The Quarterly Tax Filing Excel Template for Self-Employed Individuals streamlines the process of tracking income, expenses, and tax liabilities throughout the year. It simplifies calculations and ensures accurate quarterly tax payments, reducing the risk of penalties. This template is essential for self-employed professionals seeking to maintain organized financial records and stay compliant with tax regulations.

Quarterly Tax Filing Excel Template for Self-Employed Individuals

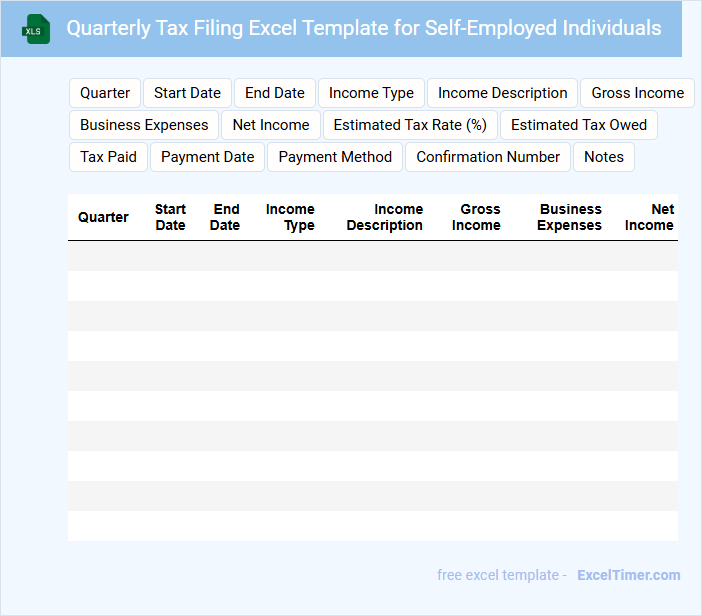

The Quarterly Tax Filing Excel Template for self-employed individuals is designed to streamline the process of calculating and documenting tax liabilities. This document typically contains sections for income tracking, deductible expenses, and tax payments made throughout the quarter. Its primary purpose is to ensure accurate record-keeping and timely tax submission to avoid penalties.

Important considerations when using this template include regularly updating income and expense entries, verifying tax rate changes specific to your jurisdiction, and maintaining supporting receipts for all deductions. Additionally, it's crucial to review the summary reports generated by the template to ensure all figures align with your financial documents. Consistent use of this template can simplify tax preparation and improve financial organization.

Income & Expense Tracker for Self-Employed Quarterly Tax Filing

This document typically contains detailed records of all income and expenses to simplify quarterly tax filing for self-employed individuals.

- Accurate Income Recording: Ensure all sources of income are documented precisely to avoid discrepancies.

- Comprehensive Expense Tracking: Include all business-related expenses to maximize deductible amounts.

- Consistent Updates: Regularly update the tracker to maintain up-to-date financial data for timely tax submission.

