The Quarterly Budget Excel Template for Startups streamlines financial planning by providing a structured format to track income, expenses, and cash flow over three months. It helps startups maintain financial discipline, identify spending patterns, and adjust budgets to align with business goals. This template is essential for ensuring accurate forecasting and effective resource allocation in the early stages of growth.

Quarterly Budget Tracker for Startups

A Quarterly Budget Tracker for startups typically contains detailed financial data including income, expenses, and cash flow over a three-month period. It helps monitor spending patterns and ensures funds are allocated efficiently to support growth.

Key components often include revenue projections, actual expenditures, and variance analysis to identify discrepancies. Regular updates and accurate data entry are crucial to make informed strategic decisions and maintain financial health.

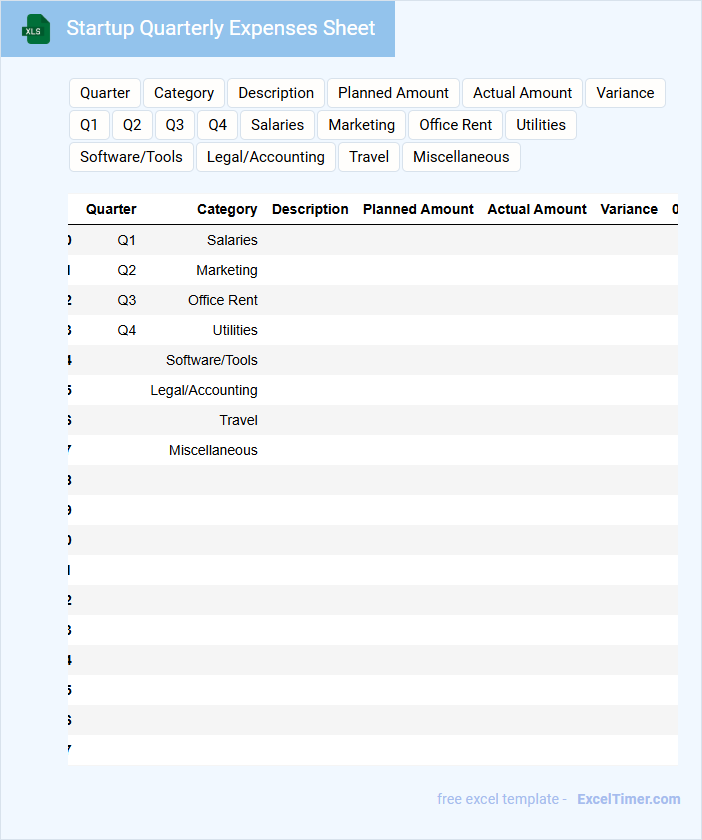

Startup Quarterly Expenses Sheet

What information is typically included in a Startup Quarterly Expenses Sheet? This document usually contains a detailed record of all expenses incurred by a startup over a three-month period, categorized by type such as operational costs, salaries, marketing, and equipment. It helps track financial health and guides budgeting decisions to ensure sustainable growth.

What is an important consideration when preparing a Startup Quarterly Expenses Sheet? Accuracy and completeness are crucial to provide a clear financial overview. It is important to regularly update the sheet and categorize expenses correctly to identify cost-saving opportunities and improve financial planning.

