The Quarterly Income Statement Excel Template for Consultants allows accurate tracking of revenue, expenses, and net profit over each quarter, optimizing financial management for consulting businesses. It features customizable categories tailored to consulting activities, enabling clear insight into cash flow and profitability trends. Essential for consultants aiming to streamline accounting and enhance decision-making, this template supports strategic financial planning.

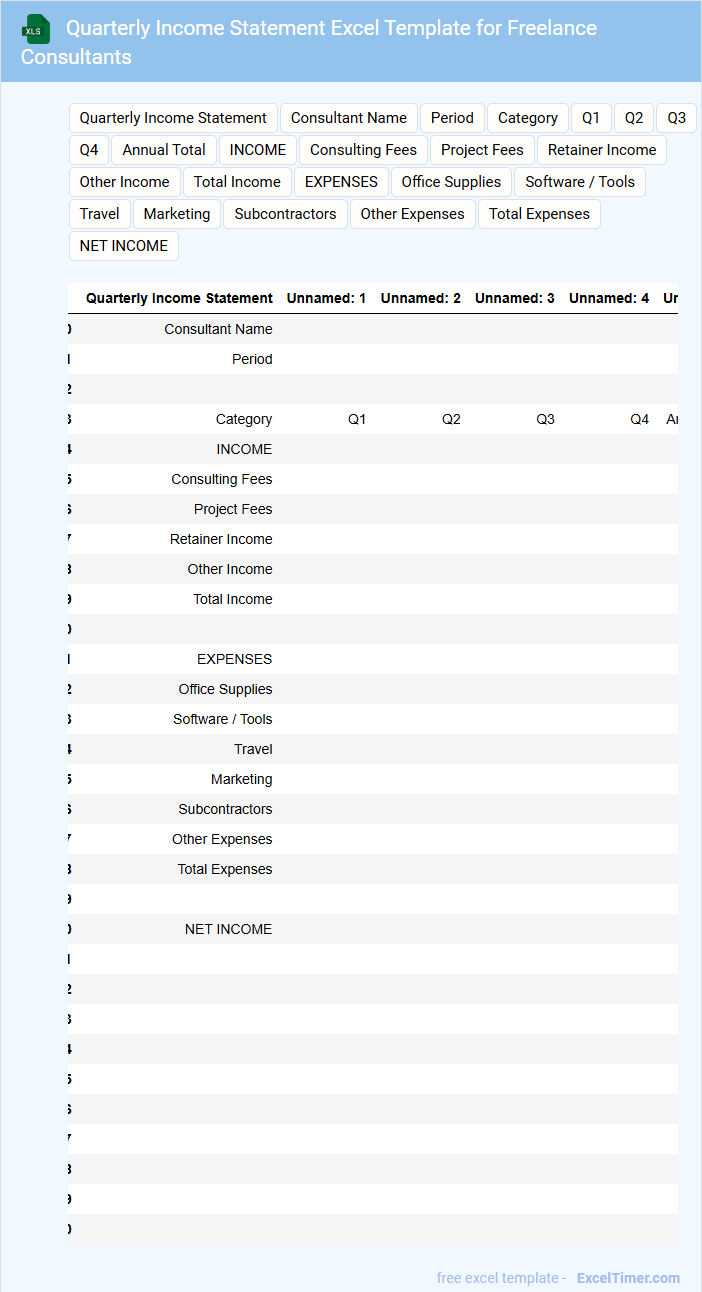

Quarterly Income Statement Excel Template for Freelance Consultants

A Quarterly Income Statement Excel Template for Freelance Consultants typically contains detailed financial data outlining revenues, expenses, and net profits over a three-month period.

- Revenue Breakdown: It should clearly categorize income sources from different clients and projects.

- Expense Tracking: All business-related costs like software, equipment, and travel should be accurately recorded.

- Profit Analysis: The template must calculate gross and net profit to help evaluate financial health and inform budgeting decisions.

