The Quarterly Payroll Summary Excel Template for HR Managers streamlines the process of tracking employee salaries, deductions, and tax withholdings across each quarter. This template ensures accurate payroll calculations, facilitates compliance with tax regulations, and provides clear reports for auditing purposes. HR managers benefit from its user-friendly interface and customizable fields tailored to organizational needs.

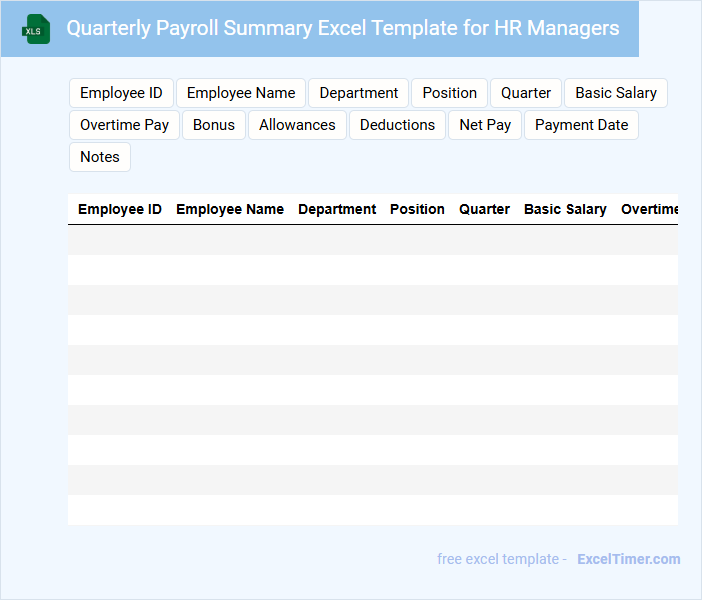

Quarterly Payroll Summary Excel Template for HR Managers

The Quarterly Payroll Summary Excel Template is designed to consolidate employee salary data, tax deductions, and benefits into an organized format, ideal for HR managers. It typically includes sections for tracking total wages, withholdings, and net pay on a quarterly basis.

This document serves as a critical tool for ensuring payroll compliance and accuracy. Important suggestions include maintaining up-to-date employee details and verifying formulas to prevent calculation errors.

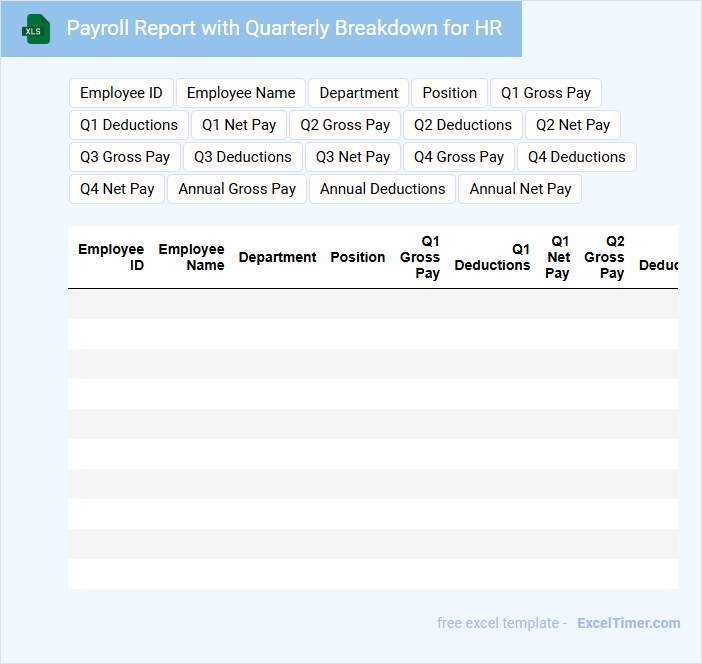

Payroll Report with Quarterly Breakdown for HR

A Payroll Report with a quarterly breakdown is a detailed document that outlines employee compensation, including salaries, wages, bonuses, and deductions over a three-month period. It provides HR with clear insights into payroll expenses and tax obligations for each quarter. Maintaining accuracy in recording all relevant payroll elements is crucial for compliance and financial planning. This type of report typically includes employee details, payment dates, tax withholdings, benefits, and net pay calculations. It also assists in identifying trends, managing budgets, and preparing for audits. Ensuring data confidentiality and timely updates can significantly enhance HR's ability to manage payroll effectively.

