The Quarterly Financial Analysis Excel Template for Nonprofits streamlines the tracking and evaluation of financial performance every three months, allowing organizations to monitor income, expenses, and cash flow effectively. This template is crucial for maintaining transparency and ensuring that nonprofit resources are allocated efficiently to support program goals. Customizable features enable users to generate detailed reports that assist in strategic decision-making and grant compliance.

Quarterly Financial Analysis Dashboard for Nonprofits

A Quarterly Financial Analysis Dashboard for Nonprofits typically contains summarized financial data, key performance indicators, and visual representations of fiscal health to aid in strategic decision-making.

- Revenue Trends: Track incoming funds across different quarters to identify growth or decline patterns for sustainability.

- Expense Breakdown: Analyze spending categories to ensure costs align with the organization's mission and budget.

- Cash Flow Monitoring: Monitor liquidity status to maintain operational stability and plan future activities effectively.

Excel Template for Quarterly Revenue Analysis of Nonprofits

What key information does an Excel template for quarterly revenue analysis of nonprofits typically include? This type of document usually contains detailed records of income sources, categorized by funding types and time periods, along with visual charts for trend analysis. It is designed to help organizations monitor financial performance and make data-driven decisions for future planning.

Quarterly Expense Tracking Spreadsheet for Nonprofit Organizations

The Quarterly Expense Tracking Spreadsheet for Nonprofit Organizations is a vital document that systematically records all financial outflows over a three-month period. It usually contains categorized expenses, dates of transactions, and corresponding amounts, enabling accurate financial oversight. This document helps nonprofits ensure accountability and maintain transparency with donors and stakeholders.

To optimize its effectiveness, it's important to include clear categories for expenses, regularly update entries, and incorporate summary sections for easy analysis. Automation features like formulas for totaling expenses and visual charts can also enhance usability. Consistent use of this spreadsheet supports sound financial management and strategic planning.

