The Quarterly Income and Expense Excel Template for Nonprofits provides a streamlined way to track and manage financial data on a quarterly basis, ensuring accurate budgeting and reporting. It includes customizable fields for income sources and expense categories, helping organizations maintain transparency and compliance with financial regulations. Easy-to-use formulas automatically calculate totals and variances, minimizing errors and saving valuable time.

Quarterly Income and Expense Tracking Template for Nonprofits

What information is typically included in a Quarterly Income and Expense Tracking Template for Nonprofits? This document usually contains detailed records of all income sources and expenses categorized by type over a three-month period. It helps organizations monitor financial health, ensure transparency, and manage budgets effectively throughout each quarter.

What important aspects should be focused on when using this template? Accurate data entry, clear categorization of income and expenses, and regular review are essential to maintain reliable financial records. Additionally, incorporating notes for unusual transactions and comparing actual numbers with budget projections can provide valuable insights for decision-making.

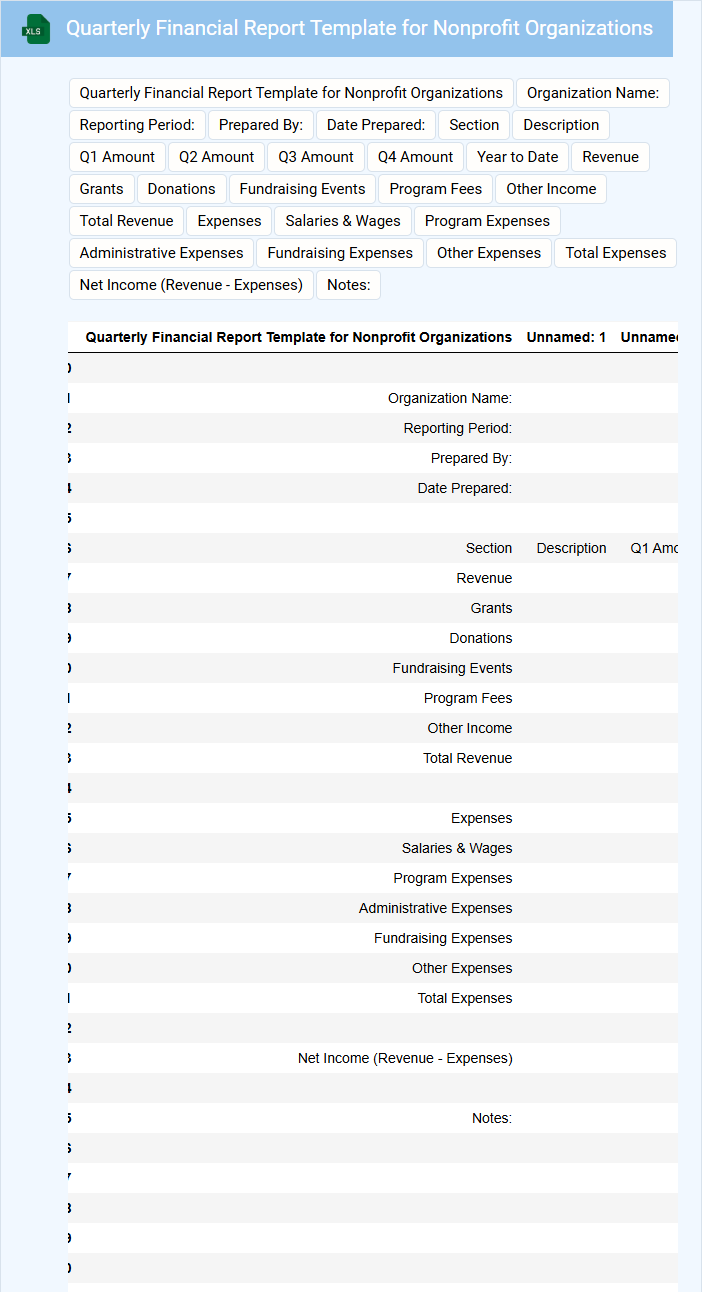

Quarterly Financial Report Template for Nonprofit Organizations

What information is typically included in a Quarterly Financial Report Template for Nonprofit Organizations? This document usually contains a detailed summary of the organization's financial activities over the quarter, including income, expenses, assets, and liabilities. It helps stakeholders understand the financial health and transparency of the nonprofit by providing clear, organized financial data aligned with the organization's goals.

