The Quarterly Cash Flow Forecast Excel Template for Startups is designed to help new businesses project their cash inflows and outflows over a three-month period, ensuring financial stability and informed decision-making. This template is crucial for tracking liquidity, planning expenses, and avoiding cash shortages during critical growth phases. Accurate forecasting using this tool enables startups to manage working capital effectively and secure funding from investors or lenders.

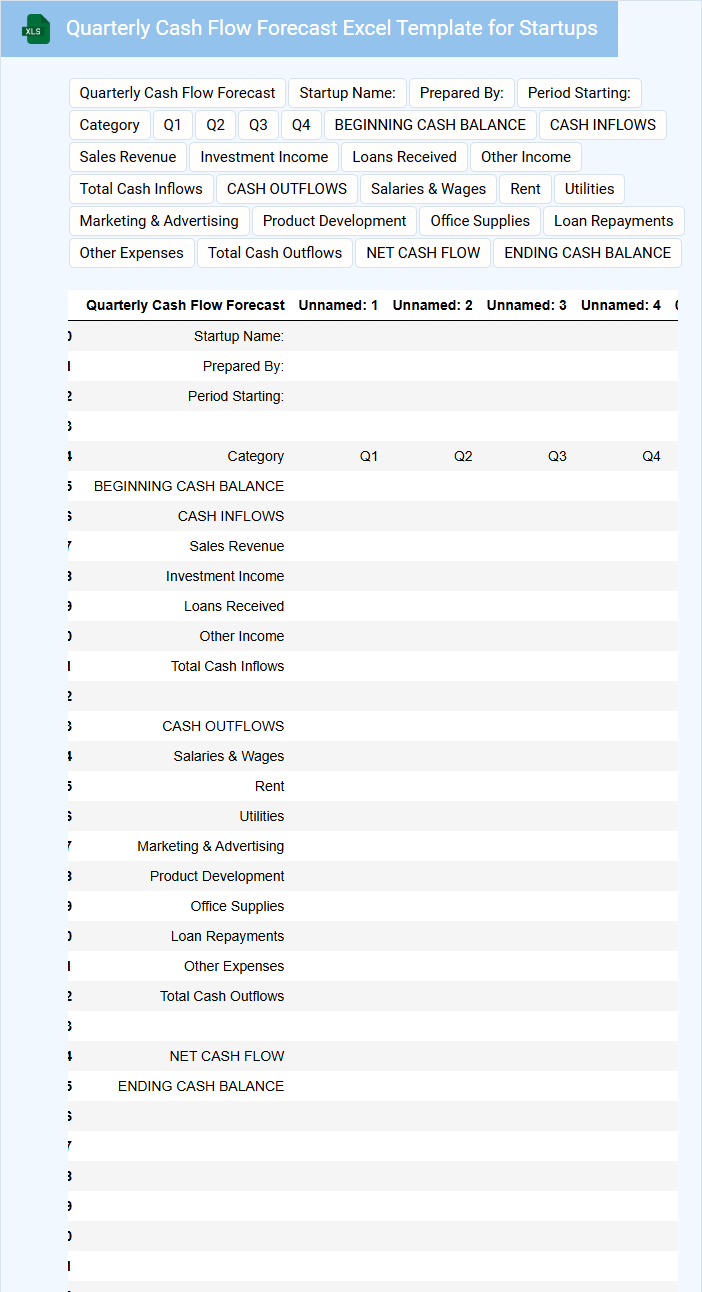

Quarterly Cash Flow Forecast Excel Template for Startups

A Quarterly Cash Flow Forecast Excel Template for Startups is a financial tool designed to project cash inflows and outflows over a three-month period. It typically contains sections for operating activities, investing activities, and financing activities to provide a comprehensive view of expected cash movements. This type of document helps startups manage liquidity, plan budgets, and anticipate cash shortages ahead of time.

Important elements to include are accurate revenue projections, detailed expense categories, and contingency plans for unexpected costs. The template should also allow for easy updating and scenario analysis to adapt to changing business conditions. Ensuring clarity and simplicity in design helps founders and investors quickly interpret the financial outlook.