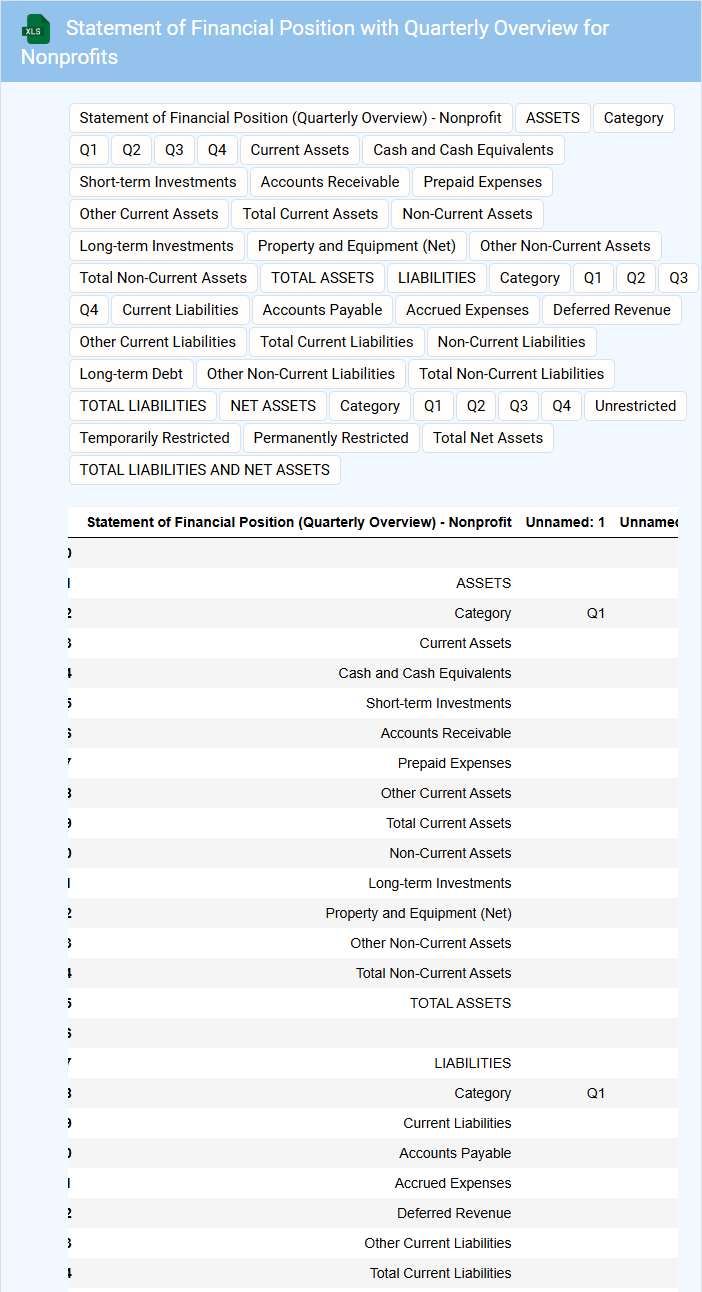

Statement of Financial Position with Quarterly Overview for Nonprofits

The Statement of Financial Position with a Quarterly Overview for Nonprofits typically contains detailed information about the organization's assets, liabilities, and net assets at a specific point in time. It provides a snapshot of financial health by highlighting key financial metrics such as cash reserves, outstanding debts, and fund balances. This document is crucial for stakeholders to assess financial stability and inform strategic planning throughout the fiscal year.

When preparing this statement, it is important to ensure accuracy and transparency in reporting all financial elements. Regular quarterly updates help in tracking trends and making timely decisions to support the nonprofit's mission. Including comparative data from previous quarters can enhance the usefulness of the report for internal and external analysis.

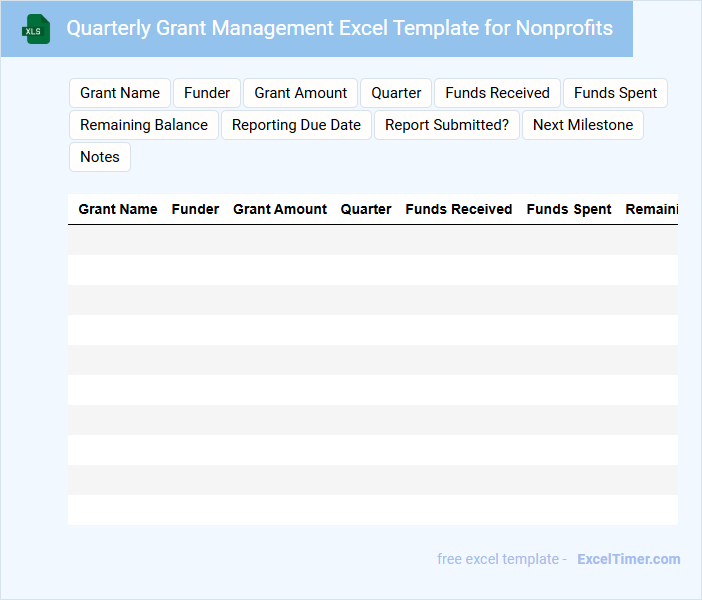

Quarterly Grant Management Excel Template for Nonprofits

What information is typically contained in a Quarterly Grant Management Excel Template for Nonprofits? This type of document usually includes detailed records of grant applications, received funds, allocation of expenses, and timeline tracking for deliverables. It helps nonprofits organize financial data and monitor progress to ensure compliance and effective use of grant resources.

What important elements should be included in this template? Key components should be clear sections for grantor information, funding amounts, expenditure tracking, deadlines, and outcome measurements to provide transparency and accountability. Incorporating automated summaries and visual charts can also enhance reporting and decision-making for nonprofit management.

