The Quarterly Rental Income Excel Template for Property Managers streamlines tracking rental payments and expenses over each quarter, ensuring accurate financial records. It offers automated calculations for income summaries, late fees, and vacancy periods, helping property managers maintain clear cash flow insights. Using this template enhances financial organization and simplifies tax reporting for multiple rental properties.

Quarterly Rental Income Tracker for Property Managers

A Quarterly Rental Income Tracker is a document commonly used by property managers to monitor and record rental payments received over a three-month period. It helps in maintaining accurate financial records and identifying payment trends or issues.

This document typically contains tenant details, rent amounts, payment dates, and any outstanding balances. Regularly updating the tracker ensures effective cash flow management and simplifies end-of-quarter financial reporting.

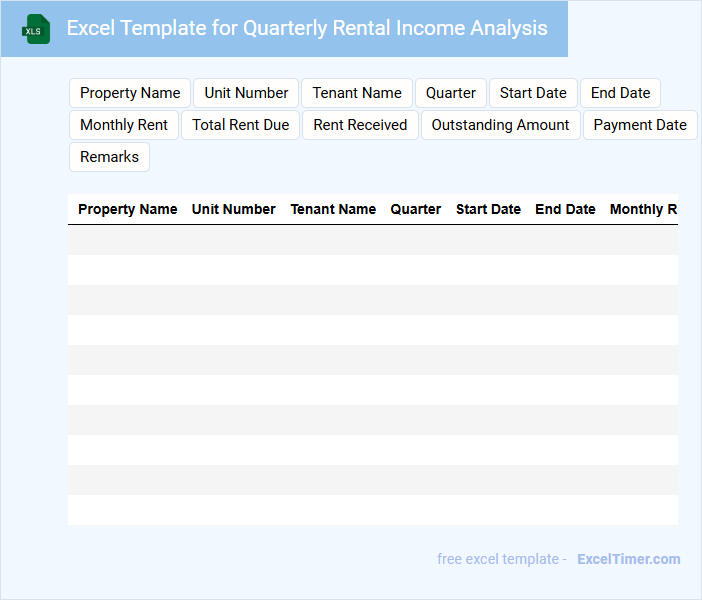

Excel Template for Quarterly Rental Income Analysis

An Excel Template for Quarterly Rental Income Analysis typically contains detailed spreadsheets designed to track rental revenues, expenses, and net income over a three-month period. It often includes tables for property details, rent collection dates, and expense categories to provide a comprehensive financial overview.

This document helps landlords and property managers monitor cash flow and identify trends for informed decision-making. Important aspects to consider are accurate data input and regular updates to reflect any changes in rental agreements or expenses.

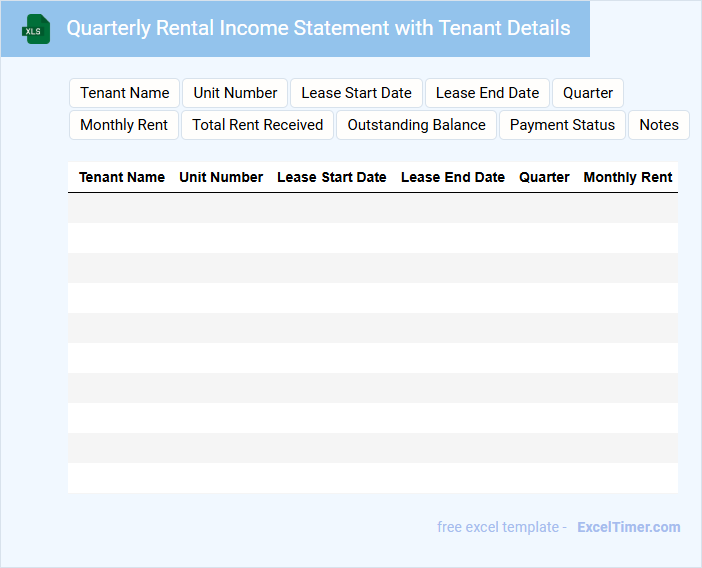

Quarterly Rental Income Statement with Tenant Details

A Quarterly Rental Income Statement with Tenant Details typically contains a detailed summary of rental income received and tenant information over a three-month period.

- Income Breakdown: An itemized list of rent payments received from each tenant during the quarter.

- Tenant Information: Detailed tenant names, lease terms, and contact information for accountability and communication.

- Financial Summary: A concise overview of total rental income, outstanding payments, and any deductions or fees applied.

