![]()

The Quarterly Budget Tracking Excel Template for Small Businesses simplifies financial management by organizing expenses and revenues into quarterly segments, allowing clear visibility of cash flow trends. Its customizable format enables users to tailor categories to their business needs, promoting accurate budget monitoring and strategic planning. Regularly updating this template helps small businesses avoid overspending and make data-driven decisions to enhance profitability.

Quarterly Budget Tracking Excel Template for Small Businesses

The Quarterly Budget Tracking Excel Template for small businesses typically contains detailed sections for income, expenses, and cash flow organized by quarter. It helps businesses monitor financial performance, manage budgets effectively, and make informed decisions. Important elements to include are clear categorization of expenses, automated calculations, and visual graphs for quick financial insights.

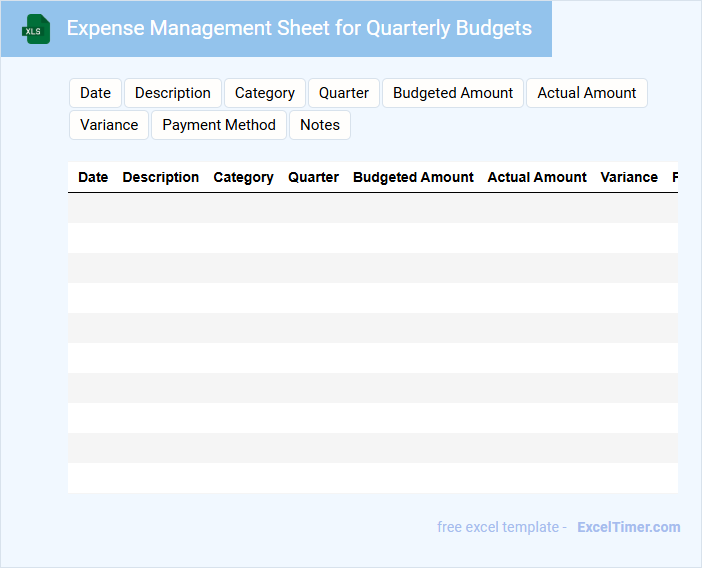

Expense Management Sheet for Quarterly Budgets

An Expense Management Sheet for Quarterly Budgets typically contains detailed records of all expenditures categorized by type, dates, and responsible departments. It also includes budgeted amounts versus actual spending to track financial performance accurately.

This document is essential for monitoring cash flow, identifying cost-saving opportunities, and ensuring adherence to budgetary constraints. Regular updates and reviews enhance its effectiveness as a financial control tool.

Important suggestions include maintaining clear categorization, using consistent data entry methods, and incorporating summary sections for quick analysis.

Quarterly Financial Tracking Spreadsheet for Small Enterprises

A Quarterly Financial Tracking Spreadsheet for small enterprises typically contains detailed records of income, expenses, profits, and losses segmented by quarter. It serves as a crucial tool for monitoring the financial health and cash flow of the business over time. Including sections for budgeting, forecasting, and variance analysis can significantly enhance decision-making and planning accuracy.

Income and Expense Tracker with Quarterly Review

What information is typically contained in an Income and Expense Tracker with Quarterly Review? This document usually records detailed records of all income and expenses over a specific period, categorized by type and date. It also includes summaries and analyses conducted every quarter to assess financial health and adjust budgets accordingly.

Why is regular quarterly review important in this document? Quarterly reviews help identify trends, detect discrepancies, and provide actionable insights for better financial planning. Consistent updates ensure accuracy and improve decision-making throughout the fiscal year.

