![]()

The Quarterly Expense Tracking Excel Template for Freelancers simplifies managing and categorizing expenses over a three-month period. It provides clear insights into spending patterns, helping freelancers maintain accurate financial records for tax purposes and budgeting. Customizable fields allow for tracking income sources alongside expenses, improving overall financial organization.

Quarterly Expense Tracking Excel Template for Freelancers

A Quarterly Expense Tracking Excel Template for Freelancers is designed to help independent professionals organize and monitor their expenses on a quarterly basis. It typically contains sections for categorizing costs, tracking payment dates, and summarizing totals for tax and budgeting purposes. This document is essential for maintaining clear financial records and making informed business decisions.

It is important to include accurate expense categories, incorporate formulas for automatic calculations, and ensure easy customization to fit individual freelancing needs. Regular updates and backups of the template can prevent data loss and improve financial accuracy. Including visual charts or summaries can also enhance expense analysis for freelancers.

Freelance Income and Expense Tracker with Quarterly Summary

A Freelance Income and Expense Tracker is a vital document that helps freelancers monitor their earnings and expenditures efficiently. It typically contains detailed entries of invoices sent, payments received, and costs incurred.

This document also includes a Quarterly Summary to provide a clear overview of financial performance over three months. Regular updates and accurate categorization are essential for effective tax preparation and financial planning.

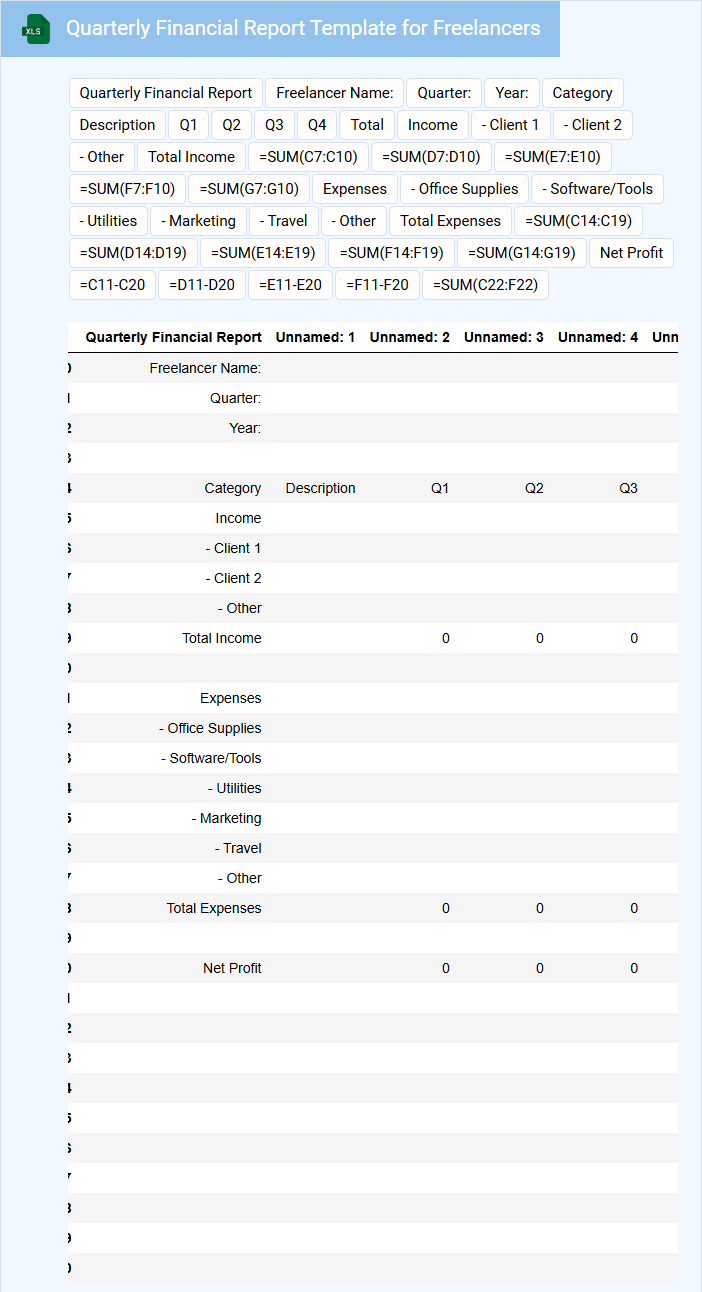

Quarterly Financial Report Template for Freelancers

What does a Quarterly Financial Report Template for Freelancers usually contain?