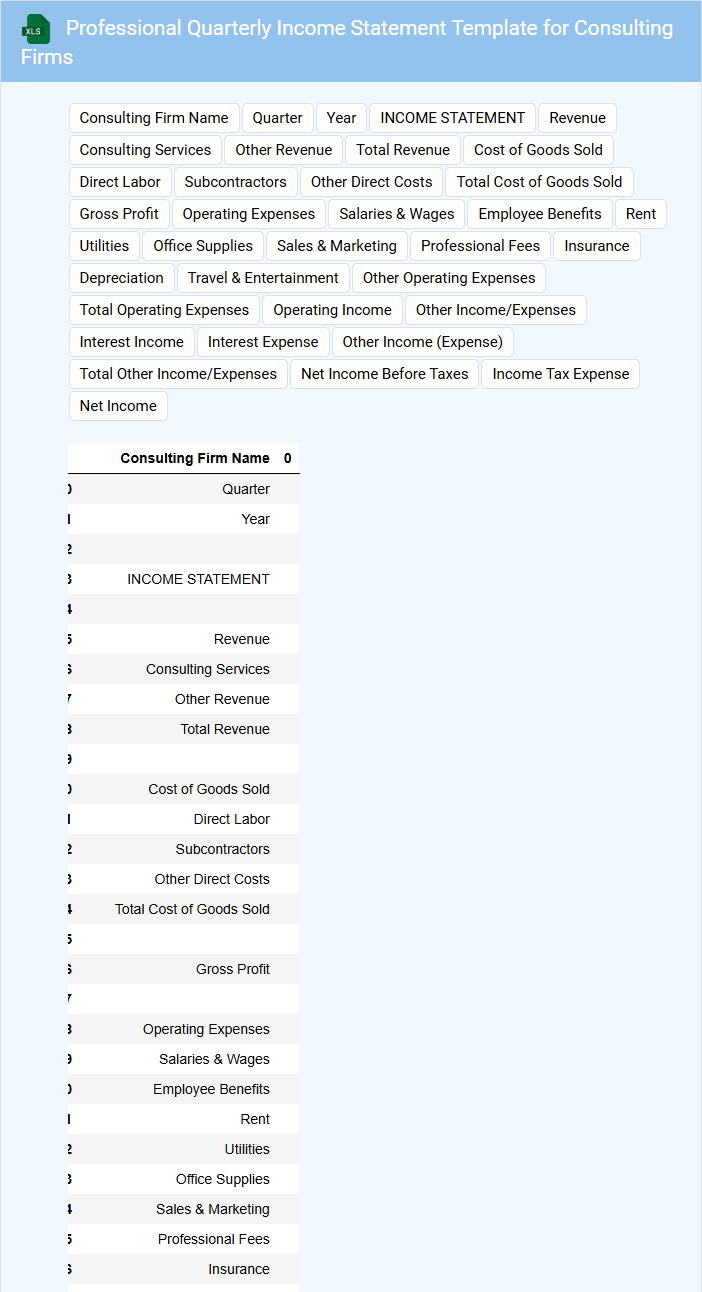

Professional Quarterly Income Statement Template for Consulting Firms

What information is typically included in a Professional Quarterly Income Statement Template for Consulting Firms? This document usually contains detailed records of revenue, expenses, and net profit over the quarter, capturing the financial performance of the consulting firm. It helps stakeholders track income sources, operational costs, and profitability trends to make informed business decisions.

What is an important aspect to consider when using this template? Accuracy in categorizing income and expenses is crucial to reflect true financial health, along with timely updates to ensure relevant data for quarterly analysis. Including clear notes or explanations for significant variances enhances transparency and aids strategic planning.

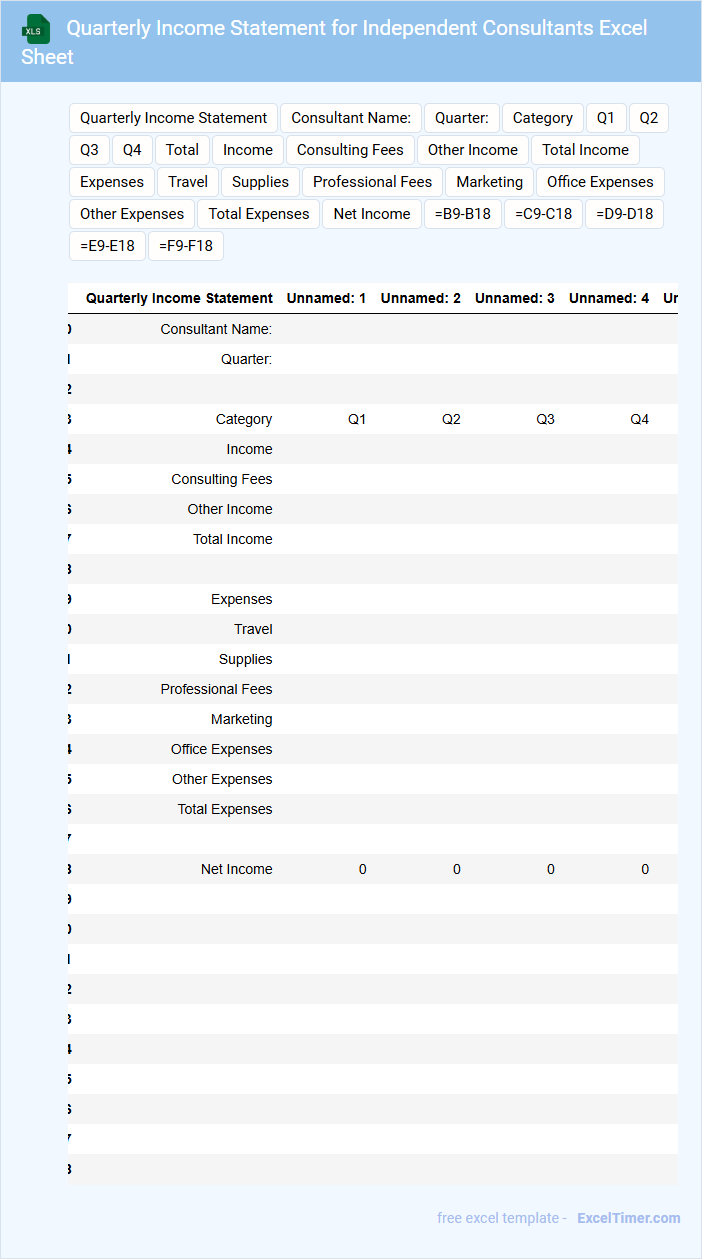

Quarterly Income Statement for Independent Consultants Excel Sheet

A Quarterly Income Statement for Independent Consultants Excel Sheet typically contains detailed records of income, expenses, and net profit for a three-month period. It helps consultants track financial performance and make informed business decisions.

Important elements include categorizing revenue streams, tracking deductible expenses, and summarizing net income. Ensuring accurate data entry and regular updates is crucial for effective financial management and tax preparation.