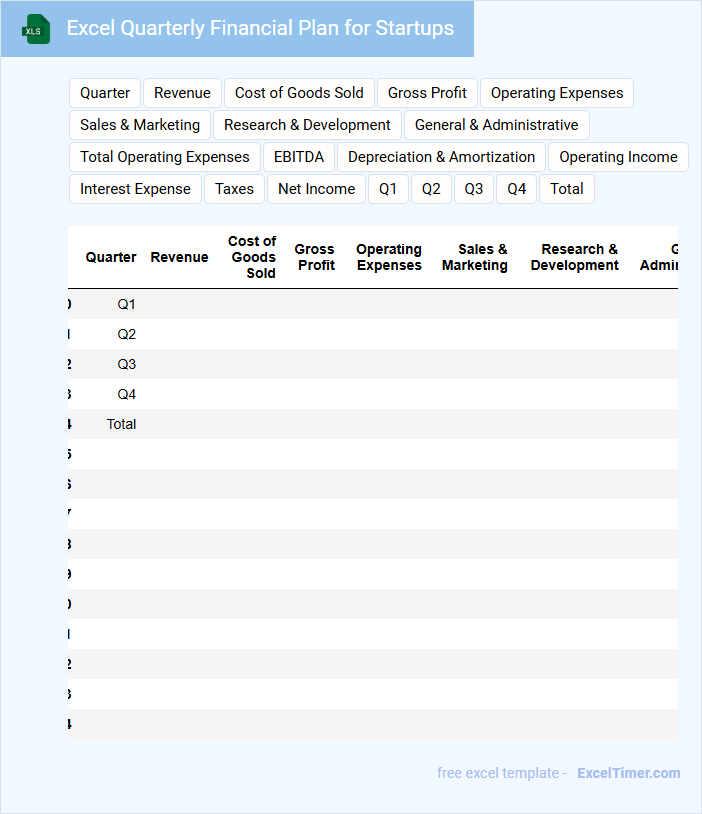

Excel Quarterly Financial Plan for Startups

An Excel Quarterly Financial Plan for startups typically contains detailed projections of revenue, expenses, and cash flow over a three-month period. It helps startups manage their finances by tracking key metrics and identifying funding needs. This document is crucial for strategic planning and investor presentations.

Important elements to include are clear assumptions, monthly breakdowns, and scenario analysis to prepare for uncertainties. Ensure your plan is easy to update and visually organized with charts and tables for quick insights. Regularly reviewing and adjusting the plan enhances decision-making and financial health.

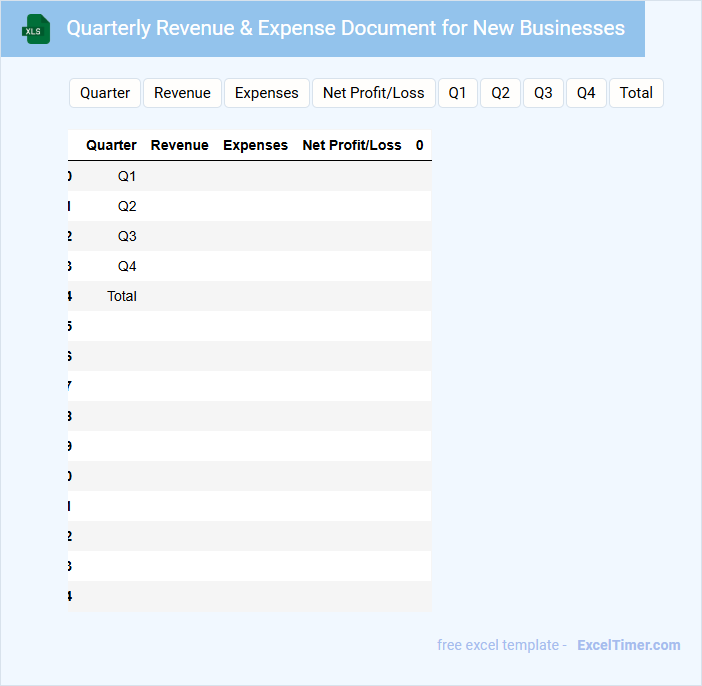

Quarterly Revenue & Expense Document for New Businesses

The Quarterly Revenue & Expense Document is a crucial financial report that outlines the income and expenditures of a new business over a three-month period. It usually contains detailed figures on sales, operational costs, and net profit or loss, helping stakeholders assess financial health. For new businesses, it is important to ensure accurate data entry and clear categorization to facilitate better financial planning and decision-making.

