The Quarterly Financial Report Excel Template for Small Businesses simplifies tracking income, expenses, and profit margins, making financial analysis efficient and accessible. It provides customizable sheets for revenue, costs, and cash flow, ensuring accurate quarterly insights. Small business owners benefit from automated calculations and visual charts that aid in strategic decision-making.

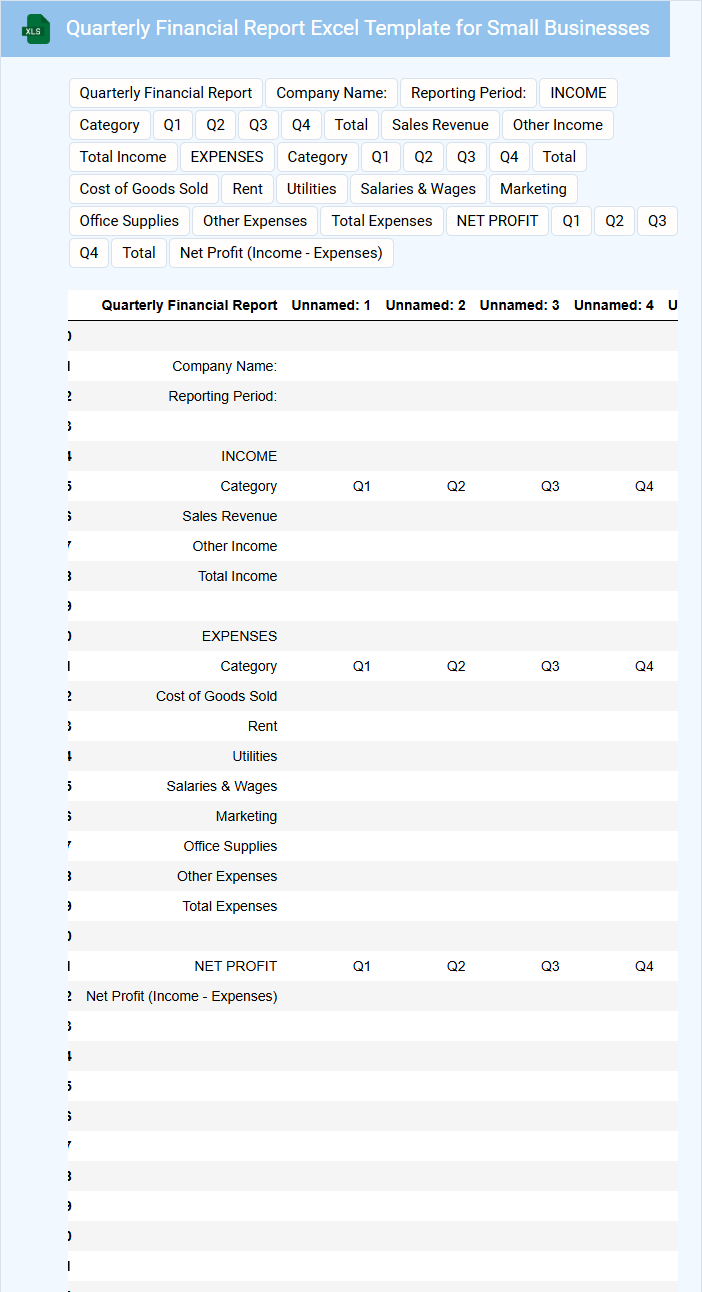

Quarterly Financial Report Excel Template for Small Businesses

The Quarterly Financial Report Excel Template for small businesses typically includes detailed financial data such as income statements, balance sheets, and cash flow summaries. This document helps business owners track their financial performance over a three-month period. Ensuring accuracy in data entry is essential for generating reliable financial insights.