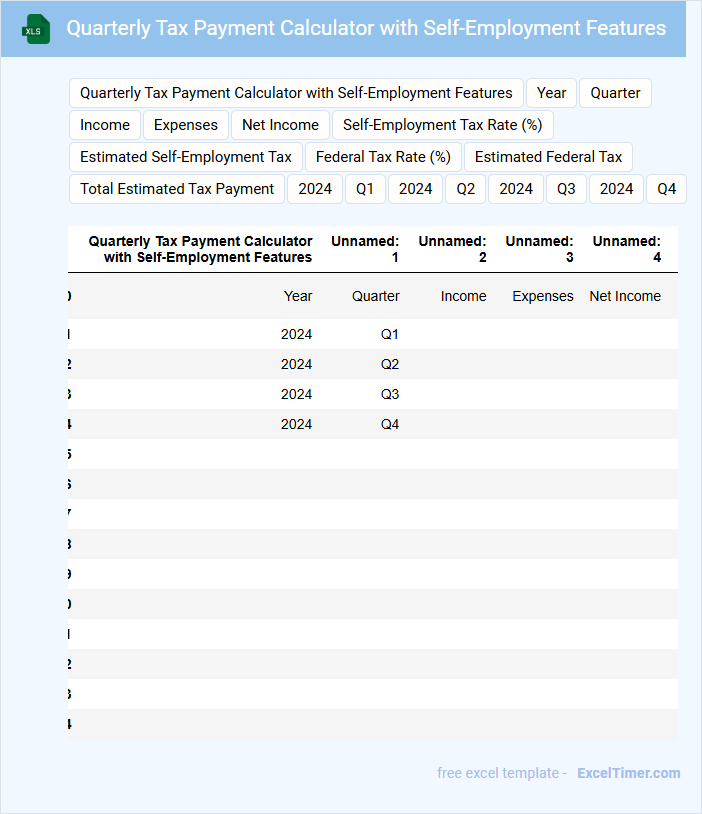

Quarterly Tax Payment Calculator with Self-Employment Features

This document typically contains a Quarterly Tax Payment Calculator designed specifically for self-employed individuals. It helps users estimate their tax liabilities based on income and expenses reported throughout the quarter. Key features often include income tracking, deductible business expenses, and estimated tax payment schedules to avoid penalties.

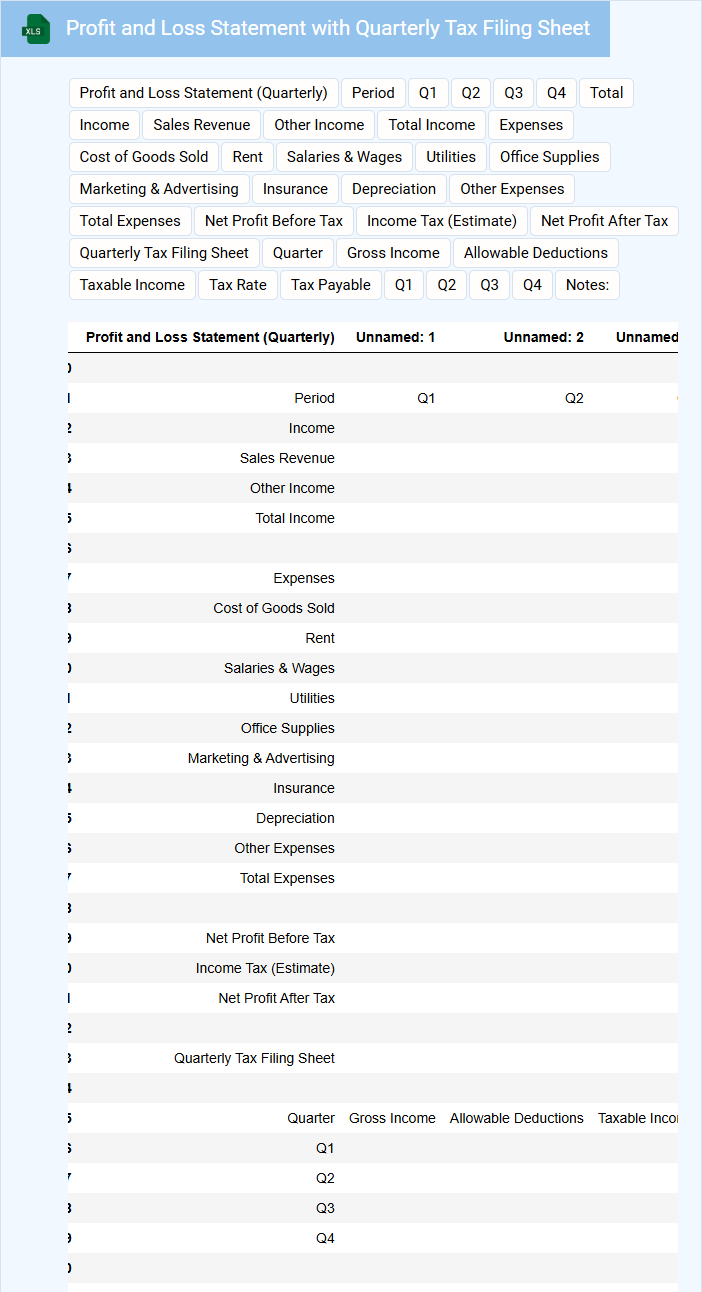

Profit and Loss Statement with Quarterly Tax Filing Sheet

A Profit and Loss Statement typically contains detailed information about revenues, expenses, and net income over a specific period. It provides a clear view of a company's financial performance.

The Quarterly Tax Filing Sheet includes tax liabilities, payments made, and any necessary adjustments for the quarter. It ensures compliance with tax regulations and accurate reporting.

When preparing these documents, accuracy in recording all financial transactions is crucial to avoid discrepancies and potential penalties.