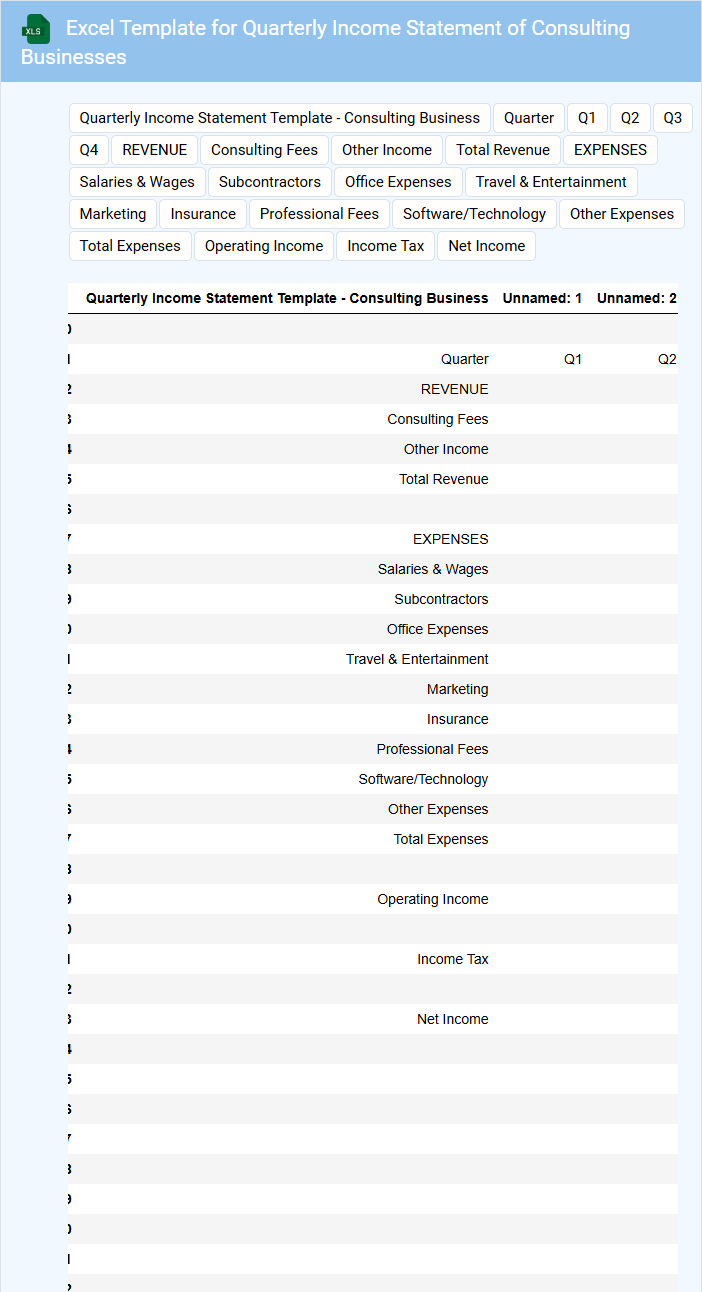

Excel Template for Quarterly Income Statement of Consulting Businesses

The Excel Template for Quarterly Income Statement is designed to help consulting businesses systematically record and analyze their financial performance over a three-month period. It typically contains sections for revenue, expenses, and net profit, providing a clear overview of the company's profitability. This structured approach allows business owners to easily track financial trends and make informed decisions based on accurate data.

Important elements to include are detailed revenue streams, categorized expenses, and summary metrics like gross profit and net income. Incorporating dynamic formulas for automatic calculations and visual charts enhances usability and insight generation. Ensuring the template is customizable will allow businesses to tailor the document to their specific consulting niche and financial reporting needs.

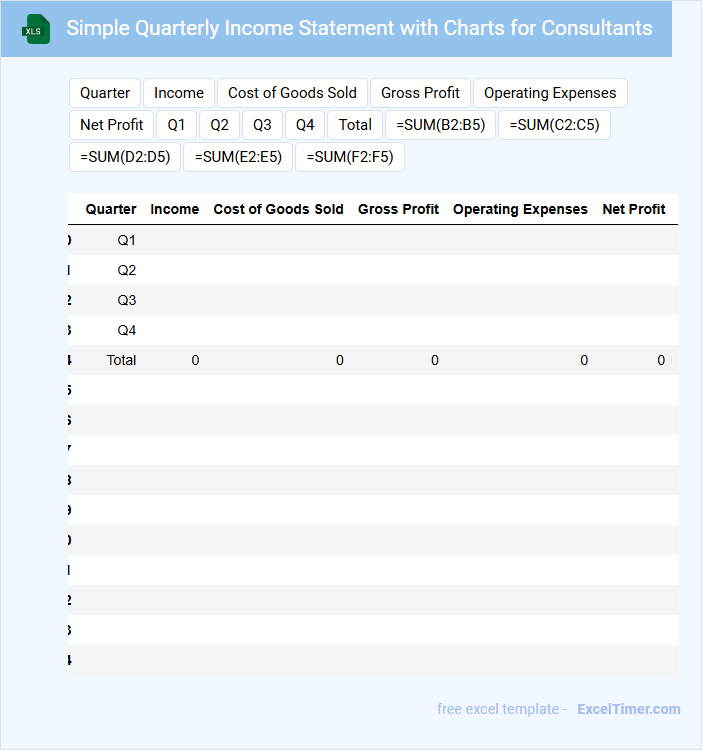

Simple Quarterly Income Statement with Charts for Consultants

A Simple Quarterly Income Statement typically contains a clear summary of revenues, expenses, and net income over a three-month period. It provides consultants with insights into their financial performance and profitability in a concise format.

Incorporating charts enhances visualization of key financial trends and comparisons, making data easier to interpret at a glance. Including graphical representations like bar or line charts for income and expenses is highly recommended to quickly identify patterns and anomalies.