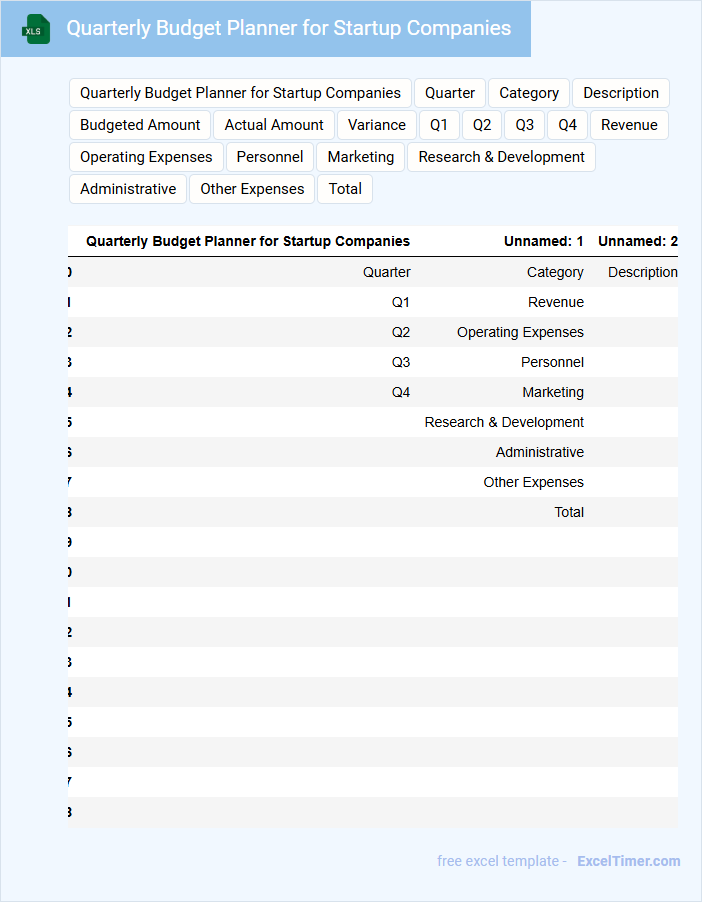

Quarterly Budget Planner for Startup Companies

What essential information does a Quarterly Budget Planner for Startup Companies typically contain? This document usually includes detailed projections of revenues, expenses, and cash flow for the upcoming quarter, helping startups monitor financial health and plan resource allocation effectively. It also suggests tracking key metrics such as burn rate and runway to ensure sustainable growth and identify potential funding needs early.

