The Quarterly Tax Preparation Excel Template for Accountants streamlines the process of organizing and calculating tax obligations for each fiscal quarter. It offers user-friendly sheets with automated formulas to ensure accuracy and timely filing, reducing errors and saving valuable time. This template is essential for accountants who manage multiple clients, helping maintain compliance and optimize tax planning efficiently.

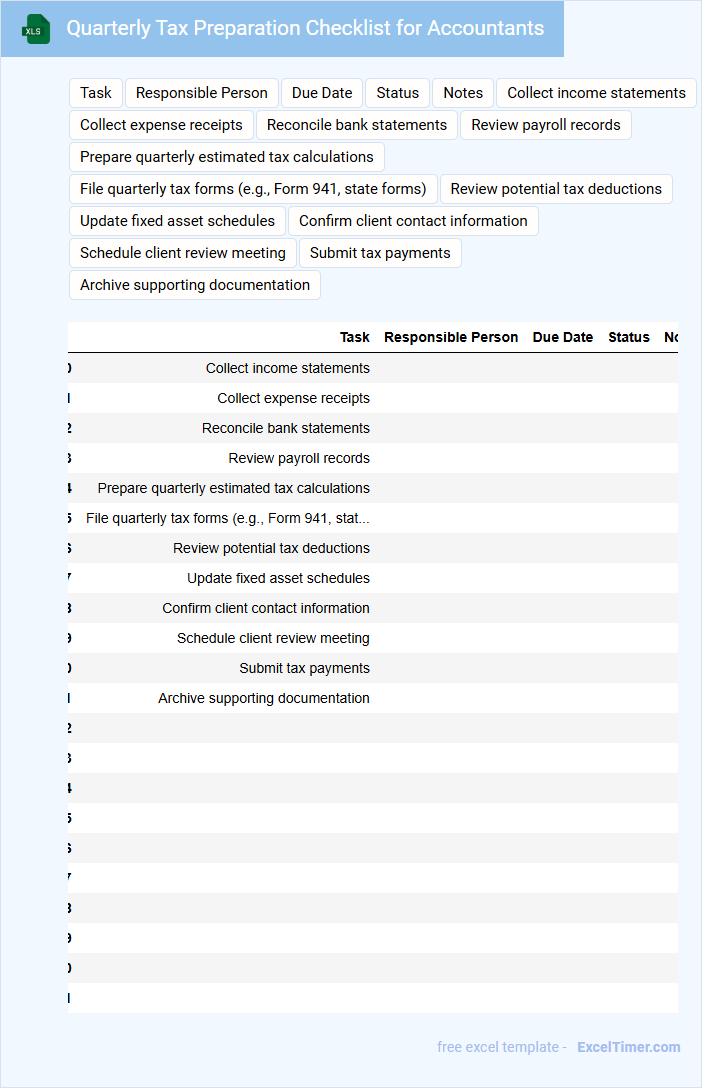

Quarterly Tax Preparation Checklist for Accountants

Quarterly Tax Preparation Checklist for Accountants

What key information should be included in a quarterly tax preparation checklist for accountants? This type of document typically contains detailed steps for organizing financial records, calculating estimated tax payments, and ensuring compliance with the latest tax regulations. It is essential for accountants to include deadlines, required forms, and reminders for reviewing client transactions to accurately prepare and file quarterly taxes.