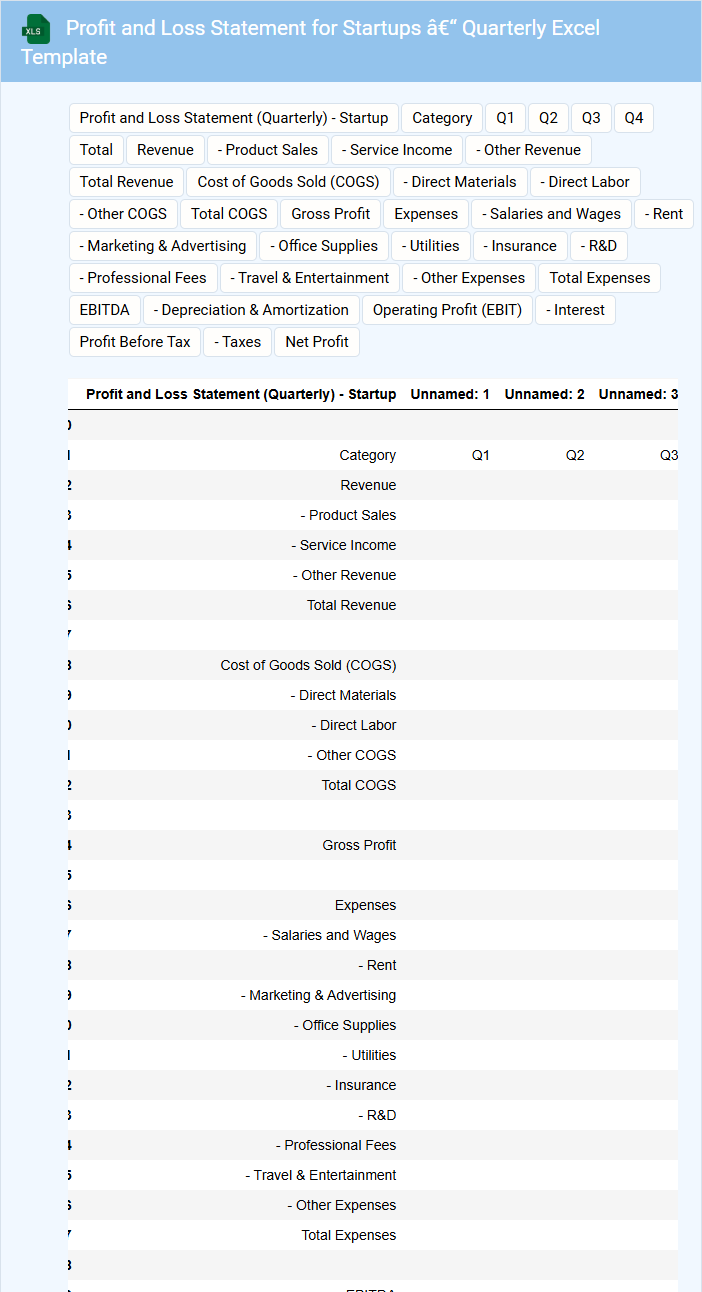

Profit and Loss Statement for Startups – Quarterly Excel Template

The Profit and Loss Statement for startups is a crucial financial document that summarizes revenues, costs, and expenses over a specific quarter. It helps new businesses track their financial performance and make informed decisions. Using a Quarterly Excel Template simplifies data entry and analysis, ensuring accuracy and timely updates.

Typically, this document contains sections for revenue streams, cost of goods sold, operating expenses, and net profit or loss. For startups, it's important to include detailed startup costs, marketing expenses, and any funding received. Regular updates and thorough categorization enable better cash flow management and investor reporting.

To maximize its usefulness, ensure formulas are correctly applied within the Excel template for automatic calculations. Customize the template to reflect your unique business model and keep backup copies for financial auditing. Consistent use of this statement fosters transparency and supports strategic growth planning.

