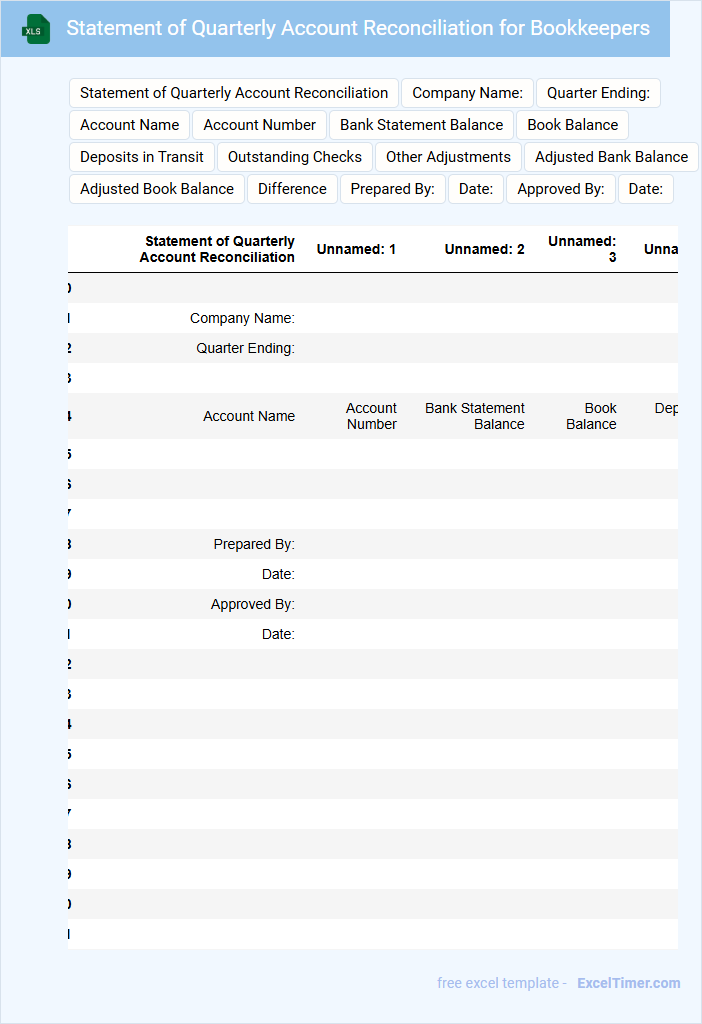

Statement of Quarterly Account Reconciliation for Bookkeepers

The Statement of Quarterly Account Reconciliation is a financial document that summarizes and verifies the accuracy of account balances over a three-month period. It ensures that all transactions are correctly recorded and discrepancies are identified promptly.

Bookkeepers rely on this statement to maintain accurate financial records and support auditing processes. Consistently reviewing and updating reconciliations helps prevent errors and maintain trustworthiness in financial reporting.

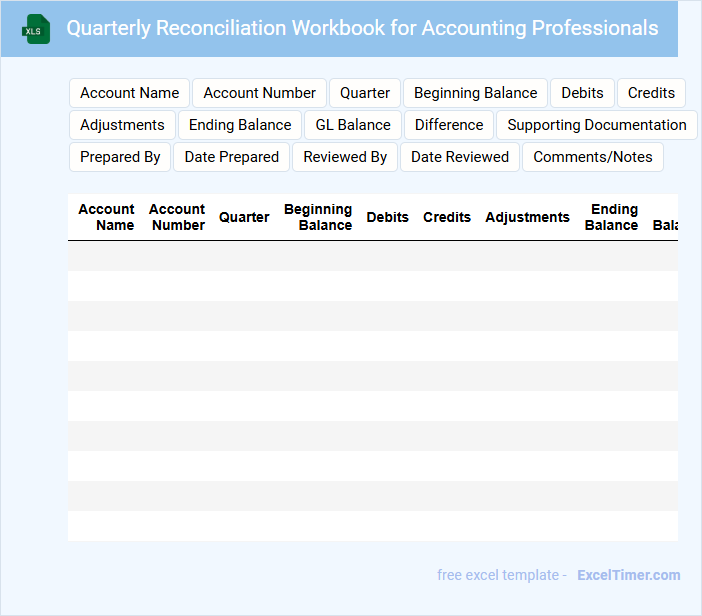

Quarterly Reconciliation Workbook for Accounting Professionals

What does a Quarterly Reconciliation Workbook for Accounting Professionals typically contain? This type of document usually includes detailed financial statements, reconciliation schedules, and variance analyses to ensure accounts are accurate and balanced. It is designed to help accounting professionals systematically verify transactions and prepare for audits.