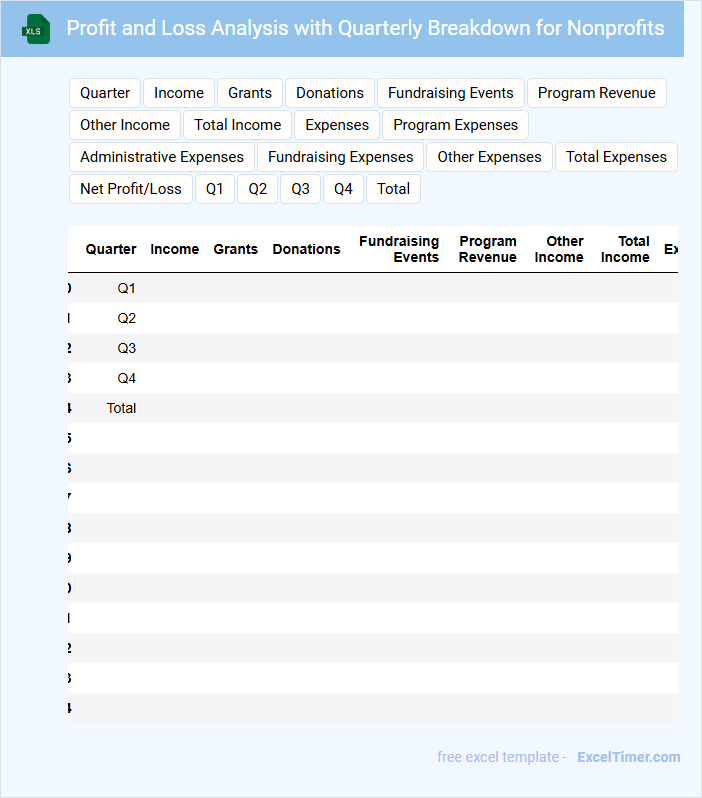

Profit and Loss Analysis with Quarterly Breakdown for Nonprofits

The Profit and Loss Analysis for nonprofits typically includes detailed records of revenues and expenses categorized by quarter, highlighting financial trends and operational efficiency. This document is essential for tracking the organization's financial health over specific periods, helping identify strengths and areas needing improvement.

Important aspects to focus on are accurate revenue recognition and expense classification to ensure transparency and accountability. Consistently updating this analysis supports strategic planning and enhances stakeholder confidence.

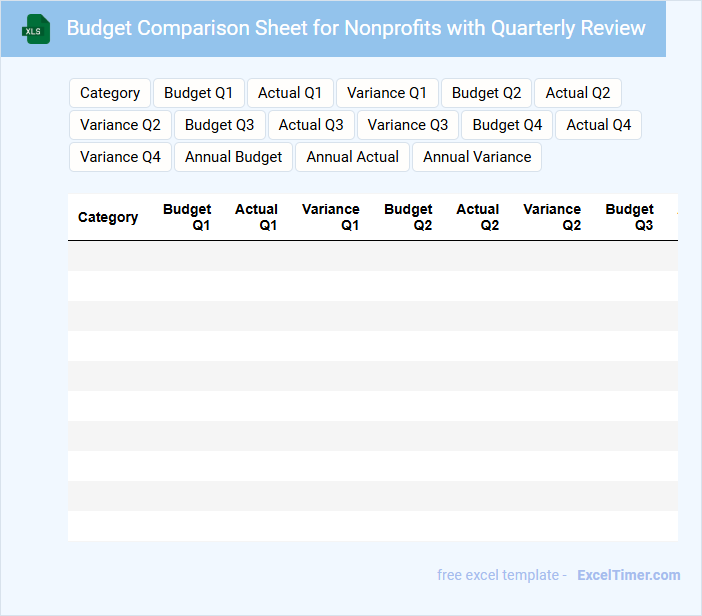

Budget Comparison Sheet for Nonprofits with Quarterly Review

A Budget Comparison Sheet for nonprofits is a financial document used to track and compare actual expenses against the planned budget. It helps organizations monitor their spending efficiency and adjust resources accordingly throughout the year. Including a quarterly review ensures timely identification of variances and supports informed decision-making for future periods.