Why is it important to include detailed notes and clear categorization in such reports? Including detailed notes explains financial figures and supports accountability, while clear categorization improves readability and helps decision-makers quickly assess financial trends. Emphasizing accuracy and transparency enhances trust among donors, board members, and regulatory bodies.

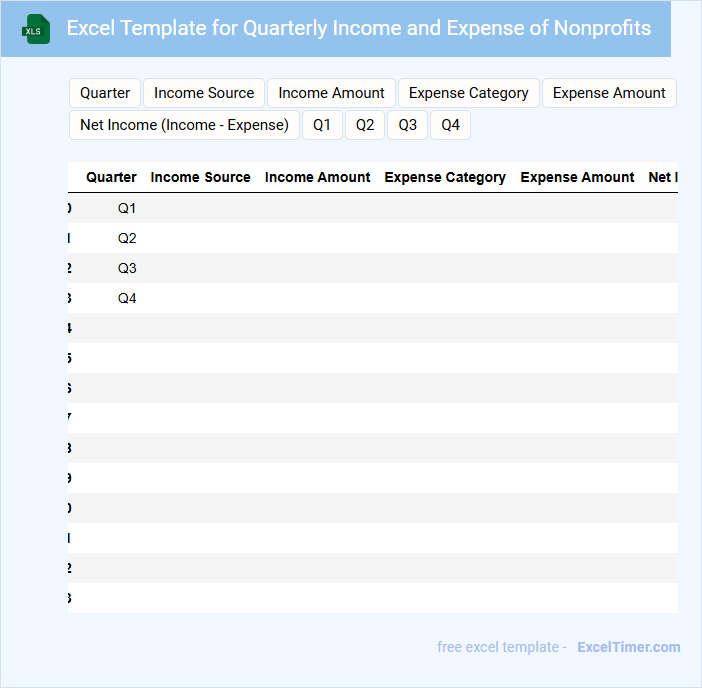

Excel Template for Quarterly Income and Expense of Nonprofits

What information does an Excel Template for Quarterly Income and Expense of Nonprofits usually contain? This type of document typically includes sections for recording various income sources, such as donations, grants, and fundraising events, alongside detailed expense categories like program costs, administrative expenses, and fundraising activities. It helps nonprofits track financial performance each quarter, ensuring transparency and accountability.

What important considerations should be made when using this template? It is crucial to ensure accurate categorization of income and expenses to maintain clear financial records and aid in reporting to stakeholders. Additionally, including a summary section with visual aids like charts can provide quick insights into the nonprofit's financial health over the quarter.