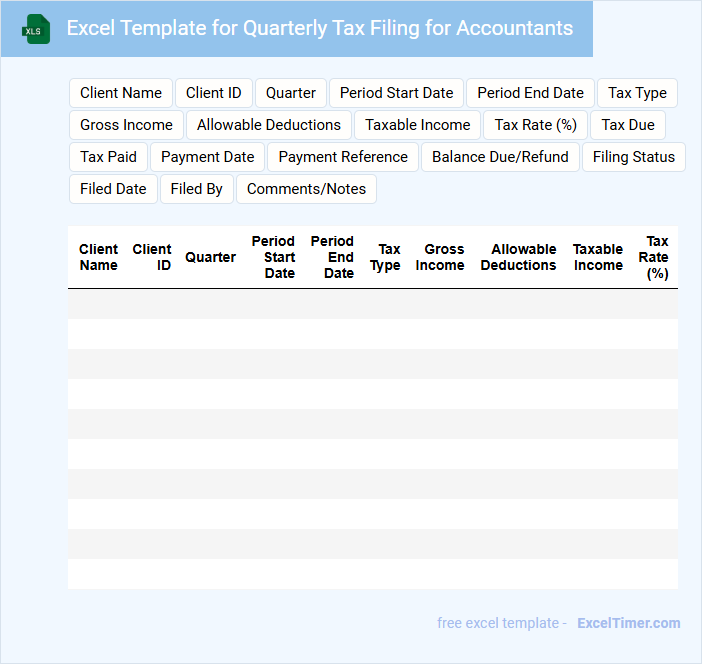

Excel Template for Quarterly Tax Filing for Accountants

This document is an Excel template designed to assist accountants in organizing and calculating quarterly tax filings efficiently. It streamlines data entry and ensures compliance with tax regulations through preformatted sheets and formulas.

- Include clearly labeled sections for income, deductions, and tax calculations to avoid errors.

- Use formulas to automate tax computations and reduce manual input.

- Add a summary sheet for quick review and verification before submission.

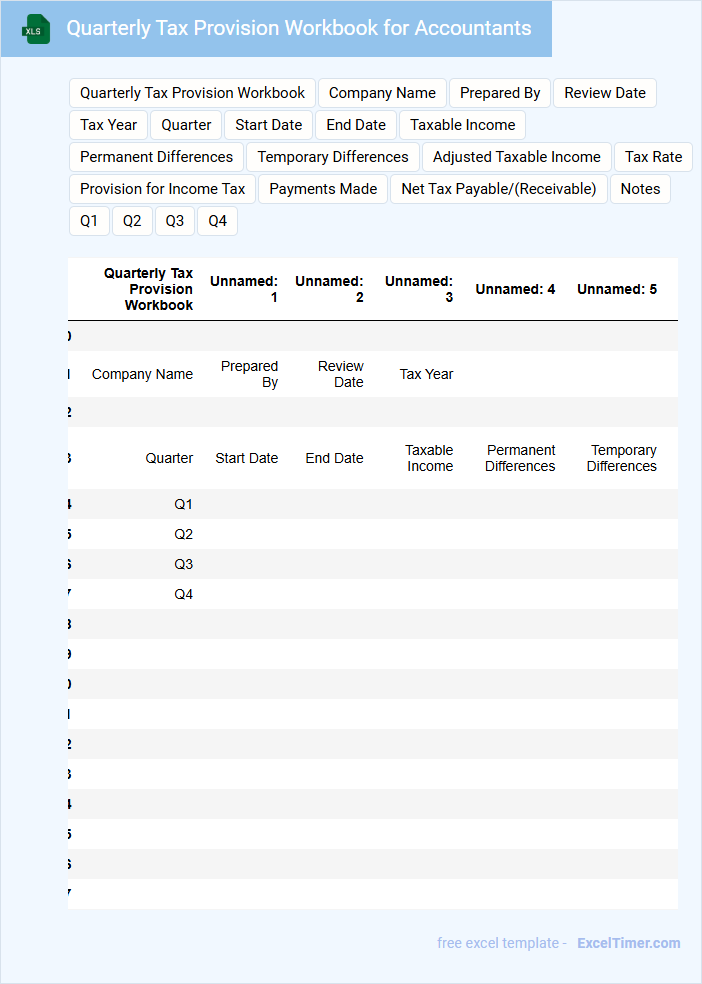

Quarterly Tax Provision Workbook for Accountants

The Quarterly Tax Provision Workbook is a vital document used by accountants to calculate and document tax liabilities on a quarterly basis. It typically contains detailed schedules, reconciliations, and adjustments related to income taxes.

This workbook helps ensure compliance with tax regulations and accurate financial reporting. A key suggestion is to maintain thorough documentation and timely updates to capture all tax-related transactions effectively.

Quarterly Estimated Tax Payment Tracker for Accountants

The Quarterly Estimated Tax Payment Tracker is a critical document used by accountants to monitor and record tax payments made throughout the fiscal year. It ensures that clients remain compliant with tax regulations by avoiding underpayments or penalties.