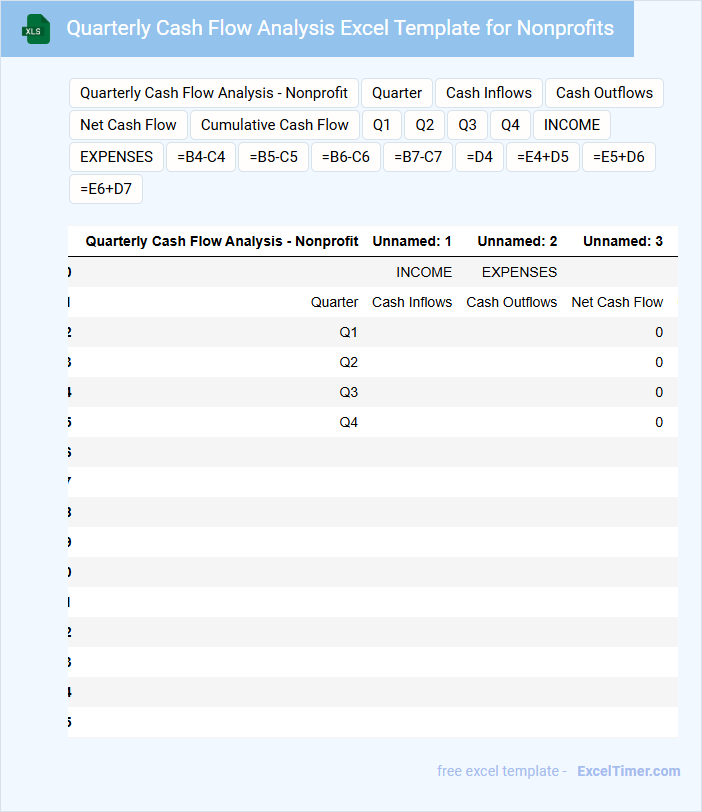

Quarterly Cash Flow Analysis Excel Template for Nonprofits

The Quarterly Cash Flow Analysis Excel Template for nonprofits is a vital document used to track and project cash inflows and outflows over a three-month period. It typically contains detailed sections for revenue sources, expenses, and net cash position to provide clear financial visibility. This template helps organizations ensure they maintain sufficient liquidity for operational stability and strategic planning.

Important considerations include accurately categorizing income streams such as donations and grants, regularly updating expense entries to reflect current obligations, and closely monitoring cash balances to avoid shortfalls. Utilizing built-in formulas and charts can enhance analysis and help stakeholders make informed financial decisions. Consistent review of quarterly trends supports better budgeting and funding allocation for nonprofit missions.

Donation Tracking Spreadsheet for Nonprofits with Quarterly Reports

Donation Tracking Spreadsheets for Nonprofits with Quarterly Reports typically contain detailed records of donations received, donor information, and financial summaries organized by quarter.

- Comprehensive donor profiles to maintain accurate contact and contribution history.

- Real-time donation tracking to monitor incoming funds and ensure transparency.

- Quarterly financial summaries designed to support reporting and strategic planning.

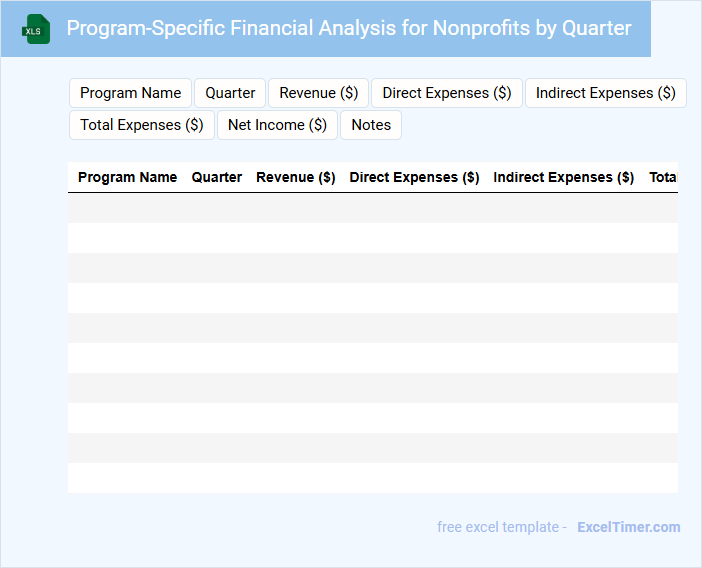

Program-Specific Financial Analysis for Nonprofits by Quarter

A Program-Specific Financial Analysis for nonprofits provides a detailed breakdown of income and expenses related to individual programs, helping organizations assess financial performance by quarter. This document typically includes revenue sources, expense allocation, and program efficiency metrics to facilitate informed decision-making.