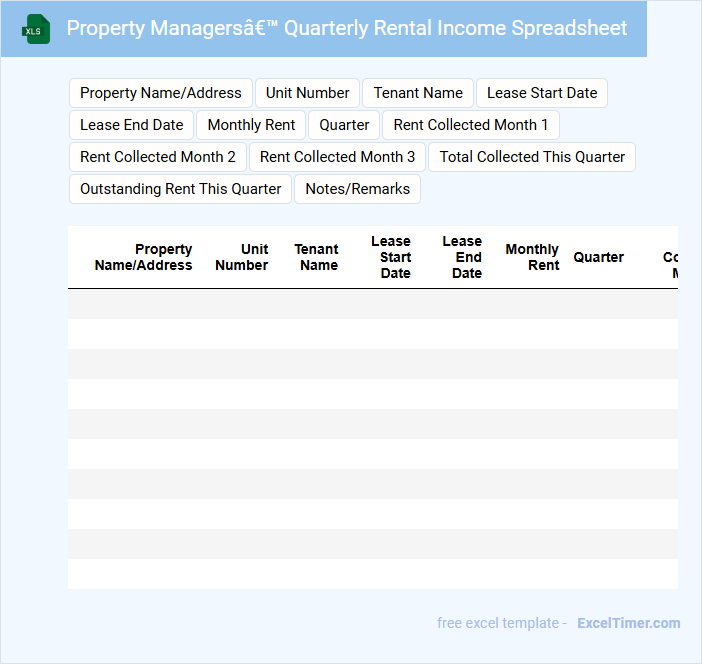

Property Managers’ Quarterly Rental Income Spreadsheet

The Property Managers' Quarterly Rental Income Spreadsheet typically contains detailed records of rental payments received, tenant information, and property expenses over a three-month period. This document helps property managers track income, manage budgets, and identify discrepancies efficiently.

It is important to include clear categorization of monthly income, outstanding payments, and recurring costs to maintain accurate financial oversight. Regular updates and cross-checking with bank statements ensure the spreadsheet remains a reliable financial tool.

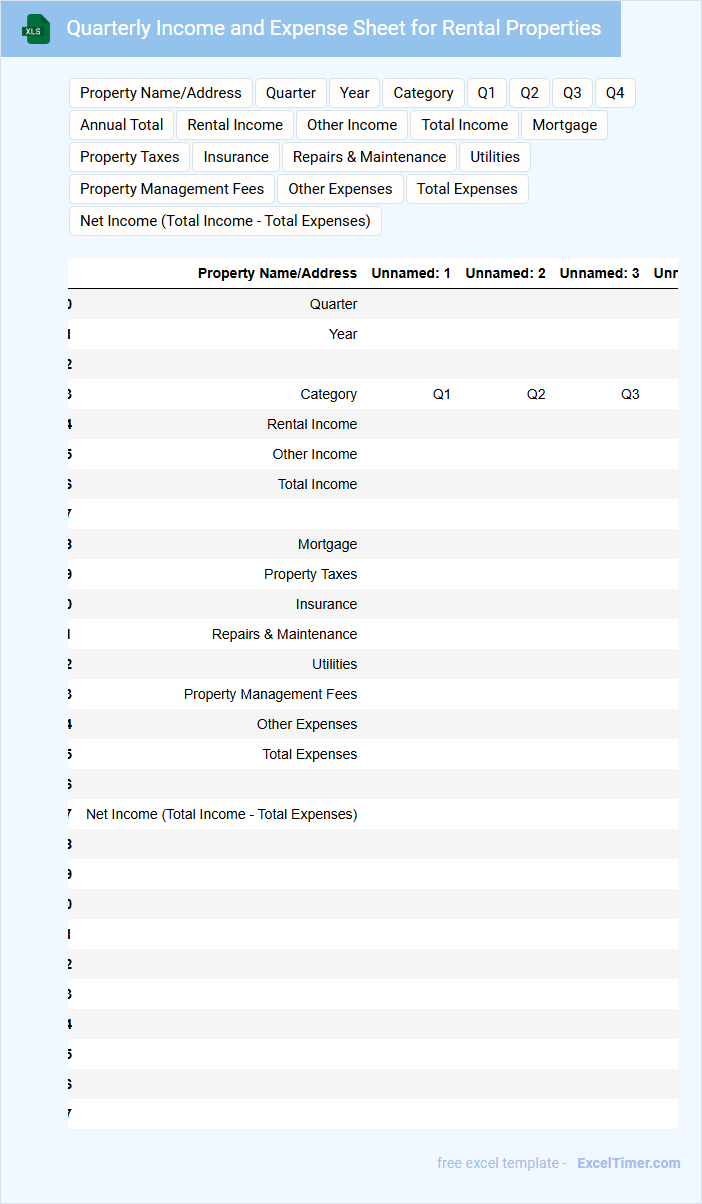

Quarterly Income and Expense Sheet for Rental Properties

A Quarterly Income and Expense Sheet for Rental Properties is a financial document that summarizes the revenue earned and costs incurred from rental properties over a three-month period. It helps property owners track profitability and manage cash flow effectively.