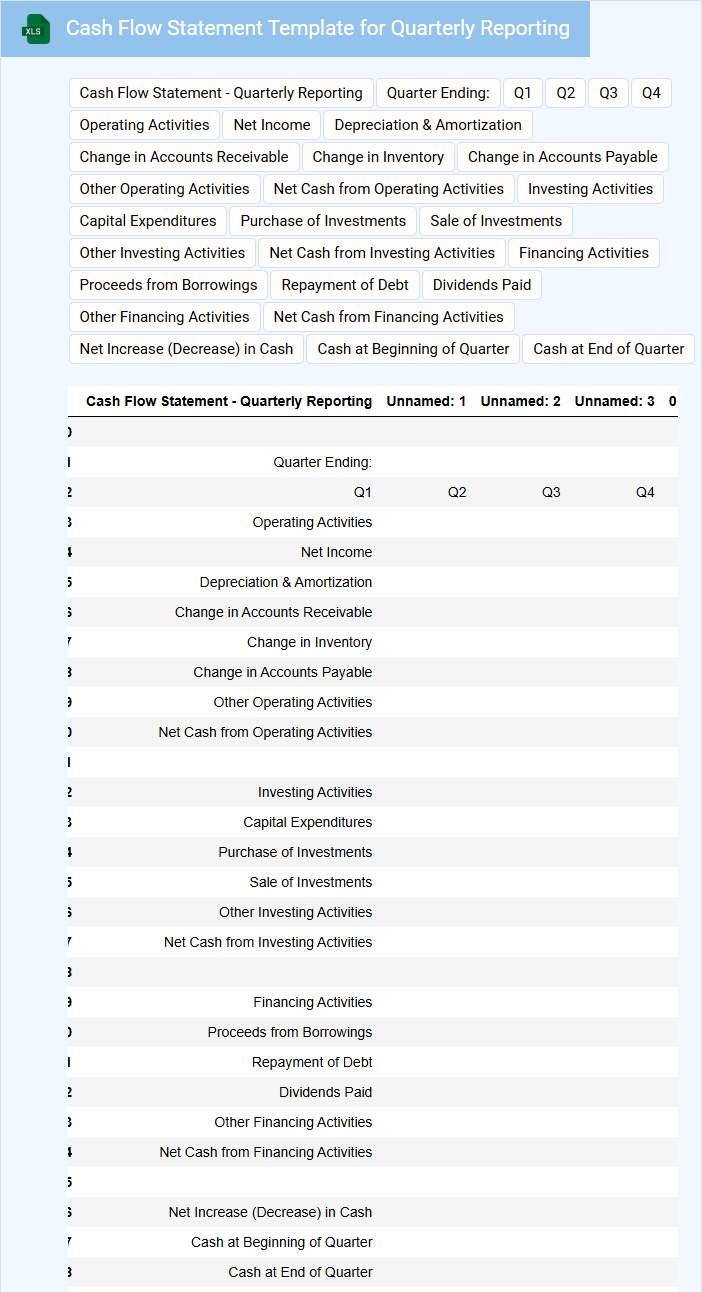

Cash Flow Statement Template for Quarterly Reporting

The Cash Flow Statement template for quarterly reporting typically contains detailed records of cash inflows and outflows within a three-month period. It helps businesses track operating, investing, and financing activities to assess liquidity and financial health. Ensuring accuracy and timely updates in the template is crucial for effective financial decision-making.

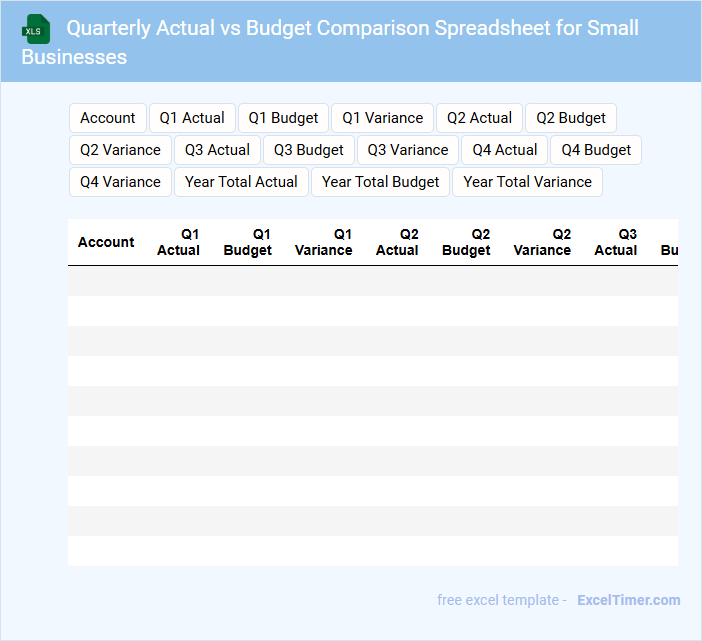

Quarterly Actual vs Budget Comparison Spreadsheet for Small Businesses

This document typically contains a comparative analysis of actual financial performance against budgeted figures on a quarterly basis for small businesses.

- Financial Overview: Summarizes income, expenses, and net profit or loss to identify variances.

- Variance Analysis: Highlights areas where actual results deviate from the budget to inform decision-making.

- Actionable Insights: Provides recommendations based on discrepancies to improve future budgeting and operational efficiency.