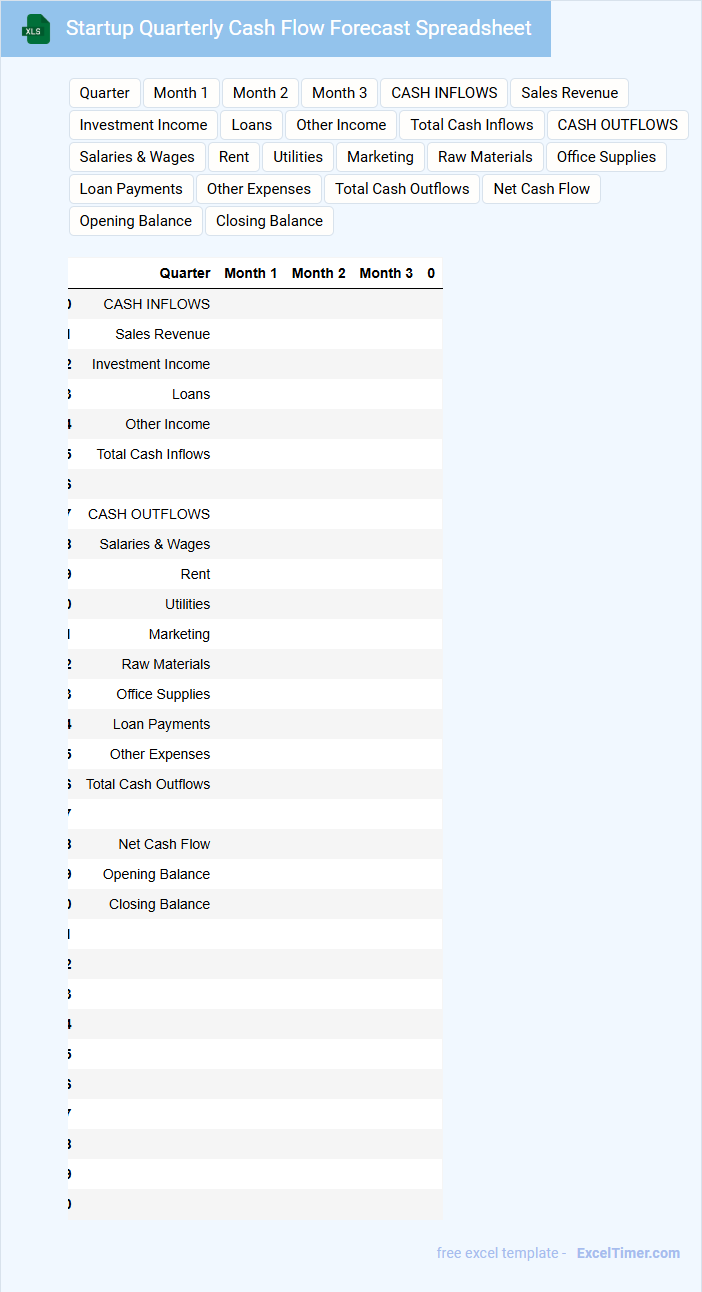

Startup Quarterly Cash Flow Forecast Spreadsheet

A Startup Quarterly Cash Flow Forecast Spreadsheet is a financial document that projects a startup's cash inflows and outflows over a three-month period. It helps founders anticipate funding needs and manage liquidity effectively.

- Include accurate revenue estimates based on realistic sales projections.

- Detail all expected expenses, including fixed and variable costs.

- Regularly update the forecast to reflect changes in business conditions.

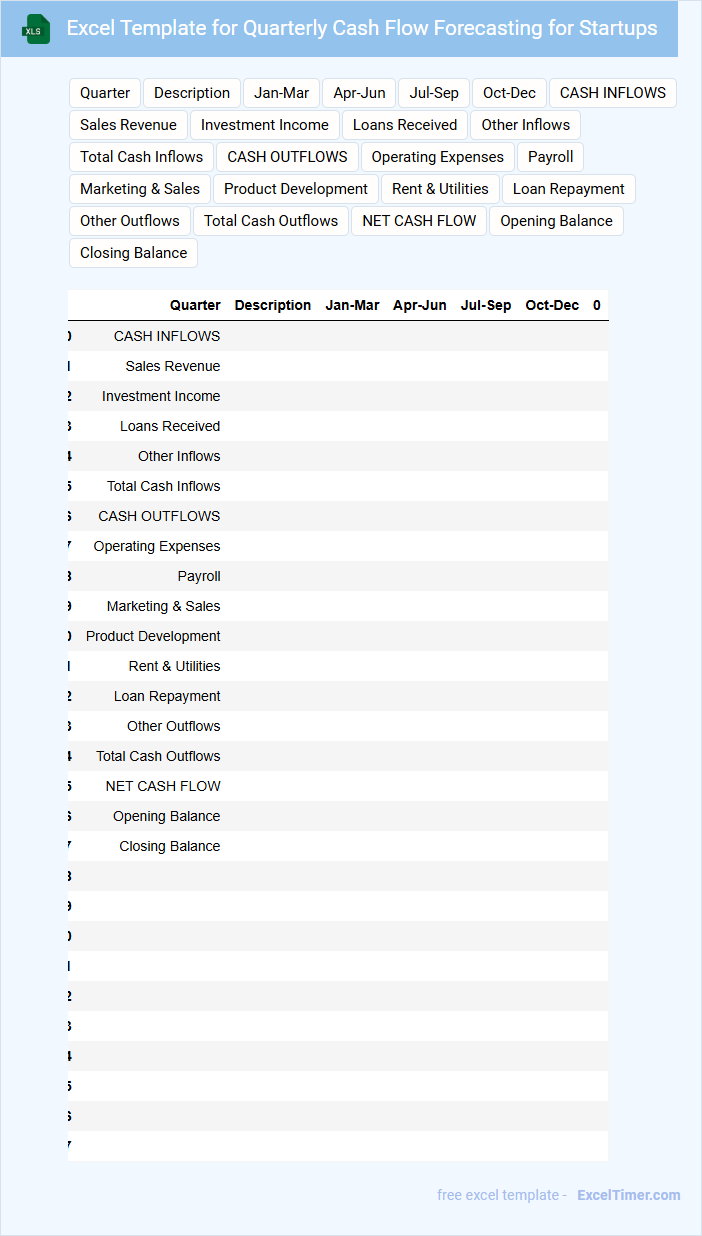

Excel Template for Quarterly Cash Flow Forecasting for Startups

What does an Excel Template for Quarterly Cash Flow Forecasting for Startups usually contain? This document typically includes detailed sections for projected income, expenses, and net cash flow over each quarter, helping startups anticipate their financial position. It also features customizable fields for revenue streams, cost categories, and assumptions, enabling tailored and dynamic forecasting.

What is an important consideration when using this template? Accuracy in input data and regular updating are crucial to reflect changes in business operations and market conditions, ensuring reliable cash flow predictions. Moreover, incorporating scenario analysis helps startups prepare for various financial outcomes and make informed decisions.

Quarterly Cash Flow Projection Template for Startup Businesses

A Quarterly Cash Flow Projection Template for startup businesses typically contains detailed forecasts of cash inflows and outflows over a three-month period. It helps entrepreneurs anticipate financial needs and manage liquidity effectively.

This document is essential for tracking revenue, expenses, and investment activities, allowing startups to plan for growth and avoid cash shortages. Including assumptions and contingency plans enhances the accuracy and usefulness of the projections.

