The Quarterly Cash Flow Excel Template for Startups provides an easy-to-use tool to track income, expenses, and cash flow projections over each quarter, allowing entrepreneurs to maintain financial clarity. This template helps identify potential cash shortages early, enabling strategic decision-making to ensure sustainability. Regularly updating the template supports accurate forecasting and assists in securing investor confidence.

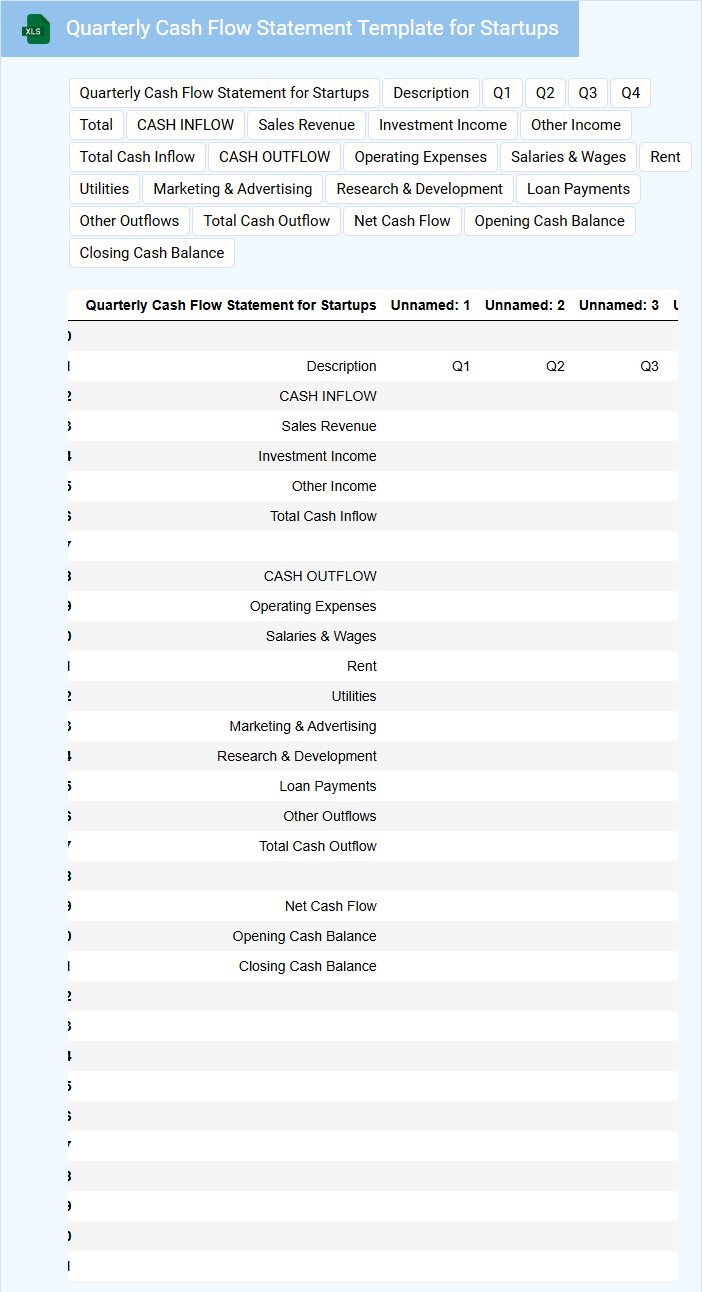

Quarterly Cash Flow Statement Template for Startups

What information does a Quarterly Cash Flow Statement Template for Startups usually contain? This document typically includes cash inflows and outflows categorized by operating, investing, and financing activities, presented on a quarterly basis. It helps startups monitor liquidity, plan budgets, and make informed financial decisions by clearly showing how cash moves in and out over time.

What important aspects should be considered when creating this template? It is essential to ensure accurate categorization of cash transactions and update figures regularly for real-time insights. Including a comparison with previous quarters or forecasts can enhance strategic planning and identify potential cash shortages early.

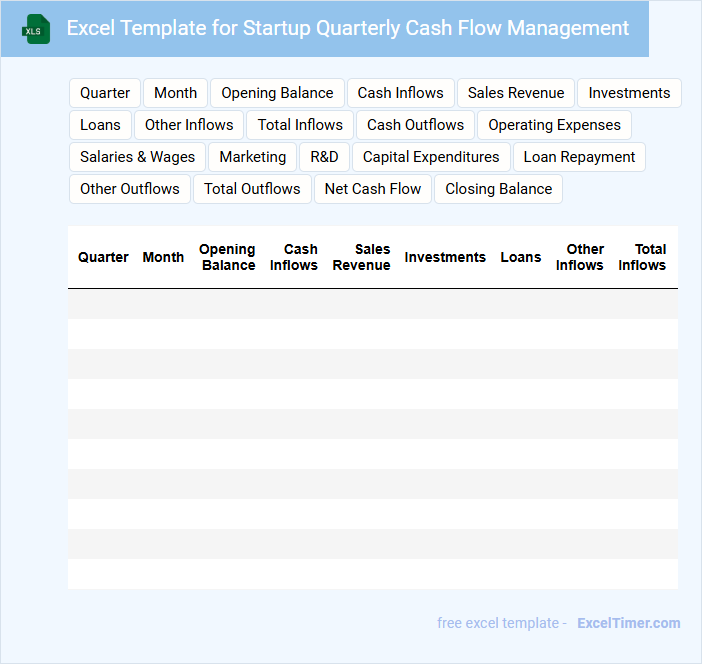

Excel Template for Startup Quarterly Cash Flow Management

An Excel Template for Startup Quarterly Cash Flow Management is designed to help startups track their cash inflows and outflows effectively. It typically contains sections for projected revenues, operating expenses, and capital expenditures.