What is an important consideration when using this workbook? Ensuring timely and accurate data entry alongside clear documentation of discrepancies is crucial to maintain integrity and facilitate effective financial reporting. Regular reviews and updates also enhance the workbook's reliability and usefulness.

Accountants’ Excel Template for Quarterly Ledger Reconciliation

What information does an Accountants' Excel Template for Quarterly Ledger Reconciliation typically contain? This type of document usually includes detailed entries of financial transactions, segmented by debits and credits, along with account balances for the quarter. It helps accountants verify the accuracy of ledger accounts by matching recorded transactions against bank statements and identifying discrepancies.

What important features should be included in this template? Key elements include clear categorization of accounts, automated formulas for calculating totals and differences, and sections for notes or explanations on adjustments. These features enhance accuracy, efficiency, and provide an audit trail for reviewing and resolving discrepancies.

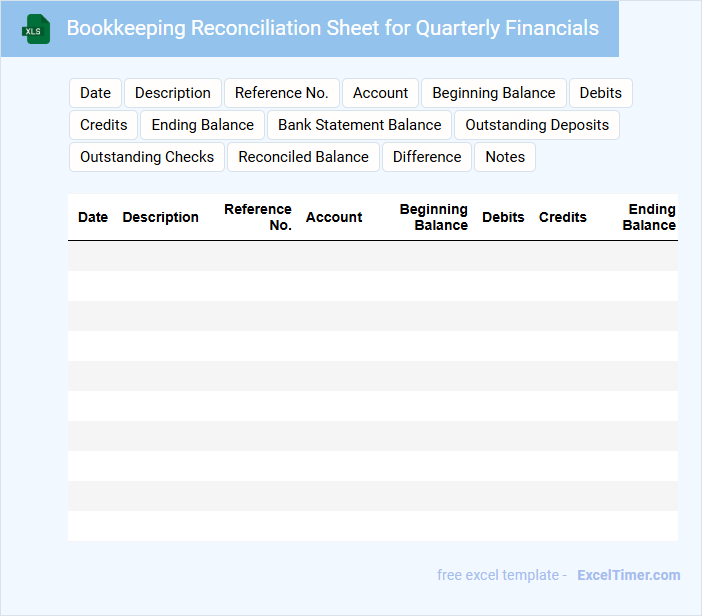

Bookkeeping Reconciliation Sheet for Quarterly Financials

What information is typically included in a Bookkeeping Reconciliation Sheet for Quarterly Financials? This document usually contains detailed comparisons between internal financial records and external statements, such as bank statements, to ensure accuracy. It highlights discrepancies, adjusts entries accordingly, and provides a clear overview of the company's financial position at the end of the quarter.

What are important considerations when preparing a Bookkeeping Reconciliation Sheet for Quarterly Financials? It is crucial to verify all transactions are recorded accurately and consistently, as errors can impact financial reporting. Additionally, timely completion and documentation of reconciliations support transparency and assist in identifying potential issues early.