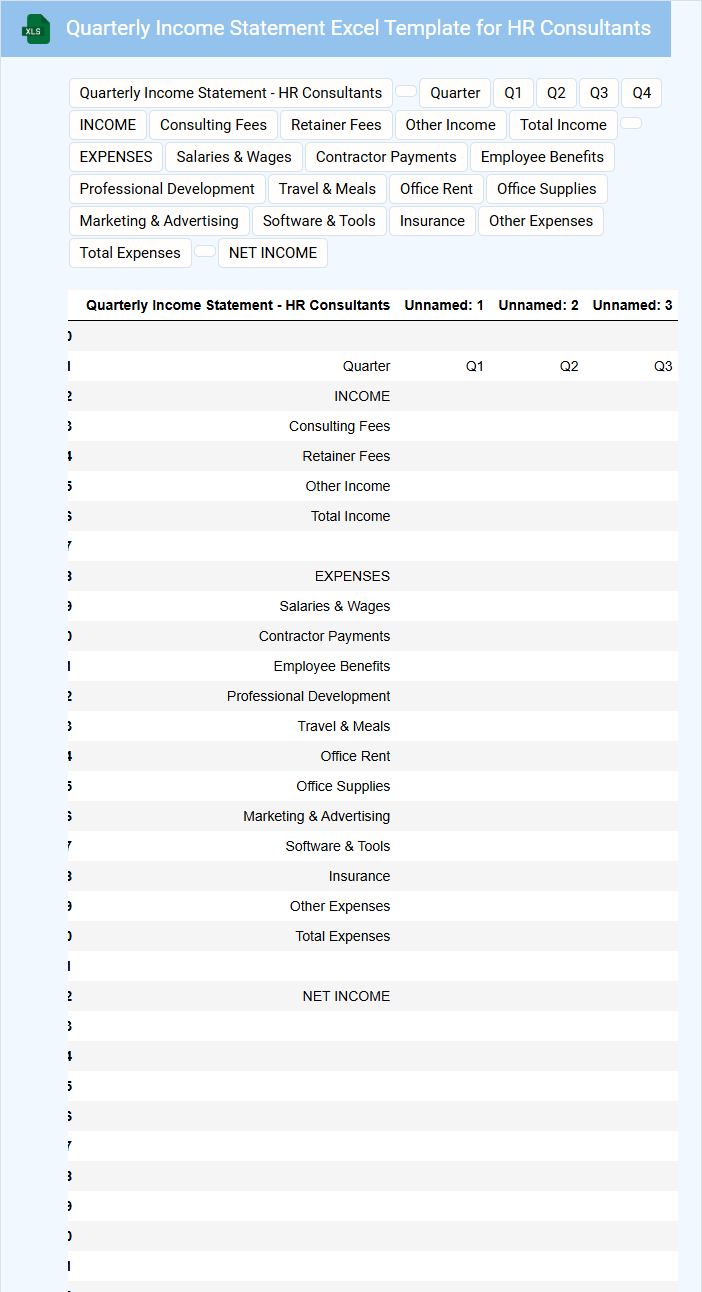

Quarterly Income Statement Excel Template for HR Consultants

What information is typically included in a Quarterly Income Statement Excel Template for HR Consultants? This document usually contains detailed revenue, expenses, and net income data segmented by quarters to help HR consultants track their financial performance over time. It also includes categories like consulting fees, operational costs, and payroll expenses to provide a comprehensive financial overview.

Why is it important to customize the template for HR consultants? Customizing the template ensures that all relevant income sources and cost centers specific to HR consulting are captured accurately, enabling better financial analysis and decision-making. Including sections for client billing cycles, project-based expenses, and employee compensation is crucial for precise financial management.

Income Statement Template for Quarterly Reporting of Consultants

An Income Statement Template for Quarterly Reporting of Consultants typically includes detailed revenue streams, associated costs, and net profit or loss for the quarter. It provides a clear snapshot of the financial performance, helping consultants track their profitability and manage expenses. This document is essential for strategic planning and informed decision-making within the consulting business.

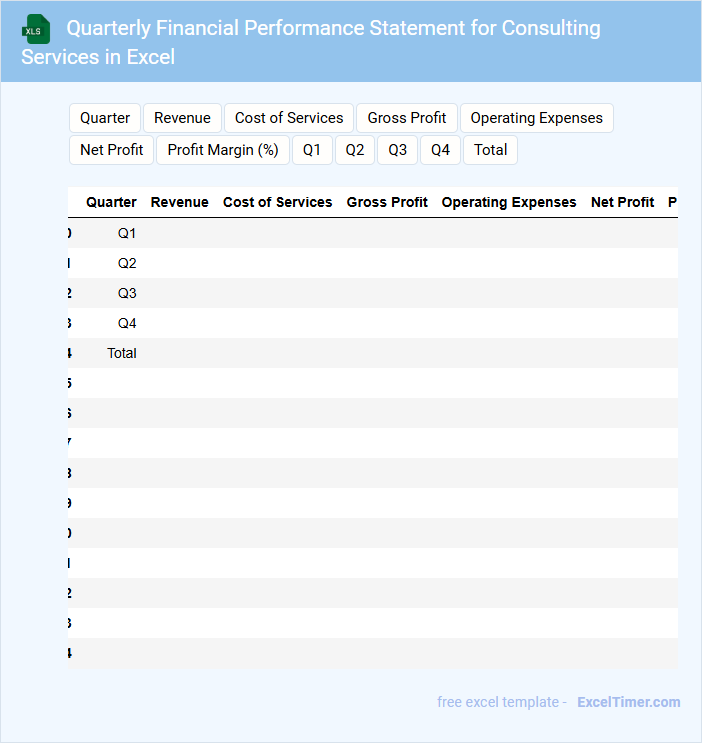

Quarterly Financial Performance Statement for Consulting Services in Excel

What information is typically included in a Quarterly Financial Performance Statement for Consulting Services in Excel? This document usually contains detailed financial data such as revenue, expenses, profit margins, and project-specific costs for the consulting services provided during the quarter. It is designed to track financial health, identify trends, and support informed decision-making through clear visualizations and organized tables.