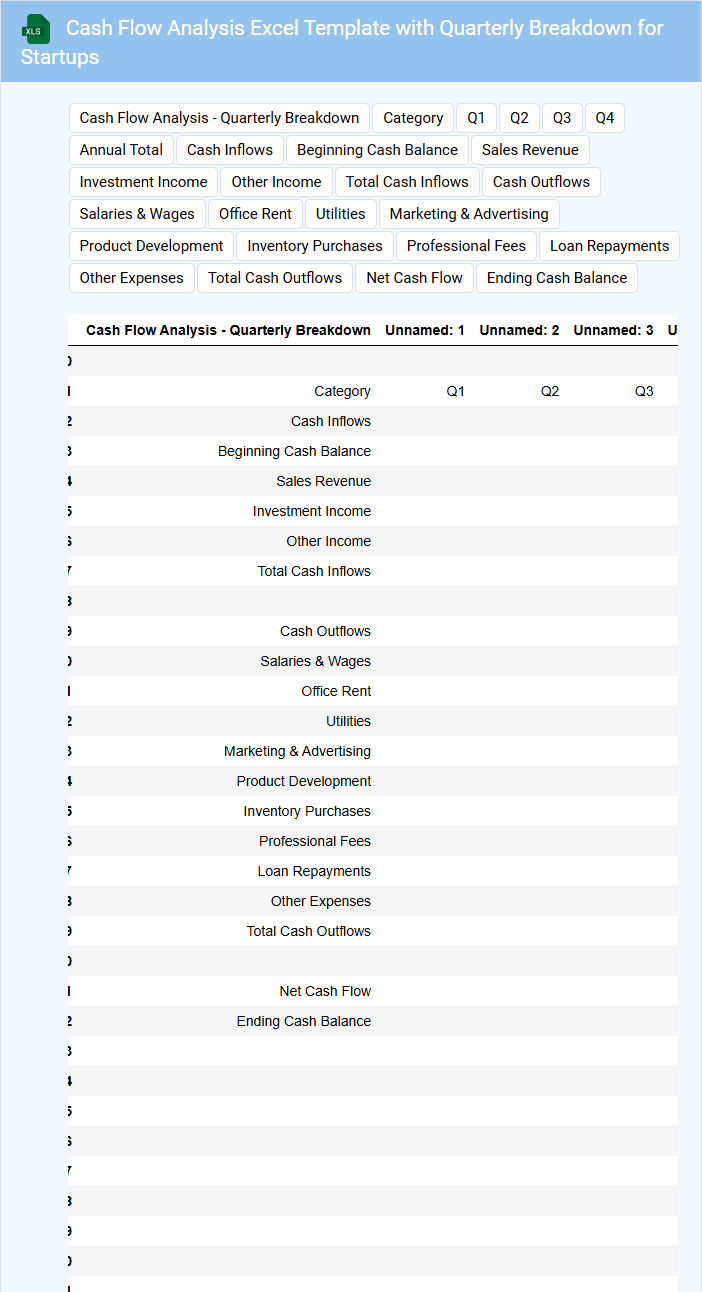

Cash Flow Analysis Excel Template with Quarterly Breakdown for Startups

What information does a Cash Flow Analysis Excel Template with Quarterly Breakdown for Startups typically contain? This document usually includes detailed sections on operating, investing, and financing cash flows, organized by quarter to provide clear visibility into the startup's financial health over time. It helps track inflows and outflows, forecast future cash positions, and identify periods of potential cash shortfalls or surpluses.

What important aspects should be considered when using this template? Accurate input of revenue projections, expense estimates, and timing of cash transactions is crucial for reliable analysis. Additionally, incorporating sensitivity analysis and regularly updating the template can enhance decision-making and support effective financial planning for the startup's growth phases.