This document is crucial for monitoring liquidity and ensuring the startup can meet its financial obligations each quarter. Incorporating accurate assumptions and regularly updating actual figures is essential for maintaining reliable cash flow forecasts.

Quarterly Cash Flow Forecast for Startups Spreadsheet

A Quarterly Cash Flow Forecast spreadsheet for startups is a vital document that projects expected cash inflows and outflows over a three-month period. It helps entrepreneurs anticipate their financial position and manage liquidity effectively. This forecast enables startups to plan expenditures, secure funding, and avoid cash shortages.

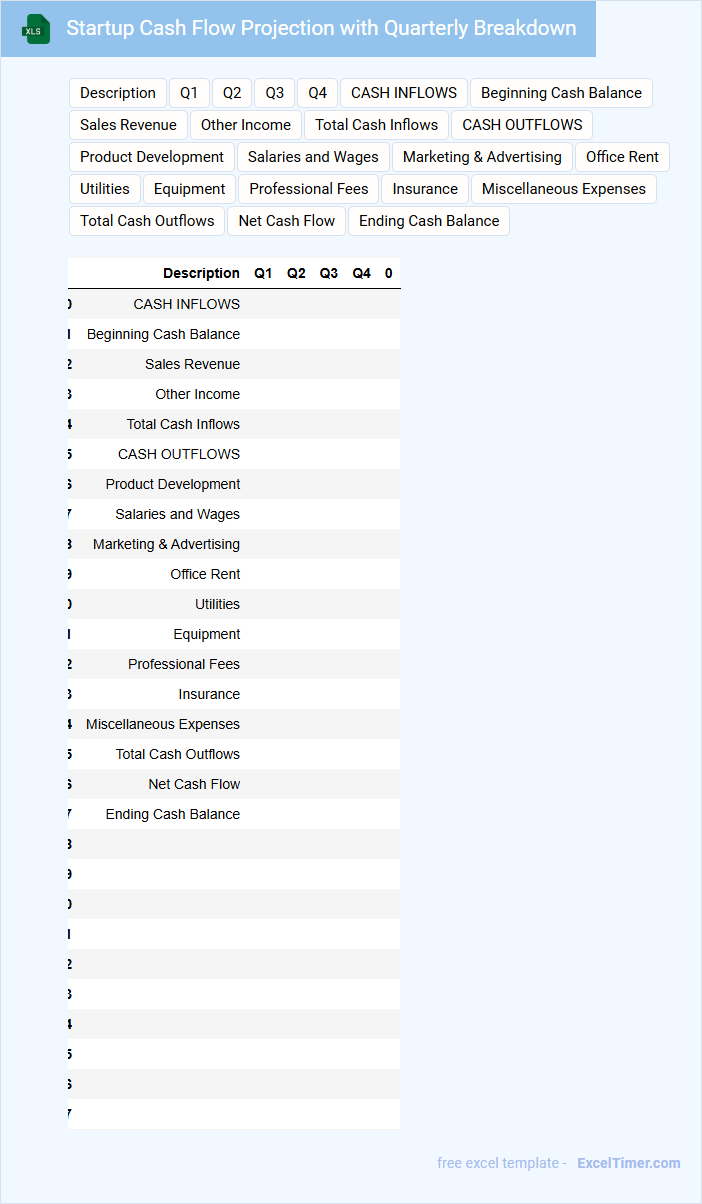

Startup Cash Flow Projection with Quarterly Breakdown

A Startup Cash Flow Projection document typically outlines the expected inflows and outflows of cash over a specific period, usually focusing on a quarterly breakdown for detailed financial planning. It helps startups anticipate funding needs and manage liquidity effectively to avoid potential cash shortages. This document is crucial for investors and stakeholders to assess the startup's financial health and sustainability.

Quarterly Cash Flow Tracker for Startup Businesses

A Quarterly Cash Flow Tracker is a crucial document for startup businesses, typically containing detailed records of cash inflows and outflows over a three-month period. It helps entrepreneurs monitor liquidity, forecast financial health, and make informed decisions about budgeting and investments. Ensuring accuracy and regularly updating the tracker are important practices for maintaining a clear financial overview.