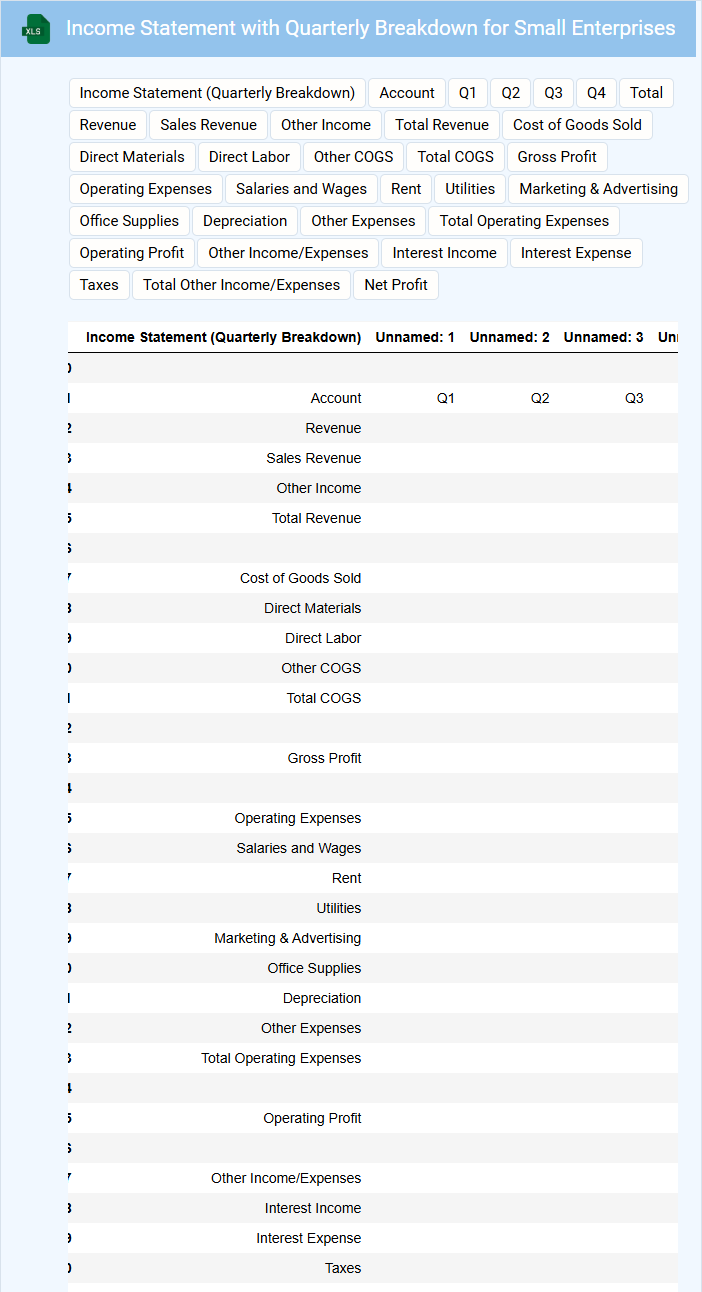

Income Statement with Quarterly Breakdown for Small Enterprises

An Income Statement with a quarterly breakdown for small enterprises provides a detailed overview of the company's financial performance over each quarter. It typically contains revenue, expenses, and net profit figures segmented by three-month periods to identify trends and seasonality. Ensuring accuracy in data entry and consistent categorization of income and expenses is crucial for meaningful analysis.