This document typically includes sections for income tracking, expense categorization, and profit calculation. It helps freelancers organize their financial data quarterly to monitor business performance and plan for taxes effectively.

What is an important suggestion for using this template?

It is essential to update the report regularly with accurate and detailed entries to maintain clarity and avoid missing deductions. Consistent record-keeping enhances financial insight and simplifies end-of-year tax preparations.

Excel Template for Quarterly Project Expense Tracking

An Excel Template for Quarterly Project Expense Tracking typically contains detailed records of all expenses incurred during each quarter. It includes sections for budget allocation, actual spending, and variance analysis to help monitor project costs effectively.

This type of document is essential for maintaining financial transparency and ensuring projects stay within budget. Important suggestions include regularly updating expense entries and categorizing costs accurately to enable insightful financial reporting.

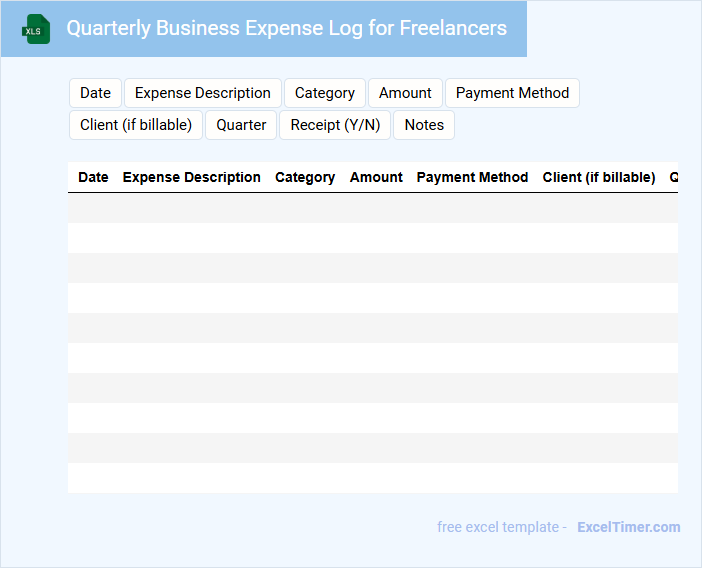

Quarterly Business Expense Log for Freelancers

A Quarterly Business Expense Log for freelancers is a document that records all business-related expenses incurred over a three-month period. It typically includes details such as date, amount, category, and purpose of each expense. Maintaining this log helps freelancers track costs, prepare for taxes, and manage budgets effectively.

Important elements to include are clear categorization of expenses, accurate receipt documentation, and regular updates to ensure completeness. Freelancers should also use this log to identify deductible expenses and monitor financial health. Consistency in maintaining this log enhances financial organization and simplifies tax reporting.