It is crucial to highlight quarterly trends and compare them against budget forecasts to identify any deviations early. This analysis supports transparency and aids in strategic planning for sustainable program growth.

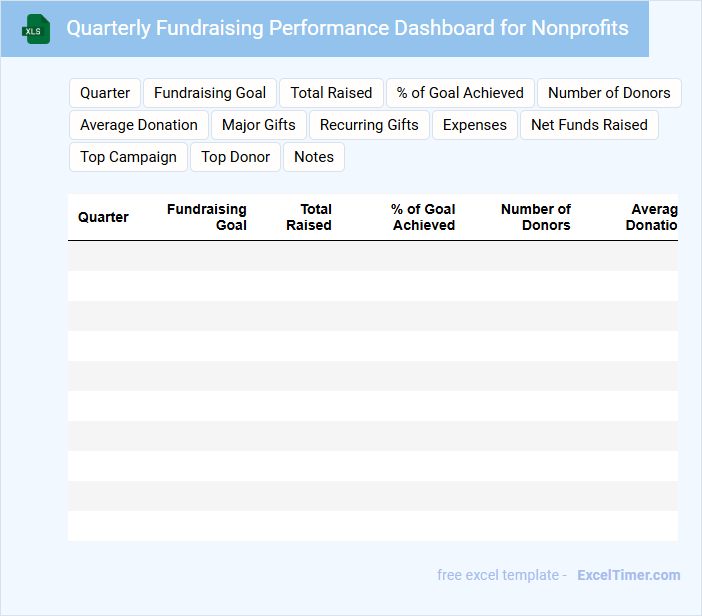

Quarterly Fundraising Performance Dashboard for Nonprofits

The Quarterly Fundraising Performance Dashboard for nonprofits typically contains key metrics such as total funds raised, donor retention rates, and campaign effectiveness. It aggregates financial data and visualizes trends to provide a clear overview of fundraising progress over the quarter.

This document highlights areas needing improvement and tracks the impact of various fundraising strategies. Organizations should focus on maintaining accurate data input and frequently updating the dashboard to ensure timely decision-making.