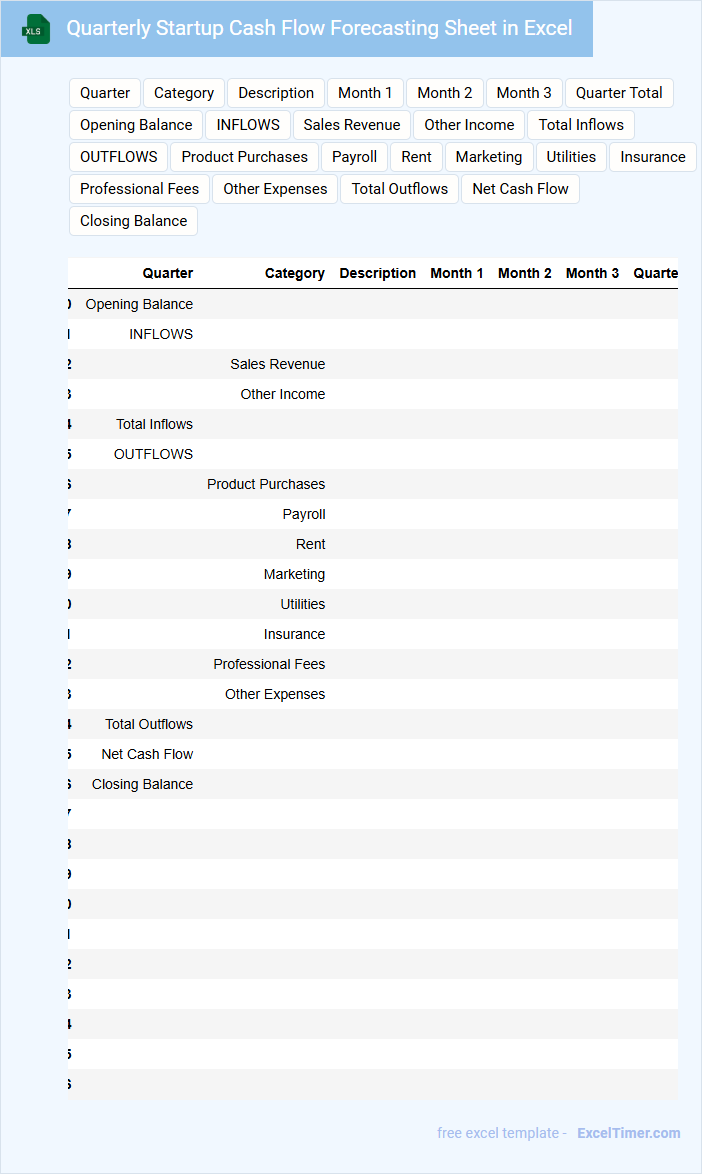

Quarterly Startup Cash Flow Forecasting Sheet in Excel

A Quarterly Startup Cash Flow Forecasting Sheet in Excel typically contains projected income, expenses, and cash balances for a three-month period. It helps startups anticipate cash shortages and surpluses by organizing anticipated revenue streams and operating costs. Essential elements include detailed inflow sources, fixed and variable expenses, and ending cash balance calculations. A key suggestion is to regularly update the sheet with actual figures and adjust assumptions to maintain accuracy and make informed financial decisions.

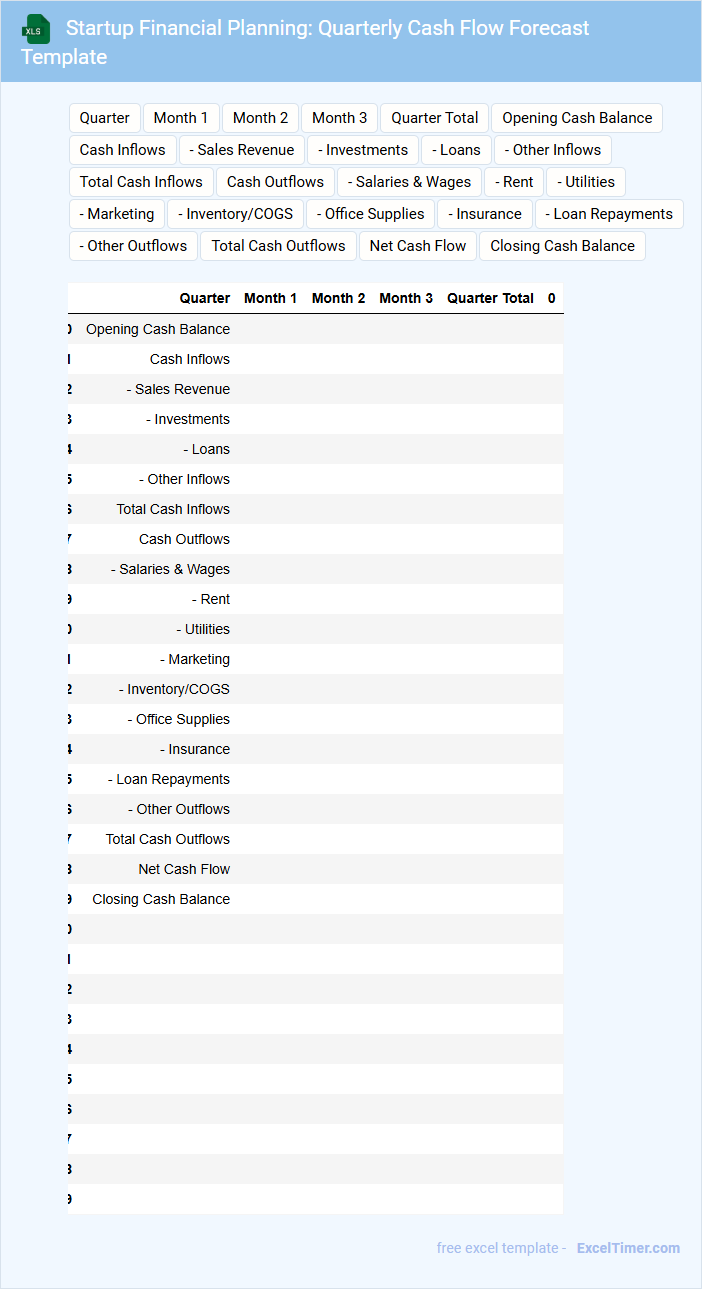

Startup Financial Planning: Quarterly Cash Flow Forecast Template

This document typically contains detailed projections of a startup's cash inflows and outflows for each quarter, helping to manage liquidity and plan for future financial needs.

- Accurate Revenue Estimates: Use realistic assumptions based on market research and historical data to forecast income.

- Detailed Expense Tracking: Include all fixed and variable costs to avoid surprises in cash requirements.

- Contingency Planning: Prepare for unexpected cash shortfalls by incorporating buffer amounts into forecasts.