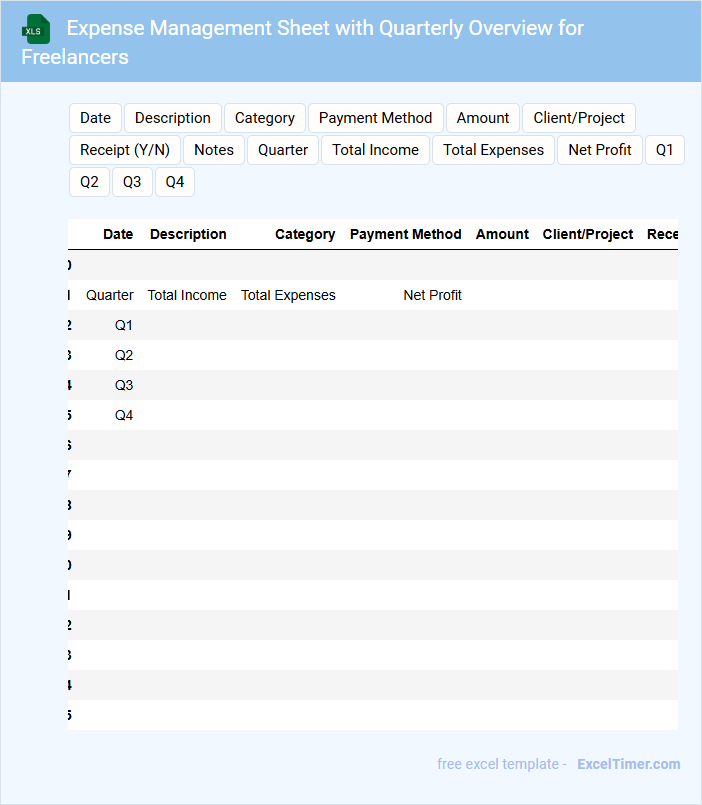

Expense Management Sheet with Quarterly Overview for Freelancers

An Expense Management Sheet for freelancers typically contains detailed records of all business-related expenses categorized by type and date. It includes a quarterly overview to help track spending patterns and budget adherence over time. This document is essential for accurate financial planning and tax preparation.

Freelancers’ Quarterly Budget Planner with Expense Tracking

Freelancers' Quarterly Budget Planners with Expense Tracking typically contain detailed financial summaries to help independent workers manage income and expenses efficiently.

- Income sources: Clearly list all streams of income to maintain accurate earnings records.

- Expense categories: Organize expenses into categories like tools, subscriptions, and travel for better budgeting.

- Quarterly summaries: Include summaries for reviewing profit, loss, and overall financial health each quarter.

Quarterly Invoice and Expense Tracker for Freelance Professionals

The Quarterly Invoice and Expense Tracker is a crucial document for freelance professionals to monitor their earnings and expenditures over a three-month period. It helps in maintaining organized financial records, facilitating easier tax filings and financial planning.

This tracker usually contains sections for invoice details, payment status, expense categories, and total amounts. An important suggestion is to regularly update the tracker to ensure accurate and timely financial management.

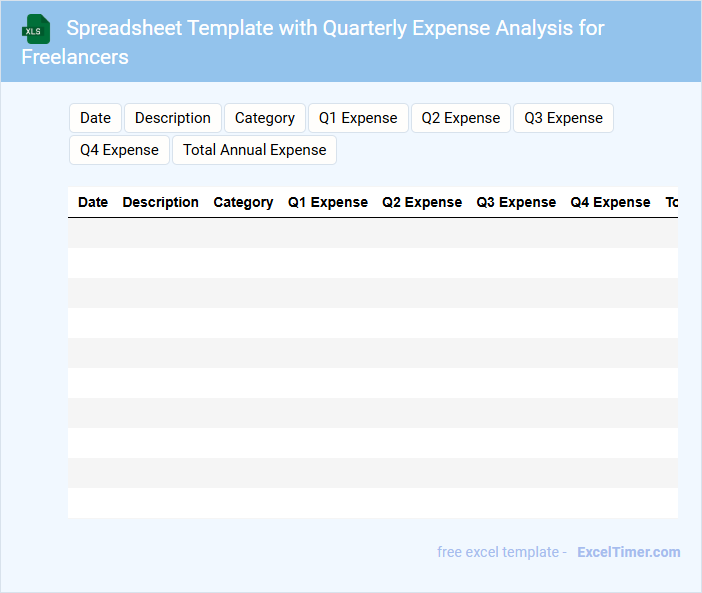

Spreadsheet Template with Quarterly Expense Analysis for Freelancers

A Spreadsheet Template with Quarterly Expense Analysis for Freelancers typically contains detailed expense categories, income tracking, and summary charts to help manage finances effectively. It includes columns for date, description, amount, and category to ensure all transactions are organized clearly. This document is essential for freelancers to monitor cash flow, prepare for tax season, and optimize budgeting by reviewing quarterly trends.