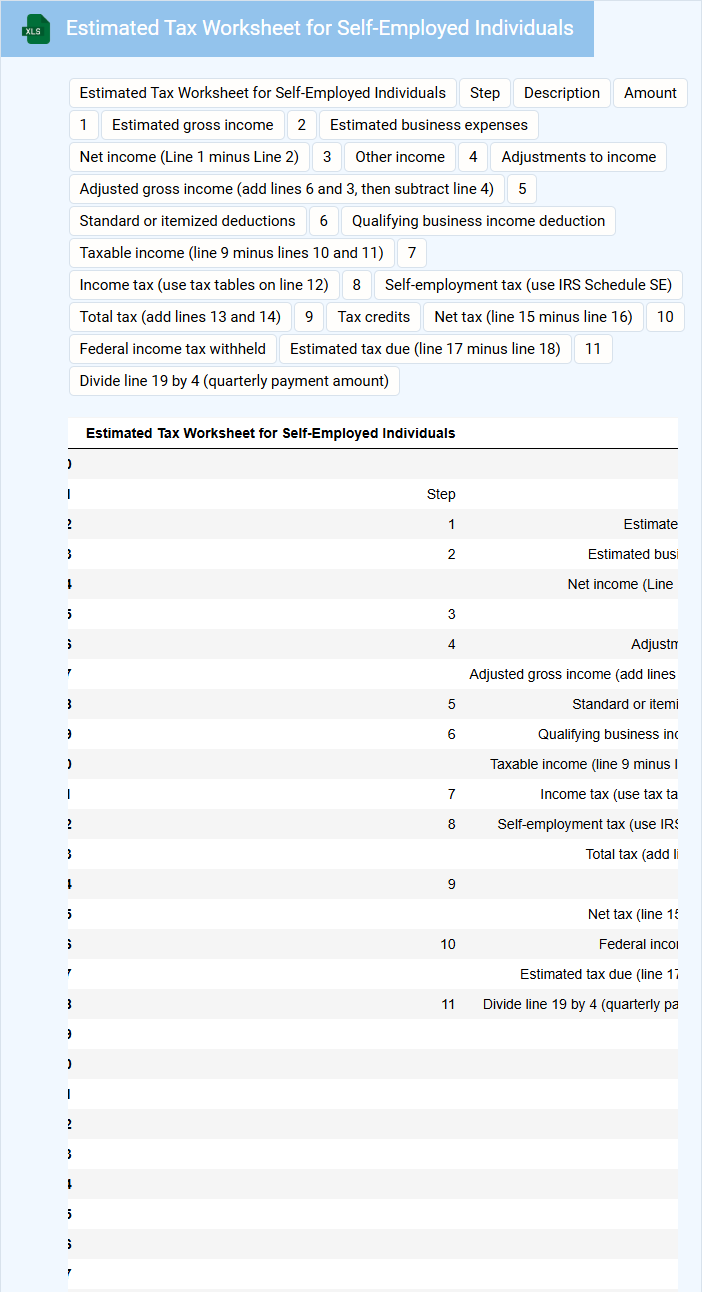

Estimated Tax Worksheet for Self-Employed Individuals

The Estimated Tax Worksheet for self-employed individuals typically contains sections to calculate expected income, deductions, and credits for the year. It helps in estimating quarterly tax payments to avoid penalties. Proper use ensures accurate tax planning and compliance.

Important elements include reporting all sources of self-employment income and factoring in business expenses. Keeping track of estimated tax payments is crucial to prevent underpayment. Regular updates to the worksheet reflect changes in income or tax laws.