- Include detailed income sources such as rent payments and additional fees.

- Record all expenses like maintenance, utilities, and property management fees.

- Ensure accurate categorization of each entry to aid in tax preparation and financial analysis.

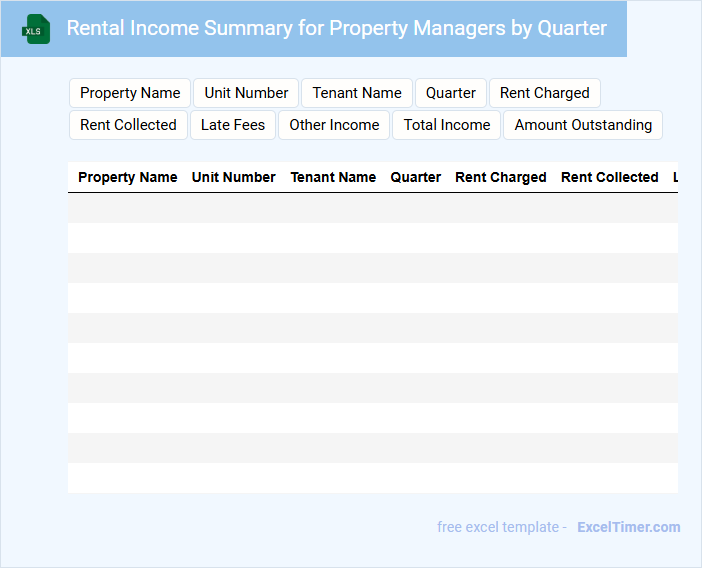

Rental Income Summary for Property Managers by Quarter

The Rental Income Summary for property managers by quarter typically contains detailed financial data outlining the rental income generated from various properties. This report helps track revenue trends and assess the financial performance over a specific period.

It is essential to include information such as total rent collected, outstanding payments, and comparisons to previous quarters. Accuracy and clear categorization of income sources ensure effective property management and financial planning.

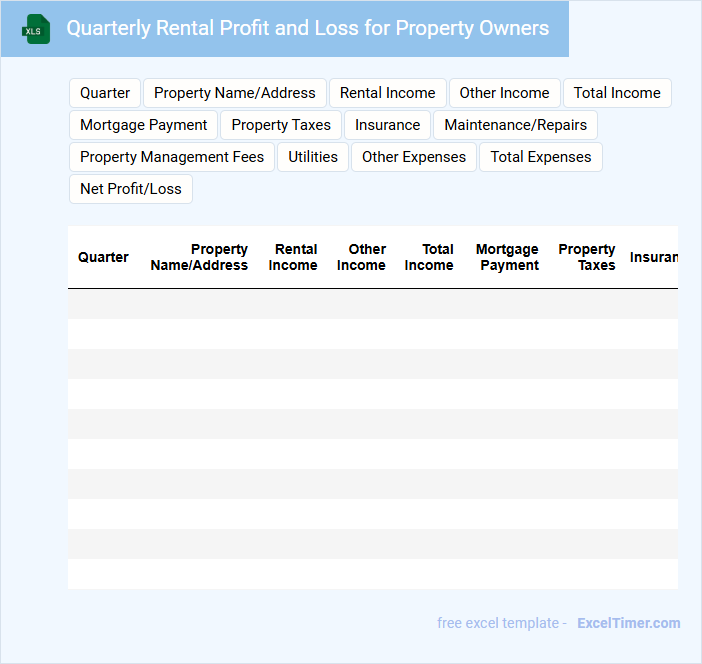

Quarterly Rental Profit and Loss for Property Owners

This document typically contains a detailed summary of income and expenses associated with rental properties over a three-month period.

- Income Breakdown: Detailed records of rent received and other related revenues.

- Expense Tracking: Comprehensive listing of all costs including maintenance, taxes, and fees.

- Net Profit Calculation: Clear statement of total earnings after deducting expenses for accurate financial analysis.