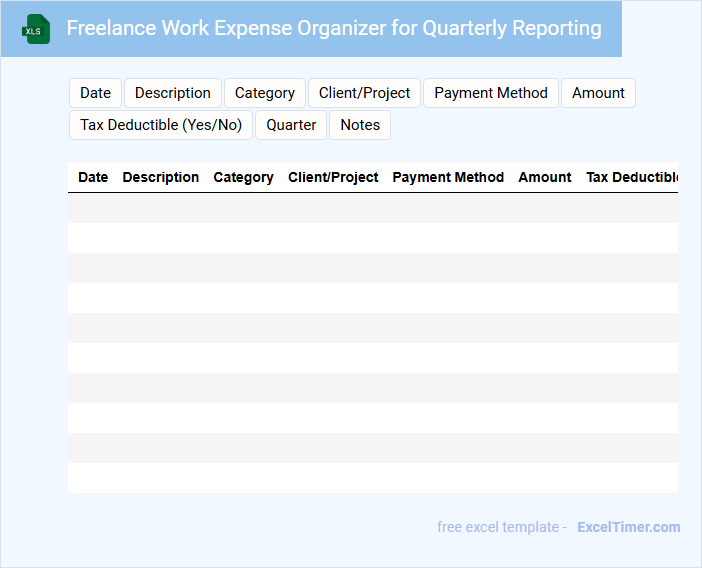

Freelance Work Expense Organizer for Quarterly Reporting

What does a Freelance Work Expense Organizer for Quarterly Reporting typically contain? This document usually includes detailed records of all business-related expenses, such as receipts, invoices, and payment dates, organized by category. It helps freelancers accurately track their expenditures to simplify quarterly tax reporting and ensure compliance with financial regulations.

Why is maintaining an accurate Freelance Work Expense Organizer important? Keeping precise and up-to-date expense records allows freelancers to maximize their tax deductions and avoid errors during tax filing. It is essential to regularly update and categorize expenses to streamline the reporting process and support financial decision-making.

Excel Tracker for Quarterly Freelance Business Expenses

What information is typically contained in an Excel Tracker for Quarterly Freelance Business Expenses? This document usually includes detailed records of all expenses incurred during each quarter, such as receipts, invoices, and payment dates. It helps freelancers monitor spending, categorize expenses, and prepare accurate financial reports for tax purposes.

What important features should be included in this tracker? Essential elements include clearly defined expense categories, formulas to calculate totals and quarterly summaries, and fields for notes or descriptions to maintain clarity. Additionally, incorporating a timeline or date filter enhances the user's ability to track expenses efficiently over time.

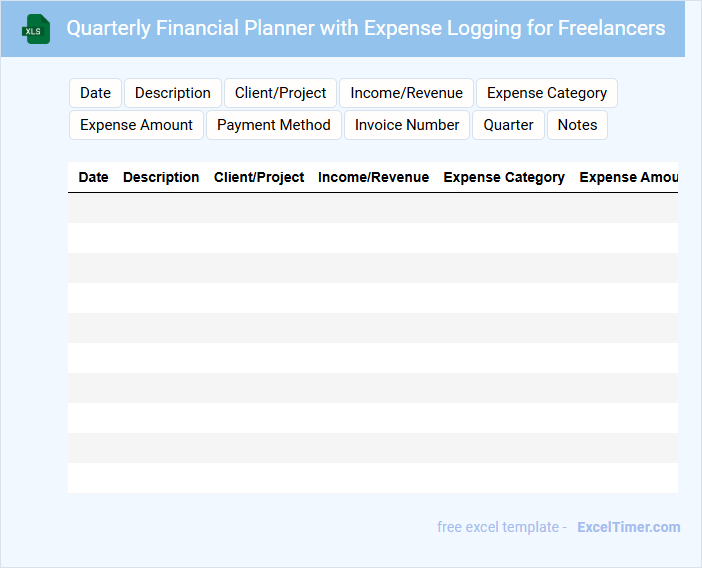

Quarterly Financial Planner with Expense Logging for Freelancers

A Quarterly Financial Planner for freelancers typically contains detailed records of income streams and expense tracking over a three-month period. It helps individuals manage cash flow, plan for taxes, and set budgetary goals efficiently. Including an expense logging feature allows for accurate monitoring of spending, ensuring better financial decisions.