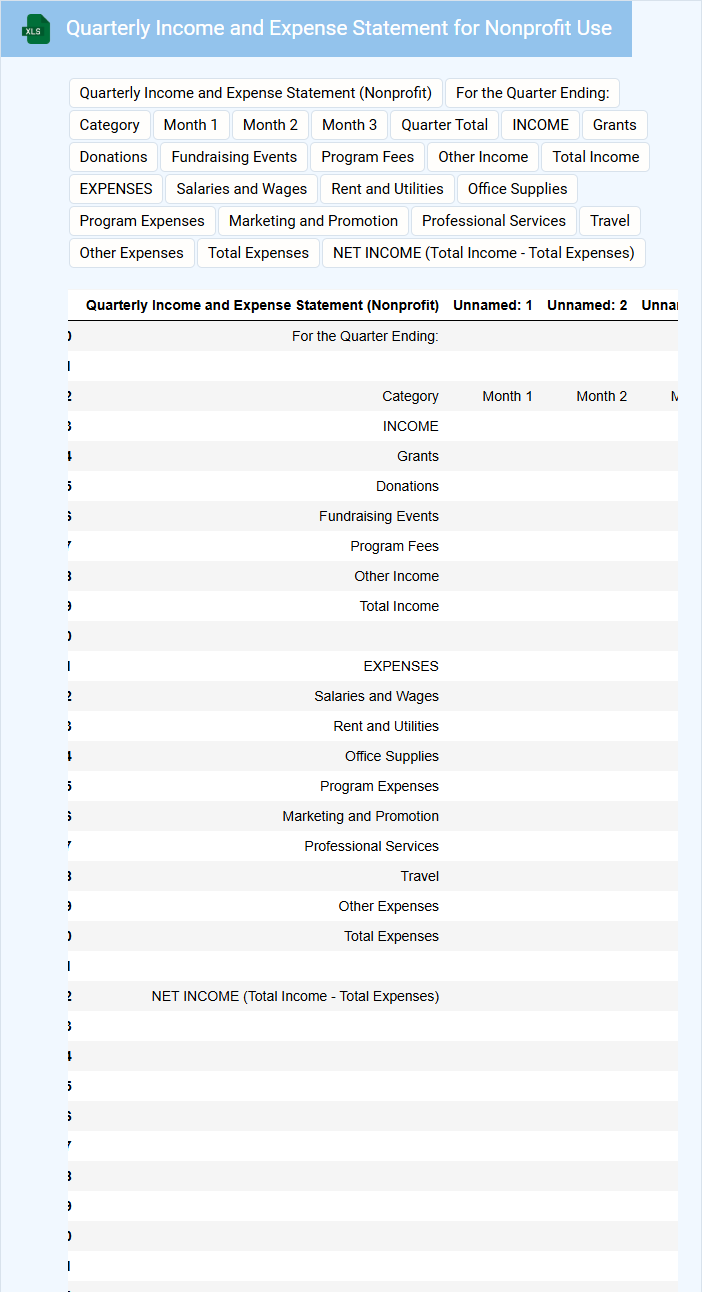

Quarterly Income and Expense Statement for Nonprofit Use

A Quarterly Income and Expense Statement for nonprofit organizations provides a detailed overview of the financial activities within a three-month period. This document typically contains categorized revenue streams, expense breakdowns, and net income or loss figures. Maintaining accuracy and transparency in these statements is crucial for regulatory compliance and stakeholder trust.

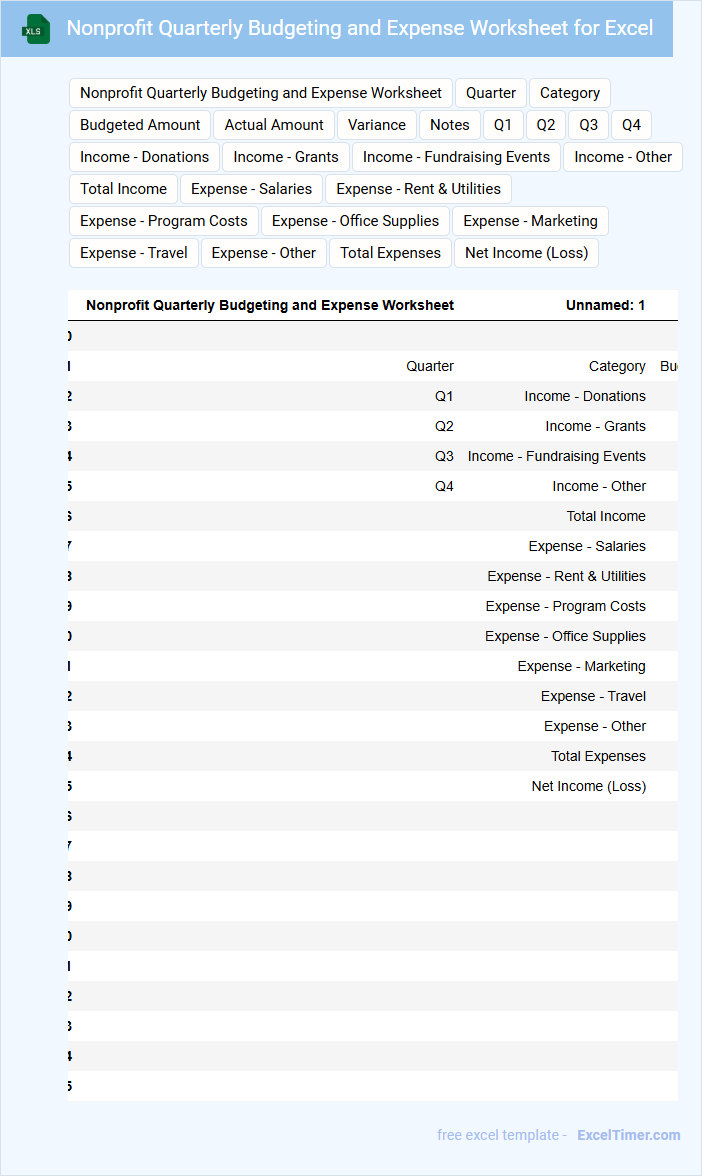

Nonprofit Quarterly Budgeting and Expense Worksheet for Excel

Nonprofit Quarterly Budgeting and Expense Worksheets for Excel typically contain detailed financial data to track income, expenses, and project budgets to ensure accountability and transparency.

- Comprehensive Expense Tracking: Accurately log all expenditures categorized by type and date to maintain clear financial records.