Rental Income with Payment Status Quarterly Tracker

A Rental Income with Payment Status Quarterly Tracker is a document used to monitor rental payments over a three-month period, ensuring timely collections and identifying any overdue amounts. It helps landlords and property managers maintain accurate financial records and streamline rent management.

- Include tenant names, rental amounts, and payment due dates.

- Track payment status clearly as paid, pending, or overdue for each quarter.

- Summarize total income received and outstanding balances for financial analysis.

Quarterly Overview of Rental Income for Property Management

This document typically summarizes rental income generated over a quarter, highlighting financial performance and property management effectiveness.

- Income Breakdown: Detailed tracking of rental income by property and unit.

- Expense Deductions: Itemization of maintenance and management costs impacting net revenue.

- Performance Trends: Analysis of occupancy rates and rent collection efficiency over the quarter.

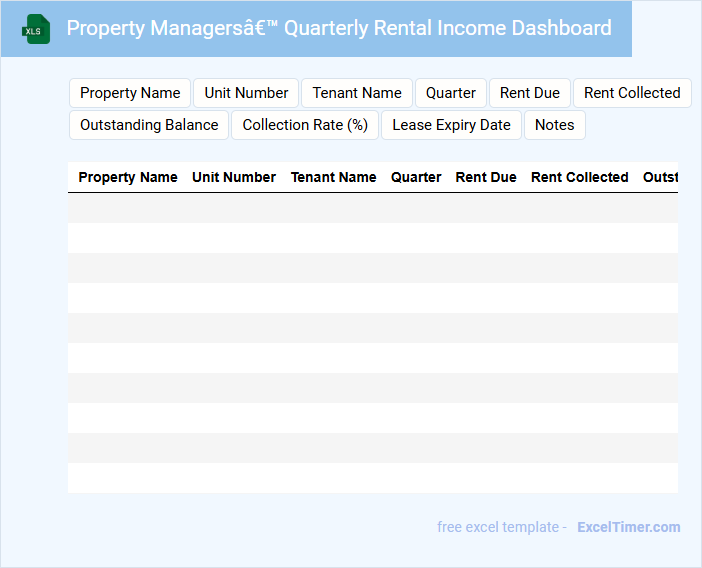

Property Managers’ Quarterly Rental Income Dashboard

A Property Managers' Quarterly Rental Income Dashboard is a comprehensive report that summarizes rental income performance over a three-month period. It typically contains details on total rent collected, outstanding payments, and occupancy rates. This document is essential for tracking financial health and making informed management decisions.

Quarterly Rental Collection Log with Late Fee Tracker

What information is typically included in a Quarterly Rental Collection Log with Late Fee Tracker? This document usually contains detailed records of monthly rent payments, dates received, and any late fees incurred by tenants during the quarter. It helps landlords monitor timely payments and assess additional charges systematically.

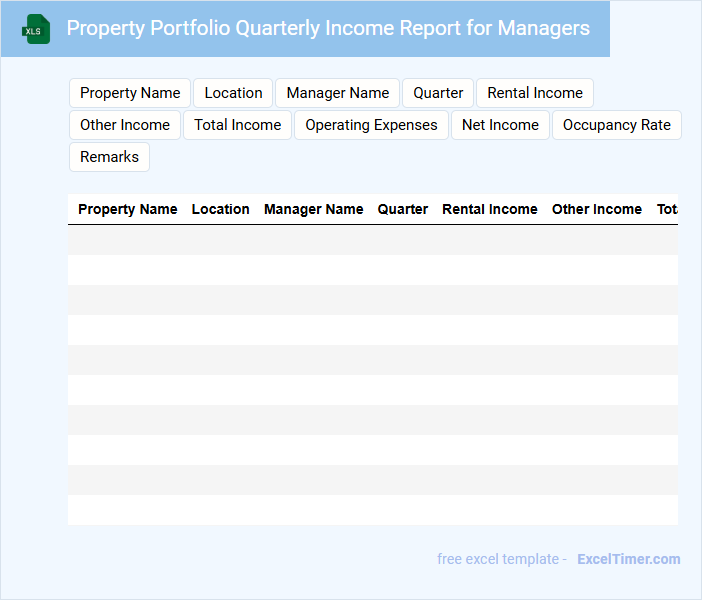

Property Portfolio Quarterly Income Report for Managers

The Property Portfolio Quarterly Income Report for managers typically contains a detailed summary of income generated from various real estate assets within the portfolio over the past quarter. It includes rental income, occupancy rates, and any significant financial changes affecting the assets. This report is essential for assessing the performance and making informed decisions about property management strategies.