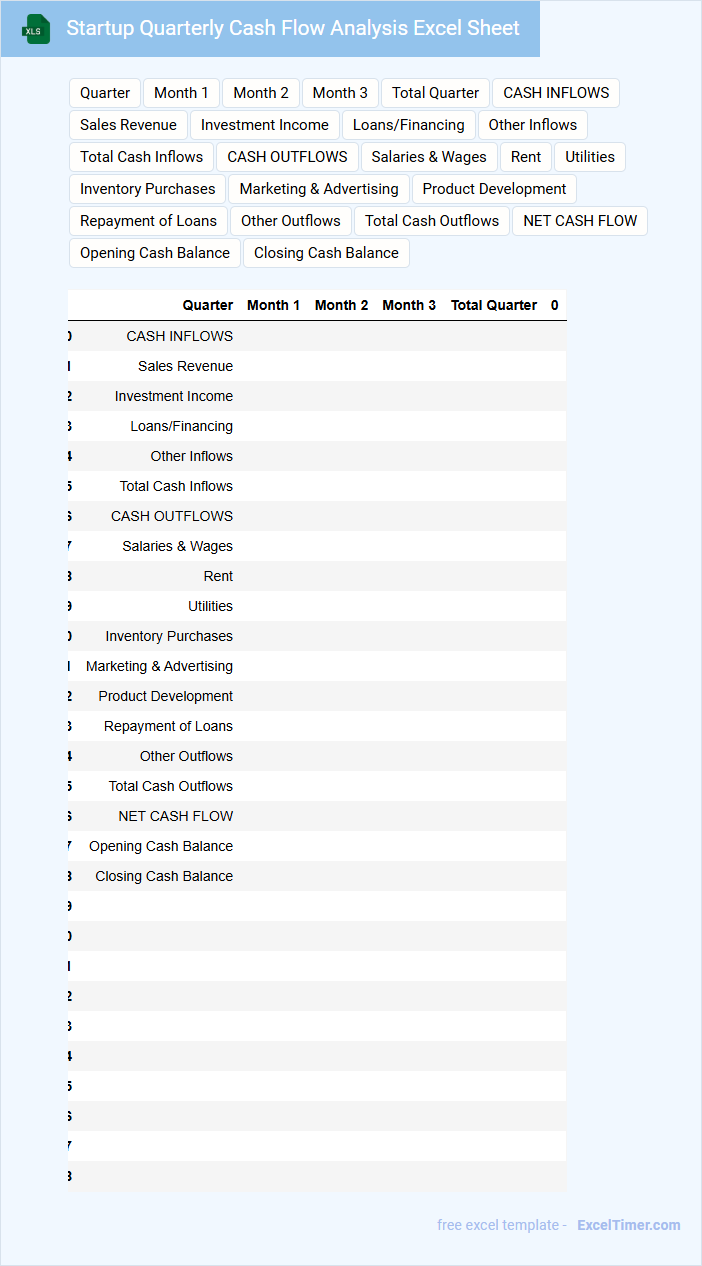

Startup Quarterly Cash Flow Analysis Excel Sheet

A Startup Quarterly Cash Flow Analysis Excel Sheet typically contains detailed records of cash inflows and outflows over a three-month period, helping startups monitor their financial health. It includes sections for operating activities, investing activities, and financing activities to provide a comprehensive overview.

This document is crucial for tracking liquidity, forecasting future cash needs, and making informed financial decisions to avoid cash shortages. Regular updates and accurate data entry are essential to ensure its effectiveness as a financial planning tool.

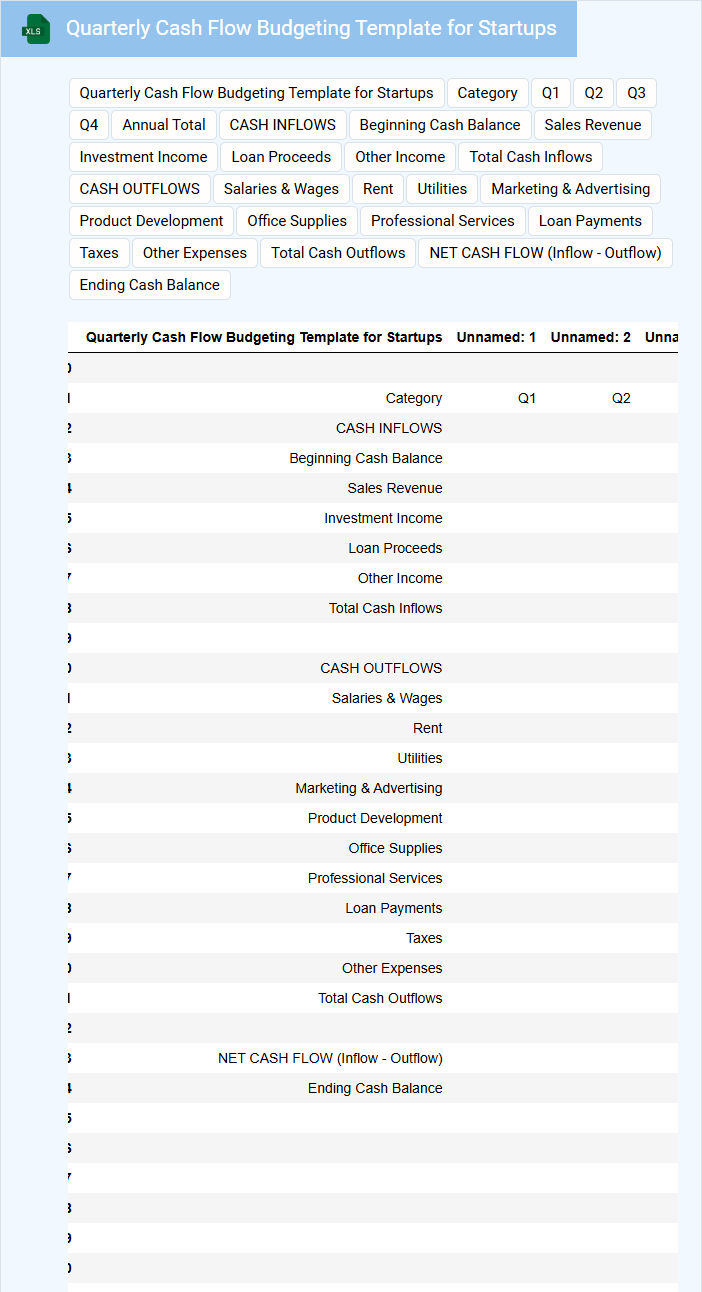

Quarterly Cash Flow Budgeting Template for Startups

What information does a Quarterly Cash Flow Budgeting Template for Startups typically contain? It usually includes detailed projections of cash inflows and outflows broken down by month to help startups manage their liquidity effectively. This template helps in forecasting expenses, revenues, and planning for cash shortages or surpluses.