What are the important considerations when preparing this statement? Accuracy in data entry, consistent formatting, and clear labeling of financial metrics are crucial to ensure reliability and ease of review. Additionally, incorporating charts and summary sections can enhance comprehension and help stakeholders quickly grasp key financial insights.

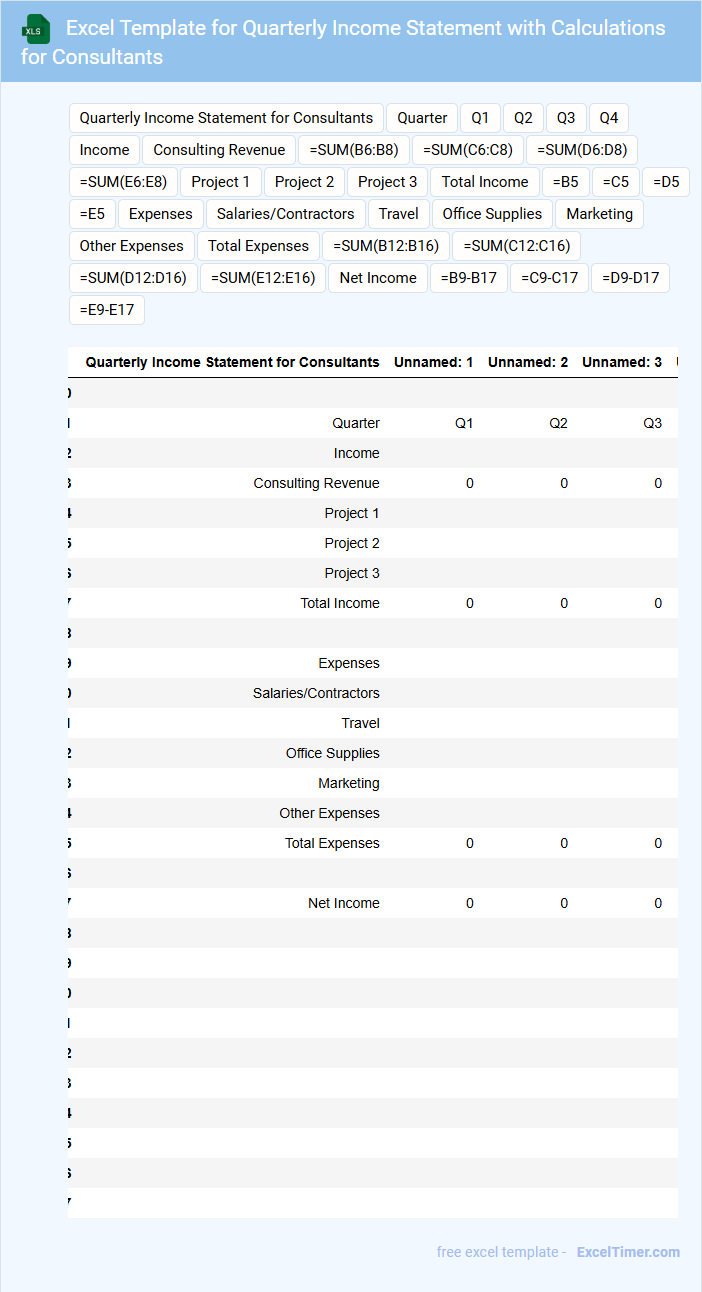

Excel Template for Quarterly Income Statement with Calculations for Consultants

An Excel Template for a Quarterly Income Statement with Calculations for Consultants typically contains detailed financial data, including revenues, expenses, and net income for each quarter. It is designed to help consultants analyze their financial performance efficiently and make informed business decisions.

- Include clear categories for income, expenses, and taxes to ensure accurate calculations.

- Incorporate automated formulas for summing totals and calculating net profit to minimize errors.

- Provide customizable sections for different clients or projects to track consultant-specific earnings.