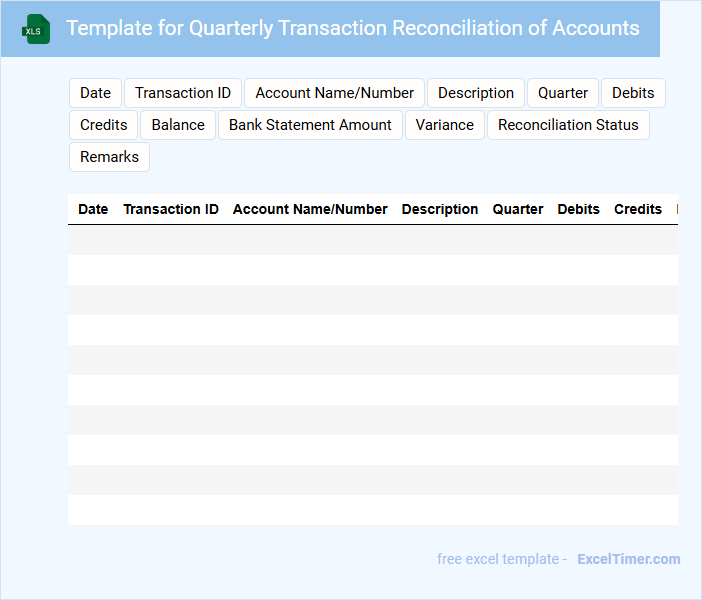

Template for Quarterly Transaction Reconciliation of Accounts

The Quarterly Transaction Reconciliation template is designed to systematically compare and verify financial transactions recorded in different accounts over a three-month period. It typically includes detailed lists of debits, credits, adjustments, and discrepancies that need resolution to ensure accuracy. This document serves as a crucial control tool for maintaining the integrity of financial data and facilitating audit compliance.

Important elements to include are clear transaction descriptions, dates, amounts, account codes, and a reconciliation status column. Additionally, providing space for notes and references to supporting documentation helps in resolving discrepancies efficiently. Ensuring timely updates and reviews by relevant finance personnel enhances the reliability of the reconciliation process.

Excel Tracker for Quarterly Bookkeeping Reconciliation

An Excel Tracker for Quarterly Bookkeeping Reconciliation typically contains organized financial data to ensure accuracy in accounting records.

- Transaction Log: Detailed entries of all income and expenses for the quarter.

- Reconciliation Summary: Comparison of bookkeeping entries against bank statements to identify discrepancies.

- Adjustment Records: Notes on corrections made during reconciliation to maintain accurate financial statements.

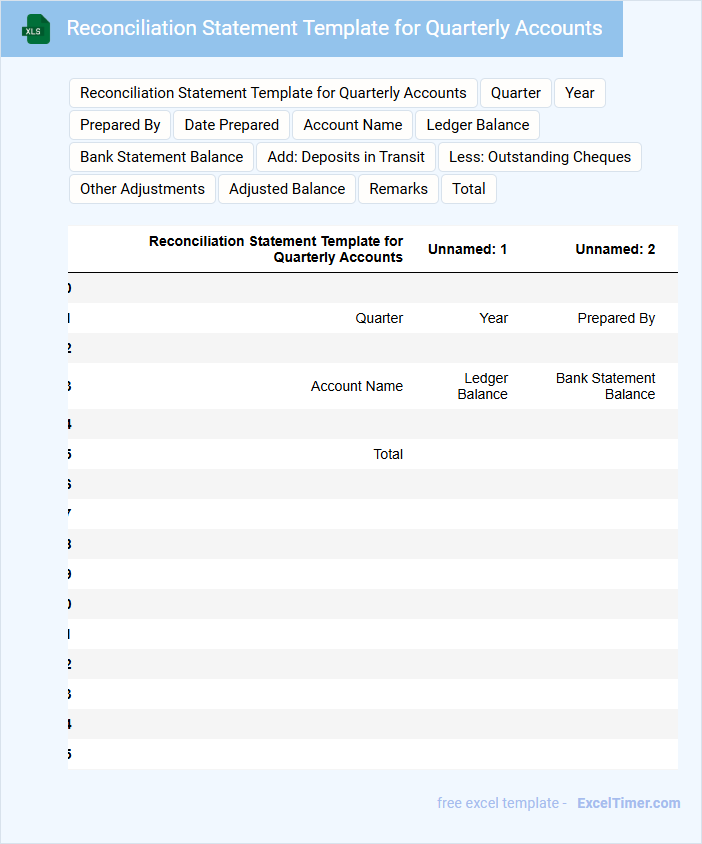

Reconciliation Statement Template for Quarterly Accounts

A Reconciliation Statement Template for Quarterly Accounts typically contains a detailed comparison of ledger balances between internal records and external statements to ensure accuracy. It helps identify discrepancies and verify the correctness of financial data for the quarter.