This document typically contains payment dates, amounts, due dates, and client identification details. Including reminders for upcoming deadlines can greatly enhance the effectiveness of the tracker.

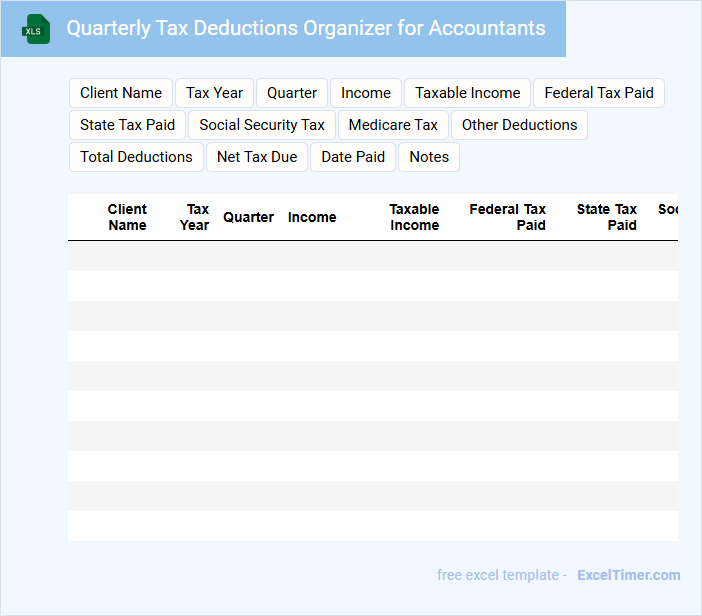

Quarterly Tax Deductions Organizer for Accountants

A Quarterly Tax Deductions Organizer for Accountants is typically a document used to systematically track and organize deductible expenses to ensure accurate tax reporting and compliance.

- Expense Categorization: It helps accountants categorize expenses clearly for easier identification of deductible items.

- Record Keeping: Maintains detailed records of all transactions and receipts relevant to quarterly tax filings.

- Deadline Management: Assists in tracking important quarterly tax submission deadlines to avoid penalties.

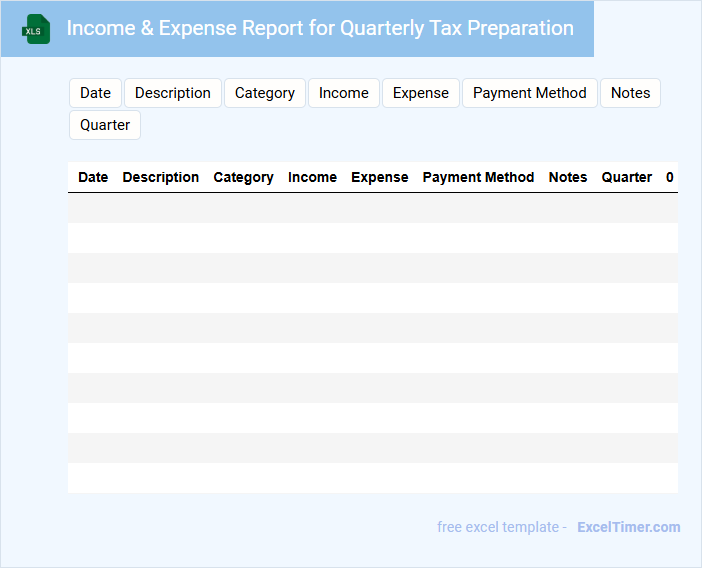

Income & Expense Report for Quarterly Tax Preparation

What information is typically included in an Income & Expense Report for Quarterly Tax Preparation? This document usually contains detailed records of all income earned and expenses incurred within the quarter. It helps individuals and businesses accurately calculate taxable income and prepare necessary tax filings.

What important factors should be considered when preparing this report? Consistent categorization of income and expenses is crucial for clarity and accuracy, and all receipts and invoices should be organized and retained. Additionally, timely updating of financial entries ensures compliance with tax deadlines and reduces the risk of errors or omissions.