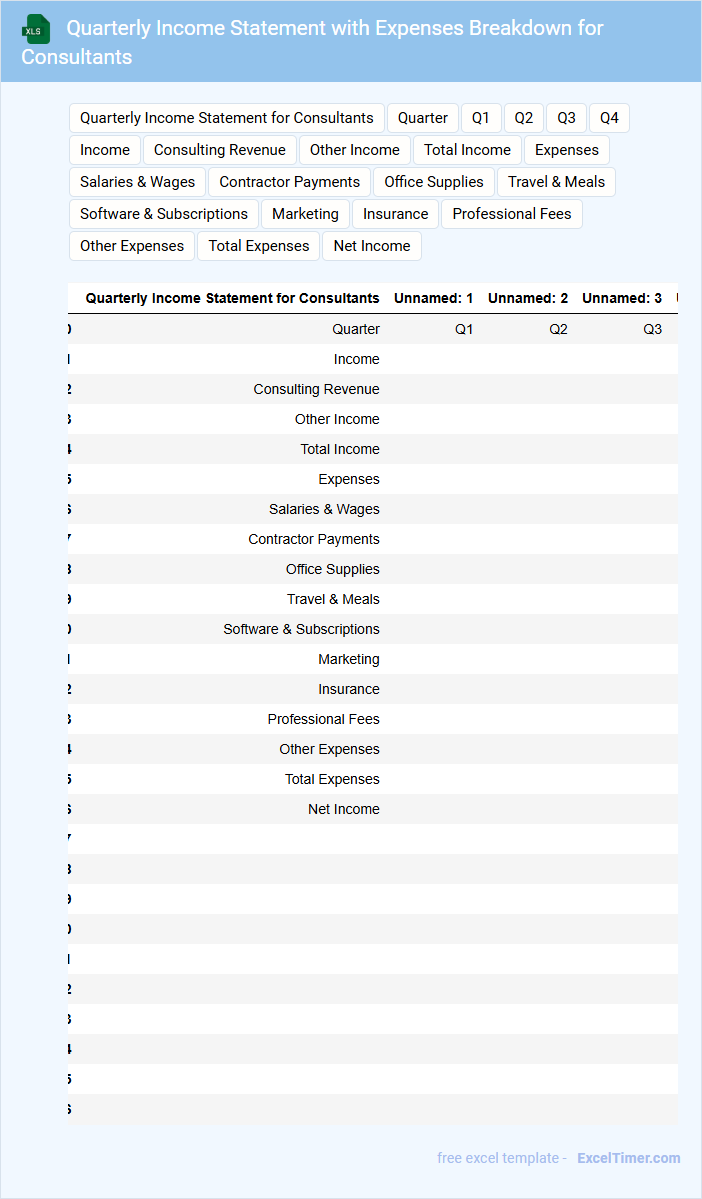

Quarterly Income Statement with Expenses Breakdown for Consultants

What information does a Quarterly Income Statement with Expenses Breakdown for Consultants typically contain?

This document usually includes the total income earned during the quarter alongside detailed categories of expenses specific to consulting activities, such as travel, software subscriptions, and client entertainment. It provides a clear financial overview to help consultants evaluate profitability and manage cash flow effectively.

What is an important consideration when preparing this document?

Ensuring accurate categorization and timely recording of all expenses is crucial to maintain transparency and support informed financial decision-making. Additionally, highlighting any unusual or one-time expenses can help identify trends and improve future budgeting strategies.

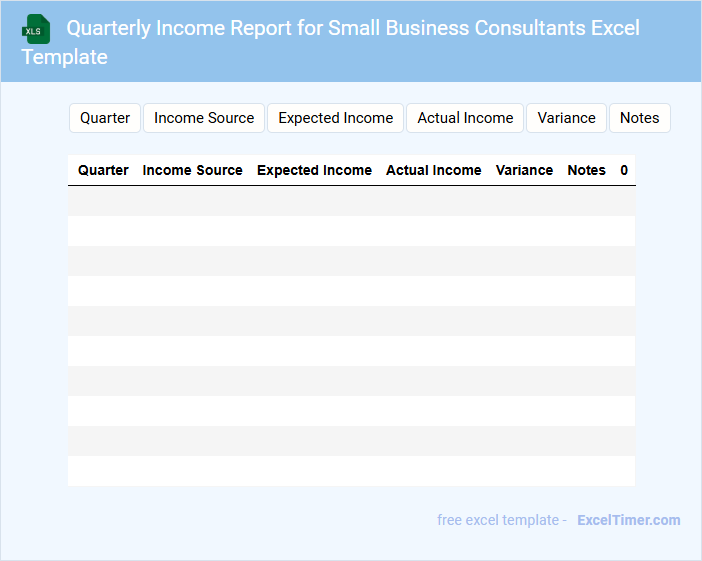

Quarterly Income Report for Small Business Consultants Excel Template

A Quarterly Income Report for Small Business Consultants Excel Template typically contains financial data summaries to track earnings and expenses over three months.

- Revenue Breakdown: Detailed sections highlighting sources of income across different consulting projects.

- Expense Tracking: Itemized lists of operational costs to monitor budget adherence efficiently.

- Profit Analysis: Clear calculation of net income to evaluate business profitability each quarter.

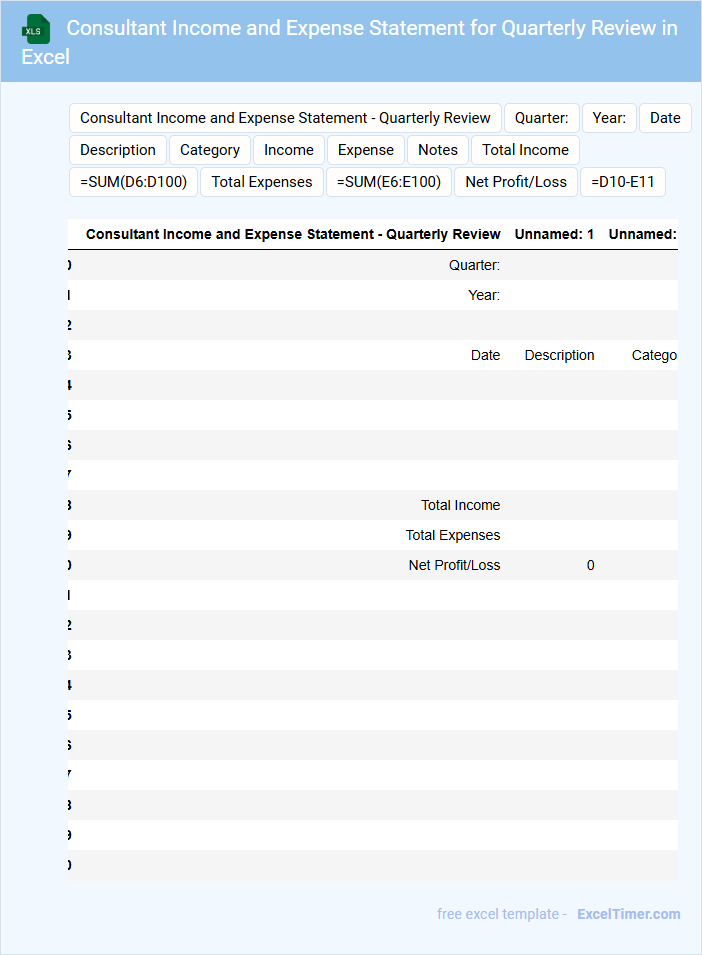

Consultant Income and Expense Statement for Quarterly Review in Excel

What information is typically found in a Consultant Income and Expense Statement for Quarterly Review in Excel? This document usually contains detailed records of all income earned and expenses incurred by a consultant over a three-month period, organized in a clear spreadsheet format. It helps track financial performance, ensuring accurate reporting and effective budget management for the quarter.