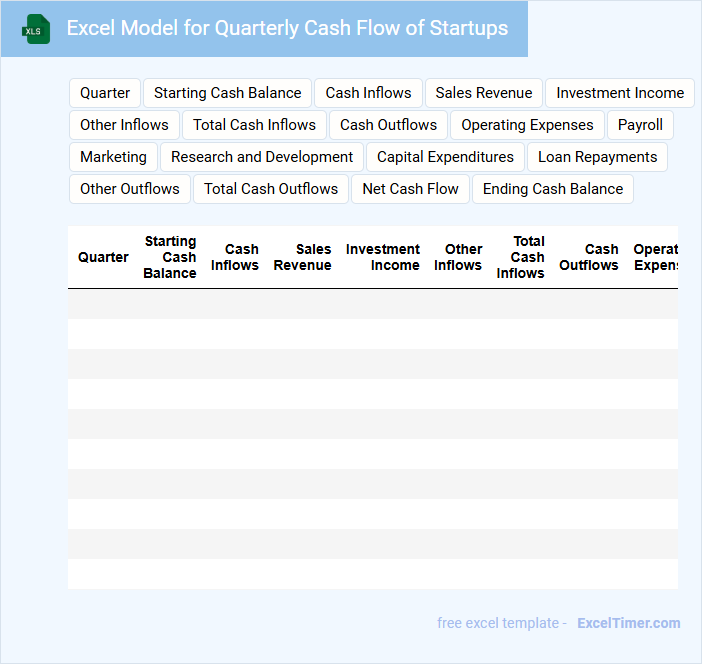

Excel Model for Quarterly Cash Flow of Startups

An Excel Model for Quarterly Cash Flow of Startups typically contains detailed projections of income, expenses, and cash balances over each quarter. These models help in visualizing the financial health and liquidity trends of a startup, making them crucial for planning and decision-making. Incorporating assumptions about sales growth and expense patterns is essential for accuracy.

This type of document often includes categorized cash inflows and outflows to track operational efficiency and funding needs. It serves as a vital tool for investors and management to assess sustainability and funding requirements. Ensuring clear labels and dynamic formulas enhances usability and forecast reliability.

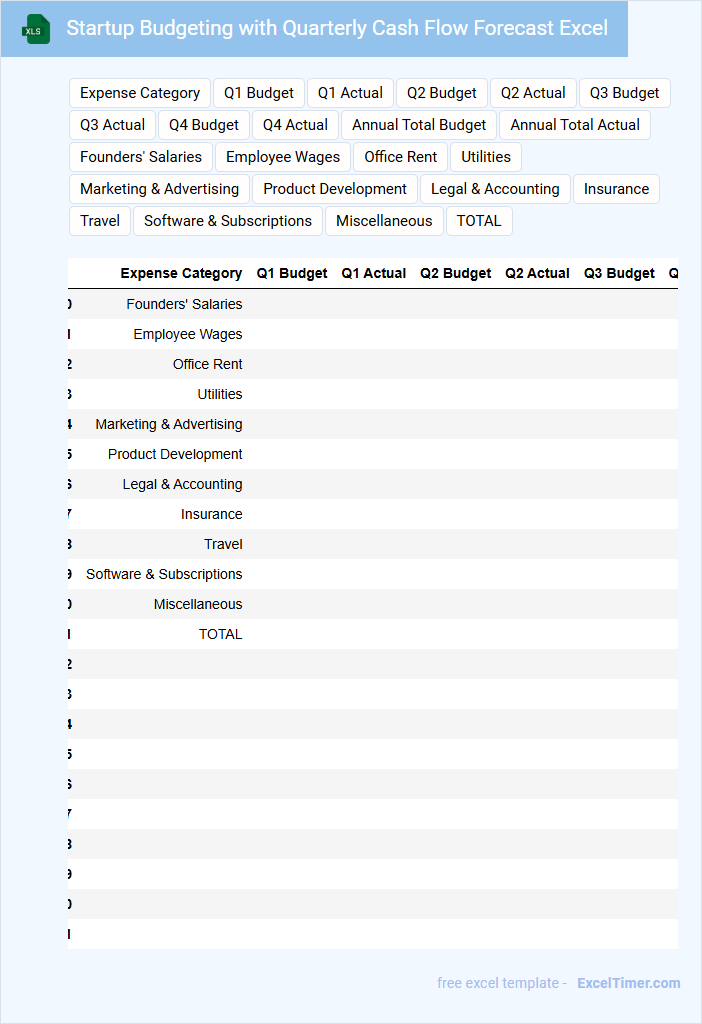

Startup Budgeting with Quarterly Cash Flow Forecast Excel

A Startup Budgeting document typically contains detailed projections of income, expenses, and capital requirements essential for launching a new business. It helps founders allocate resources effectively and plan financial strategy during critical early stages.

The Quarterly Cash Flow Forecast in Excel tracks expected cash inflows and outflows over three-month periods, ensuring the startup maintains liquidity and plans for short-term operational needs. This financial tool supports proactive decision-making by highlighting potential funding gaps.

Key suggestions include regularly updating the forecast with actual data, incorporating contingency plans, and aligning assumptions with market research to improve accuracy and reliability.