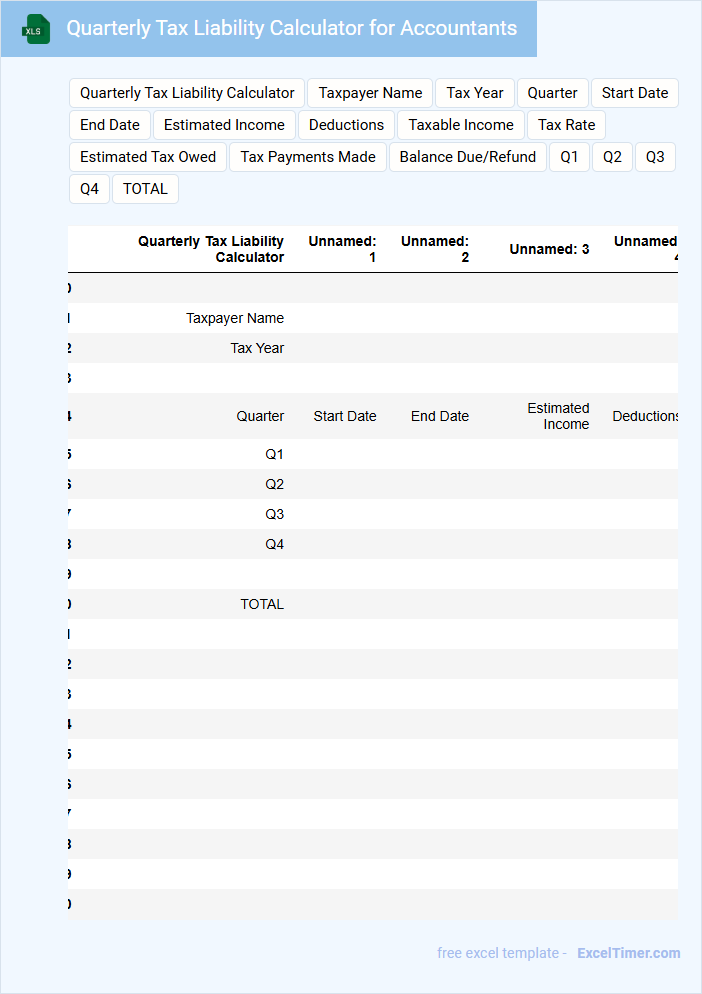

Quarterly Tax Liability Calculator for Accountants

This document typically contains a detailed framework for calculating quarterly tax liabilities, tailored specifically for accountants. It ensures accurate estimation of taxes owed based on income, deductions, and credits.

- Include clear input fields for income, deductions, and payment history.

- Highlight deadlines and penalties related to quarterly tax payments.

- Provide automated calculation results with audit trail capabilities.

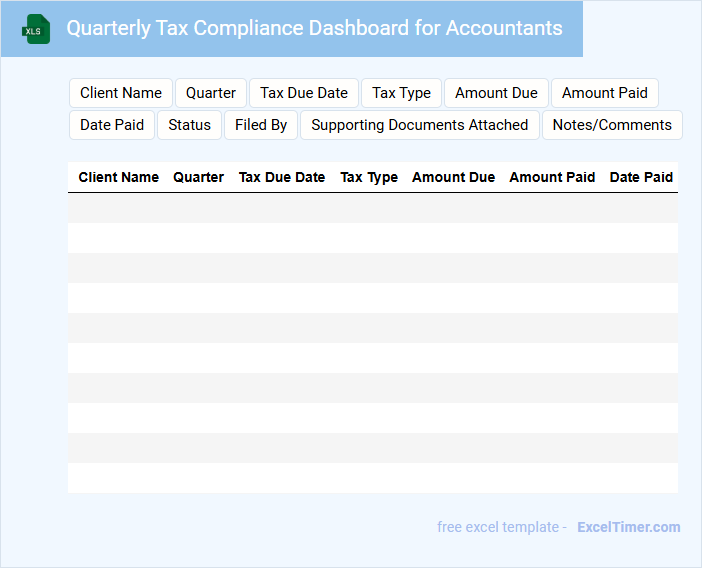

Quarterly Tax Compliance Dashboard for Accountants

The Quarterly Tax Compliance Dashboard is a critical tool designed for accountants to monitor and manage tax obligations efficiently. It typically contains summaries of tax liabilities, payment deadlines, and compliance status updates. Key features often include real-time data visualization, alerts for upcoming filings, and detailed reports to ensure accurate tax adherence.