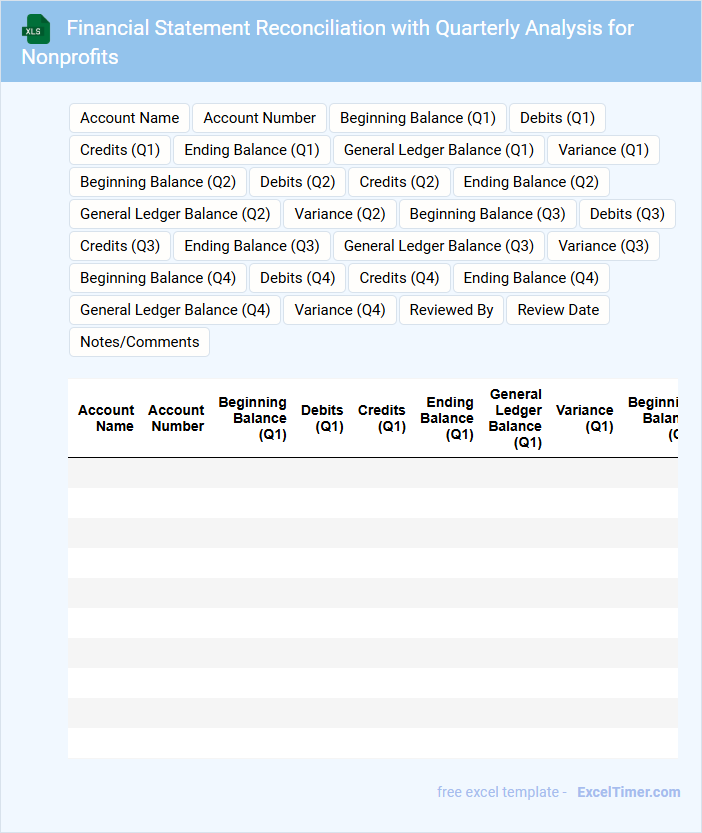

Financial Statement Reconciliation with Quarterly Analysis for Nonprofits

Financial Statement Reconciliation with Quarterly Analysis for Nonprofits typically contains financial data summaries, transaction records, and variance explanations to ensure accuracy. It provides a comprehensive overview of income, expenses, and fund allocations during each quarter. This document is crucial for maintaining transparency and accountability. The important aspect is a detailed quarterly analysis showing trends, discrepancies, and corrective actions needed. It helps nonprofit organizations track budget adherence and financial health effectively. Consistent reconciliation supports informed decision-making and regulatory compliance.

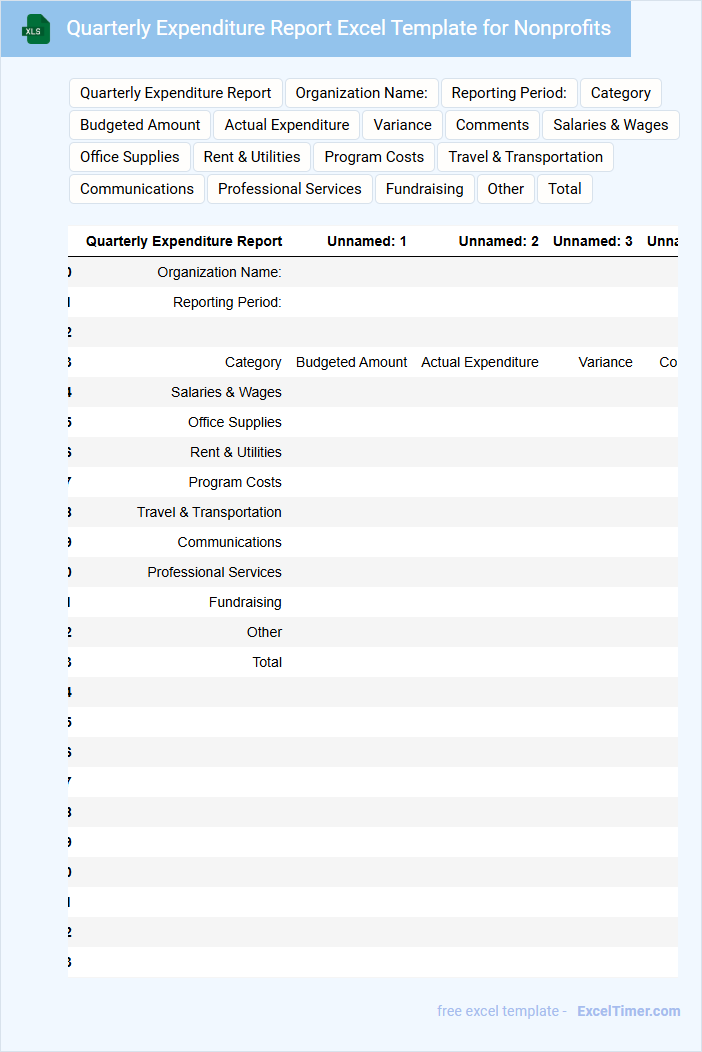

Quarterly Expenditure Report Excel Template for Nonprofits

A Quarterly Expenditure Report Excel Template for Nonprofits typically contains detailed records of all financial transactions made within the quarter, categorizing expenses by program, administrative costs, and fundraising activities. It helps organizations track spending against their budgets, ensuring transparency and accountability. This document is crucial for maintaining financial control and preparing for audits or funding reviews.

Important considerations include ensuring accurate data entry, regularly updating expense categories to reflect current needs, and customizing the template to capture specific grant or donor requirements. Including visual summaries like charts can enhance understanding for stakeholders. Consistent use of this template supports effective financial planning and demonstrates responsible stewardship of funds.