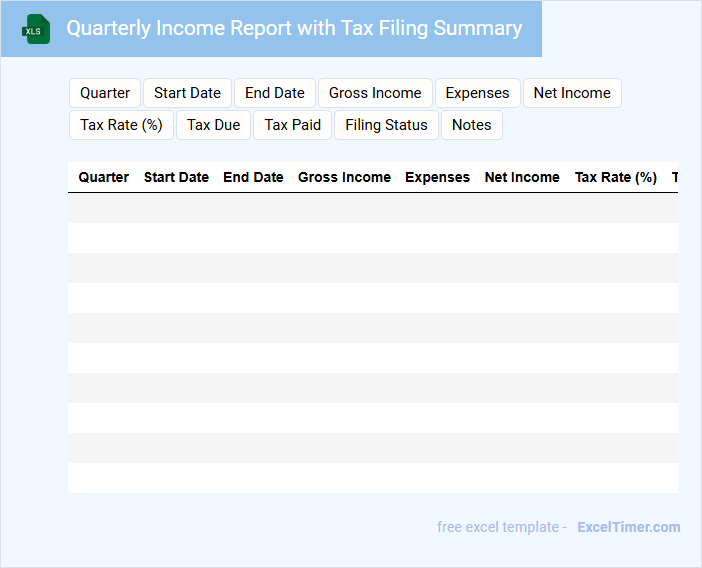

Quarterly Income Report with Tax Filing Summary

A Quarterly Income Report typically contains detailed financial statements reflecting a company's earnings, expenses, and net income over a three-month period. It provides insights into business performance, helping stakeholders track profitability and operational efficiency. Coupled with a Tax Filing Summary, it ensures all tax obligations are accurately reported and accounted for in compliance with relevant laws. Important elements to include are clear revenue breakdowns, expense categorization, tax deductions, and deadlines for filing to avoid penalties.

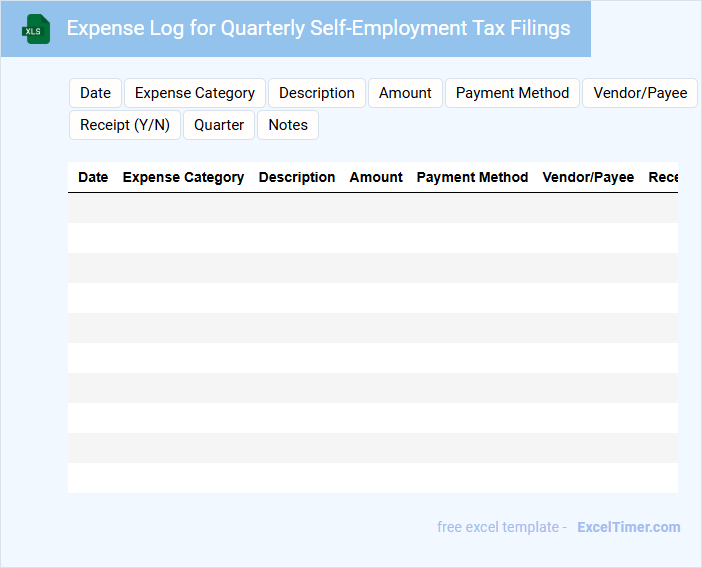

Expense Log for Quarterly Self-Employment Tax Filings

An Expense Log for quarterly self-employment tax filings is a detailed record of all business-related expenses incurred within a quarter. It typically includes categories such as office supplies, travel expenses, and client meals, helping to track deductible costs accurately. Maintaining this log is crucial for ensuring compliance and maximizing tax deductions during tax filing.

Quarterly Tax Deduction Tracker for Freelancers

A Quarterly Tax Deduction Tracker for freelancers is a document used to systematically record all tax-deductible expenses and income on a quarterly basis. It helps freelancers keep accurate financial records to ensure proper tax filing and compliance.

This tracker typically contains sections for income details, categorized expenses, tax deductions, and payment summaries. Using this tool effectively can simplify tax preparation and help avoid penalties from underpayment.