For optimal use, it is important to emphasize data accuracy, timely updates, and integration with accounting software. Including customizable notifications can help accountants avoid penalties by staying on top of deadlines. Additionally, ensuring clear compliance status indicators enhances decision-making and maintains regulatory adherence.

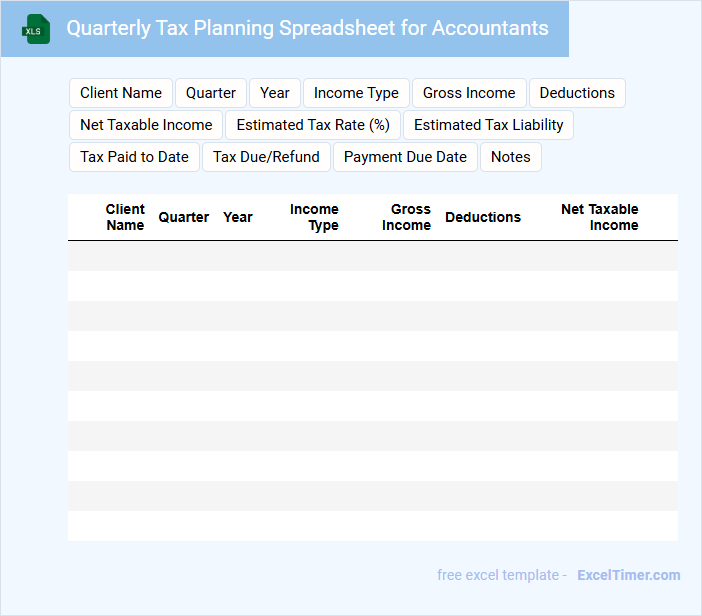

Quarterly Tax Planning Spreadsheet for Accountants

A Quarterly Tax Planning Spreadsheet typically contains detailed records of income, expenses, tax deductions, and estimated tax payments. It helps accountants monitor financial activities across each quarter to optimize tax liabilities.

Important elements include accurate categorization of transactions and timely updates to reflect changing tax regulations. Maintaining this document ensures compliance and maximizes tax savings throughout the fiscal year.

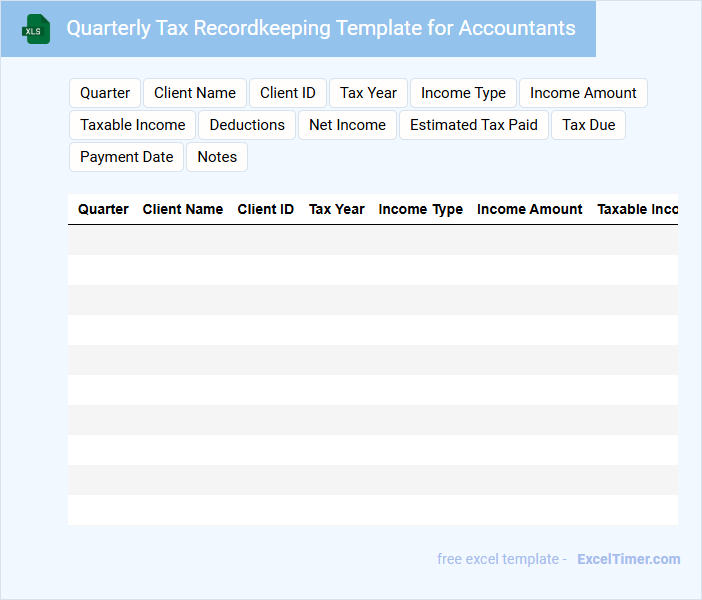

Quarterly Tax Recordkeeping Template for Accountants

A Quarterly Tax Recordkeeping Template is designed to help accountants systematically organize financial data relevant to quarterly tax filings. This document typically includes income statements, expense reports, tax payments, and relevant deadlines to ensure compliance.