- Include clear columns for opening balance, transactions, and closing balance to track changes effectively.

- Ensure space for notes or explanations for any discrepancies found during reconciliation.

- Incorporate a summary section highlighting key reconciled items and outstanding issues.

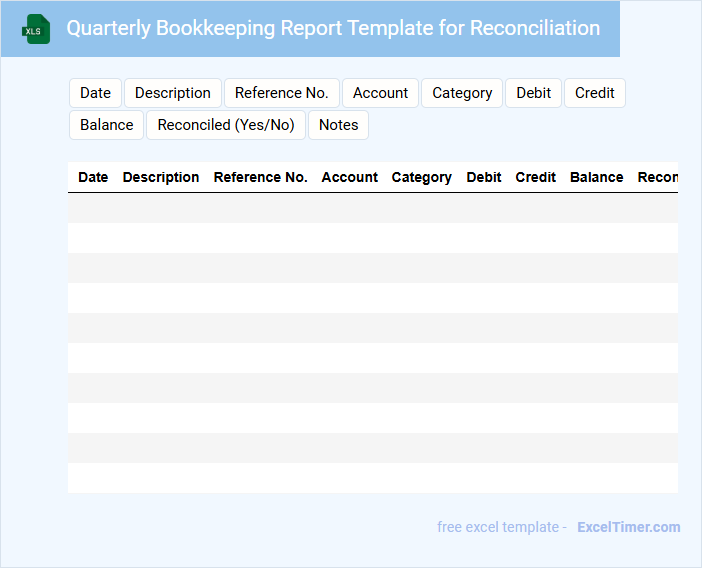

Quarterly Bookkeeping Report Template for Reconciliation

What information is typically included in a Quarterly Bookkeeping Report Template for Reconciliation? This type of document usually contains detailed records of all financial transactions within the quarter, including income, expenses, and adjustments. It also includes reconciled bank statements to ensure that the recorded balances match the actual financial institution records accurately.

What important elements should be considered when preparing this report? It is essential to include clear categorization of accounts and a summary of discrepancies found during reconciliation. Additionally, providing notes on any adjustments or unusual transactions helps maintain transparency and accuracy for future audits and financial analysis.

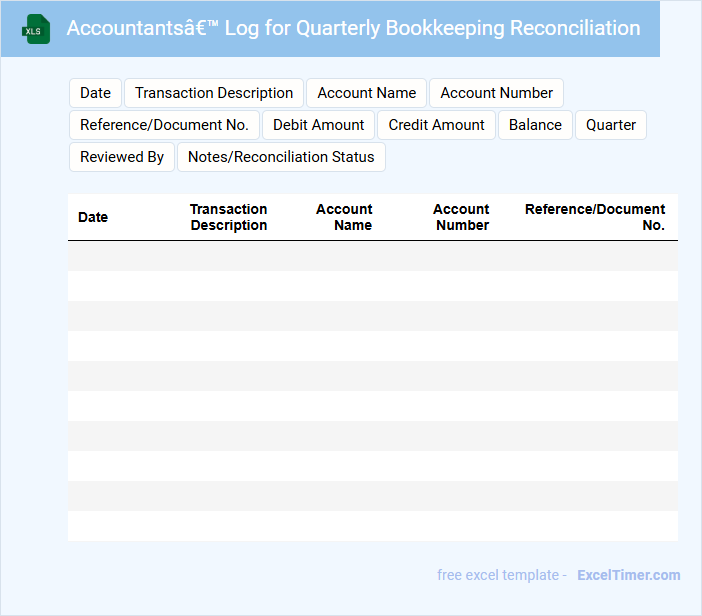

Accountants’ Log for Quarterly Bookkeeping Reconciliation

The Accountants' Log for Quarterly Bookkeeping Reconciliation typically contains detailed records of financial transactions, adjustments, and discrepancies identified during the reconciliation process. It ensures that all accounts are accurate and reflect the true financial position of the business at the end of the quarter.

Important elements to include are dates of entries, descriptions of transactions, and notes on any anomalies or corrective actions taken. Maintaining clear and organized logs helps streamline audits and improve financial transparency.

