The Quarterly Tax Preparation Excel Template for Self-Employed Professionals streamlines tax calculations and organizes income and expenses efficiently. It provides customizable fields for tracking deductions, estimated tax payments, and profit margins, ensuring accurate quarterly filings. This template helps self-employed individuals maintain compliance and avoid penalties by simplifying tax planning throughout the year.

Quarterly Income Tracker for Self-Employed Professionals

A Quarterly Income Tracker is a document used by self-employed professionals to monitor and record their income over each quarter. It helps in organizing financial data systematically for better tax preparation and financial planning.

This type of document usually contains detailed entries of earnings, categorized by source or client, and includes dates and amounts received. It is important to regularly update this tracker to ensure accuracy and to identify income trends.

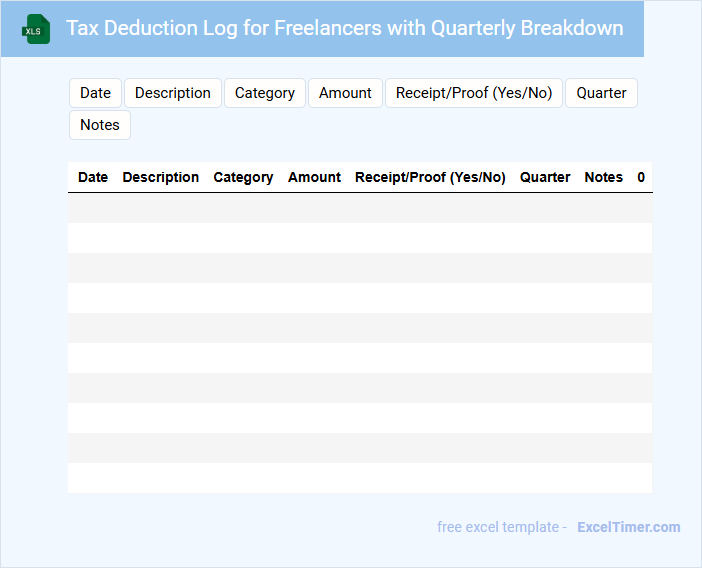

Tax Deduction Log for Freelancers with Quarterly Breakdown

A Tax Deduction Log for freelancers is a crucial document that helps track all deductible expenses throughout the financial year. It ensures accurate recording of expenses to maximize tax savings and maintain compliance with tax regulations.

The log typically contains a quarterly breakdown of income and expenses, categorizing items such as office supplies, travel costs, and professional fees. Keeping this organized not only simplifies tax filing but also provides clear documentation in case of audits.

It is important to update the log regularly and retain all supporting receipts and invoices for verification purposes.

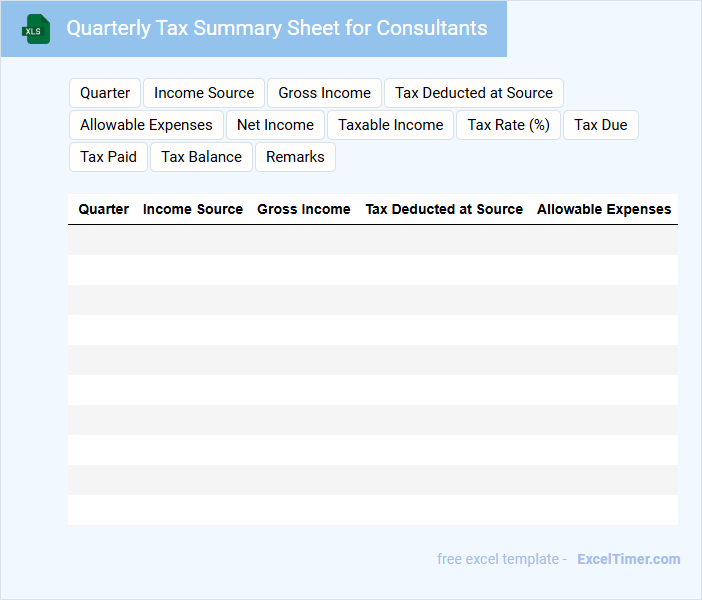

Quarterly Tax Summary Sheet for Consultants

A Quarterly Tax Summary Sheet for Consultants typically contains a detailed overview of income, expenses, and tax payments made during the quarter. This document helps consultants track their financial obligations and prepare for tax filings accurately.

- Include all sources of income and categorize deductible expenses clearly.