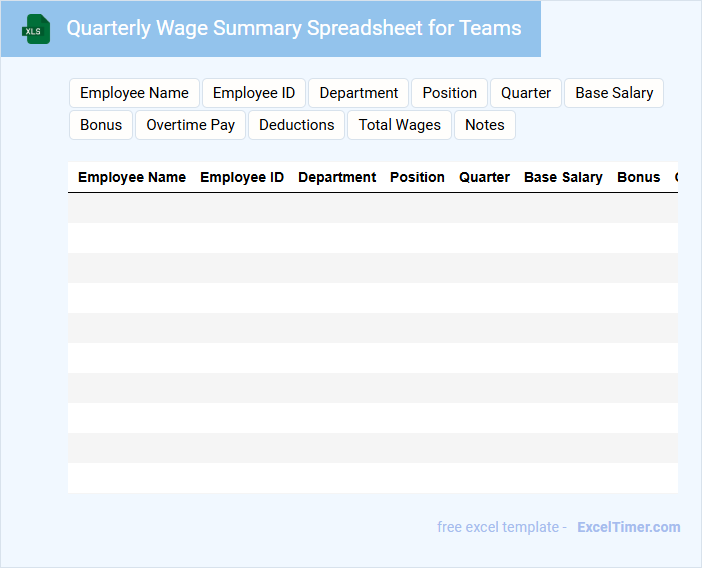

Quarterly Wage Summary Spreadsheet for Teams

What information is typically included in a Quarterly Wage Summary Spreadsheet for Teams? This document generally contains detailed records of each team member's wages earned over a quarter, including hours worked, overtime, bonuses, and deductions. It helps in tracking payroll expenses and ensuring accurate and timely payments to employees.

Why is it important to maintain accuracy in this spreadsheet? Maintaining precise data prevents payroll errors, supports regulatory compliance, and provides valuable insights for budget planning. It's crucial to regularly update and review the spreadsheet for discrepancies and consistency.

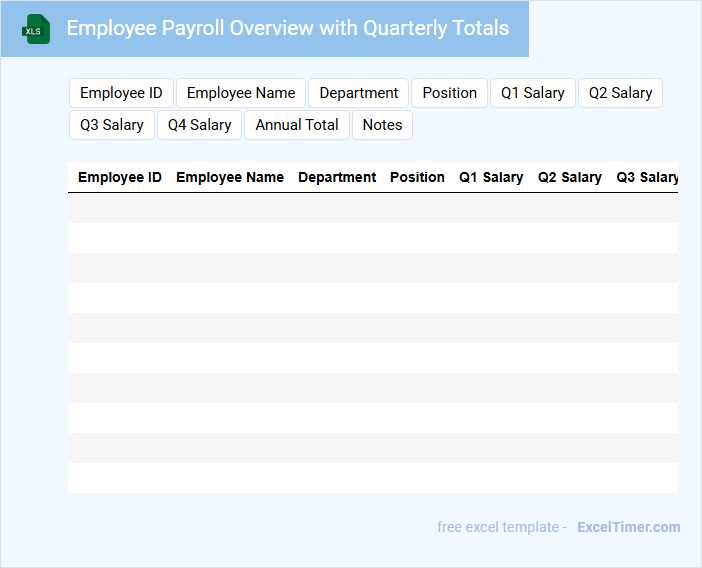

Employee Payroll Overview with Quarterly Totals

This document typically summarizes employee payroll details over a specified period, highlighting key financial metrics. It is essential for tracking compensation, ensuring compliance, and aiding budget planning.