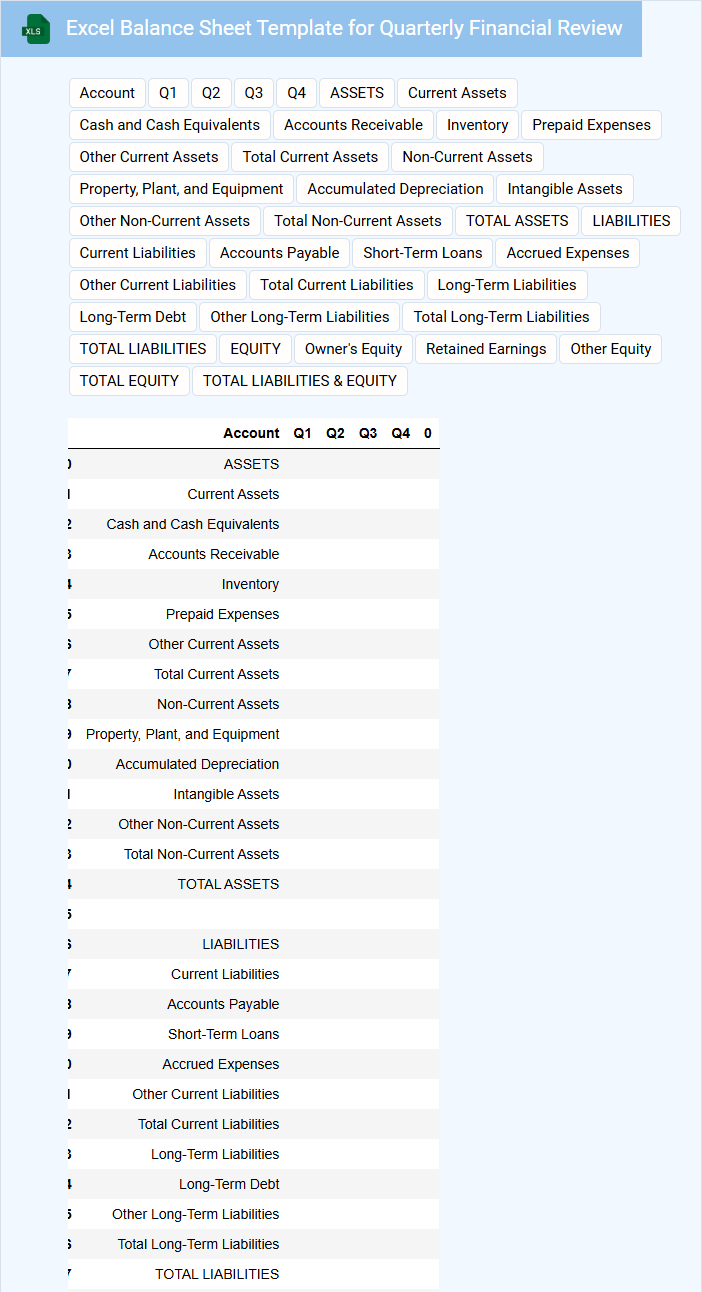

Excel Balance Sheet Template for Quarterly Financial Review

An Excel Balance Sheet Template is a structured document used to present a company's assets, liabilities, and equity at a specific point in time. This type of document is essential for conducting a quarterly financial review to assess the financial health and performance of a business. It typically includes sections for current and fixed assets, current and long-term liabilities, and shareholders' equity.

For an effective quarterly financial review, it is important to ensure that all financial data is accurate and up-to-date. Including comparative columns for previous quarters can help identify trends and financial changes over time. Additionally, incorporating clear labels and summary totals enhances readability and facilitates better decision-making.

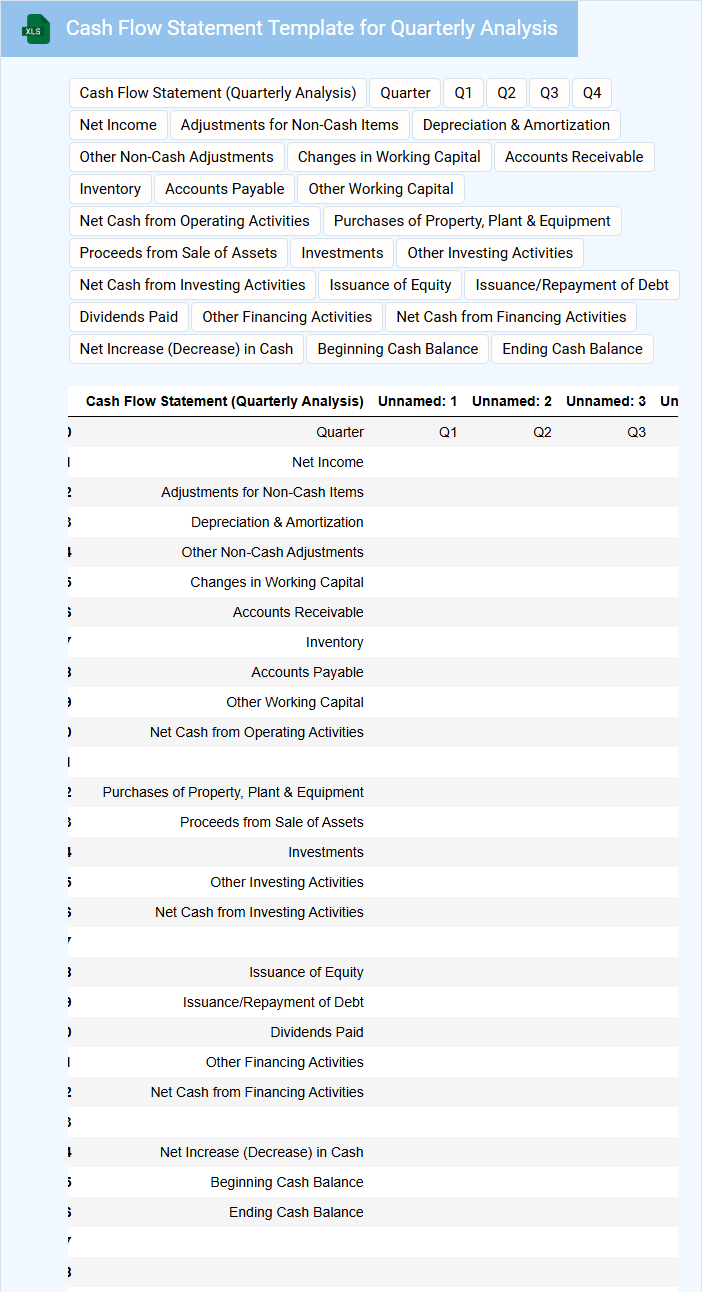

Cash Flow Statement Template for Quarterly Analysis

A Cash Flow Statement Template for Quarterly Analysis typically contains detailed records of cash inflows and outflows over each quarter. It helps businesses and analysts track liquidity and assess financial health on a quarterly basis.

- Include separate sections for operating, investing, and financing cash flows to provide clear insights.