Maintaining accurate recordkeeping throughout the quarter simplifies the tax preparation process and minimizes errors or omissions. It is important to regularly update the template with all transactions to provide a clear audit trail and support accurate tax reporting.

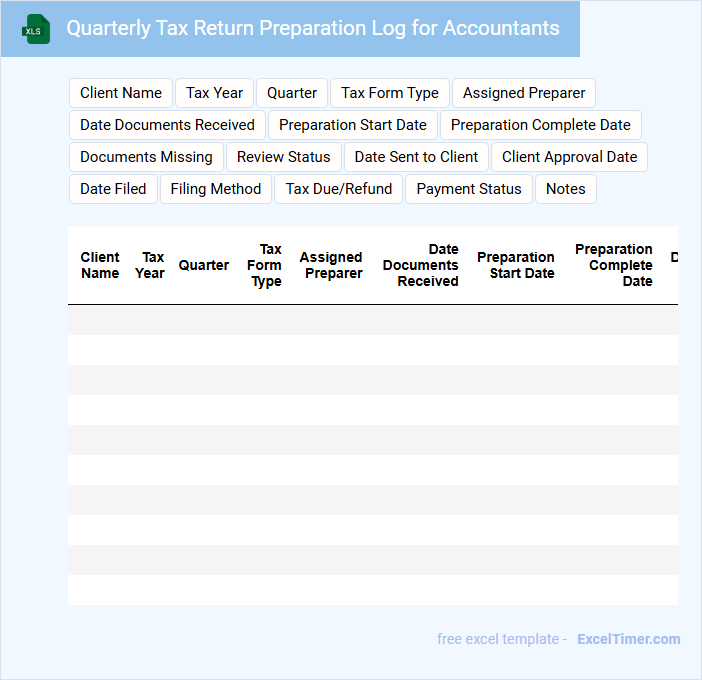

Quarterly Tax Return Preparation Log for Accountants

What information does a Quarterly Tax Return Preparation Log for Accountants typically contain? This document usually records detailed entries of all tax-related transactions, calculations, and deadlines for each quarter. It helps accountants track compliance status, manage client information, and ensure timely submission of tax returns.

Why is maintaining this log important for accountants? Keeping an accurate Quarterly Tax Return Preparation Log is crucial because it minimizes errors, enhances organization, and facilitates easier audits. Accountants should ensure they update the log consistently and verify all figures before filing returns to avoid penalties.

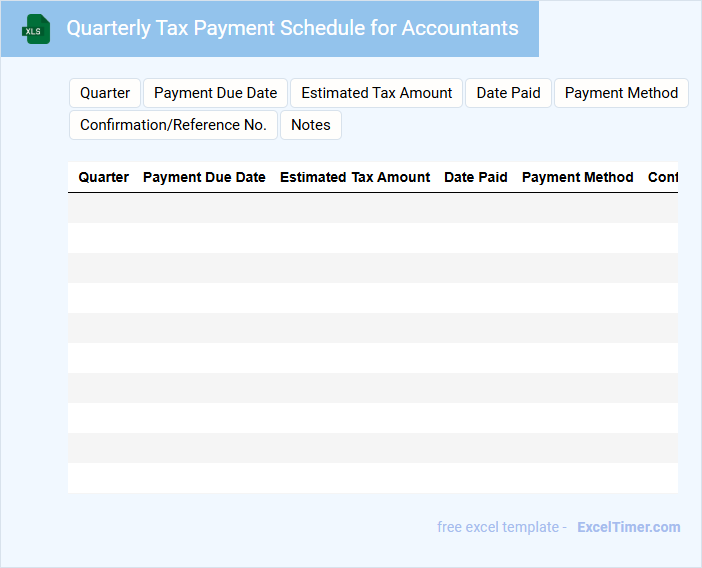

Quarterly Tax Payment Schedule for Accountants

The Quarterly Tax Payment Schedule is a crucial document for accountants that outlines the specific dates when tax payments are due throughout the fiscal year. It helps ensure timely compliance with tax authorities and avoid penalties.