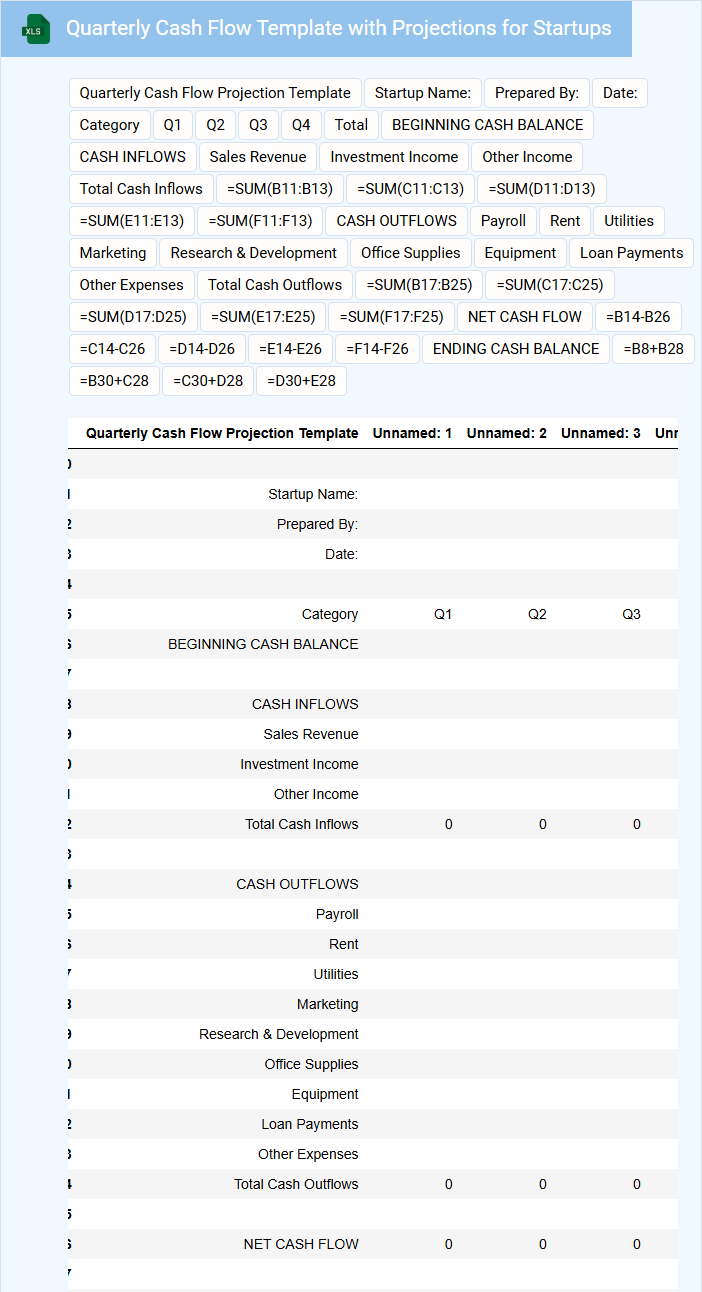

Quarterly Cash Flow Template with Projections for Startups

The Quarterly Cash Flow Template is a crucial financial document that tracks the inflows and outflows of cash within a startup over a three-month period. It typically contains sections for operating activities, investing activities, and financing activities, providing a clear overview of liquidity. Proper projections in this template help startups anticipate cash shortages and make informed decisions.

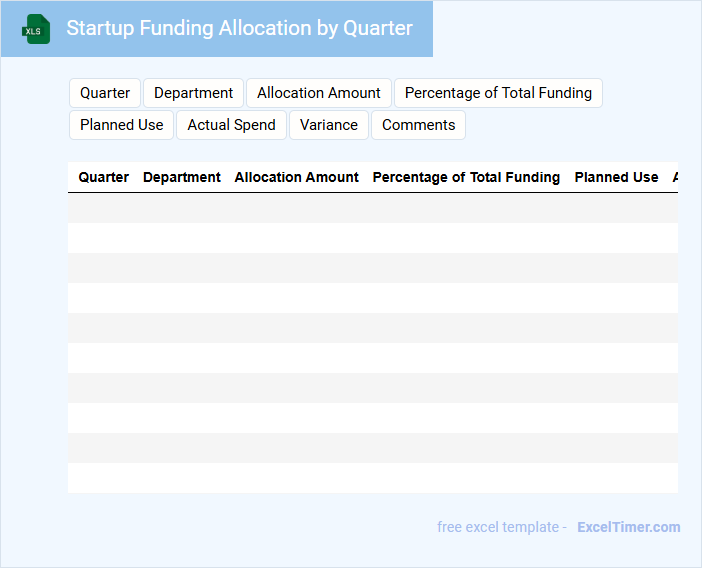

Startup Funding Allocation by Quarter

What information is typically included in a Startup Funding Allocation by Quarter document? This document usually outlines the distribution of financial resources obtained by a startup over specific three-month periods. It details planned expenditures, investment priorities, and cash flow management to ensure strategic growth and operational sustainability.