Why is it important to use a Quarterly Cash Flow Budgeting Template for startups? Accurate cash flow management is crucial for startups to avoid running out of cash and to ensure they can meet operational costs and invest in growth opportunities. Including realistic assumptions and regularly updating the template with actual figures enhances financial decision-making.

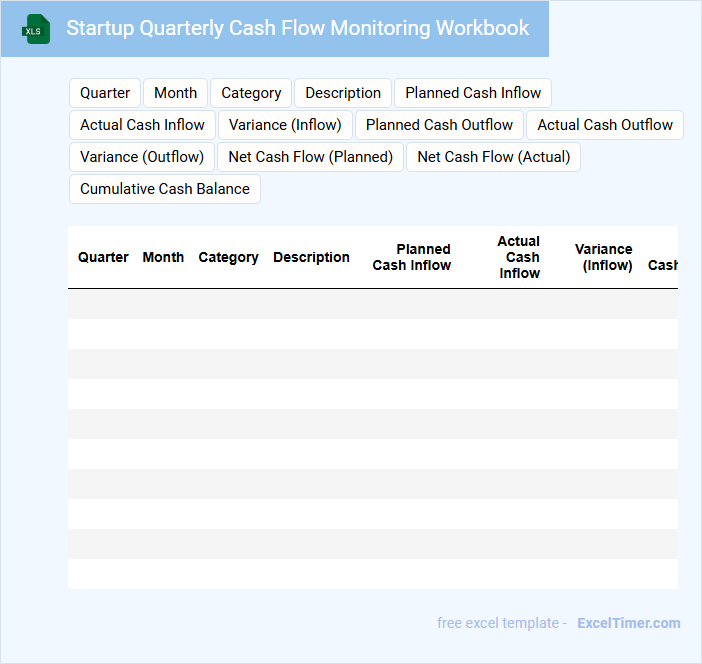

Startup Quarterly Cash Flow Monitoring Workbook

Startup Quarterly Cash Flow Monitoring Workbooks typically contain detailed financial data focused on cash inflows and outflows within a three-month period. They help startups track liquidity, manage expenses, and project future cash positions effectively. Maintaining accurate and up-to-date records is crucial for making informed business decisions. An important aspect of this document is highlighting key performance indicators (KPIs) such as burn rate and runway to assess financial health. Summarized visual representations like charts and tables are commonly included for quick analysis. Regular review and adjustment based on actual figures ensure the startup remains financially agile.

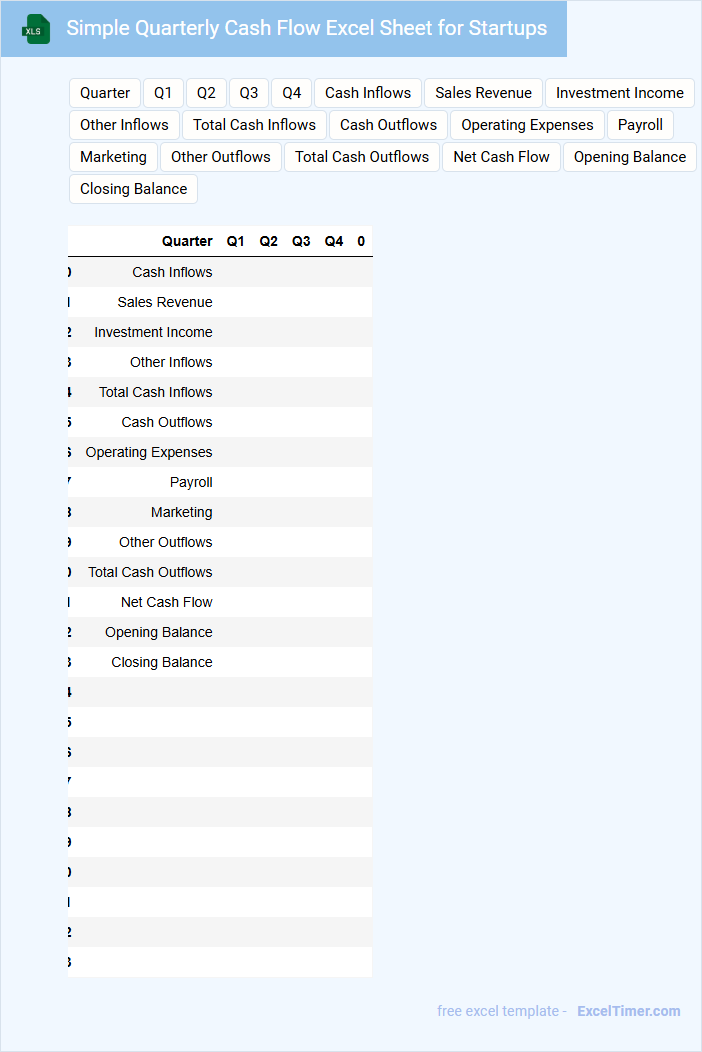

Simple Quarterly Cash Flow Excel Sheet for Startups

What information does a Simple Quarterly Cash Flow Excel Sheet for Startups typically contain? This type of document usually includes detailed records of cash inflows and outflows over a three-month period, helping startups monitor their liquidity and financial health. It typically tracks revenue sources, operating expenses, and net cash flow to provide a clear financial snapshot.