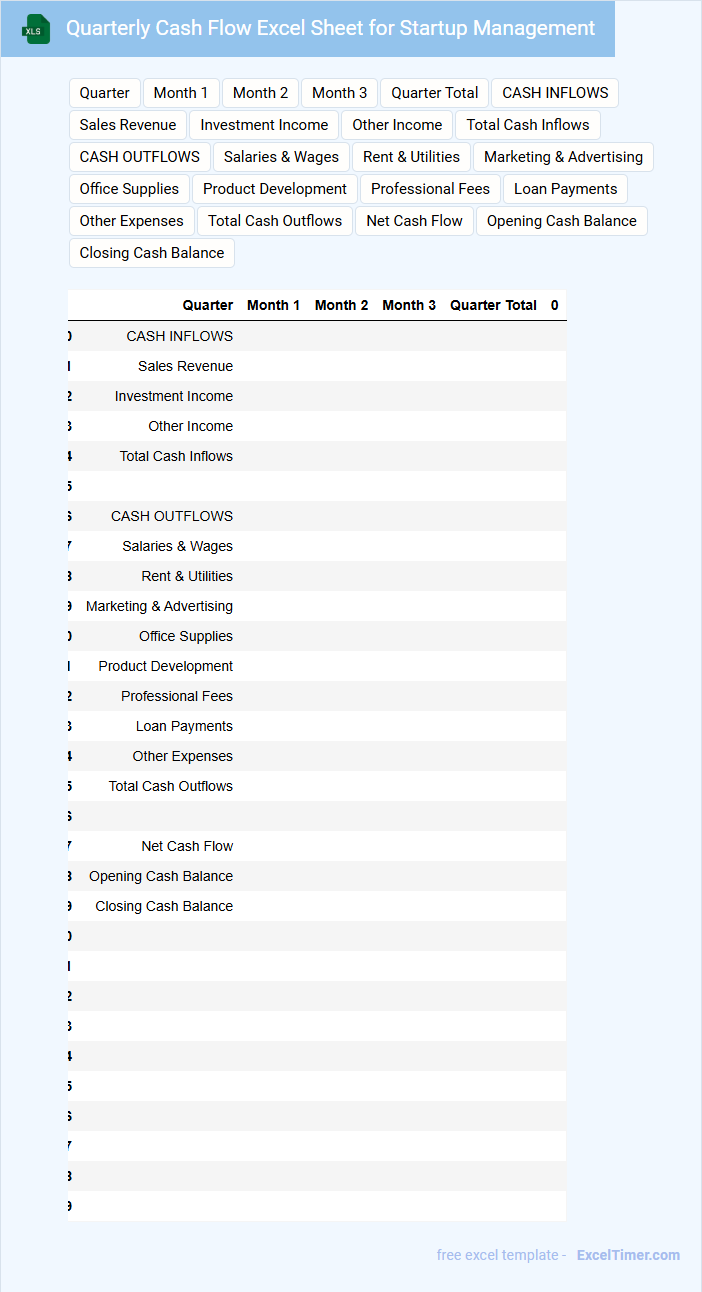

Quarterly Cash Flow Excel Sheet for Startup Management

A Quarterly Cash Flow Excel Sheet for startup management is a critical financial document that tracks the inflow and outflow of cash over a three-month period. It provides insights into the company's liquidity and helps forecast future cash positions to ensure sustainable operations. This document typically contains sections for revenue, expenses, investments, and financing activities, tailored to the startup's unique financial landscape. Important considerations include regularly updating the sheet for accuracy, categorizing cash flows clearly, and using it to identify potential funding needs or cost-saving opportunities.

Startup Finance Tracker with Quarterly Cash Flow Forecast

A Startup Finance Tracker with Quarterly Cash Flow Forecast is a crucial document that helps new businesses monitor their income, expenses, and cash position over time. It typically contains detailed financial data, projections of revenue, and anticipated costs to ensure transparency and support better decision-making. Including a quarterly cash flow forecast enables startups to anticipate funding needs and manage liquidity effectively.

To optimize its usefulness, it is important to maintain accurate and up-to-date entries, categorize expenses clearly, and regularly compare actual figures against forecasts. Incorporating visual aids like charts or graphs can enhance understanding of financial trends. Ensuring the document is accessible and shared with key stakeholders fosters collaboration and strategic planning.

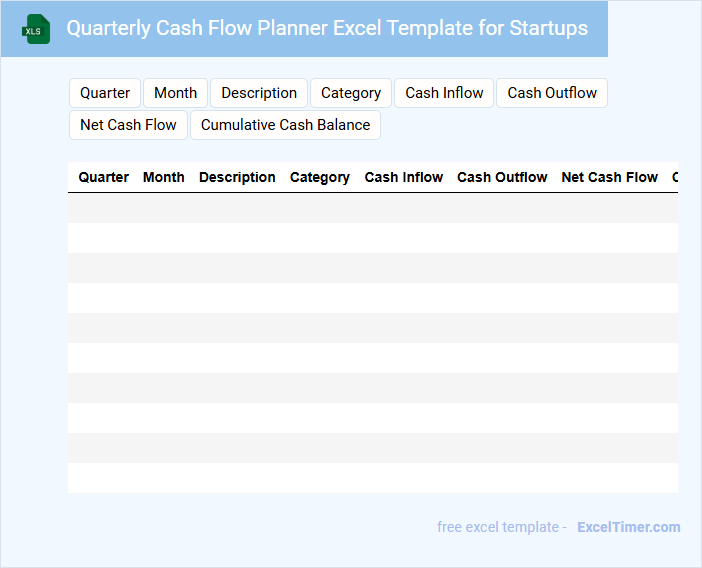

Quarterly Cash Flow Planner Excel Template for Startups

What information does a Quarterly Cash Flow Planner Excel Template for Startups typically contain? This document usually includes detailed projections of cash inflows and outflows over a three-month period to help startups manage their liquidity effectively. It provides a clear overview of expected revenues, operational expenses, and funding requirements to ensure financial stability and support strategic planning.

Why is it important to include assumptions and contingency plans in this template? Including assumptions clarifies the basis of financial projections and helps identify potential risks. Additionally, incorporating contingency plans prepares startups to handle unexpected changes in cash flow, ensuring they remain resilient during fluctuating market conditions.