- Ensure columns or rows distinctly label each quarter for streamlined comparison.

- Add space for notes or explanations to clarify significant cash movements.

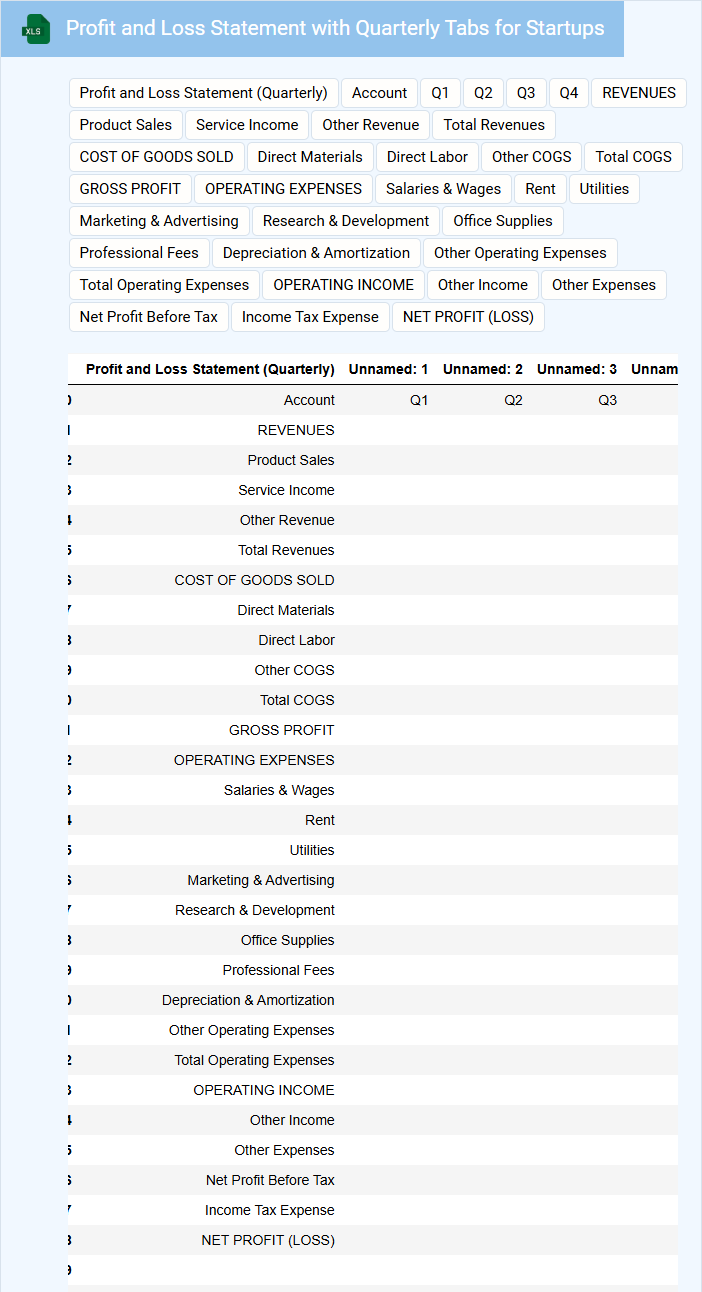

Profit and Loss Statement with Quarterly Tabs for Startups

A Profit and Loss Statement with Quarterly Tabs for Startups is a financial document that summarizes revenues, costs, and expenses over specific quarters to evaluate profitability. It provides a clear overview of financial performance, enabling better decision-making for growth.

- Include accurate revenue streams broken down by product or service for each quarter.

- Detail all operating expenses and categorize fixed versus variable costs.

- Highlight net profit or loss and compare quarterly trends to identify growth patterns.

Expense Tracking Spreadsheet for Quarterly Financial Reports

An Expense Tracking Spreadsheet is a vital tool used to record and organize all business expenditures systematically. It typically contains categorized entries, dates, amounts, and descriptions to enable detailed financial analysis. For quarterly financial reports, maintaining accuracy and consistency in data entry is crucial to provide a clear overview of spending patterns and budget adherence.