- Income and Revenue Monitoring: Record all sources of income and donations to balance budgets effectively.

- Quarterly Reporting: Summarize financial activities every quarter to facilitate strategic planning and stakeholder communication.

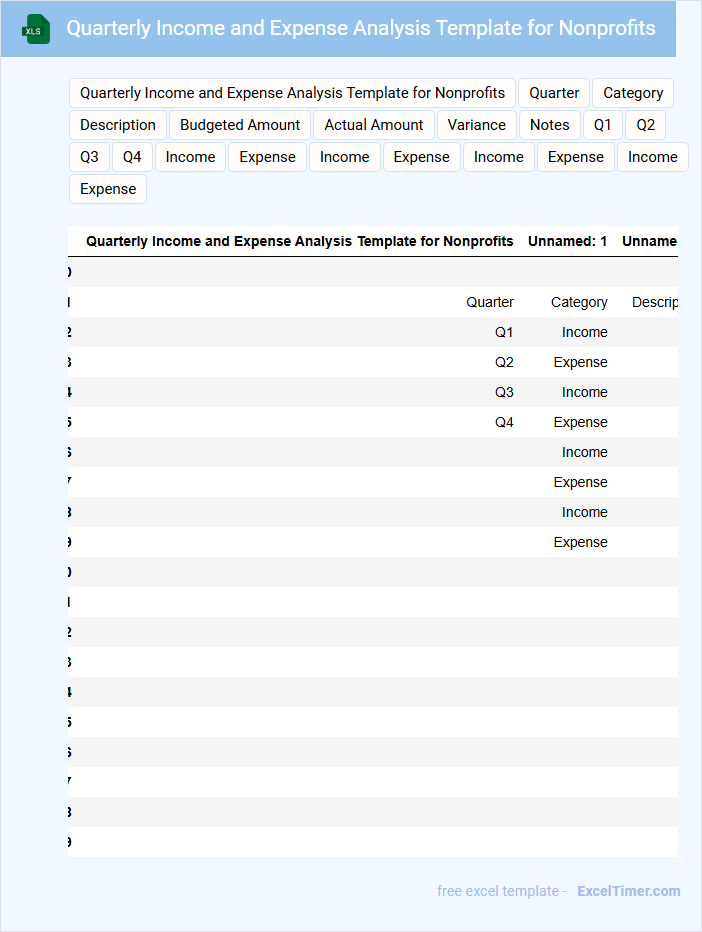

Quarterly Income and Expense Analysis Template for Nonprofits

The Quarterly Income and Expense Analysis Template for nonprofits is a crucial document for tracking and evaluating financial performance over a three-month period. It typically contains detailed records of income sources, categorized expenses, and comparison of actual figures against budgeted amounts. This template helps organizations maintain financial transparency and make informed budgeting decisions.

Important elements to include are clear categorization of income and expenses, variance analysis to highlight discrepancies, and visual aids like charts for quick interpretation. Ensuring accuracy in data entry and regular updates are essential for effective financial management. Incorporating notes or commentary sections can provide context to the numbers and aid in strategic planning.

Excel Document with Quarterly Expense and Income Tracking for Nonprofits

An Excel document for Quarterly Expense and Income Tracking for Nonprofits is designed to organize and monitor financial transactions over a specific period. It helps nonprofits maintain transparency and manage their budgets effectively.

- Include detailed categories for both income sources and expense types to ensure clarity.

- Incorporate formulas for automatic calculations of totals and variances.

- Use clear labels and consistent formatting for easy data entry and review.

Quarterly Income and Expense Breakdown for Nonprofit Groups

A Quarterly Income and Expense Breakdown document for nonprofit groups provides a detailed summary of financial activities over a three-month period. It typically includes sources of income such as donations, grants, and fundraising events, alongside a categorized list of expenses like program costs, administrative fees, and operational expenses. This report is essential for tracking financial health, ensuring transparency, and facilitating strategic planning.

Important elements to include are clear categorization of income and expenses, comparison with previous quarters for trend analysis, and notes on any significant variances or unexpected costs. Additionally, including a summary of cash flow and budget adherence helps stakeholders assess financial stability. Accurate documentation aids in compliance with regulatory requirements and builds donor trust.