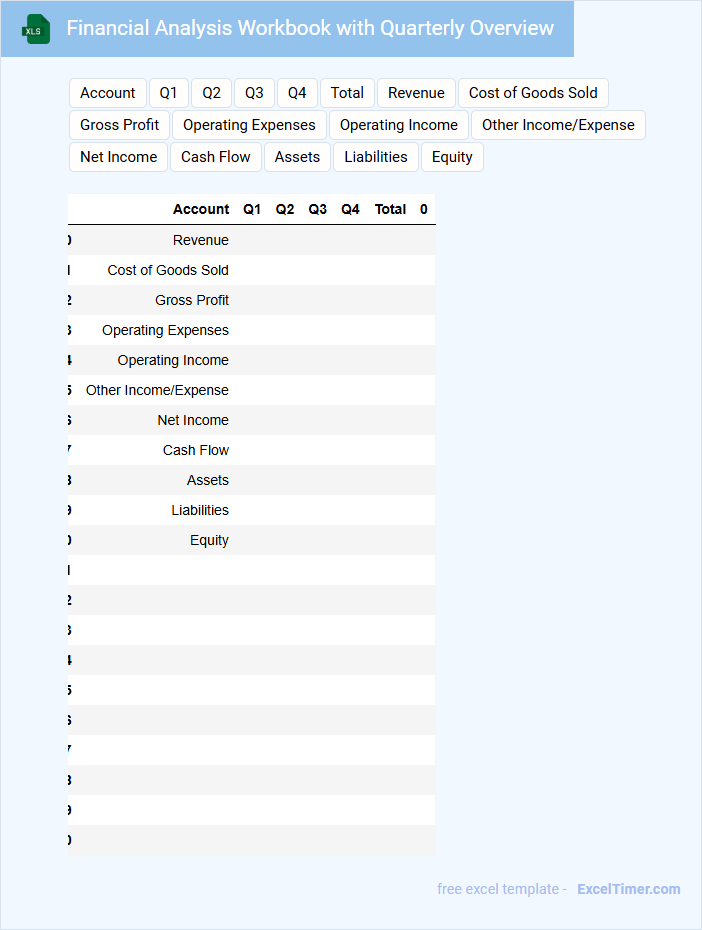

Financial Analysis Workbook with Quarterly Overview

A Financial Analysis Workbook with Quarterly Overview typically contains detailed financial data, performance metrics, and comparative quarterly results to help assess an organization's financial health. It serves as a critical tool for budgeting, forecasting, and strategic planning.

- Include clear, up-to-date financial statements for each quarter.

- Incorporate visual aids like charts and graphs for trend analysis.

- Ensure detailed notes and assumptions behind key financial figures.

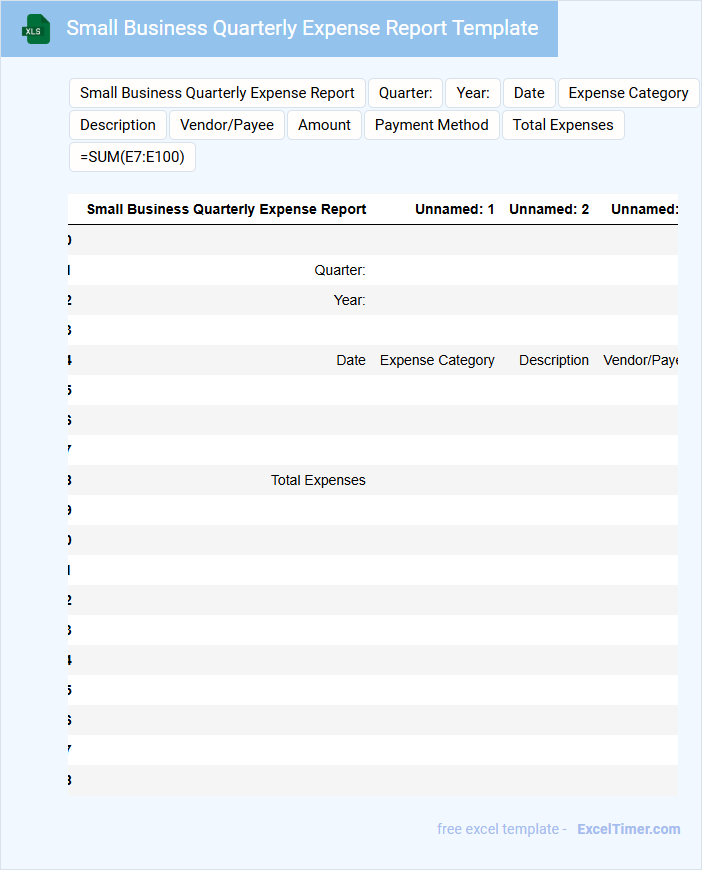

Small Business Quarterly Expense Report Template

A Small Business Quarterly Expense Report Template typically contains detailed records of all expenses incurred by a small business over a three-month period. It includes categories such as payroll, utilities, supplies, and marketing costs to help track where money is being spent.

This document is essential for monitoring business cash flow and preparing accurate financial statements. Ensuring consistent and accurate expense entries is key to effective financial management and tax preparation.

Make sure to update the template regularly and review it for discrepancies to maintain financial clarity throughout the quarter.