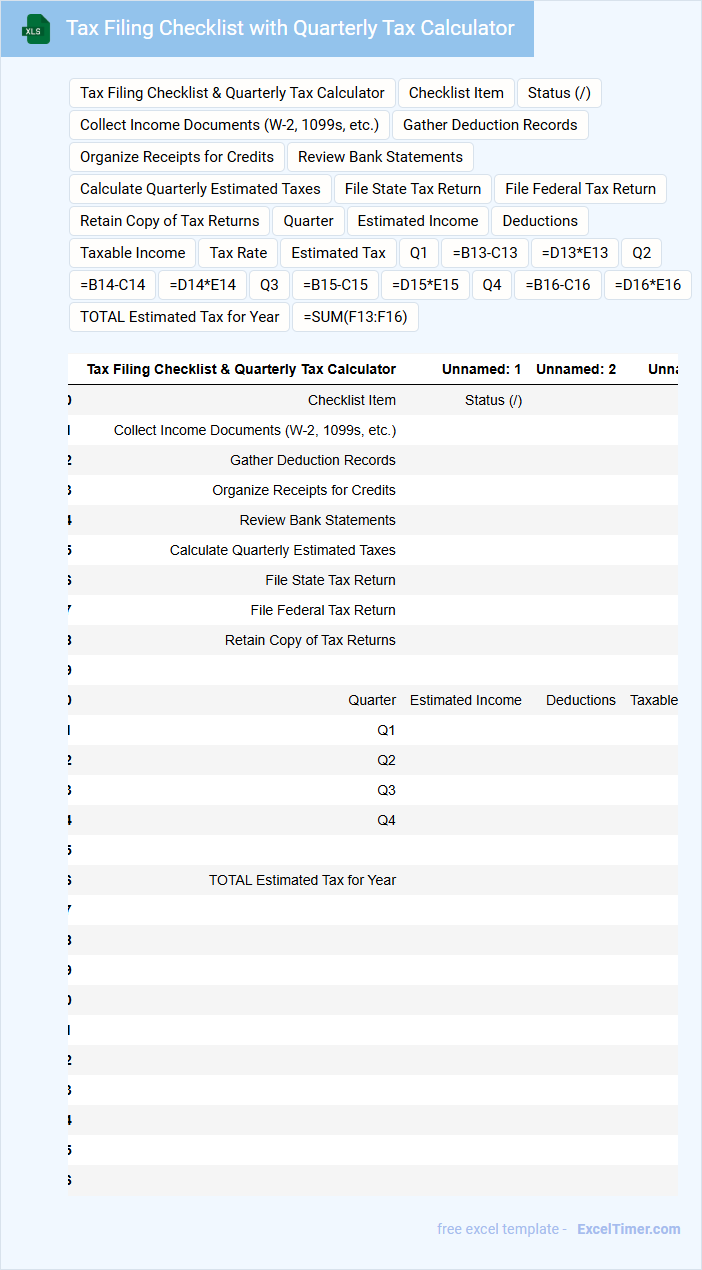

Tax Filing Checklist with Quarterly Tax Calculator

A Tax Filing Checklist with a Quarterly Tax Calculator is a document designed to help individuals and businesses organize their financial information and accurately estimate their tax obligations throughout the year. It simplifies the tax preparation process by ensuring all necessary documents are gathered and quarterly payments are calculated correctly.

- Gather income statements, expense receipts, and previous tax returns for accurate record-keeping.

- Use the quarterly tax calculator to estimate and plan timely tax payments to avoid penalties.

- Review deductible expenses and credits to maximize tax savings and ensure compliance.

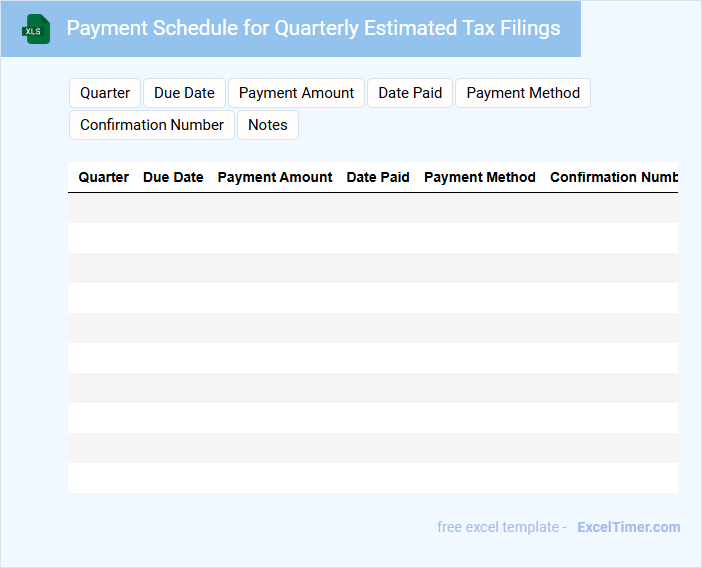

Payment Schedule for Quarterly Estimated Tax Filings

A Payment Schedule for Quarterly Estimated Tax Filings outlines the deadlines and amounts taxpayers must pay throughout the year to avoid penalties. It helps individuals and businesses manage their tax obligations effectively by breaking down annual taxes into manageable quarterly payments.

- Include accurate due dates for each quarterly payment to ensure timely submissions.

- Detail the calculation method for estimating tax amounts based on income and deductions.

- Highlight potential penalties or interest charges for missed or late payments.