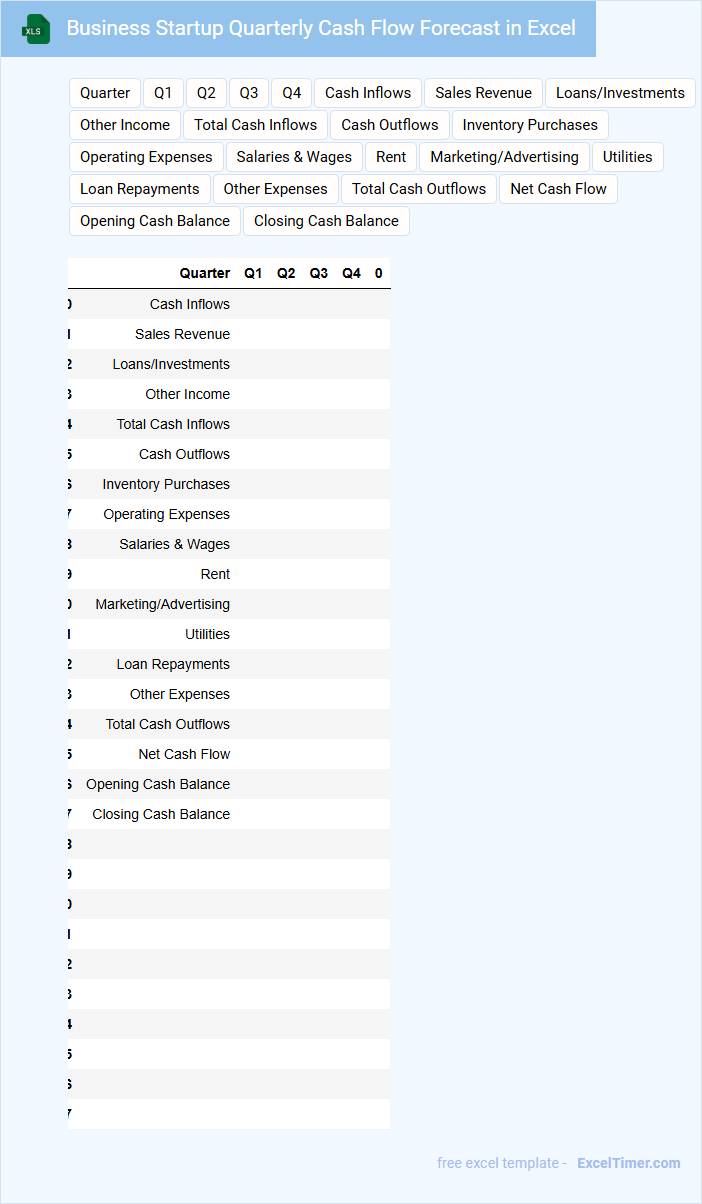

Business Startup Quarterly Cash Flow Forecast in Excel

Business Startup Quarterly Cash Flow Forecast in Excel typically contains projected income, expenses, and net cash flow for a business over a three-month period.

- Revenue Projections: Estimate your expected income from sales and other sources.

- Expense Tracking: Include all operating costs such as salaries, rent, and utilities.

- Cash Flow Analysis: Monitor the inflow and outflow to ensure liquidity and avoid shortfalls.

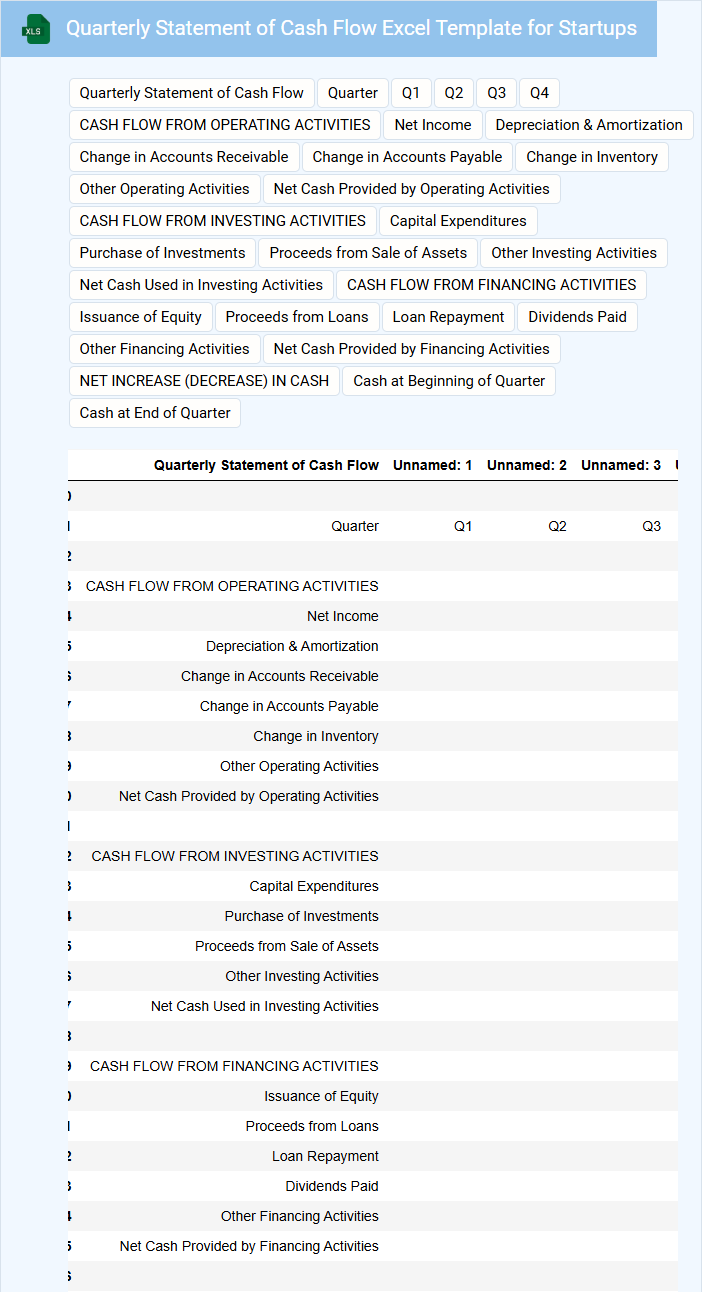

Quarterly Statement of Cash Flow Excel Template for Startups

A Quarterly Statement of Cash Flow Excel Template for Startups typically contains detailed records of cash inflows and outflows to help manage and forecast financial health.

- Cash Inflows: Track all sources of incoming cash, including sales revenue, investments, and loans.

- Cash Outflows: Record all expenditures such as operating expenses, salaries, and capital investments.