Why is it important to monitor funding allocation quarterly? Regular review helps startups adjust spending according to business needs, track progress against milestones, and maintain transparency with investors. This proactive approach supports informed decision-making and optimizes resource utilization for success.

Operational Budget Sheet for Startups – Quarterly Template

An Operational Budget Sheet for startups is a comprehensive financial document outlining expected income and expenses over a specific period, typically a quarter. It helps entrepreneurs track cash flow, allocate resources efficiently, and ensure operational sustainability. Key elements usually include revenue projections, fixed and variable costs, and contingency funds to address unforeseen expenses.

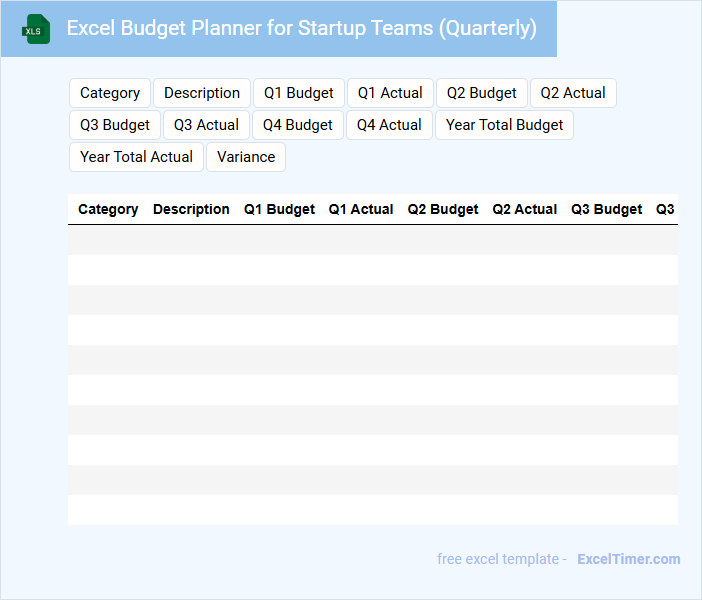

Excel Budget Planner for Startup Teams (Quarterly)

An Excel Budget Planner for Startup Teams (Quarterly) typically contains financial projections and expense tracking tailored for short-term business planning. It helps startups allocate resources efficiently over a three-month period to ensure sustainable growth.

- Include detailed categories for revenue streams and fixed versus variable costs.

- Incorporate a clear timeline with quarterly milestones for monitoring financial health.

- Use formulas for automatic calculations to reduce errors and save time.