- Record tax payments made to avoid underpayment penalties.

- Keep supporting documentation for all entries to ensure compliance and accuracy.

Expenses Tracking Template with Quarterly Tax Categories

An Expenses Tracking Template with quarterly tax categories is designed to help individuals and businesses monitor and organize their expenditures throughout the year. This type of document typically includes sections for categorizing expenses by type and by tax quarter to simplify financial reporting. Using this template ensures accurate tax filing and efficient budgeting by highlighting deductible expenses and tracking cash flow systematically.

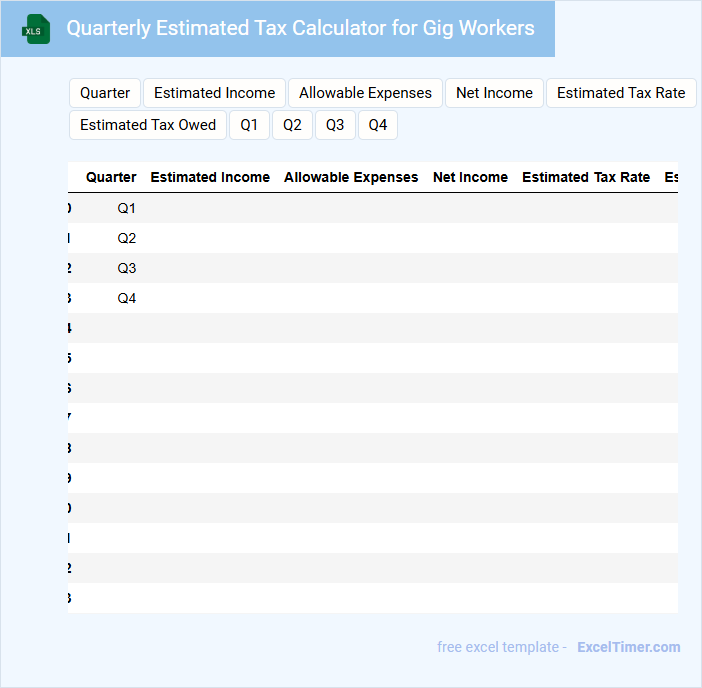

Quarterly Estimated Tax Calculator for Gig Workers

This document typically contains a tool for gig workers to estimate their quarterly tax payments accurately.

- Income Input: Allows users to enter their estimated earnings for the quarter.

- Tax Rate Calculation: Automatically applies appropriate tax rates based on income and deductions.

- Payment Schedule: Provides deadlines and suggested payment amounts to avoid penalties.

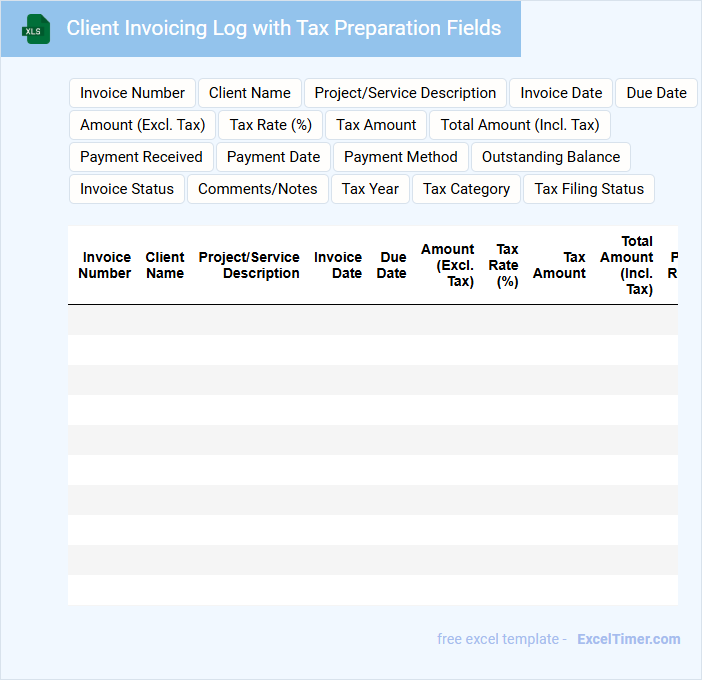

Client Invoicing Log with Tax Preparation Fields

The Client Invoicing Log typically contains detailed records of all transactions between a business and its clients, including invoice numbers, dates, amounts, and payment statuses. This document is essential for tracking revenue and managing client accounts efficiently.