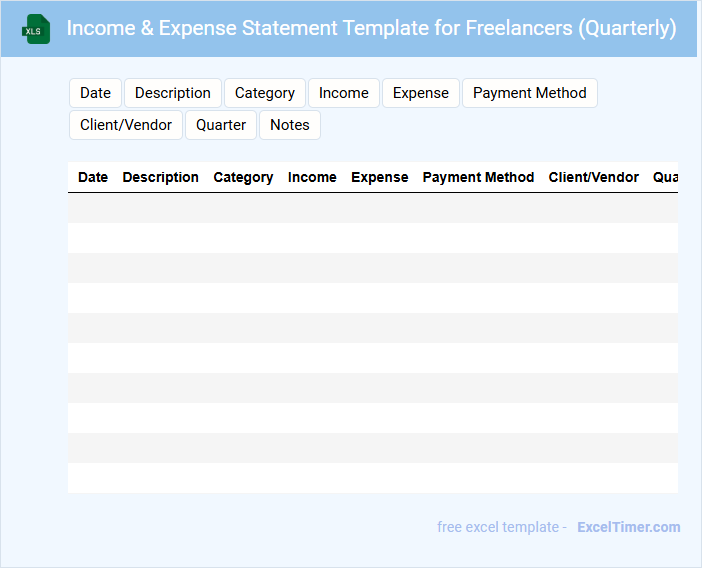

Income & Expense Statement Template for Freelancers (Quarterly)

The Income & Expense Statement Template for freelancers typically contains a detailed record of all earnings and expenditures over a specific quarter. This document helps freelancers track their financial performance and prepare for tax filings efficiently.

It usually includes sections for income sources, categorized expenses, and net profit calculations. An important suggestion is to consistently update the template to maintain accurate financial records and support informed decision-making.

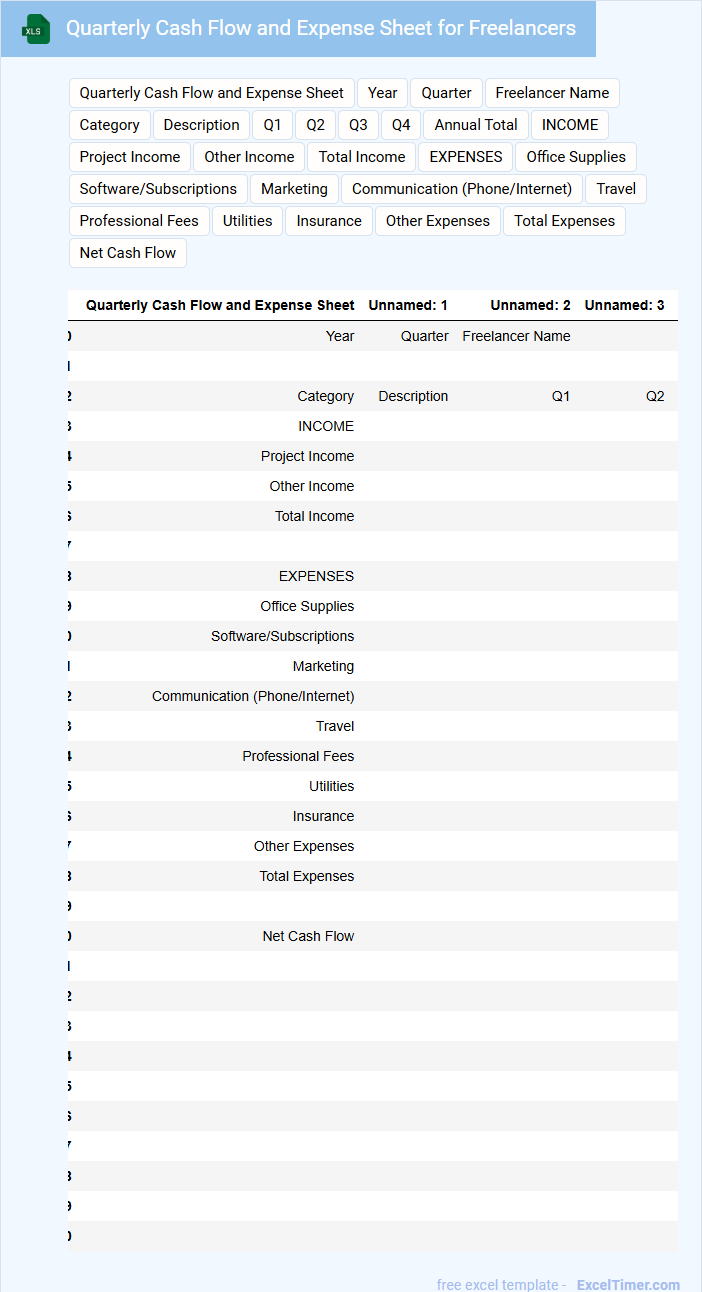

Quarterly Cash Flow and Expense Sheet for Freelancers

A Quarterly Cash Flow and Expense Sheet for Freelancers is a financial document that tracks income and expenses over a three-month period to help manage budgeting effectively. It provides insights into cash inflows and outflows, ensuring freelancers maintain financial stability.