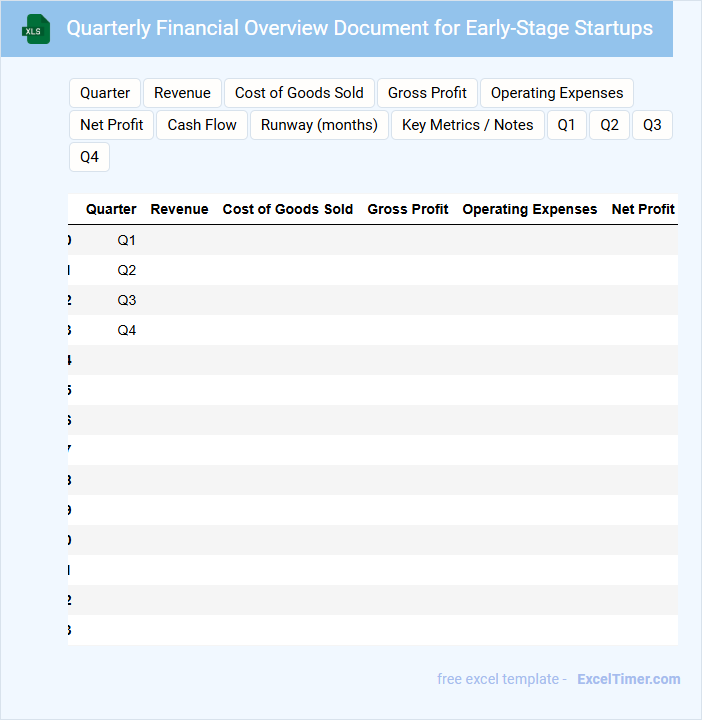

Quarterly Financial Overview Document for Early-Stage Startups

The Quarterly Financial Overview Document typically contains key financial metrics including revenue, expenses, and cash flow statements. It provides a snapshot of the startup's financial health for the past quarter.

For early-stage startups, it's crucial to highlight burn rate and runway alongside growth indicators. Clear visuals such as charts and concise executive summaries enhance understanding for stakeholders.

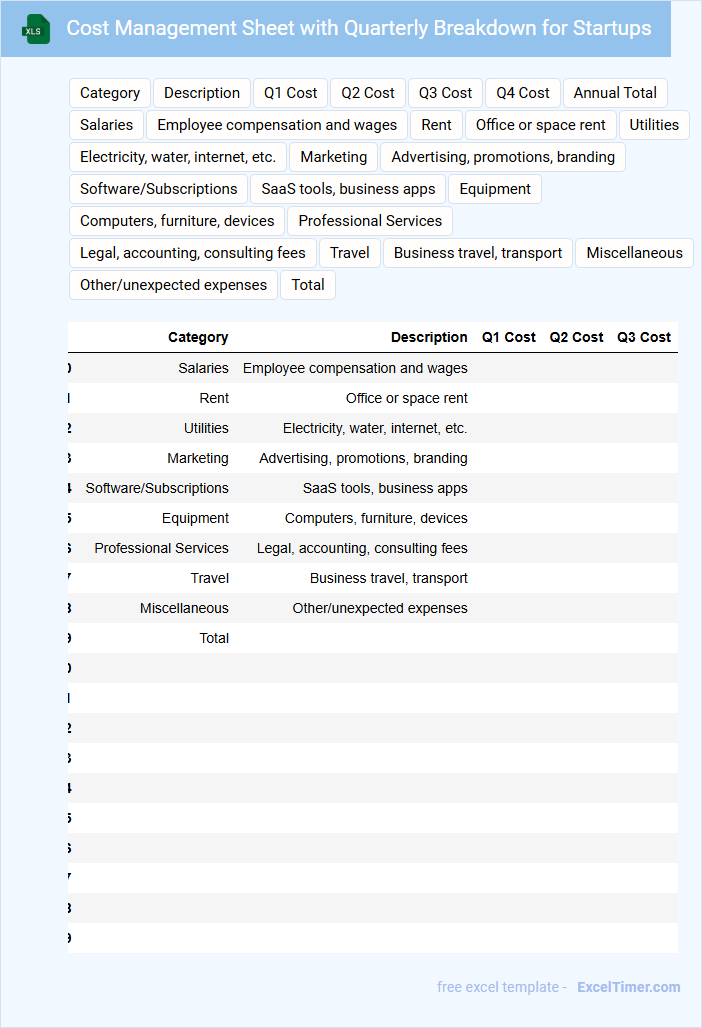

Cost Management Sheet with Quarterly Breakdown for Startups

A Cost Management Sheet with Quarterly Breakdown for Startups typically contains detailed financial data organized by time periods to track and control expenses effectively.

- Expense Categories: Clearly define and categorize all types of costs such as operational, marketing, and development expenses.

- Quarterly Analysis: Break down costs into quarterly segments to identify trends and allocate budgets efficiently.

- Forecasting and Adjustments: Include projections and allow space for periodic revisions based on actual spending versus planned budgets.

Expense Tracking Excel File for Startup Quarters

An Expense Tracking Excel File for Startup Quarters typically contains detailed records of all financial transactions during the initial business phases.

- Comprehensive expense categories to clearly differentiate types of expenditures.

- Accurate date entries to track expenses over specific quarters for precise financial analysis.

- Regular budget review sections to help manage spending and adjust forecasts effectively.