What important elements should be included in a Simple Quarterly Cash Flow Excel Sheet for Startups? It is crucial to incorporate projected cash inflows from sales or investments, anticipated expenses such as salaries and rent, and reserves for unexpected costs. Ensuring clarity and accuracy in these sections enables better financial planning and informed decision-making for the startup's growth.

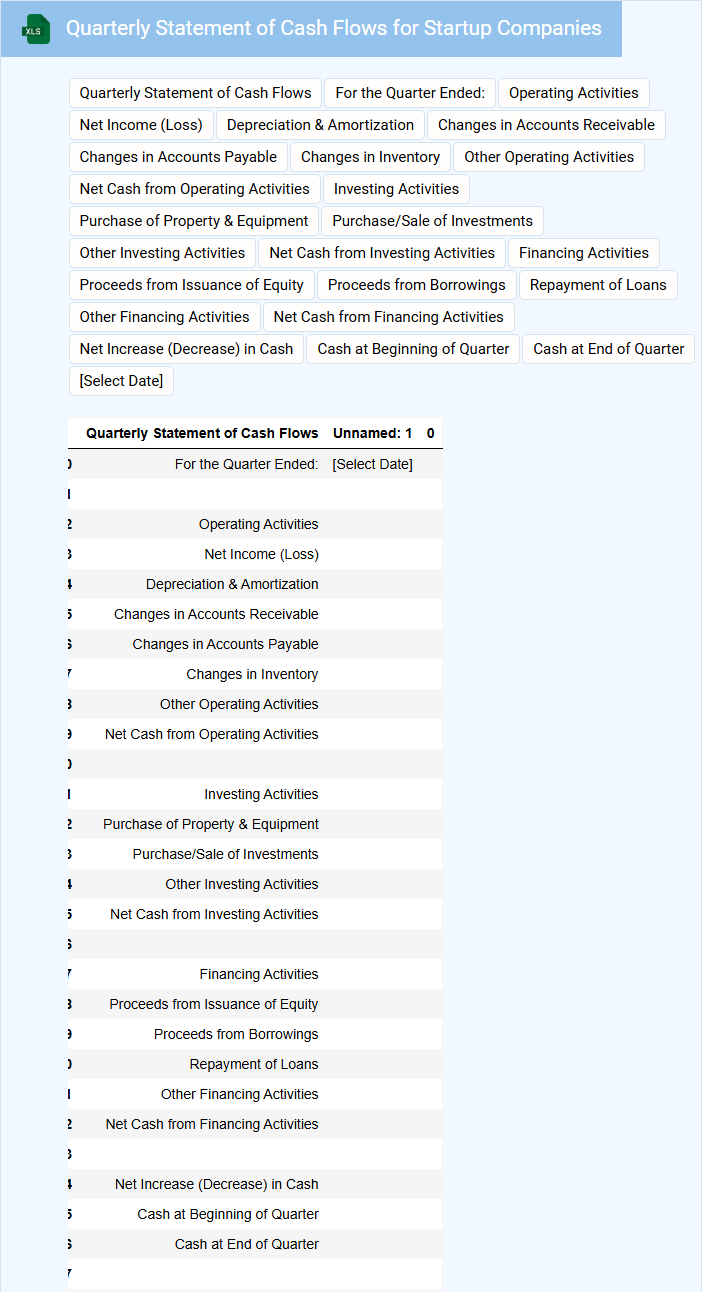

Quarterly Statement of Cash Flows for Startup Companies

A Quarterly Statement of Cash Flows for startup companies provides a detailed summary of cash inflows and outflows over a three-month period. It helps stakeholders understand the company's liquidity and operational efficiency during its critical growth phase.

- Include clear categorization of cash flows from operating, investing, and financing activities to reflect the startup's financial health accurately.

- Highlight significant cash transactions that impact runway and capital requirements to aid in strategic decision-making.

- Ensure timely and accurate data collection to maintain investor confidence and support funding efforts.