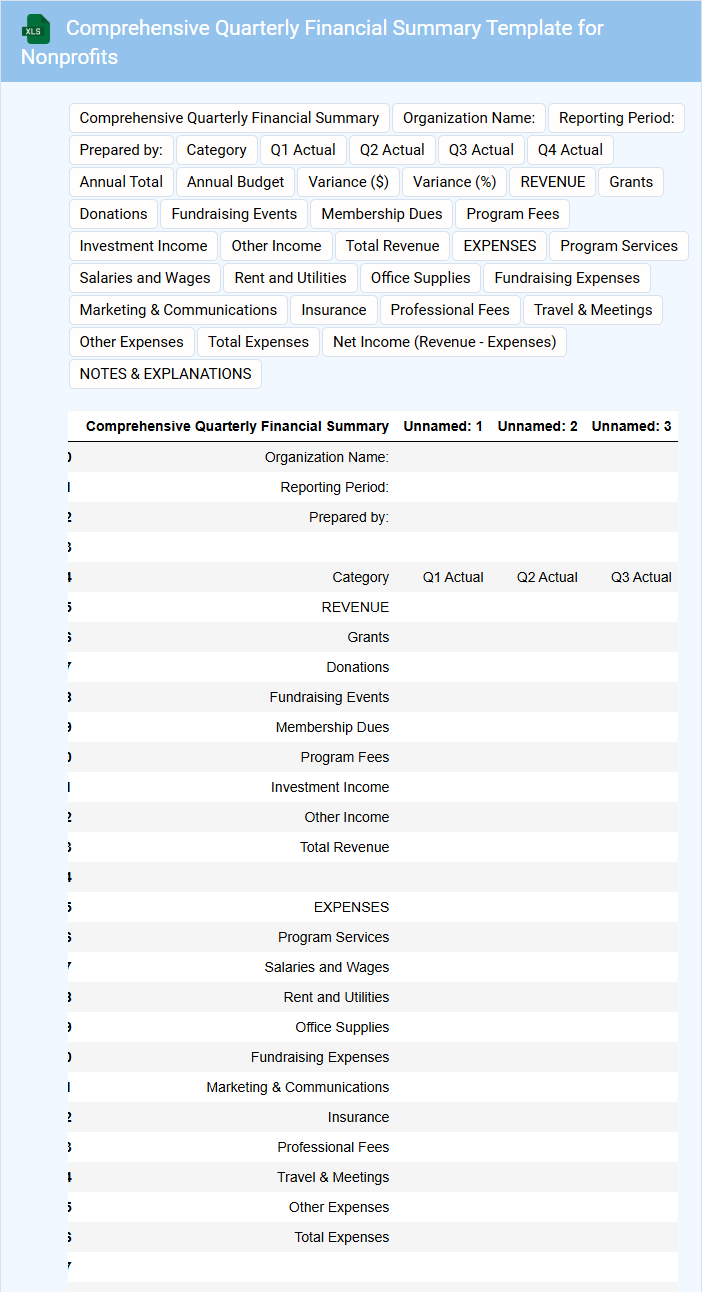

Comprehensive Quarterly Financial Summary Template for Nonprofits

What does a Comprehensive Quarterly Financial Summary Template for Nonprofits usually contain? This type of document typically includes detailed financial data such as income statements, balance sheets, and cash flow statements for the quarter. It also highlights budget vs. actual comparisons, funding sources, and explanations of significant variances to provide transparency.

Why is it important to include detailed notes and clear visuals in this summary? Detailed notes clarify complex financial information and ensure stakeholders understand the context behind the numbers. Incorporating charts and graphs enhances readability and supports better decision-making for nonprofit boards and donors.