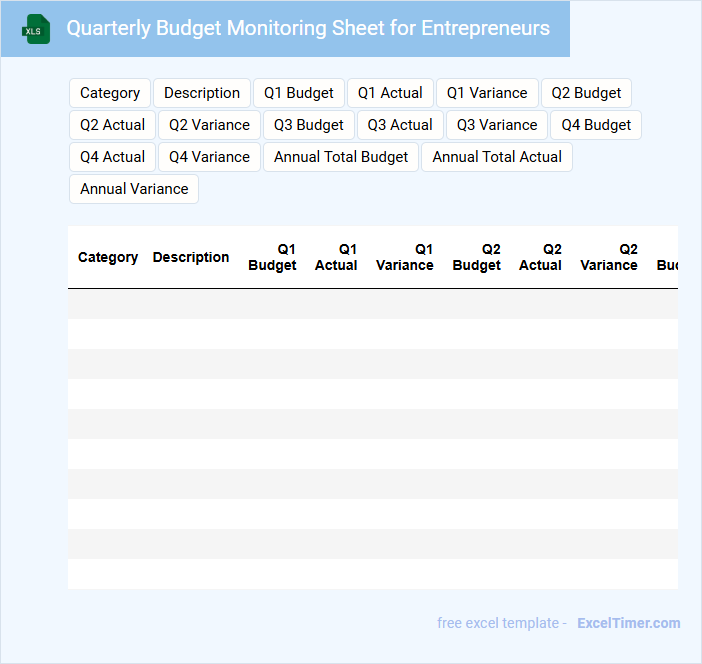

Quarterly Budget Monitoring Sheet for Entrepreneurs

A Quarterly Budget Monitoring Sheet for Entrepreneurs typically contains detailed financial data to track income, expenses, and budget variances over a three-month period.

- Income Sources: List and categorize all revenue streams to monitor cash flow.

- Expense Tracking: Record fixed and variable costs to identify overspending.

- Budget Variance: Compare actual spending against planned budget to adjust strategies accordingly.

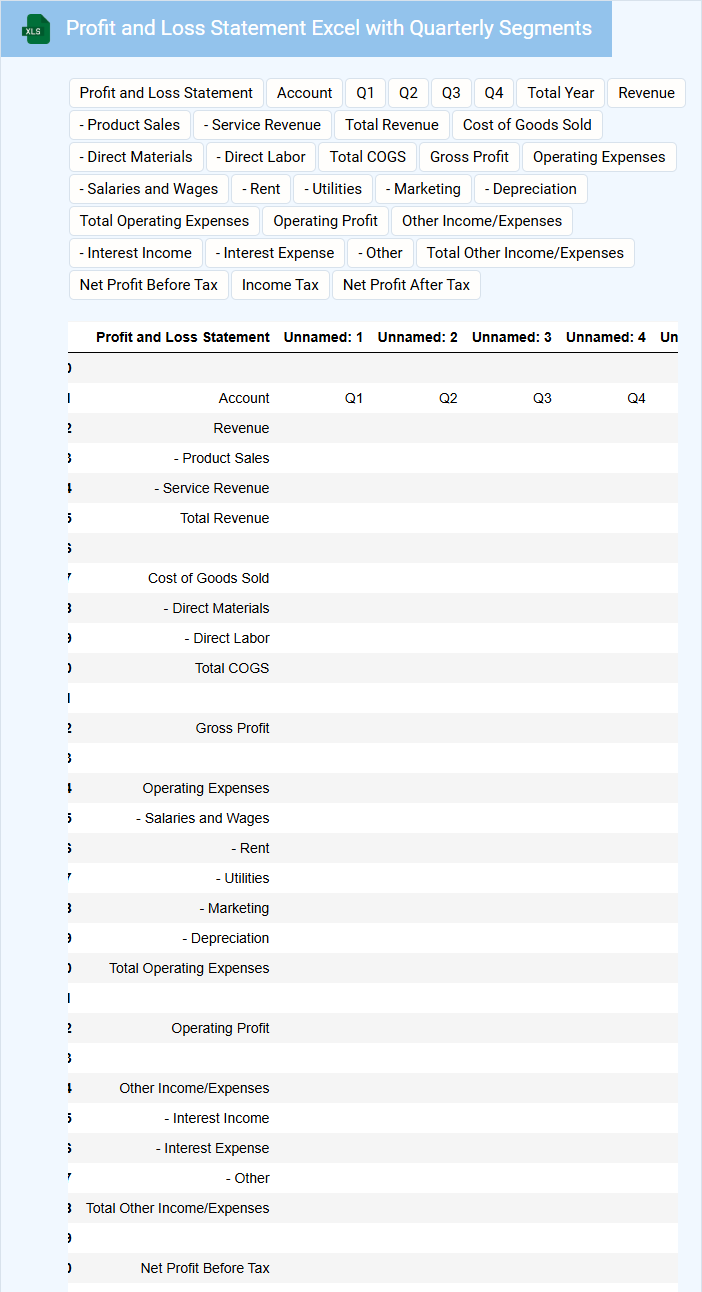

Profit and Loss Statement Excel with Quarterly Segments

What information does a Profit and Loss Statement Excel with Quarterly Segments typically contain? It usually includes detailed revenue, expenses, and net profit data broken down by each quarter to provide clear insights into the company's financial performance over time. This segmented approach helps in identifying trends, making accurate forecasts, and facilitating strategic financial planning.