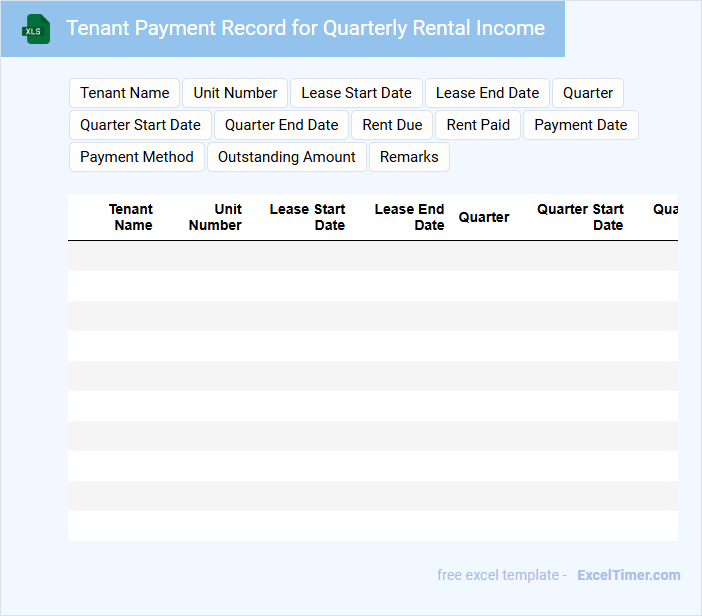

Tenant Payment Record for Quarterly Rental Income

The Tenant Payment Record for Quarterly Rental Income typically contains detailed information about rental payments made by tenants over a three-month period. It includes payment dates, amounts paid, and any outstanding balances to ensure accurate financial tracking.

Maintaining this document helps landlords monitor cash flow and verify timely payments. It is important to regularly update and review the record to avoid discrepancies and manage tenant accounts effectively.