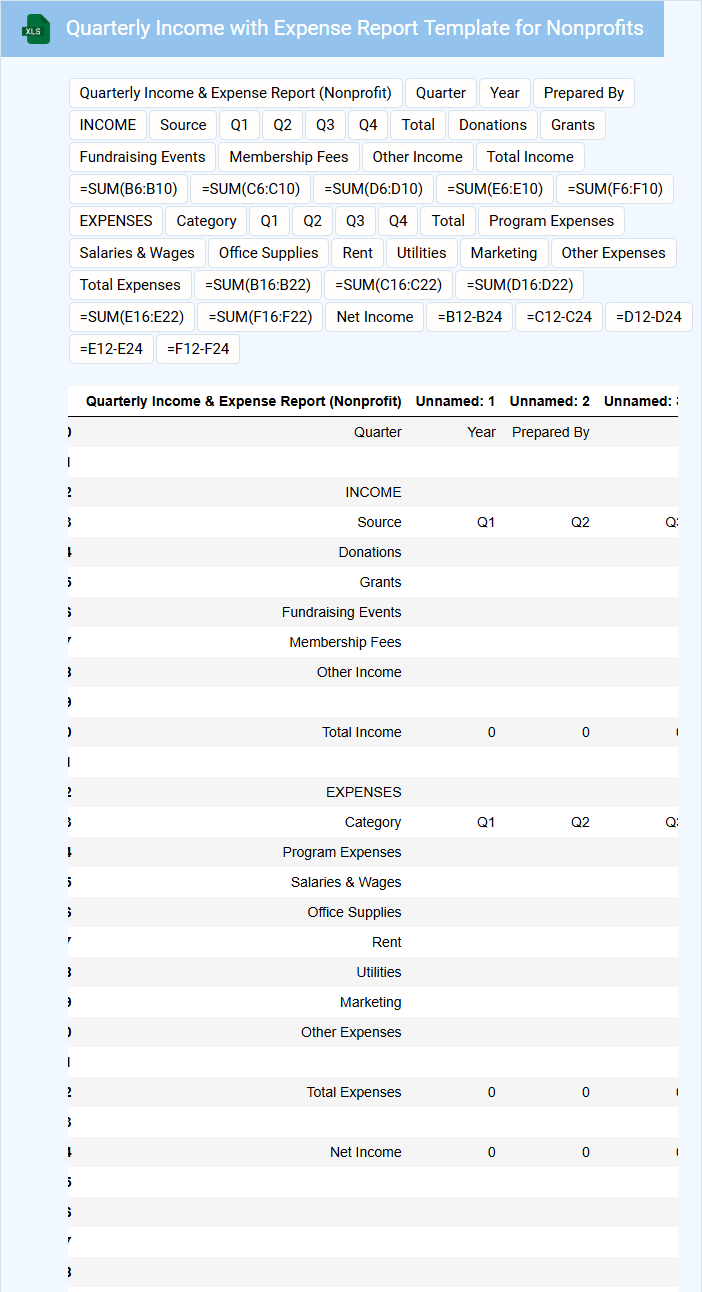

Quarterly Income with Expense Report Template for Nonprofits

The Quarterly Income with Expense Report Template for nonprofits typically includes detailed records of the organization's revenues and expenditures over a three-month period. This document helps track financial performance and ensures transparency. It is essential for maintaining accurate budgeting and financial planning.

Such reports usually contain sections for income sources, expense categories, and net income or loss. Regular review of these reports supports informed decision-making and effective resource allocation. Including clear notes and explanations for significant variances is highly recommended.