- Include total wages, bonuses, and deductions for accurate quarterly payroll reporting.

- Ensure details are categorized by employee and department for precise analysis.

- Highlight tax withholdings and benefits contributions to maintain regulatory compliance.

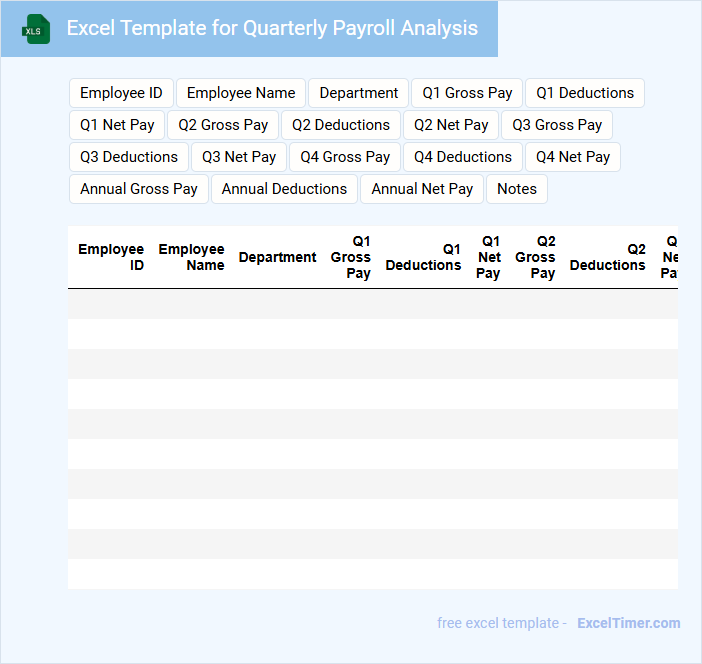

Excel Template for Quarterly Payroll Analysis

An Excel Template for Quarterly Payroll Analysis is typically used to organize and review employee payroll data over a three-month period. It usually contains sections for inputting employee names, hours worked, wages, deductions, and total payroll costs. This document helps businesses monitor payroll expenses and ensure compliance with financial regulations.

For optimal use, it is important to maintain accurate and up-to-date employee information, include formulas to automate calculations, and incorporate clear data visualization elements such as charts for trend analysis. Ensuring data confidentiality and regular backups is also crucial to protect sensitive payroll information. Finally, customizing the template to align with specific business needs can maximize its effectiveness.

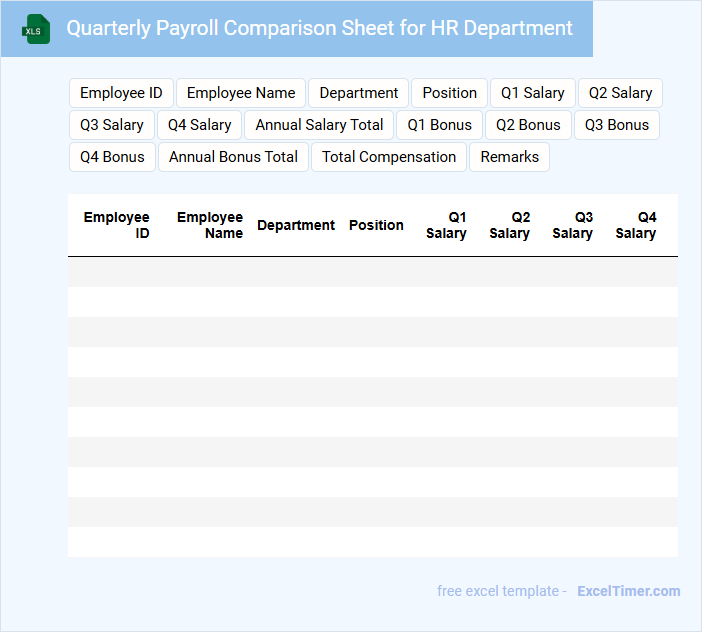

Quarterly Payroll Comparison Sheet for HR Department

A Quarterly Payroll Comparison Sheet is a document used by the HR Department to analyze payroll data across multiple quarters. It typically contains employee salary details, deductions, bonuses, and tax information for comparison purposes. This sheet helps identify trends, discrepancies, and budget adherence over time.