Typically, this schedule includes deadlines for estimated tax payments, filing dates, and important reminders for tax adjustments or extensions. Maintaining updated records and reviewing changes in tax laws are essential practices when managing this document.

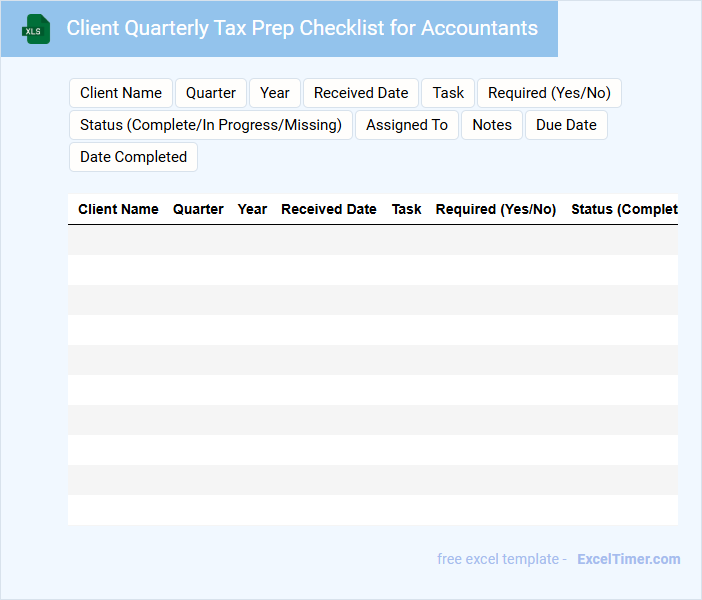

Client Quarterly Tax Prep Checklist for Accountants

A Client Quarterly Tax Prep Checklist for accountants typically contains a detailed list of documents and information needed to prepare quarterly tax filings. This includes income statements, expense receipts, payroll records, and prior tax return copies. Organizing these items ensures accurate and timely tax reporting for clients.

Important elements to focus on are verifying tax deductions, reviewing quarterly estimated tax payments, and confirming compliance with updated tax laws. Accountants should also remind clients to gather relevant financial data early to avoid last-minute issues. Maintaining clear communication throughout the process enhances efficiency and reduces errors.

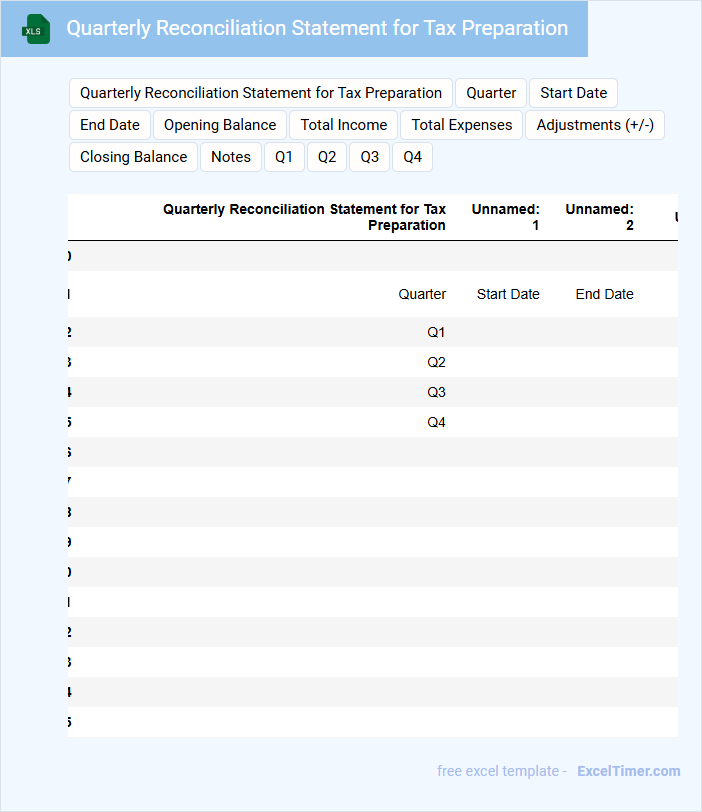

Quarterly Reconciliation Statement for Tax Preparation

The Quarterly Reconciliation Statement is a financial document used to summarize and verify all tax-related transactions within a specific quarter. It typically contains details of income, expenses, and taxes paid or owed, ensuring accuracy for tax preparation. This statement helps in identifying discrepancies and preparing accurate tax filings.