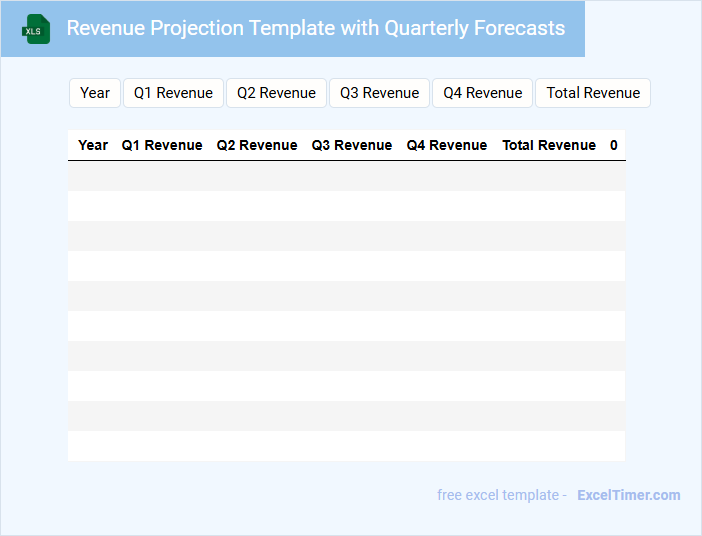

Revenue Projection Template with Quarterly Forecasts

Revenue Projection Template with Quarterly Forecasts typically contains detailed financial estimates, including expected income streams and timing, to help businesses plan and track revenue over each quarter.

- Accurate Historical Data: Incorporate past revenue figures for reliable forecasting assumptions.

- Clear Quarterly Breakdown: Segment projections by quarter to monitor trends and seasonal variations effectively.

- Adjustable Variables: Include customizable inputs like sales growth rate or market changes to refine projections.

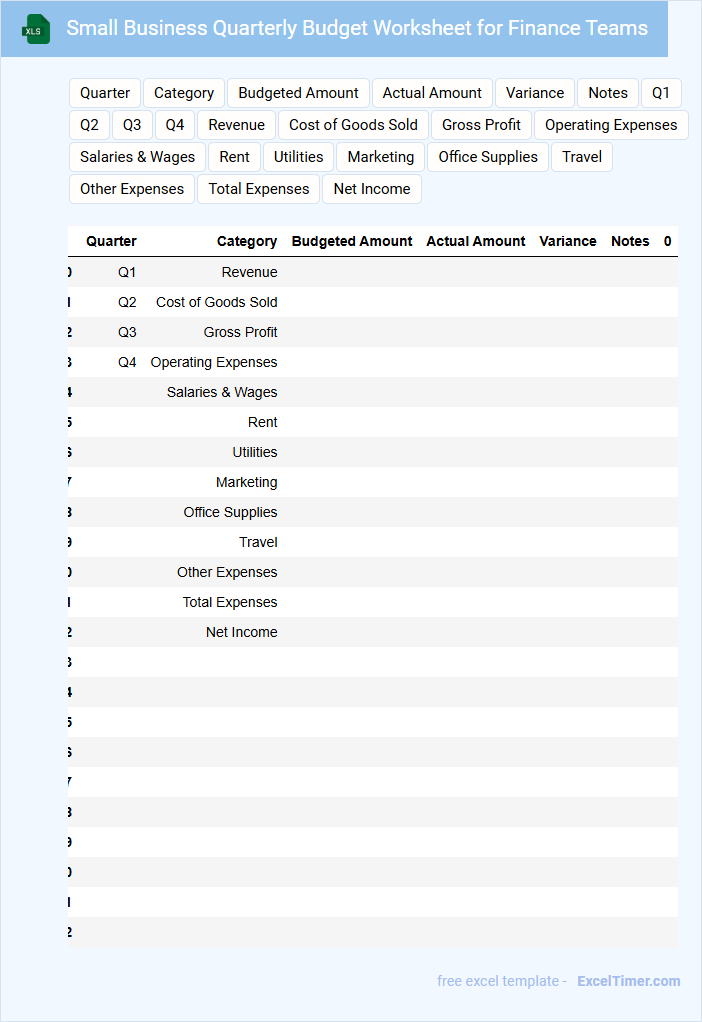

Small Business Quarterly Budget Worksheet for Finance Teams

A Small Business Quarterly Budget Worksheet is designed to help finance teams track income, expenses, and profits over a three-month period. It typically contains sections for projected revenue, fixed and variable costs, and cash flow analysis. This document ensures that businesses maintain financial control and make informed decisions for the upcoming quarter.

Important elements to include are detailed expense categories, realistic revenue forecasts, and a contingency plan for unexpected costs. Regularly updating the worksheet helps identify financial trends and adjust strategies accordingly. Clear labeling and concise notes enhance usability and accuracy during financial reviews.