What are the important elements to include in this statement? Key components should include categories for income sources, expense types, dates, amounts, and notes for clarification. It's also essential to maintain accuracy, regularly update data, and use formulas to automatically calculate totals and net income for a comprehensive financial overview.

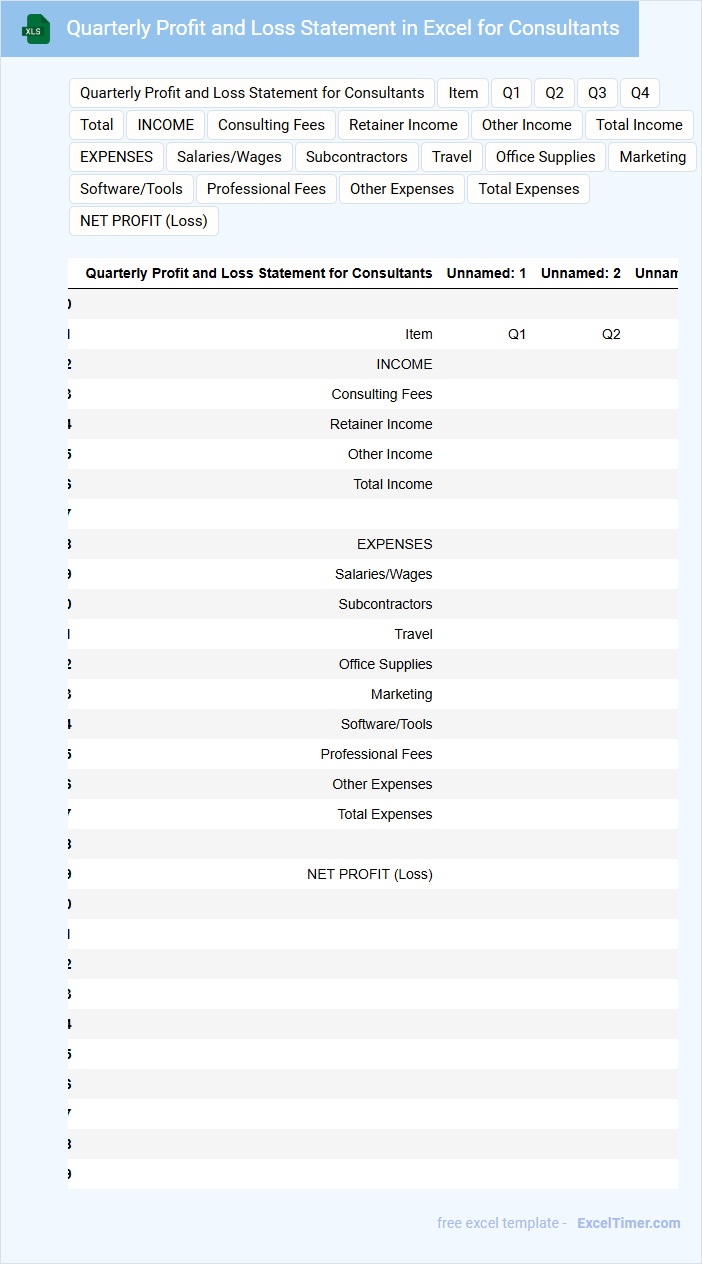

Quarterly Profit and Loss Statement in Excel for Consultants

What information does a Quarterly Profit and Loss Statement in Excel for Consultants typically contain? This document usually includes detailed records of revenue, expenses, and net profit for the quarter. It helps consultants track financial performance and make informed business decisions.

What is an important consideration when preparing this statement? Ensuring accuracy in categorizing income and expenses is crucial for clear financial insights and effective budgeting. Regular updates and reviews also help maintain relevance and support strategic planning.

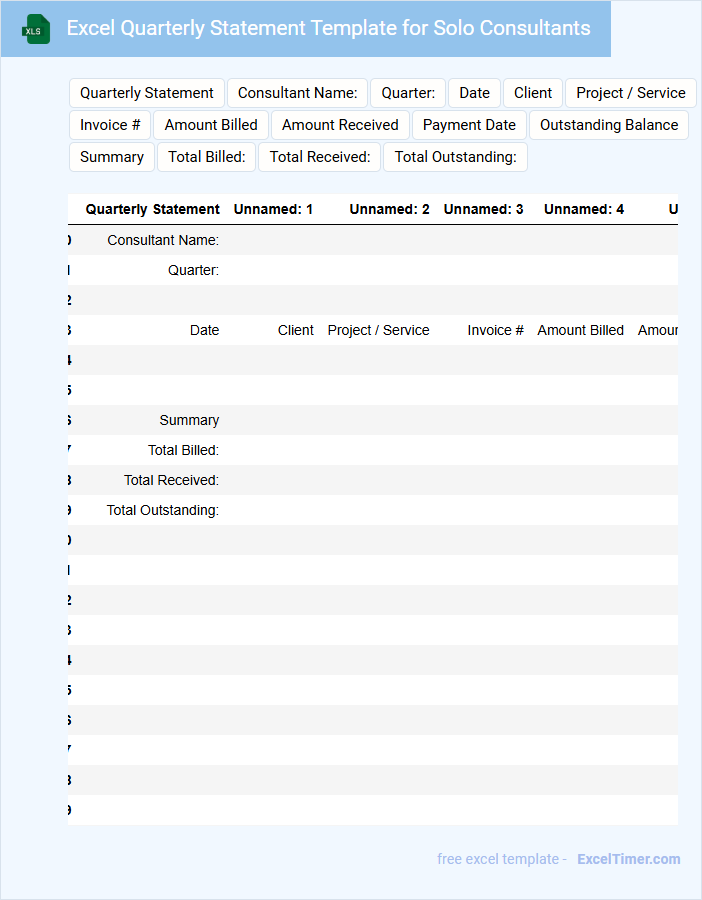

Excel Quarterly Statement Template for Solo Consultants

An Excel Quarterly Statement Template for Solo Consultants typically includes financial summaries, income and expense tracking, and project billing details. It helps solo consultants organize their financial data efficiently for each quarter. Key elements include clear categorization, automated calculations, and visual charts for quick analysis.