Tax preparation fields within the log include specific columns for tax rates, taxable amounts, and total taxes collected to ensure accurate financial reporting. Maintaining accurate tax information helps in seamless tax filing and compliance.

It is important to regularly update the invoicing log and verify all tax-related entries to prevent discrepancies and support audit readiness.

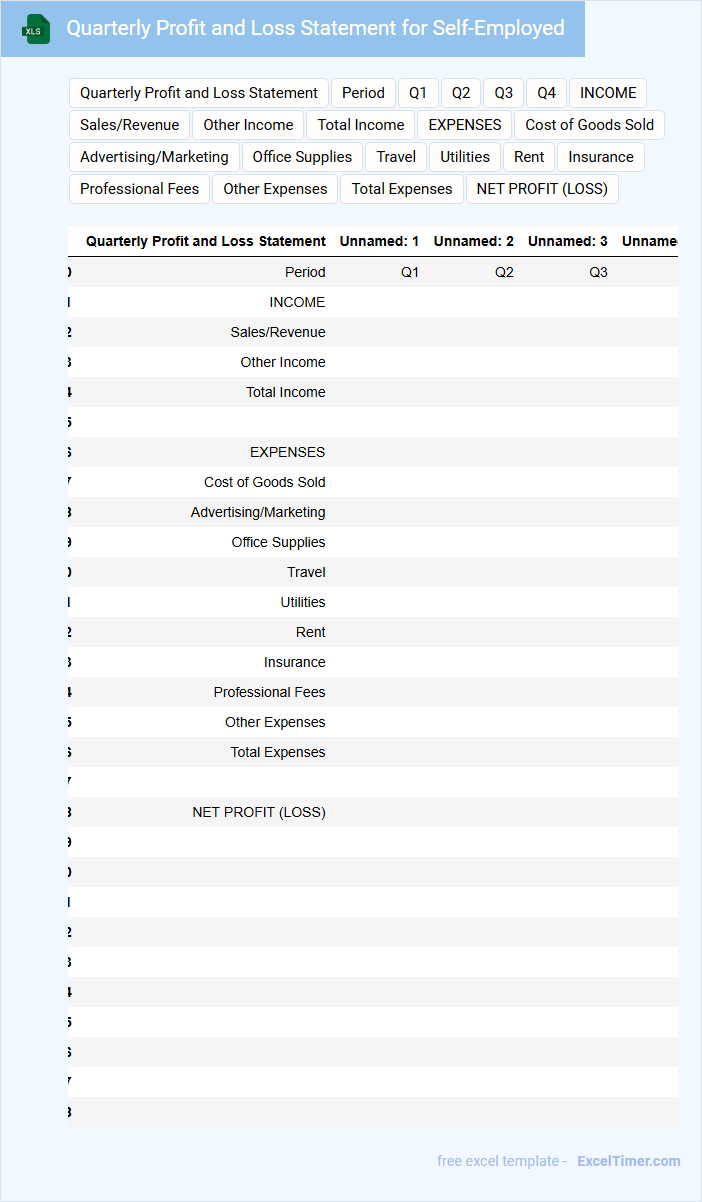

Quarterly Profit and Loss Statement for Self-Employed

The Quarterly Profit and Loss Statement for self-employed individuals typically contains detailed records of income and expenses over a three-month period, highlighting the financial performance during that quarter. This document helps in monitoring cash flow, assessing profitability, and preparing for tax obligations.

Important elements to include are accurate revenue tracking, categorized expenses, and net profit calculations to ensure clarity and usefulness. Keeping this statement organized and up-to-date is essential for making informed business decisions and securing potential funding.