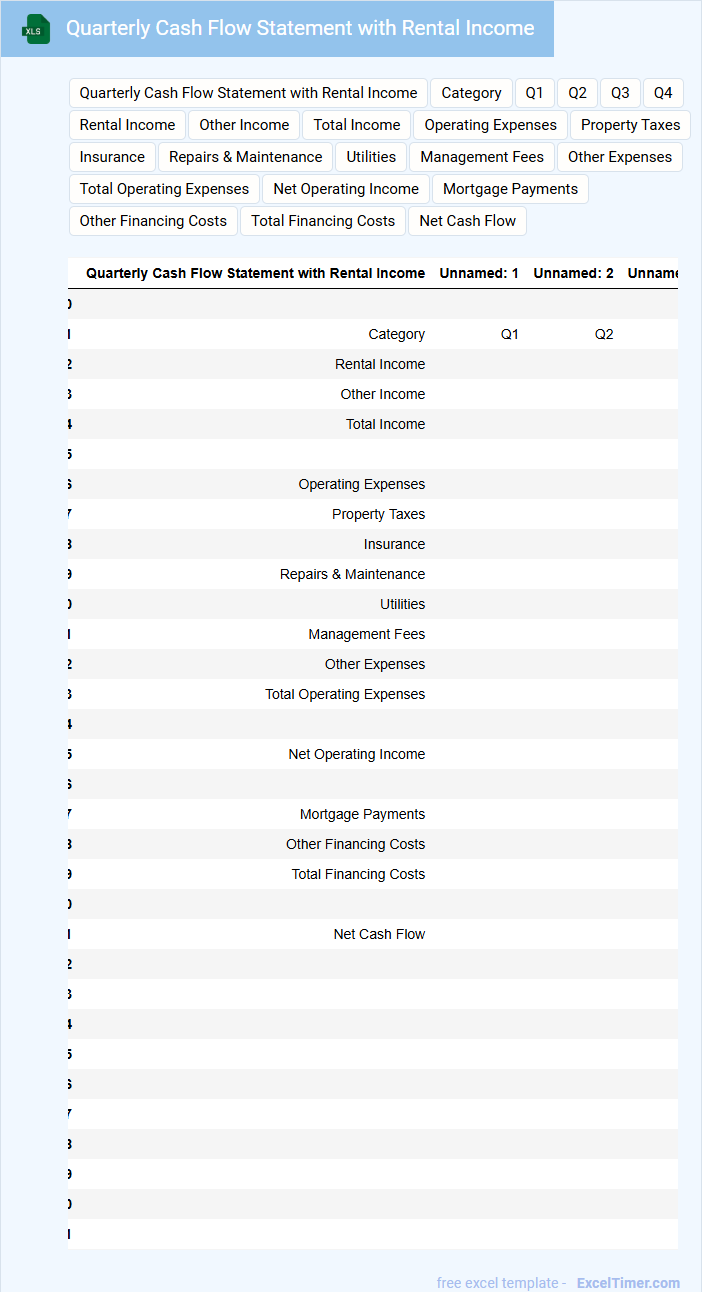

Quarterly Cash Flow Statement with Rental Income

A Quarterly Cash Flow Statement with Rental Income summarizes the cash inflows and outflows related to rental properties over a three-month period. It helps property owners track financial performance and liquidity.

- Include all rental income received during the quarter to ensure accurate revenue reporting.

- Record operating expenses such as maintenance, property management fees, and utilities to monitor costs.

- Track financing activities like loan payments or mortgage interests to understand funding impact.

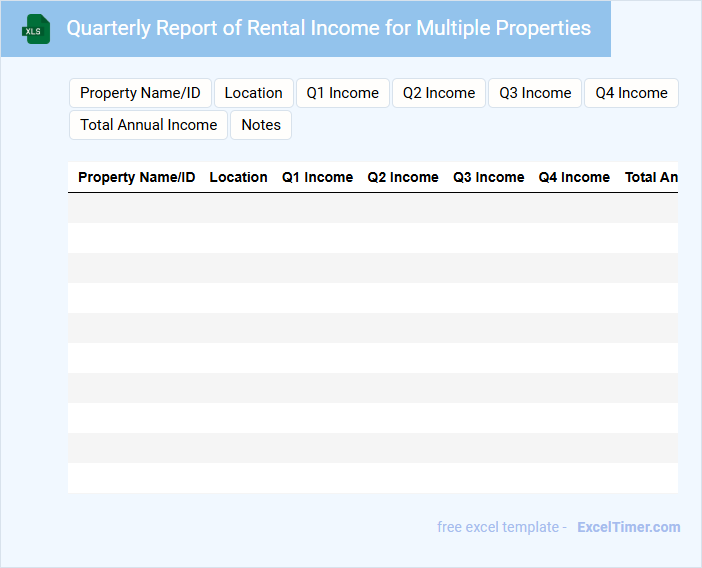

Quarterly Report of Rental Income for Multiple Properties

A Quarterly Report of Rental Income provides a detailed summary of revenue generated from multiple properties over a three-month period. It typically includes total income, expenses, and net profit for each property, allowing investors to track financial performance. Regularly reviewing this report helps identify trends and make informed decisions about property management and investment strategies.

How do you calculate total quarterly rental income using Excel formulas for multiple properties?

Calculate total quarterly rental income by summing each property's monthly rents across three months using the SUM function in Excel. Use a formula like =SUM(B2:D2) to add values for January, February, and March for one property, then drag the formula down for all properties. Your total quarterly rental income is the sum of these row totals, calculated with =SUM(E2:E10) if totals are in column E.

What is the best method to track late or missed payments in a quarterly rental income spreadsheet?

Use conditional formatting to highlight late or missed payments by comparing due dates with the payment date. Incorporate a status column with dropdown options such as "Paid," "Late," or "Missed" for easy tracking. Calculate late fees automatically with formulas based on the difference between due date and payment date.

Which Excel functions can help automatically update quarterly income summaries when rental rates change?

Excel functions like SUMIFS and INDIRECT help automatically update your quarterly rental income summaries when rental rates change. Using SUMIFS allows you to sum income based on specific properties and quarters, while INDIRECT can dynamically reference changing ranges. Combining these functions streamlines accurate and timely rental income reporting for property managers.

How can you filter or sort tenants by payment status in your Excel rental income document?

In your Excel rental income document, filter tenants by payment status using the Filter feature on the payment status column to display only paid, overdue, or pending payments. Sort the payment status column A to Z or Z to A for organized views of tenant payment records. Utilize color-coded conditional formatting to quickly identify payment statuses within the dataset.

What essential columns should be included in a quarterly rental income Excel sheet for effective property management?

Your quarterly rental income Excel sheet should include essential columns such as Property ID, Tenant Name, Rental Period, Rent Amount, Payment Date, Payment Status, and Outstanding Balance. Including these columns ensures accurate tracking of payments and helps identify any delinquencies quickly. Clear organization of this data supports effective property management and financial planning.