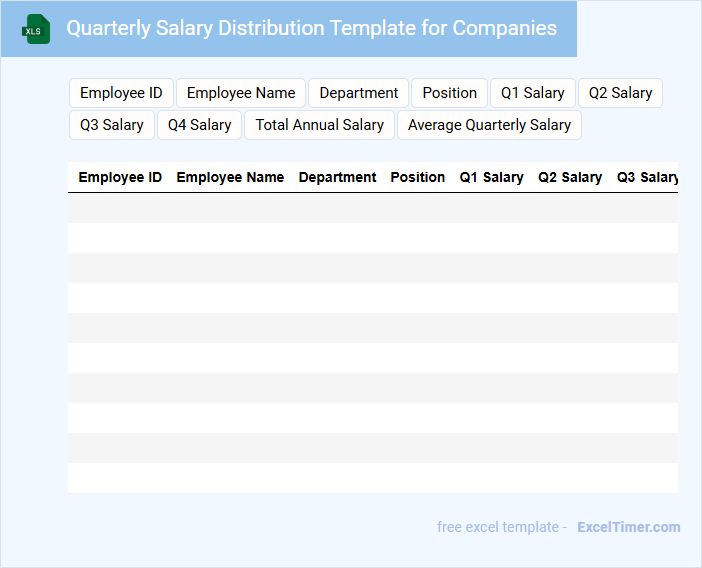

Quarterly Salary Distribution Template for Companies

The Quarterly Salary Distribution Template is a structured document used by companies to record and analyze employee salary data over a three-month period. It typically contains detailed information such as employee names, job titles, gross salaries, deductions, and net pay for each quarter.

This template helps organizations maintain transparency and accuracy in payroll management, facilitating easy tracking of salary trends and budget planning. An important consideration is ensuring up-to-date tax and compliance information is integrated to avoid discrepancies.

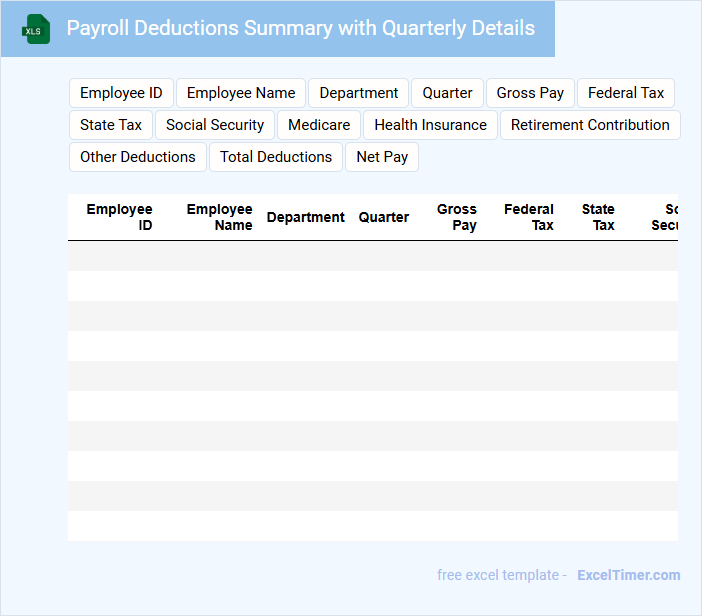

Payroll Deductions Summary with Quarterly Details

What information does a Payroll Deductions Summary with Quarterly Details typically contain? This document generally includes a detailed list of all payroll deductions made from employees' salaries over a specific quarter, such as taxes, insurance premiums, and retirement contributions. It serves as a crucial record for both employers and employees to track deduction accuracy and ensure compliance with financial and legal requirements.