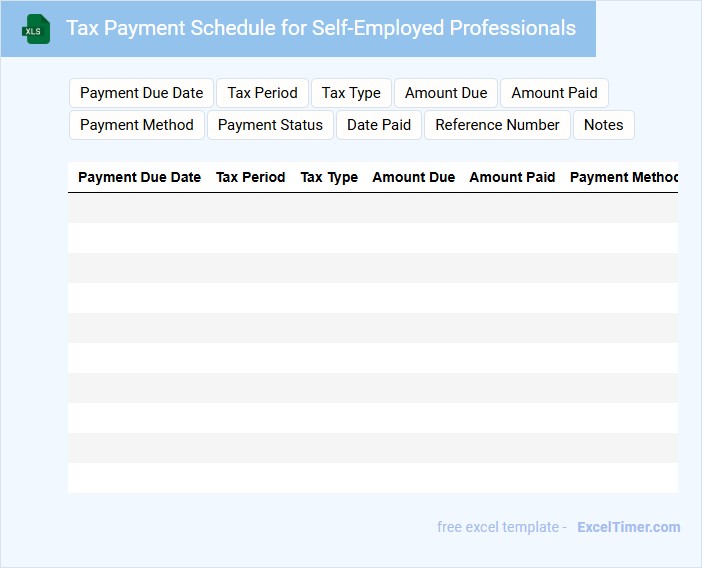

Tax Payment Schedule for Self-Employed Professionals

What information is typically included in a Tax Payment Schedule for Self-Employed Professionals? This document usually contains key dates for estimated tax payments, specific amounts due, and instructions on how to calculate and submit taxes. It helps self-employed individuals stay organized and avoid penalties by ensuring timely tax payments throughout the fiscal year.

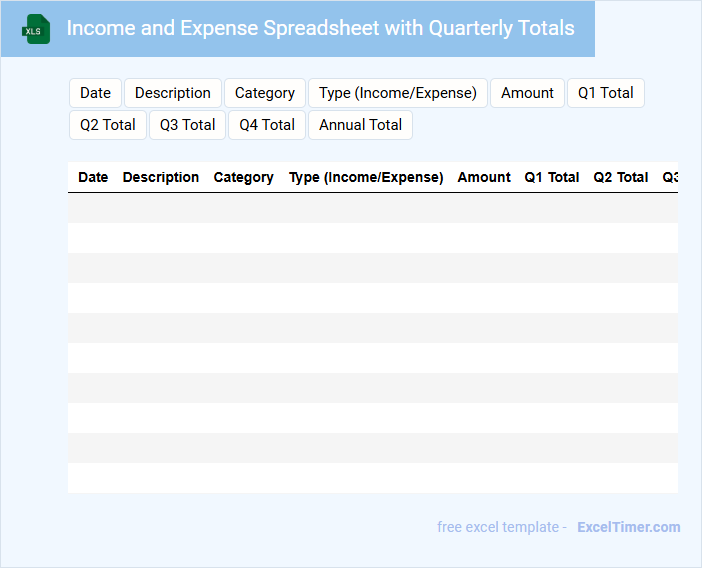

Income and Expense Spreadsheet with Quarterly Totals

An Income and Expense Spreadsheet with Quarterly Totals is a financial document used to track and summarize income and expenses over three-month periods. It helps individuals or businesses monitor their financial performance and manage budget effectively.

- Include categorized income and expense entries for accurate tracking.

- Ensure formulas automatically calculate quarterly totals for clarity.

- Regularly update the spreadsheet to maintain up-to-date financial information.

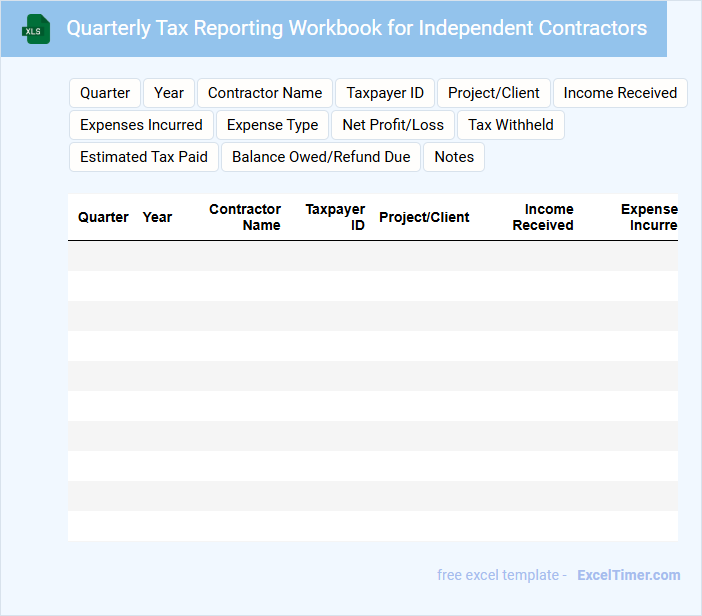

Quarterly Tax Reporting Workbook for Independent Contractors

The Quarterly Tax Reporting Workbook for Independent Contractors typically contains detailed records of income, expenses, and tax deductions on a quarterly basis. It helps track financial transactions to ensure accurate tax calculations and timely payments.