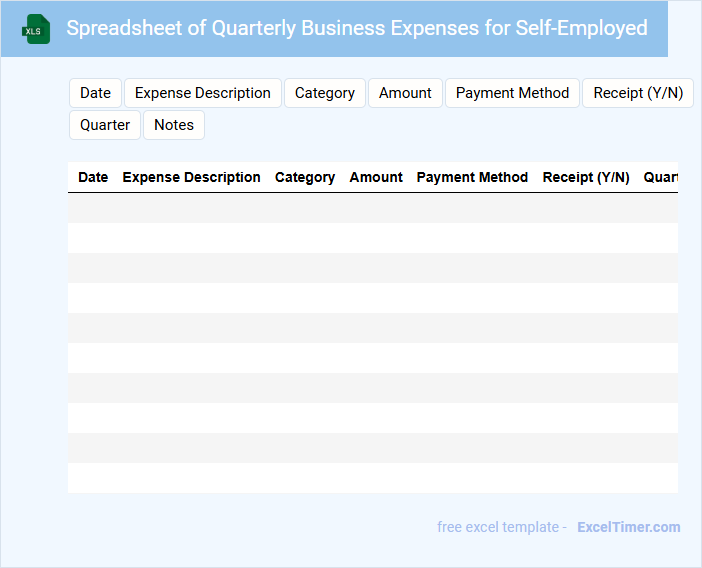

Spreadsheet of Quarterly Business Expenses for Self-Employed

This document typically contains detailed records of business-related expenses incurred each quarter by a self-employed individual. It helps in tracking financial outflows and preparing for tax filings.

Maintaining accuracy and categorizing expenses properly are crucial components of this spreadsheet.

- Include all receipt details to support expense claims.

- Separate business and personal expenses clearly.

- Update the spreadsheet regularly to avoid missing entries.

Income & Expense Summary with Quarterly Tax Payment Tracker

An Income & Expense Summary with Quarterly Tax Payment Tracker is a financial document that consolidates income and expenses to provide a clear overview of cash flow. It typically includes detailed records of earnings, expenses, and tax payments broken down by quarters. This summary aids in budgeting, tax preparation, and maintaining compliance with tax regulations.

Quarterly Tax Payment Tracking Sheet for Consultants

A Quarterly Tax Payment Tracking Sheet for consultants is a crucial document used to monitor and organize tax payments made every quarter. It typically contains sections for income details, tax amounts due, payment dates, and record of payments made. This sheet helps ensure timely tax compliance and prevents penalties by providing a clear overview of tax obligations throughout the year.

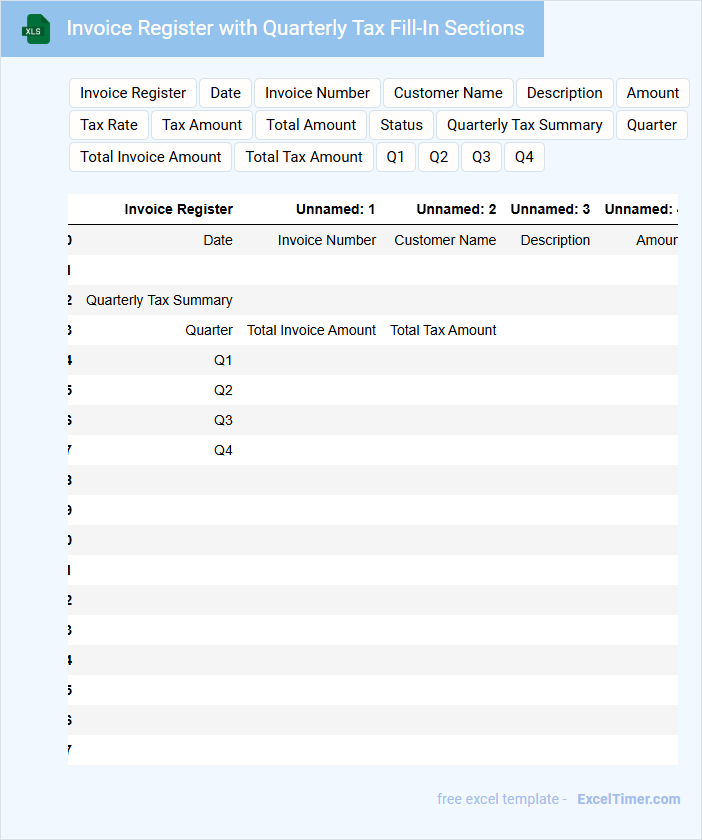

Invoice Register with Quarterly Tax Fill-In Sections

What information is typically included in an Invoice Register with Quarterly Tax Fill-In Sections? This document usually contains a detailed list of all invoices issued within a specific period, organized by date, invoice number, client details, and amounts. It also includes dedicated sections for recording quarterly tax calculations, ensuring accurate tax reporting and compliance.