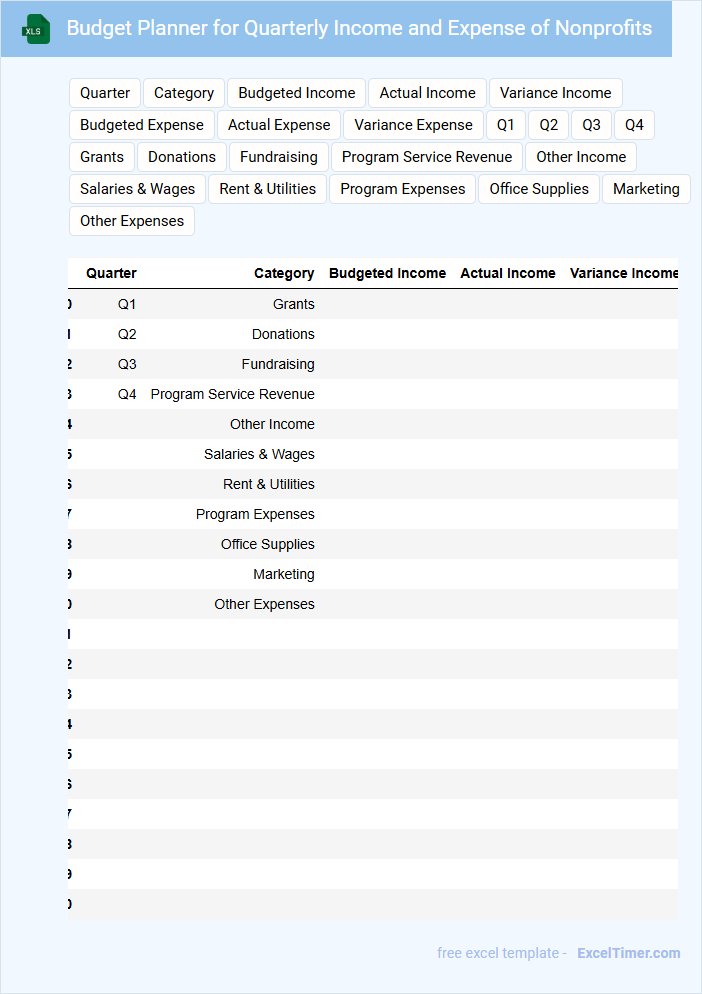

Budget Planner for Quarterly Income and Expense of Nonprofits

A Budget Planner for quarterly income and expenses of nonprofits typically contains detailed projections of all incoming funds and anticipated expenditures over three months. It helps organizations manage their financial resources effectively by categorizing income sources and expense types specifically related to nonprofit activities. This document also ensures transparency and accountability in the use of funds while guiding strategic financial decisions.

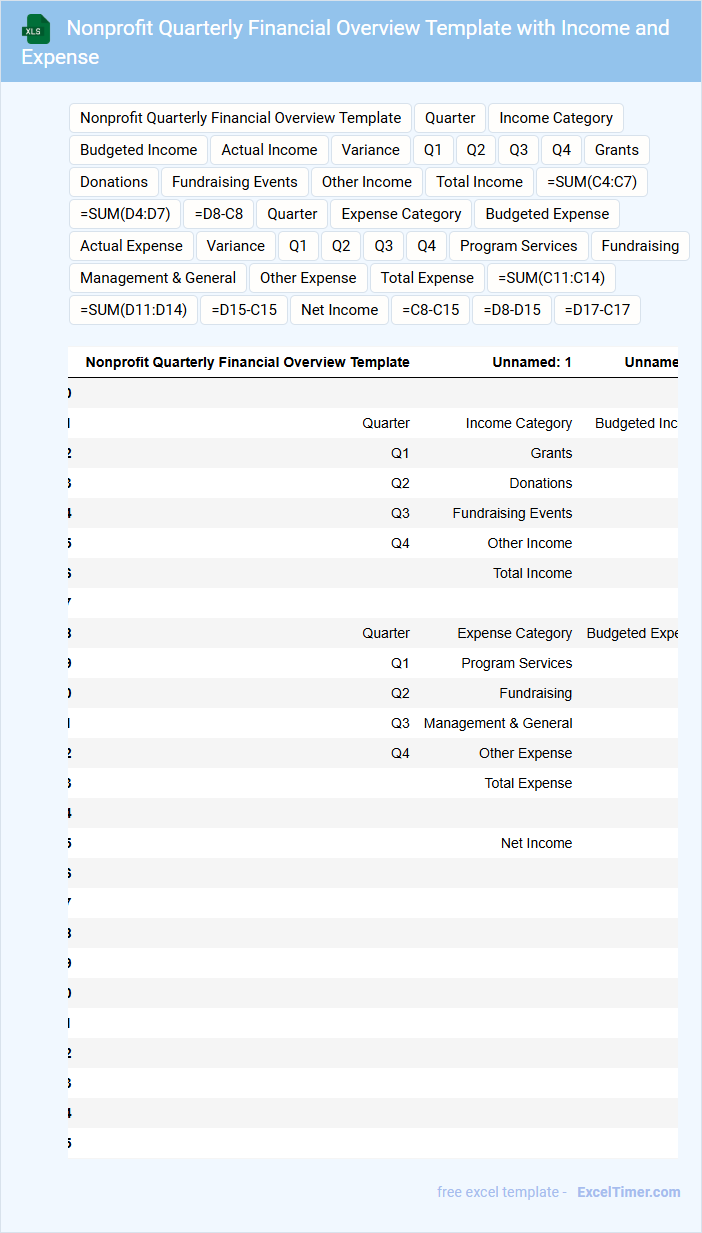

Nonprofit Quarterly Financial Overview Template with Income and Expense

The Nonprofit Quarterly Financial Overview template typically contains detailed records of income sources and expense categories to provide a clear financial snapshot. It includes sections for donations, grants, program revenues, and operational costs to help organizations track their fiscal health. Ensuring accuracy and transparency in these reports is crucial for stakeholders and regulatory compliance.

Excel Spreadsheet for Tracking Quarterly Income and Expense of Nonprofits

An Excel Spreadsheet for tracking quarterly income and expenses is essential for nonprofit organizations to monitor financial health efficiently. This type of document typically contains detailed records of revenue streams, categorized expenses, and budget comparisons. It helps in ensuring transparency and preparing accurate financial reports for stakeholders.