What important considerations should be taken when preparing this summary? It is essential to verify the accuracy of each deduction category and maintain up-to-date employee information to prevent errors or disputes. Additionally, ensuring that all deductions comply with the applicable tax laws and employment regulations will help avoid legal penalties and maintain trust with employees.

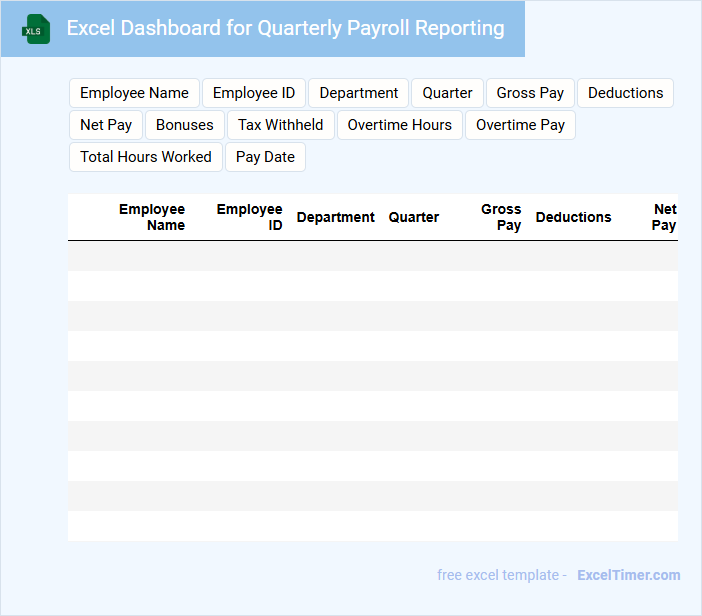

Excel Dashboard for Quarterly Payroll Reporting

What information is typically included in an Excel Dashboard for Quarterly Payroll Reporting? This type of document usually contains summarized payroll data such as total employee hours, wages, taxes, and net pay for each quarter. It presents these figures visually through charts, graphs, and tables to help stakeholders easily analyze payroll trends and discrepancies.

What important elements should be considered when creating this dashboard? Ensuring accuracy of data input and incorporating dynamic filtering options by department or employee enhances usability. Additionally, including key performance indicators like overtime costs and tax deductions supports better decision-making and compliance monitoring.

Quarterly Employee Earnings Tracker for HR Managers

A Quarterly Employee Earnings Tracker is a vital document used by HR managers to monitor and analyze employee compensation over a specific quarter. It helps in maintaining transparency and ensuring accurate payroll processing.

- Include detailed salary components such as base pay, bonuses, and deductions for clarity.

- Ensure timely updates to reflect any changes in employee earnings during the quarter.

- Incorporate data visualization like charts to quickly identify trends and discrepancies.

Template for Tracking Quarterly Payroll Expenses

A Template for Tracking Quarterly Payroll Expenses is a structured document that helps organizations monitor and record payroll costs over a three-month period. It ensures accurate financial management and compliance with tax regulations.

- Include employee names, roles, and payment details to maintain accurate records.

- Track deductions, benefits, and taxes to ensure comprehensive expense reporting.

- Update the template regularly to reflect any changes in payroll policies or employee status.

Quarterly Payroll Review Sheet with Tax Calculations

The Quarterly Payroll Review Sheet with Tax Calculations is a critical document used to summarize employee payroll data for a three-month period. It typically includes details on total wages paid, tax deductions, and employer contributions to various tax obligations. This document ensures accuracy in tax reporting and compliance with governmental regulations.