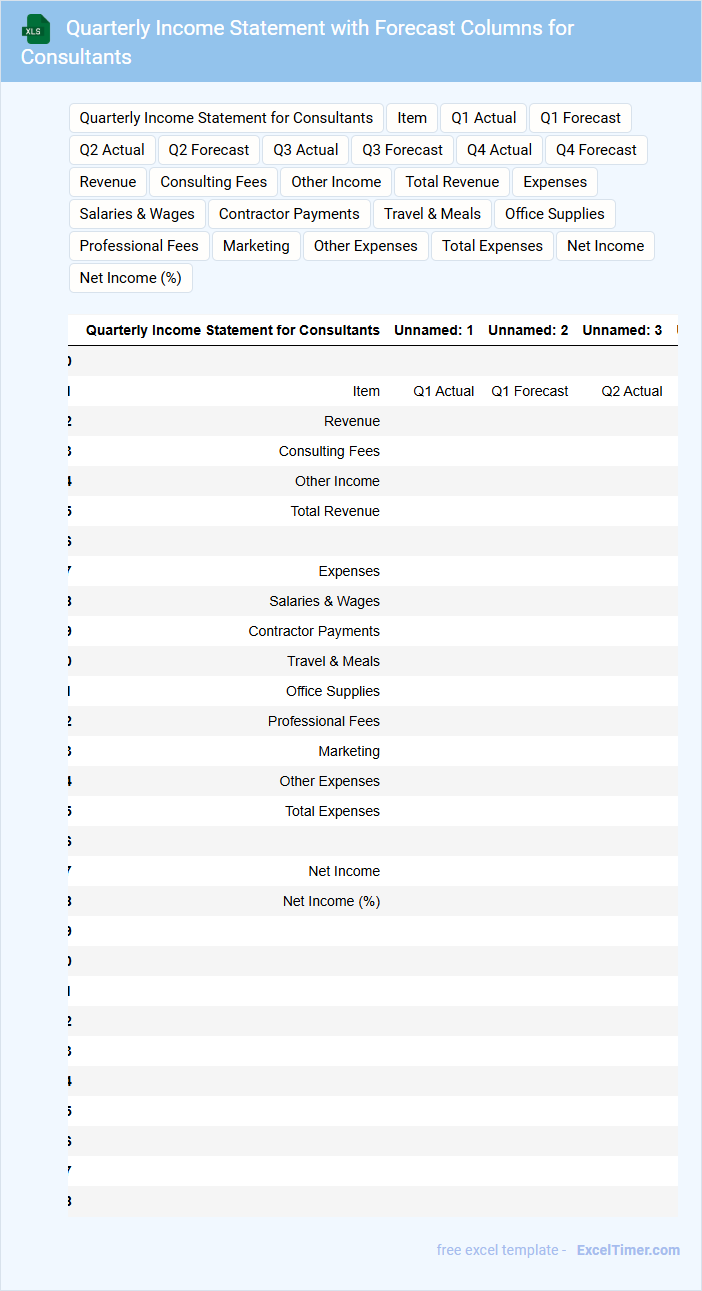

Quarterly Income Statement with Forecast Columns for Consultants

A Quarterly Income Statement with Forecast Columns is a financial document used by consultants to track and project revenue, expenses, and net income over each quarter. It combines historical data with future estimates to help in strategic planning and performance evaluation. Including detailed forecast columns allows consultants to anticipate financial outcomes and make informed decisions.

What key financial metrics should be included in a consultant's quarterly income statement?

Your quarterly income statement for consultants should include key financial metrics such as total revenue, cost of services, and gross profit to assess profitability. Operating expenses, including salaries, marketing, and administrative costs, provide insight into overhead and efficiency. Net income reflects the overall financial health, helping you make informed decisions for future consulting projects.

How are project revenues and consulting fees typically categorized and tracked quarterly?

Project revenues and consulting fees are typically categorized under distinct income streams within the Quarterly Income Statement to ensure clear financial analysis. Each category is tracked by client and project, aligned with corresponding billing cycles and payment schedules. Detailed quarterly tracking enables accurate assessment of profitability and cash flow specific to consulting activities.

What common expense types must consultants report in a quarterly income statement?

Consultants typically report common expense types such as salaries and wages, office supplies, travel and entertainment, marketing and advertising, professional development, and software subscriptions in a quarterly income statement. These expenses directly impact the net income and cash flow analysis. Accurate categorization ensures compliance with accounting standards and effective financial management.

How can quarterly profit margins be calculated and analyzed for consultant performance?

To calculate quarterly profit margins for consultants, divide the net profit by total revenue and multiply by 100 to express it as a percentage. Analyzing these margins over multiple quarters reveals trends in profitability and operational efficiency. Your focus on these metrics helps identify areas for cost management and performance improvement.

Which Excel formulas and functions are most effective for summarizing quarterly income data?

To effectively summarize quarterly income data in your Excel document, use SUMIFS to total income by quarter and IFERROR to handle any calculation errors. PivotTables provide dynamic data analysis, enabling you to quickly group and compare income across different consultants. The combination of these functions ensures accurate, clear quarterly income statements for consultants.