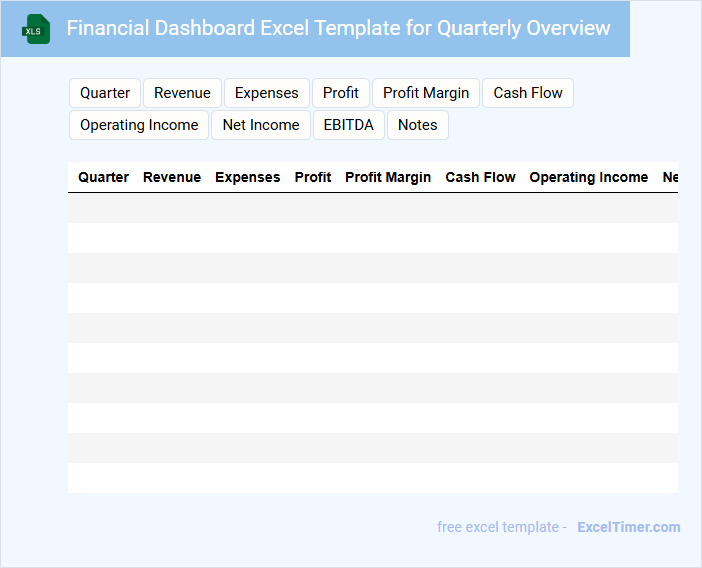

Financial Dashboard Excel Template for Quarterly Overview

A Financial Dashboard Excel Template for Quarterly Overview typically contains organized data summaries, key financial metrics, and visual charts that track performance over the quarter. It helps users easily monitor income, expenses, profits, and budget variances in one place for effective decision-making. Including interactive elements like slicers or drop-down menus enhances usability by allowing dynamic data filtering.

Important features to include are clear KPI indicators such as revenue growth, cost breakdowns, and cash flow status for quick insights. Incorporating trend lines and comparison graphs helps highlight performance changes across quarters. Ensuring the template supports automatic data updates and has a clean, intuitive layout will optimize efficiency and accessibility for users.

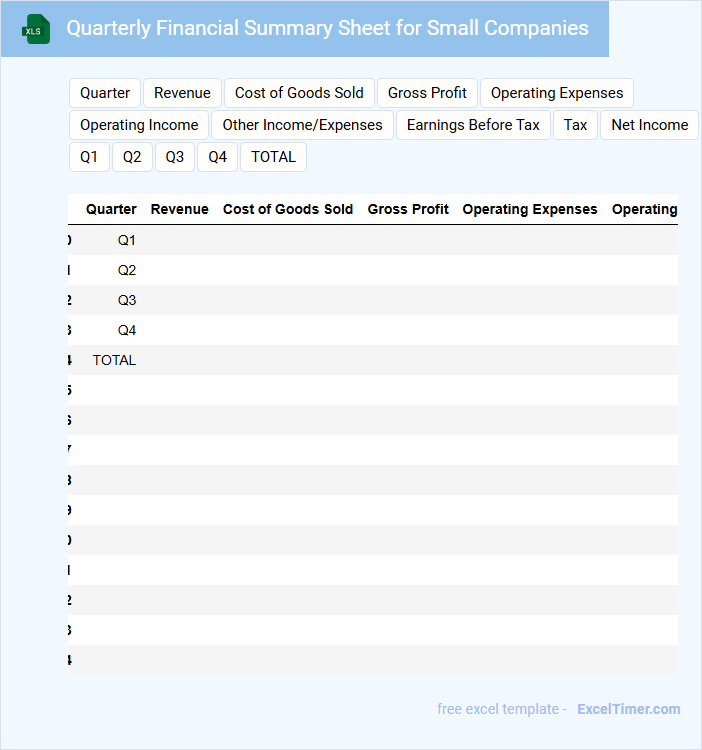

Quarterly Financial Summary Sheet for Small Companies

The Quarterly Financial Summary Sheet typically contains key financial data such as revenue, expenses, profits, and cash flow for a three-month period. It provides a snapshot of a small company's financial health and performance.

Important elements to include are clear categorization of income and expenses and comparison with previous quarters. Ensuring accuracy in reported numbers is crucial for informed business decisions.

KPI Tracker with Quarterly Metrics for Financial Reporting

A KPI Tracker with Quarterly Metrics for Financial Reporting is a vital document used to monitor and evaluate key performance indicators over specific fiscal periods. It typically contains data on revenue, expenses, profit margins, and other financial metrics organized by quarter to help businesses assess their financial health. For effective reporting, ensure the tracker includes clear visualizations, consistent data updates, and alignment with overall strategic goals.