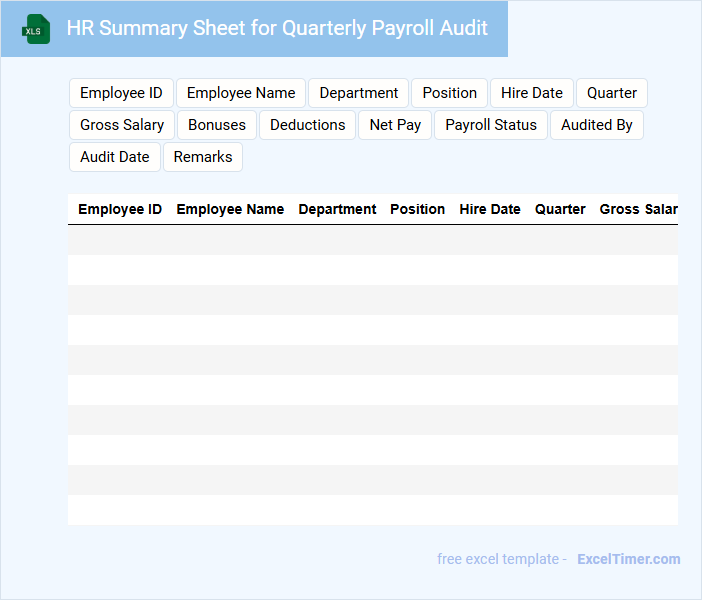

HR Summary Sheet for Quarterly Payroll Audit

The HR Summary Sheet for Quarterly Payroll Audit typically contains a comprehensive overview of payroll data and employee compensation adjustments for the quarter. It is essential for ensuring accuracy and compliance in payroll processing.

- Include detailed employee payroll records with hours worked, wages, and deductions.

- Highlight any discrepancies or anomalies detected during the audit.

- Provide a concise summary of payroll adjustments and compliance status.

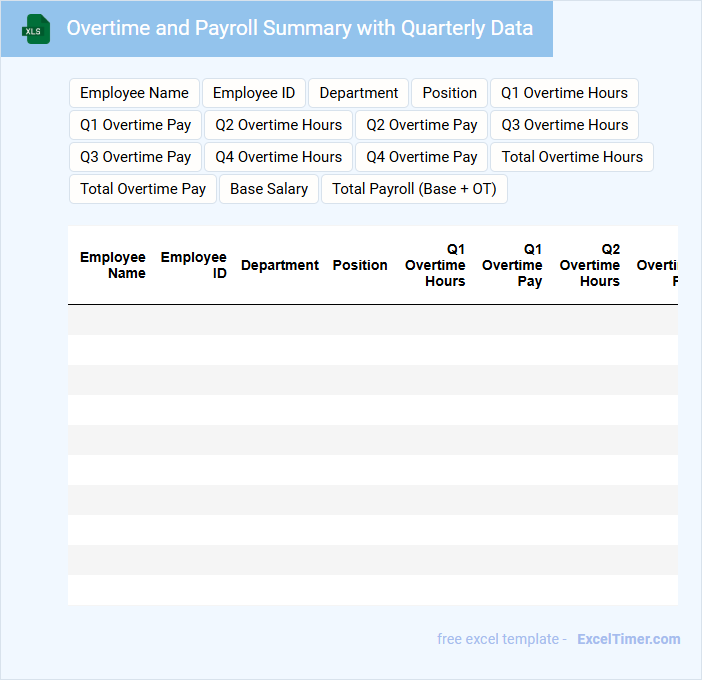

Overtime and Payroll Summary with Quarterly Data

An Overtime and Payroll Summary with quarterly data typically contains detailed records of employee hours worked beyond their regular schedule and the corresponding compensation. It includes summaries of total overtime hours, pay rates, and overall payroll expenses for the quarter. This document is essential for accurate financial reporting and ensuring compliance with labor regulations.

Important considerations include verifying the accuracy of overtime calculations, maintaining clear records of approval for extra hours, and ensuring all payroll data aligns with company policies and legal standards. Regular audits and integration with time-tracking systems can enhance reliability. Proper documentation helps avoid disputes and supports transparent payroll management.