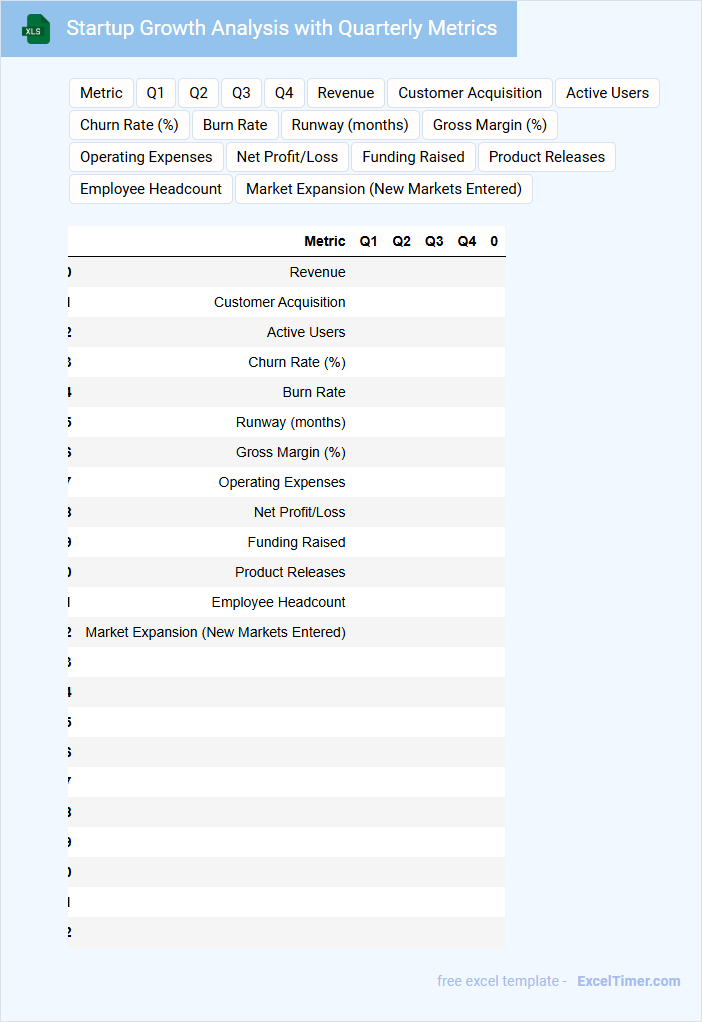

Startup Growth Analysis with Quarterly Metrics

A Startup Growth Analysis with Quarterly Metrics is a comprehensive report that tracks a startup's performance over three-month periods, focusing on key indicators such as revenue, user acquisition, and market penetration. It provides insights into the company's scalability and operational efficiency.

This type of document usually contains financial statements, customer data, and growth charts to highlight trends and identify opportunities or challenges. Including clear visualizations and a strategic action plan is important for making informed decisions and attracting investors.

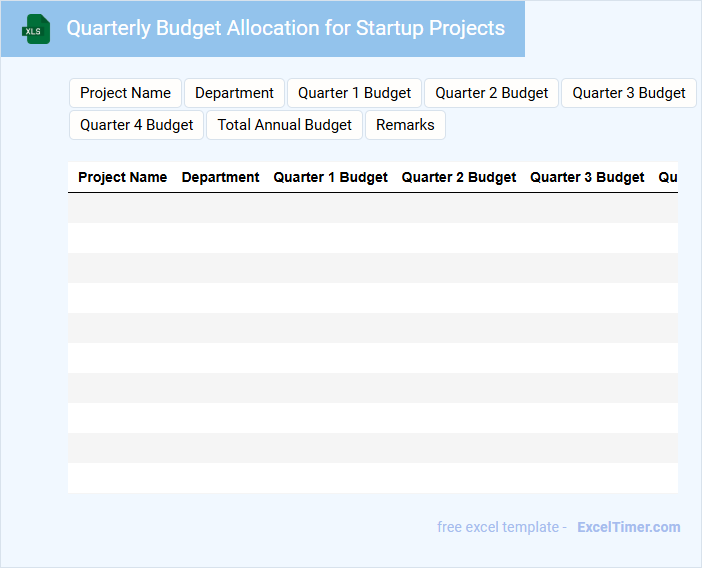

Quarterly Budget Allocation for Startup Projects

A Quarterly Budget Allocation document outlines the planned distribution of funds across various startup projects for a three-month period. It aids in financial planning and resource management to ensure project goals are met efficiently.