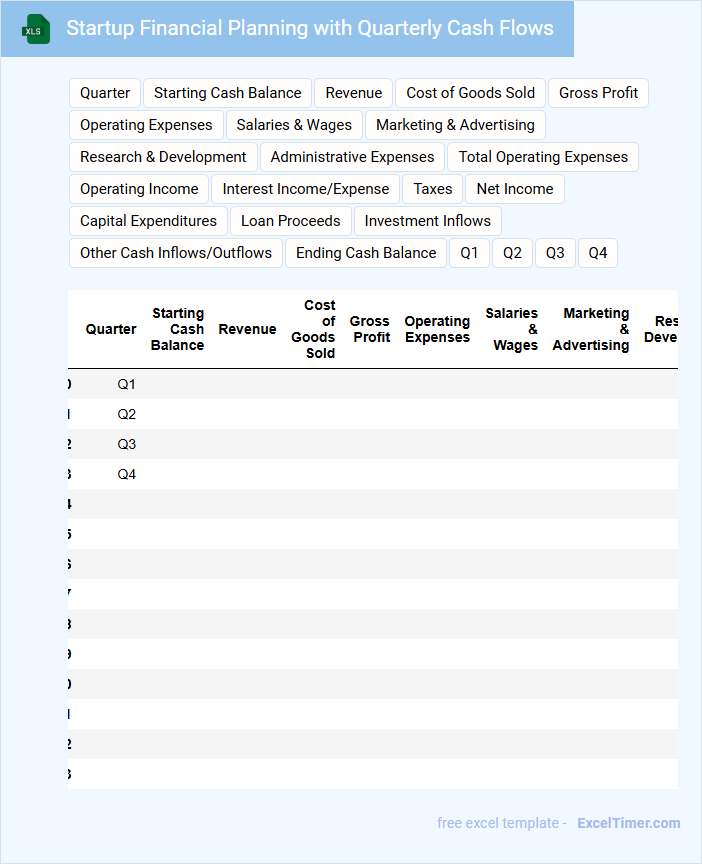

Startup Financial Planning with Quarterly Cash Flows

A Startup Financial Plan typically contains detailed projections of income, expenses, and cash flows over a specific period. It outlines the startup's expected financial performance and funding needs to ensure sustainability. This document is crucial for managing resources and attracting investors.

For a Startup Financial Planning with Quarterly Cash Flows, it is important to include realistic revenue forecasts, detailed expense breakdowns, and cash flow timing. Monitoring quarterly cash flows helps identify potential liquidity issues early. Ensuring accurate assumptions and regular updates is essential for effective financial management.

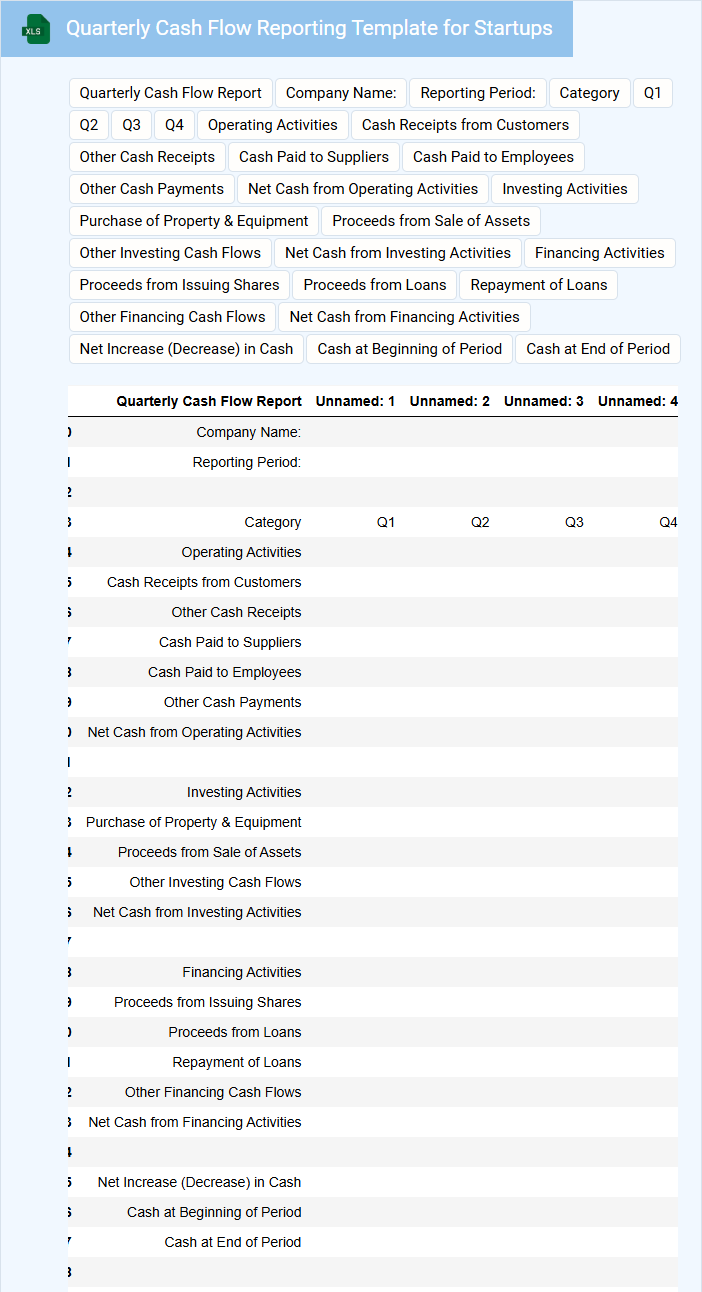

Quarterly Cash Flow Reporting Template for Startups

A Quarterly Cash Flow Report for startups typically includes detailed records of cash inflows and outflows over a three-month period, providing insights into the company's liquidity position. It usually contains sections on operating, investing, and financing activities to understand how money is generated and spent. This document is essential for stakeholders to assess financial health and make informed decisions.

Key elements to include are accurate revenue tracking, expense categorization, and projections for future cash flow to ensure sustainability. Regularly updating this template can help identify potential cash shortages early and improve budget management. Including notes on any significant financial events during the quarter adds valuable context to the numbers reported.