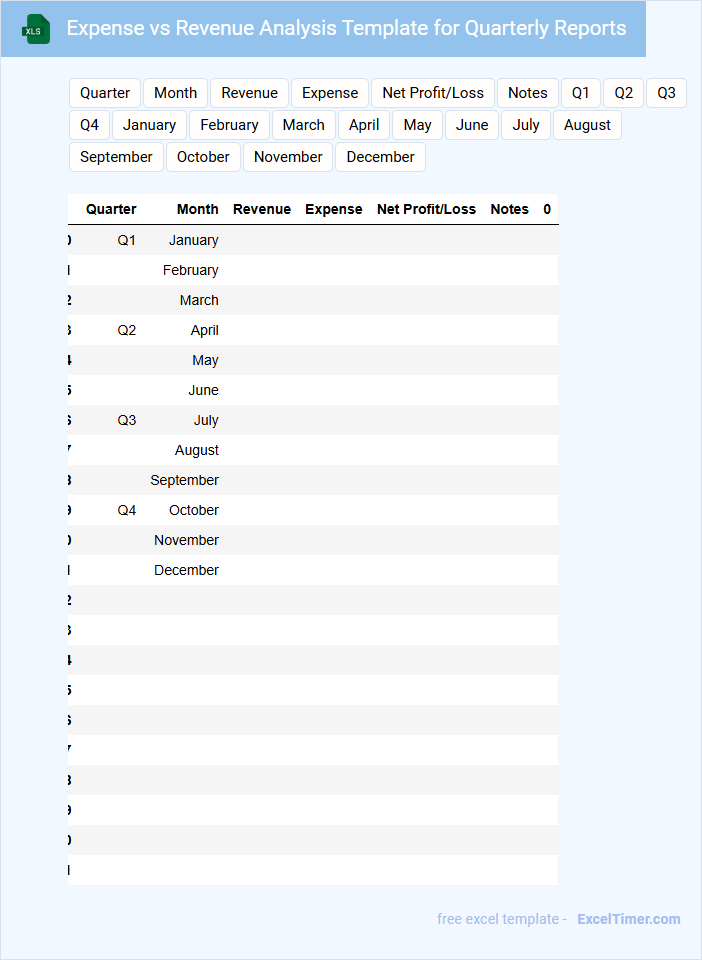

Expense vs Revenue Analysis Template for Quarterly Reports

This Expense vs Revenue Analysis Template for quarterly reports is designed to systematically compare the costs incurred against the income generated within a three-month period. It typically contains detailed entries of various expenses, multiple revenue streams, and summary calculations that highlight profitability. Including visual aids such as graphs or charts enhances comprehension and decision-making.

Its primary purpose is to provide clear insights into financial performance, helping stakeholders assess business efficiency and identify trends over time. Regular updates and accurate data entry are crucial to maintain the integrity and usefulness of the report. Ensuring all categories are comprehensive and up to date maximizes its effectiveness.

Quarterly Financial Comparison Tool for Growing Businesses

A Quarterly Financial Comparison Tool is designed to help growing businesses analyze their financial performance over consecutive quarters. It typically contains detailed revenue, expense, and profit data, along with key performance indicators (KPIs) that highlight trends and areas for improvement. Utilizing such a tool enables companies to make informed decisions based on accurate, comparative financial insights.

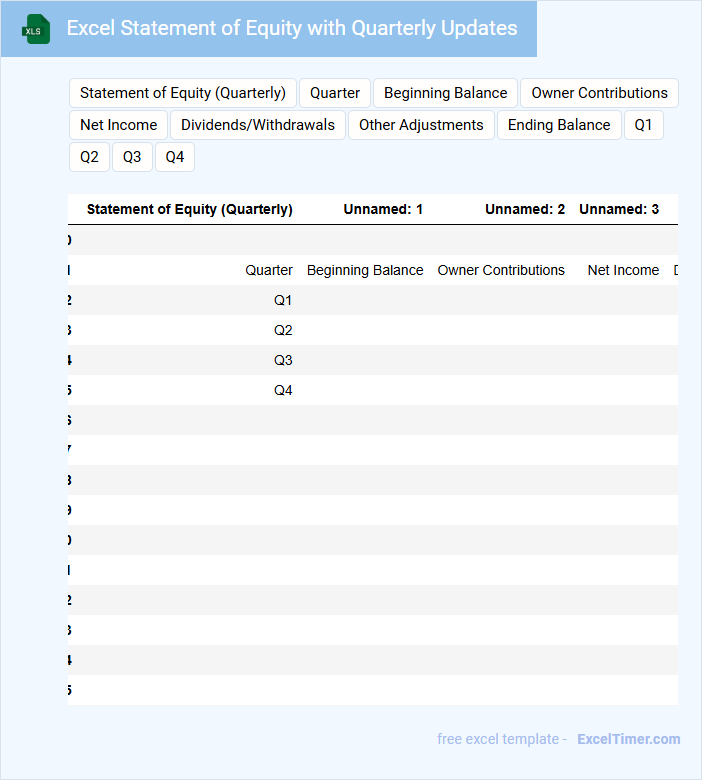

Excel Statement of Equity with Quarterly Updates

An Excel Statement of Equity typically contains detailed records of a company's equity changes over time, including share capital, retained earnings, and dividends. It provides a clear overview of the movements in equity accounts during a specific period, often quarterly.