- Clearly define budget categories and corresponding project priorities.

- Include projected expenses and contingency funds for unexpected costs.

- Regularly review and adjust allocations based on project progress and financial performance.

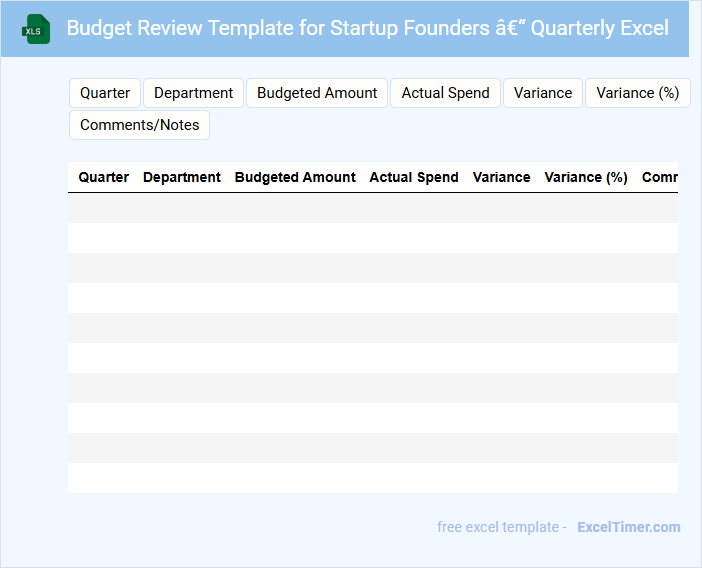

Budget Review Template for Startup Founders – Quarterly Excel

A Budget Review Template for startup founders is a structured document designed to track and analyze quarterly financial performance. It typically contains sections for income, expenses, cash flow, and variance analysis to help founders monitor their financial health. Including clear summaries and actionable insights is essential for effective decision-making and strategic planning.

What are the essential income and expense categories to include in a startup's quarterly budget Excel document?

Your quarterly budget Excel document for startups should include essential income categories such as sales revenue, investment capital, and grants. Expense categories must cover operational costs, payroll, marketing, and research and development to ensure comprehensive financial planning. Tracking these key items enhances budgeting accuracy and supports sustainable growth.

How can Excel formulas automate the calculation of quarterly cash flow and burn rate?

Excel formulas automate quarterly cash flow by summing income and subtracting expenses using functions like SUM and SUMIF. Your burn rate can be calculated by dividing total expenses by the number of months in the quarter with simple division formulas. These automated calculations provide real-time financial insights essential for startup budgeting and cash management.

Which key performance metrics (KPIs) should be tracked in a quarterly budget for startups using Excel?

Track key performance metrics such as cash burn rate, runway, gross margin, customer acquisition cost (CAC), and monthly recurring revenue (MRR) in your quarterly budget Excel document for startups. Monitoring these KPIs helps you manage expenses, forecast future funding needs, and measure growth efficiency. Excel's data visualization tools enable clear, actionable insights into your startup's financial health each quarter.

How should you structure Excel sheets to compare budgeted vs. actual figures each quarter?

Structure your Excel sheets by creating separate tabs for each quarter, with columns for budgeted and actual figures side by side. Include summary tables that calculate variances and percentage differences to easily identify budget performance. Use consistent formatting and data validation to ensure accuracy and facilitate clear comparison across quarters.

What Excel features can help in forecasting future quarters based on past data trends in a startup budget?

Excel's Forecast Sheet uses historical quarterly budget data to predict future revenues and expenses with accuracy. PivotTables enable detailed analysis of spending patterns and income sources across past quarters. Your startup can leverage these tools to create dynamic, data-driven budget forecasts for upcoming quarters.