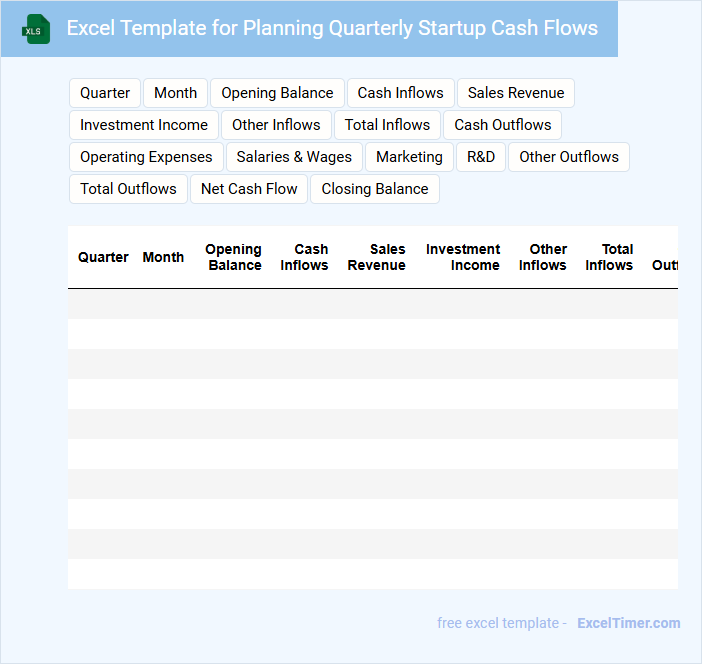

Excel Template for Planning Quarterly Startup Cash Flows

An Excel Template for Planning Quarterly Startup Cash Flows typically contains detailed projections of a startup's income and expenses over a three-month period. It helps entrepreneurs visualize their cash inflows and outflows to manage liquidity effectively. Key components often include revenue forecasts, operating costs, and cash balance summaries.

For optimal use, ensure the template allows customizable inputs for various revenue streams and expenses. Incorporate dynamic formulas to automatically update totals and net cash flow. Additionally, including charts or visual aids can enhance understanding and decision-making.

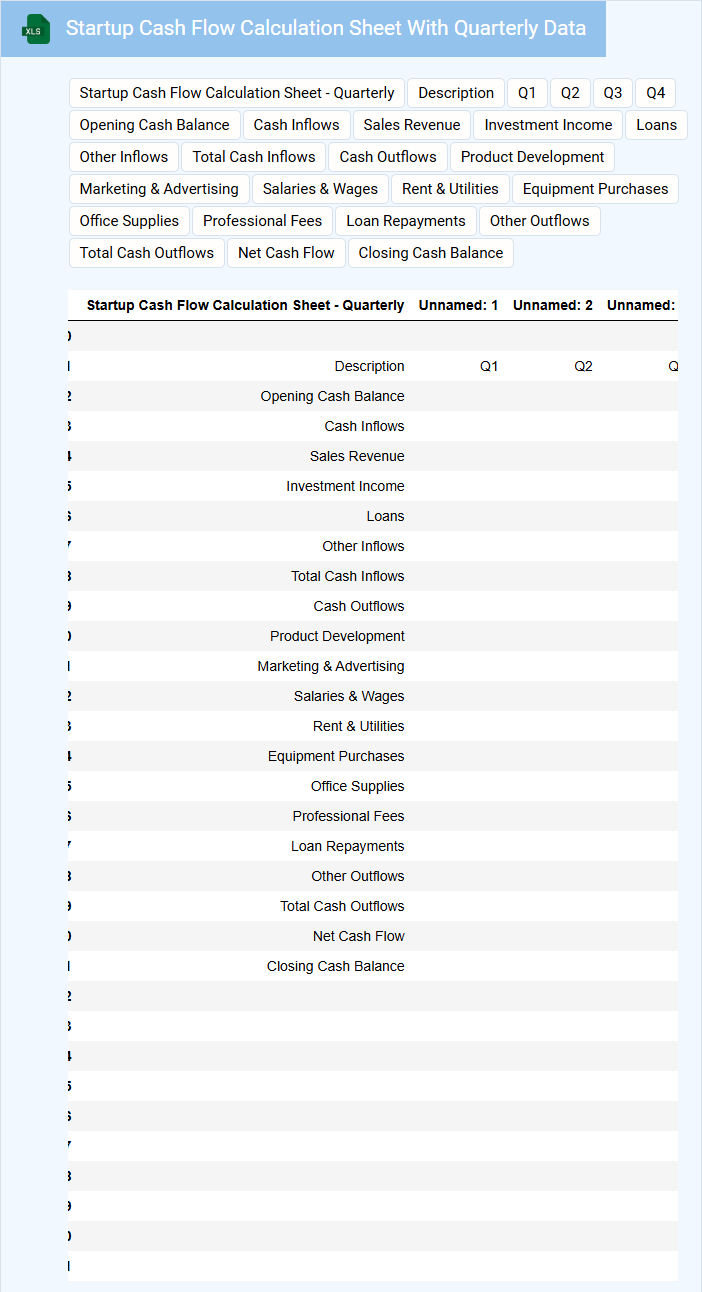

Startup Cash Flow Calculation Sheet With Quarterly Data

This type of document, a Startup Cash Flow Calculation Sheet, typically contains detailed records of cash inflows and outflows categorized by quarterly periods. It helps startups monitor their liquidity and financial health over time, ensuring they can meet operational expenses and invest in growth. Important elements to include are projected revenue, operational costs, and capital expenditures, all segmented quarterly for accurate forecasting.