Important elements to include are accurate income records, expense receipts, and tax payment details. Maintaining organized documentation throughout the quarter can streamline the reconciliation process. Ensuring timely updates and cross-verification with accounting records is crucial for compliance and minimizing errors.

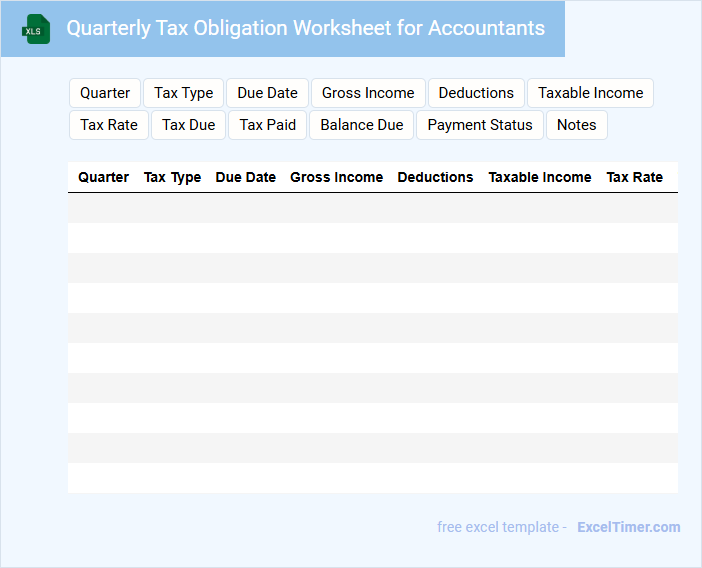

Quarterly Tax Obligation Worksheet for Accountants

A Quarterly Tax Obligation Worksheet is an essential document used by accountants to track and calculate taxes owed on a quarterly basis. It typically contains detailed income entries, deductible expenses, and estimated tax payments to ensure compliance with tax regulations. This worksheet helps in accurately projecting tax liabilities and avoiding penalties for late payments.

What are the key quarterly tax deadlines accountants must track for businesses?

Key quarterly tax deadlines accountants must track for businesses include April 15, June 15, September 15, and January 15 for estimated tax payments. Employers must also file Form 941 quarterly by the last day of the month following each quarter. Your timely tracking of these deadlines ensures accurate tax preparation and compliance.

How should accountants organize and update financial records for accurate quarterly tax reporting?

Accountants should systematically categorize income and expenses using clear Excel spreadsheets to ensure accurate quarterly tax reporting. Regularly updating financial records with precise transaction details and reconciling bank statements minimizes errors. Your diligent maintenance of organized data supports efficient tax preparation and compliance with IRS deadlines.

What common deductions or credits can businesses claim during quarterly tax preparation?

During quarterly tax preparation, businesses can claim common deductions such as office expenses, employee wages, and business-related travel costs. Your eligibility for tax credits like the Research and Development Credit or the Work Opportunity Credit can also reduce your tax liability. Properly documenting these deductions and credits ensures accurate reporting and maximizes your tax savings.

How are estimated tax payments calculated and adjusted each quarter?

Estimated tax payments are calculated based on projected annual income, deductions, and credits, divided into four quarterly installments. Accountants adjust these payments each quarter by comparing actual income and tax liabilities to initial estimates, using IRS Form 1040-ES or relevant schedules. Quarterly adjustments ensure tax obligations align with current earnings, minimizing underpayment penalties and cash flow disruptions.

What compliance risks or penalties can arise from improper or late quarterly tax filing?

Improper or late quarterly tax filing can lead to penalties such as interest charges, late payment fees, and potential audits from tax authorities. Your failure to comply with filing deadlines increases the risk of costly fines and disrupts cash flow management. Ensuring timely and accurate quarterly tax preparation is essential to avoid these compliance risks.