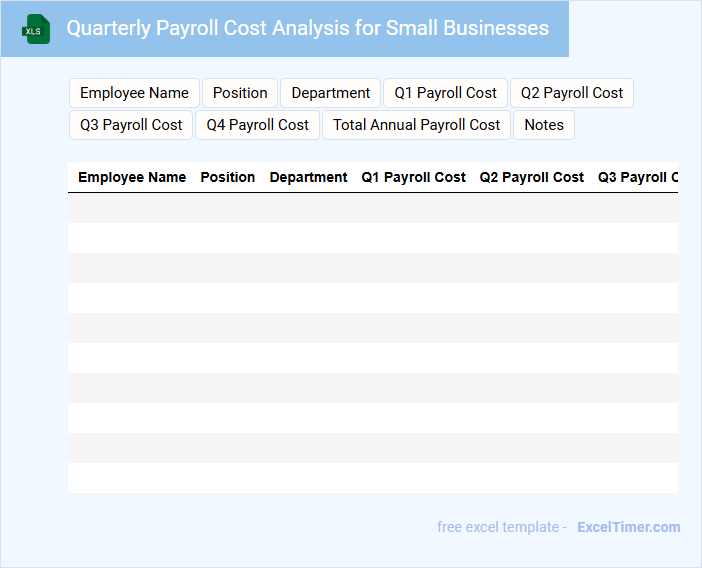

Quarterly Payroll Cost Analysis for Small Businesses

The Quarterly Payroll Cost Analysis is a document that typically contains a detailed breakdown of employee wages, taxes, and benefits over a three-month period. It helps small businesses track payroll expenses and identify trends or discrepancies. This analysis is essential for budgeting and financial planning.

Important aspects to consider in this document include accuracy in reporting hours worked and tax withholdings, as well as factoring in changes such as bonuses or new hires. Ensuring compliance with local payroll regulations is also a critical element. Regular review of this analysis supports effective cost management and decision-making.

What key data fields should be included in a Quarterly Payroll Summary Excel document for HR reporting?

A Quarterly Payroll Summary Excel document for HR reporting should include key data fields such as Employee Name, Employee ID, Department, Pay Period, Gross Pay, Deductions (taxes, benefits), Net Pay, Overtime Hours, and Total Hours Worked. Your summary should also capture Tax Withholding, Bonuses, and Payroll Dates to ensure comprehensive analysis. This data enables accurate tracking of payroll expenses, compliance, and workforce management.

How can formulas be used to automatically calculate total wages, deductions, and net pay per employee?

Excel formulas can automatically calculate total wages by summing hourly rates multiplied by hours worked, using functions like SUMPRODUCT. Deductions such as taxes and benefits are computed with predefined percentage formulas applied to gross wages. Net pay results from subtracting total deductions from total wages, enabling HR managers to streamline payroll processing efficiently.

What methods ensure data accuracy and compliance with tax regulations in quarterly payroll summaries?

Implementing automated payroll software with built-in tax code updates ensures data accuracy and compliance in quarterly payroll summaries. Regular reconciliation of payroll data against time sheets and tax filings helps detect discrepancies early. Strict adherence to government tax guidelines and periodic internal audits further maintain compliance and data integrity.

Which Excel features (e.g., filters, pivot tables) optimize analysis of payroll costs by department and role?

Using PivotTables in Excel allows HR Managers to dynamically summarize payroll costs by department and role, facilitating in-depth analysis and quick insights. Filters enable precise data segmentation, helping focus on specific time periods or employee groups within the payroll summary. Conditional Formatting highlights key payroll cost trends and anomalies, improving data visualization for more informed decision-making.

How should sensitive employee payroll information be secured and access-limited within the Excel document?

Sensitive employee payroll information in an Excel Quarterly Payroll Summary should be secured using strong password protection and worksheet-level encryption. Access can be limited by restricting editing permissions through Excel's built-in "Protect Sheet" and "Protect Workbook" features, ensuring only authorized HR managers can view or modify data. Implementing role-based access controls and regularly updating passwords further enhances data security and confidentiality.