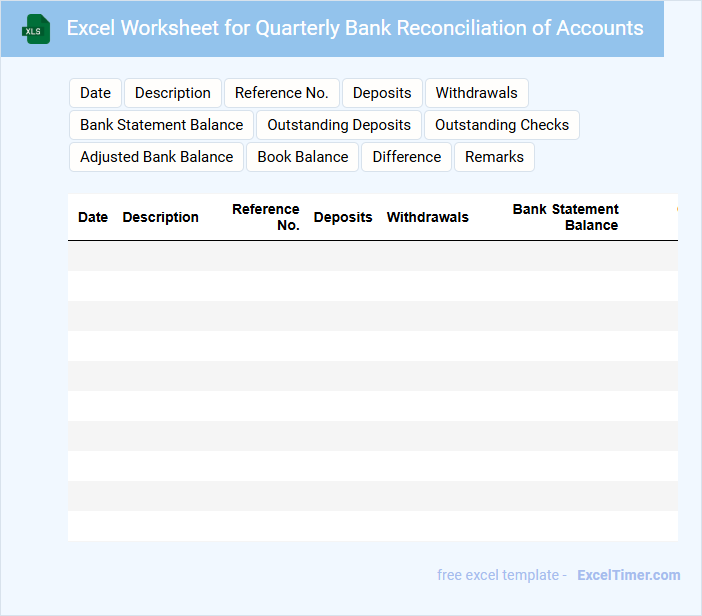

Excel Worksheet for Quarterly Bank Reconciliation of Accounts

An Excel Worksheet for Quarterly Bank Reconciliation typically contains detailed records of bank statements and company ledger entries to identify discrepancies. It includes columns for dates, descriptions, withdrawals, deposits, and balances for systematic comparison.

The worksheet also features reconciliation adjustments and a summary section highlighting the outstanding checks and deposits in transit. Regularly updating and reviewing these entries ensures accuracy in financial reporting and helps prevent errors or fraud.

Important elements to include are clear labeling of transactions, consistent formatting, and a separate section for notes explaining any discrepancies or adjustments.

Template for Quarterly Balance Sheet Reconciliation for Accountants

What is a Template for Quarterly Balance Sheet Reconciliation for Accountants typically used for? This document is used to systematically verify and validate the accuracy of accounts recorded on the balance sheet each quarter. It helps accountants identify and resolve discrepancies between ledger balances and actual account figures to ensure financial statements' integrity.

What important elements should be included in this template? Key components include a structured checklist for account verification, sections for noting discrepancies and adjustments, and clear instructions for cross-referencing transactions. Additionally, it should provide spaces for signatures and dates to confirm review and approval by responsible personnel.

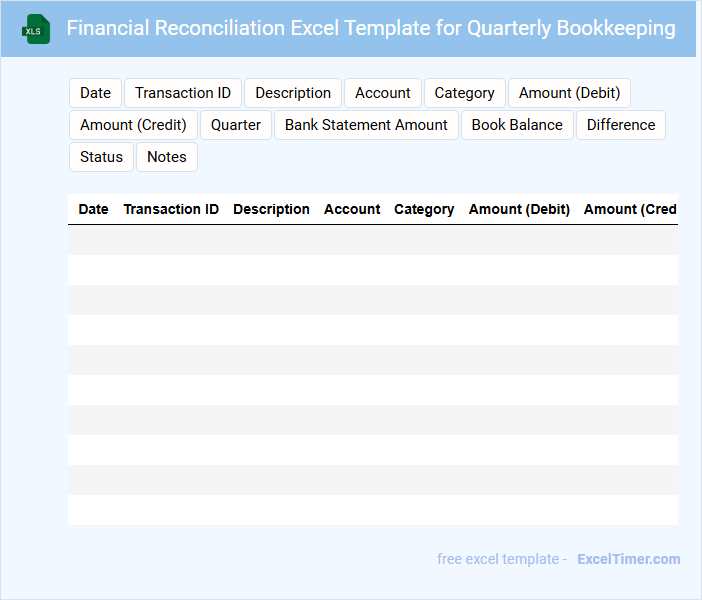

Financial Reconciliation Excel Template for Quarterly Bookkeeping

What information is typically included in a Financial Reconciliation Excel Template for Quarterly Bookkeeping? This type of document usually contains detailed records of income, expenses, and account balances organized by quarter to ensure accurate financial tracking. It helps businesses verify that their internal records match external statements, facilitating error detection and financial accuracy.