What are important considerations when creating this document? It's essential to ensure accuracy in data entry, consistent formatting for easy comparison, and inclusion of key metrics like gross margin and operating expenses. Additionally, incorporating charts or graphs can enhance understanding and support decision-making for stakeholders.

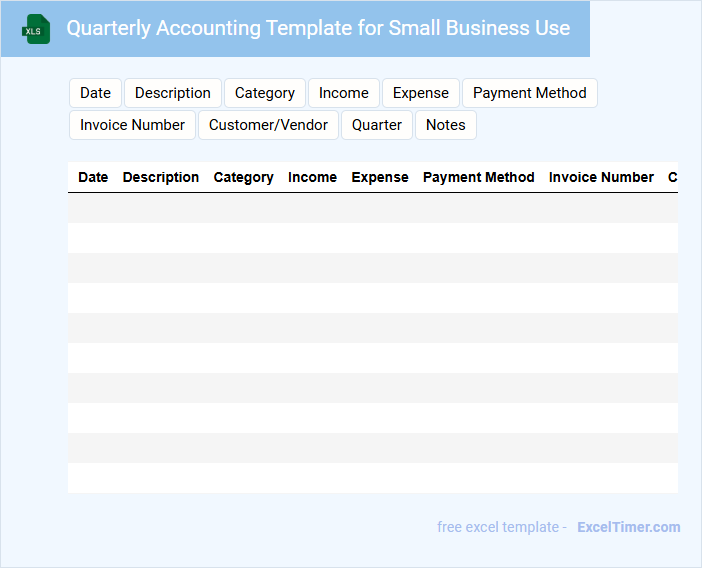

Quarterly Accounting Template for Small Business Use

A Quarterly Accounting Template is a structured document designed to track and organize financial data for small businesses over a three-month period. It typically includes sections for income, expenses, profit and loss, and tax calculations to ensure accurate financial reporting. Using such a template helps business owners monitor cash flow, prepare tax filings, and make informed decisions.

Important elements to include are clear categorization of revenue and expenses, a summary of tax obligations, and spaces for notes on unusual transactions or adjustments. Ensuring the template is easy to update and review is essential for maintaining consistent financial records. Automating calculations within the template can save time and reduce errors, improving overall accounting efficiency.

Quarterly Business Expense Tracker with Charts

A Quarterly Business Expense Tracker is typically used to monitor and record company expenditures over a three-month period, providing a clear overview of spending habits and budget adherence. It often includes detailed itemized expenses, categorized by type, to facilitate financial analysis and reporting. Incorporating charts in the tracker helps visualize trends and identify areas for cost optimization efficiently.