- Include all sources of income and categorize expenses accurately.

- Regularly update the sheet to reflect real-time financial status.

- Use it to identify trends and adjust spending or saving strategies accordingly.

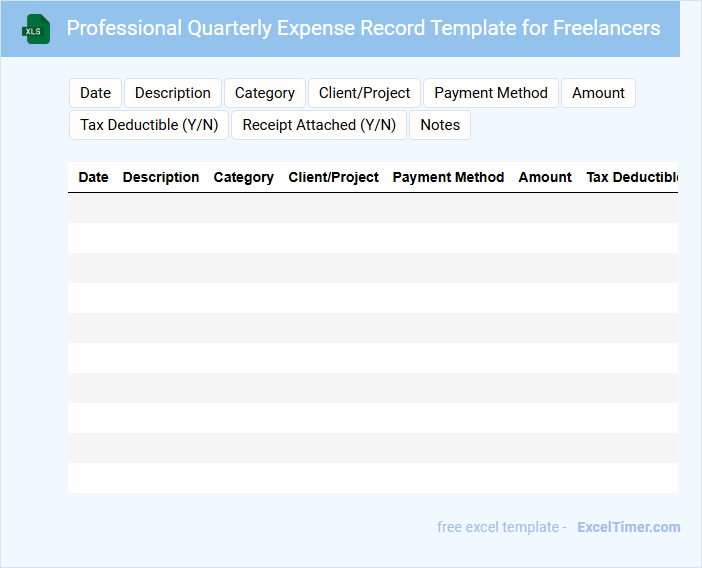

Professional Quarterly Expense Record Template for Freelancers

This Professional Quarterly Expense Record Template for Freelancers is designed to track and organize all business-related expenses efficiently over a three-month period.

- Detailed Categorization: Ensure expenses are sorted by categories such as equipment, travel, and software.

- Accurate Date Logging: Record the exact dates of transactions to maintain chronological order and facilitate audits.

- Receipt Documentation: Attach scanned copies or photos of receipts to verify each expense claimed.

What are the essential columns needed in a quarterly expense tracking Excel sheet for freelancers?

Essential columns in a quarterly expense tracking Excel sheet for freelancers include Date, Expense Category, Vendor, Description, Payment Method, Amount, and Receipt Status. Your sheet should also feature a Total Expenses column to summarize spending each quarter. Proper organization helps you monitor cash flow and maximize tax deductions efficiently.

How can you categorize expenses to optimize tax deductions as a freelancer?

To optimize tax deductions as a freelancer, categorize your expenses into clearly defined groups such as office supplies, travel, software subscriptions, and client-related costs. Use an Excel sheet to track each category quarterly, ensuring accurate records for tax reporting. Your organized expense tracking enhances deduction accuracy and simplifies filing.

Which Excel formulas help automate quarterly expense summaries and reports?

Excel formulas like SUMIFS and IFERROR help automate quarterly expense summaries by aggregating costs based on date ranges and categories. PivotTables can dynamically generate detailed quarterly reports, while CONCATENATE or TEXT functions customize report labels. You can streamline your freelance expense tracking using these powerful formulas and tools.

How do you use filters or pivot tables to analyze spending trends across different quarters?

Use filters in Excel to isolate expenses by category or quarter, enabling focused analysis of spending patterns. Pivot tables summarize data by aggregating quarterly expenses, revealing trends and comparisons across different time periods. Incorporate row labels for expense categories and column labels for quarters to visualize spending fluctuations effectively.

Which data validation techniques ensure accuracy when entering transactions in the expense tracker?

Data validation techniques such as drop-down lists for expense categories, date format restrictions, and numeric limits for transaction amounts ensure accuracy when entering data in your quarterly expense tracking document. Using required fields prevents missing information, while error alerts prompt corrections immediately. These methods reduce data entry errors and maintain consistent, reliable financial records.