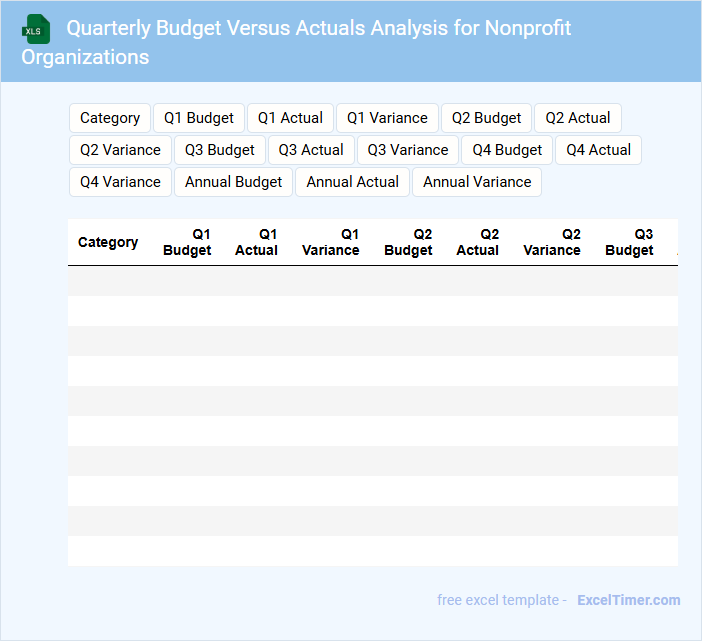

Quarterly Budget Versus Actuals Analysis for Nonprofit Organizations

The Quarterly Budget Versus Actuals Analysis document for nonprofit organizations typically contains a detailed comparison between the planned budget and the actual financial performance over a three-month period. It highlights variances to help assess financial health, resource allocation, and operational efficiency. Key elements include income sources, expenditures, and explanations for any significant discrepancies.

Quarterly Financial KPI Dashboard for Nonprofits

A Quarterly Financial KPI Dashboard for nonprofits typically contains key performance indicators such as revenue, expenses, cash flow, and fundraising efficiency. It provides a clear snapshot of the organization's financial health for strategic decision-making. To maximize its impact, the dashboard should emphasize transparency and regular updates, enabling stakeholders to track progress and identify financial trends promptly. Ensure data accuracy and include visual aids like charts for quick comprehension.

How are restricted versus unrestricted funds reflected and analyzed in quarterly financial statements for nonprofits?

Quarterly financial statements for nonprofits separate restricted funds, which are designated for specific purposes, from unrestricted funds, available for general use, to provide clear insights into resource allocation. Your analysis should highlight the impact of restricted funds on program expenditures and compare unrestricted fund balances to ensure operational sustainability. This distinction enables more accurate forecasting and compliance with donor-imposed requirements.

What key performance indicators (KPIs) should be included in a nonprofit's quarterly financial analysis?

Key performance indicators (KPIs) for a nonprofit's quarterly financial analysis should include program expense ratio, fundraising efficiency, operating reserve ratio, and revenue growth rate. Tracking your administrative expense ratio and donor retention rate also provides insights into financial health and sustainability. These metrics enable informed decision-making to maximize impact and ensure long-term viability.

How does donor revenue seasonality impact the interpretation of quarterly trends in nonprofit financial reports?

Donor revenue seasonality causes fluctuations in nonprofit income, with peaks often occurring during year-end giving campaigns. This variability impacts quarterly trends, making some quarters appear disproportionately strong or weak. Accurate interpretation requires adjusting for these seasonal patterns to assess true financial health and operational performance.

What methods can be used to track program expenses versus administrative costs each quarter in nonprofits?

Your quarterly financial analysis for nonprofits can use activity-based costing and expense categorization to track program expenses versus administrative costs accurately. Implementing detailed ledger codes and allocating shared expenses ensures precise quarterly expense reporting. Regular variance analysis highlights deviations and helps optimize fund allocation for nonprofit programs.

Why is variance analysis between budgeted and actual quarterly figures essential for nonprofit financial oversight?

Variance analysis between budgeted and actual quarterly figures is essential for nonprofit financial oversight because it helps identify discrepancies in revenue and expenses, ensuring funds are used effectively. Your organization can detect financial trends early, enabling timely adjustments to maintain fiscal responsibility. This process supports transparency and accountability critical to nonprofit stakeholders.