Regular updates ensure accuracy and reflect recent financial activities such as investments, profits, or losses. For effective quarterly tracking, it is important to include precise date entries and consistent formatting to facilitate easy comparison and analysis.

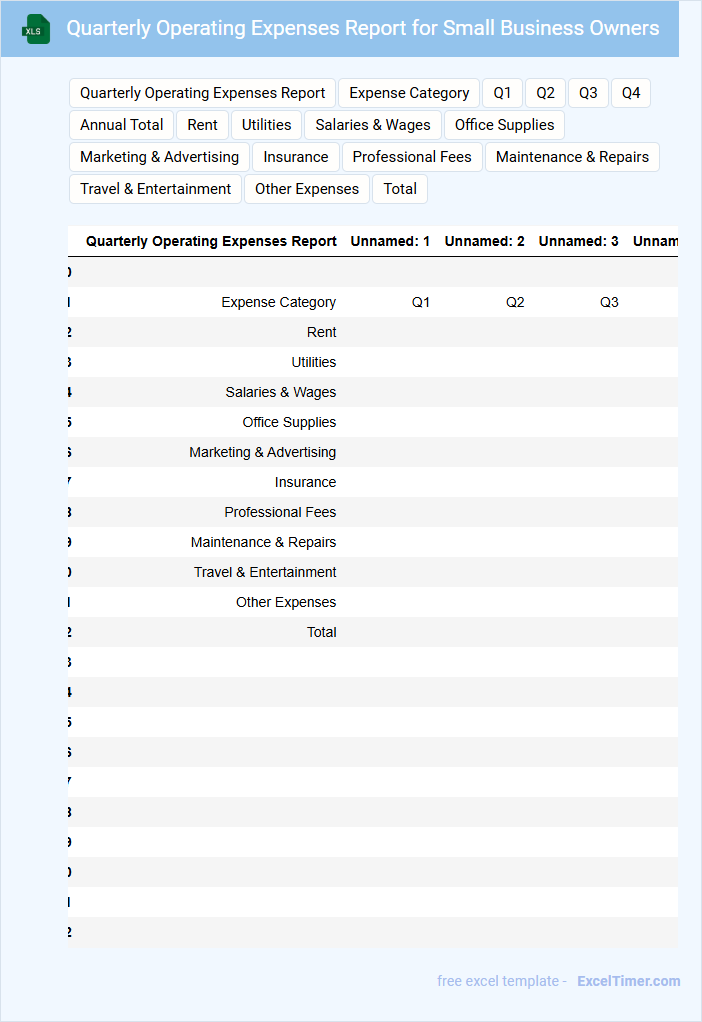

Quarterly Operating Expenses Report for Small Business Owners

The Quarterly Operating Expenses Report is a financial document that outlines all expenditures a small business incurs over a three-month period. It typically includes categories such as rent, utilities, salaries, and supplies, providing a clear overview of where money is being spent. This report helps business owners track spending trends and make informed budgeting decisions.

What key financial statements are included in a quarterly financial report for small businesses?

A quarterly financial report for small businesses typically includes the income statement, balance sheet, and cash flow statement. The income statement details revenue, expenses, and net profit for the quarter. The balance sheet provides a snapshot of assets, liabilities, and equity, while the cash flow statement tracks cash inflows and outflows during the period.

How does comparing quarterly financial reports help track business growth and trends?

Comparing quarterly financial reports enables you to identify revenue patterns, expenses, and profit margins over time, revealing critical growth trends. Detailed analysis of these reports highlights seasonal fluctuations and financial strengths or weaknesses. This ongoing evaluation supports informed decision-making to drive sustained business success.

Which critical performance indicators should be analyzed in a quarterly financial report?

Key performance indicators in a quarterly financial report for small businesses include revenue growth, net profit margin, and cash flow. Analyzing accounts receivable turnover and operating expenses provides insight into efficiency and cost management. Monitoring these metrics helps assess financial health and guide strategic decisions.

What are the required supporting documents or worksheets for quarterly financial reporting in Excel?

Required supporting documents for quarterly financial reporting in Excel include the Income Statement worksheet showing revenue and expenses, the Balance Sheet worksheet detailing assets, liabilities, and equity, and the Cash Flow Statement worksheet tracking cash inflows and outflows. Expense tracking worksheets categorize operational costs and support accurate expense reporting. Sales and revenue worksheets provide detailed transactional data essential for comprehensive quarterly financial analysis.

How can Excel formulas and charts enhance the accuracy and presentation of a quarterly financial report?

Excel formulas automate complex calculations, reducing errors and ensuring precise financial data analysis in quarterly reports. Charts visually highlight revenue trends, expense breakdowns, and profit margins, making information easier to interpret for small business stakeholders. Using Excel's built-in functions and dynamic graphs improves both the accuracy and clarity of financial presentations.