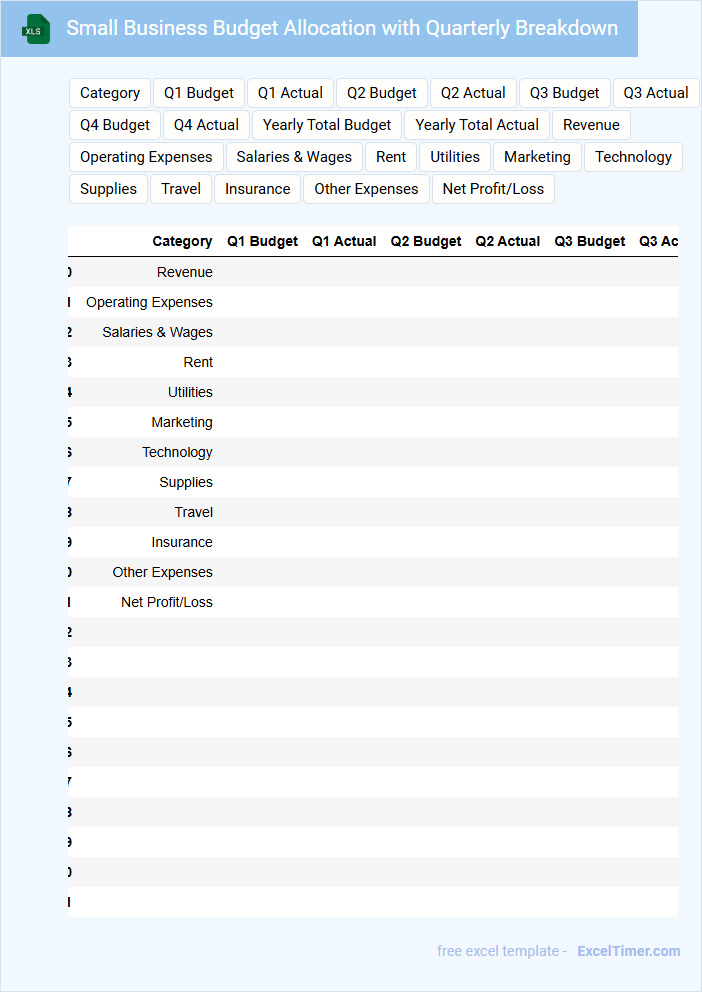

Small Business Budget Allocation with Quarterly Breakdown

A Small Business Budget Allocation document typically includes detailed projections of revenue and expenses categorized by departments or projects. It provides a systematic overview to ensure efficient use of financial resources over a specific period.

The Quarterly Breakdown adds granularity by dividing the budget into three-month segments, allowing for better financial tracking and adjustments. This approach helps small businesses monitor cash flow and plan for seasonal fluctuations effectively.

It is important to regularly review and update the budget based on actual performance and changing market conditions.

Sales and Revenue Tracking Excel for Quarterly Performance

A Sales and Revenue Tracking Excel document typically contains detailed records of sales transactions, revenue streams, and financial performance metrics. It organizes data by product, region, and time period to facilitate analysis and forecasting. This document is essential for monitoring business growth and identifying trends over the quarter.

For effective quarterly performance review, the spreadsheet should include automated formulas for calculating total sales, profit margins, and growth percentages. Visual elements like charts and dashboards enhance data interpretation and decision-making. Regular updates and data accuracy are crucial to maintain its reliability and usefulness.

What are the key categories that should be included in a small business's quarterly budget document?

A small business's quarterly budget document should include key categories such as revenue streams, operating expenses, and payroll costs. It is important to track fixed costs, variable costs, and capital expenditures separately for clearer financial insights. Including tax obligations and contingency funds ensures comprehensive budget management.

How can Excel functions (e.g., SUM, IF, VLOOKUP) be used to automate quarterly expense and revenue tracking?

Excel functions such as SUM automate quarterly tracking by totaling expenses and revenues within specific date ranges, ensuring accurate cumulative figures. The IF function categorizes and flags expenses that exceed budget limits, facilitating prompt financial decision-making. VLOOKUP efficiently retrieves corresponding revenue or expense details from separate sheets, streamlining data consolidation for small business budget analysis.

How should quarterly budget variances be highlighted and monitored within an Excel sheet?

Quarterly budget variances should be highlighted using conditional formatting with color-coded cells for quick identification of over- and under-spending. Create dynamic variance formulas comparing actual expenses against budgeted amounts to enable real-time monitoring of cash flow trends and financial performance. Your Excel sheet should incorporate pivot tables and charts to analyze variance data, facilitating informed decision-making for small business budget management.

What methods can be used in Excel to produce clear quarterly budget reports and visualizations for stakeholders?

Excel's pivot tables enable dynamic quarterly budget summaries, while conditional formatting highlights key data trends for clear stakeholder insights. Utilizing charts such as bar graphs and line charts visualizes budget performance effectively. You can also employ slicers for interactive filtering, enhancing report clarity and user engagement.

How can s be structured to compare quarterly budget projections versus actual financial performance?

Excel templates for Quarterly Budget Tracking in small businesses can be structured with separate sheets for budget projections and actual financial data, using tables to categorize income and expenses. Incorporate formula-driven columns to calculate variances and percentage differences between projected and actual figures. Visualization tools like bar charts and pivot tables enhance comparison, enabling quick identification of budget discrepancies and financial trends.