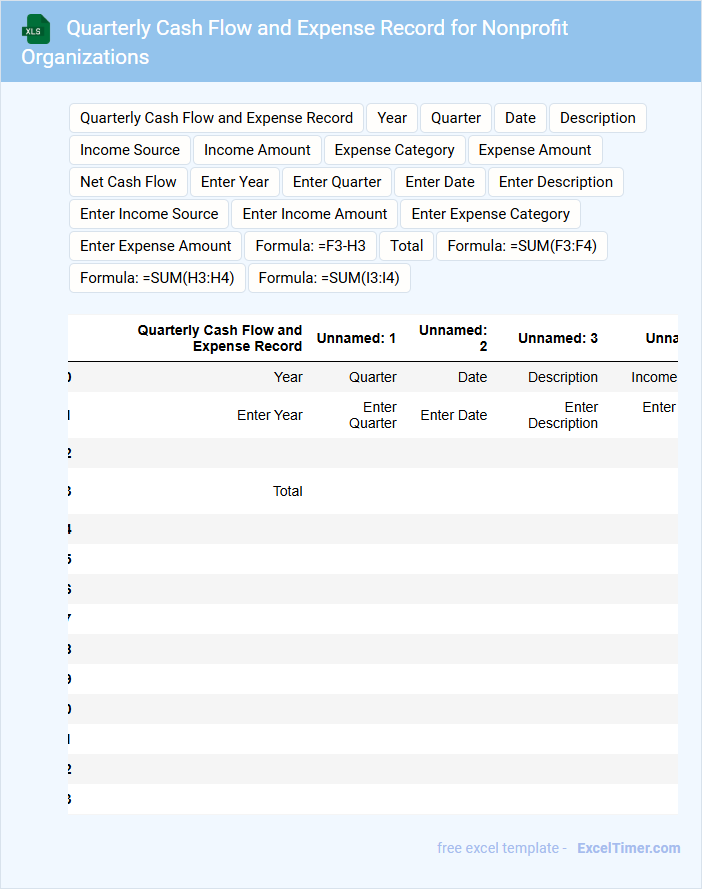

Quarterly Cash Flow and Expense Record for Nonprofit Organizations

A Quarterly Cash Flow and Expense Record for Nonprofit Organizations is a financial document that tracks the inflow and outflow of funds over a three-month period. It helps nonprofits maintain transparency and manage their budgets effectively.

- Include detailed records of all income sources and expenses to ensure accurate financial reporting.

- Regularly reconcile recorded amounts with bank statements to prevent discrepancies.

- Highlight any significant variances from the budget to identify potential financial issues early.

Simple Quarterly Income and Expense Tracker for Nonprofits

A Simple Quarterly Income and Expense Tracker for nonprofits is a vital document used to monitor financial activity over three months. It typically contains detailed records of income sources and categorized expenses, helping organizations stay within budget. Ensuring accuracy and timely updates is crucial for effective financial planning and reporting.

What are the primary sources of quarterly income for the nonprofit listed in the Excel document?

The primary sources of quarterly income for the nonprofit listed in the Excel document include donations, grants, and fundraising events. Your income also comprises membership fees and program service revenue. These revenue streams form the foundation of the nonprofit's financial stability each quarter.

Which expense categories consistently represent the largest portion of quarterly spending?

Personnel costs and program expenses consistently represent the largest portion of quarterly spending for nonprofits. Rent and utilities typically follow as significant expense categories. Tracking these categories helps optimize budget allocation and financial planning.

Are there any significant variances between projected and actual income or expenses each quarter?

Your quarterly income and expense report for nonprofits highlights significant variances between projected and actual figures, with discrepancies often seen in donation income and operational expenses. Analyzing these variances helps identify trends, optimize budgeting, and ensure financial accountability. Accurate tracking empowers your organization to make informed decisions and improve future financial planning.

How does each quarter's net surplus or deficit impact the overall financial stability of the nonprofit?

Each quarter's net surplus or deficit directly affects your nonprofit's overall financial stability by influencing cash flow and reserve levels. Consistent surpluses build financial resilience, enabling sustainable program funding and organizational growth. Recurring deficits may lead to funding shortfalls, operational cutbacks, and increased financial risk.

Are restricted and unrestricted funds clearly differentiated and properly tracked in the quarterly report?

The quarterly income and expense report for nonprofits distinctly categorizes restricted and unrestricted funds, ensuring precise tracking of each fund type. This separation supports accurate financial management and compliance with donor restrictions. Clear labeling and detailed entries enable comprehensive analysis of fund utilization across reporting periods.