Key elements include estimated tax payments, profit and loss summaries, and documentation of deductible expenses. Regularly updating this workbook is crucial for maintaining compliance and avoiding penalties.

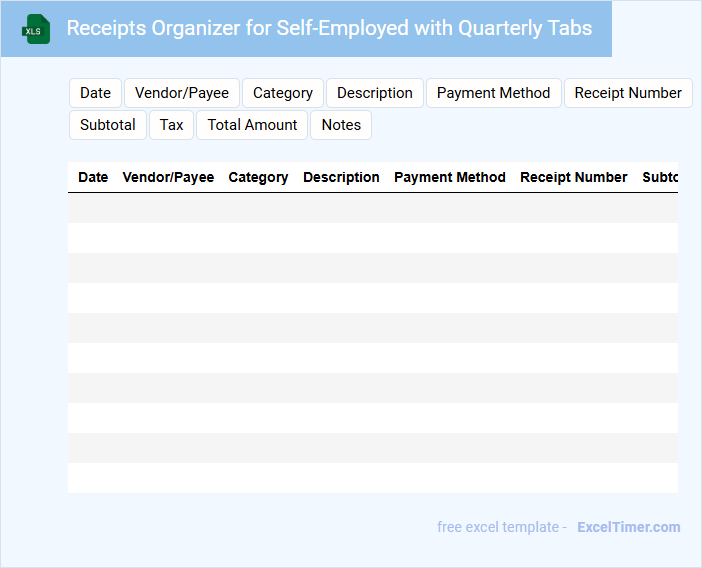

Receipts Organizer for Self-Employed with Quarterly Tabs

A Receipts Organizer for self-employed individuals is a vital tool to systematically store and categorize receipts. It typically includes sections tailored for various expense types and income records to simplify tax preparation.

Quarterly tabs help break down expenses and income by fiscal quarters, making financial tracking and tax filing more manageable. Ensure to regularly update and verify receipts to maintain accurate records.