- Net Cash Flow Analysis: Provide a clear summary of cash position changes to aid in budgeting and financial planning.

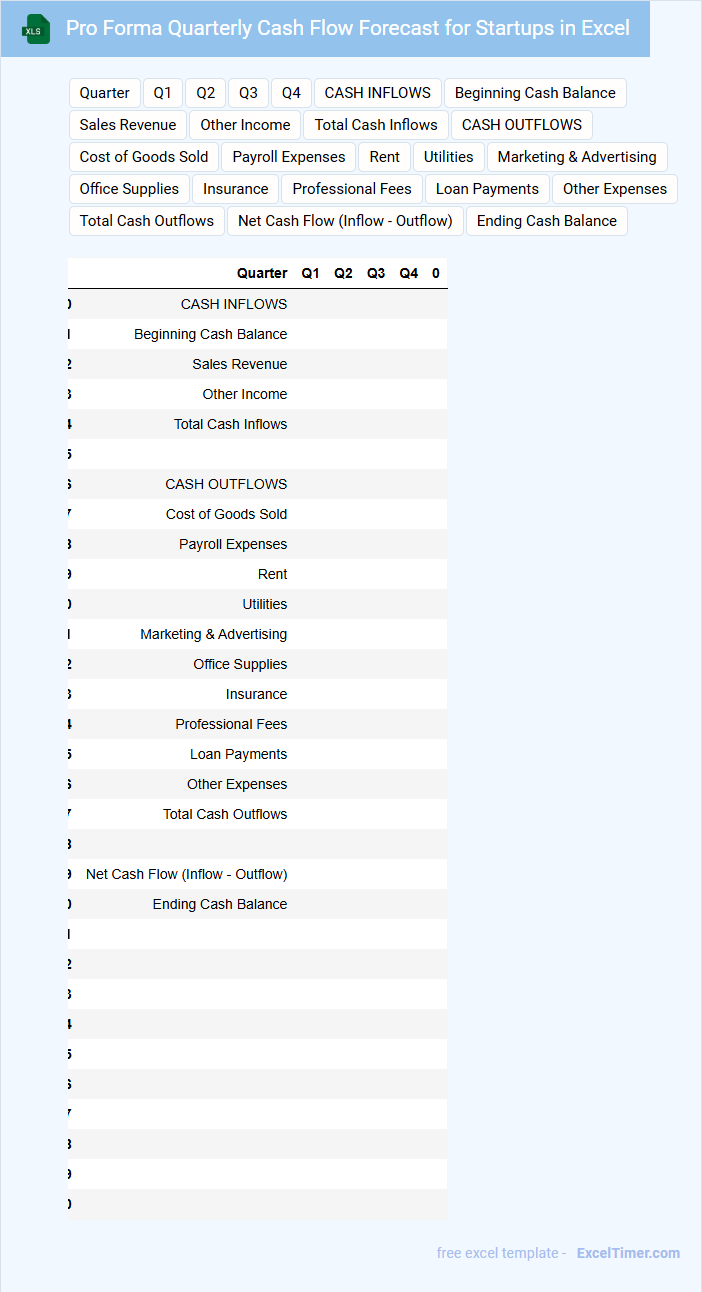

Pro Forma Quarterly Cash Flow Forecast for Startups in Excel

A Pro Forma Quarterly Cash Flow Forecast for startups is a financial document that projects the inflow and outflow of cash over each quarter, helping businesses anticipate liquidity needs. It typically contains estimated revenues, operating expenses, and capital expenditures, providing a clear view of expected cash positions. For startups, it is crucial to regularly update these forecasts to reflect changing market conditions and operational realities, ensuring effective financial planning.

What are the key components of a Quarterly Cash Flow Forecast in Excel for startups?

A Quarterly Cash Flow Forecast in Excel for startups includes key components such as projected cash inflows from sales and investments, detailed operating expenses, and anticipated financing activities. Accurate categorization of these cash movements helps you monitor liquidity and plan for funding needs. Monthly breakdowns and variance analysis ensure realistic and actionable financial insights.

How do you categorize and input revenue and expense streams in a startup cash flow template?

Categorize revenue streams by sources such as product sales, service fees, and investments, while expense streams include operational costs, salaries, and marketing expenses. Input each category into designated sections of your Quarterly Cash Flow Forecast template to accurately track inflows and outflows. This structured approach helps you monitor financial health and plan for future funding needs.

What is the significance of opening and closing cash balance columns in forecasting cash flow?

The opening cash balance represents the available funds at the start of the quarter, serving as the baseline for cash flow analysis. The closing cash balance reflects the projected funds remaining after all inflows and outflows, indicating liquidity status. These columns help startups monitor financial health and ensure sufficient cash for operations throughout the forecasted period.

How can scenario analysis (best/worst case) be integrated into an Excel cash flow forecast for a startup?

Integrate scenario analysis in an Excel cash flow forecast by creating separate sheets or sections for best-case and worst-case assumptions, adjusting revenue growth, expenses, and funding variables accordingly. Use Excel functions like Data Tables or Scenario Manager to switch between scenarios dynamically and visualize impacts on cash flow projections. This approach enables startups to anticipate financial resilience and prepare strategic responses for varying market conditions.

What Excel formulas are essential for automating cash inflow, outflow, and net cash flow calculations?

Essential Excel formulas for automating a Quarterly Cash Flow Forecast include SUM for totaling cash inflows and outflows, SUMIF or SUMIFS for conditionally aggregating specific revenue or expense categories, and simple subtraction formulas to calculate net cash flow by deducting total outflows from inflows. The use of IFERROR ensures clean handling of any calculation errors, while DATE and EOMONTH functions help in organizing cash flows by specific quarters. Implementing these formulas streamlines accurate and dynamic cash flow projections critical for startup financial planning.