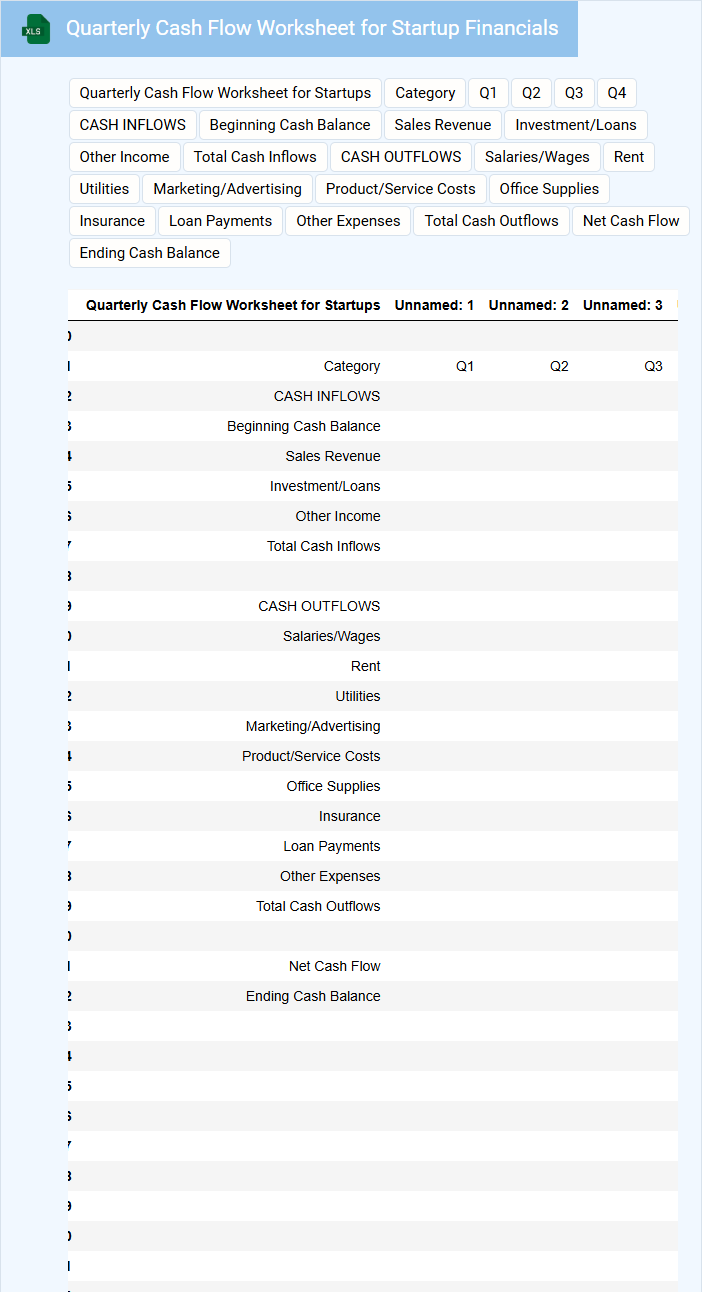

Quarterly Cash Flow Worksheet for Startup Financials

A Quarterly Cash Flow Worksheet for Startup Financials is a document used to track and project the inflow and outflow of cash over a three-month period for a startup. It helps entrepreneurs manage liquidity and ensure the business can cover its expenses.

- Include detailed categories for all sources of cash receipts and disbursements.

- Regularly update projections with actual cash flow data for accuracy.

- Highlight any potential cash shortages early to plan for financing needs.

What are the key components that should be included in a startup's quarterly cash flow statement?

A startup's quarterly cash flow statement should include operating cash flow, investing cash flow, and financing cash flow to provide a clear picture of financial health. Tracking receipts from sales, payments for expenses, equipment purchases, and funding from investors ensures accurate cash management. Your document should highlight net cash flow to help make informed business decisions.

How do you differentiate between operating, investing, and financing activities in quarterly cash flow for startups?

Operating activities in quarterly cash flow for startups include cash transactions related to core business operations, such as revenue from sales and payments for expenses. Investing activities reflect cash flows from the purchase or sale of long-term assets like equipment or investments. Financing activities capture cash movements from funding sources, including equity issuance, loans, and repayments.

Why is monitoring quarterly cash inflow and outflow critical for early-stage startups?

Monitoring quarterly cash inflow and outflow is critical for early-stage startups to maintain liquidity and ensure financial stability. Accurate tracking helps identify spending patterns and forecast future cash needs, preventing cash shortfalls. This enables startups to make informed decisions on budgeting, investments, and fundraising strategies.

What common mistakes do startups make when projecting quarterly cash flow?

Startups often overestimate revenue and underestimate expenses when projecting quarterly cash flow, leading to inaccurate forecasts. They frequently neglect to account for seasonality and unexpected costs, which disrupts cash availability. Failure to update projections regularly based on actual financial performance also undermines effective cash flow management.

How can startups use quarterly cash flow analysis to make informed financial decisions?

Startups use quarterly cash flow analysis to track incoming and outgoing cash, ensuring liquidity to cover operational expenses and investments. This analysis helps identify cash shortages or surpluses, enabling timely adjustments in budgeting and funding strategies. Accurate quarterly cash flow insights support informed financial decisions that drive sustainable growth and investor confidence.