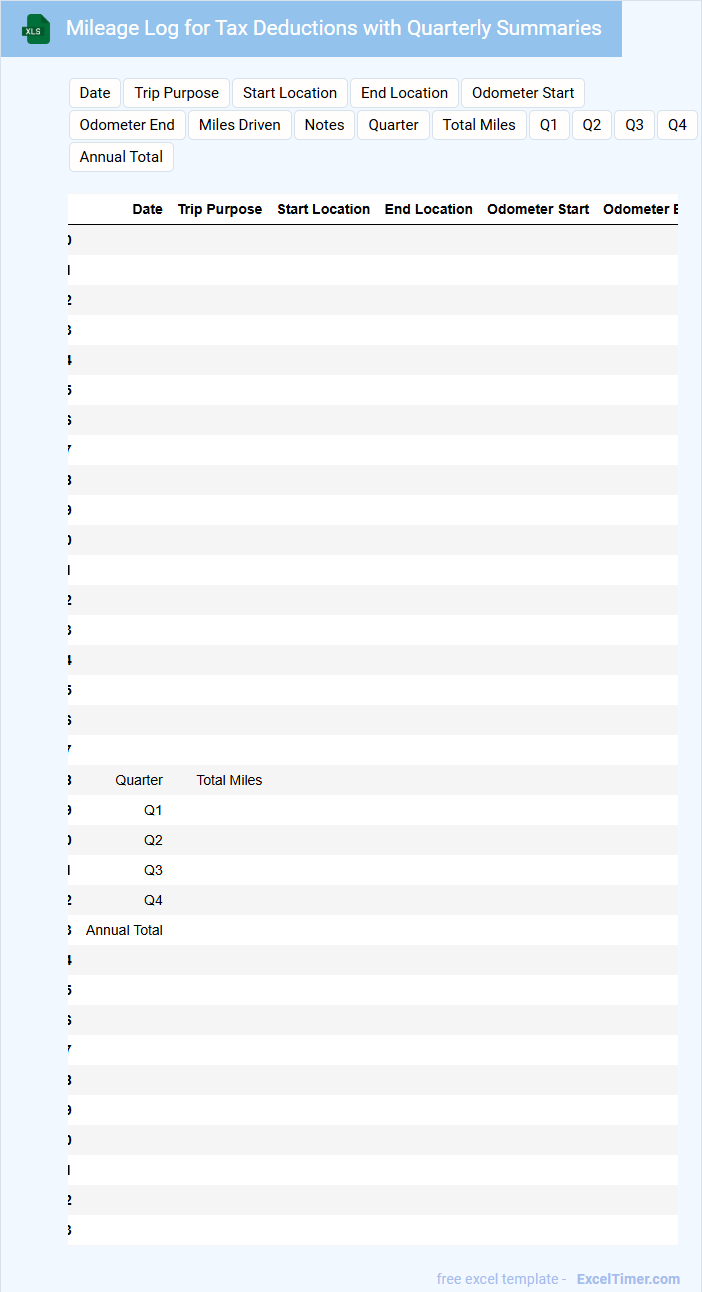

Mileage Log for Tax Deductions with Quarterly Summaries

A Mileage Log for Tax Deductions is a detailed record of all business-related travel, documenting the date, purpose, starting and ending locations, and miles driven. This type of document is crucial for accurately calculating deductible expenses and ensuring compliance with tax regulations. Including quarterly summaries helps in tracking overall mileage trends and simplifying tax filing processes.

Payment Tracker for Projects with Quarterly Tax Estimates

This document typically contains detailed records of project payments alongside quarterly tax estimate calculations to ensure accurate financial tracking and compliance.

- Payment Records: Detailed listings of all payments received and made for each project.

- Tax Estimates: Calculations of quarterly tax obligations based on project income and expenses.

- Compliance Monitoring: Regular updates to ensure alignment with tax deadlines and legal requirements.

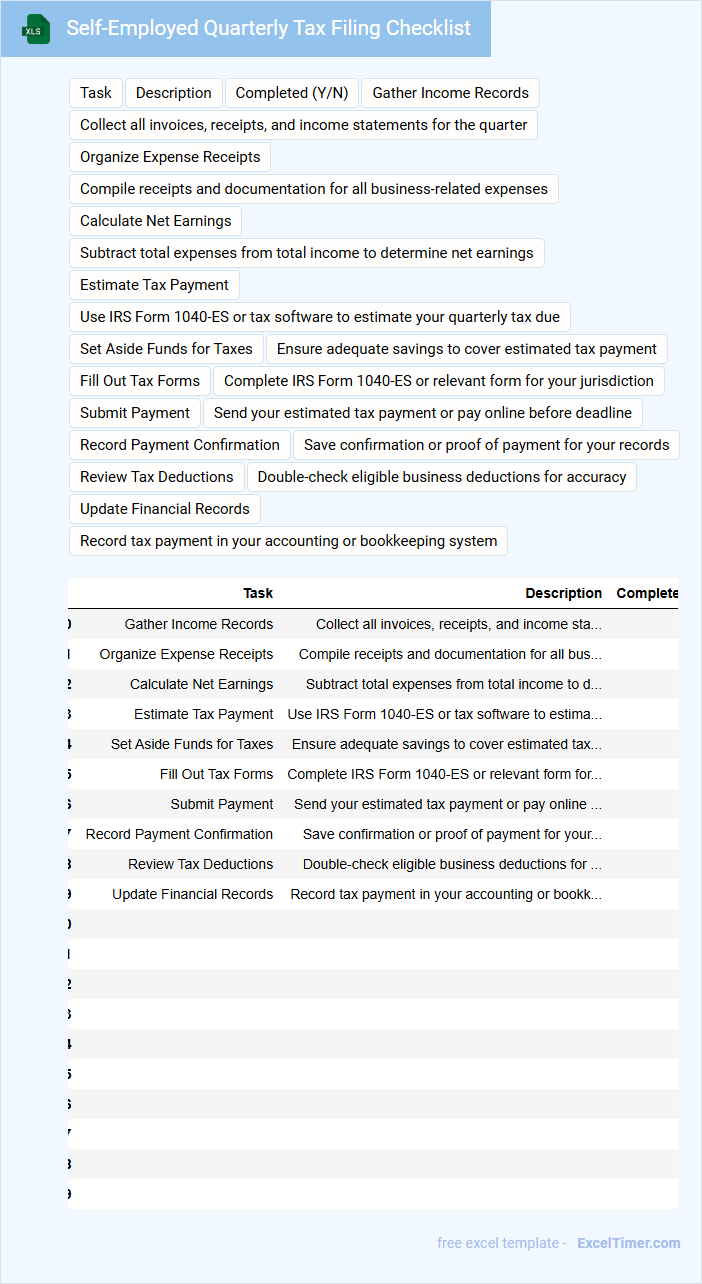

Self-Employed Quarterly Tax Filing Checklist

The Self-Employed Quarterly Tax Filing Checklist is a vital document that helps independent workers track their financial obligations each quarter. It typically contains sections for income records, deductible expenses, and estimated tax payments. This checklist ensures accurate and timely filing, minimizing the risk of penalties.

Key items to include are estimated tax calculations, business expense summaries, and important tax deadlines. Keeping organized records and consulting a tax professional are recommended practices to optimize tax savings and compliance. Staying consistent with this checklist streamlines the quarterly filing process efficiently.

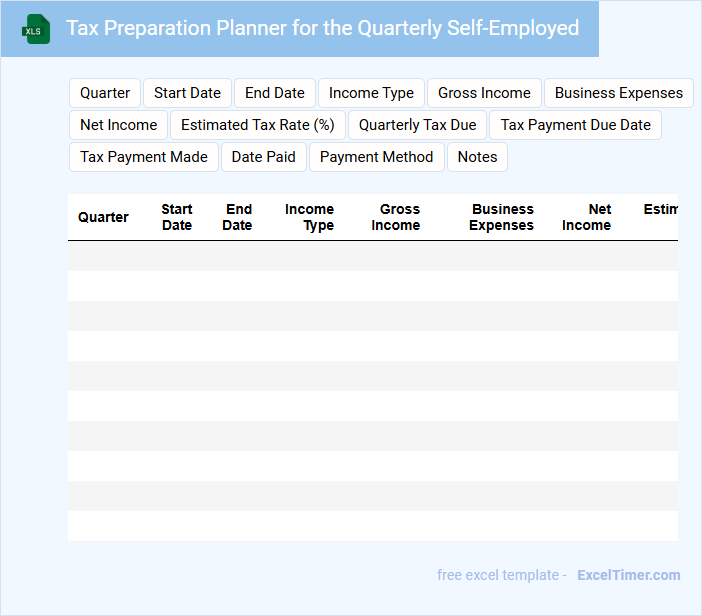

Tax Preparation Planner for the Quarterly Self-Employed

A Tax Preparation Planner for the quarterly self-employed is a crucial document that organizes financial information and deadlines to manage tax obligations effectively. It typically contains sections for income tracking, expense categorization, and estimated tax payment schedules. Ensuring accuracy and timeliness in this planner helps avoid penalties and maximizes deductions.

What are the essential quarterly tax deadlines self-employed professionals must track in Excel?

Self-employed professionals must track quarterly tax deadlines on April 15, June 15, September 15, and January 15 of the following year for estimated tax payments. Tracking these dates in Excel ensures timely filing of IRS Form 1040-ES to avoid penalties. Including columns for payment amount, due date, and confirmation status optimizes tax preparation and compliance.

How can Excel help estimate self-employment income and deductible business expenses each quarter?

Excel helps you organize and calculate self-employment income by creating detailed spreadsheets that track all revenue streams and categorize deductible business expenses. Using built-in formulas and functions, it automates quarterly income estimations and tax liability projections. This precise record-keeping ensures accurate tax preparation and timely quarterly payments.

What key tax forms (e.g., Form 1040-ES) should be referenced and organized in an Excel document?

Organize your Excel document by including key tax forms such as Form 1040-ES for estimated tax payments, Schedule C for profit or loss from business, and Schedule SE for self-employment tax. Track quarterly payment dates, amounts paid, and income sources to ensure accurate tax preparation. Maintaining this structured data supports timely submissions and minimizes tax liabilities for self-employed professionals.

How can Excel formulas automate the calculation of estimated quarterly tax payments?

Excel formulas can automate the calculation of estimated quarterly tax payments by using functions like SUM, IF, and ROUND to accurately total income, deduct expenses, and apply tax rates. A well-structured spreadsheet allows you to input your self-employment income and expenses, automatically updating your tax liability each quarter. This reduces manual errors and ensures timely, precise tax payment estimates based on your current financial data.

What supporting documentation should be recorded or attached in the Excel file for potential IRS audits?

Your Excel file should include detailed records of income statements, expense receipts, and mileage logs to support your quarterly tax preparation. Maintaining copies of 1099 forms, bank statements, and invoices helps validate reported figures during IRS audits. Proper documentation ensures accuracy and simplifies the audit process for self-employed professionals.