What are the important considerations when using this template? Ensure all data entries are accurate and up to date for reliable reconciliation, and include clear labels and categories to streamline the review process. Additionally, incorporating formulas for automatic calculations and summary sections can significantly improve efficiency and reduce errors.

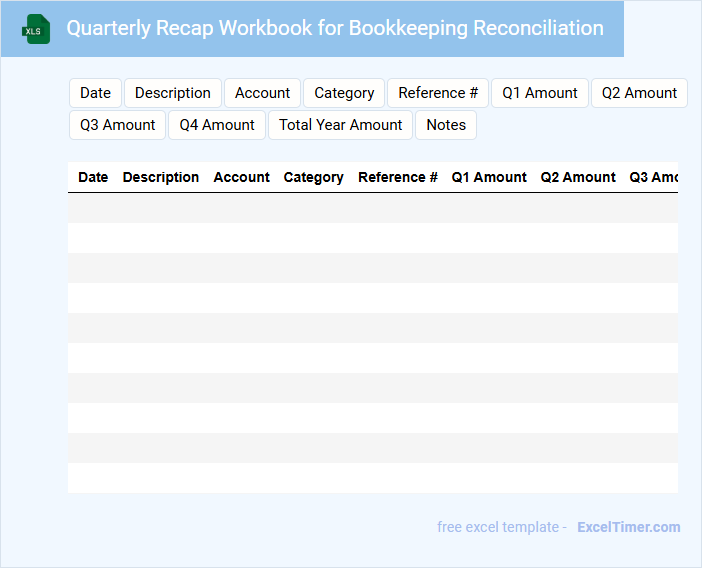

Quarterly Recap Workbook for Bookkeeping Reconciliation

The Quarterly Recap Workbook for bookkeeping reconciliation typically contains detailed financial summaries, transaction records, and adjustment logs. It serves as a comprehensive reference to verify account accuracy and ensure compliance with financial standards. Proper organization and clarity are essential to facilitate efficient review and error detection.

What are the key steps in performing a quarterly bookkeeping reconciliation in Excel?

Performing a quarterly bookkeeping reconciliation in Excel involves importing bank statements, matching transactions with ledger entries, and identifying discrepancies. Use Excel functions like VLOOKUP or INDEX-MATCH to cross-reference data and pivot tables to summarize accounts. Ensure all adjustments, corrections, and accruals are recorded accurately before finalizing the reconciliation report.

Which Excel functions are most effective for detecting discrepancies in transaction records?

Excel functions like VLOOKUP and MATCH efficiently identify discrepancies by comparing transaction records across different sheets. Conditional Formatting highlights errors and duplicates, making inconsistencies visually apparent. The SUMIF function helps verify totals against expected amounts, ensuring accuracy in quarterly bookkeeping reconciliation.

How should opening and closing balances be documented and verified in a quarterly reconciliation spreadsheet?

Opening and closing balances in a quarterly bookkeeping reconciliation spreadsheet should be clearly labeled, with the opening balance matching the previous quarter's closing balance for consistency. Verify balances by cross-referencing bank statements, ledger entries, and trial balances to ensure accuracy. Use formulas to automate balance updates and highlight discrepancies for immediate review.

What best practices should accountants follow to ensure data accuracy during the reconciliation process in Excel?

Accountants should implement data validation rules and use Excel's formula auditing tools to ensure accuracy during quarterly bookkeeping reconciliation. Regularly cross-checking ledger entries against bank statements and maintaining detailed documentation within the spreadsheet enhances reliability. You can also automate error detection through conditional formatting to quickly identify discrepancies.

Which supporting documents must be cross-referenced and attached within the Excel reconciliation file for audit compliance?

For Quarterly Bookkeeping Reconciliation, attach and cross-reference bank statements, general ledger reports, and invoice copies. Ensure supporting payroll records, expense receipts, and tax filings are also included for audit compliance. This comprehensive documentation verifies transaction accuracy and financial integrity.