Why is it important to maintain accurate entries in an Invoice Register with Quarterly Tax Fill-In Sections? Maintaining precise records helps businesses track revenue, monitor outstanding payments, and prepare for tax submissions efficiently. Regular updates can prevent errors during tax filing and simplify financial audits.

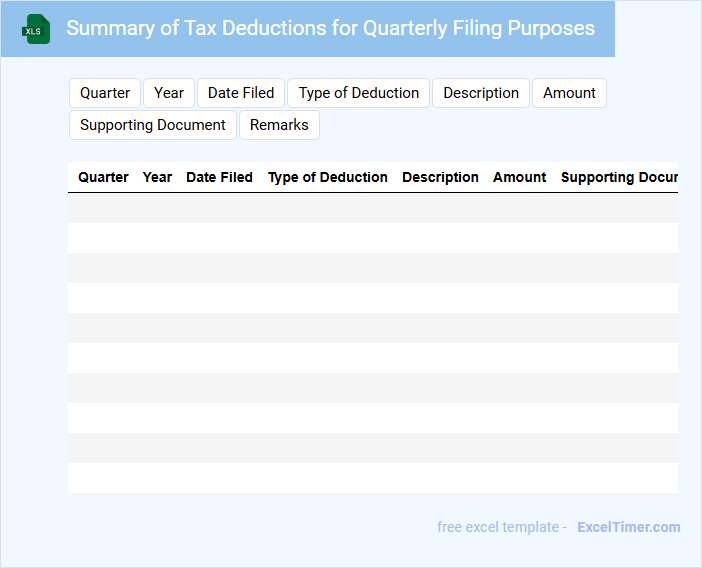

Summary of Tax Deductions for Quarterly Filing Purposes

The Summary of Tax Deductions for Quarterly Filing consolidates all deductible expenses and relevant financial transactions within a specific quarter. It typically includes itemized lists of deductions, total taxable income, and the corresponding tax amounts withheld. Ensuring accuracy and completeness in this document is crucial for timely and compliant quarterly tax submissions.

What specific worksheets or templates in Excel can help track quarterly income and expenses for self-employed tax filings?

Excel templates like "Quarterly Income Tracker" and "Expense Log" help you systematically record all earnings and expenses. The "Tax Summary" worksheet consolidates data, calculating estimated quarterly tax payments based on your income and deductions. Utilizing these templates streamlines your quarterly tax filing process for self-employed individuals.

How can formulas be used in Excel to automatically calculate quarterly estimated tax payments based on projected income?

Excel formulas like SUMPRODUCT and IF can automatically calculate your quarterly estimated tax payments by using projected income data and relevant tax rates. Incorporating logical functions enables the worksheet to adjust payments dynamically based on income fluctuations. This approach improves accuracy and simplifies the tax filing process for self-employed individuals.

What Excel methods best organize deductible expenses and receipts required for accurate quarterly tax reports?

PivotTables efficiently summarize deductible expenses by category, enabling clear tracking for quarterly tax filing. Excel Tables maintain organized, dynamic ranges for receipts, simplifying data entry and filtering. Using Data Validation ensures consistent input, improving accuracy in self-employed tax reporting.

How does Excel assist in tracking payment deadlines and amounts submitted to the IRS for quarterly self-employment taxes?

Excel streamlines tracking quarterly self-employment tax payments by allowing you to organize deadlines and payment amounts in customizable spreadsheets. Formulas automate calculations for estimated taxes owed, reducing errors and ensuring timely submissions. Conditional formatting visually highlights upcoming due dates and missed payments to maintain IRS compliance.

Which Excel features can be used to visualize or summarize self-employment tax liability trends across quarters?

Use Excel PivotTables to summarize quarterly self-employment tax liabilities by grouping data and calculating totals. Leverage line charts or bar charts to visualize trends in tax liabilities across different quarters. Apply conditional formatting to highlight quarters with unusually high or low tax amounts for quick analysis.