![]()

The Quarterly Personal Finance Tracker Excel Template for Individuals enables efficient management of income, expenses, and savings over three-month periods. It provides clear visual charts and detailed breakdowns to help users identify spending patterns and optimize budgets. Regular use of this template supports improved financial decision-making and goal tracking.

Quarterly Personal Finance Tracker Excel Template for Individuals

This type of document, a Quarterly Personal Finance Tracker Excel Template, typically includes detailed records of income, expenses, savings, and investments over a three-month period. It helps individuals monitor their cash flow and financial health with organized spreadsheets and visual graphs.

Important features to consider are categories for different types of expenses and sources of income, as well as automatic calculations for totals and balances. Including goal-setting sections can enhance financial planning and encourage disciplined budgeting.

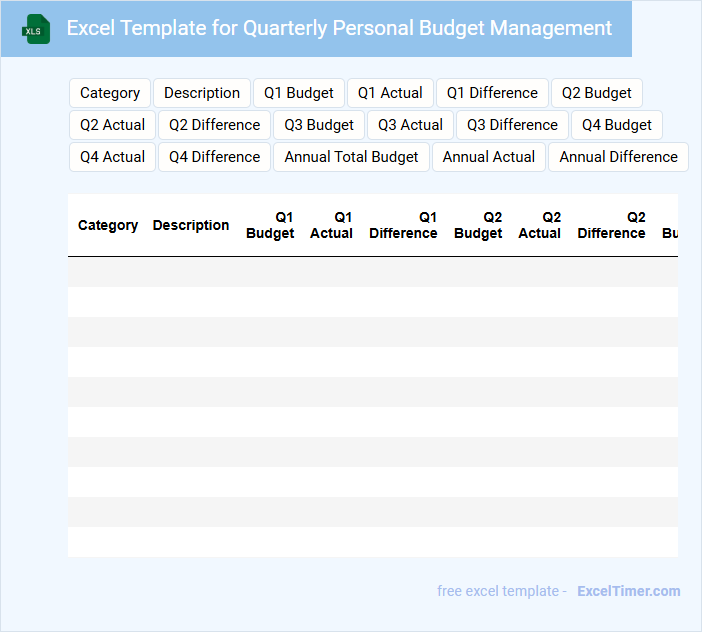

Excel Template for Quarterly Personal Budget Management

What does an Excel Template for Quarterly Personal Budget Management typically contain? This type of document usually includes sections for income, expenses, savings goals, and a summary of financial activity over a three-month period. It helps users track and analyze their spending habits to make informed decisions about budgeting and saving.

What is an important aspect to consider when using such a template? Ensuring accurate and consistent data input is crucial for reliable results, alongside setting realistic budget categories and goals that reflect your actual financial situation. Regularly reviewing the summary and adjusting your plan can improve financial discipline and achieve savings targets.

Quarterly Expense Tracking Spreadsheet for Individuals

A Quarterly Expense Tracking Spreadsheet for Individuals is a financial document used to monitor and categorize personal expenditures over three months. It helps users gain insights into their spending habits and manage their budget effectively.

- Include detailed categories for common expenses such as housing, food, and transportation.

- Ensure there is a summary section highlighting total expenses and comparisons to previous quarters.

- Incorporate fields for notes or explanations to track irregular or one-time expenses.

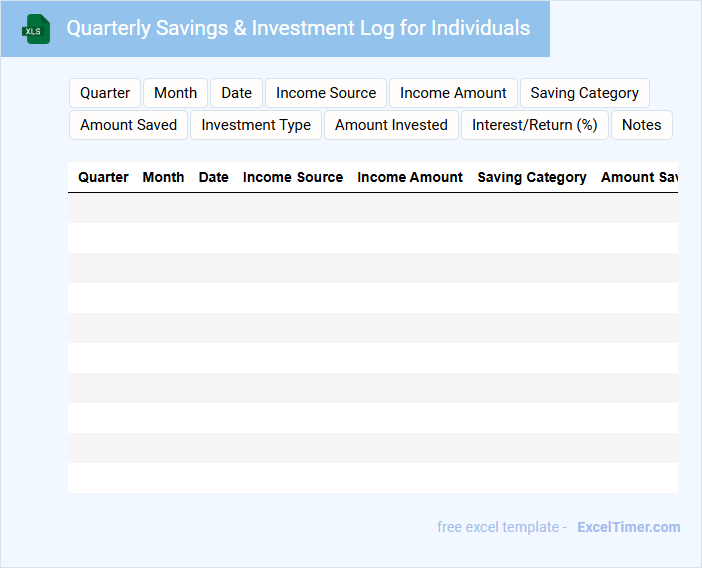

Quarterly Savings & Investment Log for Individuals

What information is typically included in a Quarterly Savings & Investment Log for Individuals? This document usually contains detailed records of an individual's savings contributions, investment purchases, and returns over a three-month period. It helps track financial progress, identify trends, and make informed decisions for future financial planning.

What are the most important elements to focus on in this log? Consistent recording of transaction dates, amounts saved or invested, and the performance of each investment are crucial. Additionally, summarizing quarterly gains or losses allows for better evaluation of financial strategies and goal adjustments.

Excel Template for Quarterly Debt Repayment Tracking

What does an Excel Template for Quarterly Debt Repayment Tracking usually contain?

This type of document typically includes tables to log debt amounts, repayment dates, interest rates, and remaining balances for each quarter. It also features charts or graphs to visualize payment progress and deadlines. These tools help users systematically monitor and manage their debt obligations over time.

What are important elements to include in such a template?

It is important to incorporate clear sections for debtor details, payment schedules, interest calculations, and cumulative totals. Additionally, incorporating conditional formatting to highlight missed or upcoming payments can improve usability and ensure timely repayments. Ensuring the template is easy to update and customize supports effective financial tracking.

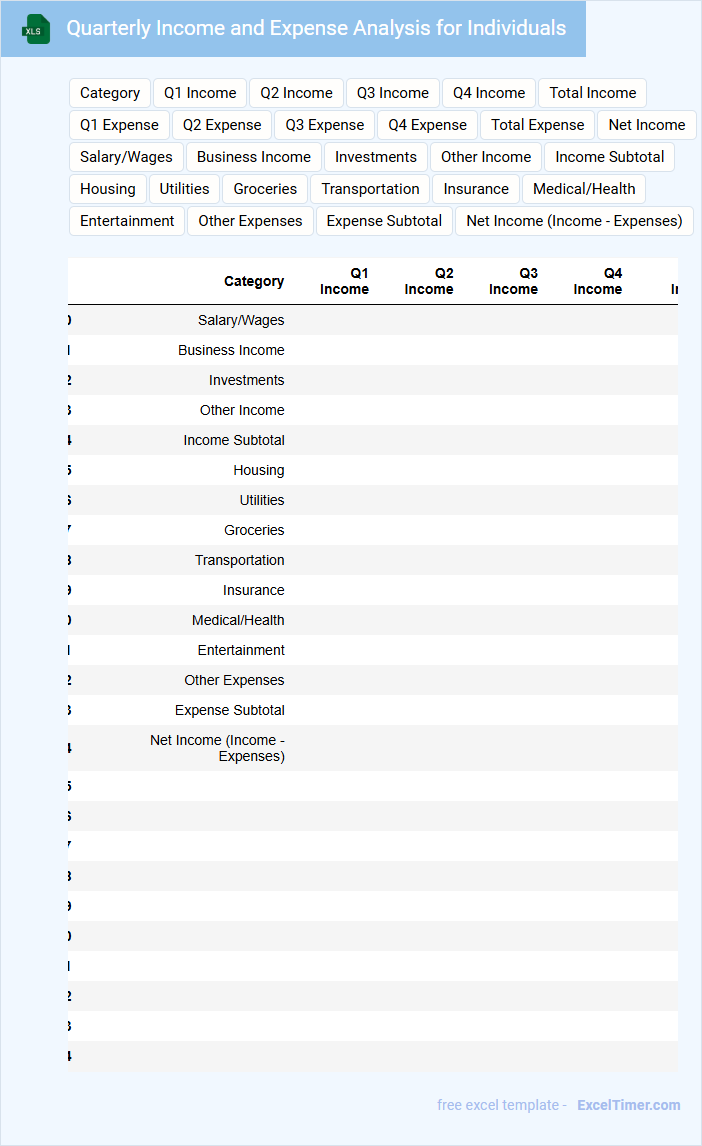

Quarterly Income and Expense Analysis for Individuals

A Quarterly Income and Expense Analysis for Individuals is a financial document that summarizes personal income and expenses over a three-month period. It helps track budgeting efficiency and financial health.

- Include all sources of income, such as salaries, investments, and other earnings.

- Record detailed expenses categorized by type, like housing, food, and entertainment.

- Highlight significant changes or trends to inform future financial planning.

Financial Goals Progress Tracker for the Quarter

A Financial Goals Progress Tracker for the quarter is a document designed to monitor and evaluate the status of financial objectives over a three-month period. It typically contains income records, expense summaries, and progress updates toward savings or investment targets. Including clear milestones and periodic reviews is essential for effective financial management and timely adjustments.

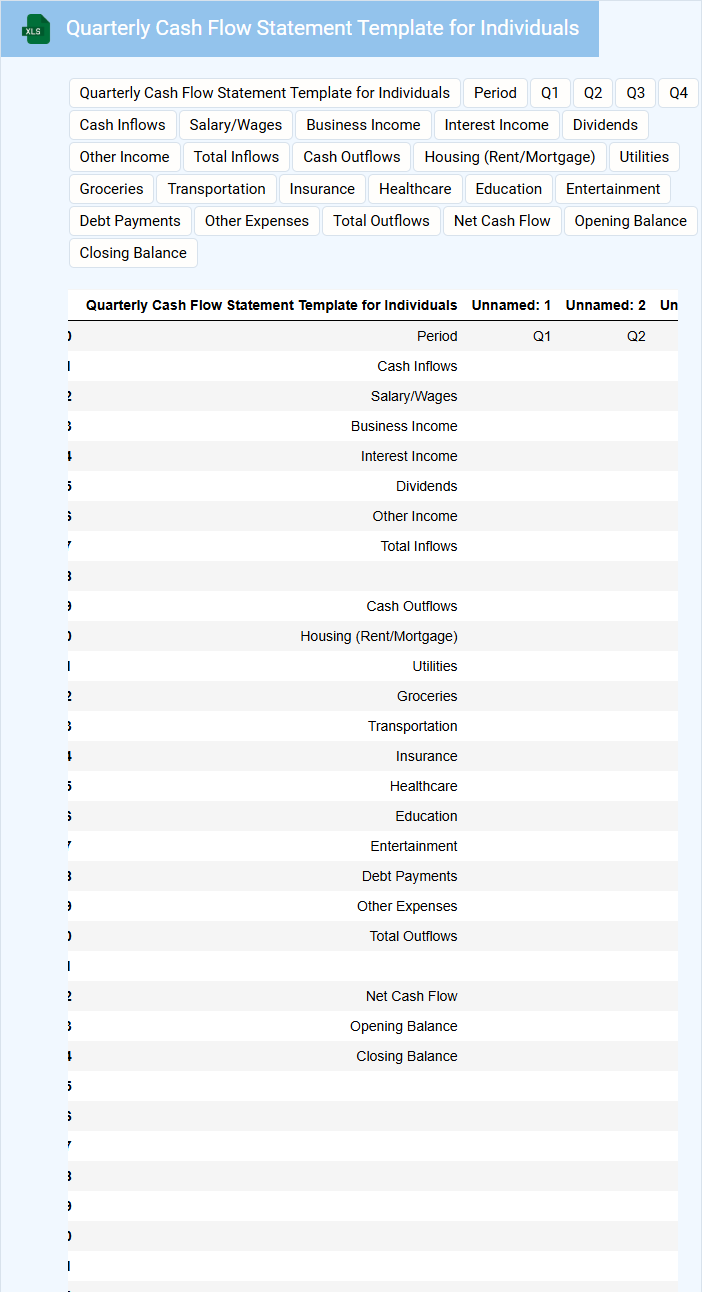

Quarterly Cash Flow Statement Template for Individuals

A Quarterly Cash Flow Statement Template for Individuals typically contains detailed records of income and expenses over a three-month period, helping track financial health and liquidity. It is essential for budgeting and planning future financial decisions.

- Include all sources of income such as salary, investments, and other earnings.

- Record all expenses clearly, categorizing fixed and variable costs.

- Maintain accuracy and update the template regularly for effective financial management.

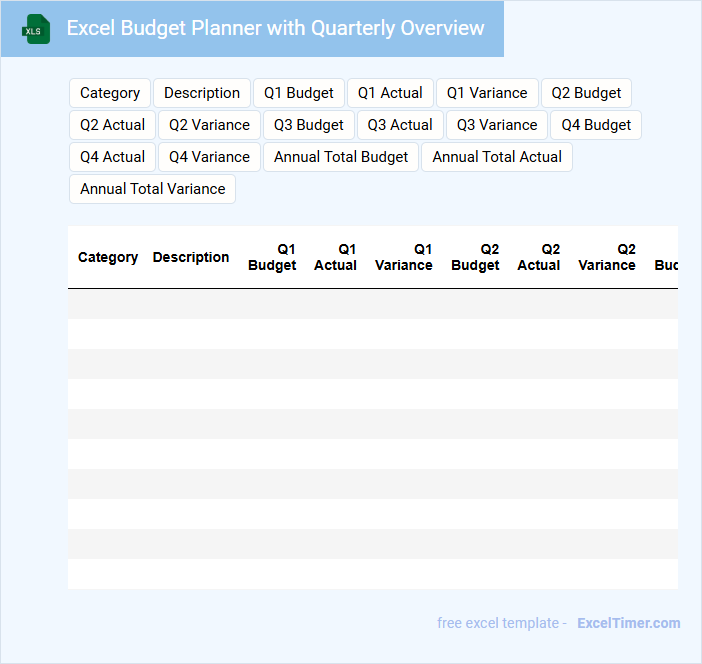

Excel Budget Planner with Quarterly Overview

An Excel Budget Planner with a Quarterly Overview is a comprehensive financial tool designed to organize and track your income and expenses over a three-month period. It typically contains detailed income sources, categorized expenses, and summary tables that highlight spending patterns.

This type of document helps users visualize cash flow and plan for future financial goals by breaking down budgets into manageable segments. For optimal use, ensure accurate data entry and regularly update the planner to reflect actual spending for effective financial management.

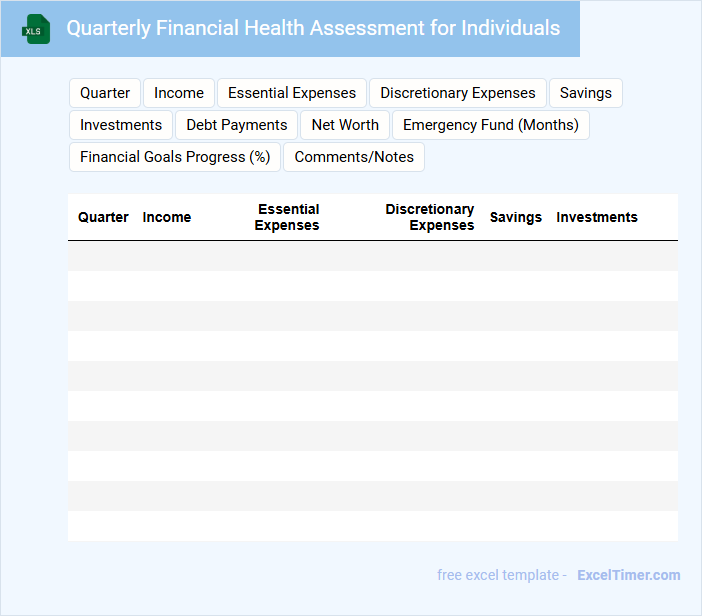

Quarterly Financial Health Assessment for Individuals

A Quarterly Financial Health Assessment for individuals typically contains a review of income, expenses, savings, investments, and debt. It evaluates financial progress and identifies areas needing adjustment to enhance monetary stability.

Important components include tracking net worth, cash flow analysis, and budgeting effectiveness. Regular assessments help maintain clear financial goals and improve long-term wealth management.

Tracker for Quarterly Bill Payments in Excel

A Tracker for Quarterly Bill Payments in Excel typically contains organized columns for bill names, payment due dates, amounts, and payment status. This structured format aids in maintaining timely payments and avoiding late fees.

Such a document often includes summary sections to highlight total quarterly expenses and alerts for upcoming payments. Incorporating conditional formatting and reminders enhances its effectiveness in financial management.

For optimal use, ensure to regularly update the tracker and customize categories to fit your specific bills and payment schedules.

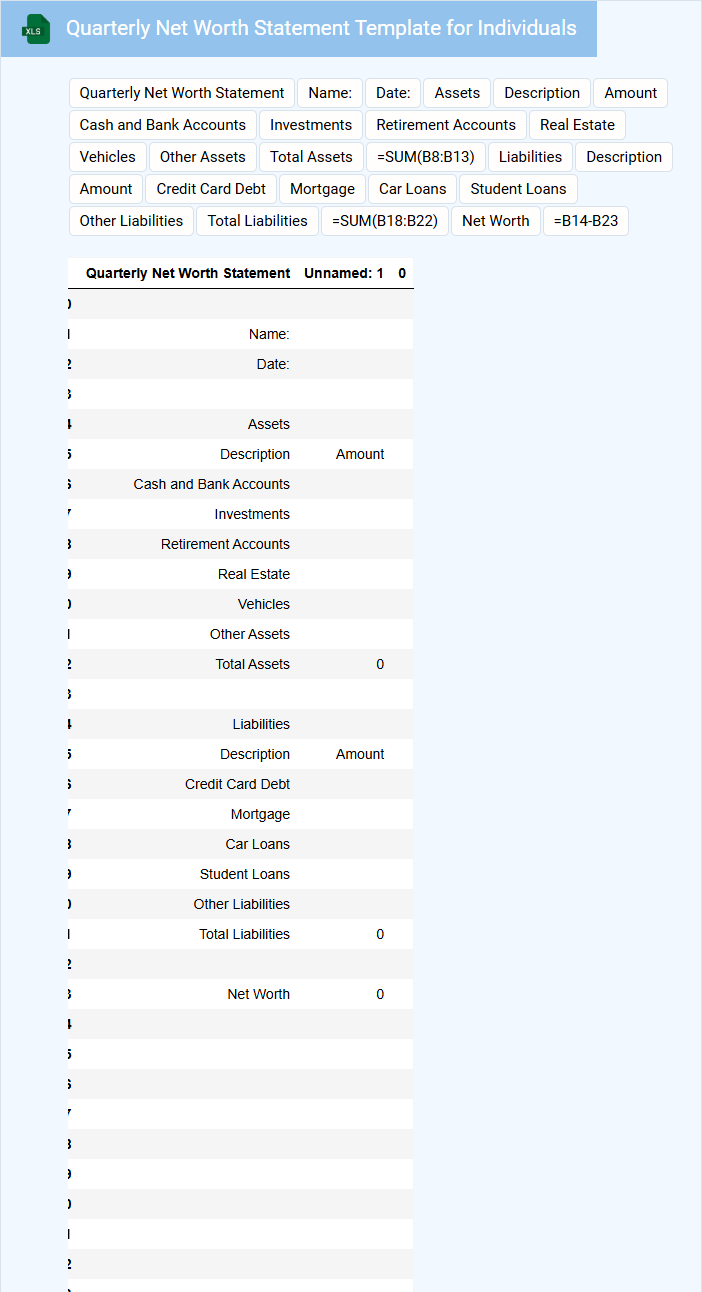

Quarterly Net Worth Statement Template for Individuals

A Quarterly Net Worth Statement template for individuals typically includes a detailed summary of assets and liabilities, providing a clear snapshot of one's financial position every three months. It helps track financial progress over time by comparing net worth values quarter by quarter.

Important elements to include are accurate listings of bank accounts, investments, debts, and property values to ensure precise calculations. Regular updates and consistent categorization of financial items are crucial for maintaining an effective and reliable net worth statement.

Quarterly Credit Card Payment Tracker for Individuals

What does a Quarterly Credit Card Payment Tracker for Individuals usually contain? This type of document typically includes details such as payment dates, amounts paid, outstanding balances, and interest charges for each credit card. It helps individuals monitor their payment history and plan future payments effectively to avoid late fees and reduce debt.

What important aspects should be considered when using a Quarterly Credit Card Payment Tracker? It is crucial to consistently update the tracker with accurate payment information and to review it regularly for any discrepancies or unusual charges. Additionally, setting payment reminders and analyzing spending patterns can improve financial discipline and credit scores.

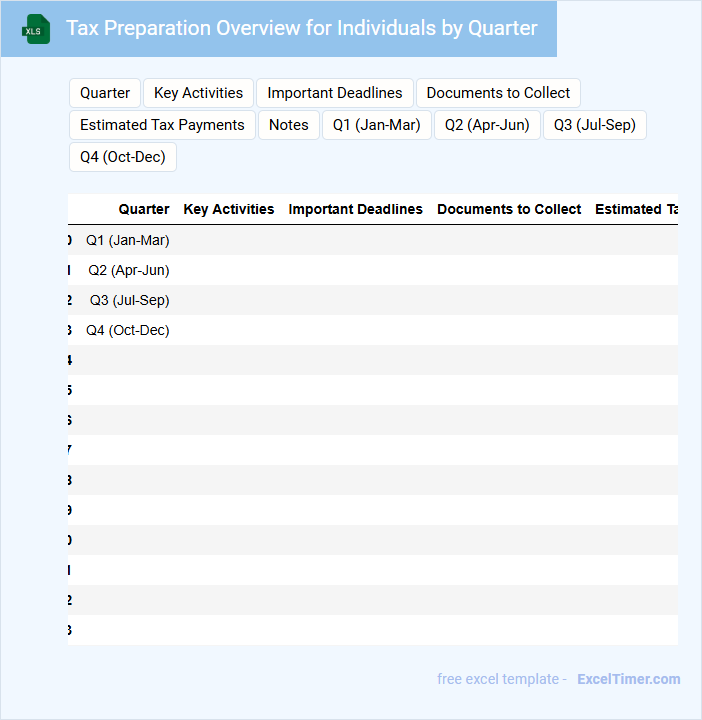

Tax Preparation Overview for Individuals by Quarter

What information is typically contained in a Tax Preparation Overview for Individuals by Quarter? This document usually includes detailed summaries of income, deductions, and tax payments reported each quarter to help individuals keep track of their tax obligations. It serves as a crucial tool for organizing financial data and ensuring timely compliance with tax deadlines throughout the year.

What important considerations should individuals keep in mind when using this overview? It is essential to accurately document all sources of income and eligible expenses quarterly to avoid errors in tax filing. Additionally, reviewing this information regularly can help identify potential tax savings and prepare for any necessary adjustments before the annual tax return submission.

Quarterly Personal Asset & Liability Tracker in Excel

A Quarterly Personal Asset & Liability Tracker in Excel is a financial document designed to monitor individual net worth by recording assets and liabilities periodically. It helps users visualize financial growth and manage debts effectively.

This type of tracker typically contains detailed lists of cash, investments, properties, loans, and credit balances. Regular updates and accurate data entry are crucial for maintaining an effective financial overview.

What key categories should be included in a Quarterly Personal Finance Tracker (e.g., income, fixed expenses, savings, investments)?

A Quarterly Personal Finance Tracker should include key categories such as income, fixed expenses, variable expenses, savings contributions, debt payments, and investments. Tracking these categories helps individuals monitor cash flow, control spending, and evaluate financial growth over the quarter. Detailed records of assets, liabilities, and emergency funds enhance comprehensive financial planning and goal setting.

How can Excel formulas be used to automatically calculate quarterly totals and variances for each financial category?

Excel formulas like SUM can calculate quarterly totals by summing monthly expenses within each financial category. Use formulas such as =SUM(B2:D2) to total values across specific months, and variance can be computed with =MAX(range)-MIN(range) or =B2-D2 for differences between quarters. These formulas enable dynamic tracking and comparison of financial data across each quarter.

What visualizations (charts or graphs) in Excel most effectively track financial progress over different quarters?

Line charts effectively illustrate your income and expenses trends across different quarters, highlighting financial progress. Bar charts compare quarterly savings or debt reduction, providing clear visual distinctions between periods. Pie charts break down spending categories each quarter, offering insights into your financial priorities.

How should you structure the Excel document to allow for easy comparison between quarters and year-over-year analysis?

Organize your Excel document with separate sheets for each quarter and a summary sheet aggregating key financial metrics for year-over-year comparison. Use consistent categories for income, expenses, and savings, and apply Excel tables with pivot charts to visualize trends effectively. Incorporate dynamic formulas like SUMIFS and YEAR functions to automate quarterly comparisons and facilitate easy updates.

Which Excel functions are essential for tracking recurring payments and forecasting cash flow in a quarterly format?

Essential Excel functions for tracking recurring payments and forecasting cash flow in a Quarterly Personal Finance Tracker include SUMIF to aggregate expenses based on categories and dates, EDATE to calculate future payment dates for recurring transactions, and FORECAST.ETS for predicting quarterly cash flow trends. PivotTables enhance data summarization by quarter, while IF functions help identify overdue or upcoming payments. Utilizing these functions ensures accurate